World-Class Spend Less & Rely on Fewer

Staff While Driving Higher Levels of Effectiveness, Agility and

Insight

World-class finance organizations now spend 42 percent less than

typical companies and use 44 percent fewer staff, while at the same

time driving higher levels of effectiveness, agility, and insight,

according to the newly-released 2016 analysis of finance benchmarks

from The Hackett Group, Inc. (NASDAQ: HCKT). The research

quantifies the performance advantage of world class compared with

typical finance organizations. For a typical company with $10

billion in revenue, attaining world-class performance represents as

much as $40 million in potential savings annually.

The research finds that digital business transformation is one

of five initiatives key to achieving world-class performance.

Digital technology is creating new opportunities to transform

finance service delivery, and world-class finance organizations

focus greater resources in this area. World-class finance

organizations also enable analytics-based decision making to

generate insights that improve enterprise agility.

A public version of the research is available on a complimentary

basis, with registration, at this link: http://bit.ly/29t7K8J.

World-class finance organizations are those that achieve

top-quartile performance in both efficiency and effectiveness

across an array of weighted metrics in The Hackett Group’s

comprehensive finance benchmark.

The Hackett Group’s research identifies a total of five

strategies that world-class finance organizations use to achieve

superior results: embrace digital transformation; enable

analytics-based decision making; reallocate resources from

transactional focus to value added; adopt customer-centric service

design and delivery; and reskill the finance function. Here are

more details on each strategy:

Embrace Digital Transformation -

Cloud-based infrastructure and applications, virtual business and

technology networks, robotic process automation, and business

analytics are coming together with rapidly transitioning employee

and consumer bases that are increasingly adept with new mobile

technologies and business models. This convergence is creating

tremendous new opportunities for finance organizations to apply

digital technologies to transform service delivery. The Hackett

Group’s research shows that more than 70 percent of all finance

organizations are planning major transformation, but most finance

organizations have made only minimal investments to date in cloud

technologies, and even less in robotic process automation, mobile,

and other digital technologies. Overall, world-class companies have

done more to automate basic transactions and finance processes

across the board, which can drive an array of benefits, such as

lower cost for customer invoices, fewer errors, shorter time to

bill, and better cash flow. Automating customer invoicing, for

example, reduces cost by 76 percent, leads to nearly 40 percent

fewer errors, and results in 44 percent shorter time to bill.

According to The Hackett Group Finance

Transformation Principal Richard Cardillo, “It’s critical for

finance organizations to explore digital transformation

opportunities to drive a more agile platform, greater cost

reduction, and improved customer experience. To succeed, finance

leaders must embrace new technologies such as improved analytics

enabled by big data, mobility, the cloud, and advanced process

automation tools. They must investigate and deploy pilot programs

so they can better understand how to scale solutions and realize

the long-term benefits promised by these technologies.

“Robotic process automation is a particularly

interesting area that is rapidly evolving with a variety of players

developing tools – some of which are competitive and others which

are complementary. Operationalizing robotics it is not about

adopting a single solution, or evolving from structured to

cognitive processing. Rather it’s about applying the appropriate

toolset to drive the maximum value depending on the issue at hand,”

explained Mr. Cardillo.

“Some leading-edge companies have begun to

explore the potential for robotic systems that can respond to basic

inquiries in areas like payables and receivables,” said Mr.

Cardillo. “Others are starting to look at robotics for call center

interactions such as insurance quotes and credit card inquiries.

These solutions have companies asking whether off-shoring

transaction processing tasks to gain the labor arbitrage benefit is

really necessary.”

Enable Analytics-Based Decision Making

– Advanced information management is key to enterprise agility.

What’s required is a “sensory” system that monitors external

conditions and analytical capabilities that comprehend this data

within the business context. World-class finance organizations have

a sophisticated information/data architecture that makes effective

data analysis possible; planning and analysis capability that is

dynamic and information driven; and performance measurement that is

aligned with the business. As just one example, at world-class

finance organizations operations managers are more than 4 times

more likely to use an online budgeting system (14 percent vs. 60

percent), enabling everyone to work from one set of data and

facilitating a shift from building budgets to analysis and judgment

based on the data. But there is dramatic room for improvement. A

total of 56 percent of all companies still use spreadsheets and

customized applications for planning and forecasting, and analysts

spend more than half of their time compiling data, leaving less

time for analysis and business advice.

Reallocate Resources from Transactional

Focus to Value Adding – By leveraging a formal service delivery

model, generally including a global business services or shared

services facility or center of excellence, world-class finance

organizations are able to shift their focus from transactional work

to higher-value activities, such as analytics, measurement, and

supporting business strategy in ways that drive business results.

Despite having much smaller staffs, world-class finance

organizations dedicate a much larger percentage of their overall

staff (36 percent versus 26 percent) to planning and performance

management than typical companies and a much smaller percentage (49

percent versus 60 percent) to transactional work.

Adopt Customer-Centric Service Design and

Delivery - Understanding and managing the customer experience

requires a holistic, structured approach, starting with a clear

understanding of customers’ needs and then improving relevant

elements of the finance service delivery model. A key part of that

focus should include educating those customers about the tradeoffs

inherent in different service levels and non-standard offerings.

World-class organizations are service oriented and customer focused

in their approaches to finance delivery.

Re-Skill the Finance Function - One of

the biggest challenges facing finance organizations is aligning the

competencies and skills of finance talent with the needs of the

business. Top management looks to finance to help the business

execute strategies more successfully and to implement the

organizational changes needed to become more agile and innovative.

This means moving beyond technical accounting and data skills to

establish broad leadership and business acumen capabilities

throughout the finance organization. World-class finance

organizations demonstrate this by having nearly 50 percent more

staff per manager than typical companies, offering greater autonomy

for individual decision-making and fewer layers in the

organization.

“Getting to world-class is a real challenge for even the most

agile finance organizations. But the benefits are tangible,” said

The Hackett Group’s Global Practice Leader of GBS and Finance

Advisory Programs Jim O’Connor. “To jump start their journey,

finance leaders can take steps like measuring baseline efficiency

and effectiveness levels to gauge performance and test their

service delivery model. They can document and evaluate the customer

value they create, and find ways to reduce complexity. They can

explore digital opportunities for more agile platforms and cost

reduction. And finally they can adopt a service delivery model that

enhances finance’s alignment with business objectives.”

The Hackett Group’s World-Class Finance Performance Advantage

Research is based on an analysis of results from recent benchmarks,

performance studies, and advisory and transformation engagements at

hundreds of large global companies.

About The Hackett Group

The Hackett Group (NASDAQ: HCKT) is an intellectual

property-based strategic consultancy and leading

enterprise benchmarking and best practices implementation

firm to global companies. Services include business

transformation, enterprise performance

management, working capital management, and global

business services. The Hackett Group also provides dedicated

expertise in business strategy, operations, finance, human capital

management, strategic sourcing, procurement, and information

technology, including its award-winning Oracle EPM and SAP

practices.

The Hackett Group has completed more than 11,000 benchmarking

studies with major corporations and government agencies, including

93% of the Dow Jones Industrials, 86% of the Fortune 100, 87% of

the DAX 30 and 52% of the FTSE 100. These studies drive its Best

Practice Intelligence Center™ which includes the firm's

benchmarking metrics, best practices repository, and best practice

configuration guides and process flows, which enable The Hackett

Group’s clients and partners to achieve world-class

performance.

More information on The Hackett Group is available at:

www.thehackettgroup.com, info@thehackettgroup.com, or by calling

(770) 225-3600.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160915005173/en/

The Hackett GroupGary Baker, 917-796-2391Global Communications

Directorgbaker@thehackettgroup.com

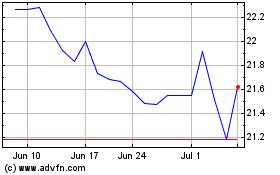

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

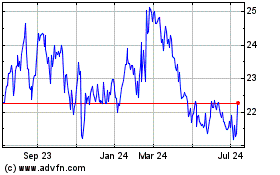

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Apr 2023 to Apr 2024