Ad Giants Omnicom and WPP Show Claws as Competition Heats up

January 11 2017 - 4:31PM

Dow Jones News

By Alexandra Bruell

Ad giants WPP and Omnicom are racing to tap into marketers'

growing digital media budgets by promising the best technology

tools and analytics and catering to clients' desire for increased

transparency in the fees they are paying.

That battle is getting testy, as recent internal communications

reviewed by CMO Today reveal.

As part of a recent reorganization, WPP media agency network

GroupM bundled data analytics and digital services, including

search, social and automated buying teams, calling the resulting

offering "completely open and fully transparent."

GroupM rival Annalect, Omnicom's central digital buying and data

unit, quickly moved to arm its people with talking points in case

clients ask about its competitor's revamped offering, according to

a document circulated among Omnicom staffers. Annalect also used

the opportunity to express confidence in its own approach and point

to recent accounts that switched over from GroupM to Omnicom.

"It is noteworthy that the (GroupM) reorganization comes several

months after losing ( Volkswagen) and AT&T -- two large,

long-standing accounts -- to the data driven approach of Omnicom,"

the Annalect document said.

In the memo, Annalect touts its own proprietary tools and

describes mPlatform as a "game of catch-up," saying GroupM's

approach replicates what Annalect has "been doing for years."

The Omnicom memo describes WPP's investment in media companies

and ownership of data as a "known conflict of interest, noting that

"mPlatform will prove to push these conflicts to the forefront for

clients." The document doesn't spell out the specific alleged

conflicts.

Some ad industry executives have been critical of agencies that

do media buying but also have investments in media companies, data

providers and advertising technology companies, saying that can

compromise their objectivity. WPP has investments in Vice Media and

ad tech firm AppNexus, among others.

"If you look at everything within [mPlatform], it offers the

power of choice," Mr. Gleason said in an interview. He called that

the "opposite of a conflict of interest."

In the document, Omnicom said WPP is trying to create a "new

walled garden of data" that will rival the media and data platforms

of Google, Facebook and Amazon. Walled gardens typically refer to

businesses that require advertisers to play by their rules,

including adopting their metrics and using their data and buying

tools. (WPP has previously acknowledged that it considers Google

and Facebook competitors.)

Annalect's strategy, by contrast, has been to link up with the

big tech companies -- creating "direct linkages to walled gardens"

to access "rich consumer data profiles," the company wrote in its

memo. Annalect also claims to have access to "person and household

based identity data" through its partnership with Neustar.

GroupM's Brian Gleason, who was recently appointed CEO of

mPlatform, obtained the Annalect document and distributed it to

senior executives. In his correspondence, he criticized Annalect

for being "100 percent dependent on partnerships," especially for

its use of Neustar. A private equity group recently agreed to

acquire Neustar.

"This creates a great deal of risk when your entire strategy is

completely out of your control," wrote Mr. Gleason.

GroupM, like Annalect, is trying to persuade clients that it is

objective. "Our dataset is unbiased, deterministic and rigorously

curated for freshness to account for ever-changing consumer

interest," Mr. Gleason wrote.

Mr. Gleason said in the interview that the mPlatform initiative

isn't totally new. "We've been on this path for quite some time,"

he said.

Addressing why Omnicom chose to send its memo, a spokeswoman for

the company said it was standard practice "to provide background

perspective and opinion to our agencies whenever there is a

significant announcement - whether it be from media vendors,

measurement companies, adtech platforms, or our competitors - about

which our employees and clients may have questions."

Write to Alexandra Bruell at alexandra.bruell@wsj.com

(END) Dow Jones Newswires

January 11, 2017 16:16 ET (21:16 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

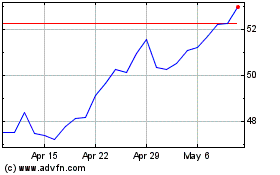

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024