Manhattan Bridge Capital, Inc. Reports Third Quarter Results

LONG ISLAND, NY-(Marketwired - Oct 26, 2016) - Manhattan Bridge

Capital, Inc. (NASDAQ: LOAN) announced today that total revenue for

the three month period ended September 30, 2016 was approximately

$1,169,000 compared to approximately $1,032,000 for the three month

period ended September 30, 2015, an increase of $137,000, or 13.3%.

The increase in revenue represents an increase in lending

operations. For the three month periods ended September 30, 2016

and 2015, approximately $960,000 and $871,000, respectively, of our

revenues were attributable to interest income on the secured

commercial loans that we offer to small businesses, and

approximately $209,000 and $160,000, respectively, of our revenues

were attributable to origination fees on such loans.

Net income for the three month period ended September 30, 2016

was approximately $725,000 or $0.10 per basic and diluted share,

versus net income of approximately $639,000 or $0.09 per basic and

diluted share for the three month period ended September 30, 2015,

an increase of $86,000 or 13.5%. This increase in net income was

mainly due to an increase in operating income as a result of

increased lending activity.

Total revenue for the nine month period ended September 30, 2016

was approximately $3,440,000 compared to approximately $2,855,000

for the nine month period ended September 30, 2015, an increase of

$585,000, or 20.5%. The increase in revenue represents an increase

in lending operations. For the nine month periods ended September

30, 2016 and 2015, revenues of approximately $2,849,000 and

$2,392,000, respectively, were attributable to interest income on

the secured commercial loans that we offer to small businesses, and

approximately $591,000 and $463,000, respectively, were

attributable to origination fees on such loans.

Net income for the nine month period ended September 30, 2016

was approximately $2,130,000 or $0.29 per basic and diluted share,

versus net income of approximately $1,645,000 or $0.25 per basic

and diluted share for the same period in 2015, an increase of

$485,000 or 29.5%. This increase in net income was mainly due to an

increase in operating income as a result of increased lending

activity.

As of September 30, 2016 total shareholders' equity was

approximately $23,125,000 compared to approximately $18,638,000 as

of June 30, 2016 and approximately $17,743,000 as of December 31,

2015.

On August 15, 2016, we completed another public offering of

672,269 common shares. In addition, the underwriter fully exercised

its over-allotment option for an additional 100,840 common shares.

The gross proceeds from the offering, including the exercise of the

over-allotment option, were approximately $4.6 million and the net

proceeds were approximately $4.2 million, after deducting our

underwriting discounts and commissions and offering expenses.

Assaf Ran, Chairman of the Board and CEO stated, "I am pleased

with the results that we have reported for the quarter. In light of

what I believe is presently a relatively risky and unstable real

estate market climate, our challenge, more than ever, is to

cherry-pick the safest lending opportunities. We have successfully

achieved another record quarter on both revenue and net earnings

while continuing our no-default track record."

About Manhattan Bridge Capital, Inc. Manhattan Bridge Capital,

Inc. offers short-term secured, non-banking loans (sometimes

referred to as "hard money" loans) to real estate investors to fund

their acquisition, renovation, rehabilitation or improvement of

properties located in the New York metropolitan area. We operate

the web site: http://www.manhattanbridgecapital.com

This report contains forward-looking statements within the

meaning of section 21E of the Securities Exchange Act of 1934, as

amended (the "Exchange Act"). Forward-looking statements are

typically identified by the words "believe," "expect," "intend,"

"estimate" and similar expressions. Those statements appear in a

number of places in this report and include statements regarding

our intent, belief or current expectations or those of our

directors or officers with respect to, among other things, trends

affecting our financial condition and results of operations and our

business and growth strategies. These forward-looking statements

are not guarantees of future performance and involve risks and

uncertainties. Actual results may differ materially from those

projected, expressed or implied in the forward-looking statements

as a result of various factors (such factors are referred to herein

as "Cautionary Statements"), including but not limited to the

following: (i) we have limited operating history as a REIT; (ii)

our loan origination activities, revenues and profits are limited

by available funds (iii)we operate in a highly competitive market

and competition may limit our ability to originate loans with

favorable interest rates; (iv) our chief executive officer is

critical to our business and our future success may depend on our

ability to retain him; (v) if we overestimate the yields on our

loans or incorrectly value the collateral securing the loan, we may

experience losses; (vi) we may be subject to "lender liability"

claims; (vii) our loan portfolio is illiquid; (viii) our due

diligence may not uncover all of a borrower's liabilities or other

risks to its business; (ix) borrower concentration could lead to

significant losses; (x) our management has no experience managing a

REIT; and (xi) we may choose to make distributions in our own

stock, in which case you may be required to pay income taxes in

excess of the cash dividends you receive. The accompanying

information contained in this report, including the information set

forth under "Management's Discussion and Analysis of Financial

Condition and Results of Operations", identifies important factors

that could cause such differences. These forward-looking statements

speak only as of the date of this report, and we caution potential

investors not to place undue reliance on such statements. We

undertake no obligation to update or revise any forward-looking

statements. All subsequent written or oral forward-looking

statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by the Cautionary

Statements.

MANHATTAN BRIDGE CAPITAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

September 30, 2016 December 31, 2015

Assets (unaudited) (audited)

---------- ----------

Current assets:

Cash and cash equivalents $ 158,519 $ 106,836

Cash - restricted 919,352 --

Short term loans receivable 23,314,500 20,199,000

Interest receivable on loans 304,338 382,572

Other current assets 49,673 32,865

---------- ----------

Total current assets 24,746,382 20,721,273

Long term loans receivable 8,217,320 10,705,040

Property and equipment, net 9,038 8,771

Security deposit 6,816 6,816

Investment in privately held

company 40,000 50,000

Deferred financing costs 68,234 164,510

---------- ----------

Total assets $ 33,087,790 $ 31,656,410

=================== ====================

Liabilities and Stockholders' Equity

Current liabilities:

Line of credit $ 4,263,055 $ 11,821,099

Short term loans -- 1,095,620

Accounts payable and accrued 71,940 99,643

expenses

Deferred origination fees 344,561 279,682

Dividends payable -- 617,443

---------- ----------

Total current liabilities 4,679,556 13,913,487

Long term liabilities:

Senior secured note (net of

deferred financing costs of 5,283,559 --

$716,441)

---------- ----------

Total liabilities 9,963,115 13,913,487

---------- ----------

Commitments and contingencies

Stockholders' equity:

Preferred shares - $.01 par value;

5,000,000 shares authorized; no -- --

shares issued

Common shares - $.001 par value;

25,000,000 authorized; 8,290,749 8,291 7,441

and 7,441,039 issued; 8,113,749

and 7,264,039 outstanding

Additional paid-in capital 23,025,856 18,500,524

Treasury stock, at cost - 177,000 (369,335) (369,335)

Retained earnings (Accumulated 459,863 (395,707)

deficit)

---------- ----------

Total stockholders' equity 23,124,675 17,742,923

---------- ----------

Total liabilities and 33,087,790 31,656,410

stockholders' equity $ $

=================== ===================

MANHATTAN BRIDGE CAPITAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

Three Months Nine Months

Ended September 30, Ended September 30,

-------------- --------------

2016 2015 2016 2015

------- ------- ------- -------

Interest income

from loans $ 960,274 $ 871,250 $ 2,848,516 $ 2,392,329

Origination fees 208,951 160,456 591,191 463,092

------- ------- ------- -------

Total revenue 1,169,225 1,031,706 3,439,707 2,855,421

------- ------- ------- -------

Operating costs

and expenses:

Interest and

amortization of

debt service

costs 205,449 159,875 593,749 493,652

Referral fees 2,263 948 5,525 3,260

General and

administrative

expenses 236,972 229,873 698,356 696,464

------- ------- ------- -------

Total operating

costs and

expenses 444,684 390,696 1,297,630 1,193,376

------- ------- ------- -------

Income from

operations 724,541 641,010 2,142,077 1,662,045

Loss on write-

down of

investment in

privately held

company -- -- (10,000) (15,000)

------- ------- ------- -------

Income before

income tax

expense 724,541 641,010 2,132,077 1,647,045

Income tax

expense -- (2,005) (2,146) (2,005)

------- ------- ------- -------

Net income $ 724,541 $ 639,005 $ 2,129,931 $ 1,645,040

============= ============= ============= =============

Basic and diluted

net income per

common share

outstanding:

-Basic $ 0.10 $ 0.09 $ 0.29 $ 0.25

============= ============= ============= =============

-Diluted $ 0.10 $ 0.09 $ 0.29 $ 0.25

============= ============= ============= =============

Weighted average

number of common

shares

outstanding

-Basic 7,598,626 7,223,043 7,407,787 6,597,987

============= ============= ============= =============

-Diluted 7,623,635 7,263,017 7,426,165 6,637,755

============= ============= ============= =============

MANHATTAN BRIDGE CAPITAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

Nine Months

Ended September 30,

--------------------

2016 2015

---------- ----------

Cash flows from operating

activities:

Net Income $ 2,129,931 $ 1,645,040

Adjustments to reconcile net

income to net cash provided by

operating activities -

Amortization of deferred

financing costs 51,474 27,501

Depreciation 2,752 4,926

Non cash compensation expense 10,192 10,248

Loss on write-down of investment

in privately held company 10,000 15,000

Changes in operating assets and

liabilities:

Interest receivable on loans 78,234 (108,815)

Other current and non current

assets (16,809) (27,377)

Accounts payable and accrued

expenses (27,702) (74,031)

Deferred origination fees 64,879 4,360

---------- ----------

Net cash provided by

operating activities 2,302,951 1,496,852

---------- ----------

Cash flows from investing

activities:

Issuance of short term loans (24,299,500) (15,346,500)

Collections received from loans 23,671,720 10,234,936

Purchase of fixed assets (3,019) (3,474)

---------- ----------

Net cash used in investing

activities (630,799) (5,115,038)

---------- ----------

Cash flows from financing

activities:

(Repayments of) Proceeds from

loans and line of credit, net (8,653,664) 1,024,238

Cash restricted for reduction of

line of credit (919,352) --

Proceeds from public offerings,

net 9,539,347 4,237,199

Deferred financing costs -- (111,400)

Proceeds from exercise of stock

options and warrants 305,004 32,838

Dividends paid (1,891,804) (1,551,221)

---------- ----------

Net cash (used in) provided

by financing activities (1,620,469) 3,631,654

---------- ----------

Net increase in cash and cash

equivalents 51,683 13,468

Cash and cash equivalents,

beginning of period 106,836 47,676

---------- ----------

Cash and cash equivalents, end of

period $ 158,519 $ 61,144

=================== ===================

Supplemental Cash Flow

Information:

Taxes paid during the period $ 1,948 $ 29

=================== ===================

Interest paid during the period $ 546,015 $ 423,650

=================== ===================

Contact: Assaf Ran CEO Vanessa Kao CFO (516) 444-3400

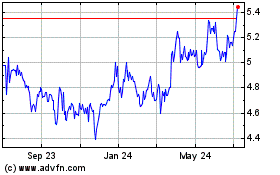

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

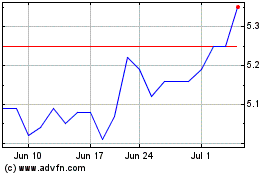

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024