- Sales of $2.5 billion; EPS of $1.24;

adjusted EPS of $1.28

- Operating cash flow 8% above

prior-year quarter

- EBITDA and operating margins of

33.3% and 22.1%, respectively

- Completed six packaged gas

acquisitions, primarily North America; annualized sales of

approximately $50 million

- Return on capital 12.4%; return on

equity 34.6%

- Second-quarter 2016 EPS guidance of

$1.32 to $1.39; adjusted full-year $5.35 to $5.70

Praxair, Inc. (NYSE: PX) reported first-quarter net income and

diluted earnings per share of $356 million and $1.24, respectively.

These results include the impact of a $16 million charge to

interest expense ($10 million after-tax) or 4 cents of diluted

earnings per share, related to a bond redemption prior to maturity.

Excluding this charge, adjusted net income and diluted earnings per

share were $366 million and $1.28, respectively.

Praxair’s sales in the first quarter were $2,509 million, 9%

below the prior-year quarter, primarily due to the impacts of

negative currency translation and lower cost pass-through, which

reduced sales by 7% and 1%, respectively. Organic sales were 1%

below the prior-year quarter. Growth from higher pricing, new

project start-ups, and healthcare and food and beverage

end-markets, was more than offset by lower volumes to energy,

metals and manufacturing end-markets, primarily in North

America.

Operating profit in the first quarter was $554 million, 11%

below the prior-year quarter. Excluding currency effects, operating

profit was 4% below the prior-year period. The operating profit

margin was 22.1% and the EBITDA margin grew to 33.3%.

First-quarter cash flow from operations was $547 million, 8%

above the prior-year quarter. Capital expenditures were $323

million and the company invested $63 million in acquisitions for

several packaged gas businesses, primarily in North America. The

company paid $214 million of dividends. During the quarter, the

company issued €550 million of 1.20% Euro-denominated notes due

2024 and $275 million of 3.20% notes due 2026. In addition, the

company repaid $400 million of 0.75% notes that became due and

redeemed $325 million of 5.20% notes due in 2017. After-tax return

on capital and return on equity for the quarter were 12.4% and

34.6%, respectively.

Commenting on the financial results and business outlook,

Chairman and Chief Executive Officer Steve Angel said, “Praxair’s

strategy of optimizing the base business, growing resilient

end-markets, executing the project backlog and capitalizing on

acquisition and project opportunities reflected positively in our

first-quarter results and continues to drive long-term value

creation.

“While North America continues to face year-over-year volume

headwinds primarily in the energy, metals and manufacturing

end-markets, we grew sales to the healthcare, food and beverage

end-markets globally, achieved higher pricing in many businesses,

and grew volumes in Europe and Asia supplemented by project

start-ups. In addition, we closed six packaged gas acquisitions

located in North America and Europe.

“Praxair employees again delivered high-quality results with an

operating margin of 22% and growth in operating cash flow of 8%,

against a difficult macro-economic environment. Consistent

high-quality results and strong cash flow affords us the long-term

ability to invest in high-quality projects and acquisitions that

align with our strategic objectives and meet our investment

criteria as well as return value to our shareholders in the form of

higher dividends and share repurchases.”

For the second quarter of 2016, Praxair expects diluted earnings

per share in the range of $1.32 to $1.39.

For full-year 2016, Praxair expects adjusted diluted earnings

per share to be in the range of $5.35 to $5.70, -2% to +4%

ex-currency from 2015. Full-year capital expenditures are expected

to be approximately $1.5 billion and the effective tax rate is

forecasted to remain at approximately 28%.

Following is additional detail on first-quarter 2016 results by

segment.

In North America, first-quarter sales were $1,353 million, down

4% from the prior-year quarter excluding lower cost-pass through,

negative currency translation and net divestitures. Organic sales

growth from higher pricing and food and beverage end-markets was

more than offset by weaker volumes in energy, metals and

manufacturing end-markets. Operating profit of $349 million was

down 4% versus the prior-year quarter, excluding currency

translation and net divestitures, due primarily to lower volumes

partially offset by price and productivity.

In Europe, first-quarter sales were $320 million, 2% below the

prior-year quarter. Excluding currency, organic sales grew 2% from

the prior year due to higher volumes, including new project

start-ups. Operating profit of $62 million grew 3% from the

prior-year, excluding currency translation, from operating leverage

on volume growth.

In South America, first-quarter sales were $311 million, 22%

below the prior-year quarter. Excluding negative currency

translation and cost pass-through, sales grew 2% from acquisitions,

higher price, and growth to food and beverage and healthcare

end-markets, partially offset by lower volumes to the manufacturing

end-market. Operating profit was $55 million.

Sales in Asia were $376 million in the quarter, 6% above the

prior year excluding currency and cost pass-through. Volume growth

included new plant start-ups in China and India. Operating profit

was $63 million.

Praxair Surface Technologies had first-quarter sales of $149

million as compared to $160 million in the prior-year quarter.

Excluding negative currency translation and cost pass-through,

sales were 4% below the prior-year period. Favorable price was more

than offset by lower volumes. Sales were primarily lower to the

energy and manufacturing end-markets. Operating profit was $25

million.

Praxair, Inc., a Fortune 250 company with 2015 sales of $11

billion, is the largest industrial gases company in North and South

America and one of the largest worldwide. The company produces,

sells and distributes atmospheric, process and specialty gases, and

high-performance surface coatings. Praxair products, services and

technologies are making our planet more productive by bringing

efficiency and environmental benefits to a wide variety of

industries, including aerospace, chemicals, food and beverage,

electronics, energy, healthcare, manufacturing, primary metals and

many others. More information about Praxair, Inc. is available at

www.praxair.com.

Adjusted amounts are non-GAAP measures. First-quarter 2016

results are adjusted to exclude the impact of a bond redemption

charge. Additionally, measures such as EBITDA, free cash flow,

after-tax return on capital, return on equity and debt-to-capital

are also non-GAAP measures. See the attachments for a summary of

non-GAAP Reconciliations and calculations of non-GAAP measures.

Attachments: Summary Non-GAAP Reconciliations, Statements of

Income, Balance Sheets, Statements of Cash Flows, Segment

Information, Quarterly Financial Summary and Appendix: Non-GAAP

Measures.

A teleconference about Praxair’s first-quarter results is being

held this morning, April 29, at 11:00am Eastern Daylight Time. The

number is (631) 485-4849 – Conference ID: 85141182. The call is

also available as a webcast live and on-demand at

www.praxair.com/investors. Materials to be used in the

teleconference are also available on the website.

This document contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements are based on management’s reasonable expectations

and assumptions as of the date the statements are made but involve

risks and uncertainties. These risks and uncertainties include,

without limitation: the performance of stock markets generally;

developments in worldwide and national economies and other

international events and circumstances; changes in foreign

currencies and in interest rates; the cost and availability of

electric power, natural gas and other raw materials; the ability to

achieve price increases to offset cost increases; catastrophic

events including natural disasters, epidemics and acts of war and

terrorism; the ability to attract, hire, and retain qualified

personnel; the impact of changes in financial accounting standards;

the impact of changes in pension plan liabilities; the impact of

tax, environmental, healthcare and other legislation and government

regulation in jurisdictions in which the company operates; the cost

and outcomes of investigations, litigation and regulatory

proceedings; continued timely development and market acceptance of

new products and applications; the impact of competitive products

and pricing; future financial and operating performance of major

customers and industries served; the impact of information

technology system failures, network disruptions and breaches in

data security; and the effectiveness and speed of integrating new

acquisitions into the business. These risks and uncertainties may

cause actual future results or circumstances to differ materially

from the projections or estimates contained in the forward-looking

statements. Additionally, financial projections or estimates

exclude the impact of special items which the company believes are

not indicative of ongoing business performance. The company assumes

no obligation to update or provide revisions to any forward-looking

statement in response to changing circumstances. The above listed

risks and uncertainties are further described in Item 1A (Risk

Factors) in the company’s Form 10-K and 10-Q reports filed with the

SEC which should be reviewed carefully. Please consider the

company’s forward-looking statements in light of those risks.

PRAXAIR, INC. AND SUBSIDIARIES SUMMARY NON-GAAP

RECONCILIATIONS (UNAUDITED) The following

adjusted amounts are non-GAAP measures and are intended to

supplement investors' understanding of the company's financial

statements by providing measures which investors, financial

analysts and management use to help evaluate the company's

operating performance. Items which the company does not believe to

be indicative of on-going business trends are excluded from these

calculations so that investors can better evaluate and analyze

historical and future business trends on a consistent basis.

Definitions of these non-GAAP measures may not be comparable to

similar definitions used by other companies and are not a

substitute for similar GAAP measures. See the Non-GAAP

reconciliations starting on page 10 for additional details relating

to the Non-GAAP adjustments. (Millions of dollars, except

per share amounts)

Sales Operating Profit

Net Income - Praxair, Inc. Diluted EPS

2016 2015

2016 2015

2016 2015

2016 2015

Quarter Ended March 31 Reported GAAP

Amounts $ 2,509 $ 2,757 $ 554 $ 623 $ 356 $ 416 $ 1.24 $ 1.43 Bond

redemption (a) - -

- - 10

- 0.04

- Total adjustments - -

- - 10

- 0.04

- Adjusted amounts $ 2,509 $

2,757 $ 554 $ 623 $ 366

$ 416 $ 1.28

$ 1.43

(a) $16 million charge to interest expense ($10 million

after-tax or $0.04 per diluted share) in the 2016 first quarter

related to a bond redemption.

PRAXAIR, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

INCOME (Millions of dollars, except per share data)

(UNAUDITED) Quarter

Ended March 31, 2016

2015 SALES $ 2,509 $ 2,757 Cost of sales 1,381

1,530 Selling, general and administrative 274 299 Depreciation and

amortization 272 277 Research and development 23 24 Other income

(expense) - net (5 ) (4 )

OPERATING PROFIT 554

623 Interest expense - net 65 44

INCOME BEFORE INCOME TAXES AND EQUITY INVESTMENTS 489 579

Income taxes 133 162

INCOME BEFORE

EQUITY INVESTMENTS 356 417 Income from equity investments

10 11

NET INCOME (INCLUDING

NONCONTROLLING INTERESTS) 366 428 Less: noncontrolling

interests (10 ) (12 )

NET INCOME - PRAXAIR,

INC. $ 356 $ 416

PER SHARE DATA -

PRAXAIR, INC. SHAREHOLDERS Basic earnings per share $

1.25 $ 1.44 Diluted earnings per share $ 1.24 $ 1.43

Cash dividends $ 0.75 $ 0.715

WEIGHTED AVERAGE SHARES

OUTSTANDING Basic shares outstanding (000's) 285,429 289,143

Diluted shares outstanding (000's) 286,665 291,652

Note: See page 4 for a reconciliation to

2016 adjusted amounts which are non-GAAP.

PRAXAIR, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Millions of dollars)

(UNAUDITED)

March 31, December 31, 2016

2015 ASSETS Cash and cash equivalents $ 221 $ 147

Accounts receivable - net 1,685 1,601 Inventories 553 531 Prepaid

and other current assets 411 347

TOTAL CURRENT ASSETS 2,870 2,626 Property, plant and

equipment - net 11,314 10,998 Goodwill 3,071 2,986 Other

intangibles - net 576 568 Other long-term assets 1,194

1,141

TOTAL ASSETS $ 19,025 $

18,319

LIABILITIES AND EQUITY Accounts payable

$ 796 $ 791 Short-term debt 174 250 Current portion of long-term

debt 8 6 Other current liabilities 821 846

TOTAL CURRENT LIABILITIES 1,799 1,893 Long-term debt

9,222 8,975 Other long-term liabilities 2,580

2,545

TOTAL LIABILITIES 13,601 13,413

REDEEMABLE NONCONTROLLING INTERESTS 119 113

PRAXAIR, INC. SHAREHOLDERS' EQUITY: Common stock 4 4

Additional paid-in capital 3,998 4,005 Retained earnings 12,371

12,229 Accumulated other comprehensive income (loss) (4,250 )

(4,596 ) Less: Treasury stock, at cost (7,235 )

(7,253 ) Total Praxair, Inc. Shareholders' Equity 4,888 4,389

Noncontrolling interests 417 404

TOTAL EQUITY 5,305 4,793

TOTAL LIABILITIES AND EQUITY $ 19,025 $ 18,319

PRAXAIR, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Millions of

dollars) (UNAUDITED)

Quarter Ended March 31, 2016

2015 OPERATIONS Net income - Praxair, Inc. $

356 $ 416 Noncontrolling interests 10 12

Net income (including noncontrolling interests) 366 428

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 272 277

Accounts receivable (20 ) (50 ) Inventory (7 ) (6 ) Payables and

accruals (77 ) (66 ) Pension contributions (2 ) (11 ) Deferred

income taxes and other 15 (64 ) Net cash

provided by operating activities 547 508

INVESTING Capital expenditures (323 ) (397 )

Acquisitions, net of cash acquired (63 ) (5 ) Divestitures and

asset sales 2 2 Net cash used for

investing activities (384 ) (400 )

FINANCING Debt increase (decrease) - net 95 290 Issuances of

common stock 34 44 Purchases of common stock (32 ) (235 ) Cash

dividends - Praxair, Inc. shareholders (214 ) (207 ) Excess tax

benefit on stock option exercises 6 14 Noncontrolling interest

transactions and other (2 ) (6 ) Net cash provided by

(used for) financing activities (113 ) (100 ) Effect of

exchange rate changes on cash and cash equivalents 24

(17 ) Change in cash and cash equivalents 74 (9 )

Cash and cash equivalents, beginning-of-period 147

126 Cash and cash equivalents, end-of-period $

221 $ 117

PRAXAIR, INC. AND

SUBSIDIARIES SEGMENT INFORMATION (Millions of

dollars) (UNAUDITED)

Quarter Ended March 31, 2016

2015 SALES North America $ 1,353

$ 1,499 Europe 320 326 South America 311 401 Asia 376 371 Surface

Technologies 149 160 Consolidated sales $ 2,509 $

2,757

OPERATING PROFIT North America $ 349 $ 379

Europe 62 62 South America 55 85 Asia 63 69 Surface Technologies

25 28 Segment operating profit $ 554 $ 623

PRAXAIR, INC. AND SUBSIDIARIES QUARTERLY FINANCIAL

SUMMARY (Millions of dollars, except per share data)

(UNAUDITED)

2016 (b) 2015 (c) Q1 Q4

Q3 Q2

Q1 FROM THE INCOME STATEMENT Sales $ 2,509 $ 2,595 $

2,686 $ 2,738 $ 2,757 Cost of sales 1,381 1,426 1,488 1,516 1,530

Selling, general and administrative 274 275 281 297 299

Depreciation and amortization 272 275 276 278 277 Research and

development 23 23 23 23 24 Cost reduction program and other charges

- - 26 146 - Other income (expense) - net (5 ) 28

2 2

(4 ) Operating profit 554 624 594 480 623

Interest expense - net 65 42 35 40 44 Income taxes 133 163 156 131

162 Income from equity investments 10 12

10 10

11 Net income (including

noncontrolling interests) 366 431 413 319 428 Less: noncontrolling

interests (10 ) (9 ) (12 )

(11 ) (12 ) Net income -

Praxair, Inc. $ 356 $ 422 $ 401

$ 308 $ 416 PER

SHARE DATA - PRAXAIR, INC. SHAREHOLDERS Diluted earnings per share

$ 1.24 $ 1.47 $ 1.40 $ 1.06 $ 1.43 Cash dividends per share $ 0.75

$ 0.715 $ 0.715 $ 0.715 $ 0.715 Diluted weighted average shares

outstanding (000's) 286,665 286,856 287,311 290,102 291,652

ADJUSTED AMOUNTS (a) Operating profit $ 554 $ 624 $ 620 $

626 $ 623 Operating margin 22.1 % 24.0 % 23.1 % 22.9 % 22.6 % Net

Income $ 366 $ 422 $ 419 $ 420 $ 416 Diluted earnings per share $

1.28 $ 1.47 $ 1.46 $ 1.45 $ 1.43

FROM THE BALANCE

SHEET Net debt (a) $ 9,183 $ 9,084 $ 9,344 $ 9,177 $ 9,243

Capital (a) $ 14,607 $ 13,990 $ 14,157 $ 14,696 $ 14,806

Debt-to-capital ratio (a) 62.9 % 64.9 % 66.0 % 62.4 % 62.4 %

FROM THE STATEMENT OF CASH FLOWS Cash flow from operations $

547 $ 791 $ 676 $ 707 $ 508 Cash flow used for investing activities

384 351 400 152 400 Cash flow used for financing activities 113 410

260 527 100 Capital expenditures 323 387 405 352 397 Acquisitions

63 39 - 38 5 Cash dividends 214 204 203 205 207

OTHER

INFORMATION After-tax return on capital (ROC) (a) 12.4 % 12.6 %

12.5 % 12.6 % 12.7 % Return on Praxair, Inc. shareholders' equity

(ROE) (a) 34.6 % 34.6 % 32.5 % 30.5 % 29.6 % Adjusted EBITDA (a) $

836 $ 911 $ 906 $ 914 $ 911 Adjusted EBITDA margin (a) 33.3 % 35.1

% 33.7 % 33.4 % 33.0 % Debt-to-adjusted EBITDA ratio (a) 2.6 2.5

2.5 2.4 2.3 Number of employees 26,558 26,657 26,989 27,302 27,680

SEGMENT DATA SALES North America $ 1,353 $ 1,421 $

1,463 $ 1,482 $ 1,499 Europe 320 325 338 331 326 South America 311

299 343 388 401 Asia 376 398 395 387 371 Surface Technologies

149 152 147

150 160

Total sales $ 2,509 $ 2,595 $ 2,686

$ 2,738 $ 2,757

OPERATING PROFIT North America $ 349 $ 406 $ 385 $ 388 $ 379 Europe

62 62 63 63 62 South America 55 55 70 81 85 Asia 63 74 77 69 69

Surface Technologies 25 27

25 25

28 Segment operating profit 554 624 620 626

623 Cost reduction program and other charges -

- (26 ) (146 )

- Total operating profit $ 554 $

624 $ 594 $ 480

$ 623 (a) Non-GAAP measure, see

Appendix. (b) 2016 includes a $16 million charge to interest

expense ($10 million after-tax, or $0.04 per diluted share) related

to the redemption of the $325 million 5.20% notes due in 2017.

(c) 2015 includes (i) a pre-tax pension settlement charge of

$7 million ($5 million after-tax, or $0.02 per diluted share) in

the third quarter related to lump sum benefit payments made from

the U.S. supplemental pension plan, and (ii) pre-tax charges of $19

million ($13 million after-tax, or $0.04 per diluted share) in the

third quarter and $146 million ($112 million after-tax and

non-controlling interests, or $0.39 per diluted share) in the

second quarter, primarily related to cost reduction actions taken

in response to lower volumes resulting from economic slowdown in

emerging markets and energy related end-markets. The cost reduction

charges by segment are as follows: $67 million in South America;

$34 million in North America; $25 million in Asia; $20 million in

Europe; and $19 million in Surface Technologies.

PRAXAIR,

INC. AND SUBSIDIARIES APPENDIX NON-GAAP MEASURES

(Millions of dollars, except per share data)

(UNAUDITED) The following non-GAAP measures are

intended to supplement investors’ understanding of the company’s

financial information by providing measures which investors,

financial analysts and management use to help evaluate the

company’s financial leverage, return on capital and operating

performance. Items which the company does not believe to be

indicative of on-going business trends are excluded from these

calculations so that investors can better evaluate and analyze

historical and future business trends on a consistent basis.

Definitions of these non-GAAP measures may not be comparable to

similar definitions used by other companies and are not a

substitute for similar GAAP measures. Adjusted amounts exclude the

impacts of the 2016 first quarter bond redemption, 2015 third

quarter cost reduction program and pension settlement, 2015 second

quarter cost reduction program and other charges, and 2014 fourth

quarter pension settlement, bond redemption and loss on Venezuela

currency devaluation.

2016

2015

2014 Q1 Q4 Q3 Q2

Q1 Q4 Q3 Q2 Q1

Free Cash Flow

(FCF) - Free cash flow is a measure used by

investors, financial analysts and management to evaluate the

ability of a company to pursue opportunities that enhance

shareholder value. FCF equals cash flow from operations less

capital expenditures.

Operating cash flow $ 547 $ 791 $ 676 $ 707 $ 508 $

772 $ 713 $ 847 $ 536 Less: capital expenditures (323 )

(387 ) (405 ) (352 ) (397 ) (482

) (430 ) (384 ) (393 )

Free Cash Flow

$ 224 $ 404 $ 271

$ 355 $ 111 $ 290

$ 283 $ 463 $ 143

Debt-to-Capital

Ratio - The debt-to-capital ratio is a measure used by

investors, financial analysts and management to provide a measure

of financial leverage and insights into how the company is

financing its operations.

Debt $ 9,404 $ 9,231 $ 9,480 $ 9,313 $ 9,360 $ 9,225 $ 9,090

$ 9,132 $ 9,236 Less: cash and cash equivalents (221 )

(147 ) (136 ) (136 ) (117 ) (126

) (168 ) (173 ) (144 ) Net debt 9,183 9,084

9,344 9,177 9,243 9,099 8,922 8,959 9,092 Equity and redeemable

noncontrolling interests: Redeemable noncontrolling interests 119

113 169 175 170 176 190 194 195 Praxair, Inc. shareholders' equity

4,888 4,389 4,264 4,964 5,018 5,623 6,552 6,911 6,600

Noncontrolling interests 417 404

380 380 375 387

388 395 398 Total equity

and redeemable noncontrolling interests 5,424

4,906 4,813 5,519 5,563

6,186 7,130 7,500

7,193 Capital $ 14,607 $ 13,990 $ 14,157 $ 14,696 $

14,806 $ 15,285 $ 16,052 $ 16,459 $ 16,285

Debt-to-capital 62.9 %

64.9 % 66.0 % 62.4

% 62.4 % 59.5 %

55.6 % 54.4 %

55.8 %

After-tax Return

on Capital (ROC) - After-tax return on capital is a

measure used by investors, financial analysts and management to

evaluate the return on net assets employed in the business. ROC

measures the after-tax operating profit that the company was able

to generate with the investments made by all parties in the

business (debt, noncontrolling interests and Praxair, Inc.

shareholders’ equity).

Adjusted operating profit (a) $ 554 $ 624 $ 620 $ 626 $ 623

$ 663 $ 711 $ 697 $ 675 Less: adjusted income taxes (a) (139 ) (163

) (164 ) (164 ) (162 ) (161 ) (187 ) (183 ) (176 ) Less: tax

benefit on adjusted interest expense (a) (14 ) (12 ) (10 ) (11 )

(12 ) (12 ) (13 ) (12 ) (13 ) Add: income from equity investments

10 12 10 10

11 12 11 10

9 Adjusted net operating profit after-tax (NOPAT) $

411 $ 461 $ 456 $ 461 $ 460 $ 502 $ 522 $ 512 $ 495 4-quarter

trailing adjusted NOPAT $ 1,789 $ 1,838 $ 1,879 $ 1,945 $ 1,996 $

2,031 $ 2,035 $ 2,011 $ 1,990 Ending capital (see above) $

14,607 $ 13,990 $ 14,157 $ 14,696 $ 14,806 $ 15,285 $ 16,052 $

16,459 $ 16,285 5-quarter average ending capital $ 14,451 $ 14,587

$ 14,999 $ 15,460 $ 15,777 $ 16,007 $ 16,094 $ 15,987 $ 15,757

After-tax ROC (4-quarter trailing NOPAT / 5-quarter

average capital) 12.4 % 12.6

% 12.5 % 12.6 %

12.7 % 12.7 %

12.6 % 12.6 % 12.6

%

Return on

Praxair, Inc. Shareholders' Equity (ROE) - Return on

Praxair, Inc. shareholders' equity is a measure used by investors,

financial analysts and management to evaluate operating performance

from a Praxair shareholder perspective. ROE measures the net income

attributable to Praxair, Inc. that the company was able to generate

with the money shareholders have invested.

Adjusted net income - Praxair, Inc. (a) $ 366 $ 422 $ 419 $

420 $ 416 $ 460 $ 477 $ 467 $ 448 4-quarter trailing adjusted net

income - Praxair, Inc. $ 1,627 $ 1,677 $ 1,715 $ 1,773 $ 1,820 $

1,852 $ 1,854 $ 1,828 $ 1,806 Ending Praxair, Inc.

shareholders' equity $ 4,888 $ 4,389 $ 4,264 $ 4,964 $ 5,018 $

5,623 $ 6,552 $ 6,911 $ 6,600 5-quarter average Praxair

shareholders' equity $ 4,705 $ 4,852 $ 5,284 $ 5,814 $ 6,141 $

6,459 $ 6,576 $ 6,452 $ 6,303

ROE (4-quarter trailing

adjusted net income - Praxair, Inc. / 5-quarter average Praxair

shareholders' equity) 34.6 %

34.6 % 32.5 % 30.5

% 29.6 % 28.7 %

28.2 % 28.3 %

28.7 %

Adjusted EBITDA,

Adjusted EBITDA Margin and Debt-to-Adjusted EBITDA

Ratio- These measures are used by investors, financial

analysts and management to assess a company's ability to meet its

financial obligations.

Adjusted net income - Praxair, Inc. (a) $ 366 $ 422 $ 419 $

420 $ 416 $ 460 $ 477 $ 467 $ 448 Add: adjusted noncontrolling

interests (a) 10 9 12 12 12 11 13 14 14 Add: adjusted interest

expense - net (a) 49 42 35 40 44 43 45 43 46 Add: adjusted income

taxes (a) 139 163 164 164 162 161 187 183 176 Add: depreciation and

amortization 272 275 276

278 277 291 301

293 285

Adjusted EBITDA

$ 836 $ 911 $ 906

$ 914 $ 911 $ 966

$ 1,023 $ 1,000 $ 969

Reported sales $ 2,509 $ 2,595 $ 2,686 $ 2,738 $ 2,757 $

2,990 $ 3,144 $ 3,113 $ 3,026

Adjusted EBITDA margin

33.3 % 35.1 % 33.7 %

33.4 % 33.0 % 32.3 %

32.5 % 32.1 % 32.0 %

Ending net debt (see above) $ 9,183 $ 9,084 $ 9,344 $

9,177 $ 9,243 $ 9,099 $ 8,922 $ 8,959 $ 9,092 5-quarter average net

debt $ 9,206 $ 9,189 $ 9,157 $ 9,080 $ 9,063 $ 8,943 $ 8,895 $

8,904 $ 8,819 4-quarter trailing adjusted EBITDA $ 3,567 $ 3,642 $

3,697 $ 3,814 $ 3,900 $ 3,958 $ 3,978 $ 3,923 $ 3,874

Debt-to-adjusted EBITDA ratio (5-quarter average net debt /

4-quarter trailing adjusted EBITDA) 2.6

2.5 2.5 2.4

2.3 2.3

2.2 2.3 2.3

(a) The following table presents adjusted amounts for

Operating Profit and Operating Profit Margin, Interest Expense -

net, Income Taxes, Effective Tax Rate, Noncontrolling Interests,

Net income - Praxair, Inc., and Diluted EPS for the periods

presented. Additionally, this table presents cash income taxes and

cash interest, net of interest capitalized and excluding the bond

redemption costs for 2016 and 2014; and presents the percentage

changes in Diluted EPS Guidance for the full year 2016 as compared

to 2015 Diluted EPS on both a GAAP and adjusted basis. The adjusted

percentages are based on Adjusted diluted EPS amounts, excluding

estimated currency impacts.

First Quarter Year

Third Quarter

Second Quarter

Year Fourth Quarter

2016 2015 2015 2015 2014

2014

Adjusted

Operating Profit and Operating Profit Margin

Reported operating profit $ 554 $ 2,321 $ 594 $ 480 $ 2,608 $ 525

Add: Cost reduction program and other charges - 165 19 146 - - Add:

Pension settlement charge - 7 7 - 7 7 Add: Venezuela currency

devaluation - - -

- 131 131 Total adjustments

- 172 26 146

138 138 Adjusted operating

profit $ 554 $ 2,493 $ 620 $ 626 $

2,746 $ 663 Reported percentage change -11 %

Adjusted percentage change -11 % Reported sales $ 2,509 $

10,776 $ 2,686 $ 2,738 $ 12,273 $ 2,990 Adjusted operating profit

margin 22.1 % 23.1 % 23.1 % 22.9 % 22.4 % 22.2 %

Adjusted Interest

Expense - net

Reported interest expense - net $ 65 $ 161 $ 35 $ 40 $ 213 $ 79

Less: Bond redemption (16 ) - -

- (36 ) (36 ) Adjusted interest expense

- net $ 49 $ 161 $ 35 $ 40 $ 177

$ 43

Adjusted Income

Taxes

Reported income taxes $ 133 $ 612 $ 156 $ 131 $ 691 $ 145 Add: Cost

reduction program and other charges - 39 6 33 - - Add: Bond

redemption 6 - - - 14 14 Add: Income tax benefit - - - - - - Add:

Pension settlement charge - 2 2

- 2 2 Total

adjustments 6 41 8

33 16 16 Adjusted income taxes $

139 $ 653 $ 164 $ 164 $ 707 $

161

Adjusted

Effective Tax Rate

Reported income before income taxes and equity investments $ 489 $

2,160 $ 559 $ 440 $ 2,395 $ 446 Add: Cost reduction program and

other charges - 165 19 146 - - Add: Bond redemption 16 - - - 36 36

Add: Pension settlement charge - 7 7 - 7 7 Add: Venezuela currency

devaluation - - -

- 131 131 Total adjustments

16 172 26 146

174 174 Adjusted income before

income taxes and equity investments $ 505 $ 2,332 $

585 $ 586 $ 2,569 $ 620 Adjusted

income taxes (above) $ 139 $ 653 $ 164 $ 164 $ 707 $ 161 Adjusted

effective tax rate 28 % 28 % 28 % 28 % 28 % 26 %

Adjusted

Noncontrolling Interests

Reported noncontrolling interests $ 10 $ 44 $ 12 $ 11 $ 52 $ 11

Add: Cost reduction program and other charges - 1 - 1 - - Less:

Income tax benefit - - -

- - - Total adjustments

- 1 - 1

- - Adjusted noncontrolling interests $

10 $ 45 $ 12 $ 12 $ 52 $ 11

Adjusted Net

Income - Praxair, Inc.

Reported net income - Praxair, Inc. $ 356 $ 1,547 $ 401 $ 308 $

1,694 $ 302 Add: Cost reduction program and other charges - 125 13

112 - - Add: Bond redemption 10 - - - 22 22 Add: Pension settlement

charge - 5 5 - 5 5 Add: Venezuela currency devaluation -

- - - 131

131 Total adjustments 10

130 18 112 158

158 Adjusted net income - Praxair, Inc. $ 366

$ 1,677 $ 419 $ 420 $ 1,852 $ 460

Reported percentage change -14 % Adjusted percentage

change -12 %

Adjusted Diluted

EPS

Reported diluted EPS $ 1.24 $ 5.35 $ 1.40 $ 1.06 $ 5.73 $ 1.03 Add:

Cost reduction program and other charges - 0.43 0.04 0.39 - - Add:

Bond redemption 0.04 - - - 0.07 0.07 Add: Pension settlement charge

- 0.02 0.02 - 0.02 0.02 Add: Venezuela currency devaluation

- - - -

0.45 0.45 Total adjustments 0.04

0.45 0.06 0.39

0.54 0.54 Adjusted diluted EPS $ 1.28 $

5.80 $ 1.46 $ 1.45 $ 6.27 $ 1.57

Cash Income Taxes

and Interest

Income taxes paid $ 420 $ 606 Interest paid, net of interest

capitalized and excluding bond redemption $ 174 $ 174

Full-Year 2016

Diluted EPS Guidance*

Full Year 2016 Low End High End

2016 adjusted diluted EPS guidance $ 5.35 $ 5.70 2015

adjusted diluted EPS (see above for full year amounts) $ 5.80 $

5.80 Adjusted percentage change -8 % -2 % Adjusted

percentage changes, excluding estimated currency impact -2 % 4 %

* Excludes a bond redemption charge recorded in the first

quarter and the impact of a pension settlement charge expected to

be recorded in the third quarter.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160429005134/en/

Praxair, Inc.InvestorsKelcey Hoyt,

203-837-2118kelcey_hoyt@praxair.comorMediaJason Stewart,

203-837-2448jason_stewart@praxair.com

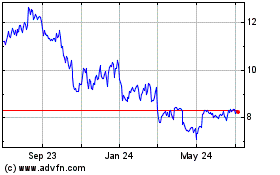

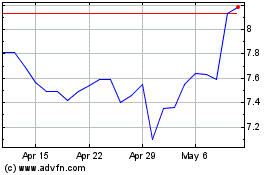

P10 (NYSE:PX)

Historical Stock Chart

From Mar 2024 to Apr 2024

P10 (NYSE:PX)

Historical Stock Chart

From Apr 2023 to Apr 2024