Current Report Filing (8-k)

February 02 2016 - 12:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 29, 2016

Jones Soda Co.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction of Incorporation)

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

66 S. Hanford Street, Suite 150

Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Secured Promissory Note

On January 29, 2016, the Company entered into an amendment and restatement of its short-term non-revolving secured promissory note (the “Amended Note”) that it previously entered into with CapitalSource Business Finance Group, a dba of BFI Business Finance (the “Lender”), on January 6, 2016 (the “Original Note”). (The Amended Note is dated for reference purposes as of January 26, 2016.) Under the terms of the Amended Note, the dates for making draws, the monthly repayment dates and maturity date have been extended, as follows:

|

·

| |

the Company may borrow from Lender, against purchase orders received by the Company, up to $500,000 in principal advances at any time on or prior to March 31, 2016; |

|

·

| |

monthly principal payments are due as follows: 20% of the outstanding principal balance as of March 31, 2016 will be due and payable on each of April 30, May 31 and June 30, 2016; and |

|

·

| |

the remaining principal balance will be due in full on July 31, 2016. |

Except as described above, no other amendments were made to the terms of the Original Note.

As of the date of this Current Report, the Company has not made any borrowings under the Amended Note or the Original Note.

The foregoing description of the material terms of the Amended Note is qualified in its entirety by reference to the Secured Promissory Note dated as of January 26, 2016, by Jones Soda Co. (USA) Inc. and Jones Soda (Canada) Inc. in favor of Lender, a copy of which is attached as Exhibit 10.1 to this Current Report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

10.1

|

Secured Promissory Note dated as of January 26, 2016, by Jones Soda Co. (USA) Inc. and Jones Soda (Canada) Inc. in favor of CapitalSource Business Finance Group, a dba of BFI Business Finance.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JONES SODA CO.

(Registrant)

|

|

|

|

|

|

|

February 2, 2016

|

|

By:

|

/s/ Jennifer L. Cue

|

|

|

|

|

|

Jennifer L. Cue, Chief Executive Officer

|

EXHIBIT 10.1

SECURED PROMISSORY NOTE

(Purchase Order Financing - Non-Revolving)

$500,000.00 January 26, 2016

FOR VALUE RECEIVED, Jones Soda Co. (USA) Inc., a(n) Washington corporation ("Jones USA") and JONES SODA (CANADA), INC. a(n) Canadian corporation ("Jones Canada") ("Jones USA and Jones Canada, each individually and collectively the "Borrower"), promises to pay to CapitalSource Business Finance Group, a dba of BFI Business Finance, a California corporation ("Lender"), or order, at Lender's place of business at 851 East Hamilton Avenue, 2nd Floor, Campbell, California 95008, or at such other place as may be designated in writing to Borrower by the holder of this Secured Promissory Note (this "Note"), such principal sum as may be advanced hereunder as set forth in Addendum A attached hereto and made a part hereof, which shall be subject to the terms and conditions of that certain Loan and Security Agreement dated December 27, 2013 and all of the riders and amendments thereto by and between Borrower and Lender (the "Loan Agreement"), together with interest from the date hereof on the unpaid principal balance at a rate (the "Rate") of two percentage point(s) (2.00%) per annum over and above the rate announced as the "prime" rate in the Western Edition of the Wall Street Journal which is in effect from time to time (the "Prime Rate"); provided that the Prime Rate shall at all times be deemed to be not less than ---zero--- percent (0.00%) per annum (the "Deemed Prime Rate"). In the event that the Prime Rate is changed, the adjustment in the interest rate charged shall be made on the day such change occurs. The Prime Rate is a rate used by certain financial institutions as one of their index rates and serves as a basis upon which effective rates of interest are calculated for loans making reference thereto and may not be the lowest of such financial institutions' index rates. Upon the occurrence of a default or an event of default under this Note, the rate of interest on the Note shall be increased at the option of Lender to an additional three percent (3.00%) in excess of the then applicable interest rate. Interest shall be computed on the basis of a 360-day year and shall be charged to Borrower's account on the first day of the following month, and, if not so paid, it shall thereafter bear like interest as the principal.

|

1.

Lender may, at its option, charge Borrower's account for the principal, interest, and fees hereunder, which are due and payable on the dates and in the manner that follows: |

|

(a)

| |

Interest payments will be due and payable in arrears commencing on the first day of the first month following disbursement and continuing on the first day of each month thereafter while amounts hereunder are due and owing; |

|

(b)

| |

Principal payments will be due and payable as set forth in Addendum A attached hereto and made a part hereof; |

|

(c)

| |

A loan fee shall be charged as set forth in Addendum A attached hereto and made a part hereof; |

|

(d)

| |

An administrative fee of fifteen hundredths of one percent (0.15%) per month of the daily outstanding balance during the preceding month, (the "Administrative Fee") shall be charged on the first day of each month following disbursement and monthly thereafter while amounts hereunder are due and owing; |

|

(e)

| |

An appraisal fee of -----n/a----- and 00/100 Dollars ($-----n/a-----) (the "Appraisal Fee") shall be charged for each appraisal of the Collateral performed by Lender or its agents; |

|

(f)

| |

Lender will transfer all loan payments due under this Note, including all accrued interest, Administrative Fees, and fees as set forth in Addendum A attached hereto and made a part hereof, to the accounts receivable line of credit extended to Borrower pursuant to the Loan Agreement; |

|

(g)

| |

Borrower shall pay all fees and legal and other costs incurred by Lender in connection with the negotiation and preparation of this Note and the documents executed in connection herewith and the perfection of any security interest in any collateral granted by Borrower or any third party to Lender in connection with this Note, including but not limited to attorneys' fees and legal and other costs, which Lender shall charge to Borrower's account at the time of the execution hereof; |

|

(h)

| |

On the Purchase Order Line of Credit Maturity Date (as defined in Section 14(e) hereof) the entire principal balance hereof, together with any and all unpaid and/or accrued interest, loan fees, monthly Administrative Fees, and attorneys' fees and legal and other costs due hereunder, shall be paid in full; |

|

(i)

| |

Interest not paid when due shall bear interest at the same rate as principal. All payments hereunder are to be applied first to the payment of accrued interest and the balance remaining applied to the payment of principal. All principal and interest due hereunder is payable in lawful money of the United States of America; and |

|

(j)

| |

In no event shall the interest rate or rates payable under this Note, plus any other amounts paid in connection herewith, exceed the highest rate permissible under any law that a court of competent jurisdiction shall, in a final determination, deem applicable. Borrower and Lender intend legally to agree upon the rate or rates of interest (and the other amounts paid in connection herewith) and manner of payment stated within this Note; provided, however, that anything contained herein to the contrary notwithstanding, if said interest rate or rates of interest (or other amounts paid in ·connection herewith) or the manner of payment exceeds the maximum allowable under applicable law, then, ipso facto as of the date of this Note, Borrower is and shall be liable only for the payment of such maximum as allowed by law, and payment received from Borrower in excess of such legal maximum, whenever received, shall be applied to reduce the principal balance of this Note to the extent of such excess. |

|

2.

Voluntary prepayments of the principal balance of this Note shall be permitted at any time; provided that each such prepayment shall be accompanied by all interest and any Administrative Fees that have accrued and remain unpaid with respect to the amount of principal being repaid and a prepayment fee equal to the following: |

|

(a)

| |

----------NIA---------- percent (----------N/A----------%) of the amount prepaid with respect to any prepayments made during the first 11 months following the first principal payment on , 20 . |

|

(b)

| |

----------NIA---------- percent (----------N/A----------%) of the amount prepaid with respect to any prepayments made on or after ----------NIA----------, and prior to July 31, 2016. |

Amounts repaid or prepaid with respect to this Note may not be reborrowed. Partial prepayments of principal shall be applied to scheduled payments of principal in the inverse order of their maturity.

|

3.

If any installment of principal, interest, or Administrative Fee hereunder is not paid when due, the holder shall have the following rights in addition to the rights set forth herein, in the Loan Agreement, and under law: |

|

(a)

| |

the right to compound interest and the Administrative Fee by adding the unpaid interest and/or Administrative Fee to principal, with such amount thereafter bearing interest and the Administrative Fee at the rates provided in this Note; and |

|

(b)

| |

if any installment is more than ten (10) days past due, the right to collect a charge equal to the greater of Fifteen and 00/100 Dollars ($15.00) or five percent (5%) of the late payment for each month in which it is late. This charge is a result of a reasonable endeavor by Borrower and the holder to estimate the holder's added legal and other costs and damages resulting from Borrower's failure to make timely payments under this Note; hence Borrower agrees that the charge shall be presumed to be the amount of damage sustained by the holder since it is extremely difficult to determine the actual amount necessary to reimburse the holder for damages. |

|

4.

Borrower expressly waives presentment, demand, protest, notice of dishonor, ·notice of non-payment, notice of maturity, notice of protest, presentment for the purpose of accelerating maturity, diligence in collection, the benefit of any exemption under the homestead exemption laws, and all other notices and demands in connection with the delivery, acceptance, performance, or enforcement of this Note. Borrower agrees that Lender may release, surrender, exchange, or substitute any collateral now held or which may hereafter be held as security for the payment of this Note, and may extend the time for payment or otherwise modify the terms of payment of any part or the whole of the debt evidenced hereby. Borrower irrevocably waives the right to direct the application of all payments at any time hereafter received by Lender on behalf of Borrower, and Borrower agrees that Lender shall have the continuing exclusive right to apply any such payments against the then due and owing obligations of Borrower to Lender as Lender may deem advisable. |

|

5.

It is expressly agreed that if a default or breach occurs in the payment of any principal or interest, as provided above, or in the payment or performance of any other of Borrower's Obligations (as that term is defined in the Loan Agreement), at Lender's option, the unpaid principal balance of this Note, together with interest accrued thereon, shall forthwith be due and payable. Notwithstanding anything to the contrary in this Note, in the event the accounts receivable line of credit extended to Borrower under the Loan Agreement is paid in full, this Note shall also be due, owing, and payable. |

|

6.

This Note is made subject to the terms and conditions of and is secured by security interests granted by Borrower in favor of Lender, and all covenants, conditions, and agreements contained in the Loan Agreement and Intellectual Property Security Agreement dated December 27, 2013, all of which are hereby incorporated and made a part hereof. All capitalized terms used herein, unless otherwise defined herein, shall have the meanings ascribed to them in the Loan Agreement. |

|

7.

Borrower hereby consents to any and all renewals, replacements, and/or extensions of time for payment of this Note before, at, or after maturity. This Note shall be binding upon all legal representatives, successors, and assigns of Borrower. However, Borrower may not assign this Note or any rights hereunder without Lender's prior written consent. Neither an unconsented assignment nor

|

an assignment consented to by Lender shall release Borrower or any guarantor of any Obligation or indebtedness hereunder. Lender reserves the right to sell, assign, transfer, negotiate, or grant participations in all or any part of, or any interest in, Lender's rights and benefits under each of the documents executed herewith or hereafter. In connection therewith, Lender may disclose all documents and information which Lender now has or may hereafter acquire relating to any credit extended by Lender to Borrower, or about Borrower or its business, any guarantor or the business of any guarantor, or any Collateral required hereunder. Any waiver of any rights under this Note, the Loan Agreement, or under any other agreement, instrument, or paper signed by Borrower is neither valid nor effective unless made in writing and signed by Lender. No delay or omission on the part of the Lender in exercising any right shall operate as a waiver thereof or of any other right. |

|

8.

Borrower promises to pay all legal and other costs and expenses of collection of this Note and to pay all reasonable attorneys' fees incurred in such collection or in any suit or action to collect this Note or any appeal thereof. Borrower and Lender agree that this Note is entered into and Borrower's performance to Lender occurs at Campbell, California. This Note shall be governed by, construed under, and enforced in accordance with the laws of the State of California. |

|

9.

Any collateral pledged to secure any obligation of Borrower shall also secure any other obligation of Borrower except that any real property pledged to secure any obligation of Borrower shall only secure any other obligation of Borrower if Lender specifically so agrees in writing. |

|

10.

An Event of Default under this Note or the Loan Agreement shall be an Event of Default under each of such loan documents, and vice versa. |

|

11.

In the event any one or more of the provisions contained in this Note is held to be invalid, illegal or unenforceable in any respect, then such provision shall be ineffective only to the extent of such prohibition or invalidity, and the validity, legality, and enforceability of the remaining provisions contained herein shall not in any way be affected or impaired thereby. |

|

12.

This Note, or a signature page thereto intended to be attached to a copy of this Note, signed and transmitted by facsimile machine, telecopier, or other electronic means (including via transmittal of a “pdf” file) shall be deemed and treated as an original document. The signature of any person thereon, for purposes hereof, is to be considered as an original signature, and the document transmitted is to be considered to have the same binding effect as an original signature on an original document. At the request of any party hereto, any facsimile, telecopy or other electronic document is to be re-executed in original form by the persons who executed the facsimile, telecopy of other electronic document. No party hereto may raise the use of a facsimile machine, telecopier, or other electronic means or the fact that any signature was transmitted through the use of a facsimile machine, telecopier, or other electronic means as a defense to the enforcement of this Note. |

|

13.

This is an integrated Note and supersedes all prior agreements or negotiations regarding the subject matter hereof. This Note may only be amended in writing. This Note amends and restates that certain Secured Promissory Note dated as of ----------NIA---------- by Jones Soda Co. (USA) Inc, and JONES SODA (CANADA), INC., however, this Note is not a novation of such prior Secured Promissory Note or the terms contained therein. |

This Note is subject to the terms and conditions set forth in Addendum A attached hereto and made a part hereof by this reference.

IN WITNESS HEREOF, this Secured Promissory Note has been executed and delivered as of the date first set forth above.

Jones Soda Co. (USA) Inc.

/s/ Jennifer L. Cue

By:Jennifer L. Cue

Title:President

JONES SODA (CANADA), INC.

/s/ Jennifer L. Cue

By:Jennifer L. Cue

Title:President

ADDENDUM A

Pursuant to this Addendum A to Secured Promissory Note (this "Addendum") executed by Jones Soda Co. (USA) Inc. and JONES SODA (CANADA), INC. (individually and collectively, the "Borrower") and CapitalSource Business Finance Group, a dba of BFI Business Finance ("Lender"), the foregoing Secured Promissory Note (the "Note") is hereby amended and/or supplemented by the following terms and conditions, which are incorporated by this reference in the Note as the following additional paragraphs to the Note:

|

14.

Borrower has requested, and Lender has agreed, subject to certain conditions, to provide, on a temporary basis under this Note certain financial accommodations based on Borrower's purchase orders as follows: |

|

(a)

Commencing on or about December 18, 2015, Lender will provide Borrower with financial accommodations based on certain of Borrower's purchase orders issued to Borrower by 7-Eleven's designated supplier under the terms of an agreement between Borrower and 7-Eleven Corporation (and expected to become accounts receivable as described in 14(c) below) (each a "Purchase Order" and collectively, the "Purchase Orders") that are acceptable to Lender (in its Sole Discretion) in order to permit Borrower to fulfill its Purchase

|

|

(b)

Lender will at its Sole Discretion lend to Borrower against the Purchase Orders (copies of which shall be provided to Lender twenty-four (24) hours in advance of each request for funds, together with any other information requested by Lender). Advances under this Note are at the discretion of the Borrower so long as i) each advance is not less than One Hundred Thousand and 00/100 Dollars ($100,000.00); ii) the combined aggregate advances hereunder do not exceed a maximum amount of Five Hundred Thousand and 00/100 ($500,000.00) (the "Purchase Order Line of Credit"); and iii) all advances are completed on or before March 31, 2016. Amounts repaid or prepaid with respect to this Note may not be reborrowed. |

|

(c)

Borrower will promptly provide Lender with copies of each Account that is generated as a part of the customer's receipt of the goods fulfilling any of the Purchase Orders. |

|

(d)

Principal payments equal to twenty percent (20%) of the outstanding principal balance hereunder as of the last business day of March 2016 will be due monthly, beginning April 30, 2016 and continuing thru June 30, 2016 (each a "Monthly Payment"). The amount of the Monthly Payment will be transferred to, and constitute an outstanding Advance under, the Domestic A/R Borrowing Base under the Loan Agreement. Additionally, on the Purchase Order Line of Credit Maturity Date, Lender will allow a maximum of One Hundred Seventy-five Thousand and 00/100 Dollars ($175,000.00) to be transferred to, and constitute and outstanding Advance under, the Inventory Borrowing Base under the Loan Agreement. |

|

(e)

The Purchase Order Line of Credit will be due, owing and payable in full on July 31, 2016 (the "Purchase Order Line of Credit Maturity Date"). |

|

(f)

Borrower shall pay a fee of Three Percent (3.00%) of the amount of each and every Advance hereunder as a condition to the granting of the Purchase Order Line of Credit. |

|

(g)

Notwithstanding any contrary provision herein, interest accrued under this Note shall not be included in the definition of Accrued Interest set forth in the Loan Agreement, nor shall it be included in the calculation of the Cumulative Minimum Annual Interest Payment set forth in the Loan Agreement. |

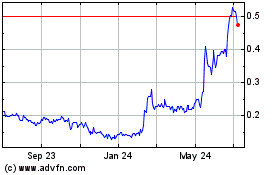

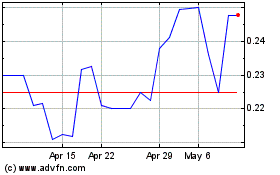

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Sep 2023 to Sep 2024