AS FILED WITH THE SECURITIES & EXCHANGE

ON DECEMBER 2, 2016

File No. 333 - _

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

CASI PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

|

DELAWARE

|

|

|

(State or other jurisdiction of

|

58-1959440

|

|

incorporation or organization)

|

(IRS Employer Identification No.)

|

9620 Medical Center Drive, Suite 300

Rockville, Maryland 20850

(240) 864-2600

(Address, including zip code, and telephone

number, including area

code, of registrant’s principal executive

offices)

Cynthia W. Hu

COO, General Counsel and Secretary

CASI PHARMACEUTICALS, INC.

9620 Medical Center Drive, Suite 300

Rockville, Maryland 20850

(240) 864-2600

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

Copies to:

Richard E. Baltz

Arnold & Porter LLP

601 Massachusetts Avenue, N.W.

Washington, D.C. 20001

(202) 942-5000

Approximate date of

commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement, as determined

by the selling stockholders.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box:

¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box:

x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering:

¨

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

¨

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller

reporting company

x

|

|

|

|

(Do not check if a smaller reporting company)

|

|

CALCULATION OF REGISTRATION FEE

|

Title of each class

of securities to be registered

|

|

Amount to be

registered (1)

|

|

|

Proposed

maximum

offering

price per

share (2)

|

|

|

Proposed

maximum

aggregate

offering price

(2)

|

|

|

Amount of

registration

fee

|

|

|

Common Stock, par value $0.01 per share

|

|

|

28,919,486

|

|

|

$

|

1.31

|

|

|

$

|

37,884,526.66

|

|

|

$

|

4,390.82

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, this registration statement shall be deemed to cover any additional securities issuable pursuant to stock splits, stock dividends and similar transactions.

|

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) of the Securities Act of 1933, as amended, based upon the average of the high and low sale prices of the Registrant’s common stock as reported on the Nasdaq Capital Market on December 1, 2016.

|

The Registrant hereby

amends this Registration Statement on such date or

dates as may be necessary to delay its effective date until the Registrant

shall file a further amendment which specifically states that this Registration

Statement shall thereafter become effective

in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the Registration Statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a),

may determine.

The

information in this prospectus is not complete and may be changed. The

selling stockholders named in this prospectus may

not sell these securities

until the Registration Statement filed with the Securities and Exchange

Commission is effective.

This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these securities in any

state where the offer or sale is not permitted.

PROSPECTUS

Subject

to Completion

Preliminary

Prospectus Dated December 2, 2016

CASI Pharmaceuticals, Inc.

Up to 28,919,486 shares of our Common Stock

This prospectus relates to up to 28,919,486

shares of our common stock that may be offered for sale by the selling stockholders named in this prospectus under “Selling

Stockholders.” We issued the shares pursuant to investment agreements and stock purchase agreements by and among the Company

and the selling stockholders which, in each case, included registration rights for the shares issued.

The prices at which the selling stockholders

may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We do not know

when or in what amount the selling stockholders may offer the shares for sale. We will not receive any of the proceeds from the

sale of the shares. The shares may be offered from time to time by the selling stockholders, their pledgees and/or donees, beginning

on the date of this prospectus. We have agreed to bear all costs, expenses and fees in connection with the registration of the

common stock offered by the selling stockholders. However, we will not be paying any underwriting discounts, commissions or brokerage

fees in this offering or any fees or expenses of the selling stockholders’ legal counsel.

The shares may be offered through ordinary

brokerage transactions on the Nasdaq Capital Market, the principal exchange on which our common stock is listed, in the over-the-counter

market or other exchanges on which our shares are traded, in negotiated transactions or otherwise, at market prices prevailing

at the time of sale or at negotiated prices.

Our common stock is

listed on the Nasdaq Capital Market and traded under the symbol “CASI.” On December 1, 2016, the last reported sale

price of our common stock on the NASDAQ Capital Market was $1.25 per share.

See “Risk Factors” beginning

on page 4 for a discussion of certain material factors that you should consider in connection with an investment in our securities

.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is _______________

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information

provided in this prospectus, including the information incorporated by reference. We have not authorized anyone to provide you

with different information. You should not assume that the information in this prospectus, or any supplement to this prospectus,

is accurate at any date other than the date indicated on the cover page of these documents.

Neither we nor the selling stockholders

are making an offer to sell these securities in any jurisdiction where such offer or sale is not permitted. Furthermore, you should

not consider this prospectus to be an offer or solicitation relating to our common stock if the person making the offer or solicitation

is not qualified to do so or it is unlawful for you to receive such an offer or solicitation.

We have not taken any action to permit a

public offering of the shares of common stock outside the United States or to permit the possession or distribution of this prospectus

outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves

about and observe any restrictions relating to the offering of the shares of common stock and the distribution of this prospectus

outside of the United States.

SUMMARY

This summary highlights information contained

in or incorporated by reference into this prospectus. This summary may not contain all of the information that you should consider

before deciding whether or not you should exercise your subscription rights. You should carefully read this prospectus, including

the documents incorporated by reference, which are described under the heading “Incorporation of Certain Documents by Reference”

in this prospectus.

CASI Pharmaceuticals, Inc.

We are a biopharmaceutical company focused

on the acquisition, development and commercialization of innovative therapeutics addressing cancer and other unmet medical needs

for the global market, with a commercial focus in China.

We intend to become a leading fully-integrated

pharmaceutical company conducting clinical development activities internationally, primarily in China, United States and Canada,

and commercializing in China, and with partners in the rest of the world. Our primary research and development focus is on oncology

therapeutics. Our strategy is to develop innovative drugs that are potential first-in-class or market-leading compounds for treatment

of cancer. The implementation of our plans will include leveraging our resources in both the United States and China.

Our product pipeline includes (1) our lead

proprietary drug candidate, ENMD-2076, a selective angiogenic kinase inhibitor currently in multiple Phase 2 oncology studies,

(2) greater China rights to MARQIBO

®

(vinCRIStine sulfate LIPOSOME injection), EVOMELA

®

(melphalan)

for Injection and ZEVALIN

®

(ibritumomab tiuxetan), all FDA approved drugs in-licensed from Spectrum currently in

various stages of the regulatory process for market approval in China, and (3) proprietary early-stage candidates in preclinical

development. We believe our pipeline reflects a risk-balanced approach between products in various stages of development, and between

products that we develop ourselves and those that we develop with our partners for the China regional market. We intend to continue

building a significant product pipeline of innovative drug candidates that we will commercialize alone in China and with partners

for the rest of the world. For ENMD-2076, our current development is focused on niche and orphan indications. For in-licensed products,

the Company uses a market-oriented approach to identify pharmaceutical candidates that it believes have the potential for gaining

widespread market acceptance, either globally or in China, and for which development can be accelerated under the Company’s

drug development strategy.

Our principal offices are located at 9620

Medical Center Drive, Suite 300, Rockville, Maryland 20850, and our telephone number is (240) 864-2600. Additional information

concerning us can be found in our periodic filings with the Securities and Exchange Commission (“SEC”), which are available

on our website at www.casipharmaceuticals.com and on the SEC’s website at www.sec.gov. The information on our website is

not deemed to be part of this prospectus.

MARQIBO®, EVOMELA® and ZEVALIN®

are registered trademarks of Spectrum Pharmaceuticals, Inc. and its affiliates.

The Offering

|

Common stock offered by selling stockholders

|

28,919,486 shares

|

|

|

|

|

Common stock outstanding as of December 2, 2016

|

60,196,574 shares

|

|

|

|

|

Use of Proceeds

|

We will not receive any of the proceeds from the sale of shares under this prospectus. All of the proceeds from the sale or other disposition of the shares of common stock offered by this prospectus will be received by the selling stockholders.

|

|

|

|

|

Dividend Policy

|

We do not expect to declare or pay dividends for the foreseeable future.

|

|

|

|

|

Risk Factors

|

See “Risk Factors” and other information included or incorporated by reference in this prospectus for a discussion of certain factors that you should carefully consider before investing in our common stock.

|

RISK FACTORS

An investment in our securities involves

significant risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties

discussed under the heading “Risk Factors” contained in our annual report on Form 10-K for the year ended December

31, 2015 filed with the SEC on March 28, 2016 and incorporated by reference in this prospectus, as the same may be amended, supplemented

or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date

hereof and incorporated by reference into this prospectus. Prospective investors should review all of these risk factors before

making an investment decision. If any of these risks or uncertainties actually occurs, our business, financial condition or results

of operations could be materially adversely affected. Additional risks and uncertainties of which we are unaware or that we currently

believe are immaterial could also materially adversely affect our business, financial condition or results of operations. In any

case, the trading price of our common stock could decline, and you could lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus contains and incorporates

certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking

statements also may be included in other statements that we make. All statements that are not descriptions of historical facts

are forward-looking statements. These statements can generally be identified by the use of forward-looking terminology such as

“believes,” “expects,” “intends,” “may,” “will,” “should,”

or “anticipates” or similar terminology. These forward-looking statements include, among others, statements regarding

the timing of our clinical trials, our cash position and future expenses, and our future revenues.

Actual results could differ materially from

those currently anticipated due to a number of factors, including: the risk that we may be unable to continue as a going concern

as a result of our inability to raise sufficient capital for our operational needs; the possibility that we may be delisted from

trading on the Nasdaq Capital Market; the volatility in the market price of our common stock; risks relating to interests of our

largest stockholders that differ from our other stockholders; the risk of substantial dilution of existing stockholders in future

stock issuances, including as a result of the closing of a private placement offering; the difficulty of executing our business

strategy in China; our inability to enter into strategic partnerships for the development, commercialization, manufacturing and

distribution of our proposed product candidates or future candidates; risks relating to the need for additional capital and the

uncertainty of securing additional funding on favorable terms; risks associated with our product candidates; risks associated with

any early-stage products under development; the risk that results in preclinical models are not necessarily indicative of clinical

results; uncertainties relating to preclinical and clinical trials, including delays to the commencement of such trials; the lack

of success in the clinical development of any of our products; dependence on third parties; and risks relating to the commercialization,

if any, of our proposed products (such as marketing, safety, regulatory, patent, product liability, supply, competition and other

risks).

We caution investors that actual results

or business conditions may differ materially from those projected or suggested in forward-looking statements as a result of various

factors including, but not limited to, those described above. We cannot assure you that we have identified all the factors that

create uncertainties. Moreover, new risks emerge from time to time and it is not possible for our management to predict all risks,

nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual

results to differ from those contained in any forward-looking statements. Readers should not place undue reliance on forward-looking

statements. We undertake no obligation to publicly release the result of any revision of these forward-looking statements to reflect

events or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of the shares of our common stock by the selling stockholders.

The selling stockholders will pay any underwriting

discounts and commissions and expenses incurred by the selling stockholders in disposing of the shares. We will bear all other

costs, fees and expenses incurred in effecting the issuance and registration of the shares covered by this prospectus, including,

without limitation, all registration and filing fees, NASDAQ Capital Market listing fees and fees and expenses of our counsel and

our accountants.

SELLING STOCKHOLDERS

This prospectus covers an aggregate of 28,919,486

shares of our common stock, consisting of (i) 24,870,106 outstanding shares of common stock and (ii) 4,049,380 shares of common

stock issuable upon the exercise of outstanding warrants held by certain of the selling stockholders.

We are registering the shares under the

Securities Act, to give the selling stockholders the opportunity, if they so desire, to publicly sell the shares for their own

accounts in such amounts and at such times and prices as each may choose. The selling stockholders may from time to time offer

and sell pursuant to this prospectus any or all of the below listed shares of common stock owned by them. The registration of these

shares does not require that any of the shares be offered or sold by the selling stockholders. The selling stockholders may from

time to time offer and sell all or a portion of their shares through ordinary brokerage transactions on the Nasdaq Capital Market,

the principal exchange on which our common stock is listed, in the over-the-counter market or other exchanges on which our shares

are traded, in negotiated transactions or otherwise, at market prices then prevailing or related to the then current market price

or at negotiated prices.

The following table sets forth information

with respect to the number of shares of common stock beneficially owned by the selling stockholders named below and as adjusted

to give effect to the sale of the shares offered hereby. The shares beneficially owned have been determined in accordance with

rules promulgated by the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose.

The information in the table below is current

as of December 2, 2016. All information contained in the table is based upon information provided to us by the selling stockholders

and we have not independently verified this information. The selling stockholders are not making any representation that any shares

covered by the prospectus will be offered for sale.

Except as described below, no affiliate

of any of the selling stockholders has held any position or office with us or any of our affiliates and no selling stockholder

has had any other material relationship with us or any of our affiliates within the past three years other than as a result of

its ownership of shares of equity securities.

|

|

·

|

Dr. Wei-Wu He currently serves as Chairman

of our Board of Directors. He is the managing member of Emerging Technology Partners LLC which is the general partner of ETP Global

Fund, L.P., one of the selling stockholders.

|

|

|

·

|

Dr. Shrotriya currently serves on our Board

of Directors as a nominee of Spectrum Pharmaceuticals, Inc. and its subsidiary and affiliate, Spectrum Pharmaceuticals Cayman,

L.P. (together “Spectrum”). Spectrum has the right to nominate one director to the Board of Directors, subject to the

reasonable approval of the Board of Directors. Dr. Shrotriya is the chairman and chief executive officer of Spectrum Pharmaceuticals,

Inc.

|

|

|

·

|

Dr. Zhou is the Managing Director and General Partner at IDG Capital Partners, an affiliate of IDG-Accel China Growth Fund II L.P. (“IDG”). IDG has the right to nominate one director to the Board of Directors.

|

|

|

·

|

In connection with the Spectrum investment agreements, CASI delivered to Talon Therapeutics, Inc., another subsidiary and affiliate of Spectrum, a $1.5 million face value promissory note, payable 18 months after the closing of the transaction, for exclusive China rights to an additional commercial oncology drug, MARQIBO®. The note is secured by the license granted by Spectrum to CASI for MARQIBO®. On September 28, 2015, CASI entered into a First Amendment to Secured Promissory Note extending the maturity date to March 17, 2017.

|

As explained

below under “Plan of Distribution,” we have agreed with the selling stockholders to bear certain expenses (other than

broker discounts and commissions, if any) in connection with the registration statement, which includes this prospectus.

We considered the following factors and

made the following assumptions regarding the table:

|

|

·

|

solely for purposes of the following table, we have assumed that the shares issuable pursuant to the warrants are owned by the selling stockholders even though the warrants have not been exercised;

|

|

|

·

|

unless otherwise indicated below, to our knowledge, the selling stockholders named below have sole voting and investment power with respect to their shares of common stock;

|

|

|

·

|

the “Number of Shares Beneficially Owned After Offering” column assumes the sale of all shares offered pursuant to this registration statement; and

|

|

|

·

|

the “Percentage Beneficial Ownership After Offering” column is based upon 60,196,574 shares of our common stock outstanding as of December 2, 2016.

|

Notwithstanding these

assumptions, the selling stockholders may sell less than all of the shares listed on the table. In addition, the shares listed

below may be sold pursuant to this prospectus or in privately negotiated transactions. Accordingly, we cannot estimate the number

of shares of common stock that the selling stockholders will sell under this prospectus.

|

Selling Stockholder

|

|

Number of

Shares

Beneficially

Owned

Prior to

Offering

|

|

|

Number of

Shares Offered

|

|

|

Number of Shares

Beneficially

Owned

After Offering

|

|

|

Percentage

Beneficial

Ownership

After Offering

|

|

|

Spectrum Pharmaceuticals, Inc. (1)

|

|

|

5,990,057

|

|

|

|

2,761,430

|

|

|

|

3,228,627

|

|

|

|

5.36

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spectrum Pharmaceuticals Cayman, L.P. (1)

|

|

|

4,038,522

|

|

|

|

1,861,767

|

|

|

|

2,176,755

|

|

|

|

3.62

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sparkle Byte Limited (2)

|

|

|

10,198,518

|

|

|

|

10,198,518

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Success Growth Limited (3)

|

|

|

987,654

|

|

|

|

987,654

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ying Yuan Gu

|

|

|

493,826

|

|

|

|

493,826

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yuchun He

|

|

|

493,826

|

|

|

|

493,826

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ETP Global Fund, L.P. (4)

|

|

|

2,245,926

|

|

|

|

2,245,926

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legend Sky International Limited (5)

|

|

|

1,975,308

|

|

|

|

1,975,308

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zhejiang Kanglaite Group Co., Ltd. (6)

|

|

|

4,938,269

|

|

|

|

4,938,269

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wealth Strategy Holding Limited (7)

|

|

|

2,962,962

|

|

|

|

2,962,962

|

|

|

|

-

|

|

|

|

-

|

|

(1) Spectrum Cayman Pharmaceuticals, L.P.

(“Spectrum Cayman”) is owned 99% by Spectrum Pharmaceuticals, Inc. (“SPPI”) and 1% by Spectrum Pharmaceuticals

International Holdings, LLC, a Delaware limited liability company (“Spectrum Holdings”). Spectrum Holdings is the sole

general partner of Spectrum Cayman and SPPI is the sole managing member of Spectrum Holdings. As a result, SPPI may be deemed to

share voting and dispositive power over the shares issued directly to Spectrum Cayman. SPPI disclaims any beneficial ownership

in the shares held directly by Spectrum Cayman except to the extent of its pecuniary interest therein.

(2) By virtue of holding 100% of the equity

interest of Sparkle Byte Limited, Snow Moon Limited may be deemed to have sole voting and dispositive power with respect to these

shares. By virtue of holding 100% of the equity interest of Snow Moon Limited, Tianjin Jingran Management Center (Limited Partnership)

may be deemed to have sole voting and dispositive power with respect to these shares. By virtue of being the general partner of

Tianjin Jingran Management Center (Limited Partnership), He Xie Ai Qi Investment Management (Beijing) Co., Ltd. may be deemed to

have sole voting and dispositive power with respect to these shares. By virtue of being the shareholders and/or directors of He

Xie Ai Qi Investment Management (Beijing) Co., Ltd., Jianguang Li, Dongliang Lin, Fei Yang and Hugo Shong may be deemed to have

shared voting and dispositive power with respect to these shares.

(3) Hebert Pang is a Director of Success Growth

Limited and may be deemed to have voting and/or investment power over the shares held by Success Growth Limited.

(4) Wei-Wu He is the managing member of Emerging

Technology Partners LLC which is the general partner of ETP Global Fund, L.P. and may be deemed to have voting and/or investment

power over the shares held by ETP Global Fund, L.P.

(5) Daofeng He is the General Manager of Legend

Sky International Limited and may be deemed to have voting and/or investment power over the shares held by Legend Sky International

Limited.

(6) Li Dapeng is the Chairman of Zhejiang

Kanglaite Group Co., Ltd. and may be deemed to have voting and/or investment power over the shares held by Zhejiang Kanglaite Group Co.,

Ltd.

(7) Kung Hung Ka is a Director of Wealth Strategy

Holding Limited and may be deemed to have voting and/or investment power over the shares held by Wealth Strategy Holding Limited.

PLAN OF DISTRIBUTION

Each of the selling stockholders and any of

their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on

any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at

fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling shares:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

|

|

|

·

|

in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or

|

|

|

·

|

a combination of any such methods or any other method permitted pursuant to applicable law.

|

The selling stockholders may, from time to time,

pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance

of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time,

under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities

Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders

under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case

the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders may also sell shares

under Rule 144 under the Securities Act, if available, rather than under this prospectus.

In connection with the sale of the securities

or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholders

may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions

with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such

broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other

financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers

or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the

Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or

indirectly, with any person to distribute the securities. In no event shall any broker-dealer receive fees, commissions and markups

which, in the aggregate, would exceed eight percent (8%).

We are required to pay certain fees and expenses

incurred by us incident to the registration of the securities. We have agreed to indemnify the selling stockholders against certain

losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because selling stockholders

may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus

delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus

which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus.

The selling stockholders have advised us that there is no underwriter or coordinating broker acting in connection with the proposed

sale of the common stock by the selling stockholders.

We agreed to keep this prospectus effective

until the earlier of (i) the date on which the securities may be resold by the selling stockholders without registration and without

regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect,(ii) such time

as the selling stockholders own no securities that are required to be registered pursuant to their respective agreements . The

common stock will be sold only through registered or licensed brokers or dealers if required under applicable state securities

laws. In addition, in certain states, the common stock covered hereby may not be sold unless they have been registered or qualified

for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied

with.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the common stock may not simultaneously engage in market making activities

with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of

the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the common

stock by the selling stockholders or any other person. If we are notified by any selling stockholder that any material arrangement

has been entered into with a broker-dealer for the sale of shares of common stock we will file, if required, a supplement to this

prospectus. If the selling stockholders use this prospectus for any sale of the shares of common stock, they will be subject to

the prospectus delivery requirements of the Securities Act.

LEGAL MATTERS

The validity of the shares of common stock offered

hereby has been passed upon for us by Arnold & Porter LLP, Washington, D.C.

EXPERTS

CohnReznick LLP (“CohnReznick”),

independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report

on Form 10-K for the year ended December 31, 2015, as set forth in their report therein, which is incorporated by reference in

this prospectus and elsewhere in the registration statement. Our consolidated financial statements are incorporated by reference

in reliance on CohnReznick’s report, given their authority as experts in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference

the information that we file with the SEC, which means that we can disclose important information to you by referring you to those

documents. The information incorporated by reference is considered to be part of this prospectus. These documents may include periodic

reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as Proxy

Statements. Any documents that we subsequently file with the SEC will automatically update and replace the information previously

filed with the SEC. Thus, for example, in the case of a conflict or inconsistency between information set forth in this prospectus

and information incorporated by reference into this prospectus, you should rely on the information contained in the document that

was filed later.

This prospectus incorporates by reference the

documents listed below that we previously have filed with the SEC and any additional documents that we may file with the SEC under

Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act between the date of this prospectus and the termination of the offering

of the securities. All filings from the date of the initial registration statement and prior to effectiveness of the registration

statement shall be deemed to be incorporated by reference into the prospectus. We are not, however, incorporating, in each case,

any documents or information deemed “furnished” but not “filed” with the SEC. These documents contain important

information about us.

|

|

1.

|

The

Company’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 28, 2016.

|

|

|

2.

|

The

Company’s Quarterly Report on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, filed

with the SEC on May 13, 2016, August 15, 2016 and November 14, 2016, respectively.

|

|

|

3.

|

The

Company’s Definitive Proxy Statement on Schedule 14A for its 2016 Annual Stockholder’s Meeting, filed with the SEC

on April 8, 2016.

|

|

|

4.

|

The

Company’s Current Reports on Form 8-K, filed on January 19, 2016, February 10, 2016, February 17, 2016, March 18, 2016,

March 31, 2016, June 3, 2016, June 27, 2016, October 5, 2016 and October 25, 2016.

|

|

|

5.

|

The

description of the Company’s common stock contained in the Company’s Registration Statement on Form 8-A filed under

the Exchange Act on May 14, 1996, including any amendment or report filed for the purpose of updating such description.

|

You can obtain a copy of any or all of the documents

incorporated by reference in this prospectus (other than an exhibit to a document unless that exhibit is specifically incorporated

by reference into that document) from the SEC on its web site at http://www.sec.gov. You also can obtain these documents from us

without charge by visiting our web site at http://www.casipharmaceuticals.com or by requesting them in writing or by telephone

at the following address:

CASI Pharmaceuticals, Inc.

9620 Medical Center Drive, Suite 300

Rockville, Maryland 20850

(240) 864-2600

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement

under the Securities Act that registers the distribution of the securities offered under this prospectus. The registration statement,

including the attached exhibits and schedules and the information incorporated by reference, contains additional relevant information

about us and the securities. The rules and regulations of the SEC allow us to omit from this prospectus certain information included

in the registration statement. You can obtain a copy of the registration statement from the SEC at the address listed below or

from the SEC’s Internet site.

We file reports, proxy statements and other

documents with the SEC. You may read and copy any document we file at the SEC’s public reference room at 100 F Street, N.E.,

Washington, D.C. 20549. You should call 1-800-SEC-0330 for more information on the public reference room. Our SEC filings are also

available to you on the SEC’s Internet site at http://www.sec.gov.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14. Other Expenses of Issuance and

Distribution.

The following table sets forth the estimated

costs and expenses in connection with the sale and distribution of the securities being registered, all of which will be paid by

the Company. All amounts are estimates except with respect to the SEC registration fee.

|

|

|

Amount

|

|

|

SEC Registration Fee

|

|

$

|

4,390.82

|

|

|

Accounting fees and expenses

|

|

$

|

3,000

|

|

|

Printing fees and expenses

|

|

$

|

1,000

|

|

|

Legal fees and expenses

|

|

$

|

5,000

|

|

|

Miscellaneous expenses

|

|

$

|

1,000

|

|

|

Total

|

|

$

|

14,390.82

|

|

ITEM 15. Indemnification of Directors and

Officers.

Section 145 of the Delaware General Corporation

Law (“DGCL”), permits, under certain circumstances, the indemnification of any person who was or is a party or is threatened

to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director,

officer, employee or agent of the corporation, or is or was serving in a similar capacity for another enterprise at the request

of the corporation. To the extent that a director, officer, employee or agent of the corporation has been successful in defending

any such proceeding, the DGCL provides that he shall be indemnified against expenses (including attorneys’ fees) actually

and reasonably incurred by him in connection therewith. With respect to a proceeding by or in the right of the corporation, such

person may be indemnified against expenses (including attorneys’ fees), actually and reasonably incurred, if he acted in

good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation. The DGCL provides,

however, that indemnification shall not be permitted in such a proceeding if such person is adjudged liable to the corporation

unless, and only to the extent that, the court, upon application, determines that he is entitled to indemnification under the circumstances.

With respect to proceedings other than those brought by or in the right of the corporation, notwithstanding the outcome of such

a proceeding, such person may be indemnified against judgments, fines and amounts paid in settlement, as well as expenses, if he

acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation and,

with respect to any criminal action, had no reason to believe his conduct was unlawful. Except with respect to mandatory indemnification

of expenses to successful defendants as described in the preceding paragraph or pursuant to a court order, the indemnification

described in this paragraph may be made only upon a determination in each specific case (1) by majority vote of the directors that

are not parties to the proceeding, even though less than a quorum, or (2) by a committee of the directors that are not a party

to the proceeding who have been appointed by a majority vote of directors who are not a party to the proceeding, even though less

than a quorum, or (3) if there are no such directors, or if such directors so direct, by independent legal counsel in a written

opinion, or (4) by the stockholders.

The DGCL permits a corporation to advance expenses

incurred by a proposed indemnitee in advance of final disposition of the proceeding, provided that the indemnitee undertakes to

repay such advanced expenses if it is ultimately determined that he is not entitled to indemnification. Also, a corporation may

purchase insurance on behalf of an indemnitee against any liability asserted against him in his designated capacity, whether or

not the corporation itself would be empowered to indemnify him against such liability. The Company has adopted provisions in its

Amended and Restated Certificate of Incorporation that provide for indemnification of its officers and directors to the maximum

extent permitted under the DGCL. As authorized by the DGCL, the Company’s Amended and Restated Certificate of Incorporation

limits the liability of directors of the Company for monetary damages. The effect of this provision is to eliminate the rights

of the Company and its stockholders to recover monetary damages against a director for breach of the fiduciary duty of care as

a director except in certain limited situations. This provision does not limit or eliminate the rights of the Company or any stockholder

to seek non-monetary relief such as an injunction or rescission in the event of a breach of a director’s duty of care. This

provision will not alter the liability of directors under federal securities laws. The Company has purchased an insurance policy

that purports to insure the officers and directors of the Company against certain liabilities incurred by them in the discharge

of their functions as such officers and directors. The foregoing descriptions are only general summaries. For additional information

we refer you to the full text of our Amended and Restated Certificate of Incorporation, filed as an exhibit to our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2006, and our Certificates of Amendment to Amended and Restated Certificate of Incorporation,

filed as exhibits to our Current Reports on Form 8-K filed on July 7, 2010 and September 20, 2012), and our Amended and Restated

By-laws, filed as an exhibit to our Current Report on Form 8-K filed on December 12, 2007 with the SEC.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers and controlling persons pursuant to the foregoing provisions,

or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in

the Securities Act and is, therefore, unenforceable.

ITEM 16. Exhibits.

The exhibits listed on

the Index to Exhibits of this Registration Statement are filed herewith or are incorporated herein by reference to other filings.

ITEM 17. Undertakings.

|

|

A.

|

The

undersigned Registrant hereby undertakes:

|

|

|

(1)

|

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement;

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

Provided,

however

, That:

|

|

(A)

|

Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

|

If the registrant is relying on Rule 430B:

|

|

|

(A)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided, however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

|

|

|

(ii)

|

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness.

Provided, however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

|

(5) That, for the purpose of determining liability

of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant

undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless

of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser

by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered

to offer or sell such securities to such purchaser: (i) Any preliminary prospectus or prospectus of the undersigned registrant

relating to the offering required to be filed pursuant to Rule 424; (ii) any free writing prospectus relating to the offering prepared

by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) the portion of any other

free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities

provided by or on behalf of the undersigned registrant; and (iv) any other communication that is an offer in the offering made

by the undersigned registrant to the purchaser.

B. The undersigned Registrant hereby undertakes that, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to section

13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration

Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the

Securities Act may be permitted to directors, officers, and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer, or controlling

person of the Registrant in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or

controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all

the requirements for filings on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

CASI PHARMACEUTICALS, INC.

|

|

|

|

|

|

Dated: December 2, 2016

|

|

|

|

|

|

By:

|

/s/ Ken K. Ren

|

|

|

|

|

Ken K. Ren

|

|

|

|

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that the

persons whose signatures appear below constitute and appoint Ken K. Ren, Cynthia W. Hu and Sara B. Capitelli as their true and

lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for them and in their names, places and

steads, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement,

and to sign any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and

any and all amendments thereto, and to file the same, with all exhibits thereto, and the other documents in connection therewith,

with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agent full power and authority to do and

perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes

as they might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or their substitutes,

may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement has been signed below by the following persons on behalf of the registrant and in the

capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/

Ken K. Ren

|

|

Chief Executive Officer and Director

|

|

December 2, 2016

|

|

Ken K. Ren

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/

Sara B. Capitelli

|

|

Principal Accounting Officer

|

|

December 2, 2016

|

|

Sara B. Capitelli

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/

Wei Wu He

|

|

Chairman

|

|

December 2, 2016

|

|

Wei-Wu He

|

|

|

|

|

|

|

|

|

|

|

|

/s/

James Z. Huang

|

|

Director

|

|

December 2, 2016

|

|

James Z. Huang

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Quan Zhou

|

|

Director

|

|

December 2, 2016

|

|

Quan Zhou

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Franklin C. Salisbury, Jr.

|

|

Director

|

|

December 2, 2016

|

|

Franklin C. Salisbury,

Jr.

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Rajesh C. Shrotriya

|

|

Director

|

|

December 2, 2016

|

|

Rajesh C. Shrotriya

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Y. Alexander Wu

|

|

Director

|

|

December 2, 2016

|

|

Y. Alexander Wu

|

|

|

|

|

INDEX TO EXHIBITS

|

Exhibit 4

|

Form of Common Stock Purchase Warrant (included in Exhibit 10.3)

|

|

|

|

|

Exhibit 5

|

Opinion of Arnold & Porter LLP

|

|

|

|

|

Exhibit 10.1

|

Investment Agreement, dated as of September 17, 2014, by and between the Company and Spectrum Pharmaceuticals, Inc. (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on September 19, 2014)

|

|

|

|

|

Exhibit 10.2

|

Investment Agreement, dated as of September 17, 2014, by and between the Company and Spectrum Pharmaceuticals Cayman, L.P. (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on September 19, 2014)

|

|

|

|

|

Exhibit 10.3

|

Form of Securities Purchase Agreement (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on November 13, 2015)

|

|

|

|

|

Exhibit 23.1

|

Consent of CohnReznick LLP, independent registered public accounting firm

|

|

|

|

|

Exhibit 23.2

|

Consent of Arnold & Porter LLP (included in Exhibit 5)

|

|

|

|

|

Exhibit 24

|

Powers of Attorney (included on signature page)

|

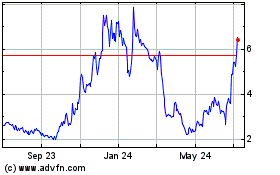

CASI Pharmaceuticals (NASDAQ:CASI)

Historical Stock Chart

From Mar 2024 to Apr 2024

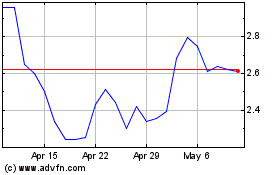

CASI Pharmaceuticals (NASDAQ:CASI)

Historical Stock Chart

From Apr 2023 to Apr 2024