UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by Registrant x

Filed by Party other than Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Materials Pursuant to §240.14a-12 |

VAPOR CORP.

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): $____ per share as determined under Rule 0-11 under the Exchange Act. |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing. |

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

Table of Contents

Vapor Corp.

3001 Griffin Road

Dania Beach, Florida 33312

(888) 482-7671

To The Stockholders of Vapor Corp.:

We are pleased to invite you to attend a Special

Meeting of the stockholders of Vapor Corp. (the “Company” “we,” “us,”

or “our”), which will be held at 10:00 A.M. Eastern Time on [Tuesday, March 1], 2016 at our corporate

headquarters in Dania Beach, Florida, at the above address, for the following purposes:

| (1) | to approve an amendment to the Company’s Certificate

of Incorporation, as amended (the “Certificate of Incorporation”)

to effect a reverse stock split (the “Reverse Stock Split”)

of our issued and outstanding shares of Common Stock at a ratio and effective upon a

date to be determined by the Company’s board of directors (the “Board”); |

| (2) | to authorize an adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if

there are not sufficient votes in favor of the Reverse Stock Split (the “Adjournment Proposal”); and |

| (3) | to transact other such business as may properly come before the Special Meeting or any adjournment or postponement thereof. |

The affirmative vote of the holders of a majority

of the outstanding shares of our Common Stock will be required to approve an amendment to the Certificate of Incorporation to effect

the Reverse Stock Split. The affirmative vote of a majority of the shares of Common Stock present in person or by proxy at the

Special Meeting will be required to approve the Adjournment Proposal. The Board has unanimously determined that the Reverse Stock

Split and the Adjournment Proposal are in the best interests of the Company and its stockholders and has approved and authorized

the Reverse Stock Split and the Adjournment Proposal.

The Board unanimously recommends that the

stockholders vote “FOR” the Reverse Stock Split and the Adjournment Proposal.

The Company’s Board of Directors has fixed

the close of business on [February 2], 2016 as the record date (the “Record Date”) for

a determination of stockholders entitled to notice of, and to vote at, this Special Meeting or any adjournment thereof.

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting of Stockholders to Be Held on [Tuesday, March 1], 2016:

We are mailing to many of our stockholders a

Notice of Internet Availability of Proxy Materials (which we refer to as a “Notice”), rather than mailing

a full paper set of the materials. The Notice contains instructions on how to access our proxy materials on the Internet, as well

as instructions on obtaining a paper copy of the proxy materials. This process is more environmentally friendly and reduces our

costs to print and distribute these materials. All stockholders who do not receive such a Notice, including stockholders who have

previously requested to receive a paper copy of the materials, will receive a full set of paper proxy materials by U.S. mail. An

electronic version of the Proxy Statement is available at: https://www.proxyvote.com.

If You Plan to Attend

Please note that space limitations make it necessary

to limit attendance to stockholders. Registration and seating will begin at 9:30 A.M. Shares can be voted at the meeting only if

the holder is present in person or by valid proxy.

For admission to the meeting, each stockholder

may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership

as of the Record Date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership. Cameras, recording

devices and other electronic devices will not be permitted at the meeting.

If you do not plan on attending the meeting,

please vote your shares via the Internet, by phone or by signing and dating the enclosed proxy and return it in the business envelope

provided. Your vote is very important.

| |

By the Order of the Board of Directors: |

| |

|

| |

/s/ Jeffrey Holman |

| |

Jeffrey Holman |

| |

Chairman of the Board and Chief Executive Officer |

Dated: February [__], 2016

Whether or not you expect to attend in person,

we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly

voting your shares via the Internet, by phone or by signing, dating, and returning the enclosed proxy card will save us the expenses

and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States

is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting

if you desire to do so, as your proxy is revocable at your option.

Your vote is important, so please act today!

Vapor Corp.

3001 Griffin Road

Dania Beach, Florida 33312

(888) 482-7671

SPECIAL MEETING OF STOCKHOLDERS PROXY STATEMENT

QUESTIONS AND ANSWERS

REGARDING THE SPECIAL MEETING

Why am I receiving these materials?

These proxy materials are being sent to the

holders of shares of the common stock of Vapor Corp., a Delaware corporation, which we refer to as “Vapor,”

the “Company,” “we,” “us,” or

“our” in connection with the solicitation of proxies by our Board of Directors, which we refer

to as the “Board” for use at the Special Meeting of Stockholders to be held at 10:00 A.M.

Eastern Time on [Tuesday, March 1], 2016 at our corporate headquarters at the above address in Dania Beach, Florida. The proxy

materials relating to the Special Meeting are first being mailed to stockholders entitled to vote at the meeting on or about February

[__], 2016.

Why is the Company doing a reverse stock split?

The quantitative listing standards of The NASDAQ

Stock Market, or NASDAQ, require, among other things, that listed companies maintain a minimum closing bid price of $1.00 per share

and maintain a minimum value of listed securities of $35 million. The Company believes that the Reverse Stock Split will increase

the stock price of shares of its common stock and increase the likelihood that the Company will meet the required NASDAQ requirements.

Why did I receive a notice in the mail regarding the Internet

availability of the proxy materials instead of a paper copy of the full set of proxy materials?

We are pleased to be using the SEC rule that

allows companies to furnish their proxy materials over the Internet. As a result, we are mailing to many of our stockholders a

notice of the Internet availability of the proxy materials instead of a paper copy of the proxy materials. All stockholders receiving

the notice will have the ability to access the proxy materials over the Internet and request to receive a paper copy of the proxy

materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found

in the notice of the Internet availability of the proxy materials. In addition, the notice contains instructions on how you may

request to access proxy materials in printed form by mail or electronically on an ongoing basis.

Why didn’t I receive a notice in the mail about the Internet

availability of the proxy materials?

We are providing some of our stockholders, including

stockholders who have previously requested to receive paper copies of the proxy materials, with paper copies of the proxy materials

instead of a notice of the Internet availability of the proxy materials.

In addition, we are providing notice of the

Internet availability of the proxy materials by e-mail to those stockholders who have previously elected delivery of the proxy

materials electronically. Those stockholders should have received an e-mail containing a link to the website where those materials

are available and a link to the proxy voting website.

How can I access the proxy materials over the Internet?

Your notice of the Internet availability of

the proxy materials, proxy card or voting instruction card will contain instructions on how to:

| · | View our proxy materials for the Special Meeting on the Internet; and |

| · | Instruct us to send our future proxy materials to you electronically by e-mail. |

Our proxy materials are also available at www.proxyvote.com.

Your notice of the Internet availability of

the proxy materials, proxy card or voting instruction card will contain instructions on how you may request to access proxy materials

electronically on an ongoing basis. Choosing to access your future proxy materials electronically will help us conserve natural

resources and reduce the costs of distributing our proxy materials. If you choose to access future proxy materials electronically,

you will receive an e-mail with instructions containing a link to the website where those materials are available and a link to

the proxy voting website. Your election to access proxy materials by e-mail will remain in effect until you terminate it.

How may I obtain a paper copy of the proxy materials?

Stockholders receiving a notice of the Internet

availability of the proxy materials will find instructions about how to obtain a paper copy of the proxy materials on their notice.

Stockholders receiving notice of the Internet availability of the proxy materials by e-mail will find instructions about how to

obtain a paper copy of the proxy materials as part of that e-mail. All stockholders who do not receive a notice or an e-mail will

receive a paper copy of the proxy materials by mail.

Who is entitled to vote?

Our Board has fixed the close of business on

[February 2], 2016 as the Record Date for a determination of stockholders entitled to notice of, and to vote at, this Special Meeting

or any adjournment thereof. On the Record Date, there were [58,881,575] shares of our common stock (“Common Stock”)

outstanding. Each share of Common Stock represents one vote that may be voted on each matter that may come before the Special Meeting.

As of the Record Date, Vapor had no other outstanding securities with voting rights.

What is the difference between holding shares as a record holder

and as a beneficial owner?

If your shares are registered in your name with

our transfer agent, Equity Stock Transfer, you are the “record holder” of those shares. If you are a record holder,

these proxy materials have been provided directly to you by Vapor.

If your shares are held in a stock brokerage

account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street

name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. As

the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the Special Meeting?

Record holders and beneficial owners may attend

the Special Meeting. If your shares are held in street name, you will need to bring a copy of a brokerage statement or other documentation

reflecting your stock ownership as of the Record Date. Please see below for instructions on how to vote at the Special Meeting

if your shares are held in street name.

How do I vote?

Whether you hold shares directly as the stockholder

of record or through a broker, trustee or other nominee as the beneficial owner, you may direct how your shares are voted without

attending the Special Meeting. There are three ways to vote by proxy:

(1) Vote by Internet. By following

the instructions on the notice, proxy card or voting instruction card.

(2) Vote by phone. Stockholders of

record may vote by phone by calling 1 (800) 690-6903. Stockholders who are beneficial owners of their shares may vote by phone

by calling the number specified on the voting instruction card provided by their broker, trustee or nominee.

(3) Vote by mail. Stockholders of

record may vote by mail by completing, signing and dating their proxy card or voting instruction card and mailing it in the accompanying

pre-addressed envelope.

If you vote by Internet or phone, please DO NOT mail your proxy

card.

Shares held in your name as the stockholder

of record may be voted by you in person at the Special Meeting. Shares held beneficially in street name may be voted by you in

person at the Special Meeting only if you obtain a legal proxy from the broker, bank, trustee, or nominee that holds your shares

giving you the right to vote the shares. Even if you plan to attend the Special Meeting, we recommend that you also submit your

proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

What constitutes a quorum?

To carry on the business of the Special Meeting,

we must have a quorum. A quorum is present when a majority of the outstanding shares of Common Stock entitled to vote, as of the

Record Date, are represented in person or by proxy. Shares owned by Vapor are not considered outstanding or considered to be present

at the Special Meeting. Broker non-votes (because there are routine matters presented at the Special Meeting) and abstentions are

counted as present for the purpose of determining the existence of a quorum.

What happens if Vapor is unable to obtain a quorum?

If a quorum is not present to transact business

at the Special Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Special Meeting, the

persons named as proxies may propose one or more adjournments of the Special Meeting to permit solicitation of proxies.

What is a broker non-vote?

If your shares are held in street name, you

must instruct the organization who holds your shares how to vote your shares. If you do not provide voting instructions, your shares

will not be voted on any non-routine proposal. This vote is called a “broker non-vote.” Broker non-votes do not count

as a vote “FOR” or “AGAINST” any of the proposals. Because Proposals 1 and 2 require a majority of our

outstanding shares to vote “FOR” approval, a broker non-vote will adversely affect these proposals.

If you are the stockholder of record, and you

sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner

recommended by our Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion

with respect to any other matters properly presented for a vote at the meeting. If your shares are held in street name and you

do not provide specific voting instructions to the organization that holds your shares, the organization may generally vote at

its discretion on routine matters, but not on non-routine matters. If you sign your vote instruction form but do not provide instructions

on how your broker should vote, your broker will vote your shares as recommended by our Board on any non-routine matter. See the

note below and the following question and answer.

What if I abstain from voting?

Abstentions with respect to a proposal are counted

for the purposes of establishing a quorum. Since the Reverse Stock Split requires the affirmative vote of a majority of our outstanding

shares of Common Stock and since, pursuant to the Company’s bylaws, the Adjournment Proposal must be approved by the majority

of the shares of Common Stock present at the meeting, a properly executed proxy card marked ABSTAIN with respect to any

proposal at the Special Meeting will have the same effect as voting AGAINST that proposal.

What effect does a broker non-vote have?

Brokers and other intermediaries, holding shares

of Common Stock in street name for their customers, are generally required to vote such shares in the manner directed by their

customers. If their customers do not give any direction, brokers may vote such shares on routine matters but not on non-routine

matters. Our management believes that the Reverse Stock Split and the Adjournment Proposal are routine matters. Consequently, if

customers do not give any direction, brokers will be permitted to vote shares of Common Stock at the Special Meeting in relation

to these matters. However, we encourage you to submit your voting instructions to your broker to ensure your shares of Common Stock

are voted at the Special Meeting.

Any shares of Common Stock represented at the

Special Meeting but not voted (whether by abstention, broker non-vote or otherwise) with respect to the proposals to approve the

Reverse Stock Split or the Adjournment Proposal will have the same effect as a vote AGAINST such proposal.

How many votes are needed for each proposal to pass, is broker

discretionary voting allowed and what is the effect of an abstention?

| Proposals |

|

Vote

Required |

|

Broker

Discretionary Vote

Allowed |

|

Effect

of

Abstentions on

the Proposal |

| (1) |

To approve an amendment to the Certificate of Incorporation

to effect a reverse stock split of our issued and outstanding shares of Common Stock at a ratio and effective upon a date to be

determined by the Board |

|

Majority of the outstanding voting shares |

|

Yes |

|

Vote Against |

| |

|

|

|

|

|

|

|

| (2) |

To authorize an adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the Reverse Stock Split |

|

Majority of the vote cast |

|

Yes |

|

No effect |

What are the voting procedures?

In voting by proxy with regard to the proposals,

you may vote in favor of each proposal or against each proposal, or in favor of some proposals and against others, or you may abstain

from voting on any of these proposals. You should specify your respective choices on the accompanying proxy card or your vote instruction

form.

Is my proxy revocable?

You may revoke your proxy and reclaim your right

to vote up to and including the day of the Special Meeting by giving written notice to the Corporate Secretary of Vapor, by delivering

a proxy card dated after the date of the proxy or by voting in person at the Special Meeting. All written notices of revocation

and other communications with respect to revocations of proxies should be addressed to: Vapor Corp., 3001 Griffin Road, Dania Beach,

Florida 33312, Attention: Corporate Secretary.

Who is paying for the expenses involved in preparing and mailing

this proxy statement?

All of the expenses involved in preparing, assembling

and mailing these proxy materials and all costs of soliciting proxies will be paid by Vapor. In addition to the solicitation by

mail, proxies may be solicited by our officers and regular employees by telephone or in person. Such persons will receive no compensation

for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians,

nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of

record by such persons, and we may reimburse such

persons for reasonable out of pocket expenses incurred by them in so doing. We have engaged Okapi Partners, LLC as proxy solicitor

at an estimated expense of $8,000.

What happens if additional matters are presented at the Special

Meeting?

Other than the items of business described

in this Proxy Statement, we are not aware of any other business to be acted upon at the Special Meeting. If you submit a signed

proxy card, the persons named as proxy holders, Messrs. Jeffrey Holman and Gregory Brauser, will have the discretion to

vote your shares on any additional matters properly presented for a vote at the Special Meeting.

What is “householding” and how does it affect me?

Record holders who have the same address and

last name will receive only one copy of their proxy materials, unless we are notified that one or more of these record holders

wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Stockholders who

participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you

and other record holders with whom you share an address, receive multiple copies of these proxy materials, or if you hold Vapor

stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your

household, please contact our Corporate Secretary at: Vapor Corp., 3001 Griffin Road, Dania Beach, Florida 33312; (888)

482-7671.

If you participate in householding and wish

to receive a separate copy of these proxy materials, or if you do not wish to continue to participate in householding and prefer

to receive separate copies of these documents in the future, please contact our Corporate Secretary as indicated above. Beneficial

owners can request information about householding from their brokers, banks or other holders of record.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to Vapor

stockholders with any of the proposals brought before the Special Meeting.

Interest of Officers and Directors in Matters to Be Acted Upon

If any of the proposals described in this proxy

statement are approved, none of our officers and directors will receive any extra or special benefit not shared on a pro rata basis

by all other holders of the Company’s securities.

The Board Recommends that Stockholders

Vote “For” Proposals 1 and 2.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information

regarding the beneficial ownership of our Common Stock as of [February 2], 2016 for:

| · | our Named Executive Officers, which include all Chief Executive Officers serving during fiscal year 2015 and our two other

most highly compensated executive officers, as determined by reference to total compensation for fiscal year 2015, who were serving

as executive officers at the end of fiscal year 2015; |

| · | all of our current directors and executive officers as a group; and |

| · | each stockholder

known by us to own beneficially more than five percent of our Common Stock. |

Except as indicated in footnotes to this table,

we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common

stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated,

the address for each director and executive officer listed is: c/o Vapor Corp., 3001 Griffin Road, Dania Beach, Florida 33312.

| Name of Beneficial Owner | |

Number of

Common Share

Equivalents

Beneficially

Owned1 | | |

Percentage of

Common Share

Equivalents

Beneficially

Owned1 | |

| Name of Executive Officers and Directors: | |

| | | |

| | |

| Jeffrey Holman2 | |

| 232,221 | | |

| * | |

| Christopher Santi3 | |

| 23,000 | | |

| * | |

| Gregory Brauser4 | |

| 207,719 | | |

| * | |

| Gina Hicks5 | |

| 0 | | |

| 0 | % |

| William Conway III6 | |

| 0 | | |

| 0 | % |

| Daniel MacLachlan7 | |

| 0 | | |

| 0 | % |

| Nikhil Raman8 | |

| 0 | | |

| 0 | % |

| All Executive Officers

and Directors as a Group (7 Persons) | |

| 542,757 | | |

| * | |

| Other Five Percent

Stockholder: | |

| | | |

| | |

| [None] | |

| [ | ] | |

| [_____ | ]% |

1

Applicable percentages are based on [58,881,575] shares of Common Stock outstanding as of February [2], 2016, adjusted as required

by rules of the SEC. Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment

power with respect to securities. Shares of Common Stock underlying options, warrants and convertible notes currently exercisable

or convertible, or exercisable or convertible within 60 days are deemed outstanding for computing the percentage of the person

holding such securities but are not deemed outstanding for computing the percentage of any other person.

2

Jeffrey Holman: A director and executive officer.

3

Christopher Santi: An executive officer. Includes 8,000 vested options.

4

Gregory Brauser: A director and executive officer. Includes 6,924 shares of common stock underlying restricted stock units

which are deliverable within 30 days.

5

Gina Hicks: The chief financial officer.

6

William Conway III: A director.

7

Daniel MacLachlan: A director.

8

Nikhil Raman: A director.

PROPOSAL 1—REVERSE

STOCK SPLIT

Introduction

Our Board has unanimously determined that it

is in the best interests of the Company and our stockholders to amend Section 4 of the Certificate of Incorporation (such amendment

as shown in Appendix B) to effect a reverse stock split of our issued and outstanding shares of Common Stock at a ratio (the “Reverse

Stock Split”).

Why did the Board approve the Reverse Stock Split?

On January 22, 2016, we received notice that

the Nasdaq Listing Qualifications Staff had determined that the continued listing of Vapor’s common stock is no longer in

the public interest as that concept is described in Nasdaq Listing Rule 5110. The Staff indicated that, given the potential for

dilution of Vapor’s shareholders that may be caused by the cashless exercise provision of Vapor’s Series A Warrants,

the Staff believes that the grace period provided to Vapor to regain compliance with the $1.00 bid price requirement is no longer

warranted. We have been provided a hearing on March 10, 2016 to determine if the Common Stock will be delisted and informing us

that our Common Stock may be involuntarily delisted from trading on The NASDAQ Capital Market if we fail to regain compliance

with (i) the minimum closing bid price requirement of $1.00 per share of Common Stock and (ii) the market value of listed securities

requirement of $35 million. A delisting of our Common Stock is likely to reduce the liquidity of our Common Stock and may inhibit

or preclude our ability to raise additional financing and may also materially and adversely impact our credit terms with our vendors.

The quantitative listing standards of The NASDAQ

Stock Market, or NASDAQ, require, among other things, that listed companies maintain a minimum closing bid price of $1.00 per share

and maintain a minimum value of listed securities of $35 million. We failed to satisfy the minimum bid price threshold and the

minimum value of listed securities threshold for 30 consecutive trading days, and on September 14, 2015, we received a letter from

NASDAQ indicating our deficiency.

On February 1, 2016, the Company’s stockholders

authorized the Board to implement a reverse stock split of our Common Stock at a ratio of between 10 to 1 and 70 to 1 that has

not been effected yet. Due to the recent decrease in the price of our Common Stock to a closing price of $0.0125 on February 2,

2016, the Board has determined a higher ratio with respect to the reverse stock split will allow the Company the best opportunity

to regain and maintain compliance with the minimum closing bid price requirement of $1.00 per share of Common Stock. If the Reverse

Stock Split is approved, the Board will not implement the previously authorized reverse stock split.

What is the purpose of the Reverse Stock Split?

Given the increased market volatility of our

Common Stock, the challenging environment in our industry and our potential lack of liquidity, we may be unable to regain compliance

with the closing bid price requirement. A delisting of our Common Stock is likely to reduce the liquidity of our Common Stock and

may inhibit or preclude our ability to raise additional financing and may make it difficult for our stockholders to sell any securities

if they desire or need to sell them.

The Board has considered the potential harm

to the Company and our stockholders should NASDAQ delist our Common Stock. Delisting from NASDAQ would adversely affect our ability

to raise additional financing through the public or private sale of equity securities and would significantly affect the ability

of investors to trade our securities. Delisting would also likely negatively affect the value and liquidity of our Common Stock

because alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets.

We believe that the Company’s best option

to meet NASDAQ’s $1.00 minimum bid price requirement required by NASDAQ is to effect the Reverse Stock Split to increase

the per-share trading price of our Common Stock. Given the volatility and fluctuations in the capital markets, the Board believes

that the likelihood of our stock price increasing to meet the NASDAQ listing requirements without the Reverse Stock Split is

remote and that the Company likely will have to take additional actions to comply with NASDAQ requirements.

If our stockholders do not approve the Reverse

Stock Split, the Company may be delisted from The NASDAQ Capital Market due to our failure to maintain a minimum bid price for

our Common Stock of $1.00 per share as required by the NASDAQ Marketplace Rules. Even if the Company effects the Reverse Stock

Split, the Company will still be subject to delisting pending its upcoming hearing with NASDAQ.

What amendments are being made to the Certificate of Incorporation?

The following paragraph will be added to Section

4 of the Certificate of Incorporation:

“Upon the effectiveness of this

Certificate of Amendment to the Certificate of Incorporation of the Corporation, every [number of shares] shares of the Corporation’s

issued and outstanding Common Stock, par value $0.0001 per share, that are issued and outstanding immediately prior to [date] shall,

automatically and without any further action on the part of the Corporation or the holder thereof, be combined into one (1) validly

issued, fully paid and non-assessable share of the Corporation’s Common Stock, par value $0.0001 per share, provided that

in the event a stockholder would otherwise be entitled to a fraction of a share of Common Stock pursuant to the provisions of this

Article, such stockholder shall receive one whole share of Common Stock in lieu of such fractional share and no fractional shares

shall be issued.”

Does the Board recommend approval of the Reverse Stock Split?

Yes. After considering the entirety of the circumstances,

the Board has unanimously concluded that the Reverse Stock Split is in the best interests of the Company and its stockholders and

the Board unanimously recommends that the Company’s stockholders vote in favor of the Reverse Stock Split.

What vote is required to approve the Reverse Stock Split?

The affirmative vote of the holders of a majority

of the outstanding shares of our Common Stock is required to amend the Certificate of Incorporation to effect the Reverse Stock

Split. Failures to vote and abstentions will be the equivalent of a vote against this proposal.

Material Effects of the Proposed Reverse Stock Split

Upon the effectiveness of the amendment to our

Certificate of Incorporation effecting the Reverse Stock Split, the outstanding shares of our Common Stock will be combined into

a lesser number of shares such that one share of our Common Stock will be issued for every two hundred shares of our Common Stock.

In connection with the Reverse Stock Split, any fractional shares that would otherwise be issued as a result of the Reverse Stock

Split will be rounded up to the nearest whole share. Even if stockholder approval of the Reverse Stock Split is obtained, the Board

may abandon the Reverse Stock Split in its sole discretion if it determines that the Reverse Stock Split is no longer in the best

interests of the Company and its stockholders.

The Reverse Stock Split will not change the

number of authorized shares of our Common Stock.

The Reverse Stock Split will affect all holders

of our Common Stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company (subject

to the treatment of fractional shares). In addition, the Reverse Stock Split will not affect any holder of Common Stock’s

proportionate voting power (subject to the treatment of fractional shares).

Based on our shares of Common Stock outstanding

as of the Record Date, the principal effects of the Reverse Stock Split will be that the number of shares of our Common Stock issued

and outstanding will be reduced from [58,881,575] shares as of the Record Date to a range of [588,816] shares (if a 1-for-100 ratio

is chosen) or to [58,882] shares (if a 1-for-1,000 ratio is chosen), depending on the exact exchange ratio chosen by the Board

and without giving effect to any rounding up of fractional shares.

The table below sets forth, as of [February

2], 2016 and for illustrative purposes only, certain effects of the potential ratios of between 1-for-100 and 1-for-1,000, inclusive,

including on our total outstanding Common Stock equivalents (without giving effect to the treatment of fractional shares).

| | |

Common Stock and

Equivalents Outstanding

Prior to Reverse Stock

Split | | |

Common Stock and Equivalents

Assuming

Certain Reverse Stock Split Ratios | |

| | |

Shares | | |

Percent

of Total | | |

1-for-100 | | |

1-for-500 | | |

1-for-1,000 | |

| Common Stock outstanding | |

| [58,881,575] | | |

| [1.47] | % | |

| [588,816] | | |

| [117,763] | | |

| [58,882] | |

| Common Stock subject to Vesting | |

| [25,733] | | |

| [0] | % | |

| [257] | | |

| [51] | | |

| [26] | |

| Common

Stock underlying warrants(1) | |

| [3,946,841,307] | | |

| [98.43] | % | |

| [39,483,490] | | |

| [7,896,698] | | |

| [3,946,841] | |

| Common Stock underlying options | |

| [39,206] | | |

| [0] | % | |

| [392] | | |

| [78] | | |

| [39] | |

| Common Stock reserved for conversion of Series

A Convertible Preferred Stock | |

| [3,908,080] | | |

| [0.10] | % | |

| [39,081] | | |

| [7,816] | | |

| [3,908] | |

| Total Common Stock and equivalents | |

| | | |

| 100 | % | |

| | | |

| | | |

| | |

| Common

Stock available for future issuance(2) | |

| 929,914,857 | | |

| | | |

| [9,299,148] | | |

| [1,859,831] | | |

| [929,914] | |

| (1) | The Common Stock underlying warrants includes a cashless exercise calculation for the outstanding 74,730,070 Series A Warrants

using a Black Scholes Value of $1.0827 per share and a closing stock price of $[0.0205] per share as of

[January 29], 2016. These amounts assume the Company delivers only common stock upon exercise of the Series A Warrants and not

cash payments as permitted under the terms of the Series A Warrants. |

| (2) | Common stock available for issuance is based on 5,000,000,000 shares of Common Stock authorized for issuance. |

In determining which ratio to implement,

if any, following receipt of stockholder approval, our Board may consider, among other things, various factors such as:

| · | the historical trading price and trading volume of our Common Stock; |

| · | the then prevailing trading price and trading volume of our Common Stock and the expected impact of the Reverse Stock Split

on the trading market for our Common Stock; |

| · | our ability to continue our listing on The NASDAQ Capital Market; |

| · | which ratio would result in the least administrative cost to us; |

| · | the number of shares of Common Stock needed to satisfy the settlement of cashless exercises of the Company’s outstanding

Series A Warrants; and |

| · | prevailing general market and economic conditions. |

The principal effects of the Reverse Stock Split will

be as follows:

| · | each 100 to 1,000 shares of Common Stock, inclusive, as determined in the sole discretion of our Board, will be combined into

one new share of Common Stock, with any fractional shares that would otherwise be issuable as a result of the split being rounded

up to the nearest whole share; |

| · | the number of shares of Common Stock issued and outstanding will be reduced accordingly, as illustrated in the table above; |

| · | proportionate adjustments will be made to the per share exercise prices and/or the number of shares of Common Stock issuable

upon exercise or conversion of outstanding preferred shares, options, warrants, and any other convertible or exchangeable securities

entitling the holders to purchase, exchange for, or convert into, shares of Common Stock, which will result in approximately the

same aggregate price being required to be paid for such securities upon exercise or conversion as had been payable immediately

preceding the Reverse Stock Split; |

| · | the Company will have available shares to conduct future equity financings; |

| · | the number of shares reserved for issuance or under the securities described immediately above will be reduced proportionately;

and |

| · | the number of shares of Common Stock available for future issuance will increase accordingly, as illustrated in the table above. |

Possible Anti-Takeover Implications of

the Reverse Stock Split

The issuance in the future of additional

shares of our Common Stock made available by the Reverse Stock Split may have the effect of diluting the earnings or loss per share

and book value per share, as well as the ownership and voting rights of the holders of our then-outstanding shares of Common Stock.

In addition, an increase in the number of authorized but unissued shares of our Common Stock due to the Reverse Stock Split may

have a potential anti-takeover effect, as our ability to issue additional shares could be used to thwart persons, or otherwise

dilute the stock ownership of stockholders, seeking to control us. Further, the ability to issue our shares of Common Stock at

a lower price may afford the Company added flexibility to deter a potential takeover of the Company by diluting the shares held

by a potential suitor or issuing shares to a stockholder that will vote in accordance with the Board’s desires at a very

low par value. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer

such stockholders a premium for their shares of Common Stock compared to the then-existing market price. The Reverse Stock Split

is not being recommended by our Board as part of an anti-takeover strategy.

Reservation of Right to Delay the Filing of, or Abandon,

the Reverse Stock Split and Par Value Change

If stockholder approval is obtained to

effect the Reverse Stock Split, the Board will have the authority to implement the Reverse Stock Split on or before [April

15], 2017. However, the Board reserves the authority to decide, in its sole discretion, to abandon the Reverse Stock

Split after such vote and before the effectiveness of the Reverse Stock Split if it determines that the Reverse Stock Split is

no longer in the best interests of the Company and its stockholders.

Fractional Shares

Our stockholders will not receive fractional

post-Reverse Stock Split shares in connection with the Reverse Stock Split. Instead, any fractional shares that would otherwise

be issuable as a result of the Reverse Stock Split will be rounded up to the nearest whole share. No stockholders will receive

cash in lieu of fractional shares.

No Going Private Transaction

The Reverse Stock Split is not intended

as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the U.S. Exchange Act.

Following the Reverse Stock Split, the Company will continue to be subject to the periodic reporting requirements of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

Effective Time

The proposed Reverse Stock Split would become

effective on the time and date (the “Effective Time”) specified in the amendment to the Certificate of

Incorporation effecting the Reverse Stock Split as filed with the office of the Secretary of State of Delaware. Except as explained

above with respect to fractional shares, at the Effective Time, shares of our Common Stock issued and outstanding immediately prior

thereto will be combined, automatically and without any action on the part of our stockholders, into one share of our Common Stock

in accordance with the ratio of between 1 for 100 and 1 for 1,000.

After the Effective Time, our Common Stock

will have a new committee on uniform securities identification procedures (“CUSIP”) number, which is

a number used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged

for stock certificates with the new CUSIP numbers by following the procedures described below.

After the Effective Time, we will continue

to be subject to periodic reporting and other requirements of the Exchange Act. If our Common Stock is not delisted by NASDAQ because

of our failure to comply with the $1.00 minimum bid price requirement or the minimum value of listed securities, our Common Stock

will continue to be listed on The NASDAQ Capital Market under the symbol “VPCO.”

Procedures for effecting the Reverse Stock Split and Exchange

of Stock Certificates

If the Company’s stockholders approve

the Reverse Stock Split and the Board determines that it is in the Company’s best interest to effect the Reverse Stock Split,

the Reverse Stock Split would become effective at such time as the amendment to the Certificate of Incorporation, the form of which

is attached as Appendix B to this Proxy Statement, is filed with the Secretary of State of Delaware or such time and date as stated

therein when filed.

As soon as practicable after the effective

date of the Reverse Stock Split, the Company will notify its stockholders that the Reverse Stock Split has been implemented. Equity

Stock Transfer, LLC, the Company’s transfer agent, will act as exchange agent for purposes of implementing the exchange of

stock certificates. Holders of pre-Reverse Stock Split shares of our Common Stock will be asked to surrender to the exchange agent

certificates representing pre-Reverse Stock Split shares of our Common Stock in accordance with the procedures to be set forth

in a letter of transmittal that will be delivered to the Company’s common stockholders. No new certificates will be issued

to a stockholder until the stockholder has surrendered to the exchange agent his, her or its outstanding certificate(s) together

with the properly completed and executed letter of transmittal. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD

NOT SUBMIT ANY CERTIFICATES UNTIL REQUESTED TO DO SO. Stockholders whose shares are held by their stockbroker do not need to submit

old share certificates for exchange. These shares will automatically reflect the new quantity of shares based on the Reverse Stock

Split. Beginning on the effective date of the Reverse Stock Split, each certificate representing pre-Reverse Stock Split shares

will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares.

Effect on Registered and Beneficial Holders of Common Stock

Upon the effectiveness of the Reverse Stock

Split, shares of our Common Stock held by stockholders that hold their shares through a broker or other nominee will be treated

in the same manner as shares held by registered stockholders that hold their shares in their names. Brokers and other nominees

that hold shares of our Common Stock will be instructed to effect the Reverse Stock Split for the beneficial owners of such shares.

However, those brokers or other nominees may implement different procedures than those to be followed by registered stockholders

for processing the Reverse Stock Split. Stockholders whose shares of our Common Stock are held in the name of a broker or other

nominee are encouraged to contact their broker or other nominee with any questions regarding the procedure of implementing the

Reverse Stock Split with respect to their shares.

Effect on Registered “Book-Entry” Holders of

Our Common Stock

Registered holders of shares of our Common

Stock may hold some or all of their shares electronically in book-entry form under the direct registration system for the securities.

Those stockholders will not have stock certificates evidencing their ownership of shares of our Common Stock, but generally have

a statement reflecting the number of shares registered in their accounts.

Stockholders that hold registered shares

of our Common Stock in book-entry form do not need to take any action to receive post-Reverse Stock Split shares. Any such stockholder

that is entitled to post-Reverse Stock Split shares will automatically receive, at the stockholder’s address of record, a

transaction statement indicating the number of post-Reverse Stock Split shares held following the implementation of the Reverse

Stock Split.

Dissenters’ Rights

Our stockholders will not be entitled to

dissenters’ rights with respect to the proposed amendment to the Certificate of Incorporation in connection with the Reverse

Stock Split.

No Effect on Authorized Preferred Stock

Pursuant to our Certificate of Incorporation,

our capital stock consists of a total of 5,001,000,000 authorized shares, of which 5,000,000,000 shares, par value $0.0001 per

share, are designated as Common Stock and 1,000,000 shares, par value $0.001 per share, are designated as preferred stock. The

proposed Reverse Stock Split would not impact the total authorized number of shares of preferred stock or the par value of the

preferred stock.

Effect on Dividends

The payment of dividends, including the

timing and amount dividends, must be made in accordance with our Certificate of Incorporation and the requirements of the Delaware

General Corporation Law (the “DGCL”). We cannot assure you that any dividends will be paid in

the future on the shares of Common Stock. Any declaration and payment of future dividends to holders of our Common Stock will be

at the discretion of our Board and will depend on many factors, including our financial condition, earnings, capital requirements,

level of indebtedness, statutory future prospects and contractual restrictions applicable to the payment of dividends, and other

considerations that our Board deems relevant. The decrease in par value may affect our ability to make dividend payments. Under

the DGCL, the aggregate par value must be deducted from the amount available for dividends (the result being “surplus,”

out of which dividends can be paid). Accordingly, the reduction in par value contemplated by this proposal would increase our surplus

for DGCL purposes, and therefore our potential dividend paying ability.

Accounting Matters

The Reverse Stock Split will change the

par value of the shares of our Common Stock and the number of shares of Common Stock issued and outstanding. As a result, as of

the effective time of the Reverse Stock Split, the stated capital attributable to the shares of our Common Stock on our balance

sheet will be reduced proportionately based on the ratio chosen by the Board for the Reverse Stock Split to reflect the new number

of shares outstanding and the new par value, and the additional paid-in capital account will be credited with the amount by which

the stated capital is reduced. The per share net income or loss will be restated because there will be fewer shares of Common Stock

outstanding.

Effect on Our Preferred Shares, Options and Warrants

If the Reverse Stock Split is effected,

the number of shares of Common Stock issuable upon exercise or conversion of our outstanding preferred shares, stock options (including

shares reserved for issuance under the Company’s stock plans) and warrants will be proportionately adjusted by the applicable

administrator, using the ratio as the Reverse Stock Split, rounded up to the nearest whole share. In connection with the Reverse

Stock Split, the Board or the applicable administrator will implement only applicable technical, conforming changes to the securities,

including ratably reducing the authorized shares of Common Stock available for awards under the Company’s stock plans. In

addition, the conversion price for each outstanding preferred shares and the exercise price for each outstanding stock option and

warrant would be increased in inverse proportion to the split ratio such that upon an conversion or exercise, the aggregate conversion

price for conversion of preferred stock and the aggregate exercise price payable by the optionee or warrantholder to the Company

for the shares subject to the option or warrant would remain approximately the same as the aggregate exercise price prior to the

Reverse Stock Split.

Interests of Directors and Executive Officers

Our directors and executive officers do

not have substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their

ownership of shares of our Common Stock or any other of our securities.

Certain Material U.S. Federal Income Tax Consequences of

the Reverse Stock Split

The following is a summary of material United

States federal income tax consequences of the Reverse Stock Split to holders of our Common Stock. Except where noted, this summary

deals only with our Common Stock that is held as a capital asset.

This summary is based upon provisions of

the Internal Revenue Code of 1986, as amended (the “Code”), and United States Treasury regulations, rulings

and judicial decisions as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to result in United

States federal income tax consequences different from those summarized below.

This summary does not address all aspects

of United States federal income taxes that may be applicable to holders of Common Stock and does not deal with non-U.S., state,

local or other tax considerations that may be relevant to stockholders in light of their particular circumstances. In addition,

it does not represent a detailed description of the United States federal income tax consequences applicable to you if you are

subject to special treatment under the United States federal income tax laws (including if you are a dealer in securities or currencies;

a financial institution; a regulated investment company; a real estate investment trust; an insurance company; a tax-exempt organization;

a person holding shares as part of a hedging, integrated or conversion transaction, a constructive sale or a straddle; a trader

in securities that has elected the mark-to-market method of accounting for your securities; a person liable for alternative minimum

tax; a person who owns or is deemed to own 10% or more of our voting stock; a partnership or other pass-through entity for United

States federal income tax purposes; a person whose “functional currency” is not the United States dollar; a United

States expatriate; a “controlled foreign corporation”; or a “passive foreign investment company”).

We cannot assure you that a change in law

will not alter significantly the tax considerations that we describe in this summary. No ruling from the Internal Revenue Service

or opinion of counsel will be obtained regarding the federal income tax consequences to stockholders as a result of the Reverse

Stock Split.

If a partnership (or other entity treated

as a partnership for United States federal income tax purposes) holds our Common Stock, the tax treatment of a partner will generally

depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership holding our

Common Stock, you should consult your own tax advisors.

We believe that the Reverse Stock Split,

if implemented, would be a tax-free recapitalization under the Code. If the Reverse Stock Split qualifies as a tax-free recapitalization

under the Code, then, generally, for United States federal income tax purposes, no gain or loss will be recognized by the Company

in connection with the Reverse Stock Split, and no gain or loss will be recognized by stockholders that exchange their shares of

pre-split Common Stock for shares of post-split Common Stock. The post-split Common Stock in the hands of a stockholder following

the Reverse Stock Split will have an aggregate tax basis equal to the aggregate tax basis of the pre-split Common Stock held by

that stockholder immediately prior to the Reverse Stock Split. A stockholder’s holding period for the post-split Common Stock

generally will be the same as the holding period for the pre-split Common Stock exchanged therefor.

Alternative characterizations of the Reverse

Stock Split are possible. For example, while the Reverse Stock Split, if implemented, would generally be treated as a tax-free

recapitalization under the Code, stockholders whose fractional shares resulting from the Reverse Stock Split are rounded up to

the nearest whole share may recognize gain for United States federal income tax purposes equal to the value of the additional fractional

share. However, we believe that, in such case, the resulting tax liability may not be material in view of the low value of such

fractional interest. Stockholders should consult their own tax advisors regarding the characterization of the Reverse Stock Split

for United States federal income tax purposes.

Certain Risks Associated with the Reverse Stock Split

The Board believes that the Reverse Stock

Split will increase the price level of our shares of Common Stock and, as a result, may enable the Company to maintain listing

of our Common Stock on The NASDAQ Capital Market. Given the volatility and fluctuations in the capital markets, however, the Board

believes that the likelihood of our stock price increasing to meet the NASDAQ listing requirements without the Reverse Stock Split

is remote and that the Company likely will have to take additional actions to comply with NASDAQ requirements. There are a number

of risks associated with the Reverse Stock Split, including as follow:

| · | The Board cannot predict the effect of the Reverse Stock Split upon the market price for our shares of Common Stock, and the

history of similar reverse stock splits for companies in like circumstances has varied. |

| · | The Reverse Stock Split will dramatically reduce the number of issued and outstanding shares of Common Stock relative to the

number of authorized shares of Common Stock, currently 5,000,000,000. A large amount of available shares of Common Stock could

have adverse consequences, including but not limited to (i) if the price of our Common Stock continues to decrease, the number

of shares of Common Stock required to settle the Series A Warrants will continue to increase, and we may be required to issue a

large number of shares of Common Stock to settle such exercises, which could massively dilute current stockholders, or if we run

out of available authorized shares of Common Stock to settle cashless exercises, we could be forced to make large cash settlement

payments, for which we might not have sufficient available capital and (ii) our current stockholders could be potentially diluted

by future issuances of shares of Common Stock for capital raising purposes, to acquire additional assets, for equity compensation

of officers and directors and for other corporate purposes. |

| · | The market price per share of Common Stock after the Reverse Stock Split may not rise in proportion to the reduction in the

number of shares of Common Stock outstanding resulting from the Reverse Stock Split. If the market price of our shares of Common

Stock declines after the Reverse Stock Split, the percentage decline as an absolute number and as a percentage of the Company’s

overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Accordingly, the total

market capitalization of our Common Stock after the Reverse Stock Split may be lower than the total market capitalization before

the Reverse Stock Split. Moreover, in the future, the market price of our Common Stock following the Reverse Stock Split may not

exceed or remain higher than the market price prior to the Reverse Stock Split. |

| · | The market price per share of our shares of Common Stock post-Reverse Stock Split may not remain in excess of the minimum bid

price per share as required by NASDAQ, or the Company may fail to meet the other requirements for continued listing on the NASDAQ,

including the minimum value of listed securities, as described above, resulting in the delisting of our Common Stock. |

| · | The market price of our shares of Common Stock may also be affected by the Company’s performance and other factors, the

effect of which the Board cannot predict. |

| · | Although the Board believes that a higher stock price may help generate the interest of new investors, the Reverse Stock Split

may not result in a per-share price that will successfully attract certain types of investors and such resulting share price may

not satisfy the investing guidelines of institutional investors or investment funds. Further, other factors, such as our financial

results, market conditions and the market perception of our business, may adversely affect the interest of new investors in the

shares of our Common Stock. As a result, the trading liquidity of the shares of our Common Stock may not improve as a result of

the Reverse Stock Split and there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits

described above. |

| · | The Reverse Stock Split could be viewed negatively by the market and other factors, such as those described above, may adversely

affect the market price of the shares of our Common Stock. Consequently, the market price per post-Reverse Stock Split shares may

not increase in proportion to the reduction of the number of shares of our Common Stock outstanding before the implementation of

the Reverse Stock Split. Accordingly, the total market capitalization of our shares of Common Stock after the Reverse Stock Split

may be lower than the total market capitalization before the Reverse Stock Split. Any reduction in total market capitalization

as the result of the Reverse Stock Split may make it more difficult for us to meet the NASDAQ Listing Rule regarding minimum value

of listed securities, which could result in our shares of Common Stock being delisted from The NASDAQ Capital Market. |

| · | In the future, the market price of the shares of our Common Stock following the Reverse Stock Split may not exceed or remain

higher than the market price of the shares of our Common Stock prior to the Reverse Stock Split. |

| · | If the Reverse Stock Split is effected and the market price of the shares of our Common Stock then declines, the percentage

decline may be greater than would occur in the absence of the Reverse Stock Split. Additionally, the liquidity of the shares of

our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the implementation

of the Reverse Stock Split. |

| · | The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of Common Stock.

Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally

somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. |

THE BOARD RECOMMENDS A VOTE “FOR”

THE AMENDMENT OF THE CERTIFICATE OF INCORPORATION TO EFFECT THE REVERSE STOCK SPLIT.

PROPOSAL 2—ADJOURNMENT

PROPOSAL

Introduction

If at the Special Meeting the number of

shares of Common Stock present or represented and voting in favor of the Reverse Stock Split is insufficient to approve the Reverse

Stock Split, management may move to adjourn, postpone or continue the Special Meeting in order to enable the Board to continue

to solicit additional proxies in favor of the proposed the Reverse Stock Split.

In this Adjournment Proposal, we are asking

you to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning, postponing or continuing the Special

Meeting and any later adjournments. If the stockholders approve the Adjournment Proposal, we could adjourn, postpone or continue

the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies

in favor of the Reverse Stock Split. Among other things, approval of the Adjournment Proposal could mean that, even if proxies

representing a sufficient number of votes against the Reverse Stock Split have been received, we could adjourn, postpone or continue

the Special Meeting without a vote on the Reverse Stock Split and seek to convince the holders of those shares to change their

votes to votes in favor of the Reverse Stock Split.

What vote is required to approve the Adjournment Proposal?

The Adjournment Proposal will be approved

if a majority of the shares of Common Stock present in person or by proxy votes FOR the proposal. Accordingly, abstentions

and broker non-votes, if any, will be counted as votes AGAINST the Adjournment Proposal. No proxy that is specifically marked

AGAINST the Reverse Stock Split will be voted in favor of the Adjournment Proposal, unless it is specifically marked FOR the

discretionary authority to adjourn, postpone or continue the Special Meeting to a later date.

Why am I being asked to vote on the Adjournment Proposal?

The Board believes that if the number of

shares of Common Stock present or represented at the Special Meeting and voting in favor of the Reverse Stock Split proposal are

insufficient to approve such proposal, it is in the best interests of the stockholders to enable the Board, for a limited period

of time, to continue to seek to obtain a sufficient number of additional votes to approve the Reverse Stock Split.

THE BOARD RECOMMENDS A VOTE “FOR”

APPROVAL OF THE ADJOURNMENT PROPOSAL.

OTHER MATTERS

The Company is unaware of any business,

other than described in this Proxy Statement, that may be considered at the Special Meeting. If any other matters should properly

come before the Special Meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxies

held by them in accordance with their best judgment.

To assure the presence of the necessary

quorum and to vote on the matters to come before the Special Meeting, please promptly indicate your choices via the Internet, by

phone or by mail, according to the procedures described on the proxy card. The submission of a proxy via the internet, by phone

or by mail does not prevent you from attending and voting at the Special Meeting.

AVAILABLE INFORMATION

The Company is subject to the informational

requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith, files reports and other information

with the Securities and Exchange Commission (the “SEC”). Any interested party may inspect

information filed by the Company, without charge, at the public reference facilities of the SEC at its principal office at 100

F. Street, N.E., Washington, D.C. 20549. Any interested party may obtain copies of all or any portion of the information filed

by the Company at prescribed rates from the Public Reference Section of the SEC at its principal office at 100 F. Street, N.E.,

Washington, D.C. 20549. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements

and other information regarding the Company and other registrants that file electronically with the SEC at http://www.sec.gov.

The Company’s Common Stock is

listed on The NASDAQ Capital Market and trades under the symbol “VPCO”.

ANNEXES

ANNEX A Form of Proxy Card

ANNEX B Certificate of Amendment

to Certificate of Incorporation regarding the Reverse Stock Split

| |

By Order of the Board of Directors, |

|

| |

|

|

| |

/s/ Jeffrey Holman |

|

| |

Chairman and Chief Executive Officer |

|

February [__], 2016

Please sign and return the enclosed form

of proxy promptly. If you decide to attend the meeting, you may, if you wish, revoke the proxy and vote your shares in person.

Annex A

VAPOR CORP.

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS

SPECIAL MEETING

OF STOCKHOLDERS—[March 1], 2016 AT 10:00 A.M.

VOTING INSTRUCTIONS

If you vote by phone or internet, please

DO NOT mail your proxy card.

| MAIL: | Please mark, sign, date, and return this Proxy Card promptly using the enclosed envelope. |

| PHONE: | Call 1 (800) 690-6903 |

| INTERNET: | https://www.proxyvote.com |

Control ID:

Proxy ID:

Password:

| |

| MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING: ☐ |

| MARK HERE FOR ADDRESS CHANGE ☐ New Address (if applicable): |

| |

| |

| |

IMPORTANT: Please sign exactly as your name

or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator,

attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name

by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized

person.

Dated: _____ ___, 2016

| (Print Name of Stockholder and/or Joint Tenant) |

| |

| |

| (Signature of Stockholder) |

| |

| |

| (Second Signature if held jointly) |

The stockholder(s) hereby appoints Jeffrey

Holman and Gregory Brauser, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes

them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of voting stock of VAPOR CORP.

that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholder(s) to be held at 10:00 A.M. Eastern Time

on [Tuesday, March 1], 2016, at Vapor’s headquarters, located at 3001 Griffin Road, Dania Beach, Florida 33312, and any

adjournment or postponement thereof.

This proxy, when properly executed, will

be voted in the manner directed herein. If no such direction is made, this proxy will be voted “FOR” Proposals 1 and

2. If any other business is presented at the meeting, this proxy will be voted by the above-named proxies at the direction of the

Board of Directors. At the present time, the Board of Directors knows of no other business to be presented at the meeting.

Proposal:

The Board of Directors recommends you vote FOR Proposals

1 and 2.

| |

|

FOR |

|

AGAINST |

|

ABSTAIN |

| (1) |

To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to effect a reverse stock split of our issued and outstanding shares of Common Stock at a ratio and effective upon a date to be determined by the Company’s board of directors (the “Reverse Stock Split”). |

¨ |

|

¨ |

|

¨ |

| (2) |

To authorize an adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the Reverse Stock Split (the “Adjournment Proposal”). |

¨ |

|

¨ |

|

¨ |

| NOTE: In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

|

|

|

Annex B

CERTIFICATE OF AMENDMENT TO CERTIFICATE

OF INCORPORATION

OF VAPOR CORP.

Vapor Corp. (the “Company”),

a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Delaware General

Corporation Law”), hereby certifies as follows:

1. Pursuant to Sections 242 and 228 of

the Delaware General Corporation Law, the amendment herein set forth has been duly approved by the Board of Directors and holders

of a majority of the outstanding capital stock of the Company.

2. Section 4 of the Certificate of Incorporation

is amended by adding the following paragraph:

“Upon the effectiveness of this Certificate

of Amendment to the Certificate of Incorporation of the Corporation, every [number of shares] shares of the Corporation’s

issued and outstanding Common Stock, par value $0.0001 per share, that are issued and outstanding immediately prior to

[date] shall, automatically and without any further action on the part of the Corporation or the holder thereof, be combined into

one (1) validly issued, fully paid and non-assessable share of the Corporation’s Common Stock, par value $0.0001 per share,

provided that in the event a stockholder would otherwise be entitled to a fraction of a share of Common Stock pursuant to the

provisions of this Article, such stockholder shall receive one whole share of Common Stock in lieu of such fractional share and

no fractional shares shall be issued.”

3. The foregoing amendment shall be effective

as of ____ on _________, 2016.

4. This Certificate of Amendment to Certificate

of Incorporation was duly adopted and approved by the stockholders of this Company on the _ day of _______, 2016 in accordance

with Section 242 of the Delaware General Corporation Law.

IN WITNESS WHEREOF, the undersigned has

executed this Certificate of Amendment to Certificate of Incorporation as of the _____ day of _____, 2016.

| |

VAPOR CORP. |

| |

|

|

| |

By |

/s/ Jeffrey Holman |

| |

|

Jeffrey Holman |

| |

|

Chief Executive Officer |

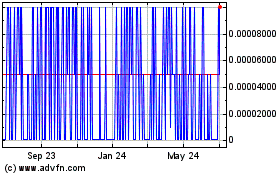

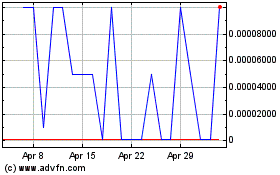

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024