U.

S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

(Mark

one)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1931

For

the fiscal year ended June 30, 2015

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ___ to ___

Commission

File No. 0-15113

| |

VERITEC, INC. |

|

| |

(Exact Name of Registrant as Specified

in its Charter) |

|

| Nevada |

95-3954373 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

(IRS

Employer

Identification

No.) |

| |

|

| 2445

Winnetka Avenue N. Golden Valley, MN |

55427 |

| (Address

of principal executive offices) |

(Zip

Code) |

| |

|

| Registrant’s

Telephone Number, Including Area Code: |

763-253-2670 |

| |

|

| Securities

registered under Section 12(b) of the Act: |

None |

| |

|

| Securities

registered under Section 12(g) of the Act: |

Common

stock, $.01 par value |

| |

(Title

of Class) |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 S-T during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☐ |

Smaller

Reporting Company ☒ |

| |

|

(Do

not check if a smaller reporting company)

|

|

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the

Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

aggregate market value of the common stock of the registrant held by non-affiliates, computed by reference to the average bid

price of the common stock on December 31, 2014, was $1,273,607.

Number

of shares outstanding as of December 15, 2015 was: 39,538,007.

VERITEC,

INC.

FORM

10-K

FOR

THE FISCAL YEAR ENDED JUNE 30, 2015

TABLE

OF CONTENTS

| FORWARD-LOOKING

STATEMENTS |

3 |

| PART

I |

|

| ITEM

1 |

BUSINESS |

3 |

| ITEM

2 |

PROPERTIES |

7 |

| ITEM

3 |

LEGAL

PROCEEDINGS |

7 |

| ITEM

4 |

MINE

SAFETY DISCLOSURES |

7 |

| PART

II |

|

| ITEM

5 |

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

8 |

| ITEM

6 |

SELECTED

FINANCIAL DATA (not applicable) |

9 |

| ITEM

7 |

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL AND REULSTS OF OPERATIONS |

9 |

| ITEM

8 |

FINANCIAL

STATEMENTS |

12 |

| ITEM

9 |

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

31 |

| ITEM

9A |

CONTROLS

AND PROCEDURES |

31 |

| ITEM

9B |

OTHER

INFORMATION |

32 |

| PART

III |

|

| ITEM

10 |

DIRECTORS,

EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE |

33 |

| ITEM

11 |

EXECUTIVE

COMPENSATION |

35 |

| ITEM

12 |

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

36 |

| ITEM

13 |

CERTAIN RELATIONSHIPS

AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

37 |

| ITEM

14 |

PRINCIPAL

ACCOUNTANT FEES AND SERVICES |

37 |

| PART

IV |

|

| ITEM

15 |

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES |

41 |

PART

I

FORWARD-LOOKING

STATEMENTS

This

Annual Report on Form 10-K (“Annual Report”), the other reports, statements, and information that we have previously

filed or that we may subsequently file with the Securities and Exchange Commission (“SEC”) and public announcements

that we have previously made or may subsequently make include, may include, incorporate by reference or may incorporate by reference

certain statements that may be deemed to be forward-looking statements. The forward-looking statements included or incorporated

by reference in this Annual Report and those reports, statements, information and announcements address activities, events or

developments that Veritec, Inc. (together with its subsidiaries hereinafter referred to as “we,” “us,”

“our”, the "Company" or “Veritec”) expects or anticipates will or may occur in the future. Any

statements in this document about expectations, beliefs, plans, objectives, assumptions or future events or performance are not

historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words

or phrases such as “may,” “should,” “could,” “predict,” “potential,”

“believe,” “will likely result,” “expect,” “will continue,” “anticipate,”

“seek,” “estimate,” “intend,” “plan,” “projection,” “would”

and “outlook,” and similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties,

which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified

in their entirety by reference to the factors discussed throughout this document. All forward-looking statements concerning economic

conditions, rates of growth, rates of income or values as may be included in this document are based on information available

to us on the dates noted, and we assume no obligation to update any such forward-looking statements.

ITEM

1 BUSINESS

Summary

The

Company was primarily engaged in the development, marketing, sales and licensing of products and rendering of professional services

related thereto in the following two fields of technology: (1) proprietary two-dimensional matrix symbology (also commonly referred

to as “two-dimensional barcodes” or “2D barcodes”), and (2) mobile banking prepaid debit card solutions.

Subsequent to June 30, 2015, the Company sold its barcode technology and focused its efforts solely on its mobile banking technology.

In

this Form 10-K, the Company’s two-dimensional matrix symbology technology will hereafter be referred to as the Company’s

“Barcode Technology”, and the Company’s mobile software banking technology will hereafter be referred to as

its “Mobile Banking Technology”. The Mobile Banking Technology is used to offer Prepaid Card Programs to sponsor banks

and approved applicants/cardholders. These programs may also be referred to as the MTC™ card or the Blinx ON-OFF™

Prepaid Card programs.

Company

History

Veritec,

Inc. was incorporated in the State of Nevada on September 8, 1982 for the purpose of development, marketing and sales of a line

of microprocessor based encoding and decoding system products that utilize matrix symbology technology, a two-dimensional barcode

technology originally invented by the founders of Veritec under United States patents 4,924,078, 5,331,176, 5,612,524 and 7,159,780.

In

1995, an involuntary proceeding under Chapter 7 of the United States Bankruptcy Code was commenced against Veritec. The proceeding

was subsequently converted to a Chapter 11 proceeding and a plan of reorganization was confirmed on April 23, 1997. The Chapter

11 plan was successfully completed and the proceeding was closed on October 13, 1999.

In

November 2003, Veritec formed a wholly owned subsidiary, Vcode, Inc., to which it assigned its United States patents 4,924,078,

5,331,176 and 5,612,524, together with all corresponding patent applications, foreign patents, foreign patent applications, and

all continuations, continuations in part, divisions, extensions, renewals, reissues and re-examinations. Vcode in turn entered

into an Exclusive License Agreement with VData LLC (VData), an Illinois limited liability company unrelated to Veritec.

The

purpose of the incorporation of Vcode and the Exclusive Licensing Agreement was to allow VData to pursue enforcement and licensing

of the patents against parties who wrongfully exploit the technology of such patents. VData is the wholly owned subsidiary of

Acacia Research Corporation (NASDAQ: ACTG). The Exclusive License Agreement provided that all expenses related to the enforcement

and licensing of the patents will be the responsibility of VData, with the parties sharing in the net proceeds, as specified under

the terms of the agreement, arising from enforcement or licensing of the patents. In November 2008, VData and Vcode mutually agreed

to terminate the Exclusive License Agreement between the two companies. As a result of the termination of the Exclusive License

Agreement and conclusion of all lawsuits and enforcement activities by VData, infringement revenue has ceased.

In

February 2005, an adverse ruling was made in the arbitration proceeding against Veritec in favor of Mitsubishi. This ruling compelled

Veritec to file a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy

Court (Bankruptcy Court) for the District of Minnesota on February 28, 2005. After reaching an agreement with Mitsubishi and other

creditors, in April 2006, Veritec’s Third Amended Plan of Reorganization was confirmed by the Bankruptcy Court. On August

8, 2006, the Bankruptcy Court entered an Order and Final Decree and closed the Chapter 11 case. In connection with the settlement

with Mitsubishi, Veritec obtained a license to certain Mitsubishi EDAC technology and Veritec granted Mitsubishi a license to

Veritec’s proprietary VeriCode® Barcode Technology software.

Pursuant

to an April 27, 2007 agreement between Veritec and RBA International, Inc. (“RBA”), Veritec acquired from RBA the

source code, documentation and software to RBA’s Java and IVR software (used for the RBA banking system). In furtherance

of such agreement, RBA granted Veritec a perpetual royalty-free non-exclusive worldwide license to use, modify and distribute

such software, without restriction, to any existing or future customers. Veritec’s development under this license, as well

as Veritec’s independent development of its own mobile banking applications and components, and integration of such items

comprises Veritec’s Mobile Banking Technology.

On

January 12, 2009, Veritec formed a wholly owned subsidiary, Veritec Financial Systems, Inc., a Delaware corporation, to bring

its Mobile Banking Technology, products and related professional services to market. In May 2009 Veritec was registered by Security

First Bank in Visa’s Third Party Registration Program as a Cardholder Independent Sales Organization and Third-Party Servicer.

As a Cardholder Independent Sales Organization, Veritec was able to promote and sell Visa branded card programs. As a Third-Party

Servicer, Veritec provided back-end cardholder transaction processing services for Visa branded card programs on behalf of Security

First Bank. As of October 2010 the Company’s registration with Security First Bank terminated. As of April 2011, the Company

signed an ISO and processor agreement with Palm Desert National Bank (which was later assigned to First California Bank) to market

and process the Company’s Visa branded card program on behalf of the bank.

The

program was implemented at First California Bank (FCB) in June, 2011. The blinx On-Off brand was introduced as part of the implementation,

at FCB. Going forward, accounts would be issued as blinx ON-OFF™ branded cards under First California Bank. In 2013 First

California Bank was acquired by Pacific Western Bank (PWB) in its entirety. PWB decided to exit the Prepaid Card sponsorship business

and notified all of its Prepaid Card Program Managers, including (Veritec) that their bank sponsorship agreements were terminated

and the programs would be closed by the end of 2013. PWB provided Veritec several references to banks that were interested in

sponsoring Prepaid Card programs such as Veritec’s blinx ON-OFF™ program including Central Bank of Kansas City (CBKC).

Veritec entered into discussions with CBKC about sponsoring the Veritec program and a sponsorship agreement was reached between

Veritec and CBKC in October 2013. The Visa and First Data Payment Networks approved the bank sponsorship change in November, 2013.

Unexpected regulatory delays to the transfer process caused PWB to extend the program closure date to February 28, 2014. The transfer

and transition of the blinx ON-OFF™ Prepaid Card program from PWB to CBKC was completed on February 5, 2014. The Veritec

blinx ON-OFF™ Prepaid Card Program became live at CBKC on that date.

The

Veritec Prepaid Card Program provides full services to the sponsor bank. These services include program management, promotion

and marketing, application processing, account activation, compliance management, fraud monitoring, accounts reconciliation and

dispute resolution. Veritec provides cardholders with automated and live agent customer service, full disclosures, an online account

management portal, monthly statements, convenient deposit options, global access to PIN and Signature transactions, and, ATM withdrawals

through the Visa and First Data/Star Networks.

On

September 30, 2014, Veritec ("Buyer"), and Tangible Payments LLC ("Seller"), a Maryland Limited Liability

Company, entered into an Asset Purchase Agreement (the "Asset Purchase Agreement") pursuant to which Veritec acquired

certain assets and liabilities of the Tangible Payments LLC. Tangible Payments is a combined-solution software package that incorporates

features the market is currently purchasing as an individual-solutions product that requires integrated services at an additional

cost. With a one-stop package, Tangible’s Payments solution eliminates costs and reduces deployment time.

On

September 30, 2015, the Company sold all of its assets of its Barcode Technology to The Matthews Group, a related party, which

was comprised solely of its intellectual property. The sale allows the Company to focus its efforts solely on its growing Mobile

Banking Technology.

Our

Products and Solutions

The

Company’s Barcode Technology was originally invented by the founders of Veritec under United States patents 4,924,078, 5,331,176,

5,612,524 and 7,159,780. Our principal licensed product to date that contains our VeriCode ® Barcode Technology has been a

product identification system for identification and tracking of manufactured parts, components and products mostly in the liquid

crystal display (LCD) markets. The VeriCode® symbol is a two-dimensional high data density machine-readable symbol that can

contain up to approximately 500 bytes of data.The Company’s VSCode® Barcode Technology is a derivative of the VeriCode®

symbol with the ability to encrypt a greater amount of data by increasing data density. The VSCode ® is a data storage “container”

that offers a high degree of security and which can also be tailored to the application requirements of the user. The VSCode ®

symbol can hold any form of binary information that can be digitized, including numbers, letters, images, photos, graphics, and

the minutia for biometric information, including fingerprints and facial image data, to the extent of its data storage capacity,

that are likewise limited by the resolution of the marking and reading devices employed by the user. VSCode ® is ideal for

secure identification documents (such as national identification cards, driver’s licenses, and voter registration cards),

financial cards, medical records and other high security applications. In its PhoneCodes™ product platform, Veritec developed

software to send, store, display, and read a VeriCode® Barcode Technology symbol on the LCD screen of a mobile phone. With

the electronic media that provide the ease of transferring information over the web, Veritec’s PhoneCodes™ technology

enables individuals and companies to receive or distribute gift certificates, tickets, coupons, receipts, or engage in banking

transactions using the VeriCode ® technology via wireless phone or PDA.

On

September 30, 2015, the Company sold all of its assets of its Barcode Technology, which was comprised solely of its intellectual

property. The sale allows the Company to focus its efforts solely on its growing Mobile Banking Technology.

| II. | Mobile

Banking Technology |

The

Company believes that its Mobile Banking Technology platform and its blinx On-Off™ debit card Program is a significant advance

in mobile banking and close loop/open loop debit technology and is capable of bringing significant value to card issuing and sponsoring

organizations, whether they be commercial or government.

| (a) | MTC™

Debit Card - Visa® Prepaid Card Programs |

In

the fourth quarter of fiscal 2009, the Company announced the release of its Mobile Toggle Card (MTC™) Program on the Company’s

mobile banking software platform under the sponsorship of Security First Bank. Veritec’s mobile banking software platform

is a debit based, pre-paid and gift card solution that is licensed by Veritec’s wholly owned subsidiary, Veritec Financial

Systems, Inc. to debit card issuers and sponsoring organizations. Under the MTC™ Program, card issuers and sponsors may

provide the MTC™ branded debit or gift cards to individuals with and without demand deposit accounts (e.g., the latter the

“under-banked”). The MTC™ card may be part of a Visa® branded program and, as such, the cards are accepted

anywhere in the world that Visa cards are accepted.

With

an MTC™ card, the cardholders are empowered to combat unpermitted and fraudulent use of their debit cards by “toggling”

their cards “on” and “off” with their mobile phones. Cardholders no longer have to completely rely on

their card issuers to monitor possible fraudulent activity on their accounts. Cardholders can now de-activate their cards themselves,

in real time, any time they choose to do so. In addition to this toggling feature, cardholders may apply for their cards online,

arrange for direct deposits to be made to their cards, and transfer money to their card from another account. Cardholders may

also elect to receive various alerts on their mobile phones about activity on their card. In the first quarter of fiscal 2010,

the Company began accepting applications for the MTC™ card from individual applicants and issuing live Visa® branded

debit cards under the MTC Mobile Toggle Card Program.

| (b) | blinx

ON-OFF Debit Card - Visa® Prepaid Card Programs |

In

June, 2011 Veritec began marketing the blinx ON-OFF™ branded card under the sponsorship of First California Bank, The blinx

ON-OFF™ card is based on the Mobile Banking Technology platform and offers the same features and functions as the MTC™

branded card but with different pricing for First California Bank sponsored cards.

| (c) | Custom

Branded Debit Card Programs |

In

addition to the MTC™ and blinx ON-OFF™ branded program, the Company enables card issuers and sponsors to issue debit,

pre-paid and gift cards under their own branded programs through licensed use of the mobile banking platform and the Company’s

provision of related professional services.

Veritec’s

mobile banking solution also enables member card programs to be processed and settled member rewards to its members in either

an open or closed loop processing environment. In addition to its front-end licensing and professional services, the Company also

provides back-end card processing services to the card issuing institutions for all cardholder transactions on the licensed platform.

The Company’s Mobile Banking Technology resides within a Payment Card Industry (PCI) compliant data processing center.

Intellectual

Property Rights

The

Company was founded upon its intellectual property and in our opinion its intellectual property will give the Company a commercial

advantage in the global marketplace. The Company relies on patent, trade secret, copyright and trademark law, as well as the company’s

contractual terms with its customers, to define, maintain and enforce the Company’s intellectual property rights in its

Barcode Technology, Mobile Banking Technology and other technologies and relationships.

The

Company has a portfolio of Seven United States and Eight foreign patents. In addition, we have three U.S. and Eight

foreign pending patent applications.

A

significant amount of the Company’s intellectual property takes the form of trade secrets and copyrighted works of authorship.

The Company treats the source code to its Barcode Technology and Mobile Banking Technology as trade secrets, and its licensed

software applications are copyrightable subject matter.

We

have a portfolio of registered and pending trademarks in the U.S. and foreign jurisdictions, including registrations for

the marks “VSCode®” and “VeriCode®”. The Company uses “Veritec” as a trade mark and

service mark, as well as it serving as the Company’s trade name.

On

September 30, 2015, the Company sold all of its existing intellectual property relating to its Barcode Technology to The Matthews

Group, a related party (see Note 12 to the attached Consolidated Financial Statements).

Major

Customers

The

Company’s has two customers in fiscal 2015 that represented an aggregate of 23% of our revenue, and three customers in 2014

that represented 55% of our revenue. During fiscal 2015 and 2014, 45% and 70% respectively, of our revenue was from customers

outside the United States.

Engineering,

Research and Development

As

of June 30, 2015, the Company employed two engineers and engaged five engineering independent contractors. During the fiscal year

that ended June 30, 2015, we concentrated on several projects which included the development of our Mobile debit and member rewards

banking platform, and the continued development and support of the liquid crystal display (LCD) business the VeriSuite™

Bio-ID software platform, the PhoneCodes™ software platform. All of these projects are currently in various stages of development

or have been completed.

Competition

Our

Mobile Banking Technology competes with other independent sales organizations and third party services of Visa branded card programs,

including TransCash Corporation, Ready Debit Card by MetaBank, Millenium Advantage Card by New Millenium Bank, and Wired Plastic

by Bancorp Bank. The Company believes, however, that there are very few companies that have the Company’s collective attributes

of (1) being an independent sales organization of Visa branded and non-branded prepaid card programs, (2) being a third party

servicer (e.g., back end processor) for banks issuing Visa branded and non-branded prepaid card programs, (3) being the developer,

marketer and licensor of the mobile banking platform on which Visa branded and non-branded card program cardholder transactions

take place, and (4) having a mobile banking platform that enables real-time transaction processing and enabling cardholders to

manage their accounts by enabling cardholders to toggle their cards and their website accounts on and off via their mobile phones.

Employees

As

of June 30, 2015, the Company employed three employee and nine independent contractor consultants.

Financial

Information about Geographic Areas

For

the fiscal year ended, June 30, 2015, United States customers accounted for 55% (44% in fiscal 2014) of the Company’s total

revenue. The remaining revenue of 45% (56% in fiscal 2014) was from foreign customers. Our foreign revenues have been concentrated

primarily in Japan, Korea, Taiwan, China and Germany.

ITEM

2 PROPERTIES

We

lease approximately 4,200 square feet of office and laboratory space at 2445 Winnetka Avenue North, Golden Valley,

Minnesota, which serves as our primary place of business. This lease is with Van Thuy Tran, the Chairman of the Board and the

Chief Executive Officer of the Company. Our lease requires monthly payments of $4,200 which ran through June 30, 2015, and

was automatically extended for two one-year terms.

ITEM

3 LEGAL PROCEEDINGS

From

time to time, we are a party to claims and legal proceedings arising in the ordinary course of business. Our management evaluates

our exposure to these claims and proceedings individually and in the aggregate and provides for potential losses on such litigation

if the amount of the loss is estimable and the loss is probable.

In

December, 2013, the Company filed a complaint in Eighth Judicial District Court of Clark County, Nevada against Pacific Stock

Transfer Company (“Pacific”). Veritec utilized the service of Pacific to administer its securities transfer for a

period of time, but because we were dissatisfied with Pacific’s performance Veritec sent Pacific a letter terminating its

services as transfer agent. Pacific refused to turn over Veritec’s documents and filed a required termination notice, demanding

a termination fee” of $7,500. Believing it was being extorted and its securities documents held hostage, Veritec filed a

lawsuit seeking injunctive relief. On September 15, 2014, this case was settled between both parties to split the $11,260 deposited

with the Court.

Except

as set forth above, there are no material litigation matters at the current time.

ITEM

4 MINE SAFETY DISCLOSURES

Not

applicable.

PART

II

ITEM

5 MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market

Information

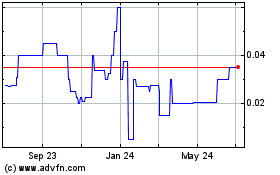

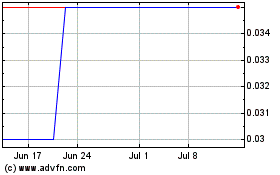

Our

common stock is quoted on the OTCQB under the symbol VRTC. Prior to that, our common stock was quoted on the OTC Bulletin Board.

Prior to September 4, 2009, our common stock was traded in the over the counter markets and quoted on the OTC Pink Sheets. The

following table sets forth the range of high and low bid quotes of our common stock per quarter as provided by the National Quotation

Bureau (which reflect inter-dealer prices without retail mark-up, mark-down or commission and may not necessarily represent actual

transactions).

| Market

Price Range of Common Stock |

Fiscal

2015 |

Fiscal

2014 |

| Quarter

Ended |

High |

Low |

High |

Low |

| September

30 |

$.15 |

$.05 |

$.09 |

$.09 |

| December

31 |

$.15 |

$.06 |

$.11 |

$.03 |

| March

31 |

$.11 |

$.28 |

$.07 |

$.07 |

| June

30 |

$.15 |

$.18 |

$.07 |

$.07 |

Shareholders

As

of December 11, 2015, there were approximately 790 shareholders of record, inclusive of those brokerage firms and/or clearinghouses

holding our common shares for their clientele.

Dividend

Information

We

have not paid or declared any dividends upon our common stock since our inception and, by reason of our present financial status

and contemplated financial requirements; we do not anticipate paying any dividends in the foreseeable future.

Unregistered

Sales of Equity Securities

During

fiscal year 2015 and 2014, we did not issue any other equity securities that were not registered under the Securities Act of 1933,

as amended.

Securities

Authorized for Issuance Under Equity Compensation Plans

The

following table sets forth information with respect to shares of common stock issuable under outstanding awards granted pursuant

to our equity compensation plan.

| Plan Category | |

Number of securities to be issued upon exercise

of outstanding options, warrants and rights | |

Weighted-average exercise price of outstanding

options, warrants and rights | |

Number of securities remaining available for future

issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved

by security holders | |

| — | | |

| — | | |

| — | |

| Equity compensation plans not approved by security holders (1) | |

| 2,520,000 | | |

$ | 0.42 | | |

| — | |

| | |

| | | |

| | | |

| | |

| Total | |

| 2,520,000 | | |

$ | 0.42 | | |

| — | |

(1)

The Board of Directors authorized the Chief Executive Officer to issue up to 1,000,000 shares of the Company’s common stock

in the form of options or stock bonuses to employees and consultants. The Company has agreements with certain employees that provide

for five years of annual grants of options, on each employment anniversary date, to purchase shares of the Company’s common

stock. The option price is determined based on the market price on the date of grant, the options vest one year from the date

of grant, and the options expire five years after vesting. The Company granted no options or stock bonuses to employees and consultants

under this arrangement in 2015 and 2014, respectively.

ITEM

6 SELECTED FINANCIAL DATA

The

Company, as a smaller reporting company, is not required to provide disclosure under this Item 6.

ITEM

7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Results

of Operations – June 30, 2015 compared to June 30, 2014

We

had a net loss of $907,474 in the fiscal year ended June 30, 2015 compared to net income of $302,053 in the fiscal year ended

June 30, 2014.

License

and other revenue

Details

of revenues are as follows:

| | |

Year Ended June 30, | |

Increase (Decrease) |

| | |

2015 | |

2014 | |

$ | |

% |

| | |

| |

| |

| |

|

| Barcode Technology | |

$ | 507,960 | | |

$ | 1,623,109 | | |

$ | (1,115,149 | ) | |

| (68.7 | ) |

| Mobile Banking Technology | |

| 437,847 | | |

| 12,254 | | |

| 425,593 | | |

| 3,473.1 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Revenues | |

$ | 945,807 | | |

$ | 1,635,363 | | |

$ | (689,556 | ) | |

| (42.2 | ) |

Barcode

Technology revenues are derived from our Product Identification systems sold principally to customers in the LCD manufacturing

industry. Identification Card revenues in these periods were a result of sales of identification card and mobile banking systems.

The

decrease in Barcode Technology revenues was mainly attributable to the decreased demand for LCD screens. Revenues from the LCD

market remain unpredictable as they are generated when customers open new production facilities or update production equipment;

however, for now the Company continues to experience relatively low demand for product identification product licenses in the

LCD industry. A large portion of our license sales are concentrated in the Asia-Pacific market, which decreased in Taiwan, Japan,

Germany, and increase in Korea and China.

2

Mobile

Banking Technology revenues includes products such as the Company’s Blinx On-Off™ prepaid toggle Card and its Open

Loop/Close Loop System and Bio ID Card Platform. Mobile Banking Technology uses web-based mobile technology to offer financial

cardholders the very best technology in conducting secure financial transactions in real time, protecting personal identity, and

financial account security. The increase in Mobile Banking Technology revenues is due to its efforts to grow this business line

which has led to several recent multiyear agreements to provide services and support.

On

September 30, 2015, the Company and The Matthews Group, a related party, entered into an Asset Purchase Agreement pursuant to

which the Company sold the intellectual property assets relating to its Barcode Technology. The sale allows the Company to focus

its efforts solely on growing its Mobile Banking Technology business.

Cost

of Sales

Cost

of sales for the year ended June 30, 2015 and 2014, totaled $329,703 and $345,107, respectively. The slight decrease in expense

was the result of decreased labor costs associated with projects implemented during the period as compared to the same period

of the prior year. As a percentage of revenue, for the year ended June 30, 2015, cost of sales was 34.9% compared to 21.1% for

the year ended June 30, 2014.

Operating

Expenses

General

and administrative expenses for the fiscal year ended June 30, 2015 were $841,816, compared to $578,947 for fiscal year ended

June 30, 2014, an increase of $262,869. The increase was the result of $134,215 in operating expenses incurred after acquiring

Tangible Payments, LLC (see Note 5 of the attached Consolidated Financial Statements). The remaining increase in expenses of $128,654

was primarily from increased salaries, benefits and professional fees.

Sales

and marketing expense for the fiscal year ended June 30, 2015 was $83,863 compared to $31,590 for the fiscal year ended June 30,

2014, an increase of $52,273. The increase was a result of the Company’s increased sales and marketing efforts to support

its mobile banking technology and to open new markets in Asia.

Research

and development expense for the year ended June 30, 2015 totaled $98,412 compared to $188,810 for the year ended June 30, 2014,

a decrease of $90,398. The decrease in expense was the result of the Company’s completion of certain research and development

projects associated with its Mobile Banking Technology as compared to the same period of the prior year.

Other

Expenses, net

Other

expense, net for year ended June 30, 2015 totaled $499,487 compared to $188,856 for the year ended June 30, 2014, an increase

of $310,631. The increase was primarily a result of $297,875 of non-cash expense relating to the beneficial conversion feature

of convertible notes payables issued during fiscal year 2015. A beneficial conversion feature is realized when the conversion

price of a convertible notes payable is below the closing market price on the date of issuance. The remaining increase of $12,767

was additional interest expense associated with our overall increased debt balances.

Capital

Expenditures and Commitments

We

made no capital purchases in fiscal 2015. In 2014, we made capital expenditures of $1,234.

Liquidity

Our

cash and cash equivalents balance at June 30, 2015 increased to $52,762 as compared to $24,665 at June 30, 2014. The increase

was the result of $192,903 in cash used in operating activities offset by $221,000 provided by financing activities. Net cash

used in operations during 2015 was $192,903 compared with $291,760 provided by operations during the same period in 2014. Cash

used in operations during 2015 was primarily due to the net loss in the period. Net cash used in investing activities was $0 during

2015 compared with $1,234 during 2014, which was the result of the purchase of property and equipment. Net cash provided by financing

activities of $221,000 during 2015 was primarily due to proceeds received from notes payable of $365,000 offset by payments of

$144,000 on notes payable. During the same period in 2014, net cash used in financing activities of $341,779 was from proceeds

received from notes payable of $68,500 offset by payments of $410,279 on notes payable.

The

accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. The Company

experienced a loss of $907,474 during the year ended June 30, 2015, and at June 30, 2015, the Company had a working capital deficit

of $5,159,420 and a stockholders’ deficiency of $5,106,433. The Company is currently in default of $3,562,707 of notes payable

and is also delinquent in payment of certain amounts due of $453,277 for payroll taxes and accrued interest and penalties as of

June 30, 2015. The Company believes its cash and forecasted cash flow from operations will not be sufficient to continue operations

through fiscal 2016 without continued external investment. The Company believes it will require additional funds to continue its

operations through fiscal 2016 and to continue to develop its existing projects and plans to raise such funds by finding additional

investors to purchase the Company’s securities, generating sufficient sales revenue, implementing dramatic cost reductions

or any combination thereof. There is no assurance that the Company can be successful in raising such funds, generating the necessary

sales or reducing major costs. Further, if the Company is successful in raising such funds from sales of equity securities, the

terms of these sales may cause significant dilution to existing holders of common stock. The consolidated financial statements

do not include any adjustments that may result from this uncertainty. Our auditor has issued a “going concern” qualification

as part of their opinion in the Audit Report for the year ended June 30, 2015.

The

Company has traditionally been dependent on The Matthews Group, LLC, a related party, for its financial support. The Matthews

Group is owned 50% by Van Tran, the Company’s CEO/Executive Chair and a director, and 50% by Lawrence J. Johanns, a significant

Company stockholder.

In

September 2015, The Matthews Group, a related party and the Company’s largest debt holder, elected to convert $1.8 million

of its convertible notes payable balance, at a conversion price of $0.08 per share of common stock, into 22.2 million shares of

the Company’s common stock.

In

September 2015, the Company sold its Barcode Technology assets to The Matthews Group, a related party, for $670,000. The proceeds

from the sale were used to reduce the Company’s notes payable balance to The Matthews Group.

Commitments

and Contractual Obligations

The

Company has one annual lease commitment of $50,400 for the corporate office building, which is leased from Ms. Tran, our chief

executive officer, which expired on June 30, 2015, and was automatically extended until June 30, 2017. The commitment is for the

corporate offices at 2445 Winnetka Avenue North, Golden Valley, Minnesota. The total amount of the two-year lease commitment is

$100,800.

Off-Balance

Sheet Arrangements

We

do not have any off-balance sheet arrangements.

Critical

Accounting Policies

Stock-Based

Compensation

The

Company periodically issues stock options and warrants to employees and non-employees in capital raising transactions, for services

and for financing costs. Stock-based compensation for employees are measured at the grant date, based on the fair value

of the award, and is recognized as expense over the requisite service period. Options vest and expire according to terms

established at the grant date. The value of the stock compensation to non-employees is based upon the measurement date as determined

at either a) the date at which a performance commitment is reached, or b) at the date at which the necessary performance to earn

the equity instruments is complete.

We

estimate volatility and forfeitures based upon historical data. As permitted by the authoritative guidance issued by the Financial

Accounting Standards Board, we use the “simplified” method to determine the expected life of an option due to the

Company’s lack of sufficient historical exercise data to provide a reasonable basis, which is a result of the relatively

high turnover rates experienced in the past for positions granted options. All of these variables have an effect on the estimated

fair value of our share-based awards.

Revenue

Recognition

The

Company accounts for revenue recognition in accordance with guidance of the Financial Accounting Standards Board. Revenues for

the Company are classified into barcode technology revenue and mobile banking technology revenue.

Revenues

from licenses and identification cards are recognized when the product is shipped, the Company no longer has any service or other

continuing obligations, and collection is reasonably assured. The process typically begins with a customer purchase order detailing

its specifications so the Company can import its software into the customer's hardware. Once importation is completed, if the

customer only wishes to purchase a license, the Company typically transmits the software to the customer via the Internet. Revenue

is recognized at that point. If the customer requests both license and other products, once the software is imported into the

hardware and the process is complete, the product is shipped and revenue is recognized at time of shipment. Once the software

and/or other products are either shipped or transmitted, the customers do not have a right of refusal or return. Under some conditions,

the customers remit payment prior to the Company having completed importation of the software. In these instances, the Company

delays revenue recognition and reflects the prepayments as customer deposits.

The

Company, as a processor and a distributor, recognizes revenue from transaction fees charged cardholders for the use of its issued

mobile debit cards. The fees are recognized on a monthly basis after all cardholder transactions have been summarized and reconciled

with third party processors.

Recently

Issued Accounting Standards

See

Footnote 1 of consolidated financial statements for a discussion of recently issued accounting standards.

ITEM

8 FINANCIAL STATEMENTS

VERITEC,

INC. AND SUBSIDIARIES

CONSOLIDATED

FINANCIAL STATEMENTS

YEARS

ENDED JUNE 30, 2015 AND 2014

| TABLE OF CONTENTS | |

| PAGE | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| 13 | |

| CONSOLIDATED BALANCE SHEETS | |

| 14 | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| 15 | |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS' DEFICIENCY | |

| 16 | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| 17 | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |

| 18 | |

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The

Board of Directors and Stockholders

Veritec,

Inc. and Subsidiaries

Golden

Valley, Minnesota

We

have audited the accompanying consolidated balance sheets of Veritec, Inc. and Subsidiaries (the “Company”) as of

June 30, 2015 and 2014, and the related consolidated statements of operations, stockholders’ deficiency and cash flows for

the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility

is to express an opinion on these consolidated financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those

standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements

are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal

control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for

designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the

effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit

includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements.

An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating

the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In

our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position

of Veritec, Inc. and Subsidiaries as of June 30, 2015 and 2014, and the results of their operations and their cash flows for the

years then ended in conformity with accounting principles generally accepted in the United States of America.

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

As discussed in Note 2 to the consolidated financial statements, the Company has had recurring losses from operations and had

a stockholders’ deficiency as of June 30, 2015. These factors raise substantial doubt about the Company’s ability

to continue as a going concern. Management’s plans concerning these matters are also described in Note 2. The accompanying

consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability

and classification of assets or the amounts and classifications of liabilities that may result from the outcome of this uncertainty.

/s/

Weinberg & Company, P.A.

Weinberg

& Company, P.A.

Los

Angeles, California

January

21, 2015

VERITEC,

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2015 AND 2014

| | |

2015 | |

2014 |

| | |

| |

|

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 52,762 | | |

$ | 24,665 | |

| Accounts receivables, net of allowance of $0 and $13,395, respectively | |

| 38,749 | | |

| 70,500 | |

| Inventories | |

| 14,461 | | |

| 7,829 | |

| Prepaid expenses | |

| 18,234 | | |

| 17,143 | |

| Total Current Assets | |

| 124,206 | | |

| 120,137 | |

| | |

| | | |

| | |

| Restricted cash | |

| 63,029 | | |

| 51,957 | |

| Property and Equipment, net | |

| 583 | | |

| 994 | |

| Intangibles, net | |

| 144,375 | | |

| — | |

| | |

| | | |

| | |

| Total Assets | |

$ | 332,193 | | |

$ | 173,088 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Notes payable – in default | |

$ | 521,610 | | |

$ | 493,017 | |

| Notes payable, related party –

in default | |

| 3,041,097 | | |

| 2,649,202 | |

| Accounts payable | |

| 630,490 | | |

| 540,794 | |

| Accounts payable, related party | |

| 96,110 | | |

| 78,753 | |

| Customer deposits | |

| 25,482 | | |

| 91,260 | |

| Deferred revenue | |

| 492,603 | | |

| 258,764 | |

| Payroll tax liabilities | |

| 453,277 | | |

| 539,218 | |

| Accrued expenses | |

| 22,957 | | |

| 104,168 | |

| Total Current Liabilities | |

| 5,283,626 | | |

| 4,755,176 | |

| | |

| | | |

| | |

| Contingent earnout liability | |

| 155,000 | | |

| — | |

| Total Liabilities | |

| 5,438,626 | | |

| 4,755,176 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' Deficiency: | |

| | | |

| | |

| Convertible preferred stock, par value $1.00; authorized

10,000,000 shares, 276,000 shares of Series H authorized, 1,000 shares issued and outstanding as of June 30, 2015 and 2014 | |

| 1,000 | | |

| 1,000 | |

| Common stock, par value $.01; authorized 50,000,000 shares,

16,530,088 and 15,920,088 shares issued and outstanding as of June 30, 2015 and 2014, respectively | |

| 165,301 | | |

| 159,201 | |

| Common stock to be issued, 940,000 shares and 400,000 shares, respectively | |

| 51,800 | | |

| 39,596 | |

| Additional paid-in capital | |

| 14,959,006 | | |

| 14,594,181 | |

| Accumulated deficit | |

| (20,283,540 | ) | |

| (19,376,066 | ) |

| Total Stockholders' Deficiency | |

| (5,106,433 | ) | |

| (4,582,088 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Deficiency | |

$ | 332,193 | | |

$ | 173,088 | |

| | |

| | | |

| | |

| The accompanying

notes are an integral part of these consolidated financial statements |

VERITEC,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED JUNE 30, 2015 AND 2014

| | |

Years Ended June 30, |

| | |

2015 | |

2014 |

| | |

| |

|

| Revenue: | |

| | | |

| | |

| Barcode technology revenue | |

$ | 507,960 | | |

$ | 1,623,109 | |

| Mobile banking technology revenue | |

| 437,847 | | |

| 12,254 | |

| Total revenue | |

| 945,807 | | |

| 1,635,363 | |

| | |

| | | |

| | |

| Cost of sales | |

| 329,703 | | |

| 345,107 | |

| | |

| | | |

| | |

| Gross Profit | |

| 616,104 | | |

| 1,290,256 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| General and administrative | |

| 841,816 | | |

| 578,947 | |

| Sales and marketing | |

| 83,863 | | |

| 31,590 | |

| Research and development | |

| 98,412 | | |

| 188,810 | |

| Total operating expenses | |

| 1,024,091 | | |

| 799,347 | |

| | |

| | | |

| | |

| Income (Loss) from Operations | |

| (407,987 | ) | |

| 490,909 | |

| | |

| | | |

| | |

| Other Expense: | |

| | | |

| | |

| Interest income | |

| — | | |

| 58 | |

| Interest expense, including $172,564

and $152,501, respectively, to related parties | |

| (499,487 | ) | |

| (188,914 | ) |

| Total other expense | |

| (499,487 | ) | |

| (188,856 | ) |

| | |

| | | |

| | |

| Net Income (Loss) | |

$ | (907,474 | ) | |

$ | 302,053 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Net Loss Per Common Share - | |

| | | |

| | |

| Basic | |

$ | (0.06 | ) | |

$ | 0.02 | |

| Diluted | |

$ | (0.06 | ) | |

$ | 0.02 | |

| | |

| | | |

| | |

| Weighted Average Number of Shares Outstanding - | |

| | | |

| | |

| Basic | |

| 16,351,956 | | |

| 15,920,088 | |

| Diluted | |

| 16,351,956 | | |

| 18,976,588 | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of these consolidated

financial statements. |

VERITEC,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS'

DEFICIENCY

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

| | |

| Preferred

Stock | | |

| Common

Stock | | |

| | | |

| | | |

| | | |

| |

| | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

Common Stock to be Issued | |

Additional Paid-in Capital | |

Accumulated Deficit | |

Stockholders’

Deficiency |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| BALANCE, July 1, 2013 | |

| 1,000 | | |

$ | 1,000 | | |

| 15,920,088 | | |

$ | 159,201 | | |

$ | 10,477 | | |

$ | 14,594,181 | | |

$ | (19,678,119 | ) | |

$ | (4,913,260) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Shares issued for services | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,869 | | |

| — | | |

| — | | |

| 3,869 |

| Stock based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| 25,250 | | |

| — | | |

| — | | |

| 25,250 |

| Net income | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 302,053 | | |

| 302,053 |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| BALANCE, June 30, 2014 | |

| 1,000 | | |

| 1,000 | | |

| 15,920,088 | | |

| 159,201 | | |

| 39,596 | | |

| 14,594,181 | | |

| (19,376,066 | ) | |

| (4,582,088) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Shares issued for acquisition | |

| — | | |

| — | | |

| 250,000 | | |

| 2,500 | | |

| — | | |

| 35,000 | | |

| — | | |

| 37,500 |

| Shares issued for services | |

| — | | |

| — | | |

| 135,000 | | |

| 1,350 | | |

| 9,300 | | |

| 8,950 | | |

| — | | |

| 19,600 |

| Shares issued for common stock issuable | |

| — | | |

| — | | |

| 225,000 | | |

| 2,250 | | |

| (25,250 | ) | |

| 23,000 | | |

| — | | |

| — |

| Stock based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| 28,154 | | |

| — | | |

| — | | |

| 28,154 |

Beneficial conversion feature on

issuance of convertible notes payable | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 297,875 | | |

| — | | |

| 297,875 |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (907,474 | ) | |

| (907,474) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| BALANCE, June 30, 2015 | |

| 1,000 | | |

$ | 1,000 | | |

| 16,530,088 | | |

$ | 165,301 | | |

$ | 51,800 | | |

$ | 14,959,006 | | |

$ | (20,283,540 | ) | |

$ | (5,106,433) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| The accompanying notes are an integral part of these consolidated

financial statements. |

VERITEC,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED JUNE 30, 2015 AND 2014

| | |

Years Ended June 30, |

| | |

2015 | |

2014 |

| | |

| |

|

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net Income (Loss) | |

$ | (907,475 | ) | |

$ | 302,053 | |

Adjustments to reconcile net income

(loss) net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation | |

| 411 | | |

| 239 | |

| Amortization | |

| 48,125 | | |

| — | |

| Allowance on accounts receivable | |

| — | | |

| 244 | |

| Beneficial

conversion feature on convertible notes payable | |

| 297,875 | | |

| — | |

| Shares issued for services | |

| 19,600 | | |

| 3,869 | |

| Stock based compensation expense | |

| 28,154 | | |

| 25,250 | |

| Interest accrued on notes payable | |

| 199,489 | | |

| 170,897 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 31,751 | | |

| 217,579 | |

| Restricted cash | |

| (11,072 | ) | |

| 447,320 | |

| Inventories | |

| (6,632 | ) | |

| (3,014 | ) |

| Prepaid expenses | |

| (1,091 | ) | |

| 15,744 | |

| Deferred

revenue | |

| 233,839 | | |

| (767,911 | ) |

| Payroll

tax liabilities | |

| (85,941 | ) | |

| (141,242 | ) |

| Customer

deposits | |

| (65,778 | ) | |

| 19,973 | |

| Accounts payables and accrued expenses | |

| 25,842 | | |

| 759 | |

| Net cash provided by (used in) operating activities | |

| (192,903 | ) | |

| 291,760 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Advances on notes receivable | |

| — | | |

| (1,234 | ) |

| Net cash used in investing activities | |

| — | | |

| (1,234 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Payment of notes payable | |

| — | | |

| (300,279 | ) |

| Proceeds from notes payable, related

party | |

| 365,000 | | |

| 68,500 | |

| Payment on notes payable, related party | |

| (144,000 | ) | |

| (110,000 | ) |

| Net cash provided by (used in) financing activities | |

| 221,000 | | |

| (341,779 | ) |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH | |

| 28,097 | | |

| (51,253 | ) |

| | |

| | | |

| | |

| CASH AT BEGINNING OF YEAR | |

| 24,665 | | |

| 75,918 | |

| | |

| | | |

| | |

| CASH AT END OF YEAR | |

$ | 52,762 | | |

$ | 24,665 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash paid for interest | |

$ | — | | |

$ | 14,423 | |

| | |

| | | |

| | |

| NON CASH INVESTING AND

FINANCING ACTIVITIES | |

| | | |

| | |

| Common stock issued for acquisition | |

$ | 37,500 | | |

$ | — | |

| Contingent earnout liability from acquisitions | |

$ | 155,000 | | |

$ | — | |

| | |

| | | |

| | |

| The accompanying notes are an integral

part of these consolidated financial statements. |

VERITEC, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

NOTE

1 - OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The

Company

Veritec,

Inc. (Veritec) was formed in the State of Nevada on September 8, 1982. Veritec’s wholly owned subsidiaries include, Vcode

Holdings, Inc. (Vcode®), and Veritec Financial Systems, Inc. (VTFS) (collectively the “Company”).

Nature

of Business

The

Company as primarily engaged in the development, marketing, sales and licensing of products and rendering of professional services

related thereto in the following two fields of technology: (1) proprietary two-dimensional matrix symbology (also commonly referred

to as “two-dimensional barcodes” or “2D barcodes”), and (2) mobile banking solutions. Subsequent to June

30, 2015, the Company began to focus exclusively on mobile banking technology, and sold its barcode technology.

Barcode

Technology

The

Company’s Barcode Technology was originally invented by the founders of Veritec under United States patents 4,924,078, 5,331,176,

5,612,524 and 7,159,780. Our principal licensed product to date that contains our VeriCode ® Barcode Technology has been a

product identification system for identification and tracking of manufactured parts, components and products mostly in the liquid

crystal display (LCD) markets. The VeriCode® symbol is a two-dimensional high data density machine-readable symbol that can

contain up to approximately 500 bytes of data. The Company’s VSCode® Barcode Technology is a derivative of the VeriCode®

symbol with the ability to encrypt a greater amount of data by increasing data density. The VSCode ® is a data storage “container”

that offers a high degree of security and which can also be tailored to the application requirements of the user. The VSCode ®

symbol can hold any form of binary information that can be digitized, including numbers, letters, images, photos, graphics, and

the minutia for biometric information, including fingerprints and facial image data, to the extent of its data storage capacity,

that are likewise limited by the resolution of the marking and reading devices employed by the user. VSCode ® is ideal for

secure identification documents (such as national identification cards, driver’s licenses, and voter registration cards),

financial cards, medical records and other high security applications. In its PhoneCodes™ product platform, Veritec developed

software to send, store, display, and read a VeriCode® Barcode Technology symbol on the LCD screen of a mobile phone. With

the electronic media that provide the ease of transferring information over the web, Veritec’s PhoneCodes™ technology

enables individuals and companies to receive or distribute gift certificates, tickets, coupons, receipts, or engage in banking

transactions using the VeriCode ® technology via wireless phone or PDA.

On

September 30, 2015, the Company sold all of its assets of its Barcode Technology, which was comprised solely of its intellectual

property. The sale allows the Company to focus its efforts solely on its growing Mobile Banking Technology (See Note 12).

Mobile

Banking Solutions

In

January 12, 2009, Veritec formed VTFS, a Delaware corporation, to bring its Mobile Banking Technology, products and related professional

services to market. In May 2009 Veritec was registered by Security First Bank in Visa’s Third Party Registration Program

as a Cardholder Independent Sales Organization and Third-Party Servicer. As a Cardholder Independent Sales Organization, Veritec

was able to promote and sell Visa branded card programs. As a Third-Party Servicer, Veritec provided back-end cardholder transaction

processing services for Visa branded card programs on behalf of Security First Bank. As of October 2010 the Company’s registration

with Security First Bank terminated. As of April 2011 the Company signed an ISO and processor agreement with Palm Desert National

Bank (which was later assigned to First California Bank) to market and processes the Company’s Visa branded card program

on behalf of the bank. First California Bank was sold to Pacific Western Bank and June 2013 Pacific Western Bank closed its entire

debit card division and transferred its contract with VTFS to Central Bank of Kansas City Bank. On February 5th, 2014 the entire

relationship between Veritec and Pacific Western Bank ended and the new relationship with Central Bank of Kansas City began.

On

September 30, 2014, Veritec ("Buyer"), and Tangible Payments LLC ("Seller"), a Maryland Limited Liability

Company, entered into an Asset Purchase Agreement (the "Asset Purchase Agreement") pursuant to which Veritec acquired

certain assets and liabilities of the Tangible Payments LLC (See Note 5).

The

Company has a portfolio of five United States and eight foreign patents. In addition, we have seven U.S. and twenty-eight

foreign pending patent applications.

Principles

of Consolidation

The

accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. Intercompany

transactions and balances were eliminated in consolidation.

Use

of Estimates

The

preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States

of America requires management to make estimates and assumptions that may affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts

of revenues and expenses during the reporting period. Actual results could differ from those estimates. Those estimates and assumptions

include estimates for reserves of uncollectible accounts, analysis of impairments of long lived assets, accruals for potential

liabilities and assumptions made in valuing stock instruments issued for services.

Accounts

Receivable

The

Company sells to domestic and foreign companies and grants uncollateralized credit to customers, but requires deposits on unique

orders. Management periodically reviews its accounts receivable and provides an allowance for doubtful accounts after analyzing

the age of the receivable, payment history and prior experience with the customer. The estimated loss that management believes

is probable is included in the allowance for doubtful accounts.

While

the ultimate loss may differ, management believes that any additional loss will not have a material impact on the Company's financial

position. Due to uncertainties in the settlement process, however, it is at least reasonably possible that management's estimate

will change during the near term.

Inventories

Inventories,

consisting of purchased components for resale, are stated at the lower of cost or market, applying the first-in, first-out (FIFO)

method. Inventory is net of reserves of $23,900 at both June 30, 2015 and 2014.

Property

and Equipment

Property

and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over estimated

useful lives of 3 to 7 years. When assets are retired or otherwise disposed, the cost and related accumulated depreciation are

removed from the accounts and the resulting gain or loss is recognized. Maintenance and repairs are expensed as incurred; significant

renewals and betterments are capitalized.

Management regularly reviews property, equipment and

other long-lived assets for possible impairment. This review occurs quarterly, or more frequently if events or changes in circumstances

indicate the carrying amount of the asset may not be recoverable. If there is indication of impairment, management prepares an

estimate of future cash flows (undiscounted and without interest charges) expected to result from the use of the asset and its

eventual disposition. If these cash flows are less than the carrying amount of the asset, an impairment loss is recognized to

write down the asset to its estimated fair value. Based upon management’s assessment, there were no indicators of impairment

at June 30, 2015 or 2014.

Concentrations

The

Company’s cash balances on deposit with banks are guaranteed by the Federal Deposit Insurance Corporation up to $250,000.

The Company may be exposed to risk for the amounts of funds held in one bank in excess of the insurance limit. In assessing the

risk, the Company’s policy is to maintain cash balances with high quality financial institutions. The Company had cash balances

in excess of the guarantee during the year ended June 30, 2015.

Major

Customers:

Customers

in excess of 10% of total revenues were as follows:

| | |

Years Ended June 30, |

| | |

2015 | |

2014 |

| | |

| |

|

| Customer A | |

| --% | | |

| 31 | % |

| Customer B | |

| 12 | % | |

| 16 | % |

| Customer C | |

| 11 | % | |

| 8 | % |

| | |

| 23 | % | |

| 55 | % |

As

of June 30, 2015, the Company had approximately $6,025 (16%), $5,650 (15%), and $4,575 (12%) of accounts receivable due from its

major customers. As of June 30, 2014, the Company had approximately $86,361 (69%) and $23,250 (19%), respectively, of accounts

receivable due from its major customers.

Foreign

Revenues

Foreign

revenues accounted for 45% (9% Korea, 19% Taiwan, and 17% others) of the Company’s total revenues in fiscal 2015 and 70%

(54% Korea, 10% Taiwan, and 6% others) in fiscal 2014.

Fair

Value of Financial Instruments

Fair

Value Measurements are adopted by the Company based on the authoritative guidance provided by the Financial Accounting Standards

Board, with the exception of the application of the statement to non-recurring, non-financial assets and liabilities as permitted.

The adoption based on the authoritative guidance provided by the Financial Accounting Standards Board did not have a material

impact on the Company's fair value measurements. Based on the authoritative guidance provided by the Financial Accounting Standards

Board defines fair value as the price that would be received to sell an asset or paid to transfer a liability in the principal

or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement

date. FASB authoritative guidance establishes a fair value hierarchy, which prioritizes the inputs used in measuring fair value

into three broad levels as follows:

Level

1- Quoted prices in active markets for identical assets or liabilities.

Level

2- Inputs, other than the quoted prices in active markets that are observable either directly or indirectly.

Level

3- Unobservable inputs based on the Company's assumptions.

The

Company had no such assets or liabilities recorded to be valued on the basis above at June 30, 2015 or 2014.

For

certain financial instruments, the carrying amounts reported in the consolidated balance sheets for cash and cash equivalents,

accounts receivable, and current liabilities, including notes payable and convertible notes, each qualify as financial instruments

and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments

and their expected realization and their current market rates of interest.

Revenue

Recognition

The

Company accounts for revenue recognition in accordance with guidance of the Financial Accounting Standards Board. Revenues for

the Company are classified into barcode technology revenue and mobile banking technology revenue.

Revenues

from licenses and identification cards are recognized when the product is shipped, the Company no longer has any service or other

continuing obligations, and collection is reasonably assured. The process typically begins with a customer purchase order detailing

its specifications so the Company can import its software into the customer's hardware. Once importation is completed, if the

customer only wishes to purchase a license, the Company typically transmits the software to the customer via the Internet. Revenue

is recognized at that point. If the customer requests both license and other products, once the software is imported into the

hardware and the process is complete, the product is shipped and revenue is recognized at time of shipment. Once the software

and/or other products are either shipped or transmitted, the customers do not have a right of refusal or return. Under some conditions,

the customers remit payment prior to the Company having completed importation of the software. In these instances, the Company

delays revenue recognition and reflects the prepayments as customer deposits.

The

Company, as a processor and a distributor, recognizes revenue from transaction fees charged cardholders for the use of its issued

mobile debit cards. The fees are recognized on a monthly basis after all cardholder transactions have been summarized and reconciled

with third party processors.

Shipping

and Handling Fees and Costs

For

the years ended June 30, 2015 and 2014, shipping and handling fees billed to customers of $997 and $2,125, respectively were included

in revenues and shipping and handling costs of $997 and $2,032, respectively were included in cost of sales.

Research

and Development

Research

and development costs were expensed as incurred.

Loss

per Common Share

Basic

earnings (loss) per share are computed by dividing the net income (loss) applicable to Common Stockholders by the weighted average

number of shares of Common Stock outstanding during the year. Diluted earnings (loss) per share is computed by dividing the net

income (loss) applicable to Common Stockholders by the weighted average number of common shares outstanding plus the number of

additional common shares that would have been outstanding if all dilutive potential common shares had been issued, using the treasury

stock method. Potential common shares are excluded from the computation as their effect is antidilutive.

For

the year ended June 30, 2015 the calculations of basic and diluted loss per share are the same because potential dilutive securities

would have an anti-dilutive effect. For the year ended June 30, 2014 the calculation of diluted earnings per share included stock

options and warrants, calculated under the treasury stock method, and excluded preferred stock and convertible notes payable since

the effect was antidilutive.

The

following table sets forth the computation of basic and diluted income per common share.

| | |

June 30, |

| | |

2015 | |

2014 |

| | |

| |

|

| Net Income (Loss) | |

$ | (907,475 | ) | |

$ | 302,053 | |

| | |

| | | |

| | |

| Weighted average common shares – basic | |

| 16,351,956 | | |

| 15,920,088 | |

| Dilutive effect of outstanding stock options | |

| — | | |

| 3,056,500 | |

| Weighted average shares outstanding – diluted | |

| 16,351,956 | | |

| 18,976,588 | |

| | |

| | | |

| | |

As