Additional Proxy Soliciting Materials (definitive) (defa14a)

October 11 2016 - 6:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by

a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐ Preliminary Proxy Statement

|

|

☐ Confidential, for Use of the Commission Only

(as permitted by Rule

14a-6(e)(2))

|

|

☐ Definitive Proxy Statement

|

|

|

|

☒ Definitive Additional Materials

|

|

|

|

☐ Soliciting Material under

§240.14a-12

|

|

|

SUNLINK HEALTH SYSTEMS, INC.

(Name of the Registrant as Specified

in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(4)

and

0-11.

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11

(Set forth the amount on which the filing fee is calculated and state how

it is determined):

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

SunLink Health Systems, Inc.

|

|

900 Circle 75 Parkway, Suite 1120

Atlanta, Georgia 30339

Phone 770-933-7000

Fax 770-933-7010

www.sunlinkhealth.com

|

October 10, 2016

Dear Shareholder:

SunLink

recently announced the adoption of a tax benefits preservation rights plan designed to protect our valuable income tax net operating loss (the NOL Rights Plan). This letter is to better inform you about the NOL Rights Plan and our reasoning for it,

and to solicit your support for the amendment to SunLink’s articles of incorporation (the NOL Charter Amendment) which we are proposing in this year’s proxy statement to work in tandem with the NOL Rights Plan. We believe each of these

actions are timely and prudent. The NOL Rights Plan needed to be promptly implemented, and the Board of Directors did so in September. The NOL Charter Amendment needs to be approved by the shareholders at the 2016 annual meeting and promptly

implemented.

We request that you vote FOR the NOL Charter Amendment which is Proposal 2 on the 2016 annual meeting agenda in the proxy statement.

The purpose of the NOL Rights Plan and the NOL Charter Amendment is to protect your shareholder value by preserving the Company’s ability

to use these valuable income tax net operating losses (NOLs) against future taxable income and thereby reduce the taxes payable on profits, whether the profits arise from operations or asset sales. As you know, our operating results in the past

fiscal year have been very disappointing and, in response, we have sold, leased and closed certain under-performing facilities. For example, we have leased a medical office building on favorable terms, discontinued operations at another hospital and

continue to take strong action to improve the Company’s results in other facilities. We have also engaged advisors to assist us in considering the sale of certain other under-performing assets. In addition, we recently concluded the sale of the

Dahlonega, GA hospital which resulted in a pre-tax gain of approximately $7,000,000. Thus, we believe the prospect of gains on any further asset sales is favorable, even though there can be no assurance any such sales will occur or that we will

recognize gains if sales do occur.

We estimate that SunLink has approximately $13,000,000 in NOLs as of June 30, 2016. These

valuable NOLs may be used to offset future taxable income and reduce federal income taxes payable. However, under the IRS rules, the Company’s ability to use its NOLs to offset future taxable income would be greatly limited if an

“ownership change” were to occur. “Ownership changes” under the IRS rules generally relate to

any

acquisition by a person of an ownership interest of 5% or more or any increase in ownership by shareholders having an

ownership interest of 5% or more (as determined under IRC Section 382) over a rolling three year period. In other words, an ownership change may occur in circumstances where a shareholder acquires 5% or more of our shares or an existing 5%

holder increases their share ownership. The NOL Rights

Plan was adopted by the Board, and the NOL Charter Amendment is being proposed to the shareholders by the Board, in order to reduce the likelihood of an “ownership change” occurring.

Under the NOL Rights Plan, if a person or group of persons acquires 4.9% or more of the outstanding common shares of the Company without

the approval of the Board of Directors, there would be a triggering event causing a very significant dilution in the ownership interest of the acquiring person or group. However, existing shareholders who currently own 4.9% or more of the

outstanding common shares of the Company will trigger a dilutive event only if they acquire additional shares, subject to certain exceptions.

In connection with our efforts to preserve SunLink’s tax benefits, the Board of Directors also has proposed to the shareholders the

adoption of the amendment to the Company’s articles of incorporation, i.e., the NOL Charter Amendment. The NOL Charter Amendment is, like the NOL Rights Plan, designed to preserve the Company’s ability to use its NOLs to offset future

taxable income. The NOL Charter Amendment generally would void transfers of shares that would result in the creation of a new 4.9% shareholder or any acquisition of additional shares by an existing 4.9% or greater shareholder. The Company has

submitted the NOL Charter Amendment for your shareholder vote at the 2016 annual meeting. A more detailed explanation of the NOL Charter Amendment is included in the proxy statement for the 2016 annual meeting recently mailed to you. If shareholders

do not approve the NOL Charter Amendment, it will not become effective.

The NOL Rights Plan and the NOL Charter Amendment are similar to

measures adopted by other public companies with significant net operating losses. The NOL Rights Plan is effective now and it will continue in effect until September 29, 2019, subject to earlier expiration in specific circumstances. If we

believe that circumstances have arisen that indicate we do not need the restrictions in the NOL Rights Plan, we will modify or terminate the Plan. The NOL Rights Plan is only designed to protect our NOLs while they are useable to offset taxable

income. The full text of the NOL Rights Plan has been filed with the SEC, and the NOL Charter Amendment is described in the proxy statement for the 2016 annual meeting.

We appreciate your support of SunLink in these very challenging times. We are working diligently to preserve the maximum shareholder value.

The NOL Rights Plan and the NOL Charter Amendments are important elements of our efforts, and we believe they will best work in tandem.

We earnestly solicit your support of the NOL Charter Amendment by voting FOR Proposal 2 on the 2016 annual

meeting agenda.

Sincerely,

Robert M. Thornton, Jr.

Chief

Executive Officer & President

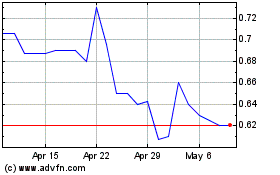

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

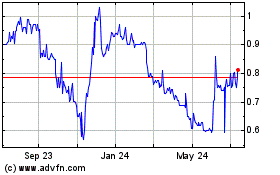

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Apr 2023 to Apr 2024