UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

LyondellBasell Industries N.V.

(Name of Issuer)

Ordinary shares, par value €0.04 per share

(Title of Class of Securities)

N53745100

(CUSIP Number)

Alejandro Moreno

c/o Access Industries, Inc.

730 Fifth Avenue, 20th Floor

New York, New York 10019

(212) 247-6400

with copies to:

Matthew E. Kaplan

Debevoise & Plimpton LLP

919 Third Avenue

New

York, New York 10022

(212) 909-6000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 8, 2016

(Date of

Event which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rules 13d-1(e), 13d-1(f) or 13d-1(g), check the following

box. ¨

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI International Chemicals S.à r.l. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Luxembourg |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

41,144,972 shares |

| |

8 |

|

SHARED VOTING POWER

36,498,394 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

41,144,972 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

36,498,394 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Len Blavatnik |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) IN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI Investments Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI SMS L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI International GP Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI SMS GP Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

0 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

0.00%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries Management, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Altep 2010 L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

259,338 shares |

| |

8 |

|

SHARED VOTING POWER

77,384,028 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

259,338 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,384,028 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Altep 2011 L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

161,701 shares |

| |

8 |

|

SHARED VOTING POWER

77,481,665 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

161,701 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,481,665 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI Altep Holdings, Inc. (formerly known as Access Industries,

Inc.) |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

498,394 shares |

| |

8 |

|

SHARED VOTING POWER

77,144,972 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

498,394 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,144,972 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) CO |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries Investment Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI European Holdings L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI European Holdings GP Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI European Holdings S.à r.l. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Luxembourg |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

16,000,000 shares |

| |

8 |

|

SHARED VOTING POWER

61,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

16,000,000 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

61,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI Petroleum Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

77,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AIPH Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

20,000,000 shares |

| |

8 |

|

SHARED VOTING POWER

57,643,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

20,000,000 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

57,643,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Altep 2014 L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

77,355 shares |

| |

8 |

|

SHARED VOTING POWER

77,566,011 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

77,355 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

77,566,011 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

77,643,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

18.04%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 430,449,954 ordinary shares issued and outstanding as of March 3, 2016, as reported in the Issuer’s preliminary Proxy Statement, filed on Schedule 14A, on March 9, 2016.

|

Amendment No. 7 to Schedule 13D

This amendment to Schedule 13D is being filed by AI International Chemicals S.à r.l. (“AIIC”), Len Blavatnik, AI Investments

Holdings LLC (“AIIH”), AI SMS L.P., AI International GP Limited, Access Industries, LLC, Access Industries Holdings LLC, Access Industries Management, LLC, Altep 2010 L.P. (“Altep 2010”), Altep 2011 L.P. (“Altep 2011”),

AI Altep Holdings, Inc. (formerly known as Access Industries, Inc.), Access Industries Investment Holdings LLC, AI European Holdings L.P., AI European Holdings GP Limited, AI European Holdings S.à r.l. (“AIEH”), AI Petroleum

Holdings LLC (“AIPH”), AIPH Holdings LLC and Altep 2014 L.P. (“Altep 2014”) (collectively, the “Reporting Persons”, and each, a “Reporting Person”) and AI SMS GP Limited (“SMS GP”) to report a

disposition of shares of ordinary shares of the issuer and the removal of SMS GP as a reporting person.

The Schedule 13D (the

“Schedule”) filed with the Securities and Exchange Commission on January 10, 2011, as amended and supplemented by Amendment No. 1, filed February 23, 2011, Amendment No. 2, filed on February 16, 2012, Amendment

No. 3, filed on December 17, 2012, Amendment No. 4, filed on August 5, 2013 Amendment No. 5, filed on December 31, 2014 and Amendment No. 6, filed on June 10, 2015, is hereby amended and supplemented by the

Reporting Persons as set forth below in this Amendment No. 7. This amendment is filed by the Reporting Persons in accordance with Rule 13d-2 of the Securities Exchange Act of 1934, as amended, and refers only to information that has materially

changed since the filing of the Schedule 13D. The items identified below, or the particular paragraphs of such items which are identified below, are amended as set forth below. Unless otherwise indicated, all capitalized terms used and not defined

herein have the respective meanings assigned to them in the Schedule.

| Item 2 |

Identity and Background |

The disclosure in Item 2 is hereby supplemented by adding the

following information regarding the identity and background of AI International GP Limited (the “New Reporting Person”):

|

|

|

|

|

|

|

| Name |

|

Address of

Business/Principal Office |

|

Principal

Business/Occupation |

|

Jurisdiction of

Organization/Citizenship |

| AI International GP Limited |

|

c/o Access Industries, Inc.

730 Fifth Avenue, 20th Floor

New York, NY 10019 |

|

Holding strategic

investments in a variety of industries worldwide |

|

British Virgin Islands |

The New Reporting Person has not, during the last five years: (i) been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors); or (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

The agreement among the Reporting Persons relating to the joint filing of this Schedule 13D is filed as Exhibit 99.1.8 hereto.

| Item 4 |

Purpose of Transaction |

The disclosure in Item 4 is hereby amended to add the

following to the end thereof:

The transactions described in Item 5(c) below were effectuated for investment purposes in the regular

course of such entity’s business.

| Item 5 |

Interest in Securities of the Issuer |

The disclosure in Items 5(a) and 5(b) is

hereby amended and restated in its entirety to read as follows:

(a) and (b) The responses of each of the Reporting Persons and SMS GP

with respect to Rows 11, 12, and 13 of the cover pages of this Schedule 13D that relate to the aggregate number and percentage of ordinary shares (including but not limited to footnotes to such information) are incorporated herein by reference.

The responses of each of the Reporting Persons with respect to Rows 7, 8, 9, and 10 of the cover pages of this Schedule 13D that relate to

the number of ordinary shares as to which each of the persons or entities referenced in Item 2 above has sole or shared power to vote or to direct the vote of and sole or shared power to dispose of or to direct the disposition of (including but

not limited to footnotes to such information) are incorporated herein by reference.

AIIC holds 41,144,972 ordinary shares directly. Each

of AIIH, Access Industries, LLC, Access Industries Holdings LLC, Access Industries Management, LLC and Len Blavatnik may be deemed to beneficially own the 41,144,972 ordinary shares to be held directly by AIIC. AIIH holds a majority of the

outstanding voting interests in AIIC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC. Access Industries Holdings LLC holds a majority of the outstanding voting interests in

AIIH and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC and AIIH. Access Industries, LLC holds a majority of the outstanding voting interests in Access Industries Holdings LLC

and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC, AIIH and Access Industries Holdings LLC.

Access Industries Management, LLC controls Access Industries, LLC, Access Industries Holdings LLC and AIIH and, as a result, may be deemed to share voting and investment power over the shares

beneficially owned by AIIC, AIIH, Access Industries Holdings LLC, and Access Industries, LLC. Mr. Blavatnik controls Access Industries Management, LLC and a majority of the outstanding voting interests in Access Industries, LLC and, as a

result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC, AIIH, Access Industries Holdings LLC, Access Industries, LLC, and Access Industries Management, LLC. Because of their relationships with

the other Reporting Persons, Altep 2010, Altep 2011, Altep 2014, AI Altep Holdings, Inc., AIPH Holdings LLC, AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AIPH, AI SMS L.P. and AI

International GP Limited may be deemed to share investment and voting power over the ordinary shares beneficially owned by AIIC, AIIH, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, and Mr. Blavatnik.

Each of AIIH, AIPH Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Altep 2014, AI Altep Holdings, Inc., AIEH, AI European Holdings L.P., AI European Holdings GP

Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI International GP Limited, AIPH, and Len Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than AIIC, disclaims

beneficial ownership of the shares held by AIIC.

AIPH Holdings LLC holds 20,000,000 ordinary shares directly. Each of Access Industries,

LLC, Access Industries Holdings LLC, Access Industries Management, LLC and Len Blavatnik may be deemed to beneficially own the 20,000,000 ordinary shares held directly by AIPH Holdings LLC. Access Industries Holdings LLC holds a majority of the

outstanding voting interests in AIPH Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIPH Holdings LLC. Access Industries, LLC holds a majority of the outstanding

voting interests in Access Industries Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by Access Industries Holdings LLC and AIPH Holdings LLC. Access Industries

Management, LLC controls Access Industries, LLC, Access Industries Holdings LLC and AIPH Holdings LLC and, as a result, may be deemed to share voting and investment power over the shares beneficially owned by AIPH Holdings LLC, Access Industries

Holdings LLC, and Access Industries, LLC. Mr. Blavatnik controls Access Industries Management, LLC and a majority of the outstanding voting interests in Access Industries, LLC and, as a result, may be deemed to share voting and investment power

over the ordinary shares beneficially owned by AIPH Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC, and Access Industries Management, LLC. Because of their relationships with the other Reporting Persons, Altep 2010, Altep 2011,

Altep 2014, AI Altep Holdings, Inc., AIIC, AIIH, AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AIPH, AI SMS L.P. and AI International GP Limited may be deemed to share investment and

voting power over the ordinary shares beneficially owned by AIPH Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, and Mr. Blavatnik. Each of AIIC, AIIH, Access Industries Holdings LLC,

Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Altep 2014, AI Altep Holdings, Inc., AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI

International GP Limited, AIPH, and Len Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than AIPH Holdings LLC, disclaims beneficial ownership of the shares held directly by AIPH

Holdings LLC.

AIEH holds 16,000,000 ordinary shares directly. Each of Access Industries Investment Holdings LLC, AI European Holdings

L.P., AI European Holdings GP Limited, AI SMS L.P., AI International GP Limited, Access Industries Holdings LLC, Access Industries, LLC, AIPH, Access Industries Management, LLC, and Len Blavatnik may be deemed to beneficially own the 16,000,000

ordinary shares held directly by AIEH. AI

European Holdings L.P. controls AIEH and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH. AI European Holdings GP Limited is

the general partner of AI European Holdings L.P. and, as such, may be deemed to share voting and investment power over the ordinary shares deemed beneficially owned by AIEH and AI European Holdings L.P. Access Industries Investment Holdings LLC

controls AI European Holdings GP Limited and, as such, may be deemed to share voting and investment power over the ordinary shares deemed beneficially owned by AIEH, AI European Holdings L.P. and AI European Holdings GP Limited. AI SMS L.P. is the

sole member of Access Industries Investment Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings L.P., AI European Holdings GP Limited and Access

Industries Investment Holdings LLC. AI International GP Limited is the general partner of AI SMS L.P. and, as such, may be deemed to share voting and investment power over the ordinary shares deemed beneficially owned by AIEH, AI European Holdings

L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC and AI SMS L.P. AIPH owns a majority of the equity of AI SMS L.P. and, as a result, may be deemed to share voting and investment power over the ordinary shares

beneficially owned by AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC and AI SMS L.P. Access Industries Holdings LLC holds a majority of the outstanding voting interests in AIPH and, as a

result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P. and AIPH. Access

Industries, LLC controls AI International GP Limited and holds a majority of the outstanding voting interests in Access Industries Holdings LLC and, as a result, may be deemed to share voting and investment power over the shares beneficially owned

by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI International GP Limited, and AIPH and Access Industries Holdings LLC. Access Industries Management, LLC controls Access

Industries, LLC, Access Industries Holdings LLC and AIIH and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access

Industries Investment Holdings LLC, AI SMS L.P., AI International GP Limited, AIPH, Access Industries Holdings LLC and Access Industries, LLC. Mr. Blavatnik controls Access Industries Management, LLC and a majority of the voting interests in

Access Industries, LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI

SMS L.P., AI International GP Limited, AIPH, Access Industries Holdings LLC, Access Industries, LLC and Access Industries Management, LLC. Because of their relationships with the other Reporting Persons, Altep 2010, Altep 2011, Altep 2014, AIPH

Holdings LLC and AI Altep Holdings, Inc. may be deemed to share investment and voting power over the ordinary shares beneficially owned by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI

SMS L.P., AI International GP Limited, AIPH, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC and Mr. Blavatnik. Each of AIIC, AIIH, AI European Holdings LP, AI European Holdings GP Limited, Access

Industries Investment Holdings LLC, AI SMS L.P., AI International GP Limited, AIPH, AIPH Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Altep 2014, AI Altep Holdings,

Inc. and Len Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than AIEH, disclaims beneficial ownership of the shares held by AIEH.

Altep 2010 holds 259,338 ordinary shares directly. Each of AI Altep Holdings, Inc. and Len Blavatnik may be deemed to beneficially own the

259,338 ordinary shares held directly by Altep 2010. AI Altep Holdings, Inc. is the general partner of Altep 2010 and, as a result, may be deemed to have voting and investment control over the shares owned directly by Altep 2010. Mr. Blavatnik

controls AI Altep Holdings, Inc. and, as a result, may be deemed to share voting and investment power over the shares held by Altep 2010. Because of their relationships with the other Reporting Persons, each of AIIC, AIIH, AI SMS L.P., AI

International GP Limited, Access Industries Holdings

LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2011, Altep 2014, Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI European Holdings

L.P., AIPH and AIPH Holdings LLC may be deemed to share investment and voting power over the ordinary shares beneficially owned by Altep 2010, AI Altep Holdings, Inc., and Mr. Blavatnik. Each of AIIC, AIIH, AI SMS L.P., AI International GP

Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, AI Altep Holdings, Inc., Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI European Holdings L.P., AIPH, AIPH

Holdings LLC, Altep 2011, Altep 2014 and Mr. Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than Altep 2010, disclaims beneficial ownership of the shares held by

Altep 2010.

Altep 2011 holds 161,701 ordinary shares directly. Each of AI Altep Holdings, Inc. and Len Blavatnik may be deemed to

beneficially own the 161,701 ordinary shares held directly by Altep 2011. AI Altep Holdings, Inc. is the general partner of Altep 2011 and, as a result, may be deemed to have voting and investment control over the shares owned directly by Altep

2011. Mr. Blavatnik controls AI Altep Holdings, Inc. and, as a result, may be deemed to share voting and investment power over the shares held by Altep 2011. Because of their relationships with the other Reporting Persons, each of AIIC, AIIH,

AI SMS L.P., AI International GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2014, Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI

European Holdings L.P., AIPH and AIPH Holdings LLC may be deemed to share investment and voting power over the ordinary shares beneficially owned by Altep 2011, AI Altep Holdings, Inc. and Mr. Blavatnik. Each of AIIC, AIIH, AI SMS L.P., AI

International GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, AI Altep Holdings, Inc., Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI European Holdings

L.P., AIPH, AIPH Holdings LLC, Altep 2010, Altep 2014 and Mr. Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than Altep 2011, disclaims beneficial ownership of the shares held

by Altep 2011.

Altep 2014 holds 77,355 ordinary shares directly. Each of AI Altep Holdings, Inc. and Len Blavatnik may be deemed to

beneficially own the 77,355 ordinary shares to be held directly by Altep 2014. AI Altep Holdings, Inc. is the general partner of Altep 2014 and, as a result, may be deemed to have voting and investment control over the shares owned directly by Altep

2014. Mr. Blavatnik controls AI Altep Holdings, Inc. and, as a result, may be deemed to share voting and investment power over the shares held by Altep 2014. Because of their relationships with the other Reporting Persons, each of AIIC, AIIH,

AI SMS L.P., AI International GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI

European Holdings L.P., AIPH and AIPH Holdings LLC may be deemed to share investment and voting power over the ordinary shares beneficially owned by Altep 2014, AI Altep Holdings, Inc., and Mr. Blavatnik. Each of AIIC, AIIH, AI SMS L.P., AI

International GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, AI Altep Holdings, Inc., Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI European Holdings

L.P., AIPH, AIPH Holdings LLC, Altep 2010, Altep 2011 and Mr. Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than Altep 2014, disclaims beneficial ownership of the shares

held by Altep 2014.

The disclosure in Item 5(c) is hereby supplemented by adding the following at the end

thereof:

(c) The following transactions in the Issuer’s securities have been effected by Reporting Persons within the 60 days prior

to this filing:

On March 8, 2016, AIIC, Altep 2010, Altep 2011 and Altep 2014 sold 258,405, 868, 542 and 259 ordinary shares,

respectively, at a weighted average price of $83.8843 per share1, 143,567, 483, 301 and 144 ordinary shares, respectively, at a weighted average price of $82.0837 per share2 and 591,609, 1,989, 1,240 and 593 ordinary shares, respectively, at a weighted average price of $81.2285 per share3 in open market transactions.

On March 9, 2016, AIIC transferred 1,200,000 ordinary shares to its sole shareholder, AIIH. AIIH contributed such shares to a

charitable trust.

On March 9, 2016, AIIC, Altep 2010, Altep 2011 and Altep 2014 sold 1,085,236, 7,682, 4,790 and 2,292 ordinary

shares, respectively, at a weighted average price of $82.5331 per share4 in open market transactions. The charitable trust also sold its 1,200,000 ordinary shares in open market transactions at

the same weighted average price.

The disclosure in Item 5(e) is hereby supplemented by adding the following at the end thereof:

(e) On January 13, 2016, AI SMS GP Limited ceased to be, and AI International GP Limited became, a beneficial owner of Issuer securities and a

Reporting Person as a result of a change in the general partner of AI SMS L.P.

| Item 7 |

Materials to Be Filed as Exhibits |

The disclosure in Item 7 is hereby supplemented

by adding the following in appropriate numerical order:

|

|

|

|

|

| Exhibit 99.1.8 |

|

Joint Filing Agreement, dated as of March 15, 2016. |

| 1 |

These shares were sold in multiple transactions at prices ranging from $83.0400 to $84.0250, inclusive. The reporting persons undertake to provide to the staff of the Securities and Exchange Commission, upon request,

full information regarding the number of shares sold at each separate price within such range. |

| 2 |

These shares were sold in multiple transactions at prices ranging from $81.6200 to $82.5350, inclusive. The reporting persons undertake to provide to the staff of the Securities and Exchange Commission, upon request,

full information regarding the number of shares sold at each separate price within such range. |

| 3 |

These shares were sold in multiple transactions at prices ranging from $80.6200 to $81.6000, inclusive. The reporting persons undertake to provide to the staff of the Securities and Exchange Commission, upon request,

full information regarding the number of shares sold at each separate price within such range. |

| 4 |

These shares were sold in multiple transactions at prices ranging from $81.9850 to $82.9200, inclusive. The reporting persons undertake to provide to the staff of the Securities and Exchange Commission, upon request,

full information regarding the number of shares sold at each separate price within such range. |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

| Date: March 15, 2016 |

|

| AI INTERNATIONAL CHEMICALS S.À R.L. |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Class A Manager |

|

| LEN BLAVATNIK |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Attorney-in-Fact |

|

| AI INVESTMENTS HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| AI SMS L.P. |

|

|

| By: |

|

AI International GP Limited, its general partner |

| By: |

|

Momats Limited, its director |

|

|

| By: |

|

/s/ LYNELLE GUMBS |

| Name: |

|

Lynelle Gumbs |

| Title: |

|

Class A Representative |

|

|

| By: |

|

/s/ SALLYON WILLIAMS |

| Name: |

|

Sallyon Williams |

| Title: |

|

Class B Representative |

|

| AI INTERNATIONAL GP LIMITED |

|

|

| By: |

|

Momats Limited, its director |

|

|

| By: |

|

/s/ LYNELLE GUMBS |

| Name: |

|

Lynelle Gumbs |

| Title: |

|

Class A Representative |

|

|

| By: |

|

/s/ SALLYON WILLIAMS |

| Name: |

|

Sallyon Williams |

| Title: |

|

Class B Representative |

|

| AI SMS GP LIMITED |

|

|

| By: |

|

Belvaux Management Limited, its director |

|

|

| By: |

|

/s/ RONAN J.E. KUCZAJ |

| Name: |

|

Ronan J.E. Kuczaj |

| Title: |

|

Director |

|

|

|

| ACCESS INDUSTRIES HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES, LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES MANAGEMENT, LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ALTEP 2010 L.P. |

|

|

| By: |

|

AI Altep Holdings, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ALTEP 2011 L.P. |

|

|

| By: |

|

AI Altep Holdings, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| AI ALTEP HOLDINGS, INC. (formerly known as ACCESS INDUSTRIES, INC.) |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

|

|

| ACCESS INDUSTRIES INVESTMENT HOLDINGS LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Manager |

|

| AI EUROPEAN HOLDINGS L.P. |

|

|

| By: |

|

AI European Holdings GP Limited, its general partner |

| By: |

|

Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

| Name: |

|

Dawn E. Shand |

| Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS GP LIMITED |

|

|

| By: |

|

Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

| Name: |

|

Dawn E. Shand |

| Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS S.À R.L. |

|

|

| By: |

|

Access Industries Management, LLC, its Class A Manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

|

| By: |

|

/s/ DAWN E. SHAND |

| Name: |

|

Dawn E. Shand |

| Title: |

|

Class B Manager |

|

| AI PETROLEUM HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

|

|

| AIPH HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ALTEP 2014 L.P. |

|

|

| By: |

|

AI Altep Holdings, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

Exhibit 99.1.8

Joint Filing Agreement

The undersigned hereby agree that they are filing this statement jointly pursuant to Rule 13d-1(k)(1). Each of them is responsible for the

timely filing of such Schedule 13D and any amendments thereto, and for the completeness and accuracy of the information concerning such person contained therein; but none of them is responsible for the completeness or accuracy of the information

concerning the other persons making the filing, unless such person knows or has reason to believe that such information is inaccurate.

In

accordance with Rule 13d-1(k)(1) promulgated under the Securities and Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with each other on behalf of each of them of such a statement on Schedule 13D (and any

amendments thereto) with respect to the ordinary shares beneficially owned by each of them, of LyondellBasell Industries N.V., a public limited liability company incorporated under the laws of the Netherlands. This Joint Filing Agreement shall be

included as an exhibit to such Schedule 13D.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing Agreement as of the 15th day of March, 2016.

|

|

|

| AI INTERNATIONAL CHEMICALS S.À R.L. |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Class A Manager |

|

| LEN BLAVATNIK |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Attorney-in-Fact |

|

| AI INVESTMENTS HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| AI SMS L.P. |

|

|

| By: |

|

AI International GP Limited, its general partner |

| By: |

|

Momats Limited, its director |

|

|

| By: |

|

/s/ LYNELLE GUMBS |

| Name: |

|

Lynelle Gumbs |

| Title: |

|

Class A Representative |

|

|

| By: |

|

/s/ SALLYON WILLIAMS |

| Name: |

|

Sallyon Williams |

| Title: |

|

Class B Representative |

|

| AI INTERNATIONAL GP LIMITED |

|

|

| By: |

|

Momats Limited, its director |

|

|

| By: |

|

/s/ LYNELLE GUMBS |

| Name: |

|

Lynelle Gumbs |

| Title: |

|

Class A Representative |

|

|

| By: |

|

/s/ SALLYON WILLIAMS |

| Name: |

|

Sallyon Williams |

| Title: |

|

Class B Representative |

|

| AI SMS GP LIMITED |

|

|

| By: |

|

Belvaux Management Limited, its director |

|

|

| By: |

|

/s/ RONAN J.E. KUCZAJ |

| Name: |

|

Ronan J.E. Kuczaj |

| Title: |

|

Director |

|

| ACCESS INDUSTRIES HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

|

|

| ACCESS INDUSTRIES, LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES MANAGEMENT, LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ALTEP 2010 L.P. |

|

|

| By: |

|

AI Altep Holdings, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ALTEP 2011 L.P. |

|

|

| By: |

|

AI Altep Holdings, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| AI ALTEP HOLDINGS, INC. (formerly known as ACCESS INDUSTRIES, INC.) |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES INVESTMENT HOLDINGS LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Manager |

|

|

|

| AI EUROPEAN HOLDINGS L.P. |

|

|

| By: |

|

AI European Holdings GP Limited, its general partner |

| By: |

|

Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

| Name: |

|

Dawn E. Shand |

| Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS GP LIMITED |

|

|

| By: |

|

Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

| Name: |

|

Dawn E. Shand |

| Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS S.À R.L. |

|

|

| By: |

|

Access Industries Management, LLC, its Class A Manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

|

| By: |

|

/s/ DAWN E. SHAND |

| Name: |

|

Dawn E. Shand |

| Title: |

|

Class B Manager |

|

| AI PETROLEUM HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

| AIPH HOLDINGS LLC |

|

|

| By: |

|

Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

|

|

|

| ALTEP 2014 L.P. |

|

|

| By: |

|

AI Altep Holdings, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

| Name: |

|

Alejandro Moreno |

| Title: |

|

Executive Vice President |

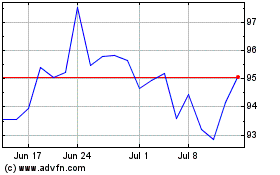

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

LyondellBasell Industrie... (NYSE:LYB)

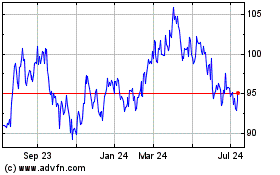

Historical Stock Chart

From Apr 2023 to Apr 2024