Current Report Filing (8-k)

December 09 2016 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 29, 2016

___________________________________________

ERICKSON INCORPORATED

(Exact name of registrant as specified in its charter)

___________________________________________

|

|

|

|

|

|

|

Delaware

|

001-35482

|

93-1307561

|

|

(State or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

5550 SW Macadam Avenue, Suite 200

Portland, Oregon 97239

|

|

(Address of principal executive offices, including Zip Code)

|

Registrant’s telephone number, including area code:

(503) 505-5800

________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

As previously disclosed, on November 8, 2016, Erickson Incorporated (the “Company”) and its subsidiaries (collectively with the Company, the “Debtors”) filed voluntary petitions in the United States Bankruptcy Court for the Northern District of Texas, Dallas Division (the “Bankruptcy Court”) seeking relief under Chapter 11 of Title 11 of the United States Code. The Chapter 11 cases are being jointly administered under the caption “In re Erickson Incorporated, et al”, Case No. 16-34393 in the United States Bankruptcy Court for the Northern District of Texas, Dallas Division.

On November 29, 2016, the Debtors filed with the Bankruptcy Court syndication procedures (the “DIP Syndication Procedures”) pursuant to which certain holders of the Company’s 8.25% Second Priority Senior Secured Notes due 2020 (“Second Priority Notes”) are being afforded the opportunity to subscribe to provide financing as lenders under the Company’s debtor-in-possession loan facility (the “DIP Term Facility”). The filing with the Bankruptcy Court and the attached Syndication Procedures are attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

On December 2, 2016, the Bankruptcy Court entered a final order approving the DIP Term Facility (the “Final DIP Order”). As authorized by the Final DIP Order, the Company began soliciting participation in the DIP Term Facility by eligible holders of the Second Priority Notes on December 8, 2016. The opportunity to participate expires at 5:00 p.m., New York City time, on December 19, 2016 unless extended or earlier terminated by mutual agreement of the Backstop Parties, the Company and the agent under the DIP Term Facility.

Participation in the opportunity is limited to an eligible holder of the Second Priority Notes that is an entity that is (i) either (A) a Qualified Institutional Buyer, as such term is defined in Rule 144A under the Securities Act or (B) an Institutional Accredited Investor within the meaning of Rule 501(A)(1), (2), (3) or (7) under the Securities or an entity in which all of the equity investors are such institutional “Accredited Investors”, (ii) a beneficial holder of Second Priority Notes on December 2, 2016, (iii) not the Company or an affiliate of the Company and (iv) a Backstop Party (as defined in the Final DIP Order).

The full text of the press release issued in connection with the Company’s commencement of solicitation for participation in the DIP Loan Facility is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

(d)

|

Exhibits.

|

|

99.1

|

Syndication Procedures, dated November 29, 2016.

|

|

99.2

|

Press Release, dated December __, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

December 8, 2016

|

|

Erickson Incorporated

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Melissa Berube

|

|

|

|

|

|

|

Melissa Berube

|

|

|

|

|

|

|

Deputy General Counsel and Corporate Secretary

|

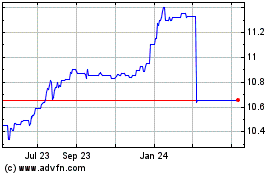

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Apr 2023 to Apr 2024