The Bancorp, Inc. ("The Bancorp") (NASDAQ: TBBK), a financial

holding company, today reported financial results for fourth

quarter and fiscal 2016.

Highlights

- Net interest income increased 34% to

$25.0 million for the quarter ended December 31, 2016 compared to

$18.6 million for the quarter ended December 31, 2015. Year over

year, net interest income increased 29% to $90.0 million from $69.9

million.

- Net interest margin increased to 2.84%

for the quarter ended December 31, 2016 compared to 2.52% for the

quarter ended December 31, 2015. Year over year, the net interest

margin was 2.74% compared to 2.37%.

- Loans, excluding loans held for sale,

increased 14% to $1.23 billion at December 31, 2016 compared to

$1.08 billion at December 31, 2015.

- Direct lease financing increased 50% to

$346.6 million from $231.5 million at December 31, 2015.

- Small Business Administration (“SBA”)

loans increased 20% to $369.8 million from $307.1 million at

December 31, 2015.

- Security backed lines of credit

(“SBLOC”) increased 9% to $630.4 million from $575.9 million at

December 31, 2015.

- Prepaid card fee income increased 2% to

$12.0 million for the quarter ended December 31, 2016 from $11.7

million for the quarter ended December 31, 2015. Year over year,

prepaid card fee income increased 8% to $51.3 million.

- Gross dollar volume on prepaid cards

(“GDV”) (1) increased 8% to $10.6 billion for Q4 2016 from $9.8

billion for Q4 2015. Year over year, GDV increased over 12%.

- Assets held for sale from discontinued

operations decreased 38% from $583.9 million at December 31, 2015

to $360.7 million at December 31, 2016.

- The rate on our average deposits and

interest bearing liabilities of $3.88 billion in Q4 2016 was 0.30%

with a rate of 0.14% for $1.86 billion of average prepaid card

deposits.

- The $1.86 billion of average Q4 2016

prepaid card deposits, which are among the lowest cost of our

deposits, reflected a 16% increase over fourth quarter 2015.

- Book value per common share at December

31, 2016 of $5.40 per share. The Bancorp and its subsidiary, The

Bancorp Bank, remain well capitalized.

(1) Gross dollar volume represents the total dollar amount

spent on prepaid and debit cards issued by The Bancorp.

The Bancorp reported a net loss of $29.0 million, or $0.52 loss

per diluted share, for the quarter ended December 31, 2016 compared

to net income of $18.6 million, or $0.49 income per diluted share

for the quarter ended December 31, 2015. Net loss from continuing

operations for the quarter ended December 31, 2016 was $24.0

million or a loss of $0.43 per diluted share compared to net income

from continuing operations of $17.3 million or income of $0.46 per

diluted share for the quarter ended December 31, 2015. Loss from

continuing operations does not include any income which may result

from the reinvestment of the proceeds from sales of the remaining

assets in The Bancorp’s discontinued operations. Tier one capital

to assets, tier one capital to risk-weighted assets, total

capital to risk-weighted assets and common equity-tier 1 ratios

were 7.06%, 13.84%, 14.13% and 13.84% compared to well capitalized

minimums of 5%, 8%, 10% and 6.5%.

Damian Kozlowski, The Bancorp’s Chief Executive Officer, said,

“Discontinued operations and Walnut Street were reevaluated with

updated values, which resulted in a significant charge during the

fourth quarter. We’ve reviewed the related loan processes and

enhanced related governance. A commercial credit, in the

discontinued loan portfolio, was impacted by suspected fraud

leading to a write-down and loss in discontinued operations. We’ve

added additional details in this release on our credits from

discontinued operations including a chart detailing the types of

assets and other related information. Our goal, as stated before,

is to reduce risk in the portfolios and complete an orderly

wind-down with the least amount of future volatility. Our

continuing operations results, excluding the charge to Walnut

Street which resulted from the 2014 financing of the sale of

certain discontinued operations loans, showed improvement this

quarter. This improvement reflected the elimination of the BSA

lookback expense which terminated in the prior quarter. It also

reflected continuing revenue growth, while expense cuts and

restructuring are also beginning to have an impact on

profitability. While certain of the expense cuts are not immediate,

we have targeted total 2017 expense reductions of $20 million.”

Conference Call Webcast

You may access the LIVE webcast of The Bancorp's Quarterly

Earnings Conference Call at 8:00 AM ET Friday, February 10, 2017 by

clicking on the webcast link on Bancorp's homepage at

www.thebancorp.com. Or, you may dial 844.775.2543, access code

51403334. You may listen to the replay of the webcast following the

live call on The Bancorp's investor relations website or

telephonically until Friday, February 17, 2017 by dialing

855.859.2056, access code 51403334.

About The Bancorp

The Bancorp, Inc. (NASDAQ: TBBK) is dedicated to serving the

unique needs of non-bank financial service companies, ranging from

entrepreneurial start-ups to those on the Fortune 500. The

company’s chief financial institution, The Bancorp Bank (Member

FDIC, Equal Housing Lender), has been repeatedly recognized in the

payments industry as the Top Issuer of Prepaid Cards (US), a top

merchant sponsor bank, and a top ACH originator. Specialized

lending distinctions include National Preferred SBA Lender, a

leading provider of securities-backed lines of credit, and one of

the few bank-owned commercial leasing groups in the nation. For

more information please visit www.thebancorp.com.

Forward-Looking Statements

Statements in this earnings release regarding Bancorp’s business

which are not historical facts are "forward-looking statements"

that involve risks and uncertainties. These statements may be

identified by the use of forward-looking terminology, including but

not limited to the words “may,” “believe,” “will,” “expect,”

“look,” “anticipate,” “estimate,” “continue,” or similar words. For

further discussion of the risks and uncertainties to which these

forward-looking statements may be subject, see Bancorp’s filings

with the SEC, including the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of those filings. These risks and

uncertainties could cause actual results to differ materially from

those projected in the forward-looking statements. The

forward-looking statements speak only as of the date of this press

release. The Bancorp does not undertake to publicly revise or

update forward-looking statements in this press release to reflect

events or circumstances that arise after the date of this

presentation, except as may be required under applicable law.

The Bancorp, Inc. Financial highlights

(unaudited) Three months ended Year ended

December 31, December 31,

Condensed income statement 2016

2015 2016 2015 (dollars in thousands except per share

data) Net interest income $ 24,978 $ 18,582 $

89,966 $ 69,931 Provision for loan and lease losses

1,550 300 3,360 2,100

Non-interest income Service fees on deposit accounts 1,789 1,889

5,124 7,468 Card payment and ACH processing fees 1,343 1,489 5,526

5,731 Prepaid card fees 11,993 11,744 51,326 47,496 Gain (loss) on

sale of loans 2,092 3,333 2,901 10,080 Gain on sale of investment

securities 40 14,497 3,171 14,435 Gain on sale of health savings

portfolio - 33,531 - 33,531 Change in value of investment in

unconsolidated entity (24,720 ) (1,412 ) (37,033 ) 1,729 Leasing

income 551 564 2,007 2,291 Debit card income 202 253 - 1,611

Affinity fees 1,056 967 4,563 3,358 Other non-interest income

508 3,412 5,401

5,337 Total non-interest income (5,146 ) 70,267 42,986 133,067

Non-interest expense Bank Secrecy Act and lookback consulting

expenses 5 14,801 29,081 41,444 Other non-interest expense

42,123 44,198 169,492

152,644 Total non-interest expense 42,128

58,999 198,573 194,088 Income (loss)

from continuing operations before income tax expense (23,846 )

29,550 (68,981 ) 6,810 Income tax expense (benefit) 153

12,267 (15,171 ) 1,450 Net

income (loss) from continuing operations (23,999 ) 17,283 (53,810 )

5,360 Net income (loss) from discontinued operations, net of tax

(5,044 ) 1,336 (42,953 ) 8,072

Net income (loss) available to common shareholders $ (29,043 ) $

18,619 $ (96,763 ) $ 13,432 Net income (loss) per

share from continuing operations - basic $ (0.43 ) $ 0.46 $

(1.21 ) $ 0.14 Net income (loss) per share from discontinued

operations - basic $ (0.09 ) $ 0.03 $ (0.96 ) $ 0.21 Net

income (loss) per share - basic $ (0.52 ) $ 0.49 $ (2.17 ) $

0.35 Net income (loss) per share from continuing operations

- diluted $ (0.43 ) $ 0.46 $ (1.21 ) $ 0.14 Net income

(loss) per share from discontinued operations - diluted $ (0.09 ) $

0.03 $ (0.96 ) $ 0.21 Net income (loss) per share - diluted

$ (0.52 ) $ 0.49 $ (2.17 ) $ 0.35 Weighted average shares -

basic 55,419,204 37,759,975 44,567,357 37,755,588 Weighted average

shares - diluted 55,790,543 37,813,345 44,776,138 38,074,218

(a) For loss periods the weighted averages shares - basic is used

in both the basic and diluted computations.

Balance sheet

December 31, September 30, June 30,

December 31, 2016 2016 2016 2015 (dollars in thousands)

Assets: Cash and cash equivalents Cash and due from banks $

4,127 $ 4,061 $ 4,006 $ 7,643 Interest earning deposits at Federal

Reserve Bank 955,733 312,605 528,094 1,147,519 Securities sold

under agreements to resell 39,199 39,463

39,360 - Total cash and cash

equivalents 999,059 356,129

571,460 1,155,162 Investment

securities, available-for-sale, at fair value 1,248,613 1,334,927

1,328,693 1,070,098 Investment securities, held-to-maturity 93,467

93,495 93,537 93,590 Loans held for sale, at fair value 663,140

562,957 441,593 489,938 Loans, net of deferred fees and costs

1,222,911 1,198,237 1,182,106 1,078,077 Allowance for loan and

lease losses (6,332 ) (6,058 ) (5,398 )

(4,400 ) Loans, net 1,216,579 1,192,179

1,176,708 1,073,677 Federal Home Loan

Bank & Atlantic Community Bancshares stock 1,614 11,014 12,289

1,062 Premises and equipment, net 24,125 21,797 22,429 21,631

Accrued interest receivable 10,589 10,496 10,271 9,471 Intangible

assets, net 6,906 5,682 6,074 4,929 Other real estate owned 104 - -

- Deferred tax asset, net 37,862 29,765 28,870 36,207 Investment in

unconsolidated entity 127,430 157,396 162,275 178,520 Assets held

for sale from discontinued operations 360,711 386,155 487,373

583,909 Other assets 50,683 55,519

60,203 47,629 Total assets $ 4,840,882

$ 4,217,511 $ 4,401,775 $ 4,765,823

Liabilities: Deposits Demand and interest checking $

3,816,524 $ 3,364,103 $ 3,569,669 $ 3,602,376 Savings and money

market 421,780 402,832 389,851 383,832 Time deposits -

- 101,160 428,549

Total deposits 4,238,304 3,766,935

4,060,680 4,414,757 Securities

sold under agreements to repurchase 274 353 318 925 Short-term

borrowings - 70,000 - - Long-term borrowings 263,099 - - -

Subordinated debenture 13,401 13,401 13,401 13,401 Other

liabilities 27,112 27,744 37,094

16,739 Total liabilities $ 4,542,190 $

3,878,433 $ 4,111,493 $ 4,445,822

Shareholders' equity: Common stock - authorized, 75,000,000

shares of $1.00 par value; 55,419,204 and 37,861,303 shares issued

at December 31, 2016 and 2015, respectively 55,419 55,419 37,945

37,861 Treasury stock (100,000 shares) (866 ) (866 ) (866 ) (866 )

Additional paid-in capital 360,564 359,793 301,680 300,549

Accumulated deficit (112,212 ) (83,169 ) (57,721 ) (15,449 )

Accumulated other comprehensive income (loss) (4,213 )

7,901 9,244 (2,094 ) Total

shareholders' equity 298,692 339,078

290,282 320,001 Total

liabilities and shareholders' equity $ 4,840,882 $ 4,217,511

$ 4,401,775 $ 4,765,823

Average balance

sheet and net interest income Three months ended

December 31, 2016 Three months ended December 31, 2015

(dollars in thousands) Average Average Average

Average

Assets: Balance Interest Rate

Balance Interest Rate Interest-earning assets: Loans net of

unearned fees and costs ** $ 1,717,927 $ 18,374 4.28 % $ 1,416,176

$ 14,502 4.10 % Leases - bank qualified* 21,018 414 7.88 % 28,658

487 6.80 % Investment securities-taxable 1,371,209 8,437 2.46 %

1,022,914 5,290 2.07 % Investment securities-nontaxable* 37,529 156

1.66 % 248,662 2,203 3.54 % Interest earning deposits at Federal

Reserve Bank 403,834 560 0.55 % 751,126 595 0.32 % Federal funds

sold and securities purchased under agreement to resell 39,485

151 1.53 % 31,406 112 1.43 % Net interest earning

assets 3,591,002 28,092 3.13 % 3,498,942 23,189 2.65 %

Allowance for loan and lease losses (5,781 ) (4,178 ) Assets held

for sale from discontinued operations 377,044 3,238 3.44 % 617,983

6,650 4.30 % Other assets 257,469 321,170 $ 4,219,734

$ 4,433,917

Liabilities and Shareholders'

Equity: Deposits: Demand and interest checking $ 3,405,296 $

2,182 0.26 % $ 3,518,223 $ 2,689 0.31 % Savings and money market

407,039 498 0.49 % 378,301 581 0.61 % Time - - 0.00 %

174,530 263 0.60 % Total deposits 3,812,335 2,680 0.28 %

4,071,054 3,533 0.35 % Short-term borrowings 55,913 96 0.69

% 18,152 12 0.00 % Repurchase agreements 304 - 0.00 % 1,148 1 0.35

% Subordinated debt 13,401 137 4.09 % 13,401 120 3.58

% Total deposits and interest bearing liabilities 3,881,953 2,913

0.30 % 4,103,755 3,666 0.36 % Other liabilities 18,896

13,313 Total liabilities 3,900,849 4,117,068

Shareholders' equity 318,885 316,849 $ 4,219,734

$ 4,433,917 Net interest income on tax equivalent

basis* $ 28,417 $ 26,173 Tax equivalent adjustment 200 942

Net interest income $ 28,217 $ 25,231 Net interest margin *

2.84 % 2.52 % *

Full taxable equivalent basis, using a 35% statutory tax rate. **

Includes loans held for sale.

Average balance sheet and net

interest income Year ended December 31, 2016 Year

ended December 31, 2015 (dollars in thousands) Average

Average Average Average

Assets:

Balance Interest Rate Balance Interest Rate Interest-earning

assets: Loans net of unearned fees and costs ** $ 1,587,306 $

66,436 4.19% $ 1,245,189 $ 48,733 3.91% Leases - bank qualified*

20,718 1,748 8.44% 25,126 1,734 6.90% Investment securities-taxable

1,303,445 31,219 2.40% 989,705 19,918 2.01% Investment

securities-nontaxable* 54,271 1,139 2.10% 452,526 16,646 3.68%

Interest earning deposits at Federal Reserve Bank 466,728 2,237

0.48% 935,093 2,354 0.25% Federal funds sold and securities

purchased under agreement to resell 30,448 450 1.48% 40,402 578

1.43% Net interest-earning assets 3,462,916 103,229 2.98% 3,688,041

89,963 2.44% Allowance for loan and lease losses (4,741)

(4,111) Assets held for sale 490,115 18,275 3.73% 715,116 28,925

4.04% Other assets 266,777 311,501 $ 4,215,067 $ 4,710,547

Liabilities and Shareholders' Equity: Deposits: Demand and

interest checking $ 3,347,191 $ 9,399 0.28% $ 3,975,475 $ 10,982

0.28% Savings and money market 394,434 1,526 0.39% 337,168 1,867

0.55% Time 77,576 447 0.58% 44,789 275 0.61% Total deposits

3,819,201 11,372 0.30% 4,357,432 13,124 0.30% Short-term

borrowings 57,517 359 0.62% 4,575 12 0.26% Repurchase agreements

685 2 0.29% 5,224 15 0.29% Subordinated debt 13,401 520 3.88%

13,401 448 3.34% Total deposits and interest bearing liabilities

3,890,804 12,253 0.31% 4,380,632 13,599 0.31% Other

liabilities 14,916 10,403 Total liabilities 3,905,720 4,391,035

Shareholders' equity 309,347 319,512 $ 4,215,067 $ 4,710,547

Net interest income on tax equivalent basis* 109,251 105,289

Tax equivalent adjustment 1,010 6,433 Net interest income $

108,241 $ 98,856 Net interest margin * 2.74% 2.37%

* Full taxable equivalent basis,

using a 35% statutory tax rate. ** Includes loans held for sale.

Allowance for loan and lease losses: Year ended

December 31, December 31, 2016 2015

(dollars in thousands) Balance in the allowance for loan and

lease losses at beginning of period (1) $ 4,400 $ 3,638

Loans charged-off: SBA non real estate 128 111 SBA

commercial mortgage - - Direct lease financing 119 30 Other

consumer loans 1,211 1,220 Total

1,458 1,361 Recoveries: SBA non real

estate 1 - Direct lease financing 17 - Other consumer loans

12 23 Total 30 23

Net charge-offs 1,428 1,338 Provision charged to operations

3,360 2,100 Balance in allowance for

loan and lease losses at end of period $ 6,332 $ 4,400

Net charge-offs/average loans 0.09 % 0.11 % Net

charge-offs/average assets 0.03 % 0.03 % (1) Excludes activity from

assets held for sale

Loan portfolio: December 31,

September 30, June 30, December 31, 2016 2016 2016 2015 (dollars in

thousands) SBA non real estate $ 74,644 $ 74,262 $ 71,596 $

68,887 SBA commercial mortgage 126,159 117,053 116,617 114,029 SBA

construction 8,826 6,317 3,751

6,977 Total SBA loans 209,629 197,632 191,964 189,893 Direct

lease financing 346,645 332,632 315,639 231,514 SBLOC 630,400

621,456 607,017 575,948 Other specialty lending 11,073 20,076

40,543 48,315 Other consumer loans 17,374

19,375 20,005 23,180 1,215,121 1,191,171

1,175,168 1,068,850 Unamortized loan fees and costs 7,790

7,066 6,938 9,227 Total loans,

net of deferred loan fees and costs $ 1,222,911 $ 1,198,237

$ 1,182,106 $ 1,078,077

Small business lending

portfolio: December 31, September 30, June 30, December 31,

2016 2016 2016 2015 (dollars in thousands) SBA loans,

including deferred fees and costs 215,786 203,196 197,544 197,966

SBA loans included in HFS 154,016 146,450

136,660 109,174 Total SBA loans $ 369,802

$ 349,646 $ 334,204 $ 307,140

Capital ratios:

Tier 1 capital Tier 1 capital Total capital

Common equity to average to risk-weighted to risk-weighted

tier 1 to risk assets ratio assets ratio assets ratio weighted

assets As of December 31, 2016 The Bancorp, Inc. 7.06 % 13.84 %

14.13 % 13.84 % The Bancorp Bank 6.83 % 13.31 % 13.60 % 13.31 %

"Well capitalized" institution (under FDIC regulations) 5.00 % 8.00

% 10.00 % 6.50 % As of December 31, 2015 The Bancorp, Inc.

7.17 % 14.67 % 14.88 % 14.67 % The Bancorp Bank 6.90 % 13.98 %

14.18 % 13.98 % "Well capitalized" institution (under FDIC

regulations) 5.00 % 8.00 % 10.00 % 6.50 % Three months ended

Year ended December 31, December 31, 2016 2015 2016

2015

Selected operating ratios: Return on average

assets (annualized) nm 1.67 % nm 0.28 % Return on average equity

(annualized) nm 23.31 % nm 4.19 % Net interest margin 2.84 % 2.52 %

2.74 % 2.37 % Book value per share $ 5.40 $ 8.47 $ 5.40 $ 8.47

December 31, September 30, June 30, December 31, 2016 2016

2016 2015

Asset quality ratios: Nonperforming loans to total

loans (2) 0.30 % 0.58 % 0.53 % 0.22 % Nonperforming assets to total

assets (2) 0.08 % 0.16 % 0.14 % 0.05 % Allowance for loan and lease

losses to total loans 0.52 % 0.51 % 0.46 % 0.41 % Nonaccrual

loans $ 2,972 $ 4,021 $ 3,147 $ 1,927 Other real estate owned

104 - - -

Total nonperforming assets $ 3,076 $ 4,021 $ 3,147

$ 1,927 Loans 90 days past due still accruing

interest $ 661 $ 2,933 $ 3,172 $ 403

(2) Nonperforming loan and asset ratios include nonaccrual

loans and loans 90 days past due still accruing interest.

Three months ended December 31, September 30, June 30, December 31,

2016 2016 2016 2015 (in thousands)

Gross dollar volume (GDV)

(1)

: Prepaid card GDV $ 10,647,520 $ 10,459,097

$ 11,442,294 $ 9,839,782 (1) Gross

dollar volume represents the total dollar amount spent on prepaid

and debit cards issued by The Bancorp.

Cumulative analysis of

marks on discontinued commercial loan principal

(dollars in millions)

Commercial Cumulative Mark loan principal marks chargedowns

Cumulative 12.31.16 12.31.16 6.30.16 marks %

to principal 12 loan relationships >$8 million $ 232 $ 232 Add

back mark chargedowns to principal 20 Total principal to

compare to cumulative marks $ 252 $ 40 $ 20 $ 60 24 % Other

loans 92 10 - 10

11 % Total discontinued loan principal * $ 324 $ 50 $ 20 $ 70

* Of the $324 million commercial loan principal at 12.31.16,

$93.5 million was non performing.

Discontinued operations

portfolio composition 12/31/2016:

Collateral type

Unpaid principalbalance

Mark 12.31.16

Mark as % ofportfolio

(dollars in millions) Commercial real estate - non-owner occupied:

Retail $ 60 $ 24.5 41 % Other 51 0.2 - Office 15 0.2 1 %

Construction and land 83 2.1 3 %

Commercial non-real estate and

industrial

38 15.5 41 % 1 to 4 family construction 31 1.3 4 % First mortgage

residential non-owner occupied 21 5.2 25 % Commercial real estate

owner occupied: Retail 11 0.2 2 % Other 2 -

-

Office - -

-

First mortgage residential owner occupied 4 0.2 5 % Multifamily 3 -

- Residential junior mortgage 3 0.1 3 % Other 2

- - Total $ 324 $ 49.5 15 %

Analysis

of Walnut Street marks: Loan activity

Marks (dollars in millions) Original Walnut Street

loan balance 12.31.14 $ 267 Marks through 12.31.14 sale date

(58 ) $ (58 ) Sales price of Walnut Street 209 Equity investment

from independent investor (16 ) 12.31.2014 Bancorp book

value 193 Additional marks 2015 and 2016 (42 ) (42 ) Payments

received (24 ) 12.31.2016 Bancorp book value* $ 127

Total marks $ (100 ) Divided by: Original Walnut Street loan

balance $ 267 Percentage of total mark to original balance 37 %

* Approximately 21% of expected principal recoveries were

classified as non performing as of 12.31.16.

Walnut Street

portfolio composition 12/31/2016: Collateral type

% of Portfolio Commercial real estate non-owner occupied

Retail 25.2 % Other 23.4 % Office 19.7 % Construction and land 19.7

% Commercial non real estate and industrial 4.7 % First mortgage

residential owner occupied 3.5 % First mortgage residential

non-owner occupied 2.7 % Other 1.1 % Total 100.0 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170209006287/en/

The Bancorp Investor RelationsAndres Viroslav, Director,

Investor Relations215-861-7990aviroslav@thebancorp.comorThe

Bancorp Media RelationsRob Tacey, Director, Public

Relations302-385-1418rtacey@thebancorp.com

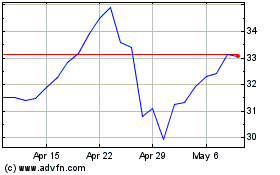

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Aug 2024 to Sep 2024

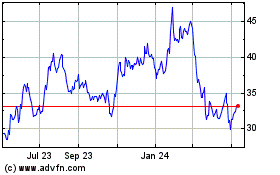

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Sep 2023 to Sep 2024