Statement of Beneficial Ownership (sc 13d)

September 09 2016 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. ________)*

COOL TECHNOLOGIES, INC.

(Name of Issuer)

Common Stock, par value $0.001

(Title

of Class of Securities)

404273104

(CUSIP Number)

Eric Hess, Esq.

Hess Legal Counsel LLC

120 West 45

th

Street, Suite 3705

New York, NY 10036

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices and Communications)

August 31, 2016

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d -1(e), 240.13d -1(f) or 240.13d

-1(g), check the following box. [ ]

Note

: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See

§240.13d -7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled

out for a reporting person's initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be "filed" for the purpose of Section 18 of the

Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities

of that section of the Act but shall be subject to all other provisions of the

Act (however, see the Notes).

|

CUSIP No.

404273104

|

13D

|

Page 2 of 5 Pages

|

|

1.

|

NAMES OF REPORTING

PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

|

KHIC, LLC EIN:

81-1330271

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see

instructions)

|

|

|

(a) [ ]

|

|

|

(b)

[ ]

|

|

3.

|

SEC USE ONLY

|

|

|

|

|

4.

|

SOURCE OF FUNDS (see instructions)

|

|

|

|

|

|

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

New

Jersey

|

|

|

7.

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

14,846,946 (1)

|

|

NUMBER OF

|

8.

|

SHARED VOTING POWER

|

|

SHARES

|

|

|

|

BENEFICIALLY

|

|

NONE

|

|

OWNED BY

|

9.

|

SOLE DISPOSITIVE

POWER

|

|

EACH

|

|

|

|

REPORTING

|

|

14,623,160 (1)

|

|

PERSON WITH

|

10.

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

NONE

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

|

|

|

|

|

14,846,946 (1)

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (see instructions) [ ]

|

|

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

|

|

|

|

|

|

12.22% (2)(3)

|

|

14.

|

TYPE OF REPORTING PERSON (see instructions)

|

|

|

|

|

|

OO

|

|

|

(1)

|

Beneficial ownership consists of 14,846,946 shares of

Common Stock, issuable upon conversion by Reporting Person of a Senior

Convertible Note with a principal amount of $371,176.33 (determined as of

August 31, 2016) at a conversion price of $0.025 per share.

|

|

|

(2)

|

The percentage is based on a total of 106,623,656 shares

of Common Stock of the Company outstanding as of August 25, 2016 as

reported in the Company’s Quarterly Report on Form 10-Q/A filed with the

Securities and Exchange Commission on August 30, 2016. Such percentage

does not include shares of Common Stock issuable upon exercise of

outstanding options or warrants.

|

|

|

(3)

|

The calculation includes shares of Common Stock issuable

upon conversion of the Senior Convertible Promissory Note beneficially

owned by the Reporting Person and assumes no other exercise of outstanding

options or warrants.

|

|

CUSIP No. 404273104

|

13D

|

Page 3 of 5 Pages

|

Item 1. Security and Issuer.

This Schedule 13D relates to the Common Stock of

Cool Technologies, Inc. (the “Company” or “Issuer”). The principal executive

offices of the Company are located at 8875 Hidden River Parkway, Tampa Florida

33637.

Item 2. Identity and Background.

|

|

(a)

|

Name of Person filing this Statement:

|

|

|

|

|

|

|

|

This Statement on 13D is being filed on behalf of KHIC,

LLC, a limited liability company formed under the laws of the State of New

Jersey (the “Reporting Person”).

|

|

|

|

|

|

|

(b)

|

Residence or Business Address:

|

|

|

|

|

|

|

|

The principal business address of the Reporting Person is

at :

|

|

|

|

|

|

|

|

120 West 45

th

Street, Ste 3705, New York,

NY

|

|

|

|

|

|

|

(c)

|

Present Principal Occupation and

Employment:

|

|

|

|

|

|

|

|

The Reporting Person is a limited liability company

formed under the laws of the State of New Jersey. The Reporting Person is

a holding company formed to hold interests in various entities.

|

|

|

|

|

|

|

(d)

|

Criminal Convictions:

|

|

|

|

|

|

|

|

The Reporting Person has not been charged or convicted in

a criminal proceeding during the last five years.

|

|

|

|

|

|

|

(e)

|

Civil Proceedings:

|

|

|

|

|

|

|

|

The Reporting Person has not been a party to a civil

proceeding of a judicial or administrative body of competent jurisdiction

during the last five years where such person, as result of such

proceeding, was or became subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with

respect to such law.

|

|

|

|

|

|

|

(f)

|

State of

Incorporation/Organization/Citizenship:

|

|

|

|

|

|

|

|

See item 2(a)

|

Item 3. Source or Amount of Funds or Other

Consideration.

Pursuant to a Securities Purchase Agreement (the "Purchase

Agreement") and a Senior Convertible Promissory Note ('Note") together with a

Registration Rights Agreement, each dated August 26, 2016, Cool Technologies,

Inc. (the “Company”) has the right to sell to the Reporting Person the Note in

the principal amount of $371,173.91 (determined as of August 31, 2016)

convertible into shares of the Company's common stock, $0.001 par value per

share (“Common Stock”), at a conversion price of $0.025 per share. All proceeds

from the Note are allocated specifically to pay off principal and interest from

existing Company convertible debt.

The Principal amount of the Note shall bear interest at a fixed

rate of three percent per annum for two years. All interest accrued shall be

payable in semi-annual installments with the first payment due six months from

the issuance date of the Note. Subsequent, interest payments will be due on the

first day of every sixth month thereafter until the principal and accrued

interest is paid in full. The outstanding principal and all accrued interest

must be repaid no later than August 24, 2018 (the "Maturity Date").

The Note shall rank senior to all indebtedness of the Company

and its subsidiaries as of the Issuance date as well as to all indebtedness of

the Company and its subsidiaries incurred after the Issuance date.

|

CUSIP No. 404273104

|

13D

|

Page 4 of 5 Pages

|

The Note may be converted at any time into shares of the Common

Stock at the conversion price, however, pursuant to the terms of the Note, the

Reporting Person may not convert more than 50% of the Note prior to September

30, 2016.

Under the terms of the Purchase Agreement which details the

specific sales milestone of achieving binding agreements to sell 1,000 of the

Company's Mobile Generation (MG) kits to any one or a combination of four

equipment manufacturers within 100 days, the Company has the right to require

the Reporting Person to purchase from the Company four million restricted shares

of Common Stock at a purchase price of $0.05 per share and a warrant to purchase

four million of common stock at an exercise price of $0.06. The warrant shall

expire five years from the date of issuance and has no provision for cashless

exercise.

Subsequently, under the terms and subject to the conditions of

the Purchase Agreement, the Reporting Person has the right to require the

Company to sell to the Reporting Person four million restricted shares of Common

Stock at a purchase price of $0.05 per share, and a warrant to purchase four

million shares of Common Stock with an exercise price of $0.06 per share. The

warrant shall expire five years from the date of issuance and has no provision

for cashless exercise.

In order to provide for registration for the public resale of

all shares and warrants, the Company and the Reporting Person executed a

Registration Rights Agreement concurrently with the Purchase Agreement.

Item 4. Purpose of Transaction.

The issuance of the Note and the right to convert the Note into

shares of Common Stock of the Company were part of a financing transaction to

enable the Company to pay off principal and interest from existing convertible

debt.

Item 5. Interest in Securities of the Issuer.

|

(a)

|

The Reporting Person currently beneficially owns

14,846,946 shares of the Company’s Common Stock, issuable upon conversion

of the Note with a principal amount of $371,176.33 (determined as of

August 31, 2016) at a conversion price of $0.025 per share. The Reporting

Person may only convert 50% of the Note into Common Stock of the Company

prior to September 30, 2016.

|

|

|

|

|

|

Shares beneficially owned by the Reporting Person account

for 12.22% of the Company’s outstanding Common Stock if shares issuable

upon conversion of the Note held by the Reporting Person are included.

Such percentage does not include shares of Common Stock issuable upon

exercise of outstanding options or warrants.

|

|

|

|

|

(b)

|

The Reporting Person holds the sole right to vote or

direct the vote and sole power to dispose or to direct the disposition of

the securities listed under items 3 and 5(a).

|

|

|

|

|

(c)

|

Other than the transactions described herein, there has

been no other transactions concerning the securities of the Company that

were effected by the Reporting Person during the past sixty (60)

days.

|

|

|

|

|

(d)

|

None.

|

|

|

|

|

(e)

|

Not applicable.

|

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

See Item 3.

Item 7. Material to Be Filed as Exhibits.

None

|

CUSIP No. 404273104

|

13D

|

Page 5 of 5 Pages

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that

the information set forth in this statement is true, complete and correct.

|

|

KHIC, LLC

|

|

|

|

|

|

By:

|

|

|

Eric Hess, Secretary

|

|

|

|

|

|

|

|

|

|

|

|

September 09, 2016

|

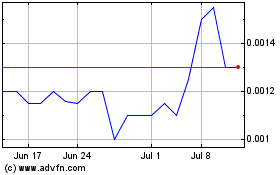

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Apr 2023 to Apr 2024