24 August 2016

The information

contained in this announcement is restricted and is not for

publication, release or distribution in the United States of

America, any member states of the European Economic Area (other

than the Netherlands and the United Kingdom), Canada, Australia,

Japan or South Africa.

Further to the announcement on 8

August 2016 regarding the publication of a Circular, the Board of

NB Private Equity Partners Limited ("NBPE" or

the "Company") announces that it today

published a prospectus (the "Prospectus")

containing full details of the Issue of up to 50 million new 2022

zero dividend preference shares ("2022 ZDP

Shares") by way of a Rollover Offer of 2017 ZDP Shares into

2022 ZDP Shares, and an Offer for Subscription and an Initial

Placing of 2022 ZDP Shares.

The Rollover Offer is being made

available to all eligible holders of the Group's existing 2017 zero

dividend preference shares ("2017 ZDP Shares")

who will have the opportunity to convert (by way of re-designation)

their 2017 ZDP Shares into 2022 ZDP Shares. The Offer for

Subscription and the Initial Placing will provide new investors

with an opportunity to invest in the 2022 ZDP Shares.

Benefits of the

Issue

The Company believes that the

creation of a new class of 2022 ZDP Shares will be beneficial for a

number of reasons:

-

The Directors believe that the current market

environment continues to produce attractive investment

opportunities for the Company and that such opportunities will

continue to be available over the next several years. An issue of

2022 ZDP Shares would provide additional resources to enable the

Investment Manager to take advantage of these opportunities without

unduly affecting the Company's conservative capital structure and

commitment coverage;

-

The Issue of 2022 ZDP Shares will allow the

Company to finance the redemption of the 2017 ZDP Shares, while

leaving significant capacity under the existing Credit Facility and

other funds available for making new investments;

-

The Issue will enable the Company to continue to

maintain an investment level at greater than 100 per cent. of the

net asset value of the Class A Shares, which is expected to lead to

continued growth in the Company's NAV as the Investment Manager

takes advantage of market opportunities by deploying additional

capital into attractive equity and debt investment opportunities

alongside high-quality private equity sponsors;

-

The Issue will provide greater diversity to the

Group's sources of capital and a staggered maturity profile for its

sources of finance; and

-

The Rollover Offer provides a tax efficient

opportunity for existing 2017 ZDP Shareholders to continue their

investment and a cost efficient manner for the Company to refinance

the 2017 ZDP Shares.

The Issue

The Company is seeking to create

up to 50 million 2022 ZDP Shares by way of the Rollover Offer,

Offer for Subscription and the Initial Placing. The Rollover Offer,

Offer for Subscription and Initial Placing will be subject to the

terms and conditions set out in the Prospectus.

The holders of 2022 ZDP Shares

will be entitled to receive a capital sum on 30 September 2022.

This capital sum per 2022 ZDP Share will be 100 pence increased at

an annual rate equal to the 2022 ZDP gross redemption yield from

the date of re-designation or issue (as applicable) until the 2022

ZDP Repayment Date being 30 September 2022.

Under the Rollover Offer, Eligible

2017 ZDP Shareholders are being given the opportunity to convert

(by way of re-designation) some or all of their holding of 2017 ZDP

Shares into new 2022 ZDP Shares at a Rollover Value per 2017 ZDP

Share of 165.14 pence. Consequently each 2017 ZDP Share validly

elected and accepted to participate in the Rollover Offer will be

exchanged for 1.6514 2022 ZDP Shares (subject to the terms and

conditions set out in the Prospectus and Form of Election). The

Rollover Value broadly represents the current market value of the

2017 ZDP Shares being the average mid-market trading price of the

2017 ZDP Shares over the 30 trading days to 22 August 2016 (being

the latest practicable date prior to the publication of the

Prospectus). In addition, the Offer for Subscription and the

Initial Placing will provide new investors with the opportunity to

invest in the 2022 ZDP Shares.

The gross redemption yield

("GRY") of the 2022 ZDP Shares will be

determined by way of a book-build reflecting orders received

pursuant to the Issue. Potential investors will be asked to

indicate the number of 2022 ZDP Shares they wish to acquire at

different gross redemption yields, ranging between 4.00 per cent.

and 4.75 per cent. (in 6 increments of 0.15 per cent. each), or at

the strike GRY. All elections and/or applications for 2022 ZDP

Shares received pursuant to the Rollover Offer, the Offer for

Subscription and the Initial Placing will be aggregated, showing

the amount of demand at each GRY. The 2022 ZDP GRY shall be set at

the lowest gross redemption yield at which valid elections under

the Rollover Offer, and applications under the Offer for

Subscription and the Initial Placing, have been received subject to

a minimum issue size of 25 million new 2022 ZDP Shares being

achieved. In the case where there are multiple possibilities for

the 2022 ZDP GRY, the 2022 GRY will be set by the Directors on the

basis of the number of elections and/or applications at each such

possibility and the investment opportunities available to the

Company. The 2022 GRY will be announced as part of the results of

the Issue.

The gross proceeds will be

utilised by the Company, at its discretion, in accordance with its

investment strategy and/or to finance the 2017 ZDP Final Capital

Entitlement of the 2017 ZDP Shares on maturity.

The Issue is for up to a maximum

of 50 million 2022 ZDP Shares of no par value, to be issued at 100

pence per 2022 ZDP Share. The Total Net Proceeds will be dependent

upon the number of 2022 ZDP Shares issued pursuant to the Issue and

the proportion of these that are issued pursuant to the Rollover

Offer. If the total number of 2022 ZDP Shares arising pursuant to

the Rollover Offer, and issued pursuant to the Offer for

Subscription and the Initial Placing, is less than 50 million, then

the Company may carry out further Placings (any such placing, a

"Subsequent Placing") in the future, at its

sole discretion. However, the Rollover Offer will be the only

opportunity that existing 2017 ZDP shareholders will have to roll

their existing shares into 2022 ZDP Shares.

The Issue is conditional on:

(1) the approval of the Class A

Shareholders by ordinary resolution, which will be sought at a

meeting of the Class A Shareholders to be held on 7 September

2016;

(2) the approval by the Company by

special resolution, which will be sought through written

resolutions of the Class B Shareholder (which holds the voting

rights in the Company) on or around 7 September 2016;

(3) valid elections under the

Rollover Offer and/or applications under the Offer for Subscription

and the Initial Placing being received in respect of at least 25

million 2022 ZDP Shares;

(4) satisfaction of the 2017 ZDP

Cover Test (as such is more fully described in the Prospectus);

and

(5) Admission of the 2022 ZDP

Shares arising or issued pursuant to the Rollover Offer, the Offer

for Subscription and the Initial Placing.

Application will be made to the

London Stock Exchange for the 2022 ZDP Shares to be admitted to

trading on the Specialist Fund Segment of the London Stock

Exchange's Main Market.

If existing 2017 ZDP Shareholders

choose not to participate in the Rollover Offer they will continue

to be entitled subject to the Articles, to receive the existing

2017 ZDP Final Capital Entitlement of 169.73 pence per ZDP share

which they hold on 31 May 2017.

ZDP Cover

Ratios

The 2022 ZDP GRY will impact the

2022 ZDP Final Capital Entitlement, 2022 ZDP Final Net Asset Cover,

2022 ZDP Final Debt Cover and 2022 ZDP Hurdle Rate (as such are

more fully described in the Prospectus). The table below sets out

the illustrative cover ratios at gross redemption yields between

4.00 per cent. and 4.75 per cent.

| 2022 ZDP GRY |

4.00% |

4.15% |

4.30% |

4.45% |

4.60% |

4.75% |

| 2022 ZDP

Final Capital Entitlement |

126.74 |

127.85 |

128.96 |

130.09 |

131.22 |

132.36 |

| 2022 ZDP

Hurdle Rate |

(19.1)% |

(19.0)% |

(19.0)% |

(19.0)% |

(18.9)% |

(18.9)% |

| 2022

Estimated Final Net Asset Cover |

9.3x |

9.2x |

9.1x |

9.0x |

9.0x |

8.9x |

| 2022

Estimated Final Debt Cover |

9.0x |

8.9x |

8.8x |

8.7x |

8.7x |

8.6x |

The statistics are calculated on

the basis of the assumptions disclosed in Part 1 of the

Prospectus.

2022 ZDP Class

Rights

The 2022 ZDP class rights are

protections for 2022 ZDP Shareholders which will be enshrined in

the Company's articles of incorporation. These include restrictions

on the Company issuing further shares and paying dividends out of

capital unless the 2022 ZDP Cover (being the ratio of the Company's

gross asset value to the aggregate of the 2022 ZDP Final Capital

Entitlement and any other prior charges of the Company with respect

to credit facilities or any equity or debt securities issued by the

Company, the calculation of which is more fully described in the

Prospectus) is at least 2.75:1 immediately following such action.

Further details on the rights of the 2022 ZDP Shareholders are

included in the Prospectus.

Prospectus

Publication

The Prospectus has been approved

by the Netherlands Authority for the Financial Markets (Autoriteit

Financiële Markten). The Prospectus will be posted to existing 2017

ZDP shareholders shortly, as well as being made available on the

Company's website at www.nbprivateequitypartners.com and on the

National Storage Mechanism at

http://www.morningstar.co.uk/uk/NSM.

Timetable

| Latest

time for receipt of the Forms of Election under the Rollover

Offer |

1 p.m. on

12 September 2016 |

| Latest

time for receipt of Application Forms under the Offer for

Subscription |

1 p.m. on

12 September 2016 |

| Record

Date for the Rollover Offer |

5 p.m. on

12 September 2016 |

| Latest

time for receipt of placing commitments under the Initial

Placing |

1 p.m. on

13 September 2016 |

|

Announcement of the results of the Rollover Offer, the Offer for

Subscription and the Initial Placing |

14 September 2016 |

| Admission

and unconditional dealings in the 2022 ZDP Shares to commence on

the SFS |

8 a.m. on

16 September 2016 |

| CREST

Accounts credited with 2022 ZDP Shares in respect of the Rollover

Offer, the Offer for Subscription and the Initial Placing |

16 September 2016 |

|

Certificates despatched for the 2022 ZDP Shares |

Approximately one week following the Admission of the 2022

ZDP Shares |

References to times are to London

times. Any changes to the expected timetable will be notified by

the Company through a Regulatory Information Service.

Capitalised terms used but not

defined in this announcement shall, unless the context requires

otherwise, have the same meaning as in the Prospectus.

This announcement contains inside

information in relation to the Company.

Talmai Morgan

Chairman

For further

information, please contact:

NBPE Investor

Relations

+1 214 647 9593

Stifel Nicolaus Europe

Limited

Neil Winward

Mark Bloomfield

Tom Yeadon

|

+44 20 7710 7600

|

Heritage International Fund Managers

Limited

Dwayne Mahrer

James Christie

|

+44 1481 716000

|

Neustria

Partners

+44 20 3021 2580

Nick

Henderson

Nick.Henderson@neustriapartners.com

Robert Bailhache

Robert.Bailhache@neustriapartners.com

Charles Gorman

Charles.Gorman@neustriapartners.com

ABOUT NB PRIVATE

EQUITY PARTNERS LIMITED

NBPE is a closed-end private

equity investment company with class A ordinary shares admitted to

trading on Euronext Amsterdam and the Specialist Fund Segment of

the Main Market of the London Stock Exchange. NBPE has ZDP shares

admitted to trading on the Specialist Fund Segment of the Main

Market of the London Stock Exchange and the Daily Official List of

The Channel Islands Securities Exchange Authority Limited. NBPE

holds a diversified portfolio of direct income investments, direct

equity investments and fund investments selected by the NB

Alternatives group of Neuberger Berman diversified across private

equity asset class, geography, industry, vintage year, and

sponsor.

ABOUT NEUBERGER

BERMAN

Neuberger Berman, founded in 1939,

is a private, independent, employee-owned investment manager. The

firm manages equities, fixed income, private equity and hedge fund

portfolios for institutions and advisors worldwide. With offices in

19 countries, Neuberger Berman's team is approximately 2,000

professionals and the company was named by Pensions &

Investments as a Best Place to Work in Money Management for three

consecutive years. Tenured, stable and long-term in focus, the firm

fosters an investment culture of fundamental research and

independent thinking. It manages $246 billion in client assets as

of June 30, 2016. For more information, please visit our website at

www.nb.com.

This announcement

appears as a matter of record only and does not constitute an offer

to sell or a solicitation of an offer to purchase any security.

Recipients of this announcement who are considering acquiring 2022

ZDP Shares are reminded that any such acquisition must be made only

on the basis of the information contained in the Prospectus which

may be different from the information contained in this

announcement.

NBPE is

established as a closed-end investment company domiciled in

Guernsey. NBPE has received the necessary consent of the Guernsey

Financial Services Commission and the States of Guernsey Policy

Council. NBPE is registered with the Dutch Authority for the

Financial Markets as a collective investment scheme which may offer

participations in The Netherlands pursuant to article 2:66 of the

Financial Markets Supervision Act (Wet op het financial toezicht).

All investments are subject to risk. Past performance is no

guarantee of future returns. The value of investments may

fluctuate. Results achieved in the past are no guarantee of future

results. This document is not intended to constitute legal, tax or

accounting advice or investment recommendations. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

Statements contained in this document that are not historical facts

are based on current expectations, estimates, projections, opinions

and beliefs of NBPE's investment manager. Such statements involve

known and unknown risks, uncertainties and other factors, and undue

reliance should not be placed thereon. Additionally, this document

contains "forward-looking statements." Actual events or results or

the actual performance of NBPE may differ materially from those

reflected or contemplated in such targets or forward-looking

statements.

This announcement

may not be published, distributed or transmitted by any means or

media, directly or indirectly, in whole or in part, in or into the

United States. This announcement does not constitute an offer

to sell, or a solicitation of an offer to buy, securities in the

United States. The securities mentioned herein have not been,

and will not be, registered under the U.S. Securities Act of 1933,

as amended (the "US Securities Act") or with any securities

regulatory authority of any state or other jurisdiction of the

United States and will not be offered, sold, exercised, resold,

transferred or delivered, directly or indirectly, in or into the

United States or to, or for the account or benefit of, any US

person (as defined under Regulation S under the US Securities

Act). The Company has not been, and will not be, registered

under the U.S. Investment Company Act of 1940, as amended.

Neither this

announcement nor any copy of it may be: (i) taken or transmitted

into or distributed in any member state of the European Economic

Area (other than the Netherlands and the United Kingdom), Canada,

Australia or the Republic of South Africa or to any resident

thereof, or (ii) taken or transmitted into or distributed in Japan

or to any resident thereof. Any failure to comply with these

restrictions may constitute a violation of the securities laws or

the laws of any such jurisdiction. The distribution of this

announcement in other jurisdictions may be restricted by law and

the persons into whose possession this document comes should inform

themselves about, and observe, any such restrictions.

Stifel Nicolaus

Europe Limited, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting only for the

Company in connection with the matters described in this

announcement and is not acting for or advising any other person, or

treating any other person as its client, in relation thereto and

will not be responsible for providing the regulatory protection

afforded to clients of Stifel Nicolaus Europe Limited or advice to

any other person in relation to the matters contained herein.

Neither Stifel Nicolaus Europe Limited nor any of its directors,

officers, employees, advisers or agents accepts any responsibility

or liability whatsoever for, or makes any representation or

warranty, express or implied, as to the truth, accuracy or

completeness of, the information in this announcement (or whether

any information has been omitted from the announcement) or any

information relating to the Company, whether written, oral or in a

visual or electronic format, and howsoever transmitted or made

available or any loss howsoever arising from any use of this

announcement or its contents or otherwise in connection with

it.

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: NB Private Equity Partners Limited via

Globenewswire

HUG#2037007

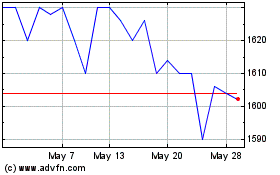

Nb Private Equity Partners (LSE:NBPE)

Historical Stock Chart

From Aug 2024 to Sep 2024

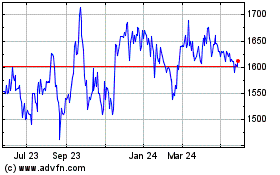

Nb Private Equity Partners (LSE:NBPE)

Historical Stock Chart

From Sep 2023 to Sep 2024