Deckers Brands (NYSE: DECK), a global leader in designing,

marketing and distributing innovative footwear, apparel and

accessories, today announced financial results for the first fiscal

quarter ended June 30, 2016.

Throughout this release, references to Non-GAAP financial

measures exclude certain restructuring charges. Additional

information regarding these Non-GAAP financial measures is set

forth under the heading "Non-GAAP Financial Measures" below.

“We are encouraged by our start to fiscal 2017, and we remain on

track to deliver the sales and profitability targets we established

for the year,” commented Dave Powers, President and Chief Executive

Officer. “Looking ahead, I am confident that our product lineup and

marketing plans for this fall and holiday will help drive sales

during our key selling season. I am excited about the progress we

are making in this transitional year, and believe we are

positioning the Company to capitalize on the opportunities in front

of us.”

First Quarter Fiscal 2017 Financial Review

- Net sales decreased 18.4% to

$174.4 million compared to $213.8 million for the same period last

year. The year over year decrease was due to the timing of order

shipments between quarters, a decrease in Direct-to-Consumer (DTC)

comparable sales, and fewer close-out sales. On a constant currency

basis, net sales decreased 18.8%.

- Gross margin was 43.7% compared

to 40.5% for the same period last year.

- SG&A expenses as a

percentage of sales were 88.6% compared to 70.3% for the same

period last year. Non-GAAP SG&A expenses as a percentage of

sales were 87.6%.

- Operating loss was $(78.3)

million compared to $(63.7) million for the same period last year.

Non-GAAP operating loss was $(76.6) million.

- Diluted loss per share was

$(1.84) compared to $(1.43) for the same period last year. Non-GAAP

diluted loss per share was $(1.80).

Brand Summary

- UGG® brand net sales for the first

quarter decreased (19.8)% to $91.9 million compared to $114.5

million for the same period last year. On a constant currency

basis, sales decreased (20)%. The decrease in sales was driven by a

shift in the timing of order shipments between quarters which

impacted global wholesale and distributor sales, a decrease in DTC

comparable sales and fewer close-out sales.

- Teva® brand net sales for the first

quarter decreased (17.3)% to $34.7 million compared to $41.9

million for the same period last year. On a constant currency

basis, sales decreased (18.3)%. The decrease in sales was driven by

a decrease in global wholesale sales.

- Sanuk® brand net sales for the first

quarter decreased (20.2)% to $26.7 million compared to $33.5

million for the same period last year on both a reported and

constant currency basis. The decrease in sales was driven by a

decrease in global wholesale sales.

- Combined net sales of the Company’s

other brands decreased (11.6)% to $21.1 million compared to $23.9

million for the same period last year. On a constant currency

basis, sales decreased (11.8)%. The decrease was primarily

attributable to discontinued brands. HOKA ONE ONE® reported sales,

which are included as part of the Company’s other brand sales,

increased 1.8% to $17.6 million compared to the same period last

year.

Channel Summary (included in the brand sales numbers

above)

- Wholesale and distributor net sales for

the first quarter decreased (24.3)% to $116.1 million compared to

$153.4 million for the same period last year. On a constant

currency basis, sales decreased (24.6)%. The decrease in sales was

driven by a shift in the timing of order shipments between quarters

and fewer close-out sales.

- DTC net sales for the first quarter

decreased (3.6)% to $58.3 million compared to $60.4 million for the

same period last year. On a constant currency basis, sales

decreased (3.8)%. DTC comparable sales for the first quarter

decreased (7.3)% over the same period last year.

Geographic Summary (included in the brand and channel sales

numbers above)

- Domestic net sales for the first

quarter decreased (18.6)% to $109.5 million compared to $134.5

million for the same period last year.

- International net sales for the first

quarter decreased (18.2)% to $64.9 million compared to $79.3

million for the same period last year. On a constant currency

basis, sales decreased (19.1)%.

Balance Sheet

At June 30, 2016, cash and cash equivalents were $202.3 million

compared to $168.7 million at June 30, 2015. The Company had $110.6

million in outstanding borrowings under its credit facility at June

30, 2016 compared to $43.4 million at June 30, 2015.

Company-wide inventories at June 30, 2016 increased 25.6% to

$469.2 million from $373.6 million at June 30, 2015. By brand, UGG

inventory increased 25.5% to $385.8 million at June 30, 2016, Teva

inventory increased 10.5% to $24.9 million at June 30, 2016, Sanuk

inventory increased 31.4% to $23.5 million at June 30, 2016, and

the other brands inventory increased 35.0% to $35.0 million at June

30, 2016. The elevated levels of inventory were in-line with

expectations given the unseasonably warm weather experienced in the

third quarter of fiscal 2016.

Full Year Fiscal 2017 Outlook for the Twelve Month Period

Ending March 31, 2017

- The Company continues to expect fiscal

year 2017 net sales to be in the range of down (3)% to flat.

- Gross margin for fiscal 2017 is

expected to be in the range of 47.0% to 47.5%.

- SG&A expenses as a percentage of

sales are projected to be approximately 37%.

- The Company expects fiscal 2017 diluted

earnings per share to be in the range of $4.05 to $4.40. This

excludes any pretax charges that may occur from any further

restructuring charges, which are expected to be in the range of

$10-$15 million in fiscal year 2017.

Second Quarter Fiscal 2017 Outlook for the Three Month Period

Ending September 30, 2016

- The Company expects second quarter

fiscal 2017 net sales to be up 1% to 3% versus same period last

year. The Company expects diluted earnings per share of

approximately $1.12 to $1.22 compared to $1.11 for the same period

last year.

- As a reminder, a significant amount of

our operating expenses are fixed and spread evenly on an absolute

dollar basis throughout each quarter. We expect the majority of our

earnings increase in fiscal 2017 to come in the third and fourth

quarters.

Non-GAAP Financial Measures

We present certain Non-GAAP financial measures in this press

release, including Non-GAAP gross margin, Non-GAAP SG&A

expenses, Non-GAAP operating income and Non-GAAP diluted earnings

per share, to provide information that may assist investors in

understanding our financial results and assessing our prospects for

future performance. We believe these Non-GAAP financial measures

are important indicators of our operating performance because they

exclude items that are unrelated to, and may not be indicative of,

our core operating results, such as restructuring charges relating

to retail store closures and office consolidations. In particular,

we believe that the exclusion of certain costs and charges allows

for a more meaningful comparison of our results from period to

period. These Non-GAAP measures, as we calculate them, may not

necessarily be comparable to similarly titled measures of other

companies and may not be appropriate measures for comparing the

performance of other companies relative to Deckers. These Non-GAAP

financial results are not intended to represent, and should not be

considered to be more meaningful measures than, or alternatives to,

measures of operating performance as determined in accordance with

GAAP. To the extent we utilize such Non-GAAP financial measures in

the future, we expect to calculate them using a consistent method

from period to period. A reconciliation of each of the financial

measures to the most directly comparable GAAP measures has been

provided under the heading “Reconciliation of GAAP Financial

Measures to Non-GAAP Financial Measures” in the financial statement

tables included below.

Conference Call Information

The Company’s conference call to review the results for the

first quarter 2017 will be broadcast live today, Thursday, July 28,

2016 at 4:30 pm Eastern Time and hosted at www.deckers.com. You can

access the broadcast by clicking on the “Investor Information” tab

and then clicking on the microphone icon at the top of the

page.

About Deckers Brands

Deckers Brands is a global leader in designing, marketing and

distributing innovative footwear, apparel and accessories developed

for both everyday casual lifestyle use and high performance

activities. The Company’s portfolio of brands includes UGG®,

Koolaburra®, HOKA ONE ONE®, Teva® and Sanuk®. Deckers Brands

products are sold in more than 50 countries and territories through

select department and specialty stores, Company-owned and operated

retail stores, and select online stores, including Company-owned

websites. Deckers Brands has a 40-year history of building niche

footwear brands into lifestyle market leaders attracting millions

of loyal consumers globally. For more information, please visit

www.deckers.com.

Forward Looking Statements

This press release contains "forward-looking statements" within

the meaning of the federal securities laws, which statements are

subject to considerable risks and uncertainties. These

forward-looking statements are intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

all statements other than statements of historical fact contained

in this press release, including statements regarding our

anticipated financial performance, including our projected net

sales, margins, expenses and earnings per share, as well as

statements regarding our product and brand strategies, marketing

plans and market opportunities. We have attempted to identify

forward-looking statements by using words such as "anticipate,"

"believe," “could,” "estimate," "expect," "intend," "may," “plan,”

“predict,” "project," "should," "will," or “would,” and similar

expressions or the negative of these expressions.

Forward-looking statements represent our management’s current

expectations and predictions about trends affecting our business

and industry and are based on information available as of the time

such statements are made. Although we do not make forward-looking

statements unless we believe we have a reasonable basis for doing

so, we cannot guarantee their accuracy or completeness.

Forward-looking statements involve numerous known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements predicted,

assumed or implied by the forward-looking statements. Some of the

risks and uncertainties that may cause our actual results to

materially differ from those expressed or implied by these

forward-looking statements are described in the section entitled

“Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended March 31, 2016, as well as in our other filings with the

Securities and Exchange Commission.

Except as required by applicable law or the listing rules of the

New York Stock Exchange, we expressly disclaim any intent or

obligation to update any forward-looking statements, or to update

the reasons actual results could differ materially from those

expressed or implied by these forward-looking statements, whether

to conform such statements to actual results or changes in our

expectations, or as a result of the availability of new

information.

DECKERS OUTDOOR CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Loss

(Unaudited) (Amounts in thousands, except for per share

data) Three-month period ended

June 30, 2016 2015 Net

sales $ 174,393 213,805 Cost of sales 98,141 127,209

Gross profit 76,252 86,596 Selling, general and

administrative expenses 154,571 150,304 Loss from

operations (78,319 ) (63,708 ) Other expense, net 562

974 Loss before income taxes (78,881 ) (64,682 )

Income tax benefit (19,963 ) (17,355 ) Net loss (58,918 ) (47,327 )

Other comprehensive income (loss), net of tax Unrealized

gain (loss) on foreign currency hedging 2,909 (1,463 ) Foreign

currency translation adjustment 3,699 2,766 Total

other comprehensive income 6,608 1,303 Comprehensive

loss $ (52,310 ) (46,024 ) Net loss per share: Basic $ (1.84

) (1.43 ) Diluted $ (1.84 ) (1.43 ) Weighted-average common

shares outstanding: Basic 32,024 33,117 Diluted 32,024

33,117

Reconciliation of

GAAP Financial Measures to Non-GAAP Financial

Measures

DECKERS OUTDOOR

CORPORATION AND SUBSIDIARIES - GAAP to Non-GAAP Reconciliation

For the Three Months Ended June 30, 2016 (Rounded to the

thousands, except per share data) (Unaudited)

Q1 FY17

Non-GAAP GAAP Measures Restructuring

Measures (As Reported) Charges (1)

(Excluding Items) (2) Net sales $ 174,393 $ 174,393 Cost of

sales 98,141 98,141 Gross profit 76,252 76,252

Selling, general and administrative expenses 154,571

(1,732 ) 152,839 Loss from operations (78,319 ) 1,732

(76,587 ) Other expense, net 562 562

Loss before income taxes (78,881 )

(77,149 ) Income tax benefit (19,963 )

(19,525 ) Net loss $ (58,918 )

$ (57,624 ) Net loss per share: Basic $ (1.84 ) $ (1.80 )

Diluted $ (1.84 ) $ (1.80 ) Weighted-average common shares

outstanding: Basic 32,024 32,024 Diluted 32,024 32,024

(1) Amounts as of June 30, 2016 reflect charges related to

restructuring costs as a result of retail store closures and office

consolidations. (2) The tax rate applied to the Non-GAAP measures

is 25.3%, which is the same as the 1Q17 GAAP measure tax rate.

DECKERS OUTDOOR CORPORATION AND

SUBSIDIARIES Condensed Consolidated Balance Sheets

(Unaudited) (Amounts in thousands)

June 30, March 31,

Assets 2016 2016 Current assets: Cash

and cash equivalents $ 202,309 $ 245,956 Trade accounts receivable,

net 102,951 160,154 Inventories 469,163 299,911 Other current

assets 84,540 79,744 Total current assets 858,963 785,765

Property and equipment, net 245,111 237,246 Other noncurrent assets

253,671 255,057 Total assets $ 1,357,745 $ 1,278,068

Liabilities and Stockholders' Equity Current

liabilities: Short-term borrowings $ 110,558 $ 67,475 Trade

accounts payable 212,723 100,593 Other current liabilities 48,750

70,430 Total current liabilities 372,031 238,498 Long-term

liabilities: Mortgage payable 32,500 32,631 Other liabilities

35,970 39,468 Total long-term liabilities 68,470 72,099

Total stockholders' equity 917,244 967,471 Total

liabilities and stockholders' equity $ 1,357,745 $ 1,278,068

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160728006547/en/

Investor Contact:Deckers BrandsSteve Fasching, VP,

Strategy & Investor Relations805.967.7611

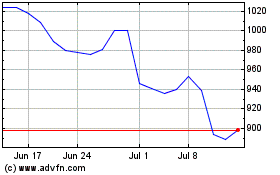

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From Apr 2023 to Apr 2024