Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

February 14 2017 - 4:12PM

Edgar (US Regulatory)

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-214882

PROSPECTUS

Up to $48,805,097

Common Stock

We have entered into a Controlled Equity Offering

SM

Sales Agreement, or sales agreement, with Cantor Fitzgerald & Co., or Cantor Fitzgerald, relating to shares of our common stock offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $60 million from time to time through Cantor Fitzgerald acting as sales agent. As of December 2, 2016, we had issued and sold shares of our common stock having an aggregate offering price of $11,194,903 pursuant to our prior registration statement on Form S-3 (File No. 333-192640). Accordingly, we may issue and sell additional shares of our common stock having an aggregate offering price of up to $48,805,097 pursuant to this prospectus.

Our common stock is traded on the NASDAQ Global Market, or NASDAQ, under the symbol “CLDX”. On February 8, 2017, the last reported sales price of our common stock on NASDAQ was $3.42 per share.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. Cantor Fitzgerald is not required to sell any specific number or dollar amount of securities, but will act as a sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between Cantor Fitzgerald and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Cantor Fitzgerald will be entitled to compensation at a fixed commission rate equal to 3.0% of the gross sales price per share sold. In connection with the sale of our common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts.

Investing in our common stock involves risks. Before buying any shares, you should read the discussion of material risks of investing in our common stock in “

Risk Factors

” beginning on page ATM-5 of this prospectus supplement, and in the risks discussed in the documents incorporated by reference in this prospectus supplement and accompanying prospectus, as they may be amended, updated or modified periodically in our reports filed with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 13, 2017.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. Under the shelf registration process, we may offer and sell shares of our common stock having an aggregate offering price of up to $48,805,097 from time to time under this prospectus at prices and on terms to be determined by market conditions at the time of offering. This prospectus is deemed a prospectus supplement to the base prospectus contained in the registration statement of which this prospectus forms a part.

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus. You should read the registration statement and the accompanying exhibits for further information. The registration statement, including the exhibits and the documents incorporated or deemed incorporated herein by reference, can be read and are available to the public over the Internet at the SEC’s website at

http://www.sec.gov

as described under the heading “Where You Can Find More Information.”

This prospectus describes the specific terms of the common stock we are offering and also adds to, and updates information contained in the documents incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference into this prospectus that was filed with the SEC before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference into this prospectus - the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in, or incorporated by reference into this prospectus and in any free writing prospectus that we may authorize for use in connection with this offering. We have not, and Cantor Fitzgerald & Co., or Cantor, has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and Cantor is not, making an offer to sell or soliciting an offer to buy our securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus, the documents incorporated by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus, the documents incorporated by reference into this prospectus, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

The distribution of this prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for the person to make an offer or solicitation.

Unless this prospectus indicates otherwise or the context otherwise requires, the terms “we,” “our,” “us,” “Celldex” or the “Company” as used in this prospectus refer to Celldex Therapeutics, Inc. and its subsidiaries

.

ATM-

1

Table of Contents

PROSPECTUS SUMMARY

The following summary of our business highlights some of the information contained elsewhere in or incorporated by reference into this prospectus. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should carefully read this prospectus, including the documents incorporated by reference, which are described under “Incorporation of Documents by Reference” and “Where You Can Find More Information” in this prospectus. You should also carefully consider the matters discussed in the section titled “Risk Factors” in this prospectus and in other periodic reports incorporated by reference herein.

Our Company

We are

a biopharmaceutical company focused on the development and commercialization of several immunotherapy technologies for the treatment of cancer and other difficult-to-treat diseases. Our drug candidates are derived from a broad set of complementary technologies which have the ability to utilize the human immune system and enable the creation of therapeutic agents. We are using these technologies to develop targeted immunotherapeutics comprised of protein-based molecules such as vaccines, antibodies and antibody-drug conjugates that are used to treat specific types of cancer or other diseases.

Our latest stage drug candidate, glembatumumab vedotin (also referred to as CDX-011) is a targeted antibody-drug conjugate in a randomized, Phase 2b study for the treatment of triple negative breast cancer and a Phase 2 study for the treatment of metastatic melanoma. Varlilumab (also referred to as CDX-1127) is an immune modulating antibody that is designed to enhance a patient’s immune response against their cancer. We established proof of concept in a Phase 1 study with varlilumab, which has allowed several combination studies to begin in various indications. We also have a number of earlier stage drug candidates in clinical development, including CDX-1401, a targeted immunotherapeutic aimed at antigen presenting cells, or APCs, for cancer indications, CDX-301, an immune cell mobilizing agent and dendritic cell growth factor, and CDX-014, an antibody drug conjugate targeting TIM-1. Our drug candidates address market opportunities for which we believe current therapies are inadequate or non-existent. As discussed below, we recently acquired Kolltan Pharmaceuticals, Inc. thereby expanding our pipeline of drug candidates.

We are building a fully integrated, commercial-stage biopharmaceutical company that develops important therapies for patients with unmet medical needs. Our program assets provide us with the strategic options to either retain full economic rights to our innovative therapies or seek favorable economic terms through advantageous commercial partnerships. This approach allows us to maximize the overall value of our technology and product portfolio while best ensuring the expeditious development of each individual product.

Recent Developments

On November 29, 2016, we consummated the transactions contemplated by that certain Agreement and Plan of Merger dated as of November 1, 2016 by and among Celldex, Kolltan Pharmaceuticals, Inc., a Delaware corporation, Connemara Merger Sub 1 Inc. a Delaware corporation and a wholly-owned subsidiary of Celldex and Connemara Merger Sub 2 LLC., a Delaware limited liability company and a wholly-owned subsidiary of Celldex.

Upon consummation of the transactions, Kolltan became a wholly-owned subsidiary of Celldex.

Prior to the merger, Kolltan was a privately-held clinical-stage company focused on the discovery and development of novel, antibody-based drug candidates targeting reception tyrosine kinases, or RTKs. Kolltan’s programs include: (i) KTN0158, a humanized monoclonal antibody that is a potent inhibitor of KIT activation and receptor dimerization in tumor cells and mast cells, which is currently in a Phase 1 dose escalation study in refractory gastrointestinal stromal tumors (GIST); (ii) KTN3379, a human monoclonal antibody designed to block the activity of ErbB3 (HER3), which recently completed a Phase 1b study with combination cohorts where meaningful responses and stable disease were observed in cetuximab (Erbitux

®

) refractory patients in head and neck squamous cell carcinoma and in BRAF-mutant non-small cell lung cancer (NSCLC); and (iii) a multi-faceted TAM program, a broad antibody discovery effort underway to generate antibodies that modulate the TAM family of RTKs, comprised of Tyro3, AXL and MerTK, which are expressed on tumor-infiltrating macrophages, dendritic cells and some tumors. Research supports TAMs having broad application and potential across immuno-oncology and inflammatory diseases.

ATM-

2

Table of Contents

Under the terms of the Merger Agreement, upon consummation of the transactions contemplated by the Merger Agreement, Kolltan’s investors received, in exchange for their share and debt interests in Kolltan, an aggregate of 18,257,996 shares of Celldex’s common stock with a calculated value of $62.5 million, based on the average closing price of Celldex’s stock for the five trading day period ending on October 28, 2016, the third calendar day prior to the date of the Merger Agreement, as adjusted downward pursuant to the terms of the Merger Agreement. The Merger Agreement provides that the number of shares that can be issued at the closing can be increased or decreased by no more than 5% in either direction based on the comparable average closing prices over the five trading days prior to the closing date. Therefore, because the average closing price of Celldex’s stock over the five trading days prior to the closing date was higher than the comparable average closing prices over the five trading days prior to the date of the Merger Agreement, there was a full 5% downward adjustment in the number of shares issued at closing. In addition, following closing, certain officers of Kolltan will receive an aggregate of 437,901 shares of Celldex’s common stock in lieu of cash severance obligations owed to them by Kolltan. In addition, in the event that certain specified preclinical and clinical development milestones related to Kolltan’s development programs and/or Celldex’s development programs and certain commercial milestones related to Kolltan’s product candidates are achieved, Celldex will be required to pay Kolltan’s stockholders milestone payments of up to $172.5 million, which milestone payments may be made, at Celldex’s sole election, in cash, in shares of Celldex’s common stock or a combination of both, subject to NASDAQ listing requirements and provisions of the Merger Agreement. The number of shares of Celldex common stock issued in connection with a milestone payment, if any, will be determined based on the average closing price per share of Celldex common stock for the five trading day period ending three calendar days prior to the achievement of such milestone. Pursuant to applicable NASDAQ listing rules, we are required to obtain stockholder approval of such issuances of our common stock to the extent that such issuances exceed 19.9% of our common stock outstanding prior to the merger. If we do not obtain stockholder approval of such common stock issuances, we may elect to pay the milestone consideration in cash to maintain compliance with applicable NASDAQ listing standards. We may still decide to pay cash even if we obtain stockholder approval.

Corporate Information

We are a Delaware corporation organized in 1983. Our principal executive offices are located at Perryville III Building, 53 Frontage Road, Suite 220, Hampton, New Jersey 08827 and our telephone number is (908) 200-7500. Our corporate website is www.celldex.com. The information on our website is not incorporated by reference into this prospectus.

ATM-

3

Table of Contents

The Offering

|

Common stock offered by us

|

|

Shares of our common stock having an aggregate offering price of up to $48,805,097.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

Up to 114,058,558 shares, assuming sales at a price of $3.81 per share, which was the closing price of our common stock on The NASDAQ Global Market, or NASDAQ, on November 30, 2016. The actual number of shares issued will vary depending on the sales price under this offering.

|

|

|

|

|

|

Manner of offering

|

|

“At the market offering” that may be made from time to time through our sales agent, Cantor Fitzgerald & Co. See “Plan of Distribution” beginning on page ATM-15 of this prospectus.

|

|

|

|

|

|

Use of Proceeds

|

|

We currently intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-12 of this prospectus.

|

|

|

|

|

|

Risk Factors

|

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page ATM-8 of this prospectus and under similar headings in the other documents that are filed after the date hereof and incorporated by reference in this prospectus for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

|

NASDAQ Global Market symbol

|

|

“CLDX”

|

The total number of shares of common stock to be outstanding immediately after this offering is based on 101,248,821 shares of common stock issued and outstanding as of September 30, 2016, which does not include the following:

·

10,150,598 shares issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $11.26 per share as of September 30, 2016;

·

3,641,582 shares available for future issuance under our equity compensation plans as of September 30, 2016, and

·

18,695,897 shares issued in connection with closing of the Kolltan acquisition on November 29, 2016.

Unless otherwise stated, all information in this prospectus:

·

assumes no exercise of outstanding options to purchase common stock and no issuance of shares available for future issuance under our equity compensation plans; and

·

reflects all currency in U.S. dollars.

ATM-

4

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” in this prospectus and our Annual Report on Form 10-K/A for the year ended December 31, 2015, respectively, as updated by any other document that we subsequently file with the Securities and Exchange Commission and that is incorporated by reference into this prospectus, as well as the risks described below and all of the other information contained in this prospectus, and incorporated by reference into this prospectus, including our financial statements and related notes, before investing in our securities. These risks and uncertainties are not the only ones facing us and there may be additional matters that we are unaware of or that we currently consider immaterial. All of these could adversely affect our business, business prospects, cash flow, results of operations and financial condition. In such case, the trading price of our common stock could decline, and you could lose all or part of your investment in our common stock.

Risks Related to this Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Because we have not designated the amount of net proceeds received by us from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

You may experience immediate and substantial dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered may be higher than the book value per share of our common stock, you may suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering. In addition, we have a significant number of options and restricted stock outstanding. If the holders of these securities exercise them or become vested in them, as applicable, you may incur further dilution.

You may experience future dilution as a result of future equity offerings or if we issue shares to former Kolltan stockholders upon achievement of certain specified milestones.

To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

In addition, pursuant to the terms of the merger agreement between Kolltan and us, in the event that certain specified preclinical and clinical development milestones related to Kolltan’s development programs and/or Celldex’s development programs and certain commercial milestones related to Kolltan’s product candidates are achieved, we will be required to pay Kolltan’s former stockholders milestone payments of up to $172.5 million, which milestone payments may be made, at our sole election, in cash, in shares of our common stock or a combination of both, subject to NASDAQ listing requirements and provisions of the Merger Agreement. As a result, we may issue additional shares of our common stock having a value of up to $172.5 million if the specified preclinical and clinical development milestones for the Celldex programs and the Kolltan programs and the commercial milestones for the Kolltan programs are achieved, which would result in further dilution to our stockholders.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We have agreed, without the prior written consent of Cantor Fitzgerald & Co. and subject to certain exceptions set forth in the sales agreement, not to sell or otherwise dispose of any common stock or securities convertible into or exchangeable for shares of common stock, warrants or any rights to purchase or acquire common stock during the period beginning on the fifth trading day immediately prior to the delivery of any placement notice delivered by us to Cantor Fitzgerald & Co. and ending on the fifth trading day immediately following the final settlement date with respect to the shares sold pursuant to such notice. We have further agreed, subject to certain exceptions set forth in the sales agreement, not to sell or otherwise dispose of any common stock or securities convertible into or exchangeable for shares of common stock, warrants or any rights to purchase or acquire common stock in any other “at-the-market” or continuous equity transaction prior to the termination of the sales agreement with Cantor Fitzgerald & Co. Therefore, it is possible that we could issue and sell additional shares of our common stock in the public markets. We cannot predict the effect that future sales of our common stock would have on the market price of our common stock

.

Our share price has been and could remain volatile.

The market price of our common stock has historically experienced and may continue to experience significant volatility. From January 2014 through December 31, 2016, the market price of our common stock has fluctuated from a high of $33.33 per share in the first quarter of 2014, to a low of $2.85 per share in the fourth quarter of 2016. Our progress in developing and commercializing our

ATM-

5

Table of Contents

products, the impact of government regulations on our products and industry, the potential sale of a large volume of our common stock by stockholders, our quarterly operating results, changes in general conditions in the economy or the financial markets and other developments affecting us or our competitors could cause the market price of our common stock to fluctuate substantially with significant market losses. If our stockholders sell a substantial number of shares of common stock, especially if those sales are made during a short period of time, those sales could adversely affect the market price of our common stock and could impair our ability to raise capital. In addition, in recent years, the stock market has experienced significant price and volume fluctuations. This volatility has affected the market prices of securities issued by many companies for reasons unrelated to their operating performance and may adversely affect the price of our common stock. In addition, we could be subject to a securities class action litigation as a result of volatility in the price of our stock, which could result in substantial costs and diversion of management’s attention and resources and could harm our stock price, business, prospects, results of operations and financial condition.

Because we do not intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment.

We have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. In addition, the terms of any existing or future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of the price of our common stock, if any, will provide a return to investors in this offering for the foreseeable future.

ATM-

6

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can identify forward- looking statements by terminology such as “may,” “will,” “should,” “plan,” “expect,” “anticipate,” “estimate,” “predict,” “intend,” “potential” or “continue” or the negative of these terms or other words of similar import, although some forward-looking statements are expressed differently. All statements other than statements of historical fact included in this prospectus and the documents incorporated by reference herein regarding our financial position, business strategy and plans or objectives for future operations are forward-looking statements. Without limiting the broader description of forward-looking statements above, we specifically note that statements regarding potential drug candidates, their potential therapeutic effect, the possibility of obtaining regulatory approval, our expected timing for completing clinical trials and clinical trial milestones for our drug candidates, our ability or the ability of our collaborators to manufacture and sell any products, market acceptance or our ability to earn a profit from sales or licenses of any drug candidate or to discover new drugs in the future are all forward-looking in nature. We cannot guarantee the accuracy of forward-looking statements, and you should be aware that results and events could differ materially and adversely from those described in the forward-looking statements due to a number of factors, including:

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

·

our ability to successfully complete research and further development, including animal, preclinical and clinical studies, and, if we obtain regulatory approval, commercialization of glembatumumab vedotin and other drug candidates and the growth of the markets for those drug candidates;

·

our ability to raise sufficient capital to fund our clinical studies and to meet our long-term liquidity needs, on terms acceptable to us, or at all. If we are unable to raise the funds necessary to meet our long-term liquidity needs, we may have to delay or discontinue the development of one or more programs, discontinue or delay on-going or anticipated clinical trials, license out programs earlier than expected, raise funds at significant discount or on other unfavorable terms, if at all, or sell all or part of our business;

·

our ability to negotiate strategic partnerships, where appropriate, for our programs, which may include, glembatumumab vedotin and varlilumab;

·

our ability to successfully integrate our and Kolltan’s businesses and to operate the combined business efficiently;

·

our ability to realize the anticipated benefits from the acquisition of Kolltan;

·

our ability to manage multiple clinical trials for a variety of drug candidates at different stages of development;

·

the cost, timing, scope and results of ongoing safety and efficacy trials of glembatumumab vedotin, and other preclinical and clinical testing;

·

the cost, timing, and uncertainty of obtaining regulatory approvals for our drug candidates;

·

the availability, cost, delivery and quality of clinical management services provided by our clinical research organization partners;

·

the availability, cost, delivery and quality of clinical and commercial grade materials produced by our own manufacturing facility or supplied by contract manufacturers, suppliers and partners, who may be the sole source of supply;

·

our ability to develop and commercialize products before competitors that are superior to the alternatives developed by such competitors;

·

our ability to develop technological capabilities, including identification of novel and clinically important targets, exploiting our existing technology platforms to develop new product candidates and expand our focus to broader markets for our existing targeted immunotherapeutics;

·

our ability to adapt our proprietary antibody-targeted technology, or APC Targeting Technology™, to develop new, safe and effective therapeutics for oncology and infectious disease indications; and

·

our ability to protect our intellectual property rights, including the ability to successfully defend patent oppositions filed against a European patent related to technology we use in varlilumab, and our ability to avoid intellectual property litigation, which can be costly and divert management time and attention.

ATM-

7

Table of Contents

You should also consider carefully the statements set forth in the section entitled “Risk Factors” in this prospectus and in our Annual Report on Form 10-K/A for the year ended December 31, 2015, respectively, as updated by any other document that we subsequently filed with the Securities and Exchange Commission and that is incorporated by reference into this prospectus, which address various factors that could cause results or events to differ from those described in the forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We have no plans to update these forward-looking statements.

ATM-

8

Table of Contents

USE OF PROCEEDS

The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement with Cantor Fitzgerald as a source of financing. We currently expect to use the net proceeds from this offering for working capital and other general corporate purposes. Until we use the net proceeds of this offering, we intend to invest the funds in short-term, investment grade, interest-bearing securities.

The amount and timing of actual expenditures for the purposes set forth above may vary based on several factors, and our management will retain broad discretion as to the ultimate allocation of the proceeds.

ATM-

9

Table of Contents

MARKET PRICE FOR OUR COMMON STOCK

Our common stock currently trades on NASDAQ under the symbol “CLDX”. The following table sets forth for the periods indicated the high and low sale prices per share for our common stock, as reported by NASDAQ.

|

Fiscal Period

|

|

High

|

|

Low

|

|

|

Year Ending December 31, 2016

|

|

|

|

|

|

|

First Quarter

|

|

$

|

15.61

|

|

$

|

2.96

|

|

|

Second Quarter

|

|

5.13

|

|

3.40

|

|

|

Third Quarter

|

|

|

4.83

|

|

|

3.23

|

|

|

Fourth Quarter

|

|

|

5.02

|

|

|

2.85

|

|

|

Year Ended December 31, 2015

|

|

|

|

|

|

|

First Quarter

|

|

$

|

32.82

|

|

$

|

17.81

|

|

|

Second Quarter

|

|

30.28

|

|

23.62

|

|

|

Third Quarter

|

|

28.08

|

|

10.11

|

|

|

Fourth Quarter

|

|

18.62

|

|

10.15

|

|

|

Year Ended December 31, 2014

|

|

|

|

|

|

|

First Quarter

|

|

$

|

33.33

|

|

$

|

16.58

|

|

|

Second Quarter

|

|

18.52

|

|

10.76

|

|

|

Third Quarter

|

|

18.30

|

|

11.93

|

|

|

Fourth Quarter

|

|

21.70

|

|

12.11

|

|

On December 30, 2016 the closing price of our common stock, as reported by NASDAQ, was $3.54 per share. We have not paid any dividends on our common stock since our inception and do not intend to pay any dividends in the foreseeable future.

ATM-

10

Table of Contents

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the price per share you pay in this offering and our pro forma net tangible book value per share after this offering. We calculate net tangible book value per share by dividing our net tangible book value, which is tangible assets less total liabilities, by the number of outstanding shares of our common stock.

Our net tangible book value as of September 30, 2016 was approximately $188.1 million, or $1.86 per share. Net tangible book value per share after this offering gives effect to the sale of $48.8 million of common stock in this offering at an assumed offering price of $3.81 per share, which was the closing price of our common stock as reported on NASDAQ on November 30, 2016, after deducting offering commissions and estimated expenses payable by us. Our net tangible book value as of September 30, 2016, after giving effect to this offering as described above, would have been approximately $235.4 million, or $2.06 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $0.20 per share to existing stockholders and an immediate dilution of $1.75 per share to new investors purchasing our common stock in this offering. The following table illustrates the per share dilution:

|

Assumed offering price per share

|

|

|

|

$

|

3.81

|

|

|

Net tangible book value per share as of September 30, 2016

|

|

$

|

1.86

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

0.20

|

|

|

|

|

Pro forma net tangible book value per share as of September 30, 2016, after giving effect to this offering

|

|

|

|

$

|

2.06

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

$

|

1.75

|

|

The above table is based on 101,248,821 shares of our common stock issued and outstanding as of September 30, 2016, which does not include the following:

·

10,150,598 shares issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $11.26 per share as of September 30, 2016;

·

3,641,582 shares available for future issuance under our equity compensation plans as of September 30, 2016; and

·

18,695,897 shares issued in connection with the closing of the Kolltan acquisition on November 29, 2016.

ATM-

11

Table of Contents

PLAN OF DISTRIBUTION

We have entered into a Controlled Equity Offering

SM

sales agreement with Cantor Fitzgerald & Co., or Cantor, pursuant to which we may offer and sell up to $60 million of shares of our common stock, $0.001 par value per share, from time to time through Cantor acting as agent. This summary of the material provisions of the sales agreement does not purport to be a complete statement of its terms and conditions. A copy of the sales agreement has been filed as an exhibit to a Current Report on Form 8-K under the Exchange Act and is incorporated by reference into the registration statement of which this prospectus is a part. See “Where You Can Find More Information” below. As of December 2, 2016, we had issued and sold shares of our common stock having an aggregate offering price of $11,194,903 pursuant to our prior registration statement on Form S-3ASR (File No. 333-192640). Accordingly, we may issue and sell additional shares of our common stock having an aggregate offering price of up to $48,805,097 pursuant to this prospectus.

Upon delivery of a placement notice and subject to the terms and conditions of the sales agreement, Cantor may sell our common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act. We or Cantor may suspend or terminate the offering of our common stock upon notice and subject to other conditions.

We will pay Cantor in cash, upon each sale of our common stock pursuant to the sales agreement, a commission in an amount equal to 3.0% of the aggregate gross proceeds from each sale of our common stock. Because there is no minimum offering amount required as a condition to this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have agreed to reimburse a portion of Cantor’s expenses, including legal fees, in connection with this offering up to a maximum of $50,000. We estimate that the total expenses for the offering, excluding compensation and expense reimbursement payable to Cantor under the terms of the sales agreement, will be approximately $110,000.

Settlement for sales of common stock will occur on the third business day following the date on which any sales are made, or on some other date that is agreed upon by us and Cantor in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Sales of our common stock as contemplated in this prospectus will be settled through the facilities of The Depository Trust Company or by such other means as we and Cantor may agree upon.

Cantor will act as sales agent on a commercially reasonable efforts basis consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of NASDAQ. In connection with the sale of the common stock on our behalf, Cantor will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Cantor against certain civil liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to the sales agreement will terminate as permitted therein. We or Cantor may terminate the sales agreement at any time upon ten (10) days’ prior notice.

Cantor and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, Cantor will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus.

This prospectus in electronic format may be made available on a website maintained by Cantor and Cantor may distribute this prospectus electronically.

ATM-

12

Table of Contents

LEGAL MATTERS

Lowenstein Sandler LLP, Roseland, New Jersey, will provide us with an opinion as to the validity of the shares of common stock offered by this prospectus. Cantor is being represented in connection with this offering by Cooley LLP, New York, New York.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus by reference to the Annual Report on Form 10-K/A for the year ended December 31, 2015 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The financial statements of Kolltan Pharmaceuticals, Inc., incorporated in this prospectus by reference to Celldex Therapeutics, Inc.’s Current Report on Form 8-K/A dated February 7, 2017, have been so incorporated in reliance upon the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. We have also filed a registration statement on Form S-3, including exhibits, under the Securities Act with respect to the securities offered by this prospectus. This prospectus is a part of the registration statement but do not contain all of the information included in the registration statement or the exhibits. You may read and copy the registration statement and any other document that we file at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington D.C. 20549. You can call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. You can also find our public filings with the SEC on the Internet at a web site maintained by the SEC located at

http://www.sec.gov

.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain information. This means that we can disclose important information to you by referring you to those documents that contain the information. The information we incorporate by reference is considered a part of this prospectus, and later information we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, on or after the date of this prospectus (other than information “furnished” under Items 2.02 or 7.01 (or corresponding information furnished under Item 9.01 or included as an exhibit)) of any Current Report on Form 8-K or otherwise “furnished” to the SEC, unless otherwise stated) until this offering is completed:

·

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on February 23, 2016;

·

Our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2015, filed with the SEC on February 25, 2016;

·

Our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, filed on May 5, 2016, August 8, 2016 and November 7, 2016, respectively;

·

Our Current Reports on Form 8-K or 8-K/A filed with the SEC on February 23, 2016, March 7, 2016, May 19, 2016, June 9, 2016, August 11, 2016, November 1, 2016, November 29, 2016, as amended by Form 8-K/A filed on February 7, 2017, December 5, 2016 and December 14, 2016 (in each case, not including any information furnished under Items 2.02 or 7.01 of Form 8-K, including the related exhibits, which information is not incorporated by reference herein);

·

Our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 21, 2016 (other than the portions thereof which are furnished and not filed); and

·

The description of our common stock contained in our Registration Statement on Form 8-A, filed on November 8, 2004, as amended by Form 8-A/A filed on October 22, 2007 and March 7, 2008.

You may request a copy of these filings, at no cost, by writing to or telephoning us at the following address:

Corporate Secretary

Celldex Therapeutics, Inc.

Perryville III Building, 53 Frontage Road, Suite 220,

Hampton, New Jersey 08827

(908) 200-7500

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You should rely only on information contained in, or incorporated by reference into, this prospectus and the accompanying prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or incorporated by reference in this prospectus. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

ATM-

13

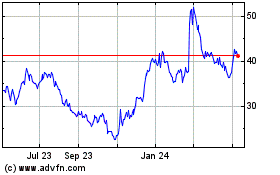

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Apr 2024 to May 2024

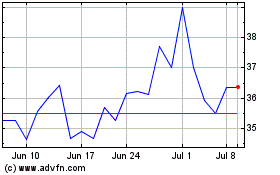

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From May 2023 to May 2024