Statement of Beneficial Ownership (sc 13d)

December 29 2016 - 4:46PM

Edgar (US Regulatory)

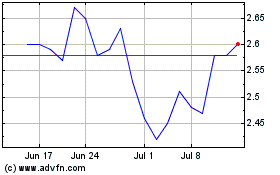

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Aug 2024 to Sep 2024

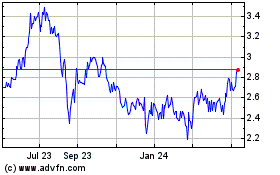

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Sep 2023 to Sep 2024