Board members of struggling Japanese electronics maker Sharp

Corp. met Thursday and agreed to sell the company to Taiwan's

Foxconn Technology Group for almost $6 billion, a decision hailed

as a symbol of a push by Japan's government to open up the

country's notoriously insular industries.

There was one snag. Foxconn, which assembles most of Apple

Inc.'s iPhones, was having second thoughts. In a written statement

released hours later, Foxconn said it would delay signing any deal

because it had been surprised by new information Sharp had

disclosed just a day before, and needed more time to study the

details.

The surprise was a list of about 100 items of contingent

liabilities—or potential future financial risks at Sharp totaling

roughly ¥ 350 billion, or $3.1 billion—that Foxconn would assume if

it completed the takeover, people familiar with the matter said.

While Foxconn said it hoped to resolve the matter quickly and

complete the deal, the 11th-hour development was symbolic of

topsy-turvy negotiations in which the foreign suitor outmaneuvered

a Japanese government-backed fund to win over one of the country's

most venerated brands.

The deal was being watched closely not just because of its

implications for Japan's reputation for protecting its prized

industrial names from foreign ownership, but because it also marked

a passing of the technological generations: 103-year-old Sharp was

a pioneer of the modern television set in Japan and the pocket

calculator; Foxconn, founded over four decades ago, has grown into

a $120 billion behemoth thanks to its proficiency in manufacturing

smartphones.

Until last month, Foxconn, formally known as Hon Hai Precision

Industry Co., was reported by Japanese media to be the underdog

bidder that trailed an offer from Innovation Network Corp. of

Japan, a fund that has rescued several ailing Japanese technology

companies since it was formed in 2009.

Foxconn won over Sharp's board, in part by offering to pay a

significant premium and through the suasion of its billionaire

chairman, Terry Gou. The Taiwanese tycoon had gained the acceptance

of Sharp's bank backers and its board through personal visits to

lay out Foxconn's bid, which included protecting jobs and keeping

Sharp's technology in Japan.

But while Mr. Gou had publicly trumpeted signs of success during

negotiations, he was silent for hours after Sharp finally said he

had won the deal he had been chasing since last year, even as INCJ

and Japan's industry minister, Motoo Hayashi, made comments that

Sharp was now under Foxconn's control. After Foxconn finally

announced the delay, Sharp declined to comment further.

It was the latest twist in a tortured history between Mr. Gou

and Sharp dating to 2012, when Foxconn reached a tentative deal to

invest in Sharp but later pulled out because Sharp's share price

had fallen during the negotiations to make the deal final.

That history made some Sharp executives hesitant about another

deal with Foxconn when Sharp's losses began piling up last year and

it started looking for a bailout, people familiar with the matter

have said. INCJ, the government-backed fund, was seen as a more

trustworthy rescuer.

The tide turned around the time Mr. Gou addressed the Sharp

board on Jan. 30 and gave a commitment to keep Sharp intact, in

contrast to INCJ's plan to split up the company. On Feb. 4, Sharp's

chief executive, Kozo Takahashi, said his company was giving more

attention to the Foxconn bid, and Mr. Gou flew to Sharp's

headquarters in Osaka, Japan, the next day in a bid to wrap

everything up.

But an all-day meeting between Messrs. Gou and Takahashi ended

inconclusively, with Mr. Gou saying the two sides were 90% of the

way toward a deal while Sharp said it was still weighing both the

Foxconn and INCJ bids.

The two sides' uneasy relationship was spotlighted by a

disagreement over whether Sharp had agreed to make Foxconn its

preferred negotiating partner. Mr. Gou, waving a piece of paper,

said it had. Shortly afterward, Sharp filed a formal statement with

the Tokyo Stock Exchange saying that was false.

Three weeks later, Sharp finally made up its mind on Thursday,

only to learn that Mr. Gou—until that point a hard-charging leader

bent on completing a deal as soon as possible—hadn't made up

his.

Foxconn didn't detail the new information it said it had been

handed Wednesday, but said it would take time to consider. "We will

have to postpone any signing of a definitive agreement until we

have arrived at a satisfactory understanding and resolution of the

situation," Foxconn said.

Under the deal outlined by Sharp, it would issue new shares to

Foxconn in exchange for an infusion of ¥ 489 billion. Sharp said

Foxconn would purchase preferred shares held by two creditors—the

core banking units of Mizuho Financial Group Inc. and Mitsubishi

UFJ Financial Group Inc.—for ¥ 100 billion.

Other payments that people familiar with the matter said would

total about ¥ 70 billion would bring the total commitment by

Foxconn to ¥ 659 billion, or $5.9 billion.

Foxconn's offer was double what INCJ was offering and included

relief for Sharp's two main banks, which are saddled with the

company's debt.

Shares in Sharp fell 14% to ¥ 149 on Thursday, while Hon Hai

shares rose 2.6%. The deal would let Foxconn buy new Sharp shares

for ¥ 118 and control nearly two-thirds of the company, diluting

existing shareholders. Foxconn's move to postpone the deal came

after markets closed for both stocks.

Contingent liabilities can often pose a hurdle in merger talks.

They represent costs a company might or might not face based on the

outcome of lawsuits, contracts or other factors. Sharp's 2015

annual report lists contingent liabilities relating to its solar

business, which signed on for long-term supplies of electricity and

raw materials that it ultimately didn't need.

In one electricity-supply arrangement, Sharp said it had agreed

to make payments of at least ¥ 43.9 billion, and it said potential

losses were difficult to estimate.

If Foxconn can join forces with Sharp, it would be in a better

position to develop advanced screens for Apple's iPhones, which

Foxconn already assembles. An iPhone's most expensive component is

its touch-screen display, making up more than 20% of manufacturing

costs, which is why Mr. Gou is eager to supply them, analysts

say.

Still, Foxconn faces skepticism about how it would reverse

Sharp's heavy losses if it takes over, given Mr. Gou's pledge not

to split up the company or make major layoffs.

Atsuko Fukase in Tokyo contributed to this article.

Write to Eva Dou at eva.dou@wsj.com, Wayne Ma at

wayne.ma@wsj.com and Takashi Mochizuki at

takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

February 25, 2016 14:15 ET (19:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

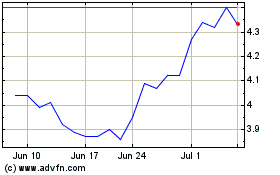

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

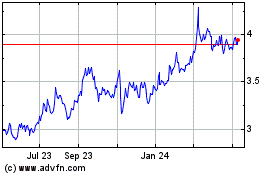

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Apr 2023 to Apr 2024