Glencore Reports Narrower Loss, Cuts Debt -- 3rd Update

August 24 2016 - 5:53AM

Dow Jones News

By Alex MacDonald

LONDON--A rebound in commodity prices and slashed costs weren't

enough to pull Glencore PLC's earnings out of the red in the first

half of the year.

The world's third-largest diversified miner by market value

reported a $369 million net loss in the six months to end-June

compared with a $676 million net loss in the same period last

year.

In Glencore's first half-year report since it embarked on a

sweeping plan to repair its balance sheet, the company said it is

on track to continue reducing debt through a combination of asset

sales, cost cuts and a bounce in commodity prices.

"We have made considerable progress toward achieving our goals,"

Glencore Chief Executive Ivan Glasenberg said on Wednesday.

Glencore launched the plan last year when investors were worried

about the company's then nearly $30 billion in net debt. The shares

fell sharply, dropping almost 30% in one day. Glencore's shares

have since rebounded, more than doubling so far this year, driven

by the rally in commodity prices and its progress in slashing debt.

The stock fell 4.4% in morning trading in London.

The company is on track to reinstate its dividend, which it

suspended last year as part of its debt-cutting plan, some time in

2017, Glencore's CEO said.

Mr. Glasenberg, once one of the mining industry's most voracious

deal-makers, said the company doesn't have plans to acquire new

assets soon. Some investors have said they want the company to keep

cutting debt and reinstate the dividend before snapping up new

mines.

"There is nothing we're really looking at right now," Mr.

Glasenberg said.

Mr. Glasenberg remained confident that the market for the

commodities his company mines and sells will continue to improve,

helped by demand in China and elsewhere. Prices for zinc and coal

are up 43% and roughly a third respectively this year, driven by

production cuts and Beijing's measures to stimulate the Chinese

economy.

"We see demand looking not bad around the world," Mr. Glasenberg

said on a conference call with reporters. "Demand in China is still

pretty good."

Mr. Glasenberg said one disappointment this year has been a

relatively flat price for copper, one of the company's biggest

earnings drivers. He said the market is unnecessarily worried about

a "big wall of supply" expected to come into the market in the

coming years.

"We don't see it," he said. "Inventory levels aren't indicating

that copper should be at these levels."

Glencore's first-half revenue fell 6% to $69.4 billion, largely

because of lower commodity prices in addition to lower copper,

zinc, coal and oil production in the first half compared with the

same period a year before. The company had cut production at some

of its coal, zinc and copper mines in response to low prices and an

oversupply of the commodities.

Glencore said it has largely achieved a major plank of its

debt-reduction plan, agreeing to $3.9 billion in asset sales so far

this year. It has a target of between $4 billion and $5 billion in

such sales.

In the latest move, Glencore said late Tuesday it struck a deal

to sell a stream of future gold production and other metals from an

Australian mine to Evolution Mining Ltd. for $670 million. The deal

comes on top of a pair of other so-called streaming deals for gold

and silver for a combined $1.4 billion.

The proceeds will be used to pay down net debt, which is now on

track to fall to a revised $16.5 billion to $17.5 billion by

year-end, down from a previous target of between $17 billion to $18

billion.

Net debt was $23.6 billion as of June end, down from $25.9

billion at the end of December.

Write to Scott Patterson at scott.patterson@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

August 24, 2016 05:38 ET (09:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

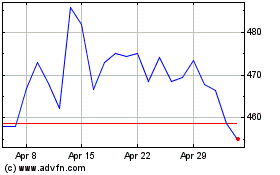

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2024 to May 2024

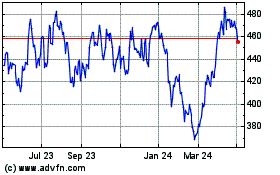

Glencore (LSE:GLEN)

Historical Stock Chart

From May 2023 to May 2024