We have entered into a sales agreement with Cowen and Company, LLC, or Cowen, relating to the sales of shares of our common stock, par value $0.001 per share,

offered by this prospectus supplement. In accordance with the terms of the sales agreement, we may offer and sell from time to time shares of our common stock having an aggregate offering price of up to $35,000,000.

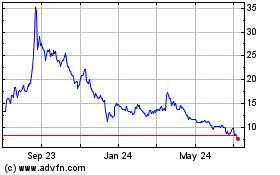

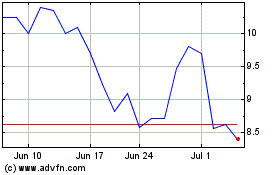

Our common stock is listed on The NASDAQ Capital Market under the symbol “PIRS”. On September 30, 2016, the last reported sale price for our

common stock was $1.68 per share.

Sales of our common stock, if any, under this prospectus supplement may be made in sales deemed to be

“at-the-market” equity offerings as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act, including sales made directly on or through The NASDAQ Capital Market, the existing trading

market for our common stock, sales made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices, and/or any

other method permitted by law. Cowen is not required to sell any specific number or dollar amount of securities, but will act as a sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually

agreed terms between Cowen and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to

Cowen for sales of common stock sold pursuant to the sales agreement will be an amount up to 3% of the gross proceeds of any shares of common stock sold under the sales agreement. In connection with the sale of the common stock on our behalf, Cowen

will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cowen will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to

Cowen with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement which describes the terms of this offering of our common stock and

supplements information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The second part, the accompanying prospectus, gives more general information, some of which may not apply

to this offering. In the event that the description of this offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. Generally, when we refer to

the prospectus, we are referring to this prospectus supplement and the accompanying prospectus combined.

You should read this prospectus

supplement, the accompanying prospectus, the documents and information incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this

offering when making your investment decision. You should also read and consider the information in the documents we have referred you to under the headings “Where You Can Find Additional Information” and “Information Incorporated by

Reference.”

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and

the accompanying prospectus. We have not, and Cowen has not, authorized anyone to provide you with information that is different. We are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and

sales are permitted. The information contained in this prospectus supplement, the accompanying prospectus, the documents and information incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing

prospectus that we have authorized for use in connection with this offering are accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement or of any sale of our common stock.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to

such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement, the

accompanying prospectus and the information incorporated by reference herein and therein include trademarks, service marks and trade names owned by us or other companies. We have registered trademarks for Pieris

®

, Anticalin

®

and Pocket Binding

®

. All other trademarks, service marks and trade

names included or incorporated by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended

to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner.

As used in this

prospectus supplement, unless the context indicates or otherwise requires, “our Company”, “the Company”, “Pieris”, “we”, “us”, and “our” refer to Pieris Pharmaceuticals, Inc., a Nevada

corporation, and its consolidated subsidiary, and the term “Pieris GmbH” refers to Pieris Pharmaceuticals GmbH, a company organized under the laws of Germany that, through a share exchange transaction completed on December 17, 2014,

has become our wholly owned subsidiary.

i

PROSPECTUS SUPPLEMENT SUMMARY

The following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under

this prospectus supplement. We urge you to read this entire prospectus supplement and the accompanying prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial statements and other

information incorporated by reference from our other filings with the Securities and Exchange Commission, or SEC. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in this prospectus supplement

and the accompanying prospectus and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus supplement and the accompanying prospectus supplement and the documents incorporated by

reference herein or therein, before purchasing our securities. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

We are a clinical

stage biotechnology company that discovers and develops Anticalin

®

-based drugs to target validated disease pathways in a unique and transformative way. Our pipeline includes immuno-oncology

multi-specifics tailored for the tumor micro-environment, an inhaled Anticalin to treat uncontrolled asthma and a half-life-optimized Anticalin to treat anemia. Our proprietary Anticalins are a novel class of protein therapeutics validated in the

clinic and by partnerships with leading pharmaceutical companies. Anticalin proteins are a class of low molecular-weight therapeutic proteins derived from lipocalins, which are naturally occurring low-molecular weight human proteins typically

found in blood plasma and other bodily fluids. Anticalin-branded proteins function similarly to monoclonal antibodies, or mAbs, by binding tightly and specifically to a diverse range of targets.

Our core Anticalin technology and platform were developed in Germany, and we have collaboration arrangements with major multi-national

pharmaceutical companies headquartered in the U.S., Europe and Japan and with regional pharmaceutical companies headquartered in India. These include existing agreements with Daiichi Sankyo Company Limited, or Daiichi Sankyo, and Sanofi Group, or

Sanofi, pursuant to which our Anticalin platform has consistently achieved its development milestones. Furthermore, we established a collaboration with F.Hoffmann—La Roche Ltd. and Hoffmann—La Roche Inc., or Roche, in December 2015. We

have discovery and preclinical collaboration and service agreements with both academic institutions and private firms in Australia, which increasingly are being handled through Pieris Australia Pty Ltd., a wholly owned subsidiary of Pieris.

Additional Information

For more

information regarding our business, see the disclosure under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” included in our most recent Annual Report on

Form 10-K. For a description of certain risks related to our business, see the disclosure under the heading “Risk Factors” beginning on page S-5 of this prospectus supplement and as set forth in our most recent annual and quarterly filings

with the SEC.

Corporate History

Pieris Pharmaceuticals, Inc. was incorporated under the laws of the State of Nevada on May 24, 2013 with the name “Marika Inc.”

and we changed our name to “Pieris Pharmaceuticals, Inc.” on December 16, 2014. On December 17, 2014, we closed a share exchange transaction in which the stockholders of Pieris GmbH

S-1

contributed all of their equity interests in Pieris GmbH to Pieris in exchange for shares of our common stock, resulting in Pieris GmbH becoming a wholly owned subsidiary of the Company.

Immediately following the closing, the business of Pieris GmbH became our sole focus.

Our corporate headquarters are located at 255 State

Street, 9th Floor, Boston, Massachusetts 02109 and our telephone number is (857) 246-8998. We maintain a website at www.pieris.com, to which we regularly post copies of our press releases as well as additional information about us. The

information contained on, or that can be accessed through, our website is not a part of this prospectus supplement. We have included our website address in this prospectus supplement solely as an inactive textual reference.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or

furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available free of charge through the investor relations page of our website as soon as reasonably practicable after we

electronically file such material with, or furnish it to, the SEC.

S-2

THE OFFERING

|

Common stock offered by us:

|

Shares of common stock having an aggregate offering price of up to $35,000,000.

|

|

Common stock to be outstanding after this offering(1):

|

Up to 20,833,333 shares of common stock, assuming the sale of all of the shares offered hereby at a price of $1.68 per share, which was the last reported sale price of our common stock on The NASDAQ Capital Market on September 30, 2016. The

actual number of shares will vary depending on the sales prices at which our common stock is sold under this offering.

|

|

Manner of offering:

|

“At-the-market offering” that may be made from time to time through our agent, Cowen. See the additional disclosure under the heading “Plan of Distribution” on page S-6 of this prospectus supplement.

|

|

Use of Proceeds:

|

We intend to use any net proceeds from the sale of securities under this prospectus supplement for our operations and our further development and pre-clinical and clinical work on product candidates in our PRS-080, PRS-060, PRS-343 and PRS-300

Series programs, as well as the development of other programs and product candidates, and other general corporate purposes. See the additional disclosure under the heading “Use of Proceeds” on page S-10 of this prospectus supplement.

|

|

Risk Factors:

|

Investing in our securities involves a high degree of risk and purchasers may lose their entire investment. See the additional disclosure under the heading “Risk Factors” beginning on page S-5 of this prospectus supplement.

|

|

NASDAQ Trading Symbol:

|

“PIRS”

|

The above table is based on 43,058,827 shares outstanding as of June 30, 2016, and excludes:

|

|

•

|

|

an aggregate of 3,750,000 shares of common stock reserved for future issuance under the Pieris Pharmaceuticals, Inc. 2016 Employee, Director and Consultant Equity Incentive Plan, or the 2016 Pieris Plan;

|

|

|

•

|

|

3,815,063 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2016, having a weighted average exercise price of $1.91 per share and issued under the Pieris Pharmaceuticals, Inc.

2014 Employee, Director and Consultant Equity Incentive Plan, or the 2014 Pieris Plan;

|

|

|

•

|

|

500,000 shares of common stock issuable upon the exercise of stock options issued outside of the 2014 Pieris Plan and 2016 Pieris Plan to a newly-hired executive officer as an inducement option, material to the

executive officer entering into employment with us in 2015, and having an exercise price of $3.36 per share;

|

S-3

|

|

•

|

|

5,445,639 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2016, having a weighted average exercise price of $2.30 per share; and

|

|

|

•

|

|

4,963 shares of Series A Preferred Convertible Preferred Stock, or Series A Preferred, which are convertible into 4,963,000 shares of our common stock.

|

S-4

RISK FACTORS

Investing in our securities involves significant risk. Prior to making a decision about investing in our securities, you should carefully

consider the specific factors discussed below and you should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent annual report on Form 10-K, as revised or

supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K on file with the SEC, all of which are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other

reports we file with the SEC in the future. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our

operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Risks Related

to an Investment in our Common Stock and this Offering

If you purchase our common stock in this offering, you will incur immediate and

substantial dilution in the book value of your shares.

The shares sold in this offering, if any, will be sold from time to time at

various prices. However, we expect that the offering price of our common stock will be substantially higher than the net tangible book value per share of our outstanding common stock. After giving effect to the sale of shares of our common stock in

the aggregate amount of $35,000,000 at an assumed offering price of $1.68 per share, the last reported sale price of our common stock on September 30, 2016 on The NASDAQ Capital Market, and after deducting commissions and estimated offering

expenses, our as adjusted net tangible book value as of June 30, 2016 would have been approximately $70.9 million or approximately $1.11 per share. This represents an immediate increase in net tangible book value of approximately $0.24 per share to

our existing stockholders and an immediate dilution in as adjusted net tangible book value of approximately $0.57 per share to purchasers of our common stock in this offering. In addition, the exercise of outstanding stock options and warrants would

result in further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering. Because the sales of the shares offered hereby

will be made directly into the market or in negotiated transactions, the prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we sell, as well as our existing shareholders, will experience

significant dilution if we sell shares at prices significantly below the price at which they invested.

We will have broad discretion in the use of

the net proceeds to us from this offering; we may not use the offering proceeds that we receive effectively.

Our management will

have broad discretion in the application of the net proceeds to us from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment

decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds to us from this offering, their ultimate use may vary from their currently

intended use. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest the net proceeds to us from this offering in investment-grade, interest-bearing securities. These investments

may not yield a favorable return to our stockholders.

S-5

DILUTION

Our net tangible book value as of June 30, 2016 was approximately $37.3 million, or $0.87 per share. Net tangible book value per share is

determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of June 30, 2016. Dilution with respect to net tangible book value per share represents the difference between the

amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the sale of 20,833,333 shares of our common stock with an aggregate offering price of $35.0 million at an assumed

offering price of $1.68 per share, the last reported sale price of our common stock on The Nasdaq Capital Market on September 30, 2016, and after deducting estimated offering commissions and offering expenses payable by us, our as adjusted net

tangible book value as of June 30, 2016 would have been approximately $70.9 million, or $1.11 per share. This represents an immediate increase in net tangible book value of $0.24 per share to existing stockholders and immediate dilution of

$0.57 per share to investors purchasing our common stock in this offering at the public offering price. The following table illustrates this dilution on a per share basis:

|

|

|

|

|

|

|

Assumed public offering price per share

|

|

$

|

1.68

|

|

|

Net tangible book value per share of as June 30, 2016

|

|

$

|

0.87

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

0.24

|

|

|

As adjusted net tangible book value per share as of June 30, 2016, after giving effect to this

offering

|

|

$

|

1.11

|

|

|

|

|

|

|

|

|

Dilution per share to investors purchasing our common stock in this offering

|

|

$

|

0.57

|

|

|

|

|

|

|

|

The above discussion and table are based on 43,058,827 shares outstanding as of June 30, 2016, and

exclude:

|

|

•

|

|

an aggregate of 3,750,000 shares of common stock reserved for future issuance under the 2016 Pieris Plan;

|

|

|

•

|

|

3,815,063 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2016, having a weighted average exercise price of $1.91 per share and issued under the 2014 Pieris Plan and the

2016 Pieris Plan;

|

|

|

•

|

|

500,000 shares of common stock issuable upon the exercise of stock options issued outside of the 2014 Pieris Plan and 2016 Pieris Plan to a newly-hired executive officer as an inducement option, material to the

executive officer entering into employment with us in 2015, and having an exercise price of $3.36 per share;

|

|

|

•

|

|

5,455,639 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2016, having a weighted average exercise price of $2.30 per share; and

|

|

|

•

|

|

4,963 shares of Series A Preferred which are convertible into 4,963,000 shares of our common stock.

|

The table above assumes for illustrative purposes that an aggregate of 20,833,333 shares of our common stock are sold during the term of

the sales agreement with Cowen at a price of $1.68 per share, the last reported sale price of our common stock on The Nasdaq Capital Market on September 30, 2016, for aggregate gross proceeds of $35.0 million. The shares subject to

the sales agreement with Cowen will be sold from time to time at various prices. An increase of $0.50 per share in the price at which the shares are sold from the assumed offering price of $1.68 per share assuming all of our common stock in the

aggregate amount of $35.0 million during the term of the sales agreement with Cowen is sold at that price, would increase our adjusted net tangible book value per share after the offering to $1.20 per share and would increase the dilution in net

tangible book value per share to new investors in this offering to $0.98 per share, after deducting commissions and estimated

S-6

aggregate offering expenses payable by us. A decrease of $0.50 per share in the price at which the shares are sold from the assumed offering price of $1.68 per share assuming all of our common

stock in the aggregate amount of $35.0 million during the term of the sales agreement with Cowen is sold at that price, would decrease our adjusted net tangible book value per share after the offering to $0.98 per share and would decrease the

dilution in net tangible book value per share to new investors in this offering to $0.20 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

To the extent that outstanding options or warrants outstanding as of June 30, 2016 have been or may be exercised or other shares issued,

investors purchasing our common stock in this offering may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our

current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

S-7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference in this prospectus supplement include forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding:

|

|

•

|

|

the results of our research and development activities, including uncertainties relating to the discovery of potential drug candidates and the preclinical and ongoing or planned clinical testing of our drug candidates;

|

|

|

•

|

|

the early stage of our drug candidates presently under development;

|

|

|

•

|

|

our ability to obtain and, if obtained, maintain regulatory approval of our current drug candidates and any of our other future drug candidates;

|

|

|

•

|

|

our need for substantial additional funds in order to continue our operations and the uncertainty of whether we will be able to obtain the funding we need;

|

|

|

•

|

|

our future financial performance;

|

|

|

•

|

|

our ability to retain or hire key scientific or management personnel;

|

|

|

•

|

|

our ability to protect our intellectual property rights that are valuable to our business, including patent and other intellectual property rights;

|

|

|

•

|

|

our dependence on third-party manufacturers, suppliers, research organizations, testing laboratories and other potential collaborators;

|

|

|

•

|

|

our ability to successfully market and sell our drug candidates in the future as needed;

|

|

|

•

|

|

the size and growth of the potential markets for any of our approved drug candidates, and the rate and degree of market acceptance of any of our approved drug candidates;

|

|

|

•

|

|

competition in our industry; and

|

|

|

•

|

|

regulatory developments in the U.S. and foreign countries.

|

Such statements in connection with

any discussion of future operations or financial performance are identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “target,” “potential,” “shall,” “will,” “would,” “could,” “should,” “continue,” and similar expressions. You also can identify them by the fact

that they do not relate strictly to historical or current facts. There are a number of important risks and uncertainties that could cause our actual results to differ materially from the results discussed in the forward-looking statements.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue

reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important cautionary statements in this

prospectus supplement or in the documents incorporated by reference in this prospectus supplement, particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from the

forward-looking statements that we make. For a summary of such factors, please refer to the section entitled “Risk Factors” in this prospectus supplement and the accompanying prospectus and in our most recent annual report on Form 10-K, as

revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any amendments thereto, as filed with the SEC and which are incorporated herein by reference. The information contained in

this document is believed to be current as of the date of this document. We do not intend to update any of the forward-looking statements after the date of this document to conform these statements to actual results or to changes in our

expectations, except as required by law.

In light of these assumptions, risks and uncertainties, the results and events discussed in the

forward-looking statements contained in this prospectus supplement or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak

S-8

only as of the date of this prospectus supplement or the date of the document incorporated by reference in this prospectus supplement and the accompanying prospectus. We are not under any

obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any

person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

S-9

USE OF PROCEEDS

We may issue and sell shares of our common stock under this prospectus supplement having aggregate gross proceeds of up to $35,000,000 from

time to time. Because there is no minimum offering amount required as a part of this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will

sell any shares under or fully utilize the sales agreement with Cowen as a source of financing.

We intend to use the net proceeds from

the sale of securities under this prospectus supplement for our operations and our further development and pre-clinical and clinical work of product candidates in our PRS-080, PRS-060, PRS-343 and PRS-300 Series programs, as well as the development

of other programs and product candidates, and other general corporate purposes, including, but not limited to, working capital, intellectual property protection and enforcement and capital expenditures. We have not determined the amounts we plan to

spend on any of the areas listed above or the timing of these expenditures. As a result, our management will have broad discretion to allocate any net proceeds we receive in connection with the securities offered pursuant to this prospectus

supplement for any purpose. Pending application of the net proceeds as described above, we may initially invest the net proceeds in short-term, investment-grade, interest-bearing securities.

S-10

PLAN OF DISTRIBUTION

We have entered into a sales agreement with Cowen, under which we may issue and sell from time to time up to $35,000,000 of our common stock

through Cowen as our sales agent. Sales of our common stock, if any, will be made at market prices by any method that is deemed to be an “at the market” offering as defined in Rule 415 under the Securities Act, including sales made

directly on The Nasdaq Capital Market or any other trading market for our common stock, or sales to or through a market maker other than on an exchange. If authorized by us in writing, Cowen may also sell our shares of common stock by any other

method permitted by law, including negotiated transactions, and Cowen may also purchase shares of our common stock as principal.

Cowen

will offer our common stock subject to the terms and conditions of the sales agreement on a daily basis or as otherwise agreed upon by us and Cowen. We will designate the maximum amount of common stock to be sold through Cowen on a daily basis or

otherwise determine such maximum amount together with Cowen. Subject to the terms and conditions of the sales agreement, Cowen will use its commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be

sold by us. We may instruct Cowen not to sell common stock if the sales cannot be effected at or above the price designated by us in any such instruction. Cowen or we may suspend the offering of our common stock being made through Cowen under

the sales agreement upon proper notice to the other party. Cowen and we each have the right, by giving written notice as specified in the sales agreement, to terminate the sales agreement in each party’s sole discretion at any time.

The aggregate compensation payable to Cowen as sales agent equals 3.0% of the gross sales price of the shares sold through it pursuant to the

sales agreement. We have also agreed to reimburse Cowen up to $50,000 of Cowen’s actual outside legal expenses incurred by Cowen in connection with this offering. We estimate that the total expenses of the offering payable by us, excluding

commissions payable to Cowen under the sales agreement, will be approximately $320,000.

The remaining sales proceeds, after deducting any

expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such common stock.

Cowen will provide written confirmation to us following the close of trading on The Nasdaq Capital Market on each day in which common stock is

sold through it as sales agent under the sales agreement. Each confirmation will include the number of shares of common stock sold through it as sales agent on that day, the volume weighted average price of the shares sold, the percentage of

the daily trading volume and the net proceeds to us.

We will report at least quarterly the number of shares of common stock sold through

Cowen under the sales agreement, the net proceeds to us and the compensation paid by us to Cowen in connection with the sales of common stock.

Settlement for sales of common stock will occur, unless the parties agree otherwise, on the third business day that is also a trading day

following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sales of our common stock on our behalf, Cowen may be deemed to be an “underwriter” within the meaning of the

Securities Act, and the compensation paid to Cowen may be deemed to be underwriting commissions or discounts. We have agreed in the sales agreement to provide indemnification and contribution to Cowen against certain liabilities, including

liabilities under the Securities Act. As sales agent, Cowen will not engage in any transactions that stabilizes our common stock.

S-11

Our common stock is listed on The Nasdaq Capital Market and trades under the symbol

“PIRS.” The transfer agent of our common stock is Computershare Trust Company, N.A.

Cowen and/or its affiliates have provided,

and may in the future provide, various investment banking and other financial services for us for which services they have received and, may in the future receive, customary fees.

S-12

L

EGAL MATTERS

The validity of the issuance of the shares of our common stock offered hereby will be passed upon for us by Brownstein Hyatt Farber Schreck,

LLP, Las Vegas, Nevada. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., Boston, Massachusetts is counsel for Pieris in connection with this offering. Goodwin Procter LLP, New York, New York is counsel for Cowen in connection with this

offering.

EXPERTS

Ernst & Young GmbH Wirtschaftsprüfungsgesellschat, independent registered public accounting firm, has audited our consolidated

financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial

statements are incorporated by reference in reliance on Ernst & Young GmbH’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, and file annual, quarterly and current

reports, proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the SEC’s public reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You can

request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference facilities. SEC filings are also available at the

SEC’s web site at http://www.sec.gov.

This prospectus supplement is only part of a registration statement on Form S-3 that we have

filed with the SEC under the Securities Act of 1933, as amended, and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded from this

prospectus supplement, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document. You may inspect a copy of the registration statement, including the exhibits

and schedules, without charge, at the public reference room or obtain a copy from the SEC upon payment of the fees prescribed by the SEC.

We also maintain a website at www.pieris.com, through which you can access our SEC filings. The information set forth on our website is not

part of this prospectus supplement.

S-13

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus supplement information that we have filed with the SEC. This

means we can disclose important information to you by referring you to other documents that contain that information. The information incorporated by reference is considered part of this prospectus supplement. We incorporate by reference the

documents listed below:

|

|

(1)

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 that we filed with the SEC on March 23, 2016.

|

|

|

(2)

|

Amendment No. 1 to our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2015 that we filed with the SEC on April 29, 2016.

|

|

|

(3)

|

Amendment No. 2 to our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2015 that we filed with the SEC on July 20, 2016.

|

|

|

(4)

|

Our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016 that we filed with the SEC on May 12, 2016.

|

|

|

(5)

|

Amendment No. 1 to our Quarterly Report on Form 10-Q/A for the quarterly period ended March 31, 2016 that we filed with the SEC on July 20, 2016.

|

|

|

(6)

|

Our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016 that we filed with the SEC on August 11, 2016.

|

|

|

(7)

|

Our Current Reports on Form 8-K, each of which were filed with the SEC (except for the information furnished under Items 2.02 and 7.01 and the exhibits thereto on the following dates:

|

|

|

•

|

|

June 6, 2016 (with respect to two reports filed on such date);

|

|

|

(8)

|

The description of our common stock contained in our Registration Statement on Form 8-A filed on June 24, 2015, including any amendment or report filed for the purpose of updating such description.

|

|

|

(9)

|

All reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of the registration statement of which this prospectus supplement forms a part

and prior to the effectiveness of such registration statement or after the date of this prospectus supplement and prior to the termination or completion of the offering of securities under this prospectus supplement shall be deemed to be

incorporated by reference in this prospectus supplement and to be a part hereof from the date of filing such reports and other documents.

|

The SEC file number for each of the documents listed above is 001-37471.

Any statement contained in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this

prospectus supplement or in the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement and the accompanying prospectus to the extent that a statement contained in this prospectus supplement or

any other subsequently filed document that is deemed to be incorporated by reference into the accompanying prospectus modifies or supersedes the statement. Any statements so modified or superseded shall not be deemed, except as so modified or

superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

S-14

You may request a copy of these documents, orally or in writing, which will be provided to you at

no cost, by contacting:

Pieris Pharmaceuticals, Inc.

255 State Street, 9th Floor

Boston, Massachusetts 02109

Attention: Investor Relations

Telephone: +1 (857) 246-8998

You

may also access these documents on our website, http://www.pieris.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus supplement. We have included our website address in this prospectus

supplement solely as an inactive textual reference.

You should rely only on information contained in, or incorporated by reference into,

this prospectus supplement and the accompany prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus supplement or the accompanying prospectus or incorporated by reference in this

prospectus supplement or the accompanying prospectus. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not

qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

S-15

PROSPECTUS

PIERIS PHARMACEUTICALS, INC.

$100,000,000

COMMON

STOCK

PREFERRED STOCK

DEBT SECURITIES

WARRANTS

RIGHTS

PURCHASE

CONTRACTS

UNITS

This prospectus

will allow us to issue, from time to time at prices and on terms to be determined at or prior to the time of the offering, up to $100,000,000 of any combination of the securities described in this prospectus, either individually or in units. We may

also offer common stock or preferred stock upon conversion of or exchange for debt securities; common stock upon conversion of or exchange for the preferred stock; common stock, preferred stock or debt securities upon the exercise of warrants,

rights or performance of purchase contracts; or any combination of these securities upon the performance of purchase contracts.

We may

offer and sell these securities on a delayed or continuous basis to or through one or more underwriters, dealers or agents, or directly to investors, in amounts, at prices and on terms to be determined by market conditions and other factors at the

time of the offering. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement. If any underwriters or agents are

involved in the sale of our securities with respect to which this prospectus is being delivered, the names of such underwriters or agents and any applicable fees, commissions or discounts and over-allotment options will be set forth in a prospectus

supplement. The price to the public of such securities and the net proceeds that we expect to receive from such sale will also be set forth in a prospectus supplement. You should read this prospectus and any prospectus supplement, as well as any

documents incorporated by reference into this prospectus or any prospectus supplement, carefully before you invest.

This prospectus

describes only the general terms of these securities and the general manner in which we will offer the securities. The specific terms of any securities we offer will, if not included in this prospectus or information incorporated by reference

herein, be included in a supplement to this prospectus. The prospectus supplement may describe the specific manner in which we will offer the securities and may also add, update or change information contained in this prospectus.

Our common stock is listed on the NASDAQ Capital Market under the symbol “PIRS”. On July 22, 2016, the last reported sale price

for our common stock was $1.69 per share. We will provide information in the related prospectus supplement for the trading market, if any, for any other securities that may be offered. Prospective purchasers of our securities are urged to obtain

current information as to the market prices of our securities, where applicable.

Investing

in our securities involves a high degree of risk. Before making any investment in any of our securities, you should read and carefully consider the risks described in this prospectus under “

Risk Factors

”

beginning on page 4 of this prospectus.

This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus is dated August 3, 2016

TABLE OF CONTENTS

i

About This Prospectus

You should rely only on the information that we have provided or incorporated by reference in this prospectus, any applicable prospectus

supplement and any related free writing prospectus that we may authorize to be provided to you. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or

to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information or representation.

This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or

any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security registered under the registration statement of which this prospectus is a part.

This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the

offering of the securities, you should refer to the registration statement, including its exhibits. This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual

documents for complete information. All of the summaries are qualified in their entirety by the actual documents. The prospectus supplement may also add, update or change information contained or incorporated by reference in this prospectus.

However, no prospectus supplement will offer a security that is not registered and described in this prospectus at the time of its effectiveness. This prospectus, together with the applicable prospectus supplements and the documents incorporated by

reference into this prospectus, includes all material information relating to the offering of securities under this prospectus. You should carefully read this prospectus, the applicable prospectus supplement, the information and documents

incorporated herein by reference and the additional information under the heading “Where You Can Find More Information” before making an investment decision.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be

deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be

relied on as accurately representing the current state of our affairs.

This prospectus may not be used to consummate sales of our

securities, unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date will

control.

As used in this prospectus, unless the context indicates or otherwise requires, “our Company”, “the

Company”, “Pieris”, “we”, “us”, and “our” refer to Pieris Pharmaceuticals, Inc., a Nevada corporation, and its consolidated subsidiary, and the term “Pieris GmbH” refers to Pieris

Pharmaceuticals GmbH, a company organized under the laws of Germany that, through a share exchange transaction completed on December 17, 2014, has become our wholly owned subsidiary.

We have registered trademarks for Pieris

®

, Anticalin

®

and Pocket Binding

®

. All other trademarks, trade names and service marks included in this prospectus are the property of their respective

owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner.

ii

PROSPECTUS SUMMARY

The following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under

this prospectus. We urge you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference from our other filings

with the SEC or included in any applicable prospectus supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements and in our most recent annual and quarterly

filings with the SEC, as well as other information in this prospectus and any prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

We are a clinical stage

biotechnology company that discovers and develops Anticalin-based drugs to target validated disease pathways in a unique and transformative way. Our pipeline includes immuno-oncology multi-specifics tailored for the tumor micro-environment, an

inhaled Anticalin to treat uncontrolled asthma and a half-life-optimized Anticalin to treat anemia. Our proprietary Anticalins are a novel class of protein therapeutics validated in the clinic and by partnerships with leading pharmaceutical

companies. Anticalin

®

proteins are a class of low molecular-weight therapeutic proteins derived from lipocalins, which are naturally occurring low-molecular weight human proteins

typically found in blood plasma and other bodily fluids. Anticalin

®

-branded proteins function similarly to monoclonal antibodies, or mAbs, by binding tightly and specifically to a diverse

range of targets.

Our core Anticalin

®

technology and platform were

developed in Germany, and we have collaboration arrangements with major multi-national pharmaceutical companies headquartered in the U.S., Europe and Japan and with regional pharmaceutical companies headquartered in India. These include existing

agreements with Daiichi Sankyo Company Limited, or Daiichi Sankyo, and Sanofi Group, or Sanofi, pursuant to which our Anticalin platform has consistently achieved its development milestones. Furthermore, we established a collaboration with

F.Hoffmann—La Roche Ltd. and Hoffmann—La Roche Inc., or Roche in December 2015. We have discovery and preclinical collaboration and service agreements with both academic institutions and private firms in Australia, which increasingly are

being handled through Pieris Australia Pty Ltd., a wholly owned subsidiary of Pieris.

Additional Information

For more information regarding our business, see the disclosure under the headings “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and “Business” included elsewhere in this prospectus. For a description of certain risks related to our business, see the disclosure under the heading “Risk Factors” beginning on

page 4 of this prospectus.

Corporate History

Pieris Pharmaceuticals, Inc. was incorporated under the laws of the State of Nevada on May 24, 2013 with the name “Marika Inc.”

and we changed our name to “Pieris Pharmaceuticals, Inc.” on December 16, 2014. On December 17, 2014, we closed a share exchange transaction in which the stockholders of Pieris GmbH contributed all of their equity interests in Pieris

GmbH to Pieris in exchange for shares of our common stock, resulted in Pieris GmbH becoming a wholly owned subsidiary of the Company. Immediately following the closing, the business of Pieris GmbH became our sole focus.

1

Our corporate headquarters are located at 255 State Street, 9

th

Floor, Massachusetts 02109 and our telephone number is (857) 246-8998. We maintain a website at www.pieris.com, to which we regularly post copies of our press releases as well as additional

information about us. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or

furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available free of charge through the investor relations page of our internet website as soon as reasonably practicable after we

electronically file such material with, or furnish it to, the SEC.

All brand names or trademarks appearing in this prospectus as the

property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsement or sponsorship of, us by the

trademark or trade dress owners.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as

defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but

are not limited to:

|

|

•

|

|

being required to provide only two years of audited financial statements in addition to any required unaudited interim financial statements, with correspondingly reduced disclosure in the “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” section of our periodic reports and registration statements;

|

|

|

•

|

|

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley Act;

|

|

|

•

|

|

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

|

|

|

•

|

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

|

We will remain an emerging growth company until the earliest of (i) the end of the fiscal year in which the market value of our common stock

that is held by non-affiliates exceeds $700 million as of the end of the second fiscal quarter, (ii) the end of the fiscal year in which we have total annual gross revenues of $1 billion or more during such fiscal year, (iii) the date on which we

issue more than $1 billion in non-convertible debt in a three-year period or (iv) December 31, 2019, the end of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration

statement filed under the Securities Act.

We may choose to take advantage of some but not all of these reduced burdens. We have taken

advantage of certain of the reduced disclosure obligations, which include providing only two years of audited financial statements and correspondingly reduced financial disclosures and reduced executive compensation disclosure in our periodic

reports, proxy statements and registration statements, and may elect to take advantage of other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other

public reporting companies in which you hold equity interests.

2

Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting

standards until such time as those standards apply to private companies. However, we have irrevocably elected not to avail ourselves of this extended transition period for complying with new or revised accounting standards and, therefore, we will be

subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Offerings Under This

Prospectus

Under this prospectus, we may offer shares of our common stock and preferred stock, various series of debt securities

and/or warrants, rights or purchase contracts to purchase any of such securities, either individually or in units, with a total value of up to $100,000,000, from time to time at prices and on terms to be determined by market conditions at the time

of the offering. This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the

specific amounts, prices and other important terms of the securities, including, to the extent applicable:

|

|

•

|

|

designation or classification;

|

|

|

•

|

|

aggregate principal amount or aggregate offering price;

|

|

|

•

|

|

maturity, if applicable;

|

|

|

•

|

|

rates and times of payment of interest or dividends, if any;

|

|

|

•

|

|

redemption, conversion or sinking fund terms, if any;

|

|

|

•

|

|

voting or other rights, if any; and

|

|

|

•

|

|

conversion or exercise prices, if any.

|

The prospectus supplement also may add, update or

change information contained in this prospectus or in documents we have incorporated by reference into this prospectus. However, no prospectus supplement will fundamentally change the terms that are set forth in this prospectus or offer a

security that is not registered and described in this prospectus at the time of its effectiveness.

We may sell the securities directly to

investors or to or through agents, underwriters or dealers. We, and our agents or underwriters, reserve the right to accept or reject all or part of any proposed purchase of securities. If we offer securities through agents or

underwriters, we will include in the applicable prospectus supplement:

|

|

•

|

|

the names of those agents or underwriters;

|

|

|

•

|

|

applicable fees, discounts and commissions to be paid to them;

|

|

|

•

|

|

details regarding over-allotment options, if any; and

|

|

|

•

|

|

the net proceeds to us.

|

This prospectus may not be used to consummate a sale of any securities unless it

is accompanied by a prospectus supplement.

3

R

ISK FACTORS

Investing in our securities involves significant risk. The prospectus supplement applicable to each offering of our securities may contain a

discussion of the risks applicable to an investment in Pieris. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable

prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and

assumptions discussed under the heading “Risk Factors” included in our most recent annual report on Form 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K on file with the

SEC, all of which are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only ones

we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered

securities.

RATIO OF EARNINGS TO FIXED CHARGES

Any time debt securities are offered pursuant to this prospectus, we will provide a table setting forth our ratio of earnings to fixed charges

on a historical basis in the applicable prospectus supplement, if required.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus include forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amending, including statements regarding:

|

|

•

|

|

the results of our research and development activities, including uncertainties relating to the discovery of potential drug candidates and the preclinical and ongoing or planned clinical testing of our drug candidates;

|

|

|

•

|

|

the early stage of our drug candidates presently under development;

|

|

|

•

|

|

our ability to obtain and, if obtained, maintain regulatory approval of our current drug candidates and any of our other future drug candidates;

|

|

|

•

|

|

our need for substantial additional funds in order to continue our operations and the uncertainty of whether we will be able to obtain the funding we need;

|

|

|

•

|

|

our future financial performance;

|

|

|

•

|

|

our ability to retain or hire key scientific or management personnel;

|

|

|

•

|

|

our ability to protect our intellectual property rights that are valuable to our business, including patent and other intellectual property rights;

|

|

|

•

|

|

our dependence on third-party manufacturers, suppliers, research organizations, testing laboratories and other potential collaborators;

|

|

|

•

|

|

our ability to successfully market and sell our drug candidates in the future as needed;

|

|

|

•

|

|

the size and growth of the potential markets for any of our approved drug candidates, and the rate and degree of market acceptance of any of our approved drug candidates;

|

|

|

•

|

|

competition in our industry; and

|

|

|

•

|

|

regulatory developments in the U.S. and foreign countries.

|

4

Such statements in connection with any discussion of future operations or financial performance

are identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “target,” “potential,”

“shall,” “will,” “would,” “could,” “should,” “continue,” and similar expressions. You also can identify them by the fact that they do not relate strictly to historical or current

facts. There are a number of important risks and uncertainties that could cause our actual results to differ materially from the results discussed in the forward-looking statements.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue

reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important cautionary statements in this

prospectus or in the documents incorporated by reference in this prospectus, particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we

make. For a summary of such factors, please refer to the section entitled “Risk Factors” in this prospectus, as updated and supplemented by the discussion of risks and uncertainties under “Risk Factors” contained in any

supplements to this prospectus and in our most recent annual report on Form 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any amendments thereto, as filed with

the SEC and which are incorporated herein by reference. The information contained in this document is believed to be current as of the date of this document. We do not intend to update any of the forward-looking statements after the date of this

document to conform these statements to actual results or to changes in our expectations, except as required by law.

In light of these

assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus or in any document incorporated herein by reference might not occur. Investors are cautioned not to place

undue reliance on the forward-looking statements, which speak only as of the date of this prospectus or the date of the document incorporated by reference in this prospectus. We are not under any obligation, and we expressly disclaim any

obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section.

USE OF

PROCEEDS

Unless otherwise indicated in the applicable prospectus supplement, we intend to use any net proceeds from the sale of

securities under this prospectus for our operations and our further development and pre-clinical and clinical work of product candidates in our PRS-080, PRS-060 and PRS-343 programs, as well as the development of other programs and product

candidates, and other general corporate purposes, including, but not limited to, working capital, intellectual property protection and enforcement, capital expenditures, repayment of any existing indebtedness, investments, acquisitions and

collaborations. We have not determined the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds, if any, we receive in

connection with securities offered pursuant to this prospectus for any purpose. Pending application of the net proceeds as described above, we may initially invest the net proceeds in short-term, investment-grade, interest-bearing securities or

apply them to the reduction of short-term indebtedness.

5

PLAN OF DISTRIBUTION

The securities covered by this prospectus may be sold from time to time, at market prices prevailing at the time of sale, at prices related to

market prices, at a fixed price or prices subject to change or at negotiated prices, by a variety of methods including the following:

|

|

•

|

|

in the over-the-counter market;

|

|

|

•

|

|

in privately negotiated transactions;

|

|

|

•

|

|

through broker-dealers, who may act as agents or principals;

|

|

|

•

|

|

through one or more underwriters on a firm commitment or best-efforts basis;

|

|

|

•

|

|

in a block trade in which a broker-dealer will attempt to sell a block of securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

directly to one or more purchasers;

|

|

|

•

|

|

in “at the market offerings” to or through a market maker or into an existing trading market, or a securities exchange or otherwise; or

|

|

|

•

|

|

in any combination of the above.

|

In effecting sales, brokers or dealers engaged by the

selling stockholders may arrange for other brokers or dealers to participate. Broker-dealer transactions may include:

|

|

•

|

|

purchases of the securities by a broker-dealer as principal and resales of the securities by the broker-dealer for its account pursuant to this prospectus;

|

|

|

•

|

|

ordinary brokerage transactions; or

|

|

|

•

|

|

transactions in which the broker-dealer solicits purchasers on a best efforts basis.

|

We may

change the price of the securities offered from time to time.

Offers to purchase securities may be solicited directly by us and the sale

thereof may be made by us directly to institutional investors or others. In this case, no underwriters or agents would be involved. We may use electronic media, including the Internet, to sell offered securities directly.

We, or agents designated by us, may directly solicit, from time to time, offers to purchase the securities. Any such agent may be deemed to be

an underwriter as that term is defined in the Securities Act. We will name any agents involved in the offer or sale of the securities and describe any commissions payable by us to these agents in the prospectus supplement. Unless otherwise indicated

in the prospectus supplement, these agents will be acting on a best efforts basis for the period of their appointment. The agents may be entitled under agreements which may be entered into with us to indemnification by us against specific civil

liabilities, including liabilities under the Securities Act. The agents may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

If we utilize any underwriters in the sale of the securities in respect of which this prospectus is delivered, we will enter into an

underwriting agreement with those underwriters at the time of sale to them. We will set forth the names of these underwriters and the terms of the transaction in the prospectus supplement, which will be used by the underwriters to make resales of

the securities in respect of which this prospectus is delivered to the public. We may indemnify the underwriters under the relevant underwriting agreement against specific liabilities, including liabilities under the Securities Act. The underwriters

or their affiliates may be customers of, may engage in transactions with and may perform services for us or our affiliates in the ordinary course of business.

6

If we utilize a dealer in the sale of the securities in respect of which this prospectus is

delivered, we will sell those securities to the dealer, as principal. The dealer may then resell those securities to the public at varying prices to be determined by the dealer at the time of resale. We may indemnify the dealers against specific

liabilities, including liabilities under the Securities Act. The dealers or their affiliates may also be our customers or may engage in transactions with, or perform services for us in the ordinary course of business.

We may offer the common stock covered by this prospectus into an existing trading market on the terms described in the prospectus supplement

relating thereto. Underwriters, dealers and agents who participate in any at-the-market offerings will be described in the prospectus supplement relating thereto.

A prospectus and accompanying prospectus supplement in electronic form may be made available on the web sites maintained by the underwriters.

The underwriters may agree to allocate a number of securities for sale to their online brokerage account holders. Such allocations of securities for internet distributions will be made on the same basis as other allocations. In addition, securities

may be sold by the underwriters to securities dealers who resell securities to online brokerage account holders.

The aggregate maximum

compensation the underwriters will receive in connection with the sale of any securities under this prospectus and the registration statement of which it forms a part will not exceed 8% of the gross proceeds from the sale.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. The

place and time of delivery for the securities in respect of which this prospectus is delivered will be set forth in the accompanying prospectus supplement.

Certain underwriters may use this prospectus and any accompanying prospectus supplement for offers and sales related to market-making

transactions in the securities. These underwriters may act as principal or agent in these transactions, and the sales will be made at prices related to prevailing market prices at the time of sale. Any underwriters involved in the sale of the

securities may qualify as “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. In addition, the underwriters’ commissions, discounts or concessions may qualify as underwriters’ compensation under the

Securities Act and the rules of the Financial Industry Regulatory Authority, Inc., or FINRA.

Shares of our common stock sold pursuant to

the registration statement of which this prospectus is a part will be authorized for listing and trading on The NASDAQ Capital Market. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any,

on The NASDAQ Capital Market or any securities market or other securities exchange of the securities covered by the prospectus supplement. Underwriters may make a market in our common stock, but will not obligated to do so and may discontinue market

making at any time without notice. We can make no assurance as to the liquidity of or the existence, development or maintenance of trading markets for any of the securities.

In connection with offerings of securities under the registration statement of which this prospectus forms a part and in compliance with

applicable law, underwriters, brokers or dealers may engage in transactions that stabilize or maintain the market price of the securities at levels above those that might otherwise prevail in the open market. Specifically, underwriters, brokers or