UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 3

TO

FORM 10-K/A

x

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended February 29, 2016

Or

o

TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File No. 333-196663

BAIXO RELOCATION SERVICES, INC.

(Exact Name of Small Business Issuer as specified in its charter)

|

Nevada

|

|

35-2511643

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

H 190 /5 Centre Horte,

Aquem Baixo, Goa, India 403601

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(011) 91-772-088-4167

Email:

baixorelocation@gmail.com

Indicate by check mark if the registrant is a well-known seasoned issuer as defined by Rule 405 of the Securities Act

Yes

o

No

x

Indicate by check mark if the registrant is not required to file reports pursuant to Rule 13 or Section 15(d) of the Act

Yes

o

No

x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the reporting requirements for the past 90 days.

Yes

x

No

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes

o

No

o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

Yes

x

No

o

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter: 8,000,000 common shares at $0.015* = $120,000. (* - last price at which the Corporation offered stock for sale under its S-1 registration statement. For purposes of this computation, our director of the registrant is considered to be affiliates of the registrant. As of May 25, 2016, no bid or asked prices are available.

The number of shares outstanding of each of the Issuer's classes of common stock, as of the latest practicable date: 8,000,000 common shares issued and outstanding as of May 25, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Cautionary Statement Regarding Forward-Looking Statements

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty.

A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made in this report. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as “may”, “will”, “should”, “plans”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" beginning on page 7, that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The cautions outlined made in this statement and elsewhere in this document should not be construed as complete or exhaustive. In many cases, we cannot predict factors which could cause results to differ materially from those indicated by the forward-looking statements. Additionally, many items or factors that could cause actual results to differ materially from forward-looking statements are beyond our ability to control. The Company will not undertake an obligation to further update or change any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. References to common shares refer to common shares in our capital stock.

In this reports, “Baixo Relocation Services”, “the Company,” “we,” “us,” and “our,” refer to Baixo Relocation Services, Inc., unless the context otherwise requires. Unless otherwise indicated, the term “fiscal year” refers to our fiscal year ending October 31. Unless otherwise indicated, the term “common stock” refers to shares of the Company’s common stock, par value $0.0001 per share.

This Amendment No. 3 to Annual Report on Form 10-K/A is being amended in accordance with that certain comment letter from the Securities and Exchange Commission dated February 15, 2017 requesting that the current officer and director sign and certify the Annual Report in his capacities on behalf of the Company and in his capacities of President, Principal Executive Officer, Principal Financial Officer, Principal Accounting Officer and Director.

PART IV

Item 15. Exhibits, Financial Statement Schedules

(a)

Financial Statements

(1) Financial statements for our Company are presented after the signature of this document

(b)

Exhibits

|

Exhibit No.

|

|

Description

|

|

(3)

|

|

Articles of Incorporation and By-laws

|

|

3.1

|

|

Articles of Incorporation (1)

|

|

3.2

|

|

Bylaws (1)

|

|

(31)

|

|

Section 302 Certification

|

|

31.1

|

|

Certification of Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C.§ 1350, as adopted pursuant to § 302 of the Sarbanes-Oxley Act of 2002. (2)

|

|

(32)

|

|

Section 906 Certification

|

|

32.1

|

|

Certification of Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002. (2)

|

_________________

(1) Previously filed with the Securities and Exchange Commission.

(2) Filed herewith.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this

Amendment No. 3 to Annual Report on Form 10-K/A to

be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

BAIXO RELOCATION SERVICES, INC.

|

|

|

|

|

|

|

|

Date: February

28,

2017

|

By:

|

/s/ Richard Hue

|

|

|

|

|

Richard Hue

|

|

|

|

|

Chief

Executive Officer and

|

|

|

|

|

Chief

Financial Officer and Director

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this

Amendment No.

3

to Annual Report on Form 10-K/A

has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

|

Date: February

28,

2017

|

By:

|

/s/ Richard Hue

|

|

|

|

|

Director,

Principal

Executive

Officer

,

Principal

Financial Officer

and

Principal Accounting Officer

, Secretary and Treasurer

|

|

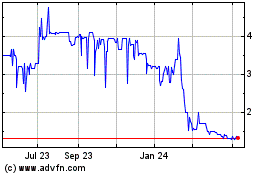

flooidCX (PK) (USOTC:FLCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

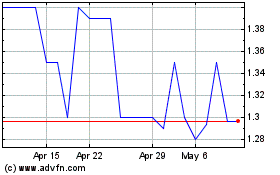

flooidCX (PK) (USOTC:FLCX)

Historical Stock Chart

From Apr 2023 to Apr 2024