Current Report Filing (8-k)

February 25 2016 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 24, 2016

PENN NATIONAL GAMING, INC.

Commission file number 0-24206

Incorporated Pursuant to the Laws of the Commonwealth of Pennsylvania

IRS Employer Identification No. 23-2234473

825 Berkshire Blvd., Suite 200

Wyomissing, PA 19610

610-373-2400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On February 24, 2016, Penn National Gaming, Inc. (the “Company”) issued a press release providing an update with respect to its pending restatement and the anticipated timing of filing of its restated financial statements, as well as its Annual Report on Form 10-K for the year ended December 31, 2015. A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated in this Item 8.01 by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated February 24, 2016 of Penn National Gaming, Inc. providing an update with respect to its pending restatement and the anticipated timing of filing of its restated financial statements, as well as its Annual Report on Form 10-K for the year ended December 31, 2015. |

* * *

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: February 24, 2016 |

PENN NATIONAL GAMING, INC. |

|

|

|

|

|

|

|

By: |

/s/ Saul V. Reibstein |

|

|

|

Name: |

Saul V. Reibstein |

|

|

|

Title: |

Executive Vice President, Finance |

|

|

|

|

Chief Financial Officer and Treasurer |

3

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated February 24, 2016 of Penn National Gaming, Inc. providing an update with respect to its pending restatement and the anticipated timing of filing of its restated financial statements, as well as its Annual Report on Form 10-K for the year ended December 31, 2015. |

4

Exhibit 99.1

|

NEWS ANNOUNCEMENT |

|

|

CONTACT: |

|

|

Saul V. Reibstein |

Joseph N. Jaffoni, Richard Land |

|

Chief Financial Officer |

JCIR |

|

610/401-2049 |

212/835-8500 or penn@jcir.com |

PENN NATIONAL GAMING UPDATES TIMING FOR

FILING RESTATED FINANCIAL STATEMENTS

Wyomissing, PA (February 24, 2016) — Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or the “Company”) today provided an update on the expected timing for the filing with the Securities and Exchange Commission (“SEC”) of the restatement of its financial statements filed since the spin-off (the “Spin-off”) of its real estate assets to Gaming and Leisure Properties, Inc. (“GLPI”) on November 1, 2013 (the “Restatement”).

As noted in the Company’s February 4, 2016 fourth quarter earnings release, the Company plans to file its 2015 Annual Report on Form 10-K on March 15, 2016, by which time the Company will also make the other outstanding restatement filings. The brief extension will permit the Company to ensure consistency throughout the reporting periods for the various adjustments described in the Company’s February 4, 2016 fourth quarter earnings release, and to reclassify one additional lease to capital lease treatment, which will result in the Company reporting approximately $25 million in additional debt on its balance sheet. As a result, the Company now intends to submit all the restated filings by March 15, 2016.

The Company’s cash flows for all prior and future periods are not affected by the changes in accounting, nor will its current tax treatment with respect to the Spin-off transaction. In addition, the adjustments in the Restatement will not have a significant impact on the Company’s leverage ratios under its senior credit facility and other debt instruments (as the terms of those obligations require the Master Lease to be treated as an operating lease regardless of the treatment required under GAAP) and it will have no future impact on the following indicators of the Company’s performance:

· the Company’s cash position;

· the Company’s revenues from continuing operations; or

· the Company’s rental payments or other obligations under the Master Lease.

Penn National Gaming Chief Financial Officer, Saul Reibstein, noted, “We thank the Company’s shareholders and lenders for their patience during this process and we’re confident that the additional time will ensure that there are no inconsistencies throughout the reporting periods. As we move toward the conclusion of the filing of the restated and 2015 financial results, our operating and corporate teams remain focused on growth initiatives in terms of enhancing current operations and profitably growing market share in key markets, generating new operating efficiencies, and the continuation of our expansion initiatives, all of which position us for further financial growth in fiscal 2016.”

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests in gaming and racing facilities and video gaming terminal operations with a focus on slot machine entertainment. At December 31, 2015, the Company operated twenty-seven facilities in seventeen jurisdictions, including Florida, Illinois, Indiana, Kansas, Maine, Massachusetts, Maryland, Mississippi, Missouri, Nevada, New Jersey, New Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario. At December 31, 2015, in aggregate, Penn National Gaming operated approximately 33,400 gaming machines, 800 table games and 4,600 hotel rooms.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the use of forward looking terminology such as “expects,” “believes,” “estimates,” “projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or “anticipates” or the negative or other variations of these or similar words, or by discussions of future events, strategies or risks and uncertainties, including future plans, strategies, performance, developments, acquisitions, capital expenditures, and operating results. Actual results may vary materially from expectations. Although the Company believes that our expectations are based on reasonable assumptions within the bounds of our knowledge of our business, there can be no assurance that actual results will not differ materially from our expectations. Meaningful factors that could cause actual results to differ from expectations include, but are not limited to, risks related to the following, risks relating to the final impact of the restatement on the Company’s financial statements; the impact of the restatement on the Company’s evaluation of the effectiveness of its internal control over financial reporting; delays in the preparation of the financial statements; the risk that additional information will come to light during the course of the preparation of restated financial statements that alters the scope or magnitude of the restatement; potential investigations, litigation or other proceedings by governmental authorities, stockholders or other parties; the risk that the Company will be unable to file its financial statements in accordance with the timeline proposed in this press release, which could give rise to a default under the Company’s senior secured credit facility or under its note indenture or have other detrimental consequences; the ability of the Company to generate sufficient future taxable income to realize its deferred tax assets; risks relating to our liquidity and ability to raise capital; risks related to the impact on the restatement on the Company’s reputation, development projects, joint ventures and other commercial contracts; and other factors as discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, each as filed with the United States Securities and Exchange Commission. The Company does not intend to update publicly any forward-looking statements except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this press release may not occur.

# # #

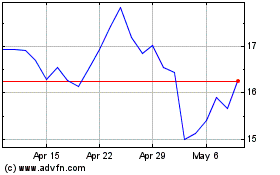

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024