UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

| [X] |

Preliminary

Information Statement |

| |

|

| [ ] |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| [ ] |

Definitive

Information Statement |

| |

Nano

Mobile Healthcare, Inc. |

|

| |

(Name

of Registrant As Specified In Its Charter) |

|

Payment

of Filing Fee (Check the appropriate box):

| [X] |

No

fee required |

| |

|

| [ ] |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| |

|

| (1) |

Title

of each class of securities to which transaction applies: |

| |

|

| |

|

| (2) |

Aggregate

number of securities to which transaction applies: |

| |

|

| |

|

| (3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined): |

| |

|

| |

|

| (4) |

Proposed

maximum aggregate value of transaction: |

| |

|

| |

|

| (5) |

Total

fee paid: |

| |

|

| |

|

| [ ] |

Fee

paid previously with preliminary materials. |

| |

|

| [ ] |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing. |

| |

|

| (1) |

Amount

Previously Paid: |

| |

|

| |

|

| (2) |

Form,

Schedule or Registration Statement No.: |

| |

|

| |

|

| (3) |

Filing

Party: |

| |

|

| |

|

| (4) |

Date

Filed: |

| |

|

Nano

Mobile Healthcare, Inc.

3

Columbus Circle

New

York, NY 10019

NOTICE

OF ACTIONS TAKEN BY

WRITTEN

CONSENT OF STOCKHOLDERS

[_____],

2016

Dear

Nano Mobile Healthcare, Inc. Stockholders:

This

Information Statement is being furnished by the Board of Directors (the “Board”) of Nano Mobile Healthcare,

Inc., a Delaware corporation (“Nano” or the “Company”), to holders of record of the Company’s

common stock, $0.001 par value (the “Common Stock”) and Series A preferred stock, $0.001 par value (the “Series

A Convertible Preferred Stock”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). The purpose of this Information Statement is to inform the holders of our Common Stock

and Series A Convertible Preferred Stock (the “Stockholders”) that, on January 8, 2016, holders of at least

a majority of the outstanding Common Stock and Series A Convertible Preferred Stock, voting together as a single class on an as-converted

basis, entitled to vote on the following matters, acted by written consent in lieu of a special meeting of stockholders in accordance

with Section 5 of the Company’s Bylaws (the “Bylaws”) and Section 228 of the Delaware General Corporation

Law (the “DGCL”) to authorize and approve an amendment to our Certificate of Incorporation, as amended (the

“Charter”), to: (1) increase our authorized capital stock from 500,000,000 to 1,000,000,000 shares (the “Capital

Stock Increase”); and (2) implement a reverse stock split of the Common Stock at a ratio of up to and including 10:1,

such ratio to be determined by the Board (the “Reverse Split”). The full text of the proposed amendments to

implement the Capital Stock Increase and the Reverse Stock Split is attached to this Information Statement as Appendix A

and B, respectively.

The

approval of the Capital Stock Increase and the Reverse Split, each as set forth in the forms of amendments to our Charter attached

to this Information Statement as Appendix A and B, respectively, will not become effective until at least 20 calendar

days after the initial mailing of this Information Statement, in accordance with Rule 14c-2 promulgated under the Exchange Act,

and neither of those amendments will be implemented until the Company files, after such effective date, the amendments to our

Charter with the Secretary of State of the State of Delaware.

No

action is required by you. The accompanying Information Statement is furnished to inform our Stockholders of the actions described

above before they take effect in accordance with Rule 14c-2 promulgated under the Exchange Act. This Information Statement is

being first mailed to you on or about [_____], 2016. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US

A PROXY.

PLEASE

NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE THE AMENDMENTS TO OUR CHARTER TO EFFECTUATE THE CAPITAL

STOCK INCREASE AND THE REVERSE SPLIT. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE WRITTEN CONSENT IS SUFFICIENT

TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH MATTERS UNDER APPLICABLE LAW, THE COMPANY’S CHARTER AND ITS BYLAWS,

SO NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS ACTION.

| |

By

Order of the Board of Directors |

| |

|

| |

Joseph

C. Peters |

| |

President |

New

York, NY

[_____],

2016

TABLE

OF CONTENTS

Nano

Mobile Healthcare, Inc.

3

Columbus Circle, 15th Floor

New

York, NY 10019

INFORMATION

STATEMENT PURSUANT TO SECTION 14(C)

OF

THE SECURITIES EXCHANGE ACT OF 1934 AND

REGULATION

14C PROMULGATED THEREUNDER

INTRODUCTORY

STATEMENT

Nano

Mobile Healthcare, Inc. (“Nano” or the “Company”) is a Delaware corporation with principal

executive offices located at 3 Columbus Circle, 15th Floor, New York, NY 10019. The Company’s telephone number

is (713) 973-5738. On December 18, 2015, the Company’s Board of Directors (the “Board”), after careful

consideration, unanimously deemed advisable and approved the amendment to our Certificate of Incorporation, as amended (the “Charter”)

to: (1) increase our authorized capital stock from 500,000,000 to 1,000,000,000 shares (the “Capital Stock Increase”),

classified as 900,000,000 shares of common stock, par value $0.001 (the “Common Stock”), and 100,000,000 shares

of preferred stock, par value $0.001 (the “Preferred Stock”); and (2) effectuate a reverse stock split of the

Common Stock at a ratio of up to and including 10:1, such ratio to be determined by the Board (the “Reverse Split”).

This Information Statement is being sent to holders of record of the Company’s Common Stock and Series A Convertible Preferred

Stock (the “Stockholders”) as of [_____], 2016 (the “Record Date”) by the Board to notify

them about actions that the Company’s Stockholders have taken by written consent in lieu of a special meeting of the Stockholders

to approve the amendments to the Charter to effectuate the Capital Stock Increase and the Reverse Split. The written consent was

obtained on January 8, 2016 in accordance with the relevant sections of the Delaware General Corporation Law (the “DGCL”),

the Company’s Charter and Bylaws (the “Bylaws”).

We

are not asking you for a proxy and you are not requested to send us a proxy.

Copies

of this Information Statement are expected to be mailed on or about [______], 2016, to the holders of record on the Record Date

of our outstanding Common Stock and Series A Convertible Preferred Stock. The approval of the amendments to our Charter to effectuate

the Capital Stock Increase and the Reverse Stock Split will not become effective until at least 20 calendar days after the initial

mailing of this Information Statement, in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), and the Capital Stock Increase and the Reverse Split will not be implemented

until the Company files, after such effective date, the amendments to our Charter with the Secretary of State of the State of

Delaware. This Information Statement is being delivered only to inform you of the corporate actions described herein before they

take effect in accordance with Rule 14c-2 promulgated under the Exchange Act.

We

have asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners

of our Common Stock and Series A Convertible Preferred Stock held of record and will reimburse such persons for out-of-pocket

expenses incurred in forwarding such material.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN.

PLEASE

NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE THE CHARTER AMENDMENTS TO EFFECTUATE THE CAPITAL

STOCK INCREASE AND THE REVERSE STOCK SPLIT. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE WRITTEN CONSENT IS SUFFICIENT

TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH MATTERS UNDER APPLICABLE LAW, THE COMPANY’S CHARTER AND ITS BYLAWS,

SO NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THESE ACTIONS.

FORWARD-LOOKING

STATEMENTS

This

Information Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainties that could cause actual results to be materially different from historical

results or from any future results expressed or implied by such forward-looking statements. Such forward-looking statements include,

among other things statements with respect to our objectives and strategies to achieve those objectives, as well as statements

with respect to our beliefs, plans, expectations, anticipations, estimates or intentions. Such forward-looking statements may

also include statements, among other things, concerning the efficacy, safety and intended utilization of Nano’s product

candidates, the conduct and results of future clinical trials, plans regarding regulatory filings, future research and clinical

trials and plans regarding partnering activities. Factors that may cause actual results to differ materially include, among others,

the risk that product candidates that appeared promising in early research and clinical trials do not demonstrate safety and/or

efficacy in larger-scale or later clinical trials, trials may have difficulty enrolling, Nano may not obtain approval to market

its product candidates, or outside financing may not be available to meet capital requirements. These forward-looking statements

are based on our current expectations. We caution that all forward-looking information is inherently uncertain and actual results

may differ materially from the assumptions, estimates or expectations reflected or contained in the forward-looking information,

and that actual future performance will be affected by a number of factors, including economic conditions, technological change,

regulatory change and competitive factors, many of which are beyond our control. Therefore, future events and results may vary

significantly from what we currently foresee.

For

a further list and description of the risks and uncertainties the Company faces, please refer to the Company’s most recent

Annual Report on Form 10-K and other periodic and other filings Nano files with the Securities and Exchange Commission (the “SEC”)

and are available at www.sec.gov. Such forward-looking statements are current only as of the date they are made, and Nano assumes

no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

APPROVAL

BY OUR STOCKHOLDERS OF

THE AMENDMENTS TO OUR CHARTER TO EFFECTUATE

THE CAPITAL STOCK INCREASE AND THE REVERSE STOCK

SPLIT

General

On

December 18, 2015, after due deliberation and careful consideration, the Board unanimously deemed advisable and approved the amendments

to our Charter to effectuate the Capital Stock Increase and the Reverse Stock Split, and determined that such matters are in the

best interests of the Company and its Stockholders. The full text of the proposed amendments to implement the Capital Stock Increase

and the Reverse Stock Split is attached to this Information Statement as Appendix A and B, respectively.

The

Company intends to file the amendment to its Charter with the Secretary of State of the State of Delaware to effectuate the Capital

Stock Increase as soon as possible after the approval of such matter is effective in accordance with Rule 14c-2 promulgated under

the Exchange Act.

The

Company intends to file the amendment to its Charter with the Secretary of State of the State of Delaware to effectuate the Reverse

Stock Split at a ratio, and at a time, to be determined by the Board. On September 9, 2015, the Company received a letter from

the OTC Markets Group Inc., stating that the Company’s bid price had closed below $0.01 for more than 30 consecutive calendar

days and no longer meets the Standards for Continued Eligibility for quotation on the OTCQB. The Company has been granted a 180

calendar day grace period to regain compliance with the OTCQB Standards, which grace period expires on March 7, 2016. The Reverse

Stock Split has been approved by the Board because it believes that it may be an effective means of regaining compliance with

the minimum bid price requirement of the OTCQB. Thus, the Board’s decision as to whether and when to effect the Reverse

Stock Split will be based on a number of factors, including market conditions, existing and expected trading prices for our Common

Stock and the Standards for Continued Eligibility to be quoted on the OTCQB market. Regardless of the stockholder approval, the

Company reserves the right not to effect the Reverse Stock Split if the Board does not deem it to be in the best interests of

the Company and its Stockholders. The Reverse Stock Split, if deemed by the Board to be in the best interests of the Company and

its Stockholders, will be effected, if at all, at a time that is not later than February 19, 2016, the last day for the Company

to regain compliance with the $0.01 per share minimum bid price. See “—OTCQB Requirements for Continued Eligibility”

below.

Approval

Required

Under

the DGCL, our Charter and our Bylaws, Stockholders holding at least a majority of voting power of a company who are entitled to

vote must approve the amendments to our Charter to effectuate the Capital Stock Increase and the Reverse Stock Split. The holders

of Common Stock are entitled to one vote for each share of Common Stock on the approval of the amendment to our Charters to effectuate

the Capital Stock Increase and the Reverse Stock Split. Each holder of outstanding Series A Convertible Preferred (as described

below) is entitled to vote with the holders of the Common Stock, as a single class, on all matters presented to the holders of

Common Stock an as-converted basis calculated as of the record date for such vote.

On

January 8, 2016, there were 341,699,478 shares of Common Stock issued and outstanding and 23,473,368 shares of Series A Convertible

Preferred issued and outstanding for a total of 459,066,318 shares of Common Stock (on an as-converted basis) entitled to vote

as a single class on the amendment to our Charter to effectuate the Capital Stock Increase and the Reverse Stock Split. On January

8, 2016, Stockholders holding an aggregate of 246,728,384 shares of Common Stock (on an as-converted basis), or approximately

53.75% of the outstanding Common Stock (on an as-converted basis), entitled to vote on the matters described herein, executed

and delivered a written consent that approved the amendments to our Charter to effectuate the Capital Stock Increase and Reverse

Stock Split.

Effective

Date

The

approval of the amendments to our Charter to effectuate the Capital Stock Increase and the Reverse Stock Split will be effective

following the 20th calendar day after this Information Statement is first mailed to our Stockholders in accordance with Rule 14c-2

promulgated under the Exchange Act. The amendment to our Charter to effectuate the Capital Stock Increase will be implemented

after the approval of such matter is effective in accordance with Rule 14c-2 promulgated under the Exchange Act and the Company

files the applicable amendment to our Charter with the Secretary of State of the State of Delaware.

Dissenters’

Rights

Stockholders

do not have the statutory right to dissent and obtain an appraisal of their shares under the DGCL in connection with the amendment

to our Charter to effectuate the Capital Stock Increase or the Reverse Stock Split, and the Company will not independently provide

Stockholders with any such right.

Interest

of Certain Persons in or Opposition to Matters to be Acted Upon

No

officer, director or director nominee of the Company has any substantial interest in the matters acted upon, other than his or

her role as an officer, director or director nominee of the Company. No director of the Company informed the Company that such

director opposed any of the action as set forth in this Information Statement.

NOTICE

ITEM 1

APPROVAL

OF THE CAPITAL STOCK INCREASE

General

The

amendment to our Charter to effectuate the Capital Stock Increase was approved by our Board on December 18, 2015, and by our Stockholders

on January 8, 2016. The Capital Stock Increase will increase of the authorized capital stock of the Company from 500,000,000 to

1,000,000,000 shares, classified as 900,000,000 shares of Common Stock, and 100,000,000 shares of Preferred Stock. The full text

of the proposed amendment to our Charter to effectuate the Capital Stock Increase is attached to this Information Statement as

Appendix A.

Reasons

for the Capital Stock Increase

Our

Board approved the Capital Stock Increase because it believes it to be in the best interest of the Company to have a sufficient

number of shares of Common Stock available for issuance in order to provide the Company with business and financing flexibility

in the future. The Company does not, however, currently have any specific plans, arrangements or understandings relating to the

issuance of any additional shares of authorized Common Stock that will become available following the Capital Stock Increase.

The

Capital Stock Increase will not affect the rights of the holders of currently outstanding Common Stock and Preferred Stock, except

for effects incidental to increasing the number of shares of capital stock outstanding, such as dilution of the earnings per share

and voting rights of current holders of capital stock. The additional shares of our Common Stock for which authorization is sought

will have the same par value, voting rights, rights to dividends and distributions and will be identical in all other respects

to the shares of our Common Stock currently authorized. Our Stockholders do not have preemptive rights with respect to our Common

Stock. Should the Board elect to issue additional shares of common stock, existing Stockholders would not have any preferential

rights to purchase such shares. The additional shares of our Preferred Stock for which authorization is sought will have the same

par value and will be identical in all other respects to the shares of our Preferred Stock currently authorized but not yet issued

or designated. Our Stockholders do not have preemptive rights with respect to any Preferred Stock. Should the Board elect to designate

and issue additional shares of Preferred Stock, existing Stockholders would not have any preferential rights to purchase such

shares.

Potential

Anti-Takeover Effect

Although

the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover

effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the

composition of the Board or contemplating a tender offer or other transaction for the combination of the Company with another

company), the Capital Stock Increase is not being proposed in response to any effort of which we are aware to accumulate shares

of our Common Stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar

amendments to the Board and Stockholders. Other than the Capital Stock Increase, our Board does not currently contemplate recommending

the adoption of any other actions that could be construed to affect the ability of third parties to take over or change control

of the Company.

Description

of Securities

General

The

following is a summary of our capital stock and provisions of our Charter and Bylaws. For more detailed information, please see

our Charter and Bylaws, which are on file with the SEC.

We

are currently authorized to issue 450,000,000 shares of Common Stock and 50,000,000 shares of Preferred Stock, and as of December

15, 2015, 341,699,478 shares of our Common Stock were outstanding and 23,473,368 shares of our Preferred Stock were outstanding.

We

have warrants to purchase 6,281,766 shares of our Common Stock outstanding. The warrants have exercise prices between $0.001 and

$0.123.

We

have convertible notes exercisable for 941,252,500 shares of our Common Stock outstanding. The convertible notes are subject to

various terms and descriptions as more fully described in our most recent Quarterly Report on Form 10-Q for the period ended September

30, 2015 on file with the SEC.

Common

Stock

Holders

of our Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of the Stockholders,

and do not have cumulative voting rights. Subject to preferences that may be applicable to any outstanding shares of Preferred

Stock, holders of Common Stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by

our board of directors out of funds legally available for dividend payments. All outstanding shares of Common Stock are fully

paid and nonassessable. The holders of Common Stock have no preferences or rights of conversion, exchange, pre-emptive or other

subscription rights. There are no redemption or sinking fund provisions applicable to the Common Stock. In the event of any liquidation,

dissolution or winding-up of our affairs, holders of Common Stock will be entitled to share ratably in any of our assets remaining

after payment or provision for payment of all of our debts and obligations and after liquidation payments to holders of outstanding

shares of Preferred Stock, if any.

Preferred

Stock

Our

Board may issue Preferred Stock in one or more series at such time or times as the Board may determine, with such powers, preferences

and rights as the Board may determine. Additionally, the resolutions providing for the issuance of any series of Preferred Stock

may provide that such series shall be superior or rank equally or be junior to the Preferred Stock of any other series to the

extent permitted by law. This is called blank-check Preferred Stock, which can be used for financing purposes or as an anti-takeover

defense because the Board can use it to create a new series of Preferred Stock that may have special voting, conversion or control

rights which could make a takeover more difficult.

Series

A Convertible Preferred Stock

On

August 24, 2015, we filed with the Secretary of State of the State of Delaware a Certificate of Designations of Rights, Preferences,

Privileges and Restrictions of Series A Convertible Preferred Stock (the “Certificate of Designation”).

Under

the terms of the Certificate of Designation, 24,000,000 shares of our Preferred Stock are designated as Series A Convertible Preferred

Stock. Each share of the Series A Convertible Preferred Stock is convertible into five (5) shares of Common Stock without the

payment of additional consideration by the holder thereof, subject to certain terms, conditions and adjustments as described in

the Certificate of Designation. The holders of Series A Convertible Preferred Stock are entitled to receive any dividends before

the holders of the Common Stock, in an amount at least equal to the product of (x) the dividend payable on each share of Common

Stock and (y) the number of shares of Common Stock issuable upon conversion of a share of Series A Convertible Preferred, in each

case calculated on the record date for determination of holders entitled to receive such dividend. Each holder of outstanding

Series A Convertible Preferred Stock is entitled to vote with the holders of the Common Stock, as a single class, on all matters

presented to the holders of Common Stock an as-converted basis calculated as of the record date for such vote.

Dividend

Policy

Our

Charter provides that our Board may declare and pay dividends on our Common Stock from time to time in their sole discretion,

at which time such a dividend would also be declared on our shares of Series A Convertible Preferred Stock.

NOTICE

ITEM 2

APPROVAL

OF THE REVERSE STOCK SPLIT

General

The

amendment to our Charter to effectuate the Reverse Stock Split was approved by our Board on December 18, 2015, and by our stockholders

on January 8, 2016. The Reverse Stock Split will combine a number of our issued and outstanding shares of Common Stock up to ten

(10), such number consisting of only whole shares, into one (1) share of Common Stock. The full text of the proposed amendment

to our Charter to effectuate the Reverse Stock Split is attached to this Information Statement as Appendix B.

The

proposed amendment to our Charter to effect the Reverse Stock Split, as more fully described below, will effect the Reverse Stock

Split but will not change the number of authorized shares of Common Stock or preferred stock, or the par value of Common Stock

or preferred stock. Although the primary purpose of the proposed Reverse Stock Split is to enable the Company to regain compliance

with $0.01 per share minimum bid price for continued quotation, the Board also considers it to be in the best interest of the

Company to have a sufficient number of shares of Common Stock available for issuance in order to provide the Company with business

and financing flexibility in the future. The Company does not, however, currently have any specific plans, arrangements or understandings

relating to the issuance of any additional shares of authorized Common Stock that will become available following the Reverse

Stock Split.

Reasons

for the Reverse Stock Split

Our

Board approved the proposal authorizing the Reverse Stock Split because it believes that effecting the Reverse Stock Split may

be an effective means of regaining compliance with the Standards for Continued Eligibility Requirement for OTCQB of a minimum

bid price of $0.01 for continued quotation of our Common Stock on the OTCQB market.

OTCQB

Standards for Continued Eligibility Requirement

Our

Common Stock trades on the OTCQB Market under the symbol “VNTH.” One of the requirements for continued trading on

the OTCQB Market is maintenance of a minimum closing bid price of $0.01.

On

September 9, 2015, we received a letter from the OTC Markets stating that for the 30 consecutive calendar days preceding the date

of the letter, the bid price of our shares of Common Stock closed below the minimum $0.01 per share requirement pursuant to the

Standards for Continued Eligibility for OTCQB (“OTCQB Standards”). In accordance with Section 2.3(2) of the

OTCQB Standards, we have grace period of 180 calendar days, or until March 7, 2016, to regain compliance with the minimum bid

price requirement. If we do not regain compliance, then our shares of Common Stock will no longer be quoted on the OTCQB market,

resulting in a less liquid market for our shares, as well as greatly impairing our ability to raise additional capital through

equity or debt financings.

There

are risks associated with the Reverse Stock Split, including that the Reverse Stock Split may not result in a sustained increase

in the per share price of our Common Stock.

We

cannot predict whether the Reverse Stock Split will increase the market price for our Common Stock on a sustained basis. The history

of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

| |

● |

the

market price per share of our Common Stock after the Reverse Stock Split will rise in proportion to the reduction in the number

of shares of our Common Stock outstanding before the Reverse Stock Split; |

| |

|

|

| |

● |

the

Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower priced

stocks; and |

| |

|

|

| |

● |

the

market price per share will either exceed or remain in excess of the $0.01 minimum bid price as required by the OTC Markets. |

The

market price of our Common Stock will also be based on our performance and other factors, some of which are unrelated to the number

of shares outstanding. If the Reverse Stock Split is effected and the market price of our Common Stock declines, the percentage

decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the

absence of a Reverse Stock Split. Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number

of shares that would be outstanding after the Reverse Stock Split.

Principal

Effects of the Reverse Stock Split

The

Reverse Stock Split will be effected simultaneously for all of the issued and outstanding shares of Common Stock, and the exchange

ratio will be the same for all issued and outstanding shares of Common Stock. The Reverse Stock Split will affect all of our Stockholders

uniformly and will not affect any Stockholder’s percentage ownership interests in the Company, except to the extent that

the Reverse Stock Split results in any of our Stockholders owning a fractional share. Common stock issued pursuant to the Reverse

Stock Split will remain fully paid and non-assessable. The Reverse Stock Split will not affect the Company continuing to be subject

to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We

do not have any plans to declare in the immediate foreseeable future, any distributions of cash, dividends or other property,

and we are not in arrears on any dividends. Therefore, we do not believe that the Reverse Stock Split would have any effect with

respect to future distributions, if any, to our Stockholders.

Procedure

for Effecting Reverse Stock Split and Exchange of Stock Certificates

If,

at such time as the Company approaches the March 7, 2016 deadline, the Board still believes that a Reverse Stock Split is in the

best interests of the Company and its Stockholders, the Board will determine the ratio of the Reverse Stock Split to be implemented.

The Company will file the Amendment to its Charter with the Secretary of State of the State of Delaware at such time as the Board

has determined the appropriate effective time for the Reverse Stock Split. The Board may delay effecting the Reverse Stock Split

without re-soliciting Stockholder approval. The Reverse Stock Split will become effective on the effective date of the split.

Beginning on the effective date of the split, each certificate representing pre-split shares will be deemed for all corporate

purposes to evidence ownership of post-split shares.

If

the Reverse Stock Split is effected, the Common Stock will have a new Committee on Uniform Securities Identification Procedures

(CUSIP) number, which is a number used to identify our equity securities, and share certificates with the former CUSIP number

will need to be exchanged for share certificates with the new CUSIP number by following the procedures described below.

Beneficial

Holders of Common Stock (i.e., Stockholders who hold in street name)

Upon

completion of the Reverse Stock Split, we would intend to treat the Common Stock held by Stockholders through a bank, broker,

custodian or other nominee, in the same manner as registered Stockholders whose shares of Common Stock are registered in their

names. Banks, brokers, custodians or other nominees will be instructed to reflect the Reverse Stock Split for their beneficial

holders holding Common Stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures

than registered Stockholders for processing the Reverse Stock Split and making payment for fractional shares. If a Stockholder

holds the Common Stock with a bank, broker, custodian or other nominee, and has any questions in this regard, Stockholders are

encouraged to contact their bank, broker, custodian or other nominee.

Registered

“Book-Entry” Holders of Common Stock (i.e., Stockholders that are registered in the registry of members but do not

hold share certificates)

Certain

of our registered holders of Common Stock may hold some or all of their Common Stock in book-entry form with the transfer agent.

These Stockholders do not have share certificates evidencing their ownership of the Common Stock. They are, however, provided

with a statement reflecting the number of shares of Common Stock registered in their name. If a Stockholder holds registered shares

of Common Stock in book-entry form, the Reverse Stock Split, if effected, will automatically be reflected in the transfer agent’s

records and on their next statement.

Holders

of Certificated Shares of Common Stock

If

the Reverse Stock Split is approved and effected, Stockholders holding Common Stock in certificated form will be sent a transmittal

letter by the transfer agent after the Reverse Stock Split is effected. The letter of transmittal will contain instructions on

how a Stockholder should surrender his, her or its certificate(s) representing the shares of Common Stock (the “Old Certificates”)

to the transfer agent in exchange for certificates representing the appropriate number of whole shares of post-Reverse Stock Split

Common Stock (the “New Certificates”). No New Certificates will be issued to a Stockholder until such Stockholder

has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent.

No Stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates. Stockholders will

then receive New Certificate(s) representing the number of whole shares of Common Stock to which they are entitled as a result

of the Reverse Stock Split. Until surrendered, we will deem outstanding Old Certificates held by Stockholders to be cancelled

and only to represent the number of whole shares of post-Reverse Stock Split Common Stock to which these Stockholders are entitled.

Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of shares, will automatically

be exchanged for New Certificates. If an Old Certificate has restrictive legends on the back of the Old Certificate(s), the New

Certificate will be issued with the same restrictive legends that are on the back of the Old Certificate(s). If a Stockholder

is entitled to a payment in lieu of any fractional share interest, such payment will be made as described below under “—Fractional

Shares.”

The

Company expects that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates.

No service charges will be payable by holders of shares of Common Stock in connection with the exchange of certificates. All of

such expenses will be borne by the Company.

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional

Shares

No

fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled

to receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares

for which each post-split share is to be exchanged, will be entitled, upon surrender to the exchange agent of certificates representing

such shares, to a cash payment in lieu thereof at a price equal to the fraction to which the Stockholder would otherwise be entitled

multiplied by the closing price of the Common Stock, as reported by the OTCQB Market, on the last trading day prior to the effective

date of the split (or if such price is not available, the average of the last bid and asked prices of the Common Stock on such

day or other price determined by the Board). The ownership of a fractional interest will not give the holder thereof any voting,

dividend or other rights, except to receive payment therefor as described herein.

Stockholders

should be aware that, under the escheat laws of the various jurisdictions where Stockholders reside, where the Company is domiciled,

and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the effective date

of the split may be required to be paid to the designated agent for each such jurisdiction, unless correspondence has been received

by the Company or the exchange agent concerning ownership of such funds within the time permitted in such jurisdiction. Thereafter,

Stockholders otherwise entitled to receive such funds will have to seek to obtain them directly from the state to which they were

paid.

Accounting

Matters

The

Reverse Stock Split will not affect the Common Stock capital account on our balance sheet. However, because the par value of our

Common Stock will remain unchanged on the effective date of the split, the components that make up the Common Stock capital account

will change by offsetting amounts. Depending on the size of the Reverse Stock Split the Board of Directors decides to implement,

the stated capital component will be reduced to an amount up to and including one-tenth (1/10th) of its present amount,

and the additional paid-in capital component will be increased with the amount by which the stated capital is reduced. The per

share net income or loss and net book value of our Common Stock will be increased because there will be fewer shares of Common

Stock outstanding. Prior periods’ per share amounts will be restated to reflect the Reverse Stock Split.

Potential

Anti-Takeover Effect

Although

the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover

effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the

composition of the Board or contemplating a tender offer or other transaction for the combination of the Company with another

company), the Reverse Stock Split proposal is not being proposed in response to any effort of which we are aware to accumulate

shares of our Common Stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar

amendments to the Board and Stockholders. Other than the Reverse Stock Split proposal, the Board does not currently contemplate

recommending the adoption of any other actions that could be construed to affect the ability of third parties to take over or

change control of the Company.

Certain

Material United States Federal Income Tax Consequences of the Reverse Stock Split

The

following discussion describes certain material United States federal income tax consequences to “U.S. holders” (as

defined below) of our capital stock relating to the Reverse Stock Split. This discussion is based upon the Internal Revenue Code

of 1986, as amended (the “Code”), the Treasury Regulations promulgated thereunder, judicial authorities, published

positions of the Internal Revenue Service (“IRS”) and other applicable authorities, all as currently in effect.

Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations (possibly with retroactive

effect), could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split. We have not obtained

a ruling from the IRS or an opinion of legal or tax counsel with respect to the tax consequences of the Reverse Stock Split. The

following discussion is for information purposes only and is not intended as tax or legal advice. Each holder should seek advice

based on the holder’s particular circumstances from an independent tax advisor.

For

purposes of this discussion, the term “U.S. holder” means a beneficial owner of our capital stock that is for United

States federal income tax purposes:

(i)

an individual citizen or resident of the United States;

(ii)

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) organized under the laws of the

United States, any state or the District of Columbia; or

(iii)

otherwise subject to U.S. federal income taxation on a net income basis in respect of our capital stock.

This

discussion assumes that a U.S. holder holds our capital stock as a capital asset within the meaning of Code Section 1221. This

discussion does not address all of the tax consequences that may be relevant to a particular Stockholder, including tax considerations

that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed

to be known by investors. This discussion does not address the tax consequences to our Stockholders who are subject to special

treatment under United States federal income tax laws including, but not limited to, financial institutions (including banks),

tax-exempt organizations, thrift institutions, insurance companies, regulated investment companies, real estate investment trusts,

partnerships (or other entities classified as partnerships for U.S. federal income tax purposes) and investors therein, “U.S.

holders” whose functional currency is not the U.S. dollar, U.S. expatriates, persons who acquired our capital stock through

the exercise of employee stock options or otherwise as compensation, persons that are broker-dealers, traders in securities who

elect the mark-to-market method of accounting for their securities, or our Stockholders holding their shares of our capital stock

as part of a “straddle,” “hedge,” “conversion transaction” or other integrated investment

transaction. This discussion also does not address the tax consequences to the Company, our Stockholders that own 5% or more of

our capital stock, or holders of our capital stock that are not U.S. holders. In addition, this discussion does not address other

United States federal taxes (such as gift or estate taxes or alternative minimum taxes), the tax consequences of the Reverse Stock

Split under state, local or foreign tax laws, the Medicare tax on net investment income, or certain tax reporting requirements

that may be applicable with respect to the Reverse Stock Split. No assurance can be given that the IRS would not assert, or that

a court would not sustain, a position contrary to any of the tax consequences set forth below.

If

a partnership (or other entity treated as a partnership for United States federal income tax purposes) is a beneficial owner of

our capital stock, the tax treatment of a partner in the partnership will generally depend upon the status of the person and the

activities of the partnership. Partnerships that hold our capital stock, and partners in such partnerships, should consult their

own tax advisors regarding the tax consequences of the Reverse Stock Split.

Tax

Consequences of the Reverse Stock Split Generally

We

believe that the Reverse Stock Split should be treated as a recapitalization for U.S. federal income tax purposes, and therefore

will qualify as a “reorganization” under Section 368(a)(1)(E) of the Code. Accordingly, provided that the fair market

value of the post-Reverse Stock Split shares is equal to the fair market value of the pre-Reverse Stock Split shares surrendered

in the Reverse Stock Split:

| |

● |

A

U.S. holder will not recognize any gain or loss as a result of the Reverse Stock Split (except to the extent of cash received

in lieu of a fractional share). |

| |

|

|

| |

● |

A

U.S. holder’s aggregate tax basis in his, her or its post-Reverse Stock Split shares will be equal to the aggregate

tax basis in the pre-Reverse Stock Split shares exchanged therefor (excluding the portion of the tax basis that is allocable

to any fractional share). |

| |

|

|

| |

● |

A

U.S. holder’s holding period for the post-Reverse Stock Split shares will include the period during which such Stockholder

held the pre-Reverse Stock Split shares surrendered in the Reverse Stock Split. |

Cash

Received Instead of a Fractional Share

A

U.S. holder who receives cash instead of a fractional share of post-Reverse Stock Split shares should recognize capital gain or

loss in an amount equal to the difference between the amount of cash received and the portion of the U.S. holder’s adjusted

tax basis of the pre-Reverse Stock Split shares exchanged in the Reverse Stock Split which is allocable to such fractional share.

Such gain or loss generally will be long-term capital gain or loss if the U.S. holder’s holding period for such pre-Reverse

Stock Split shares is more than one year as of the effective date of the Reverse Stock Split, and otherwise will be short-term

capital gain or loss. The deductibility of net capital losses by individuals and corporations is subject to limitations.

Information

Reporting and Backup Withholding

Cash

payments received by a U.S. holder (other than an exempt recipient) of our capital stock pursuant to the Reverse Stock Split are

subject to information reporting, and may be subject to backup withholding tax at the applicable rate (currently 28%) if the holder

fails to provide a valid taxpayer identification number and comply with certain certification procedures or otherwise establish

an exemption from backup withholding. Backup withholding is not an additional United States federal income tax. Rather, the U.S.

federal income tax liability of the person subject to backup withholding will be reduced by the amount of the tax withheld. If

backup withholding results in an overpayment of taxes, a refund may be obtained provided that the required information is timely

furnished to the IRS.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of December 15,

2015 for (1) all persons who are beneficial owners of 5% or more of our voting securities, (2) each director, (3) each executive

officer, and (4) all directors and executive officers as a group. The information regarding beneficial ownership of our Common

Stock and Series A Convertible Preferred has been presented in accordance with the rules of the Securities and Exchange Commission.

Under these rules, a person may be deemed to beneficially own any shares of capital stock as to which such person, directly or

indirectly, has or shares voting power or investment power, and to beneficially own any shares of our capital stock as to which

such person has the right to acquire voting or investment power within 60 days through the exercise of any stock option or other

right. The percentage of beneficial ownership as to any person as of a particular date is calculated by dividing (a) (i) the number

of shares beneficially owned by such person plus (ii) the number of shares as to which such person has the right to acquire voting

or investment power within 60 days by (b) the total number of shares outstanding as of such date, plus any shares that such person

has the right to acquire from us within 60 days. Including those shares in the tables does not, however, constitute an admission

that the named Stockholder is a direct or indirect beneficial owner of those shares. Unless otherwise indicated, each person or

entity named in the table has sole voting power and investment power (or shares that power with that person’s spouse) with

respect to all shares of capital stock listed as owned by that person or entity.

Except

as otherwise indicated, all shares are owned directly and the percentage shown is based on 341,699,478 shares of Common Stock

and 23,473,368 shares of Series A Convertible Preferred issued and outstanding, for a total of 459,066,318 shares of Common Stock

(on an as-converted basis) as of December 15, 2015. Unless otherwise indicated below, each entity or person listed below maintains

an address of 3 Columbus Circle, 15th Floor, New York, NY 10019.

| | |

Common Stock | |

| | |

Number of Shares Owned | | |

Percent of Class | |

| Directors and Executive Officers | |

| | | |

| | |

| Joseph C. Peters | |

| 2,000,000 | | |

| * | |

| Tony van Bijleveld | |

| 2,000,000 | | |

| * | |

| Steven R. Steinhubl | |

| 2,000,000 | | |

| * | |

| Edward Rollins | |

| 2,000,000 | | |

| * | |

| Executive officers and directors as a group (4 persons) | |

| 8,000,000 | | |

| 1.7 | % |

| | |

| | | |

| | |

| 5% or more Stockholders | |

| | | |

| | |

| Nanobeak LLC (1) | |

| | | |

| | |

| 3

Columbus Circle, 15th Floor | |

| | | |

| | |

| New York, NY 10019 | |

| 117,366,840 | | |

| 25.6 | % |

| Allison C. Swan (2) | |

| | | |

| | |

| 1900

Avenue of the Stars, 7th Floor | |

| | | |

| | |

| Los Angeles, CA 90067 | |

| 30,000,000 | | |

| 6.5 | % |

| John E. Groman (3) | |

| | | |

| | |

| 1212 Hancock Street, Suite LL 10 | |

| | | |

| | |

| Qunicy, MA 02169 | |

| 22,860,798 | | |

| 5.0 | % |

| *

|

Represents

beneficial ownership of less than 1% of the shares of Common Stock (on an as converted basis). |

| |

(1) |

Nanobeak

LLC holds 23,473,368 shares of Series A Convertible Preferred Stock, which may be presently converted into a total of 117,366,840

shares of common stock. Jeremy Barbera is the beneficial owner of a majority of the outstanding units of Nanobeak LLC, as

well as its Chief Executive Officer and managing member, and exercises sole voting and dispositive power over all of the shares

of Common Stock owned by Nanobeak LLC. |

| |

|

|

| |

(2) |

Consists

of a warrant for 25,000,000 shares held by Accent Healthcare Advisors, LLC and a warrant

for 5,000,000 shares held by MLPF&S CUST FBO ALLISON CAROL SWAN, Allison C. Swan’s

personal individual retirement account (the “IRA”). Ms. Swan has sole

voting and dispositive power of the warrants for 30,000,000 shares of common stock held

by Accent Healthcare Advisors, LLC and the IRA.

|

| |

(3) |

Mr.

Groman is the beneficial owner of 9,500,000 shares of common stock and warrants to purchase 14,400,000 shares of common stock.

Bella Sante Inc. is the owner of 6,773,634 shares of common stock. John Groman is the beneficial owner of 88% of Bella Sante,

Inc. In total, Mr. Groman has sole voting power over 29,860,798 shares of common stock, consisting of 15,460,798 shares of

common stock and 14,400,000 warrants to purchase common stock. |

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only

one copy of this Information Statement is being delivered to multiple Stockholders sharing an address, unless the Company has

received contrary instructions from one or more of the Stockholders. The Company will deliver promptly, upon written or oral request,

a separate copy of this Information Statement to a Stockholder at a shared address to which a single copy of this document was

delivered. A Stockholder may mail a written request to Nano Mobile Healthcare, Inc., Attention: Secretary, 3 Columbus Circle,

15th Floor, New York, NY 10019 or call (713) 973-5738, to request:

| |

● |

a

separate copy of this Information Statement; |

| |

|

|

| |

● |

a

separate copy of Information Statements in the future; or |

| |

|

|

| |

● |

delivery

of a single copy of Information Statements, if such Stockholder is receiving multiple

copies of those documents. |

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting requirements of the SEC. Accordingly, we are required to file reports with the SEC including annual

reports, quarterly reports, current reports and other reports as required by SEC rules. All reports that we file electronically

with the SEC are available for viewing free of charge over the Internet via the SEC’s EDGAR system at http://www.sec.gov.

We will provide without charge to each person who receives a copy of this Information Statement, upon written or oral request,

a copy of any information that is incorporated by reference in this Information Statement. Requests should be directed to Nano

Mobile Healthcare, Inc., Attention: Secretary, 3 Columbus Circle, 15th Floor, New York, NY 10019 or call (713) 973-5738.

For further information about us, you may read and copy any reports, statements and other information filed by us at the SEC’s

Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549-0102. You may obtain further information on the

operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Appendix

A

Form

of Amendment to Effectuate

the

Capital Stock Increase

CERTIFICATE

OF AMENDMENT

TO

THE

CERTIFICATE

OF INCORPORATION

OF

NANO

MOBILE HEALTHCARE, INC.

It

is hereby certified that:

1. The

current name of the corporation is Nano Mobile Healthcare, Inc. (the “Corporation”).

2. The

Corporation filed its Certificate of Incorporation with the Delaware Secretary of State on January 9, 2015 under the name Vantage

mHealthcare, Inc. and filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on September

8, 2015 to change its name to Nano Mobile Healthcare, Inc. (as amended, the “Certificate”).

3. The

Certificate of the Corporation is hereby amended as follows:

By

deleting the first sentence in Article FIFTH, Section A, in its entirety and replacing it with the following:

“The

total number of shares of all classes of stock which the Corporation shall have the authority to issue is 1,000,000,000 shares,

consisting of 900,000,000 shares of common stock, par value $0.001 (the “Common Stock”), and 100,000,000 shares

of preferred stock, par value $0.001 (the “Preferred Stock”).”

4. This

Certificate of Amendment to the Certificate was duly adopted pursuant to the provisions of Sections 141 and 242 of the Delaware

General Corporation Law (the “DGCL”).

5.

Pursuant to Section 228(a) of the DGCL, the holders of outstanding shares of the Corporation having no less than the minimum

number of votes that would be necessary to authorize or take such actions at a meeting at which all shares entitled to vote thereon

were present and voted, consented to the adoption of the aforesaid amendments without a meeting, without a vote and without prior

notice and that written notice of the taking of such actions has been given in accordance with Section 228(e) of the DGCL.

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Certificate of Incorporation as of [_________].

| |

NANO

MOBILE HEALTHCARE, INC. |

| |

|

|

| |

By: |

/s/

Joseph Peters |

| |

|

Joseph

Peters |

| |

|

Chief

Executive Officer |

Appendix

B

Form

of Amendment to Effectuate

the

Reverse Stock Split

CERTIFICATE

OF AMENDMENT

TO

THE

CERTIFICATE

OF INCORPORATION

OF

NANO

MOBILE HEALTHCARE, INC.

It

is hereby certified that:

1. The

current name of the corporation is Nano Mobile Healthcare, Inc. (the “Corporation”).

2. The

Corporation filed its Certificate of Incorporation with the Delaware Secretary of State on January 9, 2015 under the name Vantage

mHealthcare, Inc., filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on September 8,

2015 to change its name to Nano Mobile Healthcare, Inc. and filed an Amendment to its Certificate of Incorporation with the Delaware

Secretary of State on [______] to increase the Corporation’s authorized capital (as amended, the “Certificate”).

3.

The Board of Directors of the Corporation (the “Board”), acting in accordance with the provisions of Sections 141

and 242 of the Delaware General Corporation Law (the “DGCL”), adopted resolutions amending the Corporation’s

Certificate as follows:

4.

Article Fifth of the Corporation’s Certificate is hereby amended by adding the following Section D:

“D.

Reverse Stock Split.

| |

1. |

Upon

the effectiveness of this Certificate of Amendment to the Certificate of Incorporation of the Corporation, the shares of the

Corporation’s Common Stock issued and outstanding prior to [__________] at 5:00pm Eastern time (the “Effective

Time”) and the shares of Common Stock issued and held in treasury of the Corporation immediately prior to the Effective

Time shall automatically be reclassified into a smaller number of shares such that each [________] shares of the Corporation’s

issued and outstanding Common Stock immediately prior to the Effective Time are reclassified into one (1) validly issued,

fully paid and nonassessable share of Common Stock, without any further action by the Corporation or the holder thereof. No

fractional shares of Corporation Common Stock will be issued as a result of the reverse stock split. Instead, stockholders

of record who otherwise would be entitled to receive fractional shares, will be entitled to receive a cash payment in lieu

thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing price

of the Corporation’s Common Stock, as reported by the OTCQB Market, on the last trading day prior to the Effective Time.

|

| |

|

|

| |

2. |

Each

stock certificate that, immediately prior to the Effective Time, represented shares of Common Stock that were issued and outstanding

immediately prior to the Effective Time shall, from and after the Effective Time, be submitted to the transfer agent to be

automatically exchanged for certificates representing the appropriate number of whole shares of Common Stock after the Effective

Time. No new certificates will be issued to a stockholder until such stockholder has surrendered all certificates representing

shares of Common Stock that were issued and outstanding immediately prior to the Effective Time, together with a properly

completed and executed letter of transmittal, to the transfer agent. Upon surrender of such certificates, new certificates

evidencing and representing the number of whole shares of Common Stock after the Effective Time into which the shares of Common

Stock formerly represented by such certificate shall have been reclassified shall be issued. Until surrendered all stock certificates

representing shares of Common Stock that were issued and outstanding immediately prior to the Effective Time will be deemed

to be cancelled.” |

5.

This Certificate of Amendment shall be effective on [____________] at 5:00 p.m., Eastern time (the “Effective Time”).”

6. This

Certificate of Amendment to the Certificate was duly adopted pursuant to the provisions of Section 242 of the DGCL.

7.

Pursuant to Section 228(a) of the DGCL, the holders of outstanding shares of the Corporation having no less than the minimum

number of votes that would be necessary to authorize or take such actions at a meeting at which all shares entitled to vote thereon

were present and voted, consented to the adoption of the aforesaid amendments without a meeting, without a vote and without prior

notice and that written notice of the taking of such actions has been given in accordance with Section 228(e) of the DGCL.

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Certificate of Incorporation as of [_________].

| |

NANO

MOBILE HEALTHCARE, INC. |

| |

|

|

| |

By: |

/s/

Joseph Peters |

| |

|

Joseph

Peters |

| |

|

Chief

Executive Officer |

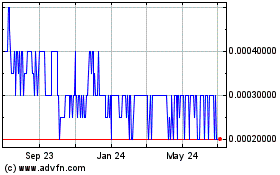

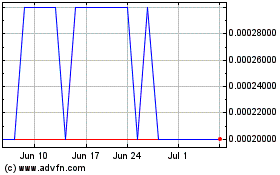

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Apr 2023 to Apr 2024