OSI Systems, Inc. (NASDAQ:OSIS) today announced financial results

for the quarter ended September 30, 2016.

Deepak Chopra, OSI Systems’ Chairman and CEO,

stated, “We are pleased to report solid fiscal first quarter

performance, including record-breaking revenue. Further, on

September 9, 2016 we completed our acquisition of American Science

and Engineering, Inc. (“AS&E”) and we have been making solid

progress in integrating AS&E’s operations into our Security

division.”

The Company reported revenues of $220.9 million

for the first quarter of fiscal 2017, an increase of 10% from the

$200.1 million reported for the first quarter of fiscal 2016. Net

income for the first quarter of fiscal 2017 was $0.7 million, or

$0.03 per diluted share, compared to net income of $10.8 million,

or $0.53 per diluted share, for the first quarter of fiscal 2016.

Non-GAAP net income (excluding the impact of impairment,

restructuring and other charges and amortization of acquired

intangible assets, net of related tax impact thereof) for the first

quarter of fiscal 2017 was $8.7 million, or $0.44 per diluted

share, compared to non-GAAP net income for the first quarter of

fiscal 2016 of $11.2 million, or $0.55 per diluted share.

During the quarter ended September 30, 2016, the

Company's book-to-bill ratio for equipment and related services

(non-turnkey) was 1.1, and as of September 30, 2016 the Company's

backlog (measured as quantifiable purchase orders or contracts that

have been signed for which revenues are expected to be recognized

within the next five years) was $725 million.

Mr. Chopra further commented, “Our Security

division achieved record first quarter revenues of $123.7 million,

of which $14.2 million was generated by our newly acquired

subsidiary, AS&E. Excluding the revenues generated by AS&E,

sales in our Security division increased 14% over sales in the same

prior-year quarter, and the non-turnkey book-to-bill ratio for the

Security division was 1.2. This organic sales growth, coupled with

the acquisition of AS&E, makes us optimistic that fiscal 2017

will be a strong year for our Security division.”

Mr. Chopra concluded, “We continued in the first

fiscal quarter to face challenges in our Healthcare division with

year-over-year sales down 11%. We are making progress in many

aspects of the business and are optimistic about improving

performance of this division.”

Fiscal Year 2017 Outlook

Subject to risks described in this press

release, the Company is raising its fiscal 2017 sales guidance to

$955 million - $990 million. The updated revenue guidance includes

approximately $90 million attributable to the acquisition of

AS&E. In addition, the Company is increasing to $2.80 - $3.20

per diluted share its non-GAAP earnings guidance, which excludes

the impact of impairment, restructuring and other charges and

amortization of acquired intangible assets, net of their related

tax impact.

Actual sales and non-GAAP diluted earnings per

share could vary from this guidance including as a result of the

matters discussed under the “Forward-Looking Statements”

section.

The Company’s fiscal 2017 diluted earnings per

share guidance is provided on a non-GAAP basis only. The

Company does not provide a reconciliation of non-GAAP diluted EPS

guidance on a forward-looking basis to diluted EPS, the most

directly comparable GAAP measure, because it is unable to provide a

meaningful or accurate compilation of reconciling items or the

information is not available without unreasonable effort.

This is due primarily to year-over-year variability or the

difficulty in making accurate forecasts and projections of

impairment, restructuring and other charges and amortization of

acquired intangible assets and their related tax effects.

Presentation of Non-GAAP Financial

Measures

This earnings release includes a presentation of

non-GAAP net income, non-GAAP diluted earnings per share and

non-GAAP operating income (loss) by segment, all of which are

non-GAAP financial measures. The presentation of these non-GAAP

figures for the three months ended September 30, 2015 and 2016 is

provided to allow for the comparison of the underlying performance

of the Company, net of impairment, restructuring and other charges

and the amortization of intangible assets acquired through

business acquisitions, and their associated tax effects when

applicable. Management believes that these non-GAAP financial

measures provide (i) additional insight into the ongoing operations

of the Company, (ii) meaningful supplemental information regarding

the Company’s results excluding amounts management does not

view as reflective of ongoing operating results when planning and

forecasting and when assessing the performance of the business and

(iii) a meaningful comparison against results for past periods of

results for current periods and guidance for future periods.

Non-GAAP financial measures should not be considered in isolation

or as a substitute for measures of financial performance prepared

in accordance with GAAP.

Reconciliations of GAAP to non-GAAP financial

information are provided in the accompanying tables.

The financial results calculated in accordance with GAAP and

reconciliations from those financial results should be carefully

evaluated.

Conference Call Information

OSI Systems, Inc. will host a conference call

and simultaneous webcast over the Internet beginning at 1:30pm PT

(4:30pm ET) today to discuss its results for the first quarter of

fiscal 2017. To listen, please visit the Investor Relations section

of the OSI Systems website,

http://investors.osi-systems.com/index.cfm and follow the link that

will be posted on the front page. A replay of the webcast will be

available shortly after the conclusion of the conference call until

November 10, 2016. The replay can either be accessed through the

Company’s website, www.osi-systems.com, or via telephonic replay by

calling 1-855-859-2056 and entering the conference call

identification number '6513459’ when prompted for the replay

code.

About OSI Systems, Inc.

OSI Systems, Inc. is a vertically integrated

designer and manufacturer of specialized electronic systems and

components for critical applications. The Company sells its

products and provides related services in diversified markets,

including homeland security, healthcare, defense and aerospace. The

Company has more than 30 years of experience in electronics

engineering and manufacturing and maintains offices and production

facilities in more than a dozen countries. The Company implements a

strategy of expansion by leveraging its electronics and contract

manufacturing capabilities into selective end-product markets

through organic growth and acquisitions. For more information on

OSI Systems, Inc. or its subsidiary companies, visit

www.osi-systems.com. News Filter: OSIS-E

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to the Company's current

expectations, beliefs and projections and similar expressions

concerning matters that are not historical facts.

Forward-looking statements are not guarantees of future performance

and involve uncertainties, risks, assumptions and contingencies,

many of which are outside the Company's control and which may cause

actual results to differ materially from those described in or

implied by any forward-looking statement. Forward-looking

statements include, but are not limited to, information provided

regarding expected revenues, earnings and growth in fiscal 2017. In

addition, the Company could be exposed to a variety of negative

consequences as a result of delays related to the award of domestic

and international contracts; delays in customer programs; delays in

revenue recognition related to the timing of customer acceptance;

unanticipated impacts of sequestration and other U.S. Government

budget control provisions; changes in domestic and foreign

government spending and budgetary, procurement and trade policies

adverse to the Company's businesses; global economic uncertainty;

impact of volatility in oil prices; unfavorable currency exchange

rate fluctuations; market acceptance of the Company's new and

existing technologies, products and services; the Company's ability

to win new business and convert orders received to sales within the

fiscal year; enforcement actions in respect of any noncompliance

with laws and regulations including export control and

environmental regulations and the matters that are the subject of

some or all of the Company's ongoing investigations and compliance

reviews; contract and regulatory compliance matters, and actions,

if brought, resulting in judgments, settlements, fines,

injunctions, debarment or penalties; AS&E integration and other

AS&E-related risks and other risks and uncertainties,

including, but not limited to, those detailed herein and from time

to time in the Company's Securities and Exchange Commission filings

which could have a material and adverse impact on the Company's

business, financial condition and results of operations. For

additional information on these and other factors that could cause

the Company's future results to differ materially from any

forward-looking statements, see the section entitled "Risk Factors"

in the Company's Annual Report on Form 10-K for the fiscal year

ended June 30, 2016 and other risks described therein and in

documents subsequently filed by the Company from time to time with

the Securities and Exchange Commission. All forward-looking

statements are based on currently available information and speak

only as of the date on which they are made. The Company assumes no

obligation to update any forward-looking statement made in this

press release that becomes untrue because of subsequent events, new

information or otherwise, except to the extent it is required to do

so in connection with requirements under federal securities

laws.

| |

| OSI SYSTEMS, INC. AND

SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (in thousands) |

| |

June 30,

2016 |

|

(unaudited)September 30,

2016 |

|

Assets |

|

|

|

| |

|

|

|

| Cash and cash

equivalents |

$ |

104,370 |

|

|

$ |

122,966 |

|

| Accounts receivable,

net |

|

141,716 |

|

|

|

177,857 |

|

| Inventories |

|

273,288 |

|

|

|

289,601 |

|

| Other current

assets |

|

35,944 |

|

|

|

45,757 |

|

| Total

current assets |

|

555,318 |

|

|

|

636,181 |

|

| Goodwill |

|

122,819 |

|

|

|

242,590 |

|

| Intangible assets |

|

56,283 |

|

|

|

129,349 |

|

| Other non-current

assets |

|

257,303 |

|

|

|

244,893 |

|

| Total

Assets |

$ |

991,723 |

|

|

$ |

1,253,013 |

|

| |

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

| |

|

|

|

| Bank lines of

credit |

$ |

125,000 |

|

|

$ |

339,000 |

|

| Current portion of

long-term debt |

|

2,759 |

|

|

|

2,681 |

|

| Accounts payable and

accrued expenses |

|

117,455 |

|

|

|

125,531 |

|

| Other current

liabilities |

|

122,621 |

|

|

|

134,136 |

|

| Total

current liabilities |

|

367,835 |

|

|

|

601,348 |

|

| Long-term debt |

|

6,054 |

|

|

|

5,623 |

|

| Deferred income

taxes |

|

29,160 |

|

|

|

29,123 |

|

| Other long-term

liabilities |

|

47,828 |

|

|

|

70,212 |

|

| Total

liabilities |

|

450,877 |

|

|

|

706,306 |

|

| Total stockholders’

equity |

|

540,846 |

|

|

|

546,707 |

|

| Total

Liabilities and Stockholders’ Equity |

$ |

991,723 |

|

|

$ |

1,253,013 |

|

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (in thousands, except per share data) |

| |

|

|

Three Months EndedSeptember

30, |

|

|

|

2015 |

|

|

|

2016 |

|

| |

|

|

|

| Revenue: |

|

|

|

|

Products |

$ |

135,501 |

|

|

$ |

153,457 |

|

|

Services |

|

64,549 |

|

|

|

67,398 |

|

| Total

revenues |

|

200,050 |

|

|

|

220,855 |

|

| Cost of goods sold: |

|

|

|

|

Products |

|

94,317 |

|

|

|

113,121 |

|

|

Services |

|

37,762 |

|

|

|

39,647 |

|

| Total cost

of goods sold |

|

132,079 |

|

|

|

152,768 |

|

| Gross

profit |

|

67,971 |

|

|

|

68,087 |

|

| Operating expenses: |

|

|

|

| Selling,

general and administrative |

|

40,393 |

|

|

|

43,553 |

|

| Research and

development |

|

11,881 |

|

|

|

12,478 |

|

|

Restructuring and other charges |

|

- |

|

|

|

9,957 |

|

| Total

operating expenses |

|

52,274 |

|

|

|

65,988 |

|

| Income from

operations |

|

15,697 |

|

|

|

2,099 |

|

| Interest and other

expense, net |

|

(794 |

) |

|

|

(1,158 |

) |

| Income before income

taxes |

|

14,903 |

|

|

|

941 |

|

| Provision for income

taxes |

|

4,098 |

|

|

|

264 |

|

| Net income |

$ |

10,805 |

|

|

$ |

677 |

|

|

|

|

|

|

| Diluted income per

share |

$ |

0.53 |

|

|

$ |

0.03 |

|

| Weighted average shares

outstanding – diluted |

|

20,474 |

|

|

|

19,591 |

|

| UNAUDITED SEGMENT INFORMATION |

| (in thousands) |

| |

| |

Three Months Ended September

30, |

| |

|

2015 |

|

|

|

2016 |

|

| Revenues – by

Segment: |

|

|

|

| Security

division |

$ |

96,410 |

|

|

$ |

123,709 |

|

| Healthcare

division |

|

51,465 |

|

|

|

45,650 |

|

|

Optoelectronics and Manufacturing division, including intersegment

revenues |

|

62,548 |

|

|

|

56,954 |

|

| Intersegment

revenues elimination |

|

(10,373 |

) |

|

|

(5,458 |

) |

| Total |

$ |

200,050 |

|

|

$ |

220,855 |

|

| |

|

|

|

| Operating

income (loss) – by Segment: |

|

|

|

| Security

division |

$ |

12,635 |

|

|

$ |

9,350 |

|

| Healthcare

division |

|

2,938 |

|

|

|

(3,264 |

) |

|

Optoelectronics and Manufacturing division |

|

5,561 |

|

|

|

4,650 |

|

|

Corporate |

|

(5,202 |

) |

|

|

(9,013 |

) |

|

Eliminations |

|

(235 |

) |

|

|

376 |

|

|

Total |

$ |

15,697 |

|

|

$ |

2,099 |

|

| RECONCILIATION OF GAAP TO

NON-GAAPOPERATING INCOME (LOSS) BY

SEGMENT(in thousands) |

| |

| Three Months Ended September 30,

2015 |

|

|

SecurityDivision |

|

HealthcareDivision |

|

Optoelectronics

andManufacturingDivision |

|

Corporate |

|

Eliminations |

|

Total |

| GAAP basis – operating

income (loss) |

$ |

12,635 |

|

|

$ |

2,938 |

|

|

$ |

5,561 |

|

|

$ |

(5,202 |

) |

|

$ |

(235 |

) |

|

$ |

15,697 |

|

| Amortization of

acquired intangible assets |

|

208 |

|

|

|

164 |

|

|

|

195 |

|

|

|

- |

|

|

|

- |

|

|

|

567 |

|

| Non-GAAP basis –

operating income (loss) |

$ |

12,843 |

|

|

$ |

3,102 |

|

|

$ |

5,756 |

|

|

$ |

(5,202 |

) |

|

$ |

(235 |

) |

|

$ |

16,264 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended September 30,

2016 |

|

|

Security Division |

|

Healthcare Division |

|

Optoelectronics and Manufacturing

Division |

|

Corporate |

|

Eliminations |

|

Total |

| GAAP basis – operating

income (loss) |

$ |

9,350 |

|

|

$ |

(3,264 |

) |

|

$ |

4,650 |

|

|

$ |

(9,013 |

) |

|

$ |

376 |

|

|

$ |

2,099 |

|

| Impairment,

restructuring and other charges: |

|

|

|

|

|

|

|

|

|

|

|

| Impairment

of assets |

|

5,332 |

|

|

|

86 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,418 |

|

|

Acquisition-related costs |

|

725 |

|

|

|

- |

|

|

|

- |

|

|

|

3,149 |

|

|

|

- |

|

|

|

3,874 |

|

| Facility

closure/ consolidation |

|

176 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

176 |

|

| Employee

termination costs |

|

150 |

|

|

|

256 |

|

|

|

65 |

|

|

|

- |

|

|

|

- |

|

|

|

471 |

|

| Other |

|

7 |

|

|

|

- |

|

|

|

- |

|

|

|

11 |

|

|

|

- |

|

|

|

18 |

|

|

Subtotal |

|

6,390 |

|

|

|

342 |

|

|

|

65 |

|

|

|

3,160 |

|

|

|

- |

|

|

|

9,957 |

|

| Amortization of

acquired intangible assets |

|

601 |

|

|

|

164 |

|

|

|

366 |

|

|

|

- |

|

|

|

- |

|

|

|

1,131 |

|

| Non-GAAP basis –

operating income (loss) |

$ |

16,341 |

|

|

$ |

(2,758 |

) |

|

$ |

5,081 |

|

|

$ |

(5,853 |

) |

|

$ |

376 |

|

|

$ |

13,187 |

|

| RECONCILIATION OF GAAP

TO NON-GAAPNET INCOME AND EARNINGS PER

SHARE(in thousands except per share

data) |

|

|

Three Months Ended September 30, |

| |

|

2015 |

|

|

|

2016 |

|

| |

Net income |

|

EPS |

|

Net income |

|

EPS |

| GAAP basis |

$ |

10,805 |

|

|

$ |

0.53 |

|

|

$ |

677 |

|

|

$ |

0.03 |

|

| Impairment,

restructuring and other charges, net of tax* |

|

- |

|

|

|

- |

|

|

|

7,163 |

|

|

|

0.37 |

|

| Amortization of

acquired intangible assets, net of tax* |

|

411 |

|

|

|

0.02 |

|

|

|

814 |

|

|

|

0.04 |

|

| Non-GAAP basis |

$ |

11,216 |

|

|

$ |

0.55 |

|

|

$ |

8,654 |

|

|

$ |

0.44 |

|

* For purposes of calculating the tax impact of these

costs, the effective tax rate for the consolidated operations of

OSI Systems was used for each period.

For Additional Information, Contact:

OSI Systems, Inc.

Ajay Vashishat

Vice President, Business Development

12525 Chadron Ave

Hawthorne, CA 90250

Tel: (310) 349-2237

avashishat@osi-systems.com

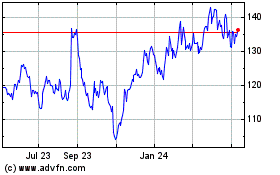

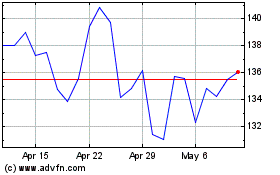

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Apr 2024 to May 2024

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From May 2023 to May 2024