– Debt principal reduction of $63.6 million from

Q2 2015 – – Net working capital reduced by $64.5 million from Q2

2015 –

BlueLinx Holdings Inc. (NYSE:BXC), a leading distributor of

building and industrial products in North America, today reported

financial results for the fiscal second quarter ended July 2,

2016.

“We are pleased to report our second quarter

results and the significant progress we’re making on our key

strategic initiatives of reducing working capital, exiting

underperforming facilities, and monetizing certain real estate.

We were able to execute on these important activities while

still improving our same center sales volume, operational

efficiency, and adjusted EBITDA. Our team is energized to continue

our focus on deleveraging our balance sheet, garnering market share

and improving our operating results,” said Mitch Lewis, President

and Chief Executive Officer.

Susan O’Farrell, Senior Vice President and Chief

Financial Officer added, “As previously announced on April 21st,

our primary focus is on deleveraging the balance sheet. We have

decreased our debt principal by $63.6 million and our net working

capital by $64.5 million when compared to the same period a year

ago primarily through our inventory and facility rationalization.

In addition, we are currently under contract to sell several of our

closed facilities and are actively marketing certain operating

facilities for sale leaseback opportunities.”

Second Quarter Results Compared to Prior

Year PeriodFor the fiscal quarter ended July 2, 2016,

BlueLinx generated net sales of $509.0 million, with a 1.7%

increase in sales unit volume. When excluding closed facilities,

revenue for same centers increased $8.3 million compared to the

same period a year ago, with a 4.1% increase in sales unit

volume.

The Company recorded gross profit in fiscal

second quarter 2016 of $57.4 million with a gross margin of 11.3%,

or 13.1% when excluding closed facilities and SKU

rationalization.

The Company recorded a net loss of $3.1 million

for fiscal second quarter 2016 compared to net income of $2.9

million from this period a year ago. The inventory and facility

rationalization initiatives reduced net income by $7.7 million

during the quarter. These charges included $1.2 million in

severance and employee benefits charges. Excluding these severance

and employee benefits charges, operating expenses remained

comparable to the same period last year, even with increased sales

volume.

Adjusted EBITDA, which is a non-GAAP measure,

for fiscal second quarter 2016 was $12.7 million, up $2.9 million

versus $9.8 million for the same period a year ago.

LiquidityAs of July 2,

2016, the Company had $65.3 million of excess availability under

its asset-based revolving credit facilities.

Conference CallBlueLinx will

host a conference call today at 10:00 a.m. Eastern Time,

accompanied by a supporting slide presentation. Investors can

listen to the conference call and view the accompanying slide

presentation by going to the BlueLinx website, www.BlueLinxCo.com,

and selecting the conference link on the Investor Relations page.

Investors will be able to access an archived recording of the

conference call for one week by calling 404-537-3406, Conference

ID# 50544972. The recording will be available two

hours after the conference call has concluded. Investors also can

access a recording of this call on the BlueLinx website.

Use of Non-GAAP

MeasuresBlueLinx reports its financial results in

accordance with accounting principles generally accepted in the

United States (“GAAP”). The Company also believes that presentation

of certain non-GAAP measures may be useful to investors. Any

non-GAAP measures used herein are reconciled in the financial

tables accompanying this news release. The Company cautions that

non-GAAP measures should be considered in addition to, but not as a

substitute for, the Company’s reported GAAP results.

We define Adjusted EBITDA as an amount equal to

net income (loss) plus interest expense and all interest expense

related items (e.g., write-off of debt issuance costs, charges

associated with mortgage refinancing), income taxes, depreciation

and amortization, and further adjusted to exclude certain non-cash

items and other adjustments to Consolidated Net Income (Loss). We

present Adjusted EBITDA because it is a primary measure used by

management to evaluate operating performance and, we believe, helps

to enhance investors’ overall understanding of the financial

performance and cash flows of our business. However, Adjusted

EBITDA is not a presentation made in accordance with GAAP, and is

not intended to present a superior measure of the financial

condition from those determined under GAAP. Adjusted EBITDA, as

used herein, is not necessarily comparable to other similarly

titled captions of other companies due to differences in methods of

calculation.

We believe Adjusted EBITDA is helpful in

highlighting operating trends. We also believe that Adjusted

EBITDA is frequently used by securities analysts, investors and

other interested parties in their evaluation of companies, many of

which present an Adjusted EBITDA measure when reporting their

results. We compensate for the limitations of using non-GAAP

financial measures by using them to supplement GAAP results to

provide a more complete understanding of the factors and

trends affecting the business than using GAAP results alone.

We believe net working capital is helpful to investors in

highlighting our operating efficiencies. Net working capital is

defined as accounts receivable plus inventories less accounts

payable and bank overdrafts. Management of net working capital

helps us monitor our progress in meeting our goals to maximize our

return on net working capital assets and our ability to easily

convert assets into cash.

We believe comparable same center sales are helpful to highlight

our performance on a go-forward basis. Same center sales exclude

closed centers which are defined as facility locations that have

been announced closed and are no longer operating and generating

revenue.

About BlueLinx Holdings

Inc.BlueLinx Holdings Inc., operating through its wholly

owned subsidiary BlueLinx Corporation, is a leading distributor of

building products in North America. The Company is

headquartered in Atlanta, Georgia and operates its distribution

business through its network of distribution centers. BlueLinx is

traded on the New York Stock Exchange under the symbol BXC.

Additional information about BlueLinx can be found on its website

at www.BlueLinxCo.com.

Forward-looking StatementsThis

press release includes “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements relating to our ability to return to

profitability, and our guidance regarding anticipated financial

results. All of these forward-looking statements are based on

estimates and assumptions made by our management that, although

believed by BlueLinx to be reasonable, are inherently uncertain.

Forward-looking statements involve risks and uncertainties,

including, but not limited to, economic, competitive, governmental

and technological factors outside of BlueLinx’s control that may

cause its business, strategy or actual results to differ materially

from the forward-looking statements. These risks and uncertainties

may include, among other things: changes in the prices, supply

and/or demand for products that it distributes, general economic

and business conditions in the United States; the activities of

competitors; changes in significant operating expenses; changes in

the availability of capital and interest rates; adverse weather

patterns or conditions; acts of cyber intrusion; variations in the

performance of the financial markets, including the credit markets;

and other factors described in the “Risk Factors” section in the

Company’s Annual Report on Form 10-K for the year ended

January 2, 2016, its Quarterly Reports on Form 10-Q, and in

its periodic reports filed with the Securities and Exchange

Commission from time to time. Given these risks and uncertainties,

you are cautioned not to place undue reliance on forward-looking

statements. BlueLinx undertakes no obligation to publicly update or

revise any forward-looking statement as a result of new

information, future events, and changes in expectation or

otherwise, except as required by law.

| BLUELINX HOLDINGS

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS ANDCOMPREHENSIVE INCOME

(LOSS)(In thousands, except per share

data)(unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

July 2, 2016 |

|

July 4, 2015 |

|

July 2, 2016 |

|

July 4, 2015 |

| Net sales |

$ |

509,011 |

|

|

$ |

515,656 |

|

|

$ |

983,337 |

|

|

$ |

970,605 |

|

| Cost of sales |

451,624 |

|

|

455,673 |

|

|

868,354 |

|

|

860,426 |

|

| Gross profit |

57,387 |

|

|

59,983 |

|

|

114,983 |

|

|

110,179 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Selling,

general, and administrative |

52,294 |

|

|

50,675 |

|

|

107,093 |

|

|

100,711 |

|

|

Depreciation and amortization |

2,396 |

|

|

2,438 |

|

|

4,872 |

|

|

4,716 |

|

| Total

operating expenses |

54,690 |

|

|

53,113 |

|

|

111,965 |

|

|

105,427 |

|

| Operating income |

2,697 |

|

|

6,870 |

|

|

3,018 |

|

|

4,752 |

|

| Non-operating expenses

(income): |

|

|

|

|

|

|

|

| Interest

expense |

6,250 |

|

|

6,690 |

|

|

13,457 |

|

|

13,243 |

|

| Other

expense (income), net |

135 |

|

|

29 |

|

|

(237 |

) |

|

387 |

|

| Income (loss) before

benefit from income taxes |

(3,688 |

) |

|

151 |

|

|

(10,202 |

) |

|

(8,878 |

) |

| Benefit from income

taxes |

(544 |

) |

|

(2,719 |

) |

|

(913 |

) |

|

(2,803 |

) |

| Net income (loss) |

$ |

(3,144 |

) |

|

$ |

2,870 |

|

|

$ |

(9,289 |

) |

|

$ |

(6,075 |

) |

| Weighted average common

shares: |

|

|

|

|

|

|

|

| Basic |

8,895 |

|

|

8,739 |

|

|

8,886 |

|

|

8,728 |

|

| Diluted |

8,895 |

|

|

8,786 |

|

|

8,886 |

|

|

8,728 |

|

| Basic and diluted net

income (loss) per share applicable to common stock |

$ |

(0.35 |

) |

|

$ |

0.33 |

|

|

$ |

(1.05 |

) |

|

$ |

(0.70 |

) |

| |

|

|

|

|

|

|

|

| Comprehensive income

(loss): |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

(3,144 |

) |

|

$ |

2,870 |

|

|

$ |

(9,289 |

) |

|

$ |

(6,075 |

) |

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

| Foreign

currency translation, net of tax |

34 |

|

|

(34 |

) |

|

306 |

|

|

(316 |

) |

|

Amortization of unrecognized pension loss, net of tax |

223 |

|

|

211 |

|

|

447 |

|

|

422 |

|

| Pension

curtailment, net of tax |

(12,185 |

) |

|

6,102 |

|

|

(12,185 |

) |

|

6,102 |

|

| Total

other comprehensive income (loss) |

(11,928 |

) |

|

6,279 |

|

|

(11,432 |

) |

|

6,208 |

|

| Comprehensive income

(loss) |

$ |

(15,072 |

) |

|

$ |

9,149 |

|

|

$ |

(20,721 |

) |

|

$ |

133 |

|

| BLUELINX

HOLDINGS INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands, except share

data)(unaudited) |

| |

|

|

|

| |

July 2, 2016 |

|

January 2, 2016 |

|

Assets: |

|

|

|

| Current assets: |

|

|

|

| Cash |

$ |

5,240 |

|

|

$ |

4,808 |

|

|

Receivables, less allowances of $3.4 million and $3.2 million,

respectively |

181,623 |

|

|

138,545 |

|

|

Inventories, net |

214,802 |

|

|

226,660 |

|

| Other

current assets |

28,562 |

|

|

32,011 |

|

| Total current

assets |

430,227 |

|

|

402,024 |

|

| Property and

equipment: |

|

|

|

| Land and

land improvements |

35,926 |

|

|

40,108 |

|

|

Buildings |

80,630 |

|

|

89,006 |

|

| Machinery

and equipment |

78,646 |

|

|

79,173 |

|

|

Construction in progress |

349 |

|

|

255 |

|

| Property and equipment,

at cost |

195,551 |

|

|

208,542 |

|

|

Accumulated depreciation |

(105,628 |

) |

|

(106,966 |

) |

| Property and equipment,

net |

89,923 |

|

|

101,576 |

|

| Other non-current

assets |

9,784 |

|

|

9,542 |

|

| Total assets |

$ |

529,934 |

|

|

$ |

513,142 |

|

|

Liabilities: |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

96,830 |

|

|

$ |

88,087 |

|

| Bank

overdrafts |

17,330 |

|

|

17,287 |

|

| Accrued

compensation |

6,829 |

|

|

4,165 |

|

| Current

maturities of long-term debt |

62,653 |

|

|

6,611 |

|

| Other

current liabilities |

12,942 |

|

|

14,023 |

|

| Total current

liabilities |

196,584 |

|

|

130,173 |

|

| Non-current

liabilities: |

|

|

|

| Long-term

debt |

340,222 |

|

|

377,773 |

|

| Pension

benefit obligation |

45,755 |

|

|

36,791 |

|

| Other

non-current liabilities |

12,934 |

|

|

14,301 |

|

| Total liabilities |

595,495 |

|

|

559,038 |

|

| Stockholders’

deficit: |

|

|

|

| Common

Stock, $0.01 par value, Authorized - 20,000,000 shares, Issued -

9,031,275 and 8,943,846 respectively. |

90 |

|

|

89 |

|

|

Additional paid-in capital |

256,959 |

|

|

255,905 |

|

|

Accumulated other comprehensive loss |

(46,206 |

) |

|

(34,774 |

) |

|

Accumulated stockholders’ deficit |

(276,404 |

) |

|

(267,116 |

) |

| Total stockholders’

deficit |

(65,561 |

) |

|

(45,896 |

) |

| Total liabilities and

stockholders’ deficit |

$ |

529,934 |

|

|

$ |

513,142 |

|

| BLUELINX HOLDINGS

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(In

thousands)(unaudited) |

| |

|

|

|

| |

Six Months Ended July 2,

2016 |

|

Six Months Ended July 4,

2015 |

| Net cash used

in operating activities |

$ |

(25,943 |

) |

|

$ |

(46,247 |

) |

| |

|

|

|

| Net cash

provided by (used in) investing activities |

1,853 |

|

|

(699 |

) |

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Repayments on revolving

credit facilities |

(282,371 |

) |

|

(187,394 |

) |

| Borrowings from

revolving credit facilities |

308,673 |

|

|

256,647 |

|

| Principal payments on

mortgage |

(9,431 |

) |

|

(8,534 |

) |

| Increase (decrease) in

bank overdrafts |

— |

|

|

(15,428 |

) |

| Decrease in restricted

cash related to the mortgage |

9,118 |

|

|

— |

|

| Other, net |

(1,467 |

) |

|

(23 |

) |

| Net cash provided by

financing activities |

24,522 |

|

|

45,268 |

|

| |

|

|

|

| Increase (decrease) in

cash |

432 |

|

|

(1,678 |

) |

| Cash balance, beginning

of period |

4,808 |

|

|

4,522 |

|

| Cash balance, end of

period |

$ |

5,240 |

|

|

$ |

2,844 |

|

| BLUELINX

HOLDINGS INC.RECONCILIATION OF NON-GAAP

MEASUREMENTS(In

thousands)(unaudited) |

| |

|

|

|

| |

Quarter Ended |

|

Six Months Ended |

|

Adjusted EBITDA |

July 2, 2016 |

|

July 4, 2015 |

|

July 2, 2016 |

|

July 4, 2015 |

| Net income (loss) |

$ |

(3,144 |

) |

|

$ |

2,870 |

|

|

$ |

(9,289 |

) |

|

$ |

(6,075 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

2,396 |

|

|

2,438 |

|

|

4,872 |

|

|

4,716 |

|

| Interest

expense |

6,250 |

|

|

6,690 |

|

|

13,457 |

|

|

13,243 |

|

| Benefit

from income taxes |

(544 |

) |

|

(2,719 |

) |

|

(913 |

) |

|

(2,803 |

) |

| Gain from

the sale of properties |

(384 |

) |

|

— |

|

|

(761 |

) |

|

— |

|

|

Share-based compensation expense, excluding restructuring |

430 |

|

|

519 |

|

|

845 |

|

|

1,135 |

|

|

Restructuring, severance, and legal |

7,581 |

|

|

(36 |

) |

|

8,069 |

|

|

(65 |

) |

|

Refinancing-related expenses |

69 |

|

|

— |

|

|

3,385 |

|

|

— |

|

| Adjusted EBITDA |

$ |

12,654 |

|

|

$ |

9,762 |

|

|

$ |

19,665 |

|

|

$ |

10,151 |

|

| |

|

Quarter Ended |

|

Six Months Ended |

| Comparable Same

Center Schedule |

|

July 2, 2016 |

|

July 4, 2015 |

|

July 2, 2016 |

|

July 4, 2015 |

| Net sales |

|

$ |

509,011 |

|

|

$ |

515,656 |

|

|

$ |

983,337 |

|

|

$ |

970,605 |

|

| Less:

closed centers |

|

31,164 |

|

|

46,121 |

|

|

65,861 |

|

|

90,973 |

|

| Same center net

sales |

|

$ |

477,847 |

|

|

$ |

469,535 |

|

|

$ |

917,476 |

|

|

$ |

879,632 |

|

| |

|

|

|

|

|

|

|

|

| Actual year-over-year

percentage increase (decrease) |

|

(1.3 |

)% |

|

|

|

1.3 |

% |

|

|

| Same center

year-over-year percentage increase |

|

1.8 |

% |

|

|

|

4.3 |

% |

|

|

| BLUELINX

HOLDINGS INC.ADDITIONAL

INFORMATION(In

thousands)(unaudited) |

| |

|

| |

Quarter Ended |

|

Debt principal |

July 2, 2016 |

|

July 4, 2015 |

| Revolving credit

facilities - principal |

$ |

246,858 |

|

|

$ |

300,020 |

|

| Mortgage -

principal |

158,769 |

|

|

169,188 |

|

| Total debt principal

payable |

$ |

405,627 |

|

|

$ |

469,208 |

|

| |

|

|

|

|

|

|

|

BlueLinx Contact Information:

Susan O’Farrell, SVP, CFO & Treasurer

BlueLinx Holdings Inc.

(770) 953-7000

Natalie Poulos, Investor Relations

BlueLinx Holdings Inc.

(770) 953-7522

investor.relations@bluelinxco.com

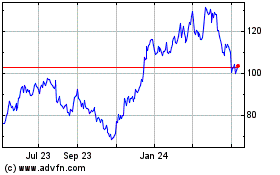

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

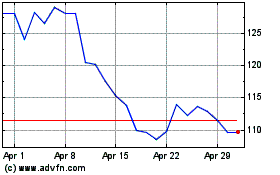

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024