By Peter Rudegeair and Laura Saunders

The tax-preparation business isn't really about taxes anymore.

It's about charging millions of Americans little or nothing for tax

preparation as a way to get at their other information.

Intuit Inc., maker of the popular TurboTax products, this year

offered free preparation to millions of Americans with simple

returns, and H&R Block Inc. countered with a more-generous

offer. Both companies hoped new customers would pay for add-ons to

their returns, or prove to be "sticky" and pay fees some day.

Meanwhile, personal-finance portal Credit Karma Inc. is charging

consumers nothing at all for its tax-prep service.

Alabama Revenue Commissioner Julie Magee is among those who

welcome Credit Karma's offer. She believes people shouldn't have to

pay to do their taxes, and she recently helped her 26-year-old

daughter file her taxes using Credit Karma's new service.

"It was easy, totally free, and very secure," said Ms. Magee,

adding that Credit Karma's "interview process looks and feels like

the software people pay for."

Behind the wave of free offers is a significant trend: More

Americans than ever are comfortable filing their taxes online. This

development has made TurboTax a household name, but it now

threatens margins across the industry. Notably, the average fee

this year for returns prepared in H&R Block's own offices is

$217, while its current online fee for many filers is $94.

As a result, tax-preparation firms need more than taxes to

ensure their future. Some are using tax filers' information to

recommend credit cards and loans; others see profits in using data

to suggest financial strategies based on tax returns.

"The winner is the taxpayer, and the loser is everyone who can't

monetize [their customers]," said Brad Smith, Intuit chief

executive.

As millions of Americans hand over some of their most private

data to corporate middlemen, though, there are risks for both

privacy and security. Credit Karma, on its consent form this year,

told tax filers it can use their 2016 return data through 2025.

As the amount of online tax data grows, so does its allure as a

target for criminals who want to steal and use it. This spring,

hacking forced a government website to shut down an online tool

that college students seeking financial aid used to link to family

tax filings. The Internal Revenue Service and industry have

undertaken security upgrades, including efforts that cut new

complaints of tax identity theft in half last year.

Among current players, Credit Karma has the most aggressive

vision of tax-prep's future. The company, founded in 2007 and

recently valued at $3.5 billion, grew by providing free credit

scores and reports to borrowers who previously often paid about $80

to get them with other services.

Credit Karma now earns hundreds of millions of dollars a year in

fees from credit-card firms and other lenders, who place products

with its 60 million consumers. To extend its reach, CEO Kenneth Lin

bought AFJC Corp., an online tax-prep provider, for an undisclosed

sum last year.

Credit Karma says it encourages, but doesn't require, users of

the free tax preparation to share their tax data so the company can

match them with lenders. "Today, virtually no one charges for the

credit score," said Mr. Lin. "We're excited that we might have a

similar impact" on tax filing.

Paid professionals signed nearly 82 million individual returns

for 2014, about the same as for 2008, according to the latest data

available from the Internal Revenue Service. Meanwhile,

self-prepared e-filed returns increased nearly 60%, to 50

million.

TurboTax deserves much of the credit for that surge. Last year,

Americans used Intuit's software to file more than a quarter of all

individual returns. To maintain and extend its dominance, Intuit is

piloting a service for TurboTax users through a partnership with

student-loan provider Earnest Inc.

If taxpayers consent, Intuit runs their data through Earnest's

algorithms, which also pull borrowing and payment histories from

credit bureaus. Earnest will then determine how much it can save

users on their loans and make offers on the spot.

In exchange for access to Intuit's estimated 5 million TurboTax

customers with student debt, Earnest will pay Intuit a referral fee

based on the loans it closes. Intuit is considering expanding such

sharing to firms offering mortgages and credit cards, among other

financial products.

"All of them need distribution... and everyone's got to pay

their taxes, " says Varun Krishna, the Intuit executive who heads

the project.

H&R Block, the oldest national tax-prep firm, also made a

free tax-filing offer. But unlike Intuit and Credit Karma, H&R

Block has an urgent need to drive foot traffic into 10,500

locations operated by the company and its franchisees. These

outposts contribute nearly $9 out of every $10 Block earns in

tax-prep fees.

H&R Block was founded in 1955 by brothers Henry and Richard

Bloch, who charged people $5 to prepare their taxes in a Kansas

City, Mo., storefront. In recent years, the company hasn't been as

successful with do-it-yourself offerings as TurboTax has been. Last

year a 6% drop in tax returns prompted the company to lay off 13%

of its workers.

H&R Block has teamed up with IBM's Watson computer system to

offer tax-wise financial strategies at no extra charge to taxpayers

using its preparers.

Starting this year, every Block tax preparer's desk has two

computer screens -- one for the preparer, and one for the customer

following along. The Watson system, based on the taxpayer's

specific data, offers suggestions -- such as reducing withholding,

buying a home or saving more in a company retirement plan. As

Watson gains experience, its recommendations are expected to become

more sophisticated, and H&R Block hopes they will help get and

keep customers.

To publicize the efforts, Block has mounted an ad blitz with the

tagline "Get your taxes won," including a 2017 Super Bowl

commercial starring "Mad Men" actor Jon Hamm.

Block, too, is bidding for customers by offering some filers

fee-free, interest-free loans of up to $1,250 against tax refunds.

Block is willing to absorb the cost of the loans, typically around

$35, in order to attract new customers. Last month, the company

said it has approved more than 855,000 refund-advance loans worth

some $700 million.

"H&R Block is trying to use every arrow in its quiver," says

Jeff Silber, an analyst at BMO Capital Markets.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com and Laura

Saunders at laura.saunders@wsj.com

(END) Dow Jones Newswires

April 07, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

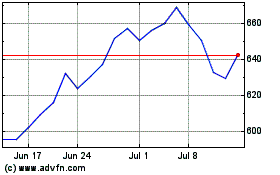

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024