UPDATE -- Sotherly Hotels Inc. Announces Dividend Tax Treatment

February 02 2017 - 2:35PM

Sotherly Hotels Inc. (NASDAQ:SOHO) (the “Company”) today announced

the estimated income tax classification of the Company’s 2016

distributions on its common shares (CUSIP #83600C103) and preferred

shares (CUSIP #83600C301). The income tax classification of the

2016 distributions as it is expected to be reported on Form

1099-DIV is set forth in the following table:

|

Type of |

|

|

Record |

|

|

Payment |

Per Common |

Ordinary |

Return of |

|

Dividend |

|

|

Date |

|

|

Date |

Share |

Dividend |

Capital |

|

Common |

|

|

12/15/2015 |

|

|

01/11/2016 |

|

0.080000 |

|

|

0.058836 |

|

|

0.021164 |

|

|

Common |

|

|

03/15/2016 |

|

|

04/11/2016 |

|

0.085000 |

|

|

0.062513 |

|

|

0.022487 |

|

|

Common |

|

|

06/15/2016 |

|

|

07/11/2016 |

|

0.090000 |

|

|

0.066190 |

|

|

0.023810 |

|

|

Common |

|

|

09/15/2016 |

|

|

10/11/2016 |

|

0.095000 |

|

|

0.069867 |

|

|

0.025133 |

|

| |

|

|

|

|

|

|

|

0.350000 |

|

|

0.257406 |

|

|

0.092594 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

100.0000 |

% |

|

73.5446 |

% |

|

26.4554 |

% |

|

Type of |

|

|

Record |

|

|

Payment |

Per Common |

Ordinary |

Return of |

|

Dividend |

|

|

Date |

|

|

Date |

Share |

Dividend |

Capital |

|

Preferred |

|

|

09/30/2016 |

|

|

10/17/2016 |

|

0.211111 |

|

|

0.155260 |

|

|

0.055850 |

|

|

Preferred |

|

|

12/30/2016 |

|

|

01/17/2017 |

|

0.500000 |

|

|

0.367723 |

|

|

0.132277 |

|

| |

|

|

|

|

|

|

|

0.711111 |

|

|

0.522983 |

|

|

0.188127 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

100.0000 |

% |

|

73.5446 |

% |

|

26.4554 |

% |

No portion of the dividends declared in 2016

represented foreign taxes or qualified dividend income. Record

holders of the Company’s common shares who received any of the

dividends specified in the table above will receive

an Internal Revenue Service (IRS) Form 1099-DIV

from American Stock Transfer & Trust Company, the

Company’s dividend paying agent. The Form 1099-DIV will report the

dividends paid with respect to 2016. Shareholders whose shares are

held in “street name” will receive an IRS Form 1099 from

the bank, brokerage firm or other nominee holding their shares. The

common share dividend declared for shareholders of record as

of December 15, 2016, and payable on January 11, 2017,

will be reported on shareholders’ IRS Form 1099-DIV for

the 2017 tax year.

The information in the table above is based on

the preliminary results of work on the tax filings of the

Company and is subject to correction or adjustment when the filings

are completed. No material change in these classifications is

expected. The tax information above should not be construed as tax

advice and is not a substitute for careful tax planning and

analysis. Shareholders are encouraged to consult with their own tax

advisors regarding the specific federal, state, local, foreign and

other tax consequences of ownership of the common shares of

Sotherly Hotels Inc. and the specific tax treatment of

distributions therefrom.

About Sotherly

Hotels Inc. Sotherly Hotels Inc. is a self-managed

and self-administered lodging REIT focused on the acquisition,

renovation, upbranding and repositioning of upscale and

upper-upscale full-service hotels in the Southern United

States. Currently, the Company’s portfolio consists of

investments in twelve hotel properties, comprising 3,011 rooms, and

an interest in the Hyde Resort & Residences, a 400-unit luxury

condo-hotel. Most of the Company’s properties operate under the

Hilton Worldwide, InterContinental Hotels Group and Marriott

International, Inc. brands. Sotherly Hotels Inc. was organized in

2004 and is headquartered in Williamsburg, Virginia. For more

information, please visit www.sotherlyhotels.com.

Contact at the Company:

Scott Kucinski

Sotherly Hotels Inc.

410 West Francis Street

Williamsburg, Virginia 23185

(757) 229-5648

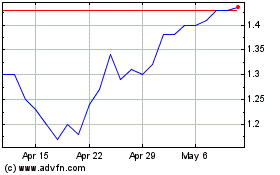

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

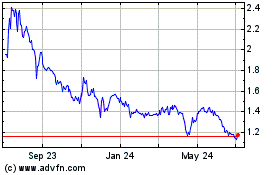

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Apr 2023 to Apr 2024