Snack giant ends monthslong pursuit after chocolate maker

rebuffs raised bid

By Annie Gasparro and Dana Cimilluca

Oreo cookie maker Mondelez International Inc. ended its pursuit

of Hershey Co. after the famed chocolatier rebuffed its latest

acquisition offer, putting an end to a monthslong takeover campaign

that would have created the world's largest candy company.

Hershey last week rebuffed a new bid by Mondelez, the second one

since June, and indicated it would be difficult to strike a deal

before next year because of the shifting dynamics at its

controlling shareholder, the Hershey Trust Co., according to people

familiar with the matter.

Mondelez said in a statement late Monday there was "no

actionable path forward" to buy Hershey, which confirmed that there

were additional communications with Mondelez but wouldn't comment

further.

Mondelez's failure to pull off the takeover, which would likely

have been valued at upward of $25 billion, will likely reinforce

the notion among analysts and investors that Hershey is

unattainable as an acquisition target in light of its majority

ownership by a trust that for years has been reluctant to sell.

The Hershey Trust, which controls about 81% of Hershey's

shareholder votes, is in the midst of overhauling its own board of

directors following an investigation by state regulators, and

investors had wondered if Mondelez would be able to win its

approval by striking during a period of uncertainty.

Mondelez Chief Executive Irene Rosenfeld walked away from her

goal of creating a snacking and confectionary giant that would

benefit from giant global scale and the combination of major brands

like Chips Ahoy and Reese's peanut butter cups.

Hershey's stock dropped 12% after market hours Monday while

shares of Mondelez rose 3.4%.

Mondelez initially made a roughly $23 billion bid for Hershey,

The Wall Street Journal first reported in June. Hershey rejected

the offer, which amounted to $107 a share, half in cash and half in

stock.

Ms. Rosenfeld privately indicated to Hershey CEO J.P. Bilbrey

last week a willingness to raise the bid to $115 a share, the

people familiar with the matter said.

Hershey responded that the starting point for discussions would

need to be $125 a share. Hershey also indicated that the trust

would need to complete a reconstitution before there could be a

deal, and that isn't expected until possibly late next year, some

of the people said.

Hershey, with a namesake hometown in Pennsylvania built by its

success, and Deerfield, Ill.-based Mondelez, both have been under

pressure in the U.S. amid a trend toward healthier eating.

Pablo Zuanic of Susquehanna estimated that had they merged, the

combined company would see a sales increase of between 9% and

19%.

Mondelez could have helped Hershey expand overseas while

Hershey's U.S. chocolate prowess had the potential boost Mondelez

domestically.

Hershey had $7.4 billion in annual sales last year, while

Mondelez towered over it, with $30 billion

Hershey arguably had the most to gain from the hypothetical

deal, in that it has been trying to diversify from its largely U.S.

candy business, whose products include chocolate Kisses and Jolly

Ranchers, to more international markets and new products sold in

the broader snack aisle.

Both of those efforts would have been achieved swiftly with an

acquisition by Mondelez, Mr. Zuanic noted.

If the outcome of the talks with Mondelez were to attract other

bidders, they may need to be more patient than Mondelez.

The Hershey Trust, as part of a settlement with state

regulators, isn't likely to have a reconstituted board of directors

until the end of 2017.

The trust, which oversees billions of dollars for a local,

nonprofit school, has agreed to make significant governance changes

in response to the Pennsylvania attorney general's office

investigation into allegations of excessive compensation and

conflicts of interest.

"Once a totally new Trust Board is in place, by early 2018,

things could be different, but we are uncertain Mondelez will exist

in its current form by then," Mr. Zuanic said in a note to

investors earlier this month, hinting at the possibility that

Mondelez would go after another smaller rival or become a takeover

target itself.

Ms. Rosenfeld said in prepared remarks Monday that while the

company was disappointed, it remains focused on its efforts to

deliver sustainable sales growth and stronger margins. Mondelez

will be disciplined in its approach to generating value, including

through acquisitions, she added.

Indeed, Mondelez called off the pursuit because the deal was

attractive but not essential and because it was eager to avoid

overpaying, according to one of the people familiar with the

matter.

Mondelez plans to provide more details at an industry conference

on Sept. 7.

While the mergers-and-acquisitions market remains relatively

healthy, the proposed combination isn't the only one to have

unraveled this year. In March, Honeywell International Inc. pulled

the plug on its $90 billion bid for United Technologies Corp. and,

in April, Pfizer Inc. walked away from its deal to buy Allergan

PLC, which ranked as 2015's largest deal.

Mondelez, meanwhile, is under pressure to cut costs and improve

its lagging profit margin, with Nelson Peltz on its board and

fellow activist investor Bill Ackman as a major shareholder. Those

two are unlikely to support a bidding war that could distract

Mondelez from its annual savings goals.

Engaging in a big deal with those pressures is never easy, and

trying to convince a likely unwilling seller like the Hershey Trust

made it even harder.

--Tess Stynes, Dana Mattioli and David Benoit contributed to

this article.

Write to Annie Gasparro at annie.gasparro@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

August 30, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

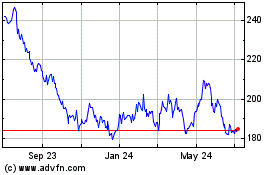

Hershey (NYSE:HSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

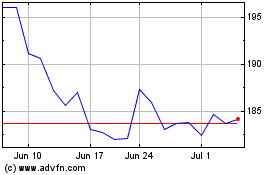

Hershey (NYSE:HSY)

Historical Stock Chart

From Apr 2023 to Apr 2024