UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2017

Commission File Number 001-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant’s name into English)

Avenida

República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by

furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

PETROBRAS ANNOUNCES OFFERING OF GLOBAL NOTES AND

COMMENCEMENT OF CASH TENDER OFFERS

RIO

DE JANEIRO, BRAZIL – January 9, 2017 –

Petróleo Brasileiro S.A. – Petrobras (“

Petrobras

”) (NYSE: PBR) announces that its wholly-owned subsidiary Petrobras Global Finance B.V. (“

PGF

”), plans

to offer global notes in one or more series (the “

Notes

”), subject to market and other conditions. The Notes will be unsecured obligations of PGF and will be fully and unconditionally guaranteed by Petrobras. PGF intends to use the

net proceeds from the sale of the Notes to repurchase notes validly tendered and accepted for purchase by PGF in the tender offers described below, and to use any remaining net proceeds for general corporate purposes including to refinance upcoming

maturities.

Petrobras also announces the commencement of offers by PGF to purchase for cash PGF’s notes of the series set forth in the table below

for an aggregate purchase price, excluding accrued and unpaid interest, of up to US$2.0 billion (all such notes, collectively, the “

Old Notes

” and each a “

series

” of Old Notes), subject to the “

Acceptance

Priority Level

” of such series of Old Notes and subject to proration (the “

Tender Offers

”). The Tender Offers are conditioned upon the consummation of the Notes offering, among other customary offering conditions.

The following table sets forth the series of Old Notes subject to the Tender Offers and the consideration payable for Old Notes accepted for purchase in the

Tender Offers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Security

|

|

CUSIP/ISIN

|

|

Principal

Amount

Outstanding

(1)

|

|

Acceptance

Priority Level

|

|

Tender Offer

Consideration

(2)

|

|

Early Tender

Premium

(2)

|

|

Total

Consideration

(2)(3)

|

|

3.000% Global Notes due January 2019

|

|

71647NAB5 /

US71647NAB55

|

|

US$1,452,566,000

|

|

1

|

|

US$976.25

|

|

US$30.00

|

|

US$1,006.25

|

|

Floating Rate Global Notes due January 2019

|

|

71647NAE9 /

US71647NAE94

|

|

US$750,492,000

|

|

2

|

|

US$986.25

|

|

US$30.00

|

|

US$1,016.25

|

|

7.875% Global Notes due March 2019

|

|

71645WAN1 /

US71645WAN11

|

|

US$1,813,907,000

|

|

3

|

|

US$1,075.00

|

|

US$30.00

|

|

US$1,105.00

|

|

3.25% Global Notes due April 2019

|

|

NA/XS0835886598

|

|

€1,300,000,000

|

|

4

|

|

€1,021.25

|

|

€30.00

|

|

€1,051.25

|

|

5.75% Global Notes due January 2020

|

|

71645WAP6 /

US71645WAP68

|

|

US$2,500,000,000

|

|

5

|

|

US$1,018.75

|

|

US$30.00

|

|

US$1,048.75

|

|

4.875% Global Notes due March 2020

|

|

71647NAH2 /

US71647NAH26

|

|

US$1,500,000,000

|

|

6

|

|

US$997.50

|

|

US$30.00

|

|

US$1,027.50

|

|

Floating Rate Global Notes due March 2020

|

|

71647NAL3 /

US71647NAL38

|

|

US$500,000,000

|

|

7

|

|

US$986.25

|

|

US$30.00

|

|

US$1,016.25

|

|

(1)

|

As of the date hereof, including Notes held by Petrobras or its affiliates.

|

|

(2)

|

Per US$1,000 or €1,000, as applicable.

|

|

(3)

|

Includes the Early Tender Premium.

|

The Tender Offers will expire at 11:59 p.m., New York City time, on February 6, 2017 unless earlier terminated or

extended by PGF (such time and date, as they may be extended, the “

Expiration Date

”). Old Notes tendered may be withdrawn at any time prior to 5:00 p.m., New York City time, on January 23, 2017, unless extended, but not thereafter.

Holders of Old Notes of any series that are validly tendered and not validly withdrawn on or prior to 5:00 p.m., New York City time, on January 23, 2017, unless extended (such time and date, as they may be extended, the “

Early Tender

Date

”) and accepted for purchase will be eligible to receive the total consideration indicated in the table above with respect to such series of Old Notes (the “

Total Consideration

”), which includes an early tender premium

in the amount indicated in the table above (the “

Early Tender Premium

”). Holders of Old Notes of any series that are validly tendered after the Early Tender Date but on or before the Expiration Date and accepted for purchase will

receive only the applicable tender offer consideration, which is equal to the Total Consideration applicable to that series of Old Notes

minus

the applicable Early Tender Premium (the “

Tender Offer Consideration

”). In

addition to the Total Consideration and the Tender Offer Consideration, as applicable, holders whose Old Notes are purchased in the Tender Offers will also receive accrued interest consisting of accrued and unpaid interest from, and including, the

last interest payment date for the Old Notes of any series to, but not including, the applicable settlement date.

Subject to the terms and conditions of

the Tender Offers, if the purchase of all Old Notes validly tendered in the Tender Offers would cause PGF to purchase an aggregate principal amount of Old Notes that would result in an aggregate amount in cash to be paid to holders, excluding

accrued and unpaid interest, in excess of US$2.0 billion (the “

Tender Cap

”), then only an aggregate principal amount of Old Notes that results in the payment of an aggregate amount to holders not in excess of the Tender Cap will be

accepted in the Tender Offers. PGF will pro rate the Old Notes accepted in the Tender Offers pursuant to the acceptance priority procedures described in the offer to purchase dated January 9, 2017 (as may be amended or supplemented from time to

time, the “

Offer to Purchase

”). PGF may, in its sole discretion and subject to applicable law, increase the Tender Cap.

In determining

the amount of Old Notes purchased against the Tender Cap and available for purchases pursuant to the Tender Offers, the aggregate U.S. dollar-equivalent principal amount of Old Notes denominated in Euros shall be calculated at the applicable

exchange rate, as of 2:00 p.m., New York City time, on the business day prior to the date on which we accept for purchase Old Notes validly tendered at or prior to the Early Tender Date or the Expiration Date, as reported on Bloomberg screen page

“FXIP” under the heading “FX Rate vs. USD,” (or, if such screen is unavailable, a generally recognized source for currency quotations selected by the dealer managers with quotes as of a time as close as reasonably possible to the

aforementioned).

The Tender Offers are being made pursuant to the Offer to Purchase and the related letter of transmittal dated January 9, 2017 (as may

be amended or supplemented from time to time, the “

Letter of Transmittal

”), which set forth in more detail the terms and conditions of the Tender Offers.

PGF has engaged Banco Bradesco BBI S.A., Citigroup Global Markets Inc., HSBC Securities (USA) Inc., Itau BBA USA Securities, Inc. and Morgan

Stanley & Co. LLC to act as joint bookrunners with respect to the offering of the Notes and as dealer managers (the “

Dealer Managers

”) in connection with the Tender Offers. Global Bondholder Services Corporation is acting

as the depositary and information agent for the Tender Offers.

This press release is neither an offer to sell nor a solicitation of an offer to buy the

securities described herein, nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. PGF and Petrobras have filed a registration statement, including a prospectus with the U.S.

Securities and Exchange Commission (“

SEC

”). Before you invest, you should read the prospectus and preliminary prospectus supplement and other documents PGF and Petrobras have

filed with the SEC for more complete information about the companies and the offering of the Notes. When available, you may access these documents for free by visiting EDGAR on the SEC web site at

www.sec.gov

. Alternatively, a copy of the

prospectus and preliminary prospectus supplement may be obtained by contacting Banco Bradesco BBI S.A. at +1 (212) 888-9145, Citigroup Global Markets Inc. at + 1 (212) 723-6106, HSBC Securities (USA) Inc. at +1 (212) 525-5552, Itau

BBA USA Securities, Inc. at +1 (212) 710-6749 and Morgan Stanley & Co. LLC at +1 (212) 761-1057.

The Tender Offers are not being made

to holders of Old Notes in any jurisdiction in which PGF is aware that the making of the Tender Offers would not be in compliance with the laws of such jurisdiction. In any jurisdiction in which the securities laws or blue sky laws require the

Tender Offers to be made by a licensed broker or dealer, the respective Tender Offers will be deemed to be made on PGF’s behalf by the Dealer Managers or one or more registered brokers or dealers that are licensed under the laws of such

jurisdiction. Any questions or requests for assistance regarding the Tender Offers may be directed to Banco Bradesco BBI S.A. at +1 (212) 888-9145, Citigroup Global Markets Inc. at + 1 (212) 723-6106, HSBC Securities (USA) Inc. at +1

(212) 525-5552, Itau BBA USA Securities, Inc. at +1 (212) 710-6749 and Morgan Stanley & Co. LLC at +1 (212) 761-1057. Requests for additional copies of the Offer to Purchase, the Letter of Transmittal and related documents

may be directed to Global Bondholder Services Corporation at +1 (866)-470-3900 (toll-free).

Neither the Offer to Purchase nor any documents related to

the Tender Offers have been filed with, and have not been approved or reviewed by any federal or state securities commission or regulatory authority of any country. No authority has passed upon the accuracy or adequacy of the Offer to Purchase or

any documents related to the Tender Offers, and it is unlawful and may be a criminal offense to make any representation to the contrary.

Forward-Looking Statements

This press release may

contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are not based on historical facts and are not

assurances of future results. No assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions. All forward-looking statements are expressly qualified in their entirety by this

cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. Petrobras undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new

information or future events or for any other reason.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PETRÓLEO BRASILEIRO S.A—PETROBRAS

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Larry Carris Cardoso

|

|

|

|

|

|

|

|

Larry Carris Cardoso

|

|

|

|

|

|

|

|

Funding General Manager

|

|

Date: January 9, 2017

|

|

|

|

|

|

|

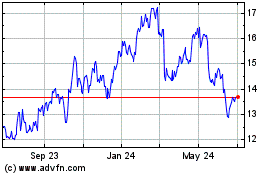

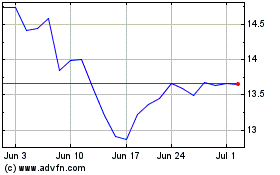

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Aug 2024 to Sep 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Sep 2023 to Sep 2024