UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2016

Commission File Number: 001-35135

Sequans

Communications S.A.

(Translation of Registrant’s name into English)

15-55 boulevard Charles de Gaulle

92700 Colombes, France

Telephone: +33 1 70 72 16 00

(Address of Principal Executive Office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): Yes

¨

No

x

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if

submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T

Rule

101(b)(7): Yes

¨

No

x

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document

that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether

the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: Yes

¨

No

x

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_____.

EXPLANATORY NOTE

On or about May 26, 2016, Sequans Communications S.A. (the “

Company

”) mailed materials to holders of record at the close

of business on May 19, 2016 of ordinary shares and American Depositary Shares (“

ADSs

”), each representing one ordinary share, of the Company in connection with an ordinary general meeting and extraordinary meeting of

shareholders to be held at the Company’s headquarters in Colombes, France on June 28, 2016. Copies of materials relating to the Company’s ordinary general meeting and extraordinary meeting of shareholders are also available on the

Company’s website at

http://www.sequans.com/investors/corporate-governance

or by contacting the Company’s investor relations department by telephone at +33 1 70 72 16 07 or by e-mail at ir@sequans.com.

The Company’s board of directors (the “

Board of Directors

”) has convened an ordinary and extraordinary general

shareholders’ meeting, in accordance with the provisions of French law and of our Articles of Incorporation and Bylaws, for the purpose of requesting a vote on the following agenda items, as further detailed below and in the attached

“Resolutions Submitted to the Ordinary General Meeting and Extraordinary Meeting of Shareholders on June 28, 2016”:

Ordinary Matters

|

1.

|

Approval of the statutory financial statements for the year ended December 31, 2015

|

|

2.

|

Approval of the consolidated accounts for the year ended December 31, 2015

|

|

3.

|

Appropriation of net loss for the year ended December 31, 2015

|

|

4.

|

Agreements within the scope of Article L. 225-38 of the French Commercial Code

|

|

5.

|

Approval of the compensation plan for non-executive directors

|

|

6.

|

Renewal of Mr. Alok Sharma as director

|

|

7.

|

Renewal of Mr. Dominique Pitteloud as director

|

|

8.

|

Appointment of Mr. Richard Nottenburg as director

|

Extraordinary Matters

|

9.

|

Subject to the condition precedent that the renewals of Messrs. Alok Sharma and Dominique Pitteloud and the appointment of Mr. Richard Nottenburg are approved, issuance of 140,000 stock subscription warrants;

establishing the conditions for exercising the stock warrants and adoption of an issuance agreement; revocation of preemptive subscription rights in favor of Mr. Alok Sharma, Mr. Richard Nottenburg, Mr. Zvi Slonimsky, Mr. Hubert

de Pesquidoux, Mr. Dominique Pitteloud, and Mr. Yves Maître; powers to be granted to the Board of Directors

|

|

10.

|

Authorization given to the Board of Directors to grant stock subscription options, and renunciation of shareholders’ preemptive subscription rights in favor of the beneficiaries of such options; conditions attached

to such authorization; powers to be granted to the Board of Directors

|

|

11.

|

Authorization granted to the Board of Directors to issue stock subscription warrants, and revocation of shareholders’ preemptive subscription rights in favor of the holders of such warrants; conditions attached to

such authorization; powers to be granted to the Board of Directors

|

|

12.

|

Authorization granted to the Board of Directors to issue restricted free shares, and revocation of shareholders’ preemptive subscription rights in favor of the holders of such restricted free shares; conditions

attached to such authorization; powers to be granted to the Board of Directors

|

|

13.

|

Setting an overall ceiling of 1,000,000 for issues of stock subscription options, stock warrants and restricted free shares

|

|

14.

|

Authority delegated to the Board of Directors to carry out a capital increase up to a maximum nominal amount of €400,000 by issuing shares and/or securities that confer rights to the Company’s equity and/or to

securities that confer the right to an allotment of debt securities, reserved to a specific class of persons and revocation of preemptive subscription rights in favor of such class

|

|

15.

|

Decision in the scope of Article L. 225-248 of the French Commercial Code

|

|

16.

|

Authority to be delegated to the Board of Directors to decide to increase stated capital by issuing shares reserved for employees and revocation of preemptive subscription rights in favor of such employees

|

|

17.

|

Powers and formalities required for the meeting to be official

|

The Board of Directors recommends that you vote “FOR” proposals 1-15 and 17 and

“AGAINST” proposal 16 reflected in the agenda items listed above.

Whether or not you plan to attend the ordinary general

meeting and extraordinary meeting of shareholders in person, we urge you to vote your shares by phone, via the internet or by signing, dating and returning the proxy card at your earliest convenience. Please see the proxy card for specific

instructions on how to vote. If you sign and return the proxy card, your shares will be voted:

|

|

•

|

|

in favor of the resolutions corresponding to proposals 1-15 and 17, whether or not you specifically indicate a “FOR” vote, unless you abstain or vote against a specific resolution; and

|

|

|

•

|

|

against the resolution corresponding to proposal 16, whether or not you specifically indicate an “AGAINST” vote, unless you abstain or vote for such resolutions.

|

Proxies are revocable, and any shareholder may withdraw his or her proxy by providing the Company with written notice or signing and returning

a proxy card with a later date, in each case prior to the deadline set forth on the proxy card.

French law classifies resolutions as

either ordinary or extraordinary, depending on the subject. For resolutions submitted to an

ordinary

meeting, the quorum required for a valid meeting is 20% of outstanding shares (voting rights) and resolutions pass by a simple majority of

shares present or represented. For resolutions submitted to an

extraordinary

meeting, the quorum required for a valid meeting is 25% of outstanding shares (voting rights) and resolutions pass by a two-thirds majority of shares present or

represented.

The resolutions corresponding to the agenda items listed above are set forth in the full “Resolutions Submitted to the

Ordinary General Meeting and Extraordinary Meeting of Shareholders on June 28, 2016” which is available on the Company’s website:

http://www.sequans.com/investors/corporate-governance

.

The following is a

summary of those resolutions.

* * *

* * * *

Ordinary Matters

|

|

|

|

|

PROPOSALS 1-3:

|

|

APPROVAL OF THE STATUTORY AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2015; APPROPRIATION OF NET LOSS FOR THE YEAR ENDED DECEMBER 31, 2015

|

The Board of Directors proposes that the shareholders approve the statutory and the consolidated financial

statements of Sequans Communications S.A. The statutory financial statements reflect the financials of the parent company only in accordance with generally accepted accounting principles in France. The consolidated financial statements are the same

as those included in the Company’s annual report on Form 20-F filed with the U.S. Securities and Exchange Commission on April 29, 2016.

The Board of Directors proposes that shareholders approve the allocation of net loss to negative retained earnings for the year ended

December 31, 2015.

The Board of Directors requests that shareholders approve these proposals.

|

|

|

|

|

PROPOSAL 4:

|

|

APPROVAL OF THE REPORT ON RELATED PARTY AGREEMENTS

|

The Board of Directors proposes that shareholders approve related party transactions in force at any time in

2016. These related party transactions, concerning the employment agreement with Georges Karam, Chairman and CEO, and a consulting agreement with Alok Sharma, director, are disclosed in the Company’s annual report on Form 20-F.

The Board of Directors requests that shareholders approve this proposal.

|

|

|

|

|

PROPOSAL 5:

|

|

APPROVAL OF THE COMPENSATION PLAN FOR NON-EXECUTIVE DIRECTORS

|

The Board of Directors proposes that each non-executive director’s cash compensation for the coming year

remain unchanged from last year:

|

|

|

|

|

|

|

- Basic directors’ fees

|

|

US$

|

20,000 per year,

per director

|

|

|

- Special directors’ fees

paid in

consideration for a director’s membership in committees

|

|

|

|

|

|

. Member of the Audit Committee

|

|

US$

|

6,000 per year

|

|

|

. Chair of the Audit Committee

|

|

US$

|

12,000 per year

|

|

|

. Member of the Compensation Committee

|

|

US$

|

4,500 per year

|

|

|

. Chair of the Compensation Committee

|

|

US$

|

9,000 per year

|

|

|

. Member of the Nominating and Corporate Governance Committee

|

|

US$

|

2,500 per year

|

|

|

. Chair of the Nominating and Corporate Governance Committee

|

|

US$

|

5,000 per year

|

|

|

|

|

No director may be a member of more than two committees or chair more than one committee.

|

|

|

|

|

|

- Lead independent director fee

|

|

US$

|

20,000 per year

|

|

The Board of Directors requests that shareholders approve this proposal.

|

|

|

|

|

PROPOSALS 6-8:

|

|

PROPOSALS TO REAPPOINT AS DIRECTORS MESSRS. ALOK SHARMA AND DOMINIQUE PITTELOUD, AND TO APPOINT AS DIRECTOR MR. RICHARD NOTTENBURG

|

The Board of Directors proposes to reappoint Messrs. Alok Sharma and Dominique Pitteloud, and to appoint for

the first time Mr. Richard Nottenburg, as members of the Board of Directors. If elected, Messrs. Sharma, Pitteloud and Nottenburg will each be appointed for a term of three years, which will expire at the conclusion of the ordinary general

shareholders’ meeting that will be held in 2019.

Messrs. Sharma, Pitteloud and Nottenburg have already given notice that they would

accept such positions.

The Board of Directors requests that shareholders approve these proposals.

Extraordinary Matters

|

|

|

|

|

PROPOSAL 9:

|

|

SUBJECT TO THE CONDITION PRECEDENT THAT THE REAPPOINTMENT OF MESSRS. ALOK SHARMA AND DOMINIQUE PITTELOUD, AND THE APPOINTMENT OF MR RICHARD NOTTENBURG, AS DIRECTOR ARE APPROVED, ISSUANCE OF A TOTAL NUMBER OF 140,000 STOCK

SUBSCRIPTION WARRANTS; ESTABLISHING THE CONDITIONS FOR EXERCISING THE STOCK WARRANTS AND ADOPTION OF AN ISSUANCE AGREEMENT; REVOCATION OF THE PREEMPTIVE RIGHT TO SUBSCRIBE FOR THESE WARRANTS IN FAVOR OF NON-EXECUTIVE DIRECTORS

|

Subject to the condition precedent that the appointment of Mr. Zvi Slonimsky is approved, the Board of

Directors proposes issuing 20,000 stock warrants to each of the existing non-executive directors and 40,000 stock warrants to the new non-executive director (i.e., a total of 140,000 stock warrants):

|

|

|

|

|

|

|

|

|

Beneficiaries

|

|

Stock Warrants

|

|

Total Subscription Price

|

|

|

Mr. Alok Sharma

|

|

20,000 stock warrants

|

|

€

|

200

|

|

|

Mr. Zvi Slonimsky

|

|

20,000 stock warrants

|

|

€

|

200

|

|

|

Mr. Dominique Pitteloud

|

|

20,000 stock warrants

|

|

€

|

200

|

|

|

Mr. Hubert de Pesquidoux

|

|

20,000 stock warrants

|

|

€

|

200

|

|

|

Mr. Yves Maître

|

|

20,000 stock warrants

|

|

€

|

200

|

|

|

Mr. Richard Nottenburg

|

|

40,000 stock warrants

|

|

€

|

400

|

|

|

Total

|

|

140,000 stock warrants

|

|

€

|

1400

|

|

The subscription price for each stock warrant will be set at €0.01 and will confer the right to purchase

one new ordinary share with a par value of €0.02 for a period of ten (10) years, with an exercise price equal to the closing price of the Company’s ADSs on the NYSE on the issue date.

Provided each non-executive director still holds the office of director on each anniversary date, one-third of the stock warrants for which he

subscribes may be exercised each year as follows: (i) one-third on the date of the first anniversary of the date they are granted by the ordinary and extraordinary general shareholders’ meeting; (ii) two-thirds on the date of the

second anniversary; and (iii) without restriction from the date of the third anniversary.

Under French law, stock options may only

be issued to employees. The legal form of instrument which may be issued to members of the Board of Directors or other non-employees is a warrant. Warrants may not be granted free of charge, but must be purchased at issuance at a set subscription

price.

The Board of Directors requests that shareholders approve these proposals.

|

|

|

|

|

PROPOSALS 10-13:

|

|

AUTHORIZATIONS TO BE GRANTED TO THE BOARD OF DIRECTORS TO ISSUE STOCK OPTIONS, STOCK SUBSCRIPTION WARRANTS AND RESTRICTED FREE SHARES

|

The Board of Directors proposes that this general shareholders’ meeting authorize the renewal of the

system for granting stock options, and the creation of a system for granting restricted free shares, to the Company’s employees and/or senior corporate officers, as well as the employees of the Company’s subsidiaries, and the renewal of

the system for granting stock subscription warrants to non-employee external partners.

The issuances of stock options, stock subscription

warrants and restricted free shares will be subject to an overall ceiling of 1,000,000 new shares with a par value of €0.02.

Each

stock option will be granted free of charge and will entitle the beneficiary thereof to acquire one new ordinary share with a par value of €0.02 for a period of ten (10) years at a fixed exercise price, provided the beneficiary complies

with the requirements for time spent with the Company. The exercise price will be equal to the closing price of the Company’s ADSs on the NYSE on the date the stock options are granted by the Board of Directors.

Each restricted free share will be granted free of charge and will permit the beneficiary thereof

to acquire one new ordinary share with a par value of €0.02, provided the beneficiary complies with the requirements for time spent with the Company.

Stock subscription warrants may be granted to the Company’s non-employee external partners (independent consultants, etc.) who contribute

to the Company’s expansion and success, and must be subscribed by the beneficiary at a price of €0.01 per warrant at the time of grant. The stock subscription warrant then entitles the beneficiary thereof to acquire one new ordinary

share with a par value of €0.02 for a period of ten (10) years at a fixed exercise price. The exercise price will be equal to the closing price of the Company’s ADSs on the NYSE on the date the stock subscriptions warrants are granted

by the Board of Directors.

The authorization to the Board of Directors to grant stock option, stock subscription warrants and restricted

free shares will terminate eighteen (18) months after of the date of the authorization granted by this general shareholders’ meeting.

The Board of Directors requests that shareholders approve these proposals.

|

|

|

|

|

PROPOSAL 14:

|

|

DELEGATION OF AUTHORITY GRANTED TO THE BOARD OF DIRECTORS TO CARRY OUT ONE OR MORE CAPITAL INCREASES FOR A MAXIMUM NOMINAL AMOUNT OF €400,000 BY ISSUING ORDINARY SHARES AND/OR SECURITIES THAT CONFER EQUITY RIGHTS AND/OR

SECURITIES THAT CONFER THE RIGHT TO AN ALLOTMENT OF CONVERTIBLE DEBT SECURITIES

|

The Board of Directors proposes that it be granted a delegation of authority to increase capital of the

Company up to a maximum limit equivalent to 20,000,000 shares in order to be able to effect one or more transactions such as acquisitions, asset purchases or financing. Pursuant to this delegation of authority, the duration of which would be set at

eighteen (18) months, the maximum allowed by French law, the Board of Directors would be authorized to decide to increase the Company’s capital, on one or more occasions, at opportune times, by issuing ordinary shares or securities that

confer equity rights or securities that confer the right to an allotment of equity rights.

The maximum nominal amount of capital

increases that may be carried out pursuant to this delegation of authority would be €400,000 (or the equivalent of this amount in any other currency that is legal tender), and the maximum nominal amount of convertible debt that may be issued

would be set at €35,000,000 (or the equivalent thereof in any foreign currency).

The issue prices of the securities that may be

issued pursuant to this delegation of authority will be set in accordance with market practices such as, for example, by reference to the price quoted on the NYSE.

The Board of Directors requests that shareholders approve this proposal.

|

|

|

|

|

PROPOSAL 15:

|

|

DECISION IN THE SCOPE OF ARTICLE L. 225-248 OF THE FRENCH COMMERCIAL CODE

|

As of December 31, 2015, the statutory net equity of the Company had fallen below half of the

Company’s statutory nominal capital. In accordance with the requirements of Article L. 225-248 of the French Commercial Code, the Board recommends to continue the operations of the Company despite the reduction in capital.

The Board of Directors requests that shareholders approve this proposal.

|

|

|

|

|

PROPOSAL 16:

|

|

AUTHORITY TO BE DELEGATED TO THE BOARD OF DIRECTORS TO DECIDE TO INCREASE STATED CAPITAL BY ISSUING SHARES RESERVED FOR EMPLOYEES, AND REVOCATION OF PREEMPTIVE SUBSCRIPTION RIGHTS IN FAVOR OF SUCH EMPLOYEES

|

Article L. 225-129-6 of the French Commercial Code provides:

“At the time of any decision to increase stated capital in consideration for cash contributions, except if the capital

increase results from a prior issue of securities that confer equity rights, an extraordinary general meeting shall vote on a draft resolution proposing a capital increase carried out in accordance with the requirements of Articles L. 3332-18 to L.

3332-24 of the French Labor Code.”

Consequently, and in order to comply with these legal provisions, the Board of Directors

notes that, as a result of the capital authorization proposals described above being submitted to an extraordinary general shareholders’ meeting, the Board of Directors is required to submit to said general shareholders’ meeting a proposal

to carry out a capital increase for cash reserved to the Company’s employees, even though the Board of Directors is already proposing stock option and restricted share plans for the benefit of the Company’s employees.

The Board of Directors therefore proposes that the general shareholders’ meeting delegate to the Board of Directors its authority to

decide to increase stated capital, on one or more occasions, up to a maximum of 3% of stated capital on the date of the Board of Directors’ decision, by issuing shares or securities that confer equity rights, reserved to members of one or more

employee savings plans (or any other membership plan for which applicable statutory and regulatory provisions permit reserving a capital increase under equivalent conditions) that may be set up within all or some of the French and foreign companies

within the Company’s consolidation scope or combination of accounts, with the right to subdelegate such authority in accordance with legal requirements.

The duration of this delegation of authority would be set at eighteen (18) months.

The issue price of the new shares or securities that confer equity rights would be determined in accordance with applicable statutory and

regulatory requirements.

The Board of Directors is

not

in favor of the adoption of this proposal since other proposals already

provide mechanisms for employee share ownership. The Board of Directors requests that shareholders DO NOT approve this proposal.

|

|

|

|

|

PROPOSAL 17:

|

|

POWERS AND FORMALITIES

|

The Board of Directors proposes that the general shareholders’ meeting grant full powers to the bearer of

the original, an excerpt or a copy of the minutes from such meeting for the purpose of performing all publication, filing and other formalities.

The Board of Directors requests that shareholders approve this proposal.

The following exhibits are attached hereto and incorporated by reference herein:

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

99.1

|

|

Resolutions submitted to the Ordinary General Meeting and Extraordinary Meeting of Shareholders on June 28, 2016

|

|

|

|

|

99.2

|

|

Proxy card for use in connection with the Ordinary General Meeting and Extraordinary Meeting of Shareholders on June 28, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

SEQUANS COMMUNICATIONS S.A.

(Registrant)

|

|

|

|

|

|

Date: May 26, 2016

|

|

By:

|

|

/s/ Deborah Choate

|

|

|

|

|

|

Deborah Choate

|

|

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

99.1

|

|

Resolutions submitted to the Ordinary General Meeting and Extraordinary Meeting of Shareholders on June 28, 2016

|

|

|

|

|

99.2

|

|

Proxy card for use in connection with the Ordinary General Meeting and Extraordinary Meeting of Shareholders on June 28, 2016

|

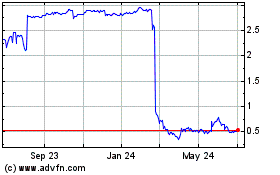

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

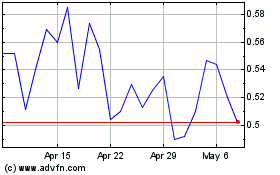

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Apr 2023 to Apr 2024