By Andrew Tangel

INDIANAPOLIS -- President Donald Trump boosted the hopes of

employees at Rexnord Corp.'s factory here in December when he

castigated the company for "viciously firing" workers and planning

to move their jobs to Mexico.

Two months later, Rexnord is still planning to close the

industrial-bearings factory, which employs about 350 people,

despite Mr. Trump's shaming and his earlier intervention to stop a

nearby Carrier Corp. furnace factory from closing.

Rexnord says moving the plant to Mexico is part of a plan to

save $30 million annually. Workers say they have been packing up

machines while their replacements, visiting from Mexico, learn how

to do their jobs.

"That's a real kick in the ass to be asked to train your

replacement," said machinist Tim Mathis, who has worked at Rexnord

for 12 years. "To train the man that's going to eat your

bread."

Milwaukee-based Rexnord is one of many companies plowing ahead

with plans to invest in Mexico despite Mr. Trump's vows to cajole

companies into keeping their assembly lines in the U.S. Some,

including heavy-equipment maker Caterpillar Inc. and steelmaker

Nucor Corp., are overseen by officials who belong to a panel

advising Mr. Trump on manufacturing policy. Executives at Peoria,

Ill.-based Caterpillar are moving ahead with a restructuring that

includes shifting jobs from a Joliet, Ill., factory to Monterrey,

Mexico. "We're just going to have to wait and see how this plays,"

Caterpillar Chief Financial Officer Brad Halverson said in a

January interview, referring to potential Trump-era shifts in trade

policy.

A Caterpillar spokeswoman said the company has been reducing its

workforce world-wide to stay viable "in the longest downturn in our

92-year history."

Charlotte, N.C.-based Nucor is moving forward with Japan's JFE

Steel to build a new plant in Mexico to make steel for car

makers.

Nucor Chief Executive John Ferriola said those plans could

change if new policies penalize U.S. companies that invest in

Mexico. "We're watching the situation in Washington very, very

closely," he told analysts on Jan. 31.

Mr. Trump hasn't specified what taxes, tariffs or trade deals he

might enact in his effort to boost U.S. manufacturing and factory

employment.

In late January, the administration announced the creation of a

28-member group of business and labor leaders to help advise the

White House "on how best to promote job growth and get Americans

back to work again." Caterpillar Chairman Doug Oberhelman and

Nucor's Mr. Ferriola were named as advisers.

On Wednesday, Intel Corp. CEO Brian Krzanich, after a meeting

with the president, announced plans to upgrade an existing facility

with a $7 billion investment in Arizona that will employ 3,000

people. Mr. Krzanich, who also is in on the advisory panel, said

Intel was encouraged by the new administration's policies to make

the U.S. a more attractive place to do business.

However, the continuing investments abroad underscore the scale

of the economic forces that confront Mr. Trump's plans. The White

House didn't respond to a request for comment.

Manitowoc Foodservice Inc. went ahead with plans to wind down

its soft-drink dispenser factory near Sellersburg, Ind., and lay

off about 80 employees in the wake of Mr. Trump's election,

according to local officials. The company, which in August had

announced plans to shift much of the production to facilities in

Mexico, declined to comment. Electronic component maker CTS Corp.

still plans to phase out production at its Elkhart, Ind., plant by

mid-2018 and shift production to China, Mexico and Taiwan, a

spokesman said. The company has said about 230 employees would be

affected as part of the restructuring.

Ford Motor Co., which Mr. Trump criticized during his

presidential campaign, decided to scrap plans to build a new

factory in Mexico and would create 700 new U.S. jobs. But the

company said in January it would still shift production of its

Focus small car from Michigan to an existing Mexican facility.

General Motors Co. is in the process of moving more production to

Mexico, despite criticism from Mr. Trump, but has also committed to

continue with pre-election plans to add more jobs in the U.S.

Rexnord Chief Executive Todd Adams said in a December letter to

employees that U.S. workers still accounted for more than half of

its approximately 8,000-employee workforce. The company has

operations across the globe, including Europe, Asia and Africa.

While Rexnord hasn't specified how many of the Indianapolis jobs

would move to Mexico, it is expected to keep about 25 office jobs

there and in Milwaukee, and add 50 jobs in Texas.

Mr. Adams declined interview requests through a spokeswoman, who

didn't respond to requests for comment.

In an earnings call with analysts last week, Mr. Adams said the

company didn't think the move to Mexico would be "something that we

would regret."

"But you know, to be determined, obviously, depending on what

happens," he said.

Rexnord workers in Indianapolis weren't optimistic about their

prospects if the sprawling plant in an industrial zone near the

airport closes down. Some said they had refused to help train the

workers from Mexico who will replace them. Rexnord has said they

aren't required to help, and offered extra pay to those that

do.

The workers worried about finding jobs that paid as well --

about $25 an hour, excluding overtime, according to their union,

the United Steelworkers Local 1999. They fretted about mortgage,

car and tuition payments.

At a rally last week attended by workers hoping for a

last-minute reprieve, speakers criticized "corporate greed" and

trade deals such as the North American Free Trade Agreement with

Canada and Mexico. Former Democratic presidential candidate Bernie

Sanders addressed the crowd via a prerecorded video message.

"It just puzzles me to think that they have to [reduce costs] by

dumping us out," said Gary Canter, a machinist who has worked at

the Rexnord factory for eight years. "It's very un-American."

Mr. Canter said he voted for Mr. Trump. He remained hopeful the

president would ultimately boost manufacturing, creating new jobs

for his colleagues elsewhere even if the Rexnord plant isn't

spared.

"We gave this man a chance because it wasn't a typical

politician that's done nothing for us," Mr. Canter said.

--Bob Tita contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

February 09, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

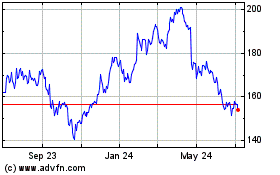

Nucor (NYSE:NUE)

Historical Stock Chart

From Aug 2024 to Sep 2024

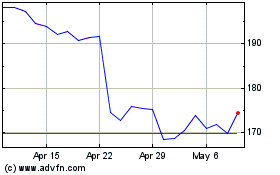

Nucor (NYSE:NUE)

Historical Stock Chart

From Sep 2023 to Sep 2024