Total Revenues of $14.1 Million Reported

for the Quarter

Vericel Corporation (NASDAQ:VCEL), a leading developer of

patient-specific expanded cellular therapies for the treatment of

severe diseases and conditions, today reported financial results

for the first quarter ended March 31, 2016.

Total net revenues for the quarter ended March 31, 2016 were

approximately $14.1 million and included approximately $8.8 million

of Carticel net revenues and approximately $5.3 million of Epicel

net revenues. Total Carticel and Epicel net revenues

increased 31% over the first quarter of 2015, with Carticel

revenues increasing 24% and Epicel revenues increasing 46%,

respectively, compared to the same period in 2015.

Gross profit for the quarter ended March 31, 2016 was $7.5

million, or 54% of net revenues, compared to $5.3 million, or 49%

of net product revenues, for the first quarter of 2015.Research and

development expenses for the quarter ended March 31, 2016 were $3.5

million, compared to $4.4 million in the first quarter of

2015. The decrease in research and development expenses in

the first quarter is primarily due to a reduction in clinical trial

expenses.

Selling, general and administrative expenses for the quarter

ended March 31, 2016 were $6.0 million compared to $5.5 million for

the same period in 2015. The increase in SG&A expenses is

primarily due to an increase in shared facility fees.Loss from

operations for the quarter ended March 31, 2016 was $2.0 million,

compared to $4.6 million for the first quarter of 2015.

Material non-cash items impacting the operating loss for the

quarter included $0.5 million of stock-based compensation expense

and $0.4 million in depreciation and amortization expense.Other

expense for the quarter ended March 31, 2016 was $1.7 million

compared to less than $0.3 million for the same period in

2015. The change in other expense for the quarter is

primarily due to the change in the fair value of warrants in the

first quarter of 2016 compared to the same period in 2015.Vericel

reported an adjusted net loss for the quarter ended March 31, 2016

of $2.0 million dollars, or $0.08 per share, compared to an

adjusted net loss of $4.5 million, or $0.19 per share, for the same

period in 2015. The adjusted net loss excludes the non-cash

change in the fair value of warrants and the non-cash accumulated

dividend on the Series B convertible preferred stock. The

adjusted earnings per share includes common shares reserved as

treasury shares received in exchange for the Series A non-voting

convertible preferred stock. Vericel’s GAAP net loss for the

quarter ended March 31, 2016 was $3.7 million, or $0.24 per share,

compared to a net loss of $4.9 million, or $0.27 per share, for the

same period in 2015.As of March 31, 2016, the company had $13.5

million in cash and cash equivalents compared to $14.6 million in

cash and cash equivalents at December 31, 2015.Recent

Business HighlightsDuring and since the first quarter of

2016, the company:

- Achieved 31% growth in total Carticel and Epicel net revenues

in the first quarter, including 24% and 46% growth in Carticel and

Epicel net revenues, respectively, versus the same period in

2015;

- Achieved gross margins of 54% of total net revenues in the

first quarter versus 49% in the same period in 2015;

- Received U.S. Food and Drug Administration (FDA) approval of

the Epicel Humanitarian Device Exemption (HDE) supplement, which

revised the Epicel label to include pediatric patients and specify

the probable benefit, mainly related to survival, for adult and

pediatric patients, and allows the company to sell Epicel for

profit on up to 360,400 grafts per year;

- Submitted a Biologics License Application for MACI for

the treatment of cartilage defects of the knee, which was accepted

for review by the FDA with a PDUFA goal date of January 3,

2017;

- Announced results from the company's Phase 2b ixCELL-DCM

clinical study of ixmyelocel-T in patients with advanced heart

failure due to ischemic dilated cardiomyopathy, which were

presented at the American College of Cardiology's (ACC) 65th Annual

Scientific Session and published in The Lancet;

- Entered into a $10 million credit facility and $5 million term

loan agreement with Silicon Valley Bank to access low-cost,

non-dilutive capital for the company; and

- Executed a service agreement with Dohmen Life Science Services,

LLC for clinical- and patient-support services for Carticel and

MACI, if approved.

“We had a very strong first quarter and made tremendous progress

across all facets of our business,” said Nick Colangelo, president

and CEO of Vericel. “Our strong revenue growth and margin

expansion reflect the success of our commercial team’s sales and

marketing initiatives, and our clinical and regulatory team made

substantial progress on our key clinical and regulatory priorities.

We believe that these results position the company for strong

growth moving forward.”

Conference Call InformationToday's conference

call will be available live at 8:00am Eastern time in the Investors

section of the Vericel website at

http://investors.vcel.com/events.cfm. Please access the site

at least 15 minutes prior to the scheduled start time in order to

download the required audio software if necessary. To

participate in the live call by telephone, please call (877)

312-5881 and reference Vericel Corporation's first-quarter 2016

investor conference call. If calling from outside the U.S.,

please use the international phone number (253) 237-1173.

If you are unable to participate in the live call, the webcast

will be available at

http://investors.vcel.com/events.cfm until May 10, 2017.

A replay of the call will also be available until 11:59 pm (EDT) on

May 14, 2016 by calling (855) 859-2056, or from outside the U.S.

(404) 537-3406. The conference ID is 93070867.

About Vericel CorporationVericel Corporation is

a leader in developing patient-specific expanded cellular therapies

for use in the treatment of patients with severe diseases and

conditions. The company markets two autologous cell therapy

products in the U.S.: Carticel® (autologous

cultured chondrocytes), an autologous chondrocyte implant for the

treatment of cartilage defects in the knee, and Epicel® (cultured

epidermal autografts), a permanent skin replacement for the

treatment of patients with deep-dermal or full-thickness burns

comprising greater than or equal to 30% of total body surface

area. Vericel is also developing MACI™, a third-generation

autologous chondrocyte implant for the treatment of cartilage

defects in the knee, and ixmyelocel-T, a patient-specific

multicellular therapy for the treatment of advanced heart failure

due to ischemic dilated cardiomyopathy. For more information,

please visit the company’s website at www.vcel.com.

Epicel® and Carticel® are registered trademarks and MACI™ is a

trademark of Vericel Corporation. © Vericel

Corporation. All rights reserved.

The Vericel Corporation logo is available

at http://www.globenewswire.com/NewsRoom/Attachment/30369.

Non-GAAP Financial Measures

Vericel has provided in this release financial information that

has not been prepared in accordance with generally accepted

accounting principles in the United States, or GAAP. Vericel

believes that the use of these non-GAAP financial measures provides

supplementary information for investors to use in evaluating

operating performance and in comparing its financial measures with

other companies in Vericel’s industry. The adjusted net loss

excludes the non-cash change in the fair value of warrants and the

non-cash accumulated dividend on the Series B convertible preferred

stock. The adjusted earnings per share includes common shares

reserved as treasury shares received in exchange for the Series A

non-voting convertible preferred stock. Non-GAAP financial measures

that Vericel uses may differ from measures that other companies may

use. In addition, non-GAAP financial measures are not required to

be uniformly applied, are not audited and should not be considered

in isolation or as substitutes for results prepared in accordance

with GAAP.

This document contains forward-looking statements, including,

without limitation, statements concerning anticipated progress,

objectives and expectations regarding the commercial potential of

our products and growth in revenues, intended product development,

clinical activity timing, and objectives and expectations

regarding our company described herein, all of which involve

certain risks and uncertainties. These statements are often, but

are not always, made through the use of words or phrases such as

"anticipates," "intends," "estimates," "plans," "expects," "we

believe," "we intend," and similar words or phrases, or future or

conditional verbs such as "will," "would," "should," "potential,"

"could," "may," or similar expressions. Actual results may differ

significantly from the expectations contained in the

forward-looking statements. Among the factors that may result in

differences are the inherent uncertainties associated with

competitive developments, clinical trial and product development

activities, regulatory approval requirements, estimating the

commercial potential of our products and product candidates and

growth in revenues and improvement in costs, market demand for our

products, and our ability to supply or meet customer demand for our

products. These and other significant factors are discussed in

greater detail in Vericel's (formerly Aastrom Biosciences,

Inc.)Annual Report on Form 10-K for the year ended December 31,

2015, filed with the Securities and Exchange Commission ("SEC") on

March 14, 2016, Quarterly Reports on Form 10-Q and other filings

with the SEC. These forward-looking statements reflect management's

current views and Vericel does not undertake to update any of these

forward-looking statements to reflect a change in its views or

events or circumstances that occur after the date of this release

except as required by law.

| VERICEL CORPORATION |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Unaudited, amounts in thousands) |

| |

| |

|

March 31, |

|

December 31, |

| |

|

2016 |

|

2015 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash |

|

$ |

13,544 |

|

|

$ |

14,581 |

|

| Accounts receivable (net of

allowance for doubtful accounts of $68 for 2016 and 2015) |

|

9,669 |

|

|

10,919 |

|

| Inventory |

|

1,942 |

|

|

1,379 |

|

| Other current assets |

|

662 |

|

|

464 |

|

| Total current assets |

|

25,817 |

|

|

27,343 |

|

| Property and equipment,

net |

|

4,393 |

|

|

4,049 |

|

| Intangible assets,

net |

|

2,847 |

|

|

2,917 |

|

| Total assets |

|

$ |

33,057 |

|

|

$ |

34,309 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

|

$ |

6,293 |

|

|

$ |

7,588 |

|

| Accrued expenses |

|

4,943 |

|

|

3,603 |

|

| Warrant liabilities |

|

2,397 |

|

|

757 |

|

| Other |

|

136 |

|

|

160 |

|

| Total current liabilities |

|

13,769 |

|

|

12,108 |

|

| Long term debt |

|

62 |

|

|

71 |

|

| Total liabilities |

|

13,831 |

|

|

12,179 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

| Series A non-voting convertible

preferred stock, no par value: shares authorized and reserved — 1;

shares issued and outstanding — 1 |

|

3,150 |

|

|

3,150 |

|

| Series B-2 voting convertible

preferred stock, no par value: shares authorized and

reserved — 39, shares issued and outstanding — 12 |

|

38,389 |

|

|

38,389 |

|

| Common stock, no par value; shares

authorized — 75,000; shares issued and outstanding — 23,891

and 23,789, respectively |

|

308,512 |

|

|

307,766 |

|

| Treasury stock — 1,250 shares |

|

(3,150 |

) |

|

(3,150 |

) |

| Accumulated deficit |

|

(327,675 |

) |

|

(324,025 |

) |

| Total shareholders’ equity |

|

19,226 |

|

|

22,130 |

|

| Total liabilities and shareholders’

equity |

|

$ |

33,057 |

|

|

$ |

34,309 |

|

| VERICEL CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited, amounts in thousands except per

share amounts) |

| |

| |

|

Three Months Ended March 31, |

| |

|

2016 |

|

2015 |

| Revenues: |

|

|

|

|

| Product sales |

|

$ |

14,108 |

|

|

$ |

10,849 |

|

| Total revenues |

|

14,108 |

|

|

10,849 |

|

| Costs and expenses: |

|

|

|

|

| Cost of product sales |

|

6,560 |

|

|

5,568 |

|

| Gross profit |

|

7,548 |

|

|

5,281 |

|

| Research and development |

|

3,536 |

|

|

4,377 |

|

| Selling, general and

administrative |

|

6,004 |

|

|

5,476 |

|

| Total operating expenses |

|

9,540 |

|

|

9,853 |

|

| Loss from

operations |

|

(1,992 |

) |

|

(4,572 |

) |

| Other income

(expense): |

|

|

|

|

| Increase in fair value of

warrants |

|

(1,640 |

) |

|

(317 |

) |

| Foreign currency translation (loss)

gain |

|

(10 |

) |

|

16 |

|

| Interest income |

|

5 |

|

|

13 |

|

| Interest expense |

|

(3 |

) |

|

(2 |

) |

| Other expense |

|

(10 |

) |

|

— |

|

| Total other income (expense) |

|

(1,658 |

) |

|

(290 |

) |

| Net loss |

|

$ |

(3,650 |

) |

|

$ |

(4,862 |

) |

| |

|

|

|

|

| Net loss per share

attributable to common shareholders (Basic and Diluted) |

|

$ |

(0.24 |

) |

|

$ |

(0.27 |

) |

| Weighted average number of

common shares outstanding (Basic and Diluted) |

|

22,604 |

|

|

23,786 |

|

| RECONCILIATION OF REPORTED NUMERATOR AND

DENOMINATOR IN NET LOSS PER SHARE |

| (GAAP) TO ADJUSTED NET LOSS PER SHARE

(NON-GAAP MEASURE) – UNAUDITED |

| |

| |

|

Three Months Ended March 31, |

|

(Amounts In

thousands except per share amounts) |

|

2016 |

|

2015 |

|

Numerator: |

|

|

|

|

| Numerator of basic and

diluted EPS |

|

$ |

(5,454 |

) |

|

$ |

(6,452 |

) |

| Add: Increase in fair value of

warrants |

|

1,640 |

|

|

317 |

|

| Add: Dividends accumulated on

convertible preferred stock |

|

1,804 |

|

|

1,590 |

|

| Adjusted net loss –

Non-GAAP |

|

$ |

(2,010 |

) |

|

$ |

(4,545 |

) |

|

Denominator: |

|

|

|

|

| Denominator for basic

and diluted EPS: |

|

|

|

|

| Weighted-average common

shares outstanding |

|

22,604 |

|

|

23,786 |

|

| Add: Treasury stock |

|

1,250 |

|

|

— |

|

| Adjusted denominator

for basic and diluted EPS |

|

23,854 |

|

|

23,786 |

|

| Adjusted net loss per

share (basic and diluted) – Non-GAAP |

|

$ |

(0.08 |

) |

|

$ |

(0.19 |

) |

CONTACT: Chad RubinThe Trout

Groupcrubin@troutgroup.com(646) 378-2947orLee SternThe Trout

Grouplstern@troutgroup.com(646) 378-2922

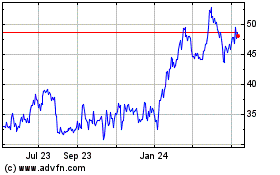

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024