UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June 2016

Golar LNG Limited

(Translation of registrant’s name into English)

2nd Floor,

S.E. Pearman Building,

9 Par-la-Ville Road,

Hamilton, HM 11

Bermuda

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

|

|

|

|

|

|

|

Form 20-F [X]

|

|

Form 40-F [ ]

|

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82-_____________________

INTERIM RESULTS FOR THE PERIOD ENDED 30 JUNE 2016

Highlights

|

|

|

|

•

|

EBITDA* in the quarter reported a loss of $17.5 million compared to a 1Q loss of $21.7 million.

|

|

|

|

|

•

|

Golar LNG Limited (“Golar” or “the Company”) and Stonepeak Infrastructure Partners (“Stonepeak”) launched Golar Power, a 50/50 joint venture that will offer integrated LNG based downstream power solutions and infrastructure.

|

|

|

|

|

•

|

Golar’s 15.9 million subordinated units in Golar LNG Partners LP (“Golar Partners” or “the Partnership”) converted to common units.

|

|

|

|

|

•

|

Refinanced and then closed the sale of FSRU Golar Tundra to Golar Partners releasing an incremental $102.8 million of liquidity.

|

Subsequent Events

|

|

|

|

•

|

Closed Golar Power transaction and received $103.0 million in new liquidity. Debt and operating cash burn in respect of two vessels together with $216.5 million of unfunded capital commitments for the FSRU new-build removed from Golar’s balance sheet.

|

|

|

|

|

•

|

Golar and Schlumberger formed OneLNG, a joint venture that will offer an integrated upstream and midstream solution for development of low cost gas reserves to LNG.

|

|

|

|

|

•

|

Shipping market commences its recovery with improving utilisation, rates and the re-appearance of round-trip economics.

|

Financial Review

Business Performance

|

|

|

|

|

|

|

|

|

|

2016

|

|

2016

|

|

|

(in thousands of $)

|

Apr-Jun

|

|

Jan-Mar

|

|

|

Total operating revenues

|

18,370

|

|

16,557

|

|

|

Vessel operating expenses

|

(14,064

|

)

|

(15,573

|

)

|

|

Voyage, charterhire & commission expenses

|

(9,826

|

)

|

(10,648

|

)

|

|

Voyage, charterhire & commission expenses - collaborative arrangements

|

(2,331

|

)

|

(473

|

)

|

|

Administrative expenses

|

(9,689

|

)

|

(11,576

|

)

|

|

EBITDA*

|

(17,540

|

)

|

(21,713

|

)

|

|

Depreciation and amortization

|

(19,705

|

)

|

(19,444

|

)

|

|

Impairment of long-term assets

|

—

|

|

(1,706

|

)

|

|

Net gain on disposals (includes amortization of deferred gains)

|

126

|

|

126

|

|

|

Other operating gains and losses (LNG Trade)

|

—

|

|

16

|

|

|

Operating loss

|

(37,119

|

)

|

(42,721

|

)

|

* EBITDA is defined as earnings before interest, depreciation and amortization. EBITDA is a non-GAAP financial measure. A non-GAAP financial measure is generally defined by the Securities and Exchange Commission as one that purports to measure historical or future financial performance, financial position or cash flows, but excludes or includes amounts that would not be so adjusted in the most comparable U.S. GAAP measure. We have presented EBITDA as we believe it provides useful information to investors because it is a basis upon which we measure our operations and efficiency. EBITDA is not a measure of our financial performance under U.S. GAAP and should not be construed as an alternative to net income (loss) or other financial measures presented in accordance with U.S. GAAP.

Golar reported today a 2Q operating loss of $37.1 million as compared to a loss of $42.7 million in 1Q 2016. Although headline shipping rates remained relatively unchanged during the quarter there was a modest improvement in utilisation which increased from 24% in 1Q to 31% in 2Q. Reflecting the uptick in utilisation, total operating revenues increased from $16.6 million in 1Q to $18.4 million in 2Q. Voyage, charter-hire and commission expenses including those from the Cool Pool collaboration increased from $11.1 million in 1Q to $12.2 million this quarter largely due to the cost of positioning the Golar Tundra from Singapore to Ghana and the two carriers formerly chartered by Nigeria LNG into the Cool Pool. As in the first quarter, included in voyage, charter-hire and commission expenses is $5.8 million in respect of the cost of chartering the Golar Grand.

Vessel operating expenses decreased $1.5 million to $14.1 million. Operating costs for the Golar Arctic normalised in 2Q having been unusually high in the prior quarter when additional storing-up and maintenance costs were incurred in preparation for the vessels two year charter off Jamaica. Savings were also recorded across most of the remaining vessels as a result of a general cost reduction exercise. Administration costs at $9.7 million were $1.9 million lower than 1Q 2016 largely due to a normalisation in project support service costs.

Relative to 1Q the above resulted in a $4.2 million decrease in 2Q EBITDA losses and a $5.6 million decrease in 2Q operating losses.

Net Income Summary

|

|

|

|

|

|

|

|

|

(in thousands of $)

|

2016

|

|

2016

|

|

|

|

Apr-Jun

|

|

Jan-Mar

|

|

|

Operating loss

|

(37,119

|

)

|

(42,721

|

)

|

|

Dividend income

|

4,089

|

|

4,178

|

|

|

Interest income

|

196

|

|

895

|

|

|

Interest expense

|

(13,331

|

)

|

(6,022

|

)

|

|

Other financial items

|

(27,471

|

)

|

(28,880

|

)

|

|

Taxes

|

609

|

|

676

|

|

|

Equity in net earnings of affiliates

|

(17,062

|

)

|

(5,397

|

)

|

|

Net income attributable to non-controlling interests

|

(9,412

|

)

|

(2,817

|

)

|

|

Net loss attributable to Golar LNG Ltd

|

(99,501

|

)

|

(80,088

|

)

|

In 2Q the Company generated a net loss of $99.5 million. Notable contributors to this are summarised as follows:

|

|

|

|

•

|

2Q interest expense at $13.3 million has increased from the prior quarters $6.0 million. The increase is largely due to a substantial reduction this quarter in capitalised interest (a credit to interest expense) in respect of assets under development. The credit in the first quarter included a catch-up element for prior quarters. This capitalised interest credit should now be at normalised levels.

|

|

|

|

|

•

|

Other Financial Items at $27.5 million for 2Q were in line overall with the prior quarter cost of $28.9 million. A 2Q mark to market loss representing the decrease in Golar’s share price from $17.97 on

|

March 31 to $15.50 on June 30 of $7.8 million was recorded against the Company’s Total Return Equity Swap. Mark-to-market losses on the valuation of interest rate swaps amounted to $5.9 million in 2Q following further decreases in long-term swap rates. Amortisation of debt related expenses increased from $4.4 million in 1Q to $11.1 million in 2Q following a change in amortisation method.

|

|

|

|

•

|

Despite a 67% increase in Golar Partners reported net income after non-controlling interests, Golar Partners overall contribution to equity in net losses of affiliates increased by $11.7 million compared to 1Q. This follows a one-off non-cash charge of $19.2 million recorded at the end of the subordination period when the Company’s 15.9 million subordinated units in Golar Partners converted into common units. Cash flows however remain unchanged. In line with 1Q, the Company has received $13.2 million in cash distributions in respect of its investment in Golar Partners.

|

Commercial Review

Existing Assets and Contracts

LNG Shipping

The modest increase in utilisation in 2Q from historically low levels in 1Q is underpinned by a much greater increase in activity. During 2Q 22 spot voyages were concluded by the Cool Pool relative to only 8 commencing in 1Q. Much of this additional activity was initially supported by an ENARSA tender for 35 cargoes into Argentina early in the quarter followed by tenders for additional cargoes into Egypt. It was activity in the Atlantic basin where structural availability is less than the Pacific or Middle East that drove this improvement in utilisation. Despite the increase in activity, hire rates throughout 2Q remained low at $30kp/day for TFDE tonnage and sub $20kp/day for modern steam vessels. Compensation for backhaul legs was only available in isolated cases.

Subsequent to the quarter end, chartering activity and LNG charter rates have climbed steeply. This improvement cannot be explained by seasonal fluctuations alone. A combination of ramped up production from new facilities that started producing in late 2015/early 2016, the withdrawal of spot traded ships in anticipation of the imminent start-up of their dedicated project volumes and more trading activity to service recently installed FSRU capacity have collectively started to absorb some of the excess spot tonnage. The delayed Gorgon and Angola export projects that weighed heavily on the 1H shipping market are also now starting up and will be accompanied by Sabine Pass’ Train 2 shortly.

The Company believes that sentiment is shifting and owners are cautiously confident in the market over the next 12-24 months. The volume of voyage charters concluded since 2Q, their headline rates and the re-emergence of full round trip economics indicates that the anticipated 2H recovery in the shipping market is finally materialising as expected. Round-trip voyages are currently being concluded at rates exceeding $40k/day out of the Atlantic. Rates in the Pacific have strengthened but not to the same extent with voyages typically being fixed in the mid-$30k/day range. There are however certain additional reserves in the fleet should maximum steaming speeds be reintroduced.

Enquiries from traders and energy majors for 3-6-12 month charters accompanied by extension options have increased notably. Discipline among ship owners is also a welcome sight. Only 4 LNG carriers have been ordered this year to date with conventional carriers on order currently representing 31% of the current fleet. Approximately 130 million tonnes of new production equivalent to 49% of current LNG production is expected to deliver between now and 2020. Golar expects further opportunities to emerge over the coming quarters as cargo owners, mindful of the tightening market seek to secure their shipping at sensible rates.

FSRUs

Golar’s existing fleet of six operating FSRUs, all of which reside within Golar Partners but are managed by the Company, have maintained operational excellence achieving 100% availability during scheduled 2Q operations.

The Golar Tundra arrived off the coast of Ghana at the end of May and issued its notice of readiness the following month. Amounts due under the contract started to accrue from mid-July. Charterers of the FSRU, West Africa Gas Limited (“WAGL”) have however experienced significant delays with respect to the part of the project for which they are responsible. Golar Partners who own the FSRU Tundra are however entitled to payment of hire and invoices have been issued for this.

Although Golar continues to receive assurances that the project remains intact, the Company has sought and received a positive opinion which strongly supports its legal position in exercising its rights under the contract should WAGL contest their obligations under the charter. Golar maintains a constructive dialogue with WAGL with regards to finding a mutually agreeable way forward for the project which is both needed and supported by the government of Ghana. The market generally for FSRUs remains positive as noted further below.

FLNG

The FLNG Hilli conversion project remains on schedule and within budget. Up to 3,000 contractors are working on the vessel during the day with a night shift of 300 also now on-board. FLNG Hilli is currently on track to deliver within its stipulated delivery window. In light of the suspension of Engie’s proposed land based LNG project and discussions with our partners in Cameroon, local authorities and key stakeholders, Golar is cautiously optimistic that increased utilisation of the FLNG Hilli can be achieved after production start-up. Assuming this occurs and depending on the incremental uplift in volumes, this will significantly improve the EBITDA. Based on the configuration of the vessel this additional EBITDA could be achieved for little or no additional investment by Golar.

Ophir and Golar continue to explore ways to develop the Fortuna reserves. Projected economics even at current gas forward prices are strong and the combined upstream and midstream investment required to complete the development should be manageable and financeable.

The biggest challenge for the project is to secure alignment between the upstream and midstream partners. Proper alignment should help secure attractive financing for the entire project. Good progress has been made on both fronts in the last quarter.

Business Development Review

FSRU Activities

Over recent quarters Golar has seen a number of companies express a desire to enter the FSRU space. Although they have been attracted by the strong underlying prospects, superior returns and increasing opportunities relative to conventional shipping, many of them lack the technical capability required to replicate Golar’s own successful conversion model or do not have the risk appetite to speculatively order a new-build. A select few will however succeed and this has the potential to put pressure on margins where competitive tenders arise. As previously communicated the company has also noted over time that a large proportion of FSRU projects are being used to directly support power projects. In many cases these power projects enjoy returns well in excess of those achieved by the established FSRU infrastructure providers.

On June 20 Golar entered into a 50/50 joint venture with Stonepeak. This venture, Golar Power, combines the Independent Power Project experience of Stonepeak with the terminal and FSRU experience of Golar

and will offer integrated LNG based downstream solutions through the ownership and operation of FSRUs and associated terminal and power generation infrastructure. At closing on July 6 Golar Power assumed from Golar two new-build carrier conversion candidates, the 2017 delivering FSRU new-build and Golar’s right to participate in Brazil’s Sergipe power project. Golar Power is now pursuing both standalone FSRU opportunities and integrated LNG/FSRU supported power projects and is working on several opportunities which have the potential to be awarded over the next year. The Sergipe project is now entering the final stages of its pre Final Investment Decision (“FID”) process. This is a large project with equally large returns but also risks that must be managed. The recent strengthening of the Brazilian Reais against the US Dollar further improves forecasted project economics and solid progress is being made toward FID in the coming months.

FLNG - Business Development Progress

Subsequent to the quarter end, Golar and Schlumberger formalised plans to co-operate on the global development of greenfield, brownfield and stranded gas reserves. On July 25 the two parties established OneLNG, a joint venture 51% owned by Golar that will develop low cost gas reserves to LNG. The combination of Schlumberger’s reservoir knowledge, wellbore technologies and production management capabilities with our own low cost FLNG solution will offer gas resource owners a faster and lower cost development solution. By presenting a united one-stop upstream and midstream solution, OneLNG reduces the number of competing interests in what can be a complicated set of negotiations and also increases the number of financing options available. Golar believes that this will materially improve the likelihood of a project succeeding.

OneLNG was established with $20 million of working capital ($10.2 million funded by Golar) and a commitment to contribute a further $250 million each upon approval of the first project.

A separate OneLNG organisation including a recruited CEO and CFO will be established in due course. The initial working capital will fund employment costs for those initially seconded and recruited into the JV as well as the cost of commissioning extensive research into potential fields and bringing the first project to a final investment decision. To this end, OneLNG is now reviewing in detail a comprehensive list of projects that suit its offering. Whilst there remains a West African bias to the current shortlist it also includes projects in Asia that Golar had not previously contemplated.

Although the cost of feed gas to North American export projects is significantly higher than West African gas today, there are also a number of opportunities in this region that have the potential to be interesting medium term prospects. These prospects would also represent an opportunity to diversify the FLNG portfolio of opportunities from both a gas source (onshore/offshore) and a geographic perspective.

Financing Review

FSRU Tundra Dropdown

On May 23 the sale of Golar Tundra to Golar Partners was completed. Proceeds from an additional drawdown against the vessels existing debt facility together with a balancing payment from Golar Partners collectively added an incremental $102.8 million liquidity to Golar’s 2Q balance sheet. The Company will however continue to consolidate the company that owns the Golar Tundra until operations under the contract with West Africa Gas Limited commence. Included in the contract is a one year put to Golar in the event that operations do not commence in accordance with contractual arrangements or no satisfactory mitigating arrangement is agreed.

GoFLNG Financing

As at June 30, 2016, $588 million has been spent on the FLNG Hilli conversion ($619 million including the vessel). To date, Golar has drawn down $150 million against the $960 million CSSCL FLNG Hilli facility.

As the project remains well within its $1.2 billion budget, all remaining conversion and site specific costs for the FLNG Hilli are expected to be satisfied by this facility. Given that Golar have already invested $400 million in the conversion of FLNG Hilli, and once the $960 million debt facility is fully drawn, an equity release of up to $160 million is expected.

Golar Power

As well as having strategic merit, the formation and subsequent sale to Stonepeak of a 50% interest in Golar Power represents an important first step in the strengthening of Golar’s financial position. Together with the addition of $103.0 million in new liquidity to the 3Q balance sheet this transaction removed Golar’s obligations to meet the remaining $216.5 million of instalment payments due to Samsung in respect of the 2017 delivering FSRU new-build and substantially reduced the equity call on Golar should the Sergipe project proceed as planned. Golar has also been relieved of the daily operating and debt service costs in respect of the two carriers, equivalent to approximately $50k/day each. Finally, in addition to paying Golar $103.0 million (net of a $10 million working capital contribution to Golar Power), Stonepeak have also subscribed to a further $100 million of preference shares in Golar Power. This, together with an additional $75 million funding commitment from Golar in the period before 2H 2018 provides Golar Power with the capital it needs to sustain its asset base, pursue FSRU and other independent power projects, and, when combined with reasonable debt assumptions, convert both of its carriers into FSRUs.

Liquidity

Golar’s total cash position as at June 30 was $464.4 million. Of this $280.0 million and $85.9 million respectively is restricted cash relating to the FLNG Hilli Letter of Credit (“LC”) and the Company’s total return swap. A further $37.9 million invested in the FLNG Hilli during 2Q will be drawable against the CSSCL debt facility in 3Q.

Since the end of June, the Company’s cash position has been improved by the closing of the Golar Power joint venture with Stonepeak. This transaction produced a $103.0 million net cash addition to Golar. After another bank syndication exercise and a reduction in mark-to-market swaps a further $13.9 million of the $280 million cash backed LC to Perenco has also been released to Golar. Restricted cash tied up in this LC now stands at $266.1 million. Efforts continue to be directed to the release of a further $31 million of this restricted cash over the next few months.

The next step to a strengthened balance sheet requires that Golar address its March 2017 maturing $250 million convertible bond. This bond is secured by shares in Golar Partners currently worth approximately $240 million. Over and above the units used to secure the bond, Golar also has ordinary units in the Partnership worth approximately $90 million and 100% of the General Partner, all of which are unencumbered.

Golar has also initiated discussions with commercial banks. The objective of these discussions is to refinance a material share of the outstanding convertible bond with a medium term commercial bank line secured by Golar’s stake in the Partnership. This could be supplemented by the monetisation of dividends associated with the incentive distribution rights which currently generate $8.6 million in annual distributions. Such an arrangement could also enhance the Partnerships ability to make accretive investments in the future. Several proposals have been received and the Board is confident that a suitable commercial solution can be agreed.

Corporate and Other Matters

As at June 30, 2016, there were 93.1 million Golar shares outstanding including 3.0 million Total Return Swap shares that have an average price of $41.55 per share. There were also 2.4 million outstanding stock options in issue with an average strike price of approximately $51.92 per share.

The Board has left the dividend unchanged at $0.05 per share for the quarter.

Outlook

Golar has delivered on two significant commitments since last reporting and changed the structure of the company as a result. Golar Power is now an independent downstream entity that is working to build the skills required to embed its FSRUs directly into power projects thus sidestepping the risk of slowly becoming an undifferentiated supplier to what will eventually become a more commoditised business. At the other end of the value chain is OneLNG, a combination with Schlumberger that now has the skills and financing clout required to deliver some of the lowest cost integrated upstream gas to LNG solutions in the market today. In between the two is Golar LNG with its shipping portfolio and technical project development capabilities that will ultimately be the link between these ventures. The shipping business shows signs of an anticipated recovery. Improving utilisation, rates and the re-emergence of full round trip economics should all help to reduce the cash burn associated with this business from 3Q forward. Golar LNG will retain the FLNG Hilli which remains well within budget and on track to deliver off the coast of Cameroon within its contracted delivery window. Discussions regarding utilisation of the vessels spare capacity also represent grounds for cautious optimism.

There are near-term concerns with the status of the FSRU Tundra contract in Ghana that need to be addressed. The commercial rational remains sound and the rhetoric from government and charterers is supportive however the pace of progress on the ground is not yet reflective of this.

At a macro level the last 18 months have been overshadowed by the conventional wisdom that China was no longer in a position to be the LNG demand engine that was the foundation for the wave of new supply that is now starting to deliver. Adding to the pessimism has been the reduced demand from mainstay markets Japan and South Korea. As with the shipping business we are now starting to see signs of new demand. Although traditional demand centres Japan and South Korea have indeed reported recent reductions in LNG imports, China and India have seen imports increase dramatically over recent months. The delinking of LNG prices from oil prices and the reduction of China’s LNG gate price is being met by a demand response. In the case of China there is scope for the gate price to reduce further and this should stimulate additional demand. India is also a price sensitive market that is now responding accordingly both with demand for LNG and also for FSRUs. This together with new demand in the Middle East should be welcome news for LNG players and it is for Golar. The Company does however firmly retain the view that conventional approaches to executing LNG projects still look unlikely to cost effectively deliver new supply in the future. This fact underpins Golar’s belief in the viability of its flexible and low cost OneLNG FLNG offering.

The Board is of the opinion that good progress has been made strategically and financially over the last year to better position the company for the future.

Forward Looking Statements

This press release contains forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) which reflects management’s current expectations, estimates and projections about its operations. All statements, other than statements of historical facts, that address activities and events that will, should, could or may occur in the future are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “expect,” “plan,” “anticipate,” “intend,” “forecast,” “believe,” “estimate,” “predict,” “propose,” “potential,” “continue,” or the negative of these terms and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Unless legally required, Golar undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changes in LNG carriers, FSRU and floating LNG vessel market trends, including charter rates, ship values and technological advancements; changes in the supply and demand for LNG; changes in trading patterns that affect the opportunities for the profitable operation of LNG carriers, FSRUs; and floating LNG vessels; changes in Golar’s ability to retrofit vessels as FSRUs and floating LNG vessels, Golar’s ability to obtain financing for such retrofitting on acceptable terms or at all and the timing of the delivery and acceptance of such retrofitted vessels; increases in costs; changes in the availability of vessels to purchase, the time it takes to construct new vessels, or the vessels’ useful lives; changes in the ability of Golar to obtain additional financing; changes in Golar’s relationships with major chartering parties; changes in Golar’s ability to sell vessels to Golar LNG Partners LP; Golar’s ability to integrate and realize the benefits of acquisitions; changes in rules and regulations applicable to LNG carriers, FSRUs and floating LNG vessels; changes in domestic and international political conditions, particularly where Golar operates; as well as other factors discussed in Golar’s most recent Form 20-F filed with the Securities and Exchange Commission. Unpredictable or unknown factors also could have material adverse effects on forward-looking statements.

August 31, 2016

The Board of Directors

Golar LNG Limited

Hamilton, Bermuda

Questions should be directed to:

Golar Management Limited - +44 207 063 7900

Oscar Spieler - Chief Executive Officer

Brian Tienzo - Chief Financial Officer

Stuart Buchanan - Head of Investor Relations

Golar LNG Limited

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2016

|

|

2016

|

|

2015

|

|

2015

|

|

|

(in thousands of $)

|

Apr-Jun

|

|

Jan-Mar

|

|

Jan-Jun

|

|

Apr-Jun

|

|

Jan-Jun

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter revenues

|

12,345

|

|

11,877

|

|

24,222

|

|

16,922

|

|

45,757

|

|

|

Time charter revenues - collaborative arrangements

|

3,341

|

|

2,595

|

|

5,936

|

|

—

|

|

—

|

|

|

Vessel and other management fees

|

2,684

|

|

2,085

|

|

4,769

|

|

3,222

|

|

6,545

|

|

|

Total operating revenues

|

18,370

|

|

16,557

|

|

34,927

|

|

20,144

|

|

52,302

|

|

|

|

|

|

|

|

|

|

Vessel operating expenses

|

14,064

|

|

15,573

|

|

29,637

|

|

14,801

|

|

29,338

|

|

|

Voyage, charter-hire and commission expenses

(1)

|

9,826

|

|

10,648

|

|

20,474

|

|

21,424

|

|

45,131

|

|

|

Voyage, charter-hire and commission expenses - collaborative arrangements

|

2,331

|

|

473

|

|

2,804

|

|

—

|

|

—

|

|

|

Administrative expenses

|

9,689

|

|

11,576

|

|

21,265

|

|

9,214

|

|

16,166

|

|

|

Depreciation and amortization

|

19,705

|

|

19,444

|

|

39,149

|

|

18,118

|

|

35,815

|

|

|

Impairment of long-term assets

|

—

|

|

1,706

|

|

1,706

|

|

—

|

|

—

|

|

|

Total operating expenses

|

55,615

|

|

59,420

|

|

115,035

|

|

63,557

|

|

126,450

|

|

|

|

|

|

|

|

|

|

Net gain (loss) on disposals to Golar Partners

(including amortization of deferred gains)

|

126

|

|

126

|

|

252

|

|

126

|

|

103,790

|

|

|

Impairment of vessel held-for-sale

|

—

|

|

—

|

|

—

|

|

(1,032

|

)

|

(1,032

|

)

|

|

Other operating gains and losses (LNG Trade)

|

—

|

|

16

|

|

16

|

|

—

|

|

—

|

|

|

Loss on disposal of vessel held-for-sale

|

—

|

|

—

|

|

—

|

|

—

|

|

(5,824

|

)

|

|

Operating (loss) income

|

(37,119

|

)

|

(42,721

|

)

|

(79,840

|

)

|

(44,319

|

)

|

22,786

|

|

|

|

|

|

|

|

|

|

Other non-operating income (expense)

|

|

|

|

|

|

|

Dividend income

|

4,089

|

|

4,178

|

|

8,267

|

|

3,914

|

|

7,495

|

|

|

Loss on sale of available-for-sale-securities

|

—

|

|

—

|

|

—

|

|

—

|

|

(3,011

|

)

|

|

Total other non-operating income

|

4,089

|

|

4,178

|

|

8,267

|

|

3,914

|

|

4,484

|

|

|

|

|

|

|

|

|

|

Financial income (expense)

|

|

|

|

|

|

|

Interest income

|

196

|

|

895

|

|

1,091

|

|

2,318

|

|

3,910

|

|

|

Interest expense

(3)

|

(13,331

|

)

|

(6,022

|

)

|

(19,353

|

)

|

(18,040

|

)

|

(34,669

|

)

|

|

Other financial items

|

(27,471

|

)

|

(28,880

|

)

|

(56,351

|

)

|

50,802

|

|

18,851

|

|

|

Net financial (expense) income

|

(40,606

|

)

|

(34,007

|

)

|

(74,613

|

)

|

35,080

|

|

(11,908

|

)

|

|

|

|

|

|

|

|

|

(Loss) income before taxes and equity in net earnings of affiliates

|

(73,636

|

)

|

(72,550

|

)

|

(146,186

|

)

|

(5,325

|

)

|

15,362

|

|

|

Taxes

|

609

|

|

676

|

|

1,285

|

|

742

|

|

1,803

|

|

|

Equity in net earnings of affiliates

(2)

|

(17,062

|

)

|

(5,397

|

)

|

(22,459

|

)

|

4,406

|

|

7,225

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

(90,089

|

)

|

(77,271

|

)

|

(167,360

|

)

|

(177

|

)

|

24,390

|

|

|

Net income attributable to non-controlling interests

|

(9,412

|

)

|

(2,817

|

)

|

(12,229

|

)

|

(2,386

|

)

|

(5,035

|

)

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to Golar LNG Ltd

|

(99,501

|

)

|

(80,088

|

)

|

(179,589

|

)

|

(2,563

|

)

|

19,355

|

|

(1)

This includes related party charter-hire expenses of $5.8 million for each of the quarters ended June 30, 2016 and March 31, 2016, respectively.

(2)

This includes $19.2 million of accumulated losses reclassified from equity to the statement of income arising from the conversion of our subordinated units in Golar Partners to common units on June 30, 2016.

(3)

Until the

Golar Tundra

commences operations and the arrangements between Golar Partners expires (including Golar Partners' right to require that the Company repurchase the shares of Tundra Corp, the disponent owner and operator of the

Golar Tundra

), the Company will continue to consolidate Tundra Corp. Accordingly, during this time, the earnings and net assets of Tundra Corp will continue to be reflected within the Company’s financial statements. The payable of the daily fee plus operating expenses due to Golar Partners in accordance with the side agreement entered into concurrently with the closing of the acquisition of the

Golar Tundra

has been recorded within “interest expense” in the consolidated statements of income for the three months ended June 30, 2016.

Golar LNG Limited

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2016

|

|

2016

|

|

2015

|

|

2015

|

|

|

(in thousands of $)

|

Apr-Jun

|

|

Jan-Mar

|

|

Jan-Jun

|

|

Apr-Jun

|

|

Jan-Jun

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

(90,089

|

)

|

(77,271

|

)

|

(167,360

|

)

|

(177

|

)

|

24,390

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

Net (loss) gain on qualifying cash flow hedging instruments

|

—

|

|

(44

|

)

|

(44

|

)

|

493

|

|

(36

|

)

|

|

Net gain (loss) on investments in available-for-sale securities

|

26,185

|

|

2,500

|

|

28,685

|

|

(3,703

|

)

|

(24,382

|

)

|

|

Other comprehensive income (loss)

|

26,185

|

|

2,456

|

|

28,641

|

|

(3,210

|

)

|

(24,418

|

)

|

|

Comprehensive loss

|

(63,904

|

)

|

(74,815

|

)

|

(138,719

|

)

|

(3,387

|

)

|

(28

|

)

|

|

|

|

|

|

|

|

|

Comprehensive loss attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders of Golar LNG Limited

|

(73,316

|

)

|

(77,632

|

)

|

(150,948

|

)

|

(5,773

|

)

|

(5,063

|

)

|

|

Non-controlling interests

|

9,412

|

|

2,817

|

|

12,229

|

|

2,386

|

|

5,035

|

|

|

|

(63,904

|

)

|

(74,815

|

)

|

(138,719

|

)

|

(3,387

|

)

|

(28

|

)

|

Golar LNG Limited

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

|

(in thousands of $)

|

Jun-30

|

|

Dec-31

|

|

|

|

Unaudited

|

|

Audited

|

|

|

|

|

|

|

ASSETS

|

|

|

|

Current

|

|

|

|

Cash and cash equivalents

|

64,720

|

|

105,235

|

|

|

Restricted cash and short-term receivables

(2)

|

196,399

|

|

228,202

|

|

|

Other current assets

|

22,135

|

|

37,877

|

|

|

Assets held-for-sale

(1)(2)

|

706,633

|

|

269,459

|

|

|

Total current assets

|

989,887

|

|

640,773

|

|

|

Non-current

|

|

|

|

Restricted cash

|

280,386

|

|

180,361

|

|

|

Investment in available-for-sale securities

|

—

|

|

25,530

|

|

|

Investment in affiliates

|

326,356

|

|

313,021

|

|

|

Cost method investments

|

204,172

|

|

204,172

|

|

|

Newbuildings

|

—

|

|

13,561

|

|

|

Asset under development

|

619,750

|

|

501,022

|

|

|

Vessels and equipment, net

|

1,915,368

|

|

2,336,144

|

|

|

Other non-current assets

|

32,812

|

|

50,850

|

|

|

Total assets

|

4,368,731

|

|

4,265,434

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

Current

|

|

|

|

Current portion of long-term debt and short-term debt

(2)(3)

|

734,755

|

|

501,618

|

|

|

Amounts due to related parties

(4)

|

136,518

|

|

7,128

|

|

|

Other current liabilities

|

226,544

|

|

255,197

|

|

|

Liabilities held-for-sale

(1)(2)

|

432,856

|

|

203,638

|

|

|

Total current liabilities

|

1,530,673

|

|

967,581

|

|

|

Long-term

|

|

|

|

Long-term debt

(2)(3)

|

1,030,801

|

|

1,334,289

|

|

|

Other long-term liabilities

|

65,993

|

|

69,225

|

|

|

Total liabilities

|

2,627,467

|

|

2,371,095

|

|

|

|

|

|

|

Equity

|

|

|

|

Stockholders' equity

|

1,708,222

|

|

1,873,526

|

|

|

Non-controlling interest

|

33,042

|

|

20,813

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

4,368,731

|

|

4,265,434

|

|

(1)

In February 2016, we entered into an agreement to sell our interests in the companies that own and operate the FSRU the

Golar Tundra

to Golar Partners. In June 2016, we entered into a joint venture agreement with Stonepeak to sell equity interests in our newly formed subsidiary, Golar Power Limited (or “Golar Power”). Golar Power’s initial asset base will comprise interests in the entities that own the FSRU newbuilding currently under construction, the two LNG carriers: the

Golar Penguin

and the

Golar Celsius

, and hold the right to invest in up to 25% of the Sergipe project. The transaction closed in July 2016. Accordingly, as of June 30, 2016, the assets and liabilities associated with these agreements were classified as 'held-for-sale'. As of March 31, 2016, only the assets and liabilities associated with the

Golar Tundra

sale were classified as 'held-for-sale'.

(2)

Included within restricted cash and short-term receivables, debt balances and assets and liabilities 'held-for-sale' are amounts relating to certain lessor entities (for which legal ownership resides with financial institutions) that we are required to consolidate under US GAAP into our financial statements as variable interest entities. Refer to Appendix A.

(3)

Following the adoption of the amendments to ASC 835, deferred charges have been re-classified as a direct deduction to the related debt as of June 30, 2016 and December 31, 2015.

(4)

Until the

Golar Tundra

commences operations and the arrangements between Golar Partners expires (including Golar Partners' right to require that the Company repurchase the shares of Tundra Corp, the disponent owner and operator of the

Golar Tundra

), the Company will continue to consolidate Tundra Corp. Accordingly, during this time, the earnings and net assets of Tundra Corp will continue to be reflected within the Company’s financial statements. As of June 30, 2016, the purchase consideration received of $107.2 million, has been presented as a short-term payable in the consolidated balance sheet.

Golar LNG Limited

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASHFLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2016

|

|

2016

|

|

2015

|

|

2015

|

|

|

(in thousands of $)

|

Apr-Jun

|

|

Jan-Mar

|

|

Jan-Jun

|

|

Apr-Jun

|

|

Jan-Jun

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

Net (loss) income

|

(90,089

|

)

|

(77,271

|

)

|

(167,360

|

)

|

(177

|

)

|

24,390

|

|

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities:

|

|

|

|

|

|

|

Depreciation and amortization

|

19,705

|

|

19,444

|

|

39,149

|

|

18,118

|

|

35,815

|

|

|

Amortization of deferred tax benefits on intra-group transfers

|

(843

|

)

|

(872

|

)

|

(1,715

|

)

|

(872

|

)

|

(1,744

|

)

|

|

Amortization of deferred charges and debt guarantee

|

9,583

|

|

2,856

|

|

12,439

|

|

(783

|

)

|

(2,427

|

)

|

|

Gain on disposal to Golar Partners (including amortization of deferred gain)

|

(126

|

)

|

(126

|

)

|

(252

|

)

|

(126

|

)

|

(103,790

|

)

|

|

Equity in net earnings of affiliates

|

17,062

|

|

5,397

|

|

22,459

|

|

(4,406

|

)

|

(7,225

|

)

|

|

Impairment of vessel held-for-sale

|

—

|

|

—

|

|

—

|

|

1,032

|

|

1,032

|

|

|

Loss on sale of vessel

|

—

|

|

—

|

|

—

|

|

—

|

|

5,824

|

|

|

Dividend income from available-for-sale and cost investments recognized in other non-operating income

|

(4,089

|

)

|

(4,178

|

)

|

(8,267

|

)

|

(3,914

|

)

|

(7,495

|

)

|

|

Dividends received

|

13,300

|

|

13,389

|

|

26,689

|

|

13,125

|

|

25,678

|

|

|

Drydocking expenditure

|

—

|

|

—

|

|

—

|

|

(36

|

)

|

(10,405

|

)

|

|

Stock-based compensation

|

1,505

|

|

1,279

|

|

2,784

|

|

1,874

|

|

3,500

|

|

|

Loss on disposal of available-for-sale securities

|

—

|

|

—

|

|

—

|

|

—

|

|

3,011

|

|

|

Change in market value of derivatives

|

13,734

|

|

12,295

|

|

26,029

|

|

(55,856

|

)

|

(30,294

|

)

|

|

Impairment of loan receivable

|

(422

|

)

|

8,049

|

|

7,627

|

|

—

|

|

—

|

|

|

Other current and long-term assets

|

1,660

|

|

23,729

|

|

25,389

|

|

25,286

|

|

7,054

|

|

|

Other current and long-term liabilities

|

(45,211

|

)

|

(1,274

|

)

|

(46,485

|

)

|

(14,372

|

)

|

(20,705

|

)

|

|

Net foreign exchange gain

|

792

|

|

29

|

|

821

|

|

458

|

|

1,601

|

|

|

Impairment of long-term assets

|

—

|

|

1,706

|

|

1,706

|

|

—

|

|

—

|

|

|

Restricted cash and short-term receivables

|

(217

|

)

|

—

|

|

(217

|

)

|

—

|

|

—

|

|

|

Net cash (used in) provided by operating activities

|

(63,656

|

)

|

4,452

|

|

(59,204

|

)

|

(20,649

|

)

|

(76,180

|

)

|

Golar LNG Limited

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASHFLOWS (CONTINUED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2016

|

|

2016

|

|

2015

|

|

2015

|

|

|

(in thousands of $)

|

Apr-Jun

|

|

Jan-Mar

|

|

Jan-Jun

|

|

Apr-Jun

|

|

Jan-Jun

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

Additions to vessels and equipment

|

(8,753

|

)

|

(4,506

|

)

|

(13,259

|

)

|

(20,572

|

)

|

(20,727

|

)

|

|

Additions to newbuildings

|

(19,065

|

)

|

(155

|

)

|

(19,220

|

)

|

(2,179

|

)

|

(392,423

|

)

|

|

Additions to asset under development

|

(18,539

|

)

|

(55,743

|

)

|

(74,282

|

)

|

(50,804

|

)

|

(64,499

|

)

|

|

Proceeds from disposal of business to Golar Partners, net of cash disposed (including repayments on related vendor financing loans granted)

(1)

|

77,247

|

|

30,000

|

|

107,247

|

|

120,000

|

|

126,872

|

|

|

Repayment of short-term loan granted to third party

|

—

|

|

—

|

|

—

|

|

—

|

|

400

|

|

|

Loans granted (including related parties)

|

—

|

|

(1,000

|

)

|

(1,000

|

)

|

—

|

|

—

|

|

|

Repayment of short-term loan granted to Golar Partners

|

—

|

|

—

|

|

—

|

|

20,000

|

|

20,000

|

|

|

Proceeds from disposal of investments in available-for-sale securities

|

—

|

|

—

|

|

—

|

|

—

|

|

207,428

|

|

|

Restricted cash and short-term receivables

|

(10,621

|

)

|

5,191

|

|

(5,430

|

)

|

16,151

|

|

39,064

|

|

|

Net cash provided by (used in) investing activities

|

20,269

|

|

(26,213

|

)

|

(5,944

|

)

|

82,596

|

|

(83,885

|

)

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

Proceeds from short-term and long-term debt (including related parties)

|

93,417

|

|

212,400

|

|

305,817

|

|

4,481

|

|

557,065

|

|

|

Repayments of short-term and long-term debt (including related parties)

|

(36,041

|

)

|

(128,316

|

)

|

(164,357

|

)

|

(27,133

|

)

|

(121,716

|

)

|

|

Financing costs paid

|

(1,397

|

)

|

(3,032

|

)

|

(4,429

|

)

|

(129

|

)

|

(10,997

|

)

|

|

Cash dividends paid

|

—

|

|

(45,061

|

)

|

(45,061

|

)

|

(40,446

|

)

|

(80,892

|

)

|

|

Proceeds from exercise of share options

|

—

|

|

—

|

|

—

|

|

23

|

|

23

|

|

|

Purchase of treasury shares

|

—

|

|

(8,214

|

)

|

(8,214

|

)

|

—

|

|

—

|

|

|

Restricted cash and short-term receivables

|

(40,788

|

)

|

(18,335

|

)

|

(59,123

|

)

|

—

|

|

—

|

|

|

Net cash provided by (used in) financing activities

|

15,191

|

|

9,442

|

|

24,633

|

|

(63,204

|

)

|

343,483

|

|

|

Net (decrease) increase in cash and cash equivalents

|

(28,196

|

)

|

(12,319

|

)

|

(40,515

|

)

|

(1,257

|

)

|

183,418

|

|

|

Cash and cash equivalents at beginning of period

|

92,916

|

|

105,235

|

|

105,235

|

|

376,085

|

|

191,410

|

|

|

Cash and cash equivalents at end of period

|

64,720

|

|

92,916

|

|

64,720

|

|

374,828

|

|

374,828

|

|

(1)

Until the

Golar Tundra

commences operations and the arrangements between Golar Partners expires (including Golar Partners' right to require that the Company repurchase the shares of Tundra Corp, the disponent owner and operator of the

Golar Tundra

), the Company will continue to consolidate Tundra Corp. Accordingly, during this time, the earnings and net assets of Tundra Corp will continue to be reflected within the Company’s financial statements. As of June 30, 2016, the purchase consideration received of $107.2 million, has been presented as net cash inflows captured within “investing activities” for the six month period then ended.

Golar LNG Limited

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands of $)

|

Share Capital

|

Treasury Shares

|

Additional Paid-in Capital

|

Contributed Surplus

(1)

|

Accumulated Other Comprehensive (Loss) Income

|

Accumulated Retained Earnings

|

Total before Non- controlling Interest

|

Non-controlling Interest

|

Total Equity

|

|

Balance at December 31, 2014

|

93,415

|

|

—

|

|

1,307,087

|

|

200,000

|

|

5,171

|

|

675,179

|

|

2,280,852

|

|

1,655

|

|

2,282,507

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

19,355

|

|

19,355

|

|

5,035

|

|

24,390

|

|

|

Dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(80,892

|

)

|

(80,892

|

)

|

—

|

|

(80,892

|

)

|

|

Exercise of share options

|

8

|

|

—

|

|

15

|

|

—

|

|

—

|

|

—

|

|

23

|

|

—

|

|

23

|

|

|

Grant of share options

|

—

|

|

—

|

|

3,231

|

|

—

|

|

—

|

|

—

|

|

3,231

|

|

—

|

|

3,231

|

|

|

Forfeiture of share options

|

—

|

|

—

|

|

(188

|

)

|

—

|

|

—

|

|

—

|

|

(188

|

)

|

—

|

|

(188

|

)

|

|

Cancellation of share options

|

—

|

|

—

|

|

787

|

|

—

|

|

—

|

|

—

|

|

787

|

|

—

|

|

787

|

|

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(24,418

|

)

|

—

|

|

(24,418

|

)

|

—

|

|

(24,418

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2015

|

93,423

|

|

—

|

|

1,310,932

|

|

200,000

|

|

(19,247

|

)

|

613,642

|

|

2,198,750

|

|

6,690

|

|

2,205,440

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands of $)

|

Share Capital

|

Treasury Shares

|

Additional Paid-in Capital

|

Contributed Surplus

(1)

|

Accumulated Other Comprehensive (Loss) Income

|

Accumulated Retained Earnings

|

Total before Non- controlling Interest

|

Non-Controlling Interest

|

Total Equity

|

|

Balance at December 31, 2015

|

93,547

|

|

(12,269

|

)

|

1,317,806

|

|

200,000

|

|

(41,254

|

)

|

315,696

|

|

1,873,526

|

|

20,813

|

|

1,894,339

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(179,589

|

)

|

(179,589

|

)

|

12,229

|

|

(167,360

|

)

|

|

Dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(9,237

|

)

|

(9,237

|

)

|

—

|

|

(9,237

|

)

|

|

Grant of share options

|

—

|

|

—

|

|

3,095

|

|

—

|

|

—

|

|

—

|

|

3,095

|

|

—

|

|

3,095

|

|

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

28,641

|

|

—

|

|

28,641

|

|

—

|

|

28,641

|

|

|

Treasury shares

|

—

|

|

(8,214

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(8,214

|

)

|

—

|

|

(8,214

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2016

|

93,547

|

|

(20,483

|

)

|

1,320,901

|

|

200,000

|

|

(12,613

|

)

|

126,870

|

|

1,708,222

|

|

33,042

|

|

1,741,264

|

|

(1)

Contributed Surplus is 'capital' that can be returned to shareholders without the need to reduce share capital, thereby giving Golar greater flexibility when it comes to declaring dividends.

Golar LNG Limited

APPENDIX A

Included within the restricted cash and short-term receivables, and debt balances are amounts relating to lessor VIE entities that we are required to consolidate under US GAAP into our financial statements as variable interest entities. The following table represents the impact of consolidating these lessor VIEs into our balance sheet, with respect to these line items:

|

|

|

|

|

|

|

|

|

(in thousands of $)

|

June 30, 2016

|

|

December 31, 2015

|

|

|

Restricted cash

and short-term receivables

|

77,045

|

|

35,450

|

|

|

|

|

|

|

Current portion of long-term debt and short-term debt

|

447,924

|

|

424,628

|

|

|

Long-term debt

|

427,062

|

|

285,700

|

|

|

|

|

|

(1)

In addition to the above disclosure there are amounts classified within assets and liabilities as 'held-for-sale' relating to the sale and leaseback of the

Golar Tundra

which includes the effect of consolidating the financing bank's subsidiary (CMBL).

As of June 30, 2016 these include restricted cash and short-term receivables of $0.2 million in current assets and long-term debt of $214.2 million in non-current liabilities, respectively

.

The long-term debt relates to our long-term

Golar Tundra

lease financing.

(2)

The consolidated results and net assets of the consolidated lessor VIE entities is based on management's best estimates.

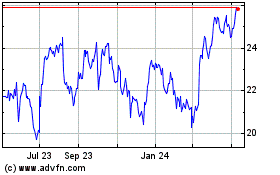

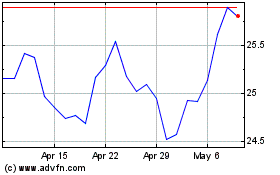

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Apr 2023 to Apr 2024