Regulatory News:

2016 Third-Quarter

- Reported diluted earnings per share of

$1.25, flat versus 2015

- Excluding unfavorable currency of

$0.04, reported diluted earnings per share up by $0.04 or 3.2%

versus $1.25 in 2015 as detailed in the attached Schedule 13

- Adjusted diluted earnings per share of

$1.25, up by $0.01 or 0.8% versus $1.24 in 2015

- Excluding unfavorable currency of

$0.04, adjusted diluted earnings per share up by $0.05 or 4.0%

versus $1.24 in 2015 as detailed in the attached Schedule 12

- Cigarette shipment volume of 207.1

billion units, down by 5.4%

- Reported net revenues of $19.9 billion,

up by 2.6%

- Net revenues, excluding excise taxes,

of $7.0 billion, up by 0.8%

- Excluding unfavorable currency of $196

million, net revenues, excluding excise taxes, up by 3.6% as

detailed in the attached Schedule 10

- Reported operating income of $3.0

billion, up by 0.6%

- Operating companies income of $3.1

billion, up by 1.2%

- Excluding unfavorable currency of $94

million, operating companies income up by 4.3% as detailed in the

attached Schedule 10

- Adjusted operating companies income,

reflecting the items detailed in the attached Schedule 11, of $3.1

billion, up by 1.2%

- Excluding unfavorable currency of $94

million, adjusted operating companies income up by 4.3% as detailed

in the attached Schedule 11

- Increased the regular quarterly

dividend by 2.0% to an annualized rate of $4.16 per common

share

2016 Nine Months

Year-to-Date

- Reported diluted earnings per share of

$3.38, down by $0.24 or 6.6% versus $3.62 in 2015

- Excluding unfavorable currency of

$0.32, reported diluted earnings per share up by $0.08 or 2.2%

versus $3.62 in 2015 as detailed in the attached Schedule 17

- Adjusted diluted earnings per share of

$3.38, down by $0.23 or 6.4% versus $3.61 in 2015

- Excluding unfavorable currency of

$0.32, adjusted diluted earnings per share up by $0.09 or 2.5%

versus $3.61 in 2015 as detailed in the attached Schedule 16

- Cigarette shipment volume of 612.4

billion units, down by 3.9%

- Reported net revenues of $55.8 billion,

up by 0.4%

- Net revenues, excluding excise taxes,

of $19.7 billion, down by 3.4%

- Excluding unfavorable currency of $1.2

billion, net revenues, excluding excise taxes, up by 2.5% as

detailed in the attached Schedule 14

- Reported operating income of $8.2

billion, down by 6.0%

- Operating companies income of $8.5

billion, down by 5.8%

- Excluding unfavorable currency of $675

million, operating companies income up by 1.8% as detailed in the

attached Schedule 14

- Adjusted operating companies income,

reflecting the items detailed in the attached Schedule 15, of $8.5

billion, down by 5.8%

- Excluding unfavorable currency of $675

million, adjusted operating companies income up by 1.8% as detailed

in the attached Schedule 15

2016 Full-Year Forecast

- PMI reaffirms its 2016 full-year

reported diluted earnings per share forecast to be in a range of

$4.53 to $4.58, as previously announced on September 29, 2016,

versus $4.42 in 2015. Excluding an unfavorable currency impact, at

prevailing exchange rates, of approximately $0.35 for the full-year

2016, the diluted earnings per share range represents a projected

increase of approximately 10.5% to 11.5% versus adjusted diluted

earnings per share of $4.42 in 2015 as detailed in the attached

Schedule 20

- This forecast does not include any

share repurchases in 2016

- This forecast excludes the impact of

any future acquisitions, unanticipated asset impairment and exit

cost charges, future changes in currency exchange rates, and any

unusual events. Factors described in the Forward-Looking and

Cautionary Statements section of this release represent continuing

risks to these projections

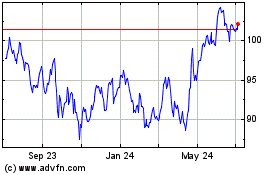

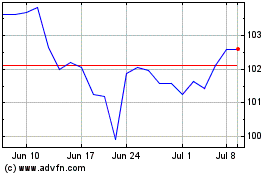

Philip Morris International Inc. (NYSE / Euronext Paris: PM)

today announced its 2016 third-quarter results.

“Our adjusted diluted EPS in the quarter increased by 4.0%,

excluding currency, in line with our expectations," said André

Calantzopoulos, Chief Executive Officer.

"We are confident that we will achieve our full-year reported

diluted EPS forecast. We continue to anticipate annual volume in

line with the September year-to-date decline of 3.9%, despite

temporary volume weakness this quarter."

“We are particularly encouraged by the strong performance of

iQOS across all of its launch geographies, particularly in Japan

where HeatSticks recorded a quarterly share of 3.5%."

Conference Call

A conference call, hosted by Jacek Olczak, Chief Financial

Officer, with members of the investor community and news media,

will be webcast at 9:00 a.m., Eastern Time, on October 18, 2016.

Access is at www.pmi.com/webcasts. The

audio webcast may also be accessed on iOS or Android devices by

downloading PMI’s free Investor Relations Mobile Application at

www.pmi.com/irapp.

Dividends and Share

Repurchases

During the quarter, PMI increased its regular quarterly dividend

by 2.0% from $1.02 to $1.04, representing an annualized rate of

$4.16 per common share. Since its spin-off in March 2008, PMI has

increased its regular quarterly dividend by 126.1% from the initial

annualized rate of $1.84 per common share. PMI did not make any

share repurchases in the first nine months of 2016.

2016 THIRD-QUARTER

CONSOLIDATED RESULTS

In this press release, “PMI” refers to Philip Morris

International Inc. and its subsidiaries. References to total

international cigarette market, defined as worldwide cigarette

volume excluding the United States, total cigarette market, total

market and market shares are PMI tax-paid estimates based on the

latest available data from a number of internal and external

sources and may, in defined instances, exclude the People's

Republic of China and/or PMI's duty free business. National

market share for HeatSticks in Japan is defined as the total

sales volume for HeatSticks as a percentage of the total estimated

sales volume for cigarettes and HeatSticks. "North Africa"

is defined as Algeria, Egypt, Libya, Morocco and Tunisia.

"OTP" is defined as other tobacco products. "EEMA" is

defined as Eastern Europe, Middle East and Africa and includes

PMI's international duty free business. In the fourth quarter of

2015, to further align with the Member State composition of the

European Union, PMI transferred the management of its operations in

Bulgaria, Croatia, Romania and Slovenia from its EEMA segment to

its European Union segment, resulting in the reclassification of

current and prior year amounts between the two segments. The

reclassification was not material to the respective segments’

results. Operating companies income, or “OCI,” is

defined as operating income, excluding general corporate expenses

and the amortization of intangibles, plus equity (income)/loss in

unconsolidated subsidiaries, net. PMI's management evaluates

business segment performance and allocates resources based on OCI.

“Adjusted EBITDA” is defined as earnings before interest,

taxes, depreciation and amortization, excluding asset impairment

and exit costs, discrete tax items and unusual items. Management

also reviews OCI, OCI margins and earnings per share, or “EPS,” on

an adjusted basis (which may exclude the impact of currency and

other items such as acquisitions, asset impairment and exit costs,

discrete tax items and unusual items), as well as free cash

flow, defined as net cash provided by operating activities less

capital expenditures, and net debt. PMI believes it is appropriate

to disclose these measures as they improve comparability and help

investors analyze business performance and trends. Non-GAAP

measures used in this release should be neither considered in

isolation nor as a substitute for the financial measures prepared

in accordance with U.S. GAAP. Comparisons are to the same

prior-year period unless otherwise stated. For a reconciliation of

non-GAAP measures to the most directly comparable GAAP measures,

see the relevant schedules provided with this press release.

"Reduced-Risk Products" (“RRPs”) is the term the company

uses to refer to products with the potential to reduce individual

risk and population harm in comparison to smoking cigarettes. PMI’s

RRPs are in various stages of development and commercialization,

and we are conducting extensive and rigorous scientific studies to

determine whether we can support claims for such products of

reduced exposure to harmful and potentially harmful constituents in

smoke, and ultimately claims of reduced disease risk, when compared

to smoking cigarettes. Before making any such claims, we will

rigorously evaluate the full set of data from the relevant

scientific studies to determine whether they substantiate reduced

exposure or risk. Any such claims may also be subject to government

review and authorization, as is the case in the United States

today. Trademarks and service marks in this press release that are

the registered property of, or licensed by, the subsidiaries of

PMI, are italicized.

NET REVENUES

(Excluding Excise Taxes)

PMI Net Revenues

(Excl.Excise Taxes)

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. European Union $ 2,200 $ 2,123 3.6

% 3.9 % $ 6,218 $ 6,134 1.4 % 3.4 %

EEMA 1,936 2,016 (4.0 )%

3.0 % 5,202 5,647 (7.9 )% 1.2 %

Asia 2,136 1,984 7.7 % 4.7 %

6,237 6,284 (0.7 )% 1.3 %

Latin America & Canada 710

804 (11.7 )% 1.7 % 2,057 2,337 (12.0 )%

6.3 %

Total PMI $ 6,982 $ 6,927

0.8 % 3.6 % $ 19,714

$ 20,402 (3.4 )% 2.5 %

In the quarter, net revenues, excluding excise

taxes, of $7.0 billion increased by 0.8%. Excluding unfavorable

currency of $196 million, net revenues, excluding excise taxes,

increased by 3.6%, driven by a favorable pricing variance of $440

million from across all Regions, principally EEMA, mainly Russia

and Turkey. The favorable pricing variance was partly offset by

unfavorable volume/mix of $189 million across all Regions,

principally EEMA, mainly Algeria and Russia.

OPERATING

COMPANIES INCOME

PMI

OCI

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. European Union $ 1,120 $ 1,045 7.2

% 4.4 % $ 3,096 $ 2,977 4.0 % 3.8 %

EEMA 962 1,002 (4.0 )%

8.7 % 2,389 2,721 (12.2 )% 4.3 %

Asia 761 690 10.3 % 2.0 %

2,288 2,421 (5.5 )% (5.0 )%

Latin America & Canada 224

294 (23.8 )% (5.8 )% 677 849 (20.3 )%

5.7 %

Total PMI $ 3,067 $ 3,031

1.2 % 4.3 % $ 8,450

$ 8,968 (5.8 )% 1.8 %

In the quarter, operating companies income of $3.1 billion was

up by 1.2%. Excluding unfavorable currency of $94 million,

operating companies income increased by 4.3%, mainly resulting from

a favorable pricing variance driven by all Regions, partly offset

by: unfavorable volume/mix of $209 million, primarily in EEMA,

mainly North Africa and Russia; and higher costs, mainly in support

of PMI's Reduced-Risk Products.

Adjusted operating companies income and margin are shown in the

table below and detailed in Schedule 11. Adjusted operating

companies income, excluding unfavorable currency, increased by

4.3%. Adjusted operating companies income margin, excluding

currency, increased by 0.2 points to 44.0%, reflecting the factors

mentioned above, as detailed on Schedule 11.

PMI

OCI

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. OCI $ 3,067 $ 3,031 1.2% 4.3 % $

8,450 $ 8,968 (5.8)% 1.8 % Asset impairment & exit costs —

— — —

Adjusted OCI $

3,067 $ 3,031 1.2% 4.3 %

$ 8,450 $ 8,968 (5.8)%

1.8 % Adjusted OCI Margin* 43.9 % 43.8 % 0.1

0.2 42.9 % 44.0 % (1.1) (0.3 )

*Margins are calculated as adjusted OCI,

divided by net revenues, excluding excise taxes.

SHIPMENT VOLUME &

MARKET SHARE

PMI cigarette shipment volume by Region is shown in the table

below.

PMI Cigarette

Shipment Volume by Region

Third-Quarter

Nine Months

Year-to-Date

(million units)

2016 2015

Change 2016

2015 Change European

Union 52,001 51,771 0.4% 148,393 147,379 0.7%

EEMA

72,172 76,318 (5.4)% 203,630 210,140 (3.1)%

Asia 61,693

67,786 (9.0)% 196,214 213,167 (8.0)%

Latin America &

Canada 21,185 23,036 (8.0)% 64,144 66,815

(4.0)%

Total PMI 207,051 218,911

(5.4)% 612,381 637,501 (3.9)%

In the quarter, PMI's total cigarette shipment volume decreased

by 5.4% due to: EEMA, principally North Africa and Russia, partly

offset by Ukraine; Asia, principally Indonesia, Pakistan, the

Philippines and Thailand; and Latin America & Canada,

predominantly Argentina, Brazil and Ecuador; partly offset by the

EU, notably France and the United Kingdom, partly offset by Greece

and Italy.

Year-to-date, PMI's total cigarette shipment volume decreased by

3.9% due to: EEMA, principally Algeria and Russia, partly offset by

Turkey and Ukraine; Asia, principally Indonesia, Japan, Pakistan,

the Philippines and Thailand, partly offset by Korea; and Latin

America & Canada, predominantly Argentina, Brazil and Ecuador,

partly offset by Mexico. The decrease was partly offset by the EU,

driven by the Czech Republic, France, Poland, Spain and the United

Kingdom, partly offset by Greece and Italy.

PMI cigarette shipment volume by brand is shown in the table

below.

PMI Cigarette

Shipment Volume by Brand

Third-Quarter

Nine Months

Year-to-Date

(million units)

2016 2015

Change 2016

2015 Change Marlboro

73,338 74,185 (1.1 )% 211,426 213,754 (1.1 )%

L&M 25,349

26,179 (3.2 )% 73,592 73,402 0.3 %

Parliament 12,200 12,289

(0.7 )% 34,247 33,372 2.6 %

Bond Street 11,709 12,045 (2.8

)% 32,792 33,003 (0.6 )%

Chesterfield 12,425 10,864 14.4 %

34,203 31,015 10.3 %

Philip Morris 8,726 9,390 (7.1 )%

26,845 25,983 3.3 %

Lark 6,994 7,320 (4.5 )% 21,031 22,034

(4.6 )%

Others 56,310 66,639 (15.5 )%

178,245 204,938 (13.0 )%

Total PMI

207,051 218,911 (5.4 )% 612,381

637,501 (3.9 )%

In the quarter, cigarette shipment volume of Marlboro decreased,

notably in Algeria, Argentina and Vietnam, partly offset by France,

Germany, Mexico, the Philippines and Spain.

Cigarette shipment volume of L&M decreased, mainly due to

Egypt, Russia, Thailand and Turkey, partly offset by Algeria,

Kazakhstan and Ukraine. Cigarette shipment volume of Parliament

decreased, due mainly to Japan and Russia, partly offset by Korea

and Ukraine. Cigarette shipment volume of Bond Street decreased,

mainly due to Russia, partly offset by Ukraine. Cigarette shipment

volume of Chesterfield increased, mainly driven by Argentina, the

morphing of Red & White in the Czech Republic, Turkey and the

United Kingdom, partly offset by Russia. Cigarette shipment volume

of Philip Morris decreased, mainly due to Argentina, partly offset

by France. Cigarette shipment volume of Lark decreased, principally

due to Turkey. Cigarette shipment volume of "Others" decreased,

mainly due to local and largely low-margin brands in Indonesia,

Pakistan, the Philippines and Russia.

Total shipment volume of OTP, in cigarette equivalent units,

decreased by 4.5%. Total shipment volume for cigarettes and OTP, in

cigarette equivalent units, decreased by 5.4%.

Total shipment volume of HeatSticks reached 2.1 billion units,

up from 278 million units during the three months ended September

30, 2015.

PMI's cigarette market share increased in a number of markets,

including Belgium, the Czech Republic, France, Germany, Kuwait,

Poland, Saudi Arabia, Spain, Switzerland, Turkey, Ukraine and the

United Kingdom.

Year-to-date, cigarette shipment volume of Marlboro decreased,

notably in Argentina, Japan, North Africa and Vietnam, partly

offset by Korea, Mexico, the Philippines and Spain.

Cigarette shipment volume of L&M increased, notably in

Kazakhstan, North Africa, Poland, Portugal and Ukraine, partly

offset by Russia, Thailand and Turkey. Cigarette shipment volume of

Parliament increased, mainly driven by Korea and Turkey, partly

offset by Russia. Cigarette shipment volume of Bond Street

decreased, mainly due to the EU and Russia, partly offset by

Ukraine. Cigarette shipment volume of Chesterfield increased,

mainly driven by: Argentina, the Czech Republic, reflecting the

morphing of Red & White; Italy, Turkey and the United Kingdom,

partly offset by Portugal, Russia and Ukraine. Cigarette shipment

volume of Philip Morris increased, driven mainly by Canada and

France; and Italy, benefiting from the morphing of Diana; partly

offset by Argentina. Cigarette shipment volume of Lark decreased,

principally due to Japan, partly offset by Turkey. Cigarette

shipment volume of "Others" decreased, mainly due to local and

largely low-margin brands in Indonesia, Pakistan, the Philippines

and Russia.

Total shipment volume of OTP, in cigarette equivalent units,

decreased by 3.9%. Total shipment volume for cigarettes and OTP, in

cigarette equivalent units, decreased by 3.9%.

Total shipment volume of HeatSticks reached 3.7 billion units,

up from 334 million units during the nine months ended September

30, 2015.

PMI's cigarette market share increased in a number of markets,

including Belgium, Canada, the Czech Republic, France, Kuwait,

Mexico, the Netherlands, Poland, Saudi Arabia, Spain, Switzerland,

Turkey and the United Kingdom.

EUROPEAN UNION REGION

(EU)

2016 Third-Quarter

Net revenues, excluding excise taxes, of $2.2 billion increased

by 3.6%. Excluding unfavorable currency of $6 million, net

revenues, excluding excise taxes, increased by 3.9%, driven by a

favorable pricing variance of $93 million, notably in Germany,

Italy and Poland, partly offset by unfavorable volume/mix of $10

million.

Operating companies income of $1.1 billion increased by 7.2%.

Excluding favorable currency of $29 million, operating companies

income increased by 4.4%, mainly driven by a favorable pricing

variance, partly offset by unfavorable volume/mix of $19 million

and higher costs, primarily related to the commercialization of

Reduced-Risk Products.

Adjusted operating companies income and margin are shown in the

table below and detailed on Schedule 11. Adjusted operating

companies income, excluding favorable currency, increased by 4.4%.

Adjusted operating companies income margin, excluding currency,

increased by 0.3 points to 49.5%, reflecting the factors mentioned

above, as detailed on Schedule 11.

EU

OCI

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. OCI $ 1,120 $ 1,045 7.2 % 4.4 % $

3,096 $ 2,977 4.0 % 3.8 % Asset impairment & exit costs —

— — —

Adjusted OCI $

1,120 $ 1,045 7.2 % 4.4

% $ 3,096 $ 2,977 4.0

% 3.8 % Adjusted OCI Margin* 50.9 %

49.2 % 1.7 0.3 49.8 % 48.5 % 1.3 0.3

*Margins are calculated as adjusted OCI,

divided by net revenues, excluding excise taxes.

2016 Third-Quarter and Nine Months

Year-to-Date

In the quarter, the estimated total cigarette market decreased

by 1.4% to 137.9 billion units, mainly reflecting the lower

contribution of two favorable factors in 2015, namely the estimated

positive impact of immigration and a recovery from illicit trade,

partly offset by improved macroeconomics and a lower prevalence of

e-vapor products. The estimated total OTP market decreased by 2.6%

to 39.8 billion cigarette equivalent units, reflecting a lower

total fine cut market, down by 2.7% to 36.9 billion cigarette

equivalent units.

Year-to-date, the estimated total cigarette

market decreased by 0.2% to 382.4 billion units, reflecting

improved macroeconomics, a lower prevalence of illicit trade and

e-vapor products and, in certain geographies, the estimated

positive impact of immigration, which was mainly concentrated in

the first half of 2016. The estimated total OTP market decreased by

0.8% to 114.9 billion cigarette equivalent units, reflecting a

lower total fine cut market, down by 0.8% to 106.8 billion

cigarette equivalent units.

Cigarette shipment volume and market share

performance by brand are shown in the tables below.

EU Cigarette

Shipment Volume by Brand

Third-Quarter

Nine Months

Year-to-Date

(in millions)

2016 2015

Change 2016

2015 Change Marlboro

25,943 25,463 1.9% 73,582 72,370 1.7%

L&M 9,454 9,570

(1.2)% 26,628 26,457 0.6%

Chesterfield 8,055 7,432 8.4%

23,111 21,090 9.6%

Philip Morris 4,330 4,101 5.6% 12,621

10,215 23.6%

Others 4,219 5,205 (18.9)% 12,451

17,247 (27.8)%

Total EU 52,001 51,771

0.4% 148,393 147,379 0.7%

EU Cigarette

Market Shares by Brand

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015

p.p. 2016

2015 p.p.

Marlboro

19.0 % 18.7 % 0.3 19.0 % 18.8% 0.2

L&M 6.8 % 6.8 % — 6.9

% 6.8% 0.1

Chesterfield 5.9 % 5.5 % 0.4 6.0 % 5.5% 0.5

Philip Morris 3.2 % 3.1 % 0.1 3.3 % 3.1% 0.2

Others

3.3 % 3.7 % (0.4 ) 3.2 % 4.0% (0.8 )

Total EU 38.2

% 37.8 % 0.4 38.4 %

38.2% 0.2

In the quarter, PMI's cigarette shipment volume increased by

0.4% to 52.0 billion units, mainly driven by France and the United

Kingdom, partly offset by Greece and Italy. Excluding the net

impact of distributor inventory movements, notably in Italy, PMI's

cigarette shipment volume decreased by 0.5%. PMI's cigarette

shipment volume of Marlboro increased by 1.9%, mainly driven by

France, Germany, Spain and the United Kingdom, partly offset by

Greece. PMI's total cigarette market share increased by 0.4 points

to 38.2%, with gains, notably in France, Germany, Poland and the

United Kingdom, partly offset by declines, mainly in Italy and

Portugal. Cigarette shipment volume of "Others" decreased, mainly

due to the morphing of various trademarks in the Baltic States, the

Czech Republic and Italy into international brands.

In the quarter, PMI's shipments of OTP decreased by 7.2% to 5.7

billion cigarette equivalent units. PMI's total OTP market share

decreased by 0.5 points to 14.6%.

Year-to-date, PMI's cigarette shipment volume increased by 0.7%

to 148.4 billion units, mainly driven by the Czech Republic,

France, Poland, Spain and the United Kingdom, partly offset by

Greece and Italy. Excluding the net impact of distributor inventory

movements, notably in Spain, PMI's cigarette shipment volume

increased by 0.3%. PMI's cigarette shipment volume of Marlboro

increased by 1.7%, mainly driven by France, Germany and Spain,

partly offset by Greece and Italy. PMI's total cigarette market

share increased by 0.2 points to 38.4%, with gains, notably in

France, Poland, Spain and the United Kingdom, partly offset by

declines, mainly in Italy and Portugal. Cigarette shipment volume

of "Others" decreased, mainly due to the same factors as for the

quarter.

Year-to-date, PMI's shipments of OTP decreased by 3.7% to 17.1

billion cigarette equivalent units. PMI's total OTP market share

decreased by 0.4 points to 14.8%.

EU Key Market

Commentaries

In France, estimated industry size, PMI cigarette

shipment volume and market share performance are shown in the table

below.

France Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 12.1 11.8 2.3 % 34.5 34.2 0.8 %

PMI Shipments

(million units) 5,034 4,746 6.1 % 14,869 14,450 2.9 %

PMI Cigarette Market Share Marlboro 26.3 % 25.8 % 0.5 26.2 %

25.7 % 0.5 Philip Morris 10.1 % 9.2 % 0.9 10.1 % 9.5 % 0.6

Chesterfield 3.1 % 3.3 % (0.2 ) 3.1 % 3.3 % (0.2 ) Others 2.7 % 2.9

% (0.2 ) 2.8 % 2.9 % (0.1 )

Total 42.2 %

41.2 % 1.0 42.2 % 41.4

% 0.8

In the quarter, the estimated total cigarette market increased

by 2.3%. Excluding the net impact of estimated trade inventory

movements, the total market increased by 1.3%, partly reflecting a

lower prevalence of illicit trade and e-vapor products. The

increase in PMI's cigarette shipment volume mainly reflected the

higher total cigarette market and market share growth, driven by

Marlboro, as well as the launch of Philip Morris 25s and 100s in

January 2016. The estimated total industry fine cut category of 3.9

billion cigarette equivalent units increased by 1.5%. PMI's market

share of the category increased by 0.7 points to 25.3%.

Year-to-date, the estimated total cigarette market increased by

0.8%, partly reflecting a lower prevalence of illicit trade and

e-vapor products. The increase in PMI's cigarette shipment volume

mainly reflected market share growth, driven by the same dynamics

as those in the quarter. The estimated total industry fine cut

category of 11.3 billion cigarette equivalent units increased by

3.7%. PMI's market share of the category increased by 0.4 points to

25.3%.

In Germany, estimated industry size, PMI cigarette

shipment volume and market share performance are shown in the table

below.

Germany Key

Market Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 21.7 21.8 (0.5)% 59.7 59.9 (0.3)%

PMI

Shipments (million units) 7,690 7,633 0.7% 22,065 22,134 (0.3)%

PMI Cigarette Market Share Marlboro 21.5 % 20.8 % 0.7

22.3 % 21.9 % 0.4 L&M 11.1 % 11.2 % (0.1) 11.6 % 12.0 % (0.4)

Chesterfield 1.5 % 1.6 % (0.1) 1.6 % 1.7 % (0.1) Others 1.3 % 1.4 %

(0.1) 1.5 % 1.4 % 0.1

Total 35.4 % 35.0

% 0.4 37.0 % 37.0 %

—

In the quarter, the moderate decline of the estimated total

cigarette market of 0.5% principally reflected a lower prevalence

of illicit trade and a decrease in the rate of out-switching to

other tobacco products. The increase in PMI's cigarette shipment

volume was driven by higher market share, principally Marlboro,

benefiting from marketing support. The estimated total industry

fine cut category of 10.7 billion cigarette equivalent units

decreased by 0.5%. PMI's market share of the category decreased by

1.5 points to 10.7%.

Year-to-date, the moderate decline of the estimated total

cigarette market of 0.3% principally reflected a lower prevalence

of illicit trade and the estimated favorable impact of immigration.

The decrease in PMI's cigarette shipment volume reflected the lower

total market. The estimated total industry fine cut category of

30.6 billion cigarette equivalent units increased by 0.6%. PMI's

market share of the category decreased by 1.1 points to 11.6%.

In Italy, estimated industry size, PMI cigarette shipment

volume and market share performance are shown in the table

below.

Italy Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 19.7 20.1 (2.2)% 55.5 55.5 —%

PMI Shipments

(million units) 9,939 10,148 (2.1)% 29,861 30,362 (1.6)%

PMI Cigarette Market Share Marlboro 24.4 % 24.8 % (0.4) 24.3

% 24.7 % (0.4) Chesterfield 11.6 % 11.2 % 0.4 11.6 % 10.8 % 0.8

Philip Morris 8.3 % 9.0 % (0.7) 8.6 % 9.3 % (0.7) Others 8.0 % 8.7

% (0.7) 8.2 % 9.1 % (0.9)

Total 52.3 %

53.7 % (1.4) 52.7 % 53.9

% (1.2)

In the quarter, the estimated total cigarette market decreased

by 2.2%, primarily reflecting the impact of price increases in the

second quarter of 2016. PMI's cigarette shipments decreased by

2.1%, or by 5.2% excluding the net impact of distributor inventory

movements. The decline mainly reflected the lower total market, and

lower cigarette market share, notably due to Marlboro as a result

of its price increase in the second quarter of 2016, and low-price

Philip Morris, impacted by the growth of the super-low price

segment, partly offset by super-low price Chesterfield. The

estimated total industry fine cut category of 1.7 billion cigarette

equivalent units increased by 3.1%. PMI's market share of the

category decreased by 2.3 points to 38.7%.

Year-to-date, the estimated total cigarette market was flat,

primarily reflecting a lower prevalence of illicit trade and the

favorable estimated impact of immigration. The decline of PMI's

cigarette shipments, down by 2.1% excluding the net impact of

distributor inventory movements, and market share reflected the

same dynamics as those in the quarter. The estimated total industry

fine cut category of 4.9 billion cigarette equivalent units

increased by 3.6%. PMI's market share of the category decreased by

2.3 points to 39.0%.

In Poland, estimated industry size, PMI cigarette

shipment volume and market share performance are shown in the table

below.

Poland Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 11.5 11.6 (0.2)% 32.3 31.9 1.3%

PMI Shipments

(million units) 4,864 4,734 2.7% 13,515 12,757 5.9%

PMI Cigarette Market Share Marlboro 11.3 % 11.4 % (0.1) 11.3

% 11.2 % 0.1 L&M 18.2 % 18.0 % 0.2 18.3 % 17.8 % 0.5

Chesterfield 9.4 % 8.6 % 0.8 9.1 % 8.4 % 0.7 Others 3.2 % 2.9 % 0.3

3.1 % 2.6 % 0.5

Total 42.1 % 40.9

% 1.2 41.8 % 40.0 %

1.8

In the quarter, the estimated total cigarette market decreased

by 0.2%. Excluding the net impact of estimated trade inventory

movements, the total market increased by 1.0%, mainly driven by a

lower prevalence of e-vapor products. The increase in PMI's

cigarette shipment volume primarily reflected higher market share,

principally driven by Chesterfield, benefiting from its 100s and

super-slims variants, and RGD in "Others," up by 0.4 points to

2.8%. The estimated total industry fine cut category of 1.1 billion

cigarette equivalent units increased by 6.2%. PMI's market share of

the category decreased by 1.3 points to 29.2%.

Year-to-date, the estimated total cigarette market increased by

1.3%. Excluding the net impact of estimated trade inventory

movements, the total market increased by 2.1%, mainly driven by a

lower prevalence of e-vapor products and non-duty paid products.

The increase in PMI's cigarette shipment volume resulted from the

higher total market and higher market share, driven principally by

L&M, reflecting the positive impact of brand support,

Chesterfield, benefiting from its 100s and super-slims variants,

and RGD in "Others," up by 0.6 points to 2.7%. The estimated total

industry fine cut category of 3.3 billion cigarette equivalent

units increased by 4.7%. PMI's market share of the category

decreased by 5.0 points to 27.1%, mainly due to increased price

competition at the bottom of the market.

In Spain, estimated industry size, PMI cigarette shipment

volume and market share performance are shown in the table

below.

Spain Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 13.0 13.1 (0.6)% 35.3 35.4 (0.3)%

PMI

Shipments (million units) 4,272 4,173 2.4% 12,637 11,861 6.5%

PMI Cigarette Market Share Marlboro 18.6 % 17.7 % 0.9

18.1 % 16.9 % 1.2 Chesterfield 8.4 % 8.8 % (0.4) 8.6 % 9.1 % (0.5)

L&M 5.3 % 5.7 % (0.4) 5.4 % 5.8 % (0.4) Others 2.1 % 1.8 % 0.3

2.0 % 1.5 % 0.5

Total 34.4 % 34.0

% 0.4 34.1 % 33.3 %

0.8

In the quarter, the moderate decline of the estimated total

cigarette market of 0.6% mainly reflected an improving economy, and

the favorable estimated impact of in-switching from other tobacco

products. Excluding the net impact of distributor inventory

movements, PMI's cigarette shipment volume increased by 0.9%,

driven by higher market share reflecting the strong performance of

Marlboro, benefiting from its round price point in the vending

channel and the new Architecture 2.0. The estimated total industry

fine cut category of 2.4 billion cigarette equivalent units

decreased by 3.4%. PMI's market share of the fine cut category

decreased by 1.4 points to 11.5%.

Year-to-date, the estimated total cigarette market decreased by

0.3%. Excluding the net impact of distributor inventory movements,

PMI's cigarette shipment volume increased by 2.1%, driven by the

same dynamics as those for the quarter. The estimated total

industry fine cut category of 7.0 billion cigarette equivalent

units decreased by 2.6%. PMI's market share of the fine cut

category decreased by 1.5 points to 12.1%.

EASTERN EUROPE, MIDDLE

EAST & AFRICA REGION (EEMA)

2016 Third-Quarter

Net revenues, excluding excise taxes, of $1.9 billion decreased

by 4.0%. Excluding unfavorable currency of $141 million, net

revenues, excluding excise taxes, increased by 3.0%, reflecting a

favorable pricing variance of $180 million, driven principally by

Russia, Saudi Arabia and Turkey, partly offset by Ukraine. The

favorable pricing variance was partly offset by unfavorable

volume/mix of $119 million, mainly due to unfavorable volume in

North Africa, principally reflecting lower market share, and

Russia, largely reflecting the lower total market and cigarette

share of market.

Operating companies income of $962 million decreased by 4.0%.

Excluding unfavorable currency of $127 million, operating companies

income increased by 8.7%, principally reflecting a favorable

pricing variance, partly offset by unfavorable volume/mix of $105

million, mainly due to North Africa and Russia.

Adjusted operating companies income and margin

are shown in the table below and detailed on Schedule 11. Adjusted

operating companies income, excluding unfavorable currency,

increased by 8.7%. Adjusted operating companies income margin,

excluding currency, increased by 2.7 points to 52.4%, reflecting

the factors mentioned above, as detailed on Schedule 11.

EEMA

OCI

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. OCI $ 962 $ 1,002 (4.0 )% 8.7 % $

2,389 $ 2,721 (12.2 )% 4.3 % Asset impairment & exit costs —

— — —

Adjusted OCI $

962 $ 1,002 (4.0 )% 8.7

% $ 2,389 $ 2,721 (12.2

)% 4.3 % Adjusted OCI Margin* 49.7 %

49.7 % — 2.7 45.9 % 48.2 % (2.3 ) 1.4

*Margins are calculated as adjusted OCI,

divided by net revenues, excluding excise taxes.

2016 Third-Quarter and Nine Months

Year-to-Date

In the quarter, PMI's cigarette shipment volume decreased by

5.4% to 72.2 billion units, mainly due to North Africa and Russia,

partly offset by Ukraine. PMI's cigarette shipment volume of

Marlboro decreased by 6.5% to 20.1 billion units, principally due

to Algeria. PMI's cigarette shipment volume of Parliament increased

by 0.3% to 9.3 billion units, primarily driven by Saudi Arabia and

Ukraine, partly offset by Russia. PMI's cigarette shipment volume

of L&M decreased by 1.3% to 13.5 billion units, mainly due to

Egypt, Russia and Turkey, partly offset by Algeria, Kazakhstan and

Ukraine.

Year-to-date, PMI's cigarette shipment volume decreased by 3.1%

to 203.6 billion units, mainly due to North Africa and Russia,

partially offset by Turkey and Ukraine. PMI's cigarette shipment

volume of Marlboro decreased by 8.8% to 55.0 billion units,

principally due to North Africa, partly offset by Saudi Arabia and

Turkey. PMI's cigarette shipment volume of Parliament increased by

1.6% to 25.5 billion units, driven by Saudi Arabia, Turkey and

Ukraine, partly offset by Russia. PMI's cigarette shipment volume

of L&M increased by 3.3% to 39.5 billion units, driven notably

by Kazakhstan, North Africa and Ukraine, partly offset by Russia,

Saudi Arabia and Turkey.

EEMA Key Market

Commentaries

In North Africa, estimated industry size, PMI cigarette

shipment volume and market share performance are shown in the table

below.

North Africa Key

Market Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 36.5 33.1 10.4% 105.0 101.0 3.9%

PMI Shipments

(million units) 8,480 9,928 (14.6)% 25,893 27,936 (7.3)%

PMI Cigarette Market Share Marlboro 10.3 % 14.1 % (3.8) 8.2

% 14.2 % (6.0) L&M 11.7 % 13.6 % (1.9) 12.6 % 11.5 % 1.1 Others

2.6 % 2.9 % (0.3) 2.9 % 2.2 % 0.7

Total 24.6 %

30.6 % (6.0) 23.7 % 27.9

% (4.2)

In the quarter, the estimated total cigarette market increased

by 10.4%, principally driven by Egypt, mainly reflecting the

favorable impact of estimated net inventory movements by PMI's

principal competitor, partly offset by Algeria, mainly due to

challenging macro-economic conditions and geopolitical instability.

Excluding the impact of the inventory movements in Egypt, the

estimated total cigarette market increased by 5.5%. The decrease in

PMI's cigarette shipment volume reflected lower market share,

mainly due to: Marlboro in Algeria, principally reflecting the

impact of excise tax-driven price increases, as well as

lower-than-anticipated acceptance of the 2.0 Architecture for

Marlboro Round Taste; and L&M in Egypt.

Year-to-date, the estimated total cigarette market increased by

3.9%, principally driven by Egypt, partly offset by Algeria. The

decrease in PMI's cigarette shipment volume, down by 12.2%

excluding the net impact of distributor inventory movements,

reflected lower market share, mainly due to Marlboro in Algeria;

partly offset by L&M in Algeria and Merit in Egypt.

In Russia, estimated industry size, PMI cigarette

shipment volume and August quarter-to-date and year-to-date market

share performance, as measured by Nielsen, are shown in the table

below.

Russia Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 76.4 81.1 (5.7 )% 208.9 219.9 (5.0 )%

PMI

Shipments (million units) 20,762 23,742 (12.6 )% 59,108 65,826

(10.2 )%

PMI Cigarette Market Share Marlboro 1.3 %

1.4 % (0.1 ) 1.4 % 1.4 % — Parliament 3.8 % 3.8 % — 3.9 % 3.8 % 0.1

Bond Street 8.2 % 8.7 % (0.5 ) 8.1 % 8.3 % (0.2 ) Others 13.6 %

15.1 % (1.5 ) 13.8 % 14.7 % (0.9 )

Total 26.9

% 29.0 % (2.1 ) 27.2

% 28.2 % (1.0 )

In the quarter, the estimated total cigarette market decreased

by 5.7%, mainly due to the impact of excise tax-driven price

increases. The decrease in PMI's cigarette shipment volume mainly

reflected the lower total market, and lower cigarette market share

due to Bond Street, a decline in "Others" of mid-price L&M and

Chesterfield and super-low Optima, reflecting the timing of retail

price increases compared to competition.

Year-to-date, the estimated total cigarette market decreased by

5.0%, reflecting the same dynamic as for the quarter. The decrease

in PMI's cigarette shipment volume mainly reflected the lower total

market, and lower cigarette market share due to the same factors as

those for the quarter, partly offset by super-low Next/Dubliss.

In Turkey, estimated industry size, PMI cigarette

shipment volume and August quarter-to-date and year-to-date market

share performance, as measured by Nielsen, are shown in the table

below.

Turkey Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 29.3 29.3 0.1% 79.4 75.0 6.0%

PMI Shipments

(million units) 14,041 14,150 (0.8)% 37,550 35,433 6.0%

PMI Cigarette Market Share Marlboro 10.4 % 9.8 % 0.6 10.2 %

9.3 % 0.9 Parliament 11.7 % 11.9 % (0.2) 11.6 % 11.7 % (0.1) Lark

7.3 % 7.7 % (0.4) 7.5 % 7.5 % — Others 15.1 % 14.7 % 0.4 14.9 %

15.0 % (0.1)

Total 44.5 % 44.1 %

0.4 44.2 % 43.5 % 0.7

In the quarter, the estimated total cigarette market was

essentially flat, mainly reflecting a lower prevalence of illicit

trade. The increase in PMI's market share was led by Marlboro,

primarily reflecting the growth of its slimmer Touch variant, and

Chesterfield, partly offset by L&M in "Others."

Year-to-date, the estimated total cigarette market increased by

6.0%, primarily reflecting a lower prevalence of illicit trade. The

increase in PMI's cigarette shipment volume was mainly driven by

the higher total market and higher market share, reflecting the

same dynamics as for the quarter.

In Ukraine, estimated industry size, PMI cigarette

shipment volume and August quarter-to-date and year-to-date market

share performance, as measured by Nielsen, are shown in the table

below.

Ukraine Key

Market Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 18.9 18.8 0.8% 55.6 52.4 6.1%

PMI Shipments

(million units) 5,624 4,704 19.6% 17,222 14,382 19.7%

PMI Cigarette Market Share Marlboro 3.2 % 3.5 % (0.3) 3.2 %

4.1 % (0.9) Parliament 3.1 % 2.8 % 0.3 2.9 % 2.9 % — Bond Street

10.3 % 8.4 % 1.9 10.4 % 8.1 % 2.3 Others 13.5 % 14.7 % (1.2) 14.0 %

15.7 % (1.7)

Total 30.1 % 29.4 %

0.7 30.5 % 30.8 % (0.3)

In the quarter, the estimated total cigarette market increased

by 0.8%. Excluding the net impact of estimated trade inventory

movements in 2015, the total market decreased by 1.6%, principally

driven by the impact of price increases in 2016. The increase in

PMI's cigarette shipment volume mainly reflected the increase in

PMI's market share, driven by low price Bond Street and L&M in

"Others," partly offset by Marlboro, reflecting the impact of

widened price gaps, and mid-price Chesterfield and super-low

President in "Others," mainly resulting from competitive price

pressure in the low price segment.

Year-to-date, the estimated total cigarette market increased by

6.1%, mainly driven by a lower prevalence of illicit trade. The

increase in PMI's cigarette shipment volume reflected the higher

total cigarette market. The decrease in PMI's market share was

primarily due to Marlboro, reflecting the impact of widened price

gaps, and mid-price Chesterfield and super-low President in

"Others," mainly resulting from competitive price pressure in the

low price segment, partly offset by Bond Street and L&M.

ASIA

REGION

2016 Third-Quarter

Net revenues, excluding excise taxes, of $2.1 billion increased

by 7.7%. Excluding favorable currency of $59 million, net revenues,

excluding excise taxes, increased by 4.7%, mainly reflecting a

favorable pricing variance of $95 million, driven principally by

Australia, Indonesia and the Philippines. The favorable pricing

variance was marginally offset by unfavorable volume/mix of $2

million, mainly due to unfavorable volume in Australia, Indonesia

and the Philippines, primarily reflecting the lower total markets,

largely offset by favorable HeatSticks volume in Japan, and

favorable mix in the Philippines.

Operating companies income of $761 million increased by 10.3%.

Excluding favorable currency of $57 million, operating companies

income increased by 2.0%, mainly driven by: a favorable pricing

variance, partly offset by unfavorable volume/mix of $35 million,

predominantly Australia and Indonesia, partly offset by favorable

HeatSticks volume in Japan, and higher costs, primarily related to

the commercialization of Reduced-Risk Products.

Adjusted operating companies income and margin are shown in the

table below and detailed on Schedule 11. Adjusted operating

companies income, excluding favorable currency, increased by 2.0%.

Adjusted operating companies income margin, excluding favorable

currency, decreased by 0.9 points to 33.9%, reflecting the factors

mentioned above, as detailed on Schedule 11.

Asia

OCI

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. OCI $ 761 $ 690 10.3 % 2.0 % $

2,288 $ 2,421 (5.5 )% (5.0 )% Asset impairment & exit costs —

— — —

Adjusted OCI $

761 $ 690 10.3 % 2.0

% $ 2,288 $ 2,421 (5.5

)% (5.0 )% Adjusted OCI Margin* 35.6 %

34.8 % 0.8 (0.9 ) 36.7 % 38.5 % (1.8 ) (2.4 )

*Margins are calculated as adjusted OCI,

divided by net revenues, excluding excise taxes.

2016 Third-Quarter and Nine Months

Year-to-Date

In the quarter, PMI's cigarette shipment volume decreased by

9.0% to 61.7 billion units, mainly due to: Indonesia, reflecting

the reversal of estimated trade inventory movements in the second

quarter of 2016 related to the timing of Ramadan; Pakistan,

reflecting a lower total estimated cigarette market resulting from

excise tax-driven price increases and the growth of illicit trade;

the Philippines, reflecting a lower total estimated cigarette

market resulting from excise-tax driven price increases; and

Thailand, primarily reflecting the impact of excise tax-driven

price increases in the first quarter of 2016, as well as lower

market share.

Cigarette shipment volume of Marlboro increased by 3.4% to 19.0

billion units, predominantly driven by the Philippines, partly

offset by Indonesia and Vietnam. Cigarette shipment volume of

Parliament decreased by 1.3% to 2.5 billion units, due mainly to

Japan, partly offset by Korea. Cigarette shipment volume of Lark

decreased by 1.0% to 4.3 billion units, due to Japan.

Year-to-date, PMI's cigarette shipment volume decreased by 8.0%

to 196.2 billion units, mainly due to: Indonesia, reflecting a

lower total estimated cigarette market, resulting from the impact

of excise-tax driven price increases, and lower market share,

reflecting the soft performance of PMI's machine-made kretek

portfolio due to competitors' discounted product offerings; Japan,

mainly reflecting the continued underlying cigarette consumption

decline and the growth of the Reduced-Risk Products category;

Pakistan, the Philippines and Thailand, reflecting the same

dynamics as for the quarter; partly offset by Korea, reflecting a

normalization of the total estimated cigarette market following the

disruptive excise tax increase in January 2015.

Cigarette shipment volume of Marlboro increased by 3.8% to 57.3

billion units, mainly driven by Korea and the Philippines, partly

offset by Japan and Vietnam. Cigarette shipment volume of

Parliament increased by 9.3% to 7.5 billion units, driven by Korea.

Cigarette shipment volume of Lark decreased by 7.7% to 13.4 billion

units, principally due to Japan.

Asia Key Market

Commentaries

In Indonesia, estimated industry size, PMI cigarette

shipment volume, market share and segmentation performance are

shown in the tables below.

Indonesia Key

Market Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 72.3 75.5 (4.3)% 229.7 232.5 (1.2)%

PMI

Shipments (million units) 25,084 26,552 (5.5)% 78,792 81,895

(3.8)%

PMI Cigarette Market Share Sampoerna A 14.4 %

14.9 % (0.5) 14.4 % 15.0 % (0.6) Dji Sam Soe 6.6 % 7.2 % (0.6) 6.6

% 7.1 % (0.5) U Mild 4.3 % 4.7 % (0.4) 4.3 % 4.9 % (0.6) Others 9.4

% 8.3 % 1.1 9.0 % 8.2 % 0.8

Total 34.7 %

35.1 % (0.4) 34.3 % 35.2

% (0.9)

Indonesia

Segmentation Data

Third-Quarter

Nine Months

Year-to-Date

Change Change 2016

2015 p.p.

2016 2015

p.p. Segment % of Total Market

Hand-Rolled Kretek (SKT) 17.2 % 18.4 % (1.2) 17.8 % 18.8 % (1.0)

Machine-Made Kretek (SKM) 76.7 % 75.2 % 1.5 76.0 % 74.9 % 1.1

Whites (SPM) 6.1 % 6.4 % (0.3) 6.2 % 6.3 % (0.1)

Total

100.0 % 100.0 % — 100.0

% 100.0 % — PMI % Share of

Segment Hand-Rolled Kretek (SKT) 38.6 % 40.3 % (1.7) 38.9 %

38.7 % 0.2 Machine-Made Kretek (SKM) 30.2 % 30.0 % 0.2 29.4 % 30.5

% (1.1) Whites (SPM) 79.7 % 80.7 % (1.0) 80.7 % 80.9 % (0.2)

In the quarter, the estimated total cigarette market decreased

by 4.3%, reflecting the reversal of estimated trade inventory

movements in the second quarter of 2016 related to the timing of

Ramadan. Excluding the impact of these inventory movements, the

estimated total cigarette market increased by 1.9%. The decrease in

PMI's cigarette shipments was mainly due to a lower total market,

and lower market share mainly reflecting the soft performance of

PMI's SKT portfolio, in line with industry trends.

Year-to-date, the estimated total cigarette market decreased by

1.2%, mainly reflecting a soft economic environment and the impact

of excise tax-driven price increases. The decrease in PMI's

cigarette shipments was mainly due to a lower total market, and

lower market share, mainly reflecting the soft performance of:

PMI's SKM portfolio, due to competitors' discounted product

offerings; and PMI's SKT portfolio, in line with industry

trends.

In Japan, estimated industry size, PMI cigarette shipment

volume and market share performance are shown in the table

below.

Japan Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 44.5 47.2 (5.8)% 130.8 135.8 (3.7)%

PMI

Shipments (million units) 10,691 10,796 (1.0)% 33,284 36,194

(8.0)%

PMI Cigarette Market Share Marlboro 11.1 %

11.3 % (0.2) 11.0 % 11.4 % (0.4) Parliament 2.4 % 2.3 % 0.1 2.4 %

2.3 % 0.1 Lark 10.0 % 10.0 % — 9.9 % 10.0 % (0.1) Others 1.7 % 1.7

% — 1.7 % 1.7 % —

Total 25.2 % 25.3

% (0.1) 25.0 % 25.4 %

(0.4)

In the quarter, the estimated total cigarette market decreased

by 5.8%, mainly reflecting the continued underlying cigarette

consumption decline, the growth of Reduced-Risk Products, and the

impact of the April price increases of certain brands of PMI's key

competitor. Excluding the net impact of distributor inventory

movements, PMI's cigarette shipment volume decreased by 6.8%,

mainly reflecting the lower cigarette market. The decline of PMI's

cigarette market share partly reflected the cannibalization by

Marlboro HeatSticks.

The estimated national market share of Marlboro HeatSticks was

3.5%, bringing PMI's total combined national market share to 27.9%,

up by 2.5 points.

Year-to-date, the estimated total cigarette market decreased by

3.7%, reflecting the same dynamics as for the quarter. Excluding

the net impact of distributor inventory movements, PMI's cigarette

shipment volume decreased by 5.1%. The decline was mainly due to a

lower total cigarette market and lower cigarette market share,

reflecting the impact of competitors' retail pricing, competitors'

differentiated menthol taste product offerings and cannibalization

by Marlboro HeatSticks.

The estimated national market share of Marlboro HeatSticks was

2.2%, bringing PMI's total combined national market share to 26.7%,

up by 1.2 points.

In Korea, estimated industry size, PMI cigarette shipment

volume and market share performance are shown in the table

below.

Korea Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 19.8 19.8 0.2% 55.6 49.4 12.6%

PMI Shipments

(million units) 4,109 4,163 (1.3)% 11,553 10,352 11.6%

PMI Cigarette Market Share Marlboro 9.7 % 9.6 % 0.1 9.5 %

9.6 % (0.1) Parliament 7.5 % 7.0 % 0.5 7.6 % 7.1 % 0.5 Virginia S.

3.1 % 3.7 % (0.6) 3.2 % 3.8 % (0.6) Others 0.5 % 0.7 % (0.2) 0.5 %

0.6 % (0.1)

Total 20.8 % 21.0 %

(0.2) 20.8 % 21.1 % (0.3)

In the quarter, the estimated total cigarette market increased

by 0.2%. Excluding the net impact of estimated trade inventory

movements, the total market increased by 1.2%, reflecting the

normalization of the market following the disruptive excise tax

increase of 120% in January 2015. The decline in PMI's cigarette

shipment volume was due to lower market share, reflecting the

impact of new brand launches by PMI's principal competitor. The

decline in market share of Virginia S. reflected the continued

morphing of Virginia Super Slims into Parliament Super Slims that

began in January 2016.

Year-to-date, the growth of the estimated total cigarette market

reflected the normalization of the market following the disruptive

excise tax increase of 120% in January 2015. The growth in PMI's

cigarette shipment volume reflected the higher estimated total

market, partly offset by a decline of market share, reflecting the

same dynamic as for the quarter.

In the Philippines, estimated industry size, PMI

cigarette shipment volume and market share performance are shown in

the table below.

Philippines Key

Market Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 20.2 23.3 (13.2)% 60.1 68.2 (11.8)%

PMI

Shipments (million units) 14,277 17,192 (17.0)% 43,558 49,821

(12.6)%

PMI Cigarette Market Share Marlboro 28.5 %

18.8 % 9.7 27.9 % 18.7 % 9.2 Fortune 23.4 % 30.9 % (7.5) 24.3 %

29.5 % (5.2) Jackpot 7.5 % 12.2 % (4.7) 8.3 % 13.0 % (4.7) Others

11.3 % 12.0 % (0.7) 11.9 % 11.9 % —

Total 70.7

% 73.9 % (3.2) 72.4 %

73.1 % (0.7)

In the quarter, the estimated total cigarette market decreased

by 13.2%, mainly due to the impact of price increases, notably in

the fourth quarter of 2015 ahead of the January 2016 excise tax

increase. The decline in PMI's cigarette shipment volume reflected

the impact of these price increases, particularly on its low and

super-low price brands, Fortune and Jackpot, partly offset by an

increase in market share of Marlboro, benefiting from its narrowed

price gap with lower-priced brands as a result of the excise tax

increase.

Year-to-date, the estimated total cigarette market decreased by

11.8%, reflecting the same factors as those described for the

quarter. The decline in PMI's cigarette shipment volume and market

share reflected the same dynamics as for the quarter.

LATIN AMERICA &

CANADA REGION

2016 Third-Quarter

Net revenues, excluding excise taxes, of $710 million decreased

by 11.7%. Excluding unfavorable currency of $108 million, net

revenues, excluding excise taxes, increased by 1.7%, driven by a

favorable pricing variance of $72 million, principally in Argentina

and Canada, partly offset by unfavorable volume/mix of $58 million,

mainly due to unfavorable volume in Argentina, Brazil and Ecuador

reflecting the impact of excise tax-driven price increases in

2016.

Operating companies income of $224 million decreased by 23.8%.

Excluding unfavorable currency of $53 million, operating companies

income decreased by 5.8%, principally due to unfavorable volume/mix

of $50 million, mainly due to Argentina, Brazil and Ecuador, and

higher costs, mainly inflation-driven in Argentina. The unfavorable

volume/mix and higher costs were partly offset by a favorable

pricing variance.

Adjusted operating companies income and margin are shown in the

table below and detailed on Schedule 11. Adjusted operating

companies income, excluding unfavorable currency decreased by 5.8%.

Adjusted operating companies income margin, excluding unfavorable

currency, decreased by 2.7 points to 33.9%, principally driven by

the factors mentioned above, as detailed on Schedule 11.

Latin America

& Canada OCI

Third-Quarter

Nine Months

Year-to-Date

(in millions) Excl.

Excl. 2016

2015 Change

Curr. 2016

2015 Change

Curr. OCI $ 224 $ 294 (23.8 )% (5.8 )% $

677 $ 849 (20.3 )% 5.7 % Asset impairment & exit costs —

— — —

Adjusted OCI $ 224

$ 294 (23.8 )% (5.8 )%

$ 677 $ 849 (20.3 )%

5.7 % Adjusted OCI Margin* 31.5 % 36.6 % (5.1

) (2.7 ) 32.9 % 36.3 % (3.4 ) (0.2 )

*Margins are calculated as adjusted OCI,

divided by net revenues, excluding excise taxes.

2016 Third-Quarter and Nine Months

Year-to-Date

In the quarter, PMI's cigarette shipment volume decreased by

8.0% to 21.2 billion units, predominantly due to Argentina, Brazil

and Ecuador, all reflecting the impact of tax-driven price

increases in 2016. While cigarette shipment volume of Marlboro

decreased by 6.2% to 8.3 billion units, its market share increased

by 0.1 point to an estimated 15.4%, primarily driven by Brazil, up

by 0.1 point to 9.8% and Colombia, up by 0.2 points to 9.3%, partly

offset by Argentina, down by 1.7 points to 22.1%, and Mexico, down

by 0.4 points to 48.5%. Cigarette shipment volume of Philip Morris

decreased by 19.4% to 3.8 billion units, mainly due to Argentina,

partly offset by Canada.

Year-to-date, PMI's cigarette shipment volume decreased by 4.0%

to 64.1 billion units, mainly due to Argentina, Brazil and Ecuador,

reflecting the same dynamics as for the quarter, partly offset by

Mexico, reflecting a higher total market. While cigarette shipment

volume of Marlboro decreased by 1.2% to 25.6 billion units, its

market share increased by 0.6 points to an estimated 15.5%,

primarily driven by Brazil, up by 0.4 points to 10.0%, Colombia, up

by 0.2 points to 9.2%, and Mexico, up by 1.0 point to 48.3%, partly

offset by Argentina, down by 1.2 points to 23.0%. Cigarette

shipment volume of Philip Morris decreased by 11.1% to 12.6 billion

units, mainly due to Argentina, partly offset by Canada.

Latin America & Canada Key Market

Commentaries

In Argentina, estimated industry size, PMI cigarette

shipment volume and market share performance are shown in the table

below.

Argentina Key

Market Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 8.5 9.9 (14.1)% 26.7 29.8

(10.5)%

PMI Shipments (million units) 6,418 7,648 (16.1)%

20,389 23,234

(12.2)%

PMI Cigarette Market Share Marlboro 22.1 % 23.8 %

(1.7) 23.0 % 24.2 %

(1.2)

Parliament 1.9 % 2.1 % (0.2) 1.9 % 2.1 %

(0.2)

Philip Morris 39.9 % 44.5 % (4.6) 43.2 % 44.6 %

(1.4)

Others 11.6 % 6.8 % 4.8 8.4 % 7.1 % 1.3

Total 75.5

% 77.2 % (1.7) 76.5 %

78.0 %

(1.5)

In the quarter, the estimated total cigarette market decreased

by 14.1%, mainly due to a soft economic environment and the impact

of the May 2016 excise tax increase that drove a more than 50%

increase in average industry retail prices. The decrease in PMI's

cigarette shipment volume was principally due to the lower total

market. PMI's lower cigarette market share primarily reflected

growth in competitors' super-low priced products benefiting from

down-trading, partly offset by low-price Chesterfield in "Others."

The capsule segment was up by 0.4 points to 16.9% of the total

market; PMI's share of the segment decreased by 1.4 points to

72.5%.

Year-to-date, the decline of the estimated total cigarette

market, PMI's cigarette shipment volume and market share reflected

the same dynamics as for the quarter. The capsule segment was up by

1.5 points to 17.6% of the total market; PMI's share of the segment

increased by 0.3 points to 73.4%.

In Canada, estimated industry size, PMI cigarette

shipment volume and market share performance are shown in the table

below.

Canada Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 6.9 7.0 (1.4)% 19.4 19.7 (1.5)%

PMI Shipments

(million units) 2,675 2,725 (1.8)% 7,466 7,424 0.6%

PMI Cigarette Market Share Belmont 3.9 % 3.6 % 0.3 3.7 % 3.3

% 0.4 Canadian Classics 10.2 % 10.8 % (0.6) 10.2 % 10.5 % (0.3)

Next 11.5 % 11.1 % 0.4 11.3 % 10.7 % 0.6 Others 13.4 % 13.7 % (0.3)

13.1 % 13.2 % (0.1)

Total 39.0 % 39.2

% (0.2) 38.3 % 37.7 %

0.6

In the quarter, the estimated total cigarette market decreased

by 1.4%, or by 2.0% excluding the net impact of estimated

competitors' trade inventory movements. The decrease in PMI's

cigarette shipment volume was mainly due to: the lower estimated

total market; and lower cigarette market share, unfavorably

impacted by the inventory movements, due to Canadian Classics, and

Accord and Number 7 in "Others," partly offset by the strong

performance of premium Belmont, low-price Next, and super-low price

Philip Morris in "Others" that benefited from down-trading.

Year-to-date, the estimated total cigarette market decreased by

1.5%. Excluding the impact of estimated competitors' trade

inventory movements, the total market increased by 0.5%, mainly

driven by improved consumer spending. The increase in PMI's

cigarette shipment volume was principally due to higher market

share, largely reflecting the strong performance of premium

Belmont, low-price Next, and super-low price Philip Morris in

"Others" that benefited from down-trading.

In Mexico, estimated industry size, PMI

cigarette shipment volume and market share performance are shown in

the table below.

Mexico Key Market

Data

Third-Quarter

Nine Months

Year-to-Date

Change Change

2016 2015 % /

p.p. 2016 2015

% / p.p. Total Cigarette Market (billion

units) 8.8 8.5 3.4% 26.2 24.6 6.2%

PMI Shipments

(million units) 6,055 5,980 1.3% 18,013 16,866 6.8%

PMI Cigarette Market Share Marlboro 48.5 % 48.9 % (0.4) 48.3

% 47.3 % 1.0 Delicados 9.6 % 10.8 % (1.2) 9.9 % 10.8 % (0.9) Benson

& Hedges 4.8 % 4.6 % 0.2 4.7 % 4.6 % 0.1 Others 5.9 % 5.9 % —

5.9 % 5.7 % 0.2

Total 68.8 % 70.2

% (1.4) 68.8 % 68.4 %

0.4

In the quarter, the estimated total cigarette market increased

by 3.4%, or by 0.8% excluding the net impact of estimated trade

inventory movements, primarily reflecting improved market

conditions and a lower prevalence of illicit trade. The increase in

PMI's cigarette shipment volume reflected the higher total

cigarette market. PMI's cigarette market share, unfavorably

distorted by the impact of estimated trade inventory movements

mentioned above, was down by 1.4 points, mainly due to low-price

Delicados. PMI's share of the premium segment, representing 56.6%

of the total market, was up by 0.4 points to 93.2%.

Year-to-date, the estimated total cigarette market increased by

6.2%, or by 3.0% excluding the net impact of estimated trade

inventory movements, reflecting the same factors as for the

quarter. The increase in PMI's cigarette shipment volume reflected

the higher total market. PMI's cigarette market share, favorably

distorted by the impact of estimated inventory movements, was up by

0.4 points, with growth of Marlboro and Benson & Hedges,

reflecting the impact of new product launches, partly offset by

low-price Delicados. PMI's share of the premium segment,

representing 56.5% of the total market, increased by 1.1 points to

93.0%.

About Philip Morris International Inc.

(“PMI”)

PMI is the world’s leading international tobacco company, with

six of the world's top 15 international brands and products sold in

more than 180 markets. In addition to the manufacture and sale of

cigarettes, including Marlboro, the number one global cigarette

brand, and other tobacco products, PMI is engaged in the

development and commercialization of Reduced-Risk Products

(“RRPs”). RRPs is the term PMI uses to refer to products with the

potential to reduce individual risk and population harm in

comparison to smoking cigarettes. Through multidisciplinary

capabilities in product development, state-of-the-art

facilities, and industry-leading scientific substantiation, PMI

aims to provide an RRP portfolio that meets a broad spectrum of

adult smoker preferences and rigorous regulatory requirements. For

more information, see www.pmi.com and

www.pmiscience.com.

Forward-Looking and Cautionary

Statements

This press release contains projections of future results and

other forward-looking statements. Achievement of future results is

subject to risks, uncertainties and inaccurate assumptions. In the

event that risks or uncertainties materialize, or underlying

assumptions prove inaccurate, actual results could vary materially

from those contained in such forward-looking statements. Pursuant

to the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995, PMI is identifying important factors

that, individually or in the aggregate, could cause actual results

and outcomes to differ materially from those contained in any

forward-looking statements made by PMI.

PMI's business risks include: significant increases in

cigarette-related taxes; the imposition of discriminatory excise

tax structures; fluctuations in customer inventory levels due to

increases in product taxes and prices; increasing marketing and

regulatory restrictions, often with the goal of reducing or

preventing the use of tobacco products; health concerns relating to

the use of tobacco products and exposure to environmental tobacco

smoke; litigation related to tobacco use; intense competition; the

effects of global and individual country economic, regulatory and

political developments; changes in adult smoker behavior; lost

revenues as a result of counterfeiting, contraband and cross-border

purchases; governmental investigations; unfavorable currency

exchange rates and currency devaluations; adverse changes in

applicable corporate tax laws; adverse changes in the cost and

quality of tobacco and other agricultural products and raw

materials; and the integrity of its information systems. PMI's

future profitability may also be adversely affected should it be

unsuccessful in its attempts to produce and commercialize products

that have the potential to reduce individual risk and population

harm; if it is unable to successfully introduce new products,

promote brand equity, enter new markets or improve its margins

through increased prices and productivity gains; if it is unable to

expand its brand portfolio internally or through acquisitions and

the development of strategic business relationships; or if it is

unable to attract and retain the best global talent.

PMI is further subject to other risks detailed from time to time

in its publicly filed documents, including the Form 10-Q for the

quarter ended June 30, 2016. PMI cautions that the foregoing list

of important factors is not a complete discussion of all potential

risks and uncertainties. PMI does not undertake to update any

forward-looking statement that it may make from time to time,

except in the normal course of its public disclosure

obligations.

Schedule 1 PHILIP MORRIS INTERNATIONAL

INC. and Subsidiaries Condensed Statements of Earnings

For the

Quarters Ended September 30, ($ in millions, except per share

data) (Unaudited)

2016 2015 %

Change Net Revenues $

19,935 $ 19,422

2.6% Cost of sales 2,432 2,383 2.1% Excise Taxes on products

(1) 12,953 12,495 3.7% Gross profit 4,550

4,544 0.1% Marketing, administration and research costs 1,554 1,566

Asset impairment and exit costs — — Amortization of intangibles 19

19

Operating Income (2) 2,977

2,959 0.6% Interest expense, net 220

247 Earnings before income taxes 2,757 2,712 1.7% Provision

for income taxes 764 748 2.1% Equity (income)/loss in

unconsolidated subsidiaries, net (35 ) (20 ) Net Earnings

2,028 1,984 2.2% Net Earnings attributable to noncontrolling

interests 90 42

Net Earnings attributable

to PMI $ 1,938

$ 1,942 (0.2)%

Per share data (3): Basic Earnings Per Share

$ 1.25 $

1.25 —% Diluted

Earnings Per Share $ 1.25

$ 1.25

—% (1) The segment detail of Excise Taxes on products

sold for the quarters ended September 30, 2016 and 2015 is shown on

Schedule 2. (2) PMI's management evaluates segment

performance and allocates resources based on operating companies

income, which PMI defines as operating income, excluding general

corporate expenses and amortization of intangibles, plus equity

(income)/loss in unconsolidated subsidiaries, net. The

reconciliation from operating income to operating companies income

is as follows:

2016 2015

% Change Operating Income $

2,977 $

2,959 0.6%

Excluding:

- Amortization of intangibles 19 19

- General corporate expenses (included in

marketing, administrationand research costs above)

36 33

Plus: Equity (income)/loss in

unconsolidated subsidiaries, net

(35 ) (20 )

Operating Companies Income $

3,067 $

3,031 1.2%

(3) Net Earnings and weighted-average shares used in the basic

and diluted earnings per share computations for the quarters ended

September 30, 2016 and 2015 are shown on Schedule 4, Footnote

1.

Schedule 2 PHILIP

MORRIS INTERNATIONAL INC. and Subsidiaries Selected Financial Data

by Business Segment

For the Quarters Ended September 30, ($

in millions) (Unaudited)

Net Revenues excluding

Excise Taxes

EuropeanUnion

EEMA Asia

LatinAmerica

&Canada

Total 2016 Net Revenues (1) $ 7,387 $

5,122 $ 5,113 $ 2,313 $

19,935 Excise Taxes on products (5,187 ) (3,186 )

(2,977 ) (1,603 ) (12,953 )

Net Revenues excluding

Excise Taxes 2,200 1,936 2,136 710

6,982 2015 Net Revenues $ 7,018 $ 5,107 $

4,880 $ 2,417 $ 19,422 Excise Taxes on products (4,895 )

(3,091 ) (2,896 ) (1,613 ) (12,495 )

Net

Revenues excluding Excise Taxes 2,123 2,016

1,984 804 6,927 Variance

Currency (6 ) (141 ) 59 (108 ) (196 ) Acquisitions — — — — —

Operations 83 61 93 14

251

Variance Total 77 (80

) 152 (94 ) 55 Variance Total

(%) 3.6 % (4.0 )% 7.7 % (11.7 )% 0.8 % Variance excluding

Currency 83 61 93 14 251 Variance excluding Currency (%) 3.9 % 3.0

% 4.7 % 1.7 % 3.6 % Variance excluding Currency &

Acquisitions 83 61 93 14 251 Variance excluding Currency &

Acquisitions (%) 3.9 % 3.0 % 4.7 % 1.7 % 3.6 %

(1) 2016 Currency increased / (decreased) Net Revenues as follows:

European Union $ (59 ) EEMA (441 ) Asia 51 Latin America &

Canada (584 ) $ (1,033 )

Schedule 3 PHILIP MORRIS INTERNATIONAL INC. and

Subsidiaries Selected Financial Data by Business Segment

For the

Quarters Ended September 30, ($ in millions) (Unaudited)

Operating Companies Income

EuropeanUnion

EEMA Asia

LatinAmerica

&Canada

Total 2016 $ 1,120 $ 962 $

761 $ 224 $ 3,067 2015 1,045 1,002 690 294

3,031 % Change 7.2 % (4.0 )% 10.3 % (23.8 )% 1.2 %

Reconciliation:

For the quarter ended September 30, 2015 $

1,045 $ 1,002 $ 690 $

294 $ 3,031 2015 Asset impairment and

exit costs — — — — — 2016 Asset impairment and exit costs — — — — —

Acquired businesses — — — — — Currency 29 (127 ) 57 (53 )

(94 ) Operations 46 87 14

(17 ) 130

For the quarter ended September

30, 2016 $ 1,120 $

962 $

761 $ 224

$ 3,067

Schedule 4 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Diluted Earnings Per Share

For the Quarters Ended September

30, ($ in millions, except per share data) (Unaudited)

Diluted E.P.S. 2016 Diluted Earnings Per Share

$ 1.25 (1) 2015 Diluted Earnings Per Share $ 1.25 (1) Change $ — %

Change — %

Reconciliation:

2015 Diluted Earnings Per Share $ 1.25 (1)

Special

Items:

2015 Asset impairment and exit costs — 2015 Tax items (0.01 ) 2016

Asset impairment and exit costs — 2016 Tax items — Currency

(0.04 ) Interest 0.01 Change in tax rate 0.01 Impact of shares

outstanding and share-based payments — Operations 0.03

2016 Diluted Earnings Per Share $ 1.25

(1) (1) Basic and diluted EPS were calculated using

the following (in millions):

Q32016

Q32015

Net Earnings attributable to PMI $ 1,938 $ 1,942 Less

distributed and undistributed earnings attributable to share-based

payment awards 5 7 Net Earnings for basic and diluted

EPS $ 1,933 $ 1,935 Weighted-average

shares for basic and diluted EPS 1,551 1,549

Schedule 5 PHILIP MORRIS INTERNATIONAL

INC. and Subsidiaries Condensed Statements of Earnings

For the

Nine Months Ended September 30, ($ in millions, except per

share data) (Unaudited)

2016 2015

% Change Net Revenues $ 55,764

$ 55,537 0.4% Cost of sales 6,892 6,990 (1.4)%

Excise Taxes on products (1) 36,050 35,135

2.6% Gross profit 12,822 13,412 (4.4)% Marketing, administration

and research costs 4,563 4,628 Asset impairment and exit costs — —

Amortization of intangibles 56 62

Operating

Income (2) 8,203 8,722 (6.0)% Interest

expense, net 690 781 Earnings before income