Revving Up Oil Fields Won't Be So Easily Done

July 07 2016 - 5:59AM

Dow Jones News

By Alison Sider

Oil-field-services companies are depleted after slashing prices

and laying off workers, and their slow recovery could crimp the

energy industry's overall ability to bounce back from the oil

bust.

The workhorses of the energy sector, the services companies,

which range from giants such as Schlumberger Ltd. to small

family-run operations, provide much of the muscle and specialty

know-how needed to extract oil and gas. They pioneered the

technologies that allowed producers to unlock massive volumes of

oil and gas trapped in shale-rock formations, and marshal critical

equipment and people to drill and pump wells from remote corners of

North Dakota to platforms miles offshore.

But they have borne the brunt of two years of belt-tightening in

the oil patch, leaving them short on cash and manpower as prices

slowly rebound and companies need them again to increase

production. IHS Energy estimates that nearly 70% of fracking

equipment in the U.S. has been idled, and 60% of field workers

involved in fracking have been laid off.

Roe Patterson, chief executive of Fort Worth, Texas-based Basic

Energy Services Inc., which fracks wells in the Permian basin and

other shale formations, said shortages of experienced workers could

hamstring a recovery in its early days. Many of the thousands laid

off have found other jobs, and the best will have to be lured back

with higher wages that companies can ill-afford, he said.

"It's scary to think what a drag and what a headwind finding

experienced labor is going to be this time around," Mr. Patterson

said, adding that while his fracking fleet is still in good shape,

a lot of equipment isn't. "Pop the hood on your car and let it sit

for a year. I guarantee the car won't be in the same

condition."

Larger and better-financed oil-field-services companies were

better positioned to weather the drop in business and are now

poised grab market share from smaller competitors that had to make

deeper cuts, analysts said.

Halliburton Co. has laid off more than 28,500 workers -- one

third of its labor force. But the company has been careful to hold

on to employees with specialized skills, said Lawrence Pope,

executive vice president of administration and chief human

resources officer.

And Halliburton has experience adding to its ranks quickly when

labor markets are heating up: In 2014, when services companies were

still trying to staff up in order to meet demand, Halliburton hired

21,000 people in a single year.

"In the upturn, we become a recruiting machine," Mr. Pope

said.

Schlumberger, the world's largest oil-field-services company,

has said it offered many senior field engineers and certain key

operators an "incentivized leave of absence" at half pay, which

will allow it to call workers back in batches over the coming

months.

But oil companies hoping to start producing again may find that

the low costs they have come to count on aren't going to stick.

Services companies have said their prices have been pushed to

break-even levels that they can't sustain.

"Most service companies are now fighting for survival with both

negative earnings and cash flow," Schlumberger Chief Executive Paal

Kibsgaard recently said. "The cost savings from lower service

pricing should largely be reversed when activity levels start

picking up."

Smaller firms are being pushed to the brink. Robert Drummond,

chief executive of Key Energy Services, a Houston-based company

that works on wells, said in May that producers will have to accept

higher prices in order for the firms to get back to work.

For Key Energy, those higher prices can't come soon enough: it

disclosed on June 15 that it was in discussion with lenders about a

potential prepackaged chapter 11 bankruptcy filing and

restructuring. Its shares have fallen to 22 cents from $9 when oil

prices peaked in 2014. Key Energy officials weren't available for

further comment.

Since the beginning of 2015, more than 70 services firms have

filed for bankruptcy -- nearly half of them since the start of this

year, according to the law firm Haynes & Boone LLP.

Seventy Seven Energy Inc., a services company spun off from

Chesapeake Energy Corp., filed for chapter 11 bankruptcy protection

last month -- handing the company's equity over to bondholders and

wiping out more than $1 billion in debt.

Some customers are getting nervous that the most indebted

oil-field-services firms could be too risky to hire, said Stephens

Inc. analyst Matthew Marietta. That could set off a downward spiral

for the companies and make bankruptcy a more urgent prospect.

As prices rebound and activity picks up, the race to hire back

workers and repair equipment will put more strain on services

companies' already stretched finances. As things stand, only

handful are in good enough shape to step on the gas if called to,

said Piper Jaffray Cos. analyst Bill Herbert.

"I don't think the industry yet realizes essentially how arduous

this recovery could be," he said.

(END) Dow Jones Newswires

July 07, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

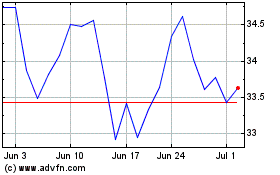

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

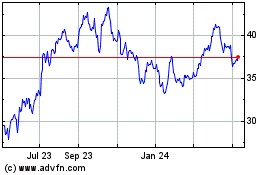

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024