As filed with

the Securities and Exchange Commission on November 7, 2016.

Registration No. 333-208817

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

Amendment No.

1 to

FORM F-1

XTL Biopharmaceuticals Ltd.

(Exact name of registrant as specified

in its charter)

|

Israel

|

2834

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

5 HaCharoshet St.,

Raanana, Israel 43656

Tel: 972-9-955 7080

(Address, including

zip code, and telephone number, including area code, of registrant’s principal executive offices)

c/o Corporation Trust Company

Corporation Trust Center

1209 N. Orange Street

Wilmington, DE 19801

800-677-3394

(Name, Address, including zip code, and

telephone number, including area code, of agent for service)

Copies of all correspondence to:

|

Gregory

Sichenzia, Esq.

|

Ronen

Kantor, Adv.

|

Robert

Charron, Esq.

|

|

Avital Even-Shoshan,

Esq.

|

Doron

Tikotzky Kantor Gutman Cederboum & Co.

|

Ellenoff

Grossman & Schole LLP

|

|

Sichenzia Ross

Ference Kesner LLP

|

12 Abba Hillel

Silver Rd.

|

1345 Avenue

of the Americas

|

|

61 Broadway

|

Ramat

Gan, Israel 52506

|

New

York, NY 10105-0302

|

|

New York, NY

10006

|

Tel: 972-3-6133371

|

Tel: (212)

370-1300

|

|

Tel: (212)

930 9700

|

Fax: 972-3-6133372

|

Fax: (212)

370-7889

|

|

Fax: (212)

930-9725

|

|

|

Approximate date of commencement of proposed sale to the

public:

From time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box.

¨

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering.

¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

|

Proposed

maximum

aggregate

offering

price

(1)(2)(3)

|

|

|

Amount

of

registration

fee

(4)

|

|

|

Ordinary shares, par value NIS 0. 1 per share,

represented by American Depositary Shares

|

|

$

|

|

|

|

$

|

|

|

|

Series A American Depositary Shares Purchase Warrant

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Ordinary

shares underlying the American Depositary Shares issuable upon exercise of the Series A American Depositary Shares Purchase

Warrant

|

|

$

|

|

|

|

$

|

|

|

|

Series B American Depositary Shares Purchase Warrant

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Ordinary

shares underlying the American Depositary Shares issuable upon exercise of the Series B American Depositary Shares Purchase

Warrant

|

|

$

|

|

|

|

$

|

|

|

|

Placement

Agent’s American Depositary Shares Purchase Warrant

(5)

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Ordinary

shares underlying the American Depositary Shares issuable upon exercise of the Placement Agent’s American Depositary

Shares Purchase Warrant

(6)

|

|

$

|

|

|

|

$

|

|

|

|

Total Registration

Fee

|

|

$

|

15,000,000

|

|

|

$

|

1,738.50

|

|

|

|

(1)

|

Estimated solely

for the purpose of calculating the registration fee pursuant to Rule 457(o) under the

Securities Act of 1933, as amended (the “Securities Act”).

|

|

|

(2)

|

American

Depositary Shares, or ADSs, issuable upon deposit of ordinary shares registered hereby

are registered under a separate registration statement on Form F-6 (Registration No.

333- 147677). Each ADS represents twenty (20) ordinary shares.

|

|

|

(3)

|

Pursuant

to Rule 416 under the Securities Act, the ordinary shares registered hereby also include

an indeterminate number of additional ordinary shares as may from time to time become

issuable by reason of stock splits, stock dividends, recapitalizations or other similar

transactions.

|

|

|

(4)

|

The

Registrant previously paid an aggregate of $1,737.08 in the initial filing of this Registration

Statement on December 31, 2015.

|

|

|

(5)

|

No

registration fee required pursuant to Rule 457(g) under the Securities Act.

|

|

|

(6)

|

Estimated solely

for the purpose of calculating the registration fee in accordance with Rule 457(g).

|

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Commission,

acting pursuant to said Section 8(a), may determine.

The information in this

prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are

not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 7, 2016

_______ American Depositary Shares

Series A Warrants to purchase _________

American Depositary Shares

(___________American Depositary Shares

underlying the Series A Warrants)

Pre-Funded Series B Warrants to purchase

_________ American Depositary Shares

(___________American Depositary Shares

underlying the Pre-Funded Series B Warrants)

Each American Depositary Share Represents

Twenty (20) Ordinary Shares

We are offering up to American

Depositary Shares, or ADSs, together with warrants, or the Series A warrants, to purchase up to ADSs

(and the ADSs issuable upon exercise of the Series A warrants). Each ADS we sell in this offering will be accompanied by a Series

A warrant to purchase ADS. The Series A warrants will have an exercise price

of $ per ADS, will be exercisable upon

issuance and have an exercise term of

five

years. Each ADS and accompanying Series A warrant will be sold together at a negotiated price of $

. The ADSs and Series A warrants will be issued separately but can only be purchased together in this offering. Each ADS represents

twenty (20) of our ordinary shares, par value NIS 0.1 per share, or the ordinary shares.

We are also offering pre-funded warrants,

or the Series B warrants, to purchase up to

ADSs (and the ADSs issuable upon exercise of the Series B warrants) together with Series A warrants to purchase

ADSs (and the ADSs issuable upon exercise of the Series A warrants), in lieu of ADSs to the extent that the purchase of ADSs would

cause the beneficial ownership of a purchaser, together with its affiliates and certain related parties, to exceed 4.99%

(or,

at the election of the purchaser, 9.99%)

of our ordinary shares. The Series B warrants will have an exercise price of $0.01

per ADS and will be exercisable upon issuance until exercised in full. Each Series B warrant to purchase one ADS we sell in this

offering will be accompanied by a Series A warrant to purchase ADSs.

Each Series B warrant and accompanying Series A warrant will be sold together at a negotiated price of $

. The Series B warrants and Series A warrants will be issued separately but can only be purchased together in this offering.

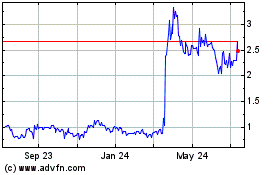

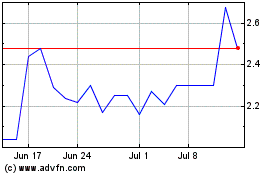

The ADSs are traded on the NASDAQ Capital

Market, or Nasdaq, and our ordinary shares are listed on the Tel-Aviv Stock Exchange, or TASE, under the symbol “XTLB”.

The last reported sale price of the ADSs on Nasdaq was $0.80 per share on November 4, 2016 and the last reported sale price of

our ordinary shares on the TASE on November 4, 2016 was NIS 0.16, or $0.04, per share (based on the exchange rate reported by

the Bank of Israel on that date, which was NIS 3.807 = $1.00

). We

have applied to list the Series A warrants on the NASDAQ Capital Market under the symbol “_____.” There is no assurance

that our application to list the Series A warrants will be approved

. We have not applied and do not intend

to apply to list the Series B warrants on any securities exchange or quotation system, and we do not expect that such warrants

will be quoted on the NASDAQ Capital Market.

Investing in our securities involves

certain significant risks. See “Risk Factors” beginning on page ___ of this prospectus. You should carefully consider

these risk factors, as well as the information contained in this prospectus, before you invest.

None of the Securities and Exchange

Commission, the Israeli Securities Authority or any other state or foreign regulatory body has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We have engaged H.C. Wainwright &

Co., LLC (“Wainwright” or the “Placement Agent”) to act as our exclusive placement agent in connection

with this offering. Wainwright is not purchasing or selling the securities offered by us, and is not required to sell any specific

number or dollar amount of securities, but will use its

“

reasonable best

efforts

”

to arrange for the sale of the securities offered. We have agreed

to pay Wainwright a cash commission fee equal to 7% of the aggregate gross proceeds to us from the sale of the securities in the

offering, except that Wainwright shall receive a cash commission fee of 3.5% for proceeds raised from certain investors previously

identified to

Wainwright

. Wainwright shall also receive a

management

fee equal to 1% of the aggregate gross proceeds

to us

from all investors. Wainwright

may engage one or more sub-agents or selected dealers in connection with this offering. We estimate total expenses of this offering,

excluding the Placement Agent’s fees, will be approximately $ .

Because there is no minimum offering amount required as a condition to closing this offering, the actual public offering amount,

the Placement Agent’s fees, and proceeds to us, if any, are not presently determinable and may be substantially less than

the total maximum offering amounts set forth below. This offering will terminate on

, 2016, unless the offering is fully subscribed before that date or we decide to terminate the offering prior to that date. In

either event, the offering may be closed without further notice to you.

|

|

|

Per ADS and

Series

A Warrant

|

|

|

Per Series B

Warrant

and

Series A

Warrant

|

|

|

Total

|

|

|

Offering Price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Placement Agent’s Fees (1)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to Us (Before Expenses)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

(1) We

have agreed to reimburse the Placement Agent for certain of its expenses

in connection

with this offering

and to

grant to the Placement Agent

ADS purchase warrants

to

purchase up to an aggregate of 5% of the ADSs sold in the offering, including the

ADSs underlying the Series B warrants but excluding the ADSs underlying the Series A warrants

. See “Plan of Distribution”

on page ___ of this prospectus for a description of the compensation payable to the Placement Agent.

Delivery of

the shares will take place on or about

, 2016.

Sole Book-Running

Manager

Rodman

& Renshaw

a unit of H.C. Wainwright & Co.

Prospectus dated

, 2016.

TABLE OF CONTENTS

Neither

we nor the Placement Agent have authorized anyone to provide you with information that is different from that contained in this

prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision

about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus

or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this

prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus

is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation

of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of our securities and the distribution of this prospectus outside the United States.

Unless

otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including

our general expectations and market position, market opportunity and market share, is based on information from our own management

estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third

parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based

on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent

source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our

industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including

those described in "Risk Factors". These and other factors could cause our future performance to differ materially from

our assumptions and estimates. See "Special Note Regarding Forward-Looking Statements".

We are a “foreign

private issuer” as defined in Rule 3b-4 under the Securities Exchange Act of 1934, or the Exchange Act. As a result, our

proxy solicitations are not subject to the disclosure and procedural requirements of Regulation 14A under the Exchange Act and

transactions in our equity securities by our officers and directors are exempt from Section 16 of the Exchange Act. In addition,

we are not required under the Exchange Act to file periodic reports and financial statements as frequently or as promptly as U.S.

companies whose securities are registered under the Exchange Act.

This prospectus

contains trademarks and trade names of XTL Biopharmaceuticals Ltd., including our name and

logo. Other service marks, trademarks

and trade names referred to in this document are the property of their respective owners.

GLOSSARY OF CERTAIN

TERMS

In this prospectus, unless the context otherwise

requires:

|

|

·

|

references

to the American Depositary Shares, which are ordinary shares that have been deposited with the Bank of New York Mellon, or the

“Depositary”;

|

|

|

·

|

references to the “Company,” “we,” “our” and “XTL” refer to XTL Biopharmaceuticals, Ltd., an Israeli company and its consolidated subsidiaries;

|

|

|

·

|

references to the “Companies Law” or “Israeli Companies Law” are to Israel’s Companies Law, 5759-1999, as amended;

|

|

|

·

|

references to “dollars,” “U.S. dollars” and “$” are to United States Dollars;

|

|

|

·

|

references to “ordinary shares,” “our shares” and similar expressions refer to our Ordinary Shares, NIS 0.1 nominal (par) value per share;

|

|

|

·

|

references to “Securities Law” or “Israeli Securities Law” are to Israel Securities Law, 5728-1968, as amended;

|

|

|

·

|

references to “shekels” and “NIS” are to New Israeli Shekels, the Israeli currency; and

|

|

|

·

|

references to the “SEC” are to the United States Securities and Exchange Commission.

|

PROSPECTUS SUMMARY

This summary

highlights selected information presented in greater detail elsewhere in this prospectus. This summary does not include all the

information you should consider before investing in our securities. Before investing in our securities, you should read this entire

prospectus carefully for a more complete understanding of our business and this offering, including our audited and unaudited

financial statements and related notes and the sections titled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations.”

Business Overview

We are a biopharmaceutical

company engaged in the acquisition and development of pharmaceutical drugs for the treatment of autoimmune diseases. Our current

drug development program is focused on hCDR1 for the treatment of systemic lupus erythematosus, or SLE.

Our lead drug candidate

is hCDR1, a Phase II-ready asset for the treatment of SLE, the most prominent type of lupus. There is currently no known cure for

SLE. Only one new treatment, Benlysta, has been approved by the U.S. Food and Drug Administration, or FDA, in the last 50 years

for SLE. Lupus is a chronic autoimmune disease involving many systems in the human body, including joints, kidneys, the central

nervous system, heart, the hematological system and others. The biologic basis of the disease is a defect in the immune (defense)

system, leading to production of self (auto) antibodies, attacking healthy organs and causing irreversible damage. According to

research estimates of the Lupus Foundation of America, at least 1.5 million Americans have the disease (more than 5 million worldwide)

with more than 16,000 new cases diagnosed each year in the United States.

hCDR1 is a peptide

that is administered subcutaneously and acts as a disease-specific treatment to modify the SLE-related autoimmune process. It

does so by specific upstream immunomodulation through the generation of regulatory T cells, reducing inflammation and resuming

immune balance. More than 40 peer-reviewed papers have been published on hCDR1. Two placebo controlled Phase I trials and a placebo

controlled Phase 2 trial, or the PRELUDE trial, were conducted by Teva Pharmaceutical Industries, Ltd., or Teva, which had previously

in-licensed hCDR1 from Yeda Research and Development, or Yeda. The studies consisted of over 400 patients and demonstrated that

hCDR1 is well tolerated by patients and has a favorable safety profile. The PRELUDE trial did not achieve its primary efficacy

endpoint based on the SLE Disease Activity Index, or SLEDAI scale, resulting in Teva returning the asset to Yeda. However, the

PRELUDE trial showed encouraging results in its secondary clinical endpoint, the British Isles Lupus Activity Group index, or

BILAG index, and, in fact, the 0.5 mg weekly dose showed a substantial effect. Multiple post-hoc analyses also showed impressive

results for this dose using the BILAG index. Such dose will be the focus of the clinical development plan moving forward. Subsequent

to Teva’s return of the program to Yeda, the FDA directed that the primary endpoint in future trials for Lupus therapies,

including those for hCDR1, should be based on either the BILAG index or the SLE Responder Index (“SRI”). The FDA has

provided the Company with written guidance confirming the acceptability of BILAG as the primary endpoint in our planned study.

Given the FDA’s recommendation and the positive findings from the PRELUDE trial (which showed a substantial effect in the

BILAG index), we intend to initiate a new advanced clinical trial, which will include the 0.5 mg dose..

Our

second drug candidate is recombinant human erythropoietin, or rHuEPO, which we have licensed from Yeda, and Mor Research Applications,

or Mor, for the extension of survival of patients with advanced/end-stage multiple myeloma. Multiple myeloma is a severe and incurable

malignant hematological cancer of plasma cells. A clinical observation confirmed the high success rate of rHuEPO in treating the

anemia in patients with multiple myeloma. Six patients with very poor prognostic features of multiple myeloma, whose expected

survival was less than six months continued treatment with rHuEPO beyond the initial designed 12 week period, and they lived for

45–133 months cumulatively with the multiple myeloma diagnosis and 38–94 months with rHuEPO (with a good quality of

life). We were granted an Orphan-drug designation from the FDA in May 2011, for rHuEPO.

As our focus is currently

on the development of our lead drug candidate, we do not anticipate conducting material research and development activities for

rHuEPO before 2017 and are exploring opportunities to sell or license rHuEPO or collaborate with partners in its development.

Our Strategy

Our objective is

to be a leading biopharmaceutical company engaged in the acquisition and development of pharmaceutical products for the treatment

of autoimmune diseases.

Under our current near-term

strategy with respect to our pharmaceutical and biopharmaceutical products, we plan to:

|

|

·

|

initiate

an international, prospective advanced clinical study intended to assess the safety and efficacy of hCDR1 when given to patients

with SLE;

|

|

|

·

|

continually build our pipeline of therapeutic candidates; and

|

|

|

·

|

develop collaborations with large pharmaceutical companies to sublicense/develop, and market our hCDR1 and rHuEPO drug development programs.

|

Recent Developments

Registered Direct

Offering

In April 2015, we entered

into security purchase agreements providing for the issuance of an aggregate of 1,777,778 ADSs representing 35,555,560 ordinary

shares in a registered direct offering at $2.25 per ADS for aggregate gross proceeds of $4,000,000. In addition, we issued unregistered

warrants to purchase 888,889 ADSs representing 17,777,778 ordinary shares in a private placement. At the closing, we also issued

placement agent warrants to purchase up to 89,888 ADSs representing 1,797,760 ordinary shares. The warrants may be exercised at

any time for a period of five and one-half years from issuance and have an exercise price of $2.25 per ADS, subject to adjustment

as set forth therein.

InterCure Transactions

In July 2012, we

acquired control of InterCure Ltd, or InterCure, a public company whose shares are traded on the TASE and which develops a home

therapeutic device for non-medicinal and non-invasive treatment of various diseases such as hypertension, heart failure, sleeplessness

and mental stress and markets and sells a home therapeutic device for hypertension. As a result of a series of transactions including

a transaction, that closed in February 2015, between InterCure and Green Forest Global Ltd., or Green Forest, a company wholly

owned by Mr. Alexander Rabinovitch (a greater than 5% shareholder of ours), our holdings in InterCure were diluted to approximately

5%. See “Certain Relationships and Related Party Transactions” on page 55.

Risk Factors

Our business is

subject to numerous risks, as more fully described in the section titled “Risk Factors” immediately following this

prospectus summary. You should read and carefully consider these risks and all of the other information in this prospectus, including

the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in our

securities. In particular, such risks include, but are not limited to, the following:

|

|

·

|

We have incurred substantial operating losses since our inception and expect to continue to incur losses in the future in our drug development activity and may never become profitable.

|

|

|

·

|

We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

|

|

|

·

|

We have not yet commercialized any products or technologies, and we may never become profitable.

|

|

|

·

|

We have limited experience in conducting and managing clinical trials necessary to obtain regulatory approvals. If our drug candidates and technologies do not receive the necessary regulatory approvals, we will be unable to commercialize our products.

|

|

|

·

|

Even if we or our collaborative/strategic partners or potential collaborative/strategic partners receive approval to market our drug candidates, if our products fail to achieve market acceptance, we will never record meaningful revenues. We might be unable to develop product candidates that will achieve commercial success in a timely and cost-effective manner, or ever.

|

|

|

·

|

Any acquisitions or in-licensing transactions we make may dilute your equity or require a significant amount of our available cash and may not be scientifically or commercially successful.

|

|

|

·

|

Because all of our proprietary drug candidates and technologies are licensed to us by third parties, termination of these license agreements could prevent us from developing our drug candidates.

|

|

|

·

|

Our U.S. shareholders may suffer adverse tax consequences if we are characterized as a passive foreign investment company, or PFIC.

|

Implications of being a Foreign Private Issuer

We are subject to the

information reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, that are applicable to “foreign

private issuers,” and under those requirements we file reports with the SEC. As a foreign private issuer, we are not subject

to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting

obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For

example, although we report our financial results on a quarterly basis, we will not be required to issue quarterly reports, proxy

statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation

information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of

each fiscal year to file our annual reports with the SEC and will not be required to file current reports as frequently or promptly

as U.S. domestic reporting companies. We may also present financial statements pursuant to IFRS instead of pursuant to U.S. generally

accepted accounting principles, or U.S. GAAP. Furthermore, although the members of our management and supervisory boards will be

required to notify the Israeli Securities Authority of certain transactions they may undertake, including with respect to our ordinary

shares, our officers, directors and principal shareholders will be exempt from the requirements to report transactions in our equity

securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private

issuer, we are also not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. These

exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those

applicable to a U.S. domestic reporting companies.

Our Corporate Information

Our legal and commercial

name is XTL Biopharmaceuticals Ltd. We are incorporated in the State of Israel. Our principal offices are located at 5 HaCharoshet

St., Raanana 4365603, Israel, and our telephone number is +972-9-955-7080. Our primary internet address is

www.xtlbio.com

. None of the information on our website is part of this prospectus or the registration statement of which they are a part and

no portion of such information is incorporated herein. For further information regarding us and our financial information, you

should refer to our recent filings with the SEC. See “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.”

THE OFFERING

|

Securities

offered by us

|

Up

to ADSs, pre-funded Series B warrants to purchase up to ADSs

,

and Series A warrants to purchase up to ADSs.

|

|

Description

of Series A Warrants

|

The

ADSs or Series B warrants, as applicable, and Series A warrants will be sold together as one ADS or a Series B warrant to

purchase one ADS, as applicable, and one Series A warrant to purchase one ADS. The ADSs or Series B warrants, as applicable,

and the Series A warrants are immediately separable upon issuance. Each Series A warrant will have an exercise price of $ per

share, will be exercisable upon issuance and will expire years from the date of issuance.

|

|

Description

of Pre-funded Series B Warrants

|

The

pre-funded Series B warrants are being issued to prevent the beneficial ownership of a purchaser in this offering (together

with its affiliates and certain related parties) of our ordinary shares from exceeding 4.99%

(or, at the election of the purchaser, 9.99%)

. Each Series B warrant will have an exercise price of $ per

ADS, will be exercisable upon issuance and will expire only when exercised in full. As stated above, purchasers of Series

B warrants will also receive Series A warrants as if such purchasers were buying ADSs in this offering.

|

|

Ordinary

shares outstanding immediately after this offering

|

ordinary

shares (including ordinary shares represented by the ADSs issuable upon exercise of the Series A warrants, Series

B warrants and warrant issued to the Placement Agent)

|

|

Depositary

|

The

Bank of New York Mellon, Depositary

|

|

|

|

|

Use

of proceeds

|

We intend to

use the net proceeds from this offering to continue the development of hCDR1, our leading drug candidate and for working capital

and other general corporate purposes. See “Use of Proceeds”.

|

|

NASDAQ

Capital Market Symbol for ADSs

|

XTLB

|

|

|

|

|

Proposed

NASDAQ Capital Market Symbol for Series A warrants

|

_______

|

|

|

|

|

Risk

Factors

|

You should read

the “Risk Factors” section starting on page ___ of this prospectus for a discussion of factors to consider before

deciding to invest in our securities.

|

The number of ordinary

shares that will be outstanding immediately after this offering is based on 274,205,799 ordinary shares outstanding as of November

4, 2016. This number excludes, as of such date:

|

|

·

|

19,222,220

ordinary shares represented by 961,111 ADSs issuable upon the exercise of warrants at

a weighted average exercise price of $2.29;

|

|

|

·

|

7,390,000

ordinary shares issuable upon the exercise of stock options at a weighted average exercise

price of $0.56 per share;

|

|

|

·

|

3,280,000 ordinary

shares reserved for future issuances under our stock option and incentive plans;

|

|

|

|

|

|

|

·

|

ordinary

shares represented by ADSs issuable

upon the exercise of Series A warrants issued in this offering at an exercise price of $ per

ADS;

|

|

|

|

|

|

|

·

|

ordinary

shares represented by ADSs issuable

upon the exercise of Series B warrants issued in this offering at an exercise price of $0.01 per ADS; and

|

|

|

·

|

ordinary

shares underlying the ADS purchase warrant to be issued to the Placement Agent in connection

with this offering, at an exercise price of per

ADS.

|

Unless otherwise

indicated, all information in this prospectus assumes or gives effect to no exercise of outstanding options or warrants described

above, including the Placement Agent’s ADS purchase warrant.

SELECTED FINANCIAL DATA

The following tables

summarize our financial data. We have derived the following selected consolidated operating data for the years ended December

31, 2015, 2014 and 2013 and the selected consolidated balance sheet data as of December 31, 2015 and 2014, from our audited consolidated

financial statements, included elsewhere in this prospectus. We have derived the summary consolidated operating data for the years

ended December 31, 2012 and 2011 and the selected consolidated balance sheet data as of December 31, 2013, 2012 and 2011 from

our audited consolidated financial statements not included in this prospectus. The selected financial data as of June 30, 2016

and for the six months ended June 30, 2016 and 2015 are derived from our unaudited interim financial statements that are included

elsewhere in this prospectus. In the opinion of management, these unaudited interim financial statements include all adjustments,

consisting of normal recurring adjustments, necessary for a fair statement of our financial position and operating results for

these periods. Results from interim periods are not necessarily indicative of results that may be expected for the entire year.

Our historical results are not necessarily indicative of the results that may be expected in the future.

Our consolidated financial

statements included in this prospectus were prepared in United States dollars in accordance with IFRS, as issued by the International

Accounting Standards Board.

The following summary

financial data should be read in conjunction with “Management's Discussion and Analysis of Financial Condition and Results

of Operations” and our financial statements and related notes included elsewhere in this prospectus.

Operating Data:

|

|

|

Unaudited

Six

months ended

June 30,

|

|

|

Audited

Year

ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

|

|

U.S Dollars in thousands,

except share and per share data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

(355

|

)

|

|

|

(111

|

)

|

|

|

(578

|

)

|

|

|

(278

|

)

|

|

|

(82

|

)

|

|

|

(92

|

)

|

|

|

(158

|

)

|

|

General and administrative expenses

|

|

|

(713

|

)

|

|

|

(746

|

)

|

|

|

(1,419

|

)

|

|

|

(1,744

|

)

|

|

|

(1,329

|

)

|

|

|

(2,448

|

)

|

|

|

(1,078

|

)

|

|

Impairment of intangible assets

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,604

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Other gains (loss), net

|

|

|

-

|

|

|

|

-

|

|

|

|

(10

|

)

|

|

|

-

|

|

|

|

1,059

|

|

|

|

802

|

|

|

|

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(1,068

|

)

|

|

|

(857

|

)

|

|

|

(3,611

|

)

|

|

|

(2,022

|

)

|

|

|

(352

|

)

|

|

|

(1,738

|

)

|

|

|

(1,224

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income

|

|

|

19

|

|

|

|

19

|

|

|

|

4

|

|

|

|

41

|

|

|

|

114

|

|

|

|

55

|

|

|

|

24

|

|

|

Finance expenses

|

|

|

(5

|

)

|

|

|

(205

|

)

|

|

|

(15

|

)

|

|

|

(138

|

)

|

|

|

(55

|

)

|

|

|

(5

|

)

|

|

|

(7

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income (expenses), net

|

|

|

14

|

|

|

|

(186

|

)

|

|

|

(11

|

)

|

|

|

(97

|

)

|

|

|

59

|

|

|

|

50

|

|

|

|

(17

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (losses) from investment in associate

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(845

|

)

|

|

|

569

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

|

(1,054

|

)

|

|

|

(1,043

|

)

|

|

|

(3,622

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Loss from discontinued operation

|

|

|

-

|

|

|

|

(460

|

)

|

|

|

(689

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Total loss for the period

|

|

|

(1,054

|

)

|

|

|

(1,503

|

)

|

|

|

(4,311

|

)

|

|

|

(2,119

|

)

|

|

|

(1,138

|

)

|

|

|

(1,119

|

)

|

|

|

(1,207

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of marketable securities

|

|

|

111

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Items that might be classified to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

108

|

|

|

|

114

|

|

|

|

-

|

|

|

Reclassification of foreign currency translation adjustments to other

gains, net

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(221

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Total other comprehensive income

|

|

|

111

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

(113

|

)

|

|

|

114

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss from continuing operations

|

|

|

(943

|

)

|

|

|

(1,043

|

)

|

|

|

(3,622

|

)

|

|

|

(2,119

|

)

|

|

|

(1,251

|

)

|

|

|

(1,005

|

)

|

|

|

(1,207

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loss from discontinued operations

|

|

|

-

|

|

|

|

(460

|

)

|

|

|

(689

|

)

|

|

|

(746

|

)

|

|

|

(2,575

|

)

|

|

|

(623

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss for the period

|

|

|

(943

|

)

|

|

|

(1,503

|

)

|

|

|

(4,311

|

)

|

|

|

(2,865

|

)

|

|

|

(3,826

|

)

|

|

|

(1,628

|

)

|

|

|

(1,207

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the Company

|

|

|

(1,054

|

)

|

|

|

(1,505

|

)

|

|

|

(4,313

|

)

|

|

|

(2,527

|

)

|

|

|

(2,476

|

)

|

|

|

(1,390

|

)

|

|

|

(1,207

|

)

|

|

Non-controlling interests

|

|

|

-

|

|

|

|

2

|

|

|

|

2

|

|

|

|

(338

|

)

|

|

|

(1,237

|

)

|

|

|

(352

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,054

|

)

|

|

|

(1,503

|

)

|

|

|

(4,311

|

)

|

|

|

(2,865

|

)

|

|

|

(3,713

|

)

|

|

|

(1,742

|

)

|

|

|

(1,207

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss for the period attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the Company

|

|

|

(943

|

)

|

|

|

(1,505

|

)

|

|

|

(4,313

|

)

|

|

|

(2,527

|

)

|

|

|

(2,589

|

)

|

|

|

(1,276

|

)

|

|

|

(1,207

|

)

|

|

Non-controlling interests

|

|

|

-

|

|

|

|

2

|

|

|

|

2

|

|

|

|

(338

|

)

|

|

|

(1,237

|

)

|

|

|

(352

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(943

|

)

|

|

|

(1,503

|

)

|

|

|

(4,311

|

)

|

|

|

(2,865

|

)

|

|

|

(3,826

|

)

|

|

|

(1,628

|

)

|

|

|

(1,207

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss from continuing and discontinued operations (in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From continuing operations

|

|

|

(0.004

|

)

|

|

|

(0.004

|

)

|

|

|

(0.014

|

)

|

|

|

(0.009

|

)

|

|

|

(0.005

|

)

|

|

|

(0.005

|

)

|

|

|

(0.006

|

)

|

|

From discontinued operations

|

|

|

-

|

|

|

|

(0.002

|

)

|

|

|

(0.003

|

)

|

|

|

(0.002

|

)

|

|

|

(0.006

|

)

|

|

|

(0.001

|

|

|

|

-

|

|

|

Basic and diluted loss per share (in U.S. dollars)

|

|

|

(0.004

|

)

|

|

|

(0.006

|

)

|

|

|

(0.017

|

)

|

|

|

(0.011

|

)

|

|

|

(0.011

|

)

|

|

|

(0.006

|

)

|

|

|

(0.006

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of issued ordinary shares

|

|

|

273,862,042

|

|

|

|

253,717,462

|

|

|

|

263,730,467

|

|

|

|

231,224,512

|

|

|

|

223,605,181

|

|

|

|

217,689,926

|

|

|

|

201,825,645

|

|

Balance Sheet Data:

|

|

|

As of June 30,

|

|

|

As of December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

|

|

U.S Dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and bank deposits

|

|

|

2,605

|

|

|

|

3,817

|

|

|

|

2,159

|

|

|

|

4,165

|

|

|

|

3,312

|

|

|

|

1,495

|

|

|

Total assets

|

|

|

4,337

|

|

|

|

5,323

|

|

|

|

5,644

|

|

|

|

8,015

|

|

|

|

11,086

|

|

|

|

4,073

|

|

|

Long term liabilities

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

11

|

|

|

|

13

|

|

|

|

-

|

|

|

Total shareholders’ equity

|

|

|

4,079

|

|

|

|

4,887

|

|

|

|

4,660

|

|

|

|

6,265

|

|

|

|

7,353

|

|

|

|

3,444

|

|

|

Non-controlling interests

|

|

|

-

|

|

|

|

-

|

|

|

|

19

|

|

|

|

520

|

|

|

|

2,071

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital*

|

|

|

2,959

|

|

|

|

3,829

|

|

|

|

2,102

|

|

|

|

3,870

|

|

|

|

2,143

|

|

|

|

955

|

|

* Working capital means total current assets

minus total current liabilities.

RISK FACTORS

Before you invest

in our securities, you should understand the high degree of risk involved. You should carefully consider the risks described below

and other information in this prospectus, including our financial statements and related notes included elsewhere in this prospectus,

before you decide to purchase our securities. If any of the following risks actually occur, our business, financial condition

and operating results could be adversely affected. As a result, the trading price of our ordinary shares or ADSs could decline

and you could lose part or all of your investment.

Risks Related to Our Financial Position

and Capital Requirements

We have incurred substantial operating

losses since our inception. We expect to continue to incur losses in the future in our drug development activity and may never

become profitable.

You should consider

our prospects in light of the risks and difficulties frequently encountered by development stage companies. We have incurred operating

losses since our inception and expect to continue to incur operating losses for the foreseeable future. We have not yet commercialized

any of our drug candidates or technologies and cannot be sure we will ever be able to do so. Even if we commercialize one or more

of our drug candidates or technologies, we may not become profitable. Our ability to achieve profitability depends on a number

of factors, including our ability to complete our development efforts, consummate out-licensing agreements, obtain regulatory approval

for our drug candidates and technologies and successfully commercialize them.

We expect to continue

to incur losses for the foreseeable future, and these losses will likely increase as we:

|

|

●

|

initiate and manage pre-clinical development and clinical trials for our current and new product candidates;

|

|

|

|

|

|

|

●

|

seek regulatory approvals for our product candidates;

|

|

|

|

|

|

|

●

|

implement internal systems and infrastructures;

|

|

|

|

|

|

|

●

|

seek to license additional technologies to develop;

|

|

|

|

|

|

|

●

|

hire management and other personnel; and

|

|

|

|

|

|

|

●

|

progress product candidates towards commercialization.

|

If our product candidates

fail in clinical trials or do not gain regulatory clearance or approval, or if our product candidates do not achieve market acceptance,

we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on

a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial

condition, results of operations and cash flows. Moreover, our prospects must be considered in light of the risks and uncertainties

encountered by an early-stage company and in highly regulated and competitive markets, such as the biopharmaceutical market, where

regulatory approval and market acceptance of our products are uncertain. There can be no assurance that our efforts will ultimately

be successful or result in revenues or profits.

We will require substantial additional

financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce

or terminate our product development or commercialization efforts.

As of June 30,

2016, we had approximately $2,605,000 in cash, cash equivalents and bank deposits, working capital of approximately $2,959,000

and an accumulated deficit of approximately $153,460,000. We have incurred continuing losses and depend on outside financing resources

to continue our activities. Based on existing business plans, we estimate that our outstanding cash and cash equivalent balances,

as of November 4, 2016, will allow us to finance our activities for an additional period of at least 12 months from the date of

this prospectus. In order to perform clinical trials aimed at developing our product until obtaining its marketing approval, we

will need to raise additional financing by issuing securities. Should we fail to raise additional capital under terms acceptable

to us, we will be required to reduce our development activities or sell or grant a sublicense to third parties to use all or part

of our technologies.

We have expended and

believe that we will continue to expend significant operating and capital expenditures for the foreseeable future developing our

product candidates. These expenditures will include, but are not limited to, costs associated with research and development, manufacturing,

conducting preclinical experiments and clinical trials, contracting CMOs and CROs, hiring additional management and other personnel

and obtaining regulatory approvals, as well as commercializing any products approved for sale. Because the outcome of our planned

and anticipated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully

complete the development and commercialization of our product candidates and any other future product. In addition, other unanticipated

costs may arise. As a result of these and other factors currently unknown to us, upon closing of this offering we will require

additional funds, through public or private equity or debt financings or other sources, such as strategic partnerships and alliances

and licensing arrangements. In addition, we may seek additional capital due to favorable market conditions or strategic considerations

even if we believe we have sufficient funds for our current or future operating plans. A failure to fund these activities may harm

our growth strategy, competitive position, quality compliance and financial condition.

Our future capital

requirements depend on many factors, including:

|

|

·

|

the number and characteristics of products we develop;

|

|

|

·

|

the scope, progress, results and costs of researching and developing our product candidates and conducting preclinical and clinical trials;

|

|

|

·

|

the timing of, and the costs involved in, obtaining regulatory approvals;

|

|

|

·

|

the cost of commercialization activities if any are approved for sale, including marketing, sales and distribution costs;

|

|

|

·

|

the cost of manufacturing any product candidate we successfully commercialize;

|

|

|

·

|

our ability to establish and maintain strategic partnerships, licensing, supply or other arrangements and the financial terms of such agreements;

|

|

|

·

|

the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation costs and the outcome of such litigation;

|

|

|

·

|

hCDR1 patent expiration in 2024 and failure to obtain patent term extension, expand patent protection or obtain data exclusivity in the U.S. and Europe;

|

|

|

·

|

rHuEPO patent expiration in 2019 and failure to retain orphan drug designation in the U.S. or obtain orphan drug designation in Europe;

|

|

|

·

|

the costs of in-licensing further patents and technologies.

|

|

|

·

|

the cost of development of in-licensed technologies

|

|

|

·

|

the timing, receipt and amount of sales of, or royalties on, any future products;

|

|

|

·

|

the expenses needed to attract and retain skilled personnel; and

|

|

|

·

|

any product liability or other lawsuits related to existing and/or any future products.

|

Additional funds may

not be available when we need them, on terms that are acceptable to us, or at all. If adequate funds are not available to us on

a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other research

and development activities for our product candidates or delay, limit, reduce or terminate our establishment of sales and marketing

capabilities or other activities that may be necessary to commercialize our product candidates or any future products.

Raising additional capital may cause

dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product

candidates.

We may seek additional

capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances and

licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities,

the ownership interests of existing shareholders will be diluted, and the terms may include liquidation or other preferences that

adversely affect shareholder rights. Debt financing, if available, may involve agreements that include covenants limiting or restricting

our ability to take certain actions, such as incurring debt, making capital expenditures or declaring dividends. If we raise additional

funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable

rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If we are unable to

raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our

product development or commercialization efforts or grant rights to develop and market product candidates that we would otherwise

prefer to develop and market ourselves.

Risks Related to our Drug Development

Business

We have not yet commercialized any

products or technologies, and we may never become profitable.

We have not yet commercialized

any products or technologies, and we may never be able to do so. We do not know when or if we will complete any of our product

development efforts, obtain regulatory approval for any product candidates incorporating our technologies or successfully commercialize

any approved products. Even if we are successful in developing products that are approved for marketing, we will not be successful

unless these products gain market acceptance for appropriate indications at favorable reimbursement rates. The degree of market

acceptance of these products will depend on a number of factors, including:

|

|

●

|

the

timing of regulatory approvals in the countries, and for the uses, we seek;

|

|

|

●

|

the competitive environment;

|

|

|

●

|

the establishment and demonstration in the medical community of the safety and clinical efficacy of our products and their potential advantages over existing therapeutic products;

|

|

|

●

|

our ability to enter into strategic agreements with pharmaceutical and biotechnology companies with strong marketing and sales capabilities;

|

|

|

●

|

the adequacy and success of distribution, sales and marketing efforts; and

|

|

|

●

|

the pricing and reimbursement policies of government and third-party payors, such as insurance companies, health maintenance organizations and other plan administrators.

|

Physicians, patients,

third-party payors or the medical community in general may be unwilling to accept, utilize or recommend, and in the case of third-party

payors, cover any of our products or products incorporating our technologies. As a result, we are unable to predict the extent

of future losses or the time required to achieve profitability, if at all. Even if we successfully develop one or more products

that incorporate our technologies, we may not become profitable.

If we are unable to successfully

complete our clinical trial programs for our drug candidates, or if such clinical trials take longer to complete than we project,

our ability to execute our current business strategy will be adversely affected.

Whether or not and

how quickly we complete clinical trials depends in part upon the rate at which we are able to engage clinical trial sites and,

thereafter, the rate of enrollment of patients, and the rate at which we are able to collect, clean, lock and analyze the clinical

trial database. Patient enrollment is a function of many factors, including the size of the patient population, the proximity of

patients to clinical sites, the eligibility criteria for the study, the existence of competitive clinical trials, and whether existing

or new drugs are approved for the indication we are studying. We are aware that other companies are planning clinical trials that

will seek to enroll patients with the same diseases and stages as we are studying. If we experience delays in identifying and contracting

with sites and/or in patient enrollment in our clinical trial programs, we may incur additional costs and delays in our development

programs, and may not be able to complete our clinical trials on a cost-effective or timely basis.

We have limited experience in conducting

and managing clinical trials necessary to obtain regulatory approvals. If our drug candidates and technologies do not receive the

necessary regulatory approvals, we will be unable to commercialize our products.

We have not received,

and may never receive, regulatory approval for commercial sale for hCDR1 or rHuEPO. We currently do not have any drug candidates

pending approval with the Food and Drug Administration, or FDA or with regulatory authorities of other countries. We will need

to conduct significant additional research and human testing before we can apply for product approval with the FDA or with regulatory

authorities of other countries. In order to obtain FDA approval to market a new drug product, we or our potential partners must

demonstrate proof of safety and efficacy in humans. To meet these requirements, we and/or our potential partners will have to conduct

“adequate and well-controlled” clinical trials.

Clinical development

is a long, expensive and uncertain process. Clinical trials are very difficult to design and implement, in part because they are

subject to rigorous regulatory requirements. Satisfaction of regulatory requirements typically depends on the nature, complexity

and novelty of the product and requires the expenditure of substantial resources. The commencement and rate of completion of clinical

trials may be delayed by many factors, including:

|

|

·

|

obtaining regulatory approvals to commence a clinical trial;

|

|

|

·

|

reaching agreement on acceptable terms with prospective CROs, and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

|

|

|

·

|

slower than expected rates of patient recruitment due to narrow screening requirements and competing clinical studies;

|

|

|

·

|

the inability of patients to meet protocol requirements imposed by the FDA or other regulatory authorities;

|

|

|

·

|

the need or desire to modify our manufacturing process;

|

|

|

·

|

delays, suspension, or termination of the clinical trials due to the institutional review board responsible for overseeing the study at a particular study site; and

|

|

|

·

|

governmental or regulatory delays or “clinical holds” requiring suspension or termination of the trials.

|

Following the completion

of a clinical trial, regulators may not interpret data obtained from pre-clinical and clinical tests of our drug candidates and

technologies the same way that we do, which could delay, limit or prevent our receipt of regulatory approval. In addition, the

designs of any clinical trials may not be reviewed or approved by the FDA prior to their commencement, and consequently the FDA

could determine that the parameters of any studies are insufficient to demonstrate proof of safety and efficacy in humans. Failure

to approve a completed study could also result from several other factors, including unforeseen safety issues, the determination

of dosing, low rates of patient recruitment, the inability to monitor patients adequately during or after treatment, the inability

or unwillingness of medical investigators to follow our clinical protocols, and the lack of effectiveness of the trials.

Additionally, the regulators

could determine that the studies indicate the drugs may have serious side effects. In the U.S., this is called a black box warning,

which is a type of warning that appears on the package insert for prescription drugs indicating that they may cause serious adverse

effects. A black box warning means that medical studies indicate that the drug carries a significant risk of serious or even life-threatening

adverse effects.

If the clinical trials

fail to satisfy the criteria required, the FDA and/or other regulatory agencies/authorities may request additional information,

including additional clinical data, before approval of marketing a product. Negative or inconclusive results or medical events

during a clinical trial could also cause us to delay or terminate our development efforts. If we experience delays in the testing

or approval process, or if we need to perform more or larger clinical trials than originally planned, our financial results and

the commercial prospects for our drug candidates and technologies may be materially impaired.

Clinical trials have

a high risk of failure. A number of companies in the pharmaceutical industry, including biotechnology companies, have suffered

significant setbacks in clinical trials, even after achieving promising results in earlier trials. It may take us many years to