UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Preliminary Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [ ]

Filed by a party other than the Registrant [X]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by*

Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under 240.14a-12

HYPERDYNAMICS CORPORATION

(Name of Registrant as Specified In Its Charter)

Empower Capital

Dr. Gerald Bailey

William Hayden

James Wilson

Andrew Windham

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1)*

and 0-11

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant*

to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is *

calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange*

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee *

was paid previously. Identify the previous filing by registration statement *

number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

xx 2016

Dear Fellow Shareholders:

We are furnishing this proxy statement and the accompanying GOLD proxy card*

to stockholders of Hypderdynamics Corporation (the Company) in connection*

with solicitation of proxies for our slate of four experienced, proven, *

and focused director nominees to be used at the Companys 2015 annual meeting*

of stockholders (the Annual Meeting). The Annual Meeting is scheduled to be*

held on Wednesday, January 27, 2015, at 9 a.m. (CST). at the Hotel Sorella *

City Centre at 800 Sorella Court, Houston, TX 77024. This proxy statement and*

the accompanying GOLD proxy card are first being furnished to stockholders *

on or about January xx, 2016.

At the Annual Meeting, we are seeking the election of our four*

director nominees*

to the board of directors of the Company (the Board). We are using this proxy*

statement to solicit proxies from holders of the Companys common stock, par *

value $ XX per share (the Common Stock), to vote for the election to the *

Board of our four experienced, focused, and trusted director nominees, and to*

vote on the other proposals identified in this proxy statement.

Only stockholders of record at the close of business on December 23, 2015 (the *

Record Date) are entitled to attend and vote at the Annual Meeting and any *

adjournments or postponements thereof. Stockholders of record at the close of*

business on the Record Date will be entitled to one vote at the Annual Meeting*

for each share of Common Stock held on the Record Date with regard to each *

matter to be voted upon.

Whether or not you plan to attend the Annual Meeting, we urge you to vote for*

the election of our slate of four experienced, focused, and trusted director *

nominees to election to the Board by signing, dating and returning the enclosed*

GOLD proxy card in the postage-paid envelope, or by voting via the*

Internet or *

telephone. WE URGE YOU NOT TO RETURN ANY WHITE PROXY CARD SENT TO YOU BY THE *

COMPANY. Please note that if you submit a WHITE proxy card to WITHHOLD*

your vote*

with respect to any of the Companys nominees, that submission will not cause *

your shares to be counted as a vote FOR our slate of three*

experienced, focused,*

and trusted director nominees, and will revoke any prior GOLD proxy card that*

you may have submitted. If you want to vote for our slate, use only*

the GOLD card.

Also, if you hold your shares of Common Stock in a stock brokerage account*

or by*

a bank or other nominee, only they can exercise voting rights with respect*

to your*

shares and only upon receipt of your specific instructions. Accordingly,*

it is *

critical that you promptly contact the person responsible for your*

account and *

give instructions to vote the GOLD proxy card.

If you have any questions or require any assistance in executing your proxy, *

please email us at info@empowercap.com.

Sincerely,

Empower Capital

James Wilson

2015 ANNUAL MEETING OF STOCKHOLDERS

OF

HYPERDYNAMICS CORPORATION

To Be Held on January 27, 2016

PROXY STATEMENT OF Empower Capital and James Wilson

We are furnishing this proxy statement and the accompanying GOLD proxy*

card to *

fellow stockholders of Hyperdynamics Corporation (the Company) in connection *

with the solicitation of proxies for our slate of four experienced,*

proven, and*

focused director nominees to be used at the Companys 2015 annual meeting of *

stockholders (the Annual Meeting). The Annual Meeting is scheduled to be held*

on Wednesday, January 27, 2015. Only stockholders of record at the close of *

business on December 23, 2015 (the Record Date) are entitled to attend and *

vote at the Annual Meeting and any adjournments or postponements thereof.

We are soliciting your proxy for the Annual Meeting (and any adjournments or *

postponements thereof) for the following purposes:

- Proposal 1: To vote FOR the election of our slate of four*

experienced, proven,*

and focused director nominees to the board of directors of the Company *

(the Board).

Additionally, there are three other proposals being presented for your *

consideration at the Annual Meeting, including:

- Proposal 2: To ratify the appointment of Hein and Associates LLP as the *

Companys independent auditor for the fiscal year ending June 30, 2016.

- Proposal 3: To hold an advisory vote to approve the executive compensation*

of the Companys named executive officers.

- Proposal 4: To amend the Companys 2010 Equity Incentive Plan to increase *

the number of shares of common stock authorized for issuance thereunder from*

1,250,000 shares to 2,000,000 shares.

We are not aware of any other matters to be brought before the Annual Meeting *

other than as set forth in this proxy statement. Should any other matters be *

brought before the Annual Meeting, the proxies identified in the GOLD proxy *

card will vote the shares that they have been authorized to represent in *

accordance with their discretion. We are making this solicitation on the behalf*

of our slate of four experienced, proven, and focused director nominees, and *

not on behalf of the Board or management of the Company.

Stockholders who vote on the enclosed GOLD proxy card will have the opportunity*

to vote for the other candidates nominated by the Company for the other two *

seats on the Board that are up for election at the Annual Meeting. This gives *

stockholders who want to vote for our slate the ability to use the GOLD proxy *

card to vote for additional candidates to fill the other two seats.

For your information, the mailing address of the principal executive*

office of *

the Company is 12012 Wickchester Lane, Suite 475 Houston, Texas 77079.*

According*

to the Company, as of the Record Date, there were 21,046,591 shares of*

common *

stock outstanding.

WE URGE YOU TO SIGN, DATE AND RETURN THE GOLD PROXY CARD IN FAVOR OF*

THE ELECTION*

OF OUR SLATE OF FOUR EXPERIENCED, PROVEN, AND FOCUSED DIRECTOR NOMINEES*

TO THE *

BOARD.

WE URGE YOU NOT TO SIGN ANY WHITE PROXY CARD SENT TO YOU BY THE*

COMPANY. IF YOU *

HAVE ALREADY DONE SO, YOU MAY REVOKE YOUR PROXY BY DELIVERING A*

LATER-DATED GOLD *

PROXY CARD IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE, BY EXECUTING*

A VOTE VIA THE *

INTERNET OR TELEPHONE, OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

IF YOU HOLD YOUR SHARES OF COMMON STOCK IN A STOCK BROKERAGE*

ACCOUNT OR BY A BANK *

OR OTHER NOMINEE, ONLY THEY CAN EXERCISE VOTING RIGHTS WITH RESPECT TO*

YOUR SHARES *

AND ONLY UPON RECEIPT OF YOUR SPECIFIC INSTRUCTIONS. ACCORDINGLY,*

WE URGE YOU TO *

PROMPTLY CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT AND GIVE*

INSTRUCTIONS TO *

VOTE THE GOLD PROXY CARD.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on Wednesday, January 27, 2016

This proxy statement and the GOLD proxy card are available at

https:// xx

IMPORTANT

Your vote is important, no matter how many shares you own. We urge you to *

either go online, call, or to sign, date and return the enclosed GOLD proxy *

card today to vote FOR the election of our slate of four*

experienced, proven, *

and focused director nominees to the Board.

- If your shares are registered in your own name, please use the GOLD proxy *

card to vote by signing and dating the enclosed GOLD proxy card and*

returning *

it in the enclosed postage-paid envelope today.

- If your shares are held in a stock brokerage account or by a bank or other *

nominee, you are considered the beneficial owner of the shares,*

and these proxy *

materials are being forwarded to you by your broker or bank. If you have *

received a GOLD voting instruction form, you can vote in one of the following *

ways:

- By signing, dating and mailing the voting instruction form in the enclosed *

pre-paid envelope;

- By telephone by calling the telephone number provided and following the *

instructions; or

- By Internet using the instructions included with your materials.

If a GOLD voting instruction form has not been provided, you must call your *

broker or bank and give the person responsible for your account instructions *

about how you would like them to vote on your behalf.

Because only your latest dated proxy card will count, we urge*

you not to return *

any proxy card you receive from the Company. Even if you return*

a WHITE proxy *

card marked WITHHOLD as a protest, it will revoke any GOLD proxy card you may *

have previously sent to us. Remember, you can vote for our slate of four *

experienced, proven, and focused director nominees only on the GOLD*

proxy card. *

So please make certain that the latest dated proxy card you*

return is the GOLD *

proxy card.

If you have any questions, require assistance in voting your GOLD*

proxy card, *

or need additional copies of our proxy materials, please contact us *

at info@empowercap.com

Reasons for Solicitation

Long-term focused shareholder group recommends replacing CEO and*

certain legacy*

board members which has overseen almost $1 billion in value destruction, *

totaling more than 97% of Hyperdynamics market value, during the past five *

years.

Calls for new strategy focused on rebuilding the strained relationship with *

the Companys partners, addressing capital allocation issues, and creating *

significant value for shareholders led by a reconfigured board and*

leadership *

with proven expertise, the right relationships, and a clear plan.

Dear Fellow Hyperdynamics Shareholders:

We have a deep understanding of Hyperdynamics Corporation and *

have engaged with the Companys global partners and stakeholders*

and we believe*

that the future of the Company is at stake. We are very troubled by the *

extent of the mistakes, questionable actions, and unaccountability of the *

CEO and certain legacy board members. This is a situation where the*

problems are *

extensive and real change is urgently needed.

We recently informed the Company about our plan to nominate a slate of three *

experienced and proven oil & gas and Africa focused business leaders to the *

Board of Directors of the Company at the annual shareholder meeting,*

including*

Dr. Gerald Bailey, Mr. William Hayden, and Mr. James Wilson.

However, instead of working with us to improve the situation at the Company, *

the CEO and certain members of the legacy board have responded by*

postponing the*

shareholder meeting from its original date of December 15, 2015 to *

January 27, 2016 and by increasing the size of the board to include a medical *

malpractice attorney who appears to have no business, capital markets, *

natural resources, or Africa experience. The effect of this is to*

further delay*

the opportunity for shareholders to have our voices heard and address the*

legacy and current problems, as well as unnecessarily increasing*

corporate costs.

As a result of these actions of the CEO and certain members of the*

legacy board,*

we have further recently updated and supplemented our notice to include an *

additional director nominee, Mr. Andrew Windham, in accordance with*

the Companys*

by-laws. The CEO and certain members of the legacy board are attempting to *

not allow us to do this, however, we have noticed the relevant*

parties at the *

Company that we have followed proper procedure and thus have the right to *

include our additional director nominee.

Thus, we are writing to ask you to support our slate of director*

nominees, which *

will have a mandate to replace the current CEO with an experienced*

and focused *

oil & gas executive and together with the reconfigured board pursue a *

refocused strategy to successfully take the Company to a new level of growth *

while addressing the historical capital allocation and other issues.

We have prepared a comprehensive presentation in which we analyze the Companys*

situation, provide a detailed background of our nominees and explain our *

plan to rebuild the trust in the Company with investors and partners thus *

positioning Hyperdynamics for long-term growth that will unlock *

transformational value for all shareholders. This comprehensive *

presentation will be filed separately.

Numerous compelling reasons to replace the CEO and certain legacy board members

When you think about how to vote at this year's annual meeting, we*

ask that you *

remember the value destruction and multiple questionable actions*

that we believe*

is caused by the CEO and certain legacy board members which shows they *

lack the credibility and competence to run the Company, while*

having no strategy*

or vision to unlock growth and create substantial value for shareholders:

- Lost substantial shareholder value every year for the past five years, *

totaling almost $1 billion or 97% in value destruction

- This dismal result is primarily related to factors other than the decline *

in oil prices or the previous DOJ & SEC FCPA investigation as most of this *

value destruction occurred before then

- Spent almost $50 million in administrative and general expenses since 2012

- This is especially questionable when the operatorship of their*

only asset was*

farmed out in December 2012, there were no growth initiatives*

executed during *

this time, and this amount excludes the costs incurred during the FCPA cases

- Costly failed and unexplained attempt to "diversify asset base" with two *

separate down payments totaling $10 million that was then completely lost *

within 5 months, which at the time was over 20% of the companys cash balance

- Shareholders were also not informed as to the country or company the *

investment was to be made in nor the strategic benefit this investment was*

going to provide

- Since 2011, the top management and directors have paid themselves almost*

$18,000,000 in salary and payments, with salaries being raised again in *

October 2015

- In 2014 and 2015, the Board approved Ray Leonards cash salary and bonus*

of $1,200,000, even while acknowledging that he achieved none*

of the Companys*

compensation metrics and goal

- Overspent to drill only one well for $125 million, more than 3.5x original*

estimate, when consistently stating that it would be easy to drill*

two wells *

for only $80 million

- Publicly antagonized and acted aggressively with their key*

operating partner,*

at a time when cooperation was needed, as well as showing*

consistent disregard *

for the Company and shareholders

- This was further displayed with Ray Leonards comments on*

January 5 of this*

year accusing Tullow of failure when Tullow has actually*

led the work program,*

budget discussions, and traveled to Guinea on numerous*

occasions and indicated*

their willingness to fund their portion of the drilling of the well.

- Sued in 3 separate instances by different sets of shareholders*

for misleading*

shareholders and also for misrepresentation

- Spent almost $13 million on fees relating to the FCPA cases,*

when our research*

and also a Wall Street Journal report has shown that for a*

company like *

Hyperdynamics and with only one asset in one country the cost*

should be no more*

than $5 million if not lower

- Changed the companys by-laws to require 50% more shares for*

shareholders to*

initiate a shareholder meeting just before they announced the*

unexplained lose*

of the $10 million in down payments and a number of other negative news

- Multiple internal and reporting control issues almost every*

year since 2009 *

which culminated in the independent auditor, Deloitte, declining*

to continue as*

such this year

- Have not had a shareholder meeting in almost two years, which*

appears to be in*

violation of the Companys by-laws that require a shareholder*

meeting every year

- Now has delayed the current shareholder meeting, thus further*

displaying a *

disregard for shareholders

Even with the destruction of shareholder value, the missing of*

multiple growth*

opportunities that would have positioned the Company for the future,*

and the*

squandering of the Companys cash reserves that the CEO and certain*

legacy board*

members have led, we still believe in the potential of the Company*

to grow and *

also in the potential of the oil block in Guinea. However, this growth and*

value can only be achieved by replacing the CEO and certain legacy*

board members*

with a proven, experienced, and focused group.

Overview of our proven, experienced, and focused director nominees

Our nominees are highly qualified and known value creators:

Dr. Gerald Bailey is a former Exxon President with over 40 years*

of experience*

in the international petroleum industry in all aspects, both upstream and *

downstream with specific Middle East and Africa skills and U.S.*

onshore/offshore*

sectors. Dr. Bailey has served in a senior leadership or*

executive capacity *

in Abu Dhabi, Qatar, Libya, amongst other countries. Dr. Bailey*

has a PhD, has*

written multiple papers and studies on the oil industry, and has*

appeared as *

a keynote speaker at a number of industry conferences.

Mr. William Hayden is a geologist with over 35 years of experience*

in the mineral,*

energy, and exploration industry focused primarily in Africa*

and Asia. Mr. Hayden*

currently serves as a Chairman or director of a number of public and *

private resources exploration companies and has consistently been a*

successful*

first mover in Africa, including having discovered two of the most *

prolific natural resource finds in southern Africa since the 1990s.*

Mr. Hayden*

was also a co-founding director of Ivanhoe Agadem Petroleum, which was *

one of the first western oil exploration groups to re-enter the now prolific*

Agadem oil basin in Niger.

Mr. James Wilson is a merchant banker with over 15 years experience*

in financing*

and developing companies and projects globally and is a Senior Advisor to *

leading global 500 companies operating in Africas petroleum, resources, and*

development sectors. Mr. Wilson is a director of a Republic of*

Guinea focused*

exploration and resources company where he was an integral part*

of the group that*

led the company through to its successful and over-subscribed IPO.*

Mr. Wilson*

is a former investment banker with JP Morgan, Morgan Joseph, and Standard*

Chartered and has an MBA from the Wharton Business School. Mr. Wilson*

is considered a thought leader and innovative deal-maker in Africa and*

other emerging growth regions, where he maintains deep and close *

relationships with key decision makers across multiple countries in*

Africa, China, and globally.

Mr. Andrew Windham is the former Managing Director of the Africa region at*

Tullow Oil and has over 30 years of experience in the oil exploration sector*

primarily focused on Africa. During his tenure at Tullow, Mr. Windham*

played a key role in making Tullow what it is today and led the companys*

entry into now prolific countries with significant oil discovers such as *

Ghana, Kenya, Uganda, among many others. Mr. Windham is currently a Director*

at T5 Oil and Gas, which is an Africa focused oil & gas exploration and*

investment company founded by previous Tullow Board members and senior *

executives. Mr. Windham was a senior executive and on the Board of Energy*

Africa prior to it being acquired by Tullow. Based in Cape Town, South *

Africa, Mr. Windham was trained as a lawyer and received his law degree from*

Cambridge University in the United Kindgom.

Further background on the director nominees is available in our presentation*

and below in the Additional Information About Our Slate of Nominees.

Strategic plan for sustainable growth and unlocking substantial shareholder*

value

We believe that Hyperdynamics should implement a refocused strategy that *

leverages the current low oil price environment to grow*

substantially, reengage*

with the global investment community and other key partners to gain needed *

support, and improve capital allocation issues.

Improve capital allocation & emphasize partnerships: Over the past several*

years, the Company has operated in a disastrous way where overspending has*

been the norm and the use of capital has not been carried out in a prudent*

and strategic manner. This has led to significant questionable actions and*

mistakes across multiple areas which have been under explained or*

not explained*

at all. Part of our plan to improve capital allocation is to decrease and*

realign salaries so that the Company can be in a strong position for future*

development and *

to continue with a large working interest in its Guinea oil block while*

emphasizing partnerships.

Rebuild trust with the global investment community and other key stakeholders:*

Over the past several years the CEO has not engaged or communicated well with*

shareholders, the Companys only operating partner, the host government of the*

Companys only asset, and the global investment community. Even with the*

recent challenges that the Company faced, there is no excuse for*

not effectively*

communicating with key stakeholders or for taking actions that shows disdain*

for the Company, shareholders, and partners. The actions of the*

CEO and the *

legacy board have caused the Company to lose complete credibility*

and undermined*

the trust in the Company and its current leadership thus putting*

the future of *

Hyperdynamics in jeopardy. Without the support of current shareholders, the*

global investment community, and other current and future partners,*

Hyperdynamics will not be able to raise capital in the future nor garner the*

support to continue as a significant working interest partner in the*

Guinea concession. It is imperative that the Company reengages with and uses*

effective communication with these important stakeholders as a matter of*

immediate urgency led by a reconfigured board that is experienced*

and trusted.*

Opportunistically acquire a low cost world-class prolific potential asset: *

Hyperdynamics has a sizable working interest in one of the largest*

concessions in*

West Africa, which is fully funded for the next stage of exploration.*

However, this is the Companys only asset. We believe the current*

low oil price*

environment creates a unique opportunity to leverage Hyperdynamics*

position and*

public company status as well as the support indicated to our director*

nominees by potential future investors and partners to create a*

very focused high*

impact Africa oil explorer with targeted world-class assets. With support*

of shareholders, our proven nominees will look to selectively*

acquire a very*

high potential and already de-risked asset in established regions*

that have low*

economic break-even prices in a country where we have strong*

relationships and*

only in an opportunistic scenario.

Your vote is important

We believe that Hyperdynamics needs a reconfigured board with*

strong directors*

and a proven ability to create value in oil & gas and in Africa.*

Hyperdynamics needs a reconfigured board with a mandate to put in place a CEO*

with the right exploration experience and shareholder focus. Hyperdynamics*

needs a reconfigured board with the ability to position the Company for*

significant long-term growth.

Your vote is important, no matter how many or how few shares you own.*

We ask that you vote for our slate of three director nominees to lead*

the reconfigured board. Let's work together to make the necessary*

changes that are urgently needed.

PROPOSAL 1

ELECTION OF DIRECTORS

According to the proxy statement filed by the Company on December 28, 2015 *

(the Company Proxy Statement), all six of the Companys Board of Director*

positions will be up for election at the Annual Meeting. The term of office*

of a person elected as a director at the Annual Meeting will continue*

for a term*

of one year each or until their successors are elected and qualified.*

As stated in the Company Proxy Statement, directors of the Company will*

be elected*

on a plurality basis, meaning the six nominees who receive the greatest*

number of votes For at the Annual Meeting will be elected.

About this Solicitation

Pursuant to this proxy statement, we are soliciting proxies from holders of *

Common Stock to vote for our slate of four experienced, proven, and focused*

director nominees at the Annual Meeting.

As discussed above in the section titled "Reasons for Solicitation":

We believe that new leadership and vision is needed

The current CEO, Ray Leonard, and specific other board members should be *

replaced with proven and focused directors. The reconfigured board will be*

able to put in place a CEO with the right exploration experience and*

shareholder*

focus and together will be able to implement the strategic and urgent*

initiatives*

which will position the Company for long-term success.

Our slate of four director nominees are uniquely qualified and*

proven value creators

The four director nominees each has skills important and necessary for*

taking the*

Company to the next level of growth and development. Along with their*

fresh and unique perspectives, they possess the right experience,*

skill sets,*

relationships, and focus to transform Hyperdynamics and position*

the Company to*

create substantial shareholder value.

Please refer to the Company Proxy Statement for the backgrounds*

and qualifications*

of the Companys nominees, and certain other information about them.

Additional Information About Our Slate of Nominees

Dr. Gerald Bailey, PhD

Dr. Bailey has over 40 years of experience in the international*

petroleum industry*

in all aspects, both upstream and downstream with specific Middle*

East and*

Africa skills and U.S. onshore/offshore sectors. Along with being*

the CEO of MCW*

Energy Group, he is currently the Chairman of Bailey Petroleum, LLC,*

a consulting*

firm for major oil and gas exploration/development corporations.*

In*

addition, he is Chief Operating Officer of Indoklanicsa, Nicaragua,*

Vice*

Chairman, Trinity Energy Group, Inc., Chairman of American Impact*

Energy and*

CEO of American Dakota Refinery, LLC.

Dr. Bailey is retired from Exxon, lastly as President, Arabian Gulf.*

During his Exxon career, he also served as the Assistant General*

Manager,*

Administration & Commercial, Abu Dhabi Onshore Oil Company;*

Operations Manager,*

Qatar General Petroleum Corp., Dukhan Operations and the Operations*

Manager,*

Qatar General Petroleum Corp., Umm Said Operations. He was also the*

Operations*

Superintendent, Exxon Lago Oil, Aruba and has spent time in Libya as*

Operations Superintendent for Esso Standard, Libya, Brega, with*

experience in*

LNG and oil field production. His earlier career included *

service with Texaco*

where he gained skills in oil additives and petrochemicals manufacturing.

Dr. Bailey holds a BS Degree in Chemical Engineering from the*

University of*

Houston, an MS Degree in Chemical Engineering from the New Jersey*

Institute of*

Technology, Newark, New Jersey, a PhD Degree from Columbia Pacific*

University,*

San Rafael, CA and is a graduate of Engineering Doctoral Studies from*

Lamar*

University, Beaumont, TX. He has written many articles, papers and*

studies on*

the oil industry, and has been a keynote speaker of many international*

industry conferences including the Money Show conference with his*

address, The*

Future of Oil & Gas Developments, and FreedomFest Conference,*

Investing In*

Oil, and also has appeared recently on national Chinese television*

discussing*

the World Energy Outlook. He is a member of the Middle East Policy*

Council,*

Society of Petroleum Engineers and the American Institute of Chemical*

Engineers.

William Hayden, BsC

Mr. Hayden is a geologist with over 35 years experience in the*

mineral, energy,*

and exploration industry, much of which has been in Africa and the*

Asia-Pacific region. Since 1983, he has worked in a management*

capacity with*

several natural resource exploration companies.

Mr. Hayden was a Co-founding Director of Ivanhoe Agadem Petroleum,*

one of the*

first western oil exploration groups to re-enter the now prolific*

Agadem oil*

basin and work with the Government of Niger and their most recent*

petroleum code*

advisors to explore the basin prior to CNPC. He is also the*

Co-founder and *

former President of Ivanplats, currently TSX-listed Ivanhoe Mines*

Ltd, a *

successful first mover in the Democratic Republic of Congo and*

South Africa having*

discovered and initiated develop of two of the largest natural resource*

projects in Africa since the early 1990s. Mr. Hayden has also*

previously*

served as President of Ivanhoe Philippines and GoviEx Uranium Niger.

Mr. Hayden currently serves as a director of TSX-listed Ivanhoe*

Mines Ltd, NYSE and*

TSX-listed NovaCopper, Sky Alliance Resources, HKSE-listed*

China Polymetallic Mining, ASX-listed Condoto Platinum, and*

ASX-listed Globe Metals & Mining.

He holds a Bachelor of Science (Hons) in Geology from*

Sierra Nevada College, Nevada.

James Wilson, MBA

James Wilson has over 15 years experience in financing and*

developing public and*

private companies and projects in the United States, Africa,*

and Asia. He *

is the Chairman of Empower Capital, an emerging natural resource*

and development*

projects sponsor. Empower Capital has partnered with some of the largest*

international infrastructure and resource development companies for growth*

projects in Africa, including in Nigeria, Ethiopia, Kenya, Ivory Coast,*

and other countries.

Mr. Wilson is a Senior Advisor to leading global 500 companies operating *

in Africa, including Sinopec and China Railway Construction Corporation.

He is a Board Director of Sky Alliance Resources, a minerals exploration *

and development company with assets in the Republic of Guinea. He was part*

of the group that led the company through the successful and*

over-subscribed*

IPO of its principle mining asset.

He is a former investment banker with JP Morgan, Morgan Joseph,*

and Standard*

Chartered, where he specialized in raising capital in the public and private*

markets as well as in mergers & acquisitions for corporate and*

private equity*

clients globally.

Considered a thought leader on the emerging Africa growth story,*

Mr. Wilson *

maintains deep and close relationships with key decision makers*

across multiple*

countries in Africa, China, and globally. He is a frequent speaker at*

international conferences and has been recognized by global media*

outlets as an*

innovative emerging markets and Africa-focused entrepreneur and deal-maker.

A fluent Mandarin Chinese speaker, he has studied at the East China*

University *

of Politics & Law where he undertook his masters level studies in Investment*

Law exclusively in Mandarin Chinese.

Mr. Wilson received his MBA from the Wharton Business School of the*

University of*

Pennsylvania, where he was Chairman of the Wharton Asia Business*

Conference,*

and has a BSc from Carnegie Mellon University, where he graduated with*

distinction from the Phi Beta Kappa Honor Society.

Mr. Andrew Windham, BA

Mr. Windham was brought up in East Africa and has over 30 years*

experience in the*

oil exploration industry, primarily focused in Africa where he*

has explored*

for or developed oil & gas projects in over 10 African countries*

where in many*

cases he and his team were one of the first movers in those now prolific*

countries. Mr. Windham is currently a Director of T5 Oil and Gas,*

which is an*

Africa focused oil & gas exploration and investment company founded by*

previous Tullow Board members and senior executives.

Mr. Windham was with Tullow Oil, first serving as a full-time*

consultant to the*

company for two years before becoming the Managing Director for Africa from*

2007 to 2012. During his tenure at Tullow, and its predecessor,*

Energy Africa,*

Mr. Windham played a key role in making Tullow what it is today and, with*

others, and led the companys entry into the now prolific countries*

of Ghana,*

Kenya, Uganda, among others, which all have significant oil*

discoveries and*

where Tullow is a leading operator.

Mr. Windham was a senior executive of Energy Africa prior to it*

being acquired*

by Tullow. While at Energy Africa, Mr. Windham served as General Counsel*

based in London but traveling extensively throughout Africa. He*

was subsequently*

promoted to Commercial Director and became a Board member, helping*

to lead*

the growth that prompted Tullow to acquire the company.

Mr. Windham has a law degree from Cambridge University and began*

his career as a*

qualified solicitor in the City of London with Stephen Harwood & Tatham*

before moving into industry first in the defence sector (Westland*

Aircraft Ltd)*

and then in 1983 into the oil & gas sector where he became legal*

director of*

Clyde Petroleum plc.

***

- No participant within the past year has been, a party to any contract, *

arrangement or understanding with any persons with respect to any*

securities*

of the Company, including, but not limited to, joint ventures, loan*

or option*

arrangements, puts or calls, guarantees against loss or guarantees*

of profits,*

divisions of losses or profits, or the giving or withholding of proxies;

- No participant within the past year has been, a party to, and*

neither of us*

nor our family members have had a direct or indirect material*

interest with*

respect to, any transaction or series of similar transactions*

since the*

beginning of the Companys last fiscal year to which the Company*

or any*

of its subsidiaries was or is a party.;

- No participant has not been convicted in a criminal proceeding nor is a*

named subject of a pending criminal proceeding (excluding traffic*

violations*

and similar misdemeanors) during the past ten years; and*

- No participant has any arrangement or understanding with any person with*

respect to any future employment by the Company or its affiliates or with*

respect to any future transactions to which the Company or any of its*

affiliates will or may be a party.

Overview of skills matrix of our slate of nominees

Additional reasons we believe specific legacy directors need to be replaced

Our slate of four director nominees is looking to replace four current*

directors on the board, including the CEO, Ray Leonard, and three*

non-executive directors, William Strange, Fred Zeidman, and Gary Elliston.

We believe only replacing Ray Leonard on the board will not be enough to*

fix and address the problems at the Company. In addition to replacing*

Ray Leonard, our slate of director nominees are will also replace the *

three above mentioned so-called independent directors who are neither *

independent nor qualified to serve on the board of the Company.

William Strange

- A Director since 2010, he is one of the longest serving directors on*

the Board, thus we believe he has overseen and approved essentially all*

of the destructive actions by Ray Leonard.

- Although he was an audit partner with Deloitte for over 29 years, we*

believe he failed to provide the needed oversight to prevent the*

ineffectual controls that led to the multiple disastrous missteps.

- For the majority of the time that he has been a director, the Company*

has reported some type of material internal control or accounting issue,*

including in 2011, 2012, 2013, and now Deloitte declining to be the*

auditor for the 2016 fiscal year.

Fred Zeidman

- A Director since 2009, he is the longest serving legacy director and we*

believe a very key decision maker in the disastrous actions that Ray *

Leonard has taken and continues to take.

- He has been specifically identified and accused in the ongoing lawsuit*

by other shareholders for hiding and misrepresenting information and*

possibly lying to shareholders.

- He has been paid almost $800,000 as a non-executive and we believe*

is a clear part of the culture of excess and unaccountability.

Gary Elliston

- Appointed in November 24, 2015, in our opinion, he appears to be a Ray*

Leonard crony and that his Director appointment is a form of payment for*

buying shares to vote at the shareholder meeting.

- A medical malpractice attorney, he seems to have no relevant business,*

capital markets, oil & gas, nor international experience.

- Ray Leonard increased the size of the board to add him as a Director *

when we believe he appears to provide very little if any benefit to*

the Company as a director.

Given what appears to be the lack of independence, specific highly*

questionable actions, and lack of experience by these members of the*

Board, we believe it is clear why the Company has experienced the*

problems it has and thus we believe that Ray Leonard and these other*

three directors need to be replaced and a culture of shareholder focus*

and director accountability put in place.

Use Your GOLD Card

The accompanying GOLD proxy card will be voted in accordance with your*

instructions. You may specify that your shares should be voted FOR our*

slate of nominees or you may WITHHOLD authority to vote for our slate.*

If you do not want your shares to be voted for the Companys other*

nominees either, you may also withhold authority to vote for them by*

writing their names on the proxy card in the space provided.

If you hold your shares of common stock in a stock brokerage account*

or by a bank or other nominee, only they can exercise voting rights*

with respect to your shares and only upon receipt of your specific*

instructions. Accordingly, we urge you to use your voting instruction*

form, or otherwise promptly contact the person responsible for your*

account, and give them instructions to vote the GOLD proxy card.

According to the Company Proxy Statement, the election of a director*

by stockholders shall be determined by a plurality of the votes cast*

by the stockholders of record entitled to vote at the election present*

in person or represented by proxy, and the nominees receiving the*

greatest number of affirmative votes of the shares present in person,*

or represented by proxy, and entitled to vote at the Annual Meeting will*

be elected, provided a quorum is present. According to the Company Proxy*

Statement, abstentions and broker non-votes will not be counted toward a*

nominees total. According to the Company Proxy Statement, because brokers*

or other nominees who hold shares in street name do not have*

discretionary*

voting authority over such shares in an election of directors, shares held*

in street name will not be voted in this election for a director*

unless the*

holder specifically instructs the holders brokers or other nominees*

on how *

to vote.

If no instructions are given with respect to this proposal and the GOLD proxy*

card is returned, the GOLD proxy card will be voted FOR our slate.

NOTIFICATION OF ADDITIONAL DIRECTOR NOMINEE

In accordance with the Companys by-laws, on December 17, 2015 we informed the*

Companys Corporate Secretary of an update and supplement to our notification*

regarding our intention to nominate an alternative slate of*

director nominees *

to the Companys board of directors. Along with the other director nominees,*

Mr. Andrew Windham will also be an important addition to the board*

of directors*

given his previous experience and relationship with Tullow Oil, a*

key partner in*

the Companys Guinea oil concession. Although we believe that it is*

clear our*

update and supplement is timely and proper, the Companys management*

is attempting*

not to allow for our additional director nominee. We have notified*

the Companys*

Corporate Secretary that we have been informed by our legal counsel*

that we are able*

to include our additional director nominee. Given the current situation*

at the*

Company, we believe it is important for the Company to have Mr. Andrew*

Windham *

and our other nominees as Directors on the Companys board.

WE RECOMMEND THAT YOU VOTE FOR THE ELECTION OF

OUR SLATE OF FOUR EXPERIENCED, PROVEN, AND FOCUSED

DIRECTOR NOMINEES TO THE BOARD

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

According to the Company Proxy Statement, the Company will solicit proxies to*

ratify the selection of Hein & Associates LLP (Hein) by the Board as*

independent registered public accounting firm to audit the accounts and *

records of the Company for the fiscal year ending June 30, 2016.

We recommend that you vote FOR this proposal. You may vote on*

the ratification*

of the selection of Hein by marking the proper box on the GOLD*

proxy card, or,*

if you hold your shares through a brokerage firm or bank, by*

using your voting*

instruction form to instruct them how to vote your shares on*

the GOLD proxy*

card. If no instructions are given with respect to this proposal*

and the GOLD*

proxy card is returned, the GOLD proxy card will be voted FOR the*

ratification*

of the selection of Hein. According to the Company Proxy Statement,*

ratification of the Companys selection of independent registered public*

accounting firm will require the affirmative vote of a majority of the*

shares present in person, or represented by proxy, and entitled to vote*

at the Annual Meeting, provided a quorum is present. According to the*

Company Proxy Statement, because brokers or other nominees who hold shares*

in street name do not have discretionary voting authority over such*

shares, shares held in in street name would not be voted on this proposal*

unless the holders specifically instruct* their brokers or other nominees*

on how to vote.

WE RECOMMEND THAT YOU VOTE FOR THE RATIFICATION OF THE

SELECTION OF HEIN & ASSOCIATES LLP

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

According to the Company Proxy Statement, the Company is requesting advisory*

approval of the compensation of the Companys named executive officers as*

disclosed in the compensation table and the narrative discussion set forth*

in the Company Proxy Statement. This non-binding advisory vote is commonly*

referred to as a say on pay vote and is required to be conducted pursuant*

to Section 14A of the Securities Exchange Act of 1934, as amended. The next*

stockholder advisory vote will occur at the Companys 2018 annual meeting,*

unless stockholders determine otherwise.

Pursuant to this proxy statement, we are soliciting proxies from holders of*

Common Stock to vote against the compensation of the Companys*

named executive*

officers as described in the Company Proxy Statement. We intend*

to use this*

proxy to vote against the compensation of the Companys named*

executive officers*

as described in the Company Proxy Statement as we feel that the*

salary and bonus*

paid are excessive given that the Named Executive Officers have*

not created*

value to shareholders.

In the section titled Reason for Solicitation, we provide more details*

regarding why we feel that the salaries, bonus, and additional payments*

have been and continue to be excessive.

We recommend that you vote AGAINST this proposal. You may vote on the*

advisory*

approval of the compensation of the Companys named executive officers by*

marking the proper box on the GOLD proxy card, or, if you hold*

your shares *

through a brokerage firm or bank, by using your voting instruction form to*

instruct them how to vote your shares on the GOLD proxy card. If no*

instructions*

are given with respect to this proposal and the GOLD proxy card*

is returned,*

the GOLD proxy card will be voted AGAINST the advisory approval of*

the compensation*

of the Companys named executive officers. According to the Company Proxy*

Statement, advisory approval of the compensation of the Companys*

named executive*

officers will require the affirmative vote of a majority of the shares*

present in person, or represented by proxy, and entitled to vote at the*

Annual Meeting, provided a quorum is present. According to the Company*

Proxy Statement, because brokers or other nominees who hold shares*

in street name do not have discretionary voting authority over such*

shares, shares held in in street name would not be voted on this*

proposal unless the holders specifically*

instruct their brokers or other nominees on how to vote.

WE RECOMMEND THAT YOU VOTE AGAINST THE COMPENSATION OF THE NAMED*

EXECUTIVE*

OFFICERS AS DISCLOSED IN THE COMPANYS PROXY STATEMENT

PROPOSAL 4

AMENDMENT TO THE COMPANYS 2010 EQUITY INCENTIVE PLAN

According to the Company Proxy Statement, Stockholders are being asked to*

approve an amendment to the Companys 2010 Equity Incentive Plan to*

increase the number of shares available for issuance under the 2010*

Plan by 750,000 shares from 1,250,000 to 2,000,000 shares.

We believe that the number of shares of Common Stock currently available*

for issuance under the 2010 Plan is insufficient since there will*

not be enough*

shares remaining for any future annual equity incentive grants after*

the Companys*

equity incentive grants for the fiscal year ended June 30, 2015 are fully*

vested and thus limit the Companys ability to attract, retain and motivate*

top quality employees and non-employee members of the*

Board of Directors. We*

believe that if the Amendment is not approved it may be difficult to retain*

officers and non-employee directors for the Company.

We recommend that you vote FOR this proposal. You may vote on*

approval of the*

amendment to the Companys 2010 Equity Incentive Plan by marking*

the proper box*

on the GOLD proxy card, or, if you hold your shares through a*

brokerage firm or*

bank, by using your voting instruction form to instruct them how*

to vote your*

shares on the GOLD proxy card. If no instructions are given with*

respect to this*

proposal and the GOLD proxy card is returned, the GOLD proxy card*

will be*

voted FOR the approval of the amendment to the Companys 2010 Equity*

Incentive*

Plan. According to the Company Proxy Statement, the approval of the*

amendment*

to the Companys 2010 Equity Incentive Plan will require the*

affirmative vote of*

a majority of the shares present in person, or represented by*

proxy, and*

entitled to vote at the Annual Meeting, provided a quorum is present.*

According to the Company Proxy Statement, because brokers or other*

nominees*

who hold shares in street name do not have discretionary voting*

authority*

over such shares, shares held in in street name would not be*

voted on this*

proposal unless the holders specifically instruct their brokers*

or other*

nominees on how to vote.

WE RECOMMEND THAT YOU VOTE FOR THE APPROVAL OF THE AMENDMENT

TO THE COMPANY 2010 EQUITY INCENTIVE PLAN

VOTING PROCEDURES

According to the Company Proxy Statement, only holders of record*

of shares of*

Common Stock as of the close of business on the Record Date are*

entitled to*

notice of, and to vote at, the Annual Meeting and at any adjournments or*

postponements thereof. According to the Company Proxy Statement, as of the*

Record Date of December 23, 2015, there were 21,046,591 shares*

of Common Stock*

outstanding, and each stockholder is entitled to one vote for each share of*

Common Stock held as of the Record Date on all matters presented*

at the Annual*

Meeting.

As explained in the detailed instructions on your GOLD proxy card,*

there are four*

ways you may vote your shares of Common Stock:

- Sign, date and return the GOLD proxy card in the postage-paid*

envelope. We*

recommend that you vote using the GOLD proxy card even if you*

plan to attend*

the Annual Meeting in person;

- Vote via the Internet by following the voting instructions on*

the GOLD proxy*

card;

- Vote by telephone by following the voting instructions on the GOLD proxy*

card; or

- Vote in person by attending the Annual Meeting. Note, however,*

if you hold*

your shares of Common Stock through a brokerage firm or bank, you*

must obtain*

a legal proxy from such custodian in order to vote in person at the Annual*

Meeting.

If you are the beneficial owner of shares held in a stock brokerage account*

or by a bank or other nominee on the Record Date, such institution should*

provide you with information regarding the methods by which you can direct*

such institution to vote your shares. Your brokerage firm or bank should*

send you a GOLD voting instruction card to be completed, signed, dated *

and returned by a date in advance of the Annual Meeting, and/or information*

on how to communicate your voting instructions to them by telephone or over*

the Internet.

If you are the beneficial owner of shares held though a brokerage*

firm or bank,*

we encourage you to promptly provide instructions to such*

institution to vote*

your shares in accordance with the GOLD proxy card. This ensures that your*

shares will be voted at the Annual Meeting.

If you give us your proxy, your shares will be voted in the manner you*

indicate. You may specify whether your shares should be voted FOR the*

election of our slate, or whether you WITHHOLD authority for your shares*

to be voted for the election of our slate. You may also indicate that you*

wish to WITHHOLD authority for your shares to be voted for the Companys*

nominees. You may also specify whether your shares should be voted FOR or*

AGAINST each of the other proposals. If you sign, date and return the GOLD*

proxy card without indicating your instructions, your shares will be voted*

as follows:

FOR the election to the Board of our slate of four director*

nominees as well*

as Patricia N. Moller and Ian Norbury;

FOR the ratification of the appointment of Hein & Associates LLP as the*

Companys independent auditor for the fiscal year ending June 30, 2016.*

AGAINST the advisory vote to approve the executive compensation of the *

Companys named executive officers.

FOR the amendment of the Companys 2010 Equity Incentive Plan to*

increase*

the number of shares of common stock authorized for issuance*

thereunder*

from 1,250,000 shares to 2,000,000 shares.

With respect to matters other than those set forth above that may*

properly*

come before the Annual Meeting, or at any postponement or adjournment*

thereof, we will vote the shares we have been authorized to represent *

in accordance with what we believe is in the best interest of the*

shareholders*

and the Company.

Broker Non-Votes and Required Votes

If you hold your shares of Common Stock through a bank, broker or*

other nominee*

(commonly referred to as holding your shares in street name) and do not*

provide voting instructions to the record holder of the shares, your shares*

of Common Stock will not be voted on any proposal on which your*

bank, broker*

or other nominee does not have discretionary authority, under*

applicable rules,*

to vote. Accordingly, if your shares of Common Stock are held*

in street name,*

your bank, broker or other nominee has enclosed a voting*

instruction card with*

this proxy statement. We strongly encourage you to vote your*

shares of Common*

Stock in favor of the election of our slate of nominees to the Board by*

following the instructions provided on the voting instruction card.

According to the Company Proxy Statement, the election of a director by*

stockholders (Proposal 1) shall be determined by a plurality of the votes*

cast by the stockholders of record entitled to vote at the election present*

in person or represented by proxy, and the nominees receiving the greatest*

number of affirmative votes of the shares present in person, or represented*

by proxy, and entitled to vote at the Annual Meeting will be elected,*

provided a quorum is present. Abstentions and broker non-votes will not*

be counted toward a nominees total. According to the Company Proxy*

Statement, because brokers or other nominees who hold shares in street*

name do not have discretionary voting authority over such shares in an*

election of directors, shares held in street name will not be voted*

in this election for a director unless the holder specifically instructs*

the holders brokers or other nominees on how to vote.

According to the Company Proxy Statement, the proposal on the ratification*

of the Companys selection of independent registered public accounting*

firm (Proposal 2) will be approved if the votes cast in favor exceed the*

votes cast against approval. According to the Company Proxy Statement,*

abstentions and broker non-votes will not be counted as either a vote*

For or Against Proposal 2. According to the Company Proxy Statement,*

because brokers or other nominees who hold shares in street name do not*

have discretionary voting authority over such shares in such non-routine*

matters, shares held in street name will not be voted on this advisory*

vote on executive compensation unless the holders specifically instruct*

their brokers or other nominees on how to vote.

According to the Company Proxy Statement, the proposal on approval of*

executive compensation (Proposal 3) will be approved in a non-binding*

advisory vote if the votes cast in favor exceed the votes cast against*

approval. According to the Company Proxy Statement, abstentions and*

broker non-votes will not be counted as either a vote For or Against*

Proposal 3. According to the Company Proxy Statement, because brokers*

or other nominees who hold shares in street name do not have*

discretionary*

voting authority over such shares in such non-routine matters, shares held*

in street name will not be voted on this advisory vote on executive*

compensation unless the holders specifically instruct their brokers or*

other nominees on how to vote.

According to the Company Proxy Statement, the proposal on approval of the*

amendment to the Companys 2010 Equity Incentive Plan (Proposal 4) will be*

approved if the votes cast in favor exceed the votes cast against approval.*

According to the Company Proxy Statement, abstentions and broker non-votes*

will not be counted as either a vote For or Against Proposal 3.*

According to the Company Proxy Statement, because brokers or other*

nominees who hold shares in street name do not have discretionary voting*

authority over such shares in such non-routine matters, shares held in*

street name will not be voted on this advisory vote on executive *

compensation unless the holders specifically instruct their brokers or*

other nominees on how to vote.

Revocation of Proxies

You may revoke or change your proxy instructions at any time prior to the*

vote at the Annual Meeting by:

- submitting a properly executed, subsequently dated GOLD proxy card that*

will revoke all prior proxy cards, including any WHITE proxy cards that*

you may have submitted to the Company;

- providing instructions by telephone or via the Internet as to how you*

would like your shares of Common Stock voted;

- attending the Annual Meeting and withdrawing your proxy by voting in*

person (although attendance at the Annual Meeting will not in and of*

itself constitute revocation of a proxy); or

- delivering written notice of revocation to either Empower Capital at*

xx or to the Company (to the attention of Paolo Amoruso, Corporate*

Secretary) at 12012 Wickchester Lane, Suite 475 Houston, Texas 77079.

Although a revocation is effective if delivered to the Company, we*

request that either the original or a copy of any revocation be emailed*

to us at info@empowercap.com or mailed to Empower Capital at xx, so*

that we will be aware of all revocations. You may also email us at*

info@empowercap.com for assistance with sending a copy of the revocation.

IF YOU PREVIOUSLY SIGNED AND RETURNED A WHITE PROXY CARD TO THE COMPANY,*

WE URGE YOU TO REVOKE IT BY (1) MARKING, SIGNING, DATING AND RETURNING *

THE GOLD PROXY CARD, (2) PROVIDING INSTRUCTIONS BY TELEPHONE OR VIA THE*

INTERNET AS TO HOW YOU WOULD LIKE YOUR SHARES OF COMMON STOCK VOTED IN*

ACCORDANCE WITH THE GOLD PROXY CARD, (3) ATTENDING THE ANNUAL MEETING*

AND VOTING IN PERSON OR (4) DELIVERING A WRITTEN NOTICE OF REVOCATION TO ME.

Other Matters to be Considered at the Annual Meeting

Except as set forth above, we are not aware of any other matters to be*

brought before the Annual Meeting. Should other matters properly be *

brought before the Annual Meeting, the attached GOLD proxy card, when *

duly executed, will give us discretionary authority to vote on all such *

other matters and on all matters incident to the conduct of the Annual *

Meeting. In furtherance of the foregoing, should the Board, management or*

any other stockholder bring before the Annual Meeting any proposal to *

adjourn the Annual Meeting, the attached GOLD proxy card, when duly *

executed, will give us the discretionary authority to vote on such *

adjournment proposal.

Execution and delivery of a proxy by a record holder of shares of *

Common Stock will be presumed to be a proxy with respect to all shares*

held by such record holder unless the proxy specifies otherwise.

SOLICITATION OF PROXIES

We have entered into an agreement with an transaction and proxy advisory*

firm to help conduct our proxy solicitation process , for which this *

firm will receive a fee not to exceed $xx, together with*

reimbursement for its*

reasonable out-of-pocket expenses, and will be indemnified against *

certain liabilities and expenses. Proxies may be solicited from*

individuals, banks, brokers,custodians, nominees, other institutional*

holders and other fiduciaries*

in person and by mail, phone, publication and electronic means.*

We will request*

such individuals and institutions to forward all solicitation materials*

to the beneficial owners of the shares of Common Stock they hold of record.*

We will reimburse these record holders for their reasonable out-of-pocket*

expenses in so doing.

Total costs related to this solicitation of proxies are expected to be*

approximately $xx, of which approximately $xx has been expended to*

date. We will pay the costs of this solicitation*

of proxies, including the cost of*

preparing, assembling and mailing this proxy material to stockholders.*

The cost for solicitation may be sought from the registrant.

ADDITIONAL INFORMATION

Please refer to the Company Proxy Statement for the following*

information:

- the date by which proposals of stockholders intended to be presented*

at the 2016 annual meeting of stockholders must be received by the *

Company in order to be included in the Companys proxy materials for*

that meeting;

- the date by which the submission of nominees of stockholders intended*

to be nominated as directors at the 2016 annual meeting of stockholders*

must be received by the Company in order to be included in the Companys *

proxy materials for that meeting;

- information regarding the securities of the Company held by the*

Companys directors, nominees, executive officers and beneficial*

holders of more than five percent of the Common Stock, and

- information concerning the Companys compensation policies and *

compensation paid or payable to the Companys executive officers*

and directors.

We take no responsibility for the accuracy or completeness of any*

information or statements contained in the Company Proxy Statement, *

including any such information or statements appearing herein.

ANNEX A

BENEFICIAL OWNERSHIP IN, AND TRANSACTIONS IN SECURITIES OF,

THE COMPANY DURING THE PAST TWO YEARS

As of December 23, 2015, James Wilson beneficially owns one*

share of Common Stock. James Wilsons business address is at xx.

VOTE BY INTERNET - xx

Use the Internet to transmit your voting instructions up until xx.*

Have your proxy card in hand when you access the web site and follow*

the instructions to obtain your records and to create an electronic*

voting instruction form.

VOTE BY PHONE - xx

Use any touch-tone telephone to transmit your voting instructions up*

until xx. Have your proxy card in hand when you call and then follow*

the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid*

envelope that has been provided or return it to xx.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

KEEP THIS PORTION FOR YOUR RECORDS

-----------------------------------------------------------*

DETACH AND RETURN THIS PORTION ONLY

HYPERDYNAMICS CORPORATION

THIS GOLD PROXY IS SOLICITED ON BEHALF OF EMPOWER CAPITAL *

AND JAMES WILSON

THE BOARD OF DIRECTORS IS NOT SOLICITING THIS PROXY

ANNUAL MEETING OF STOCKHOLDERS

JANUARY 27, 2016

Important Notice Regarding the Availability of Proxy Materials*

for the Annual Meeting of Stockholders To Be Held on January 27,*

2016:

The Notice, Proxy Statement, Proxy Card and Form 10-K are*

available at xx.

-------------------------------------------------------------*

1

This regulatory filing also includes additional resources:

preschedule14a.pdf

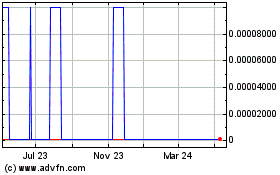

Hyperdynamics (CE) (USOTC:HDYNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

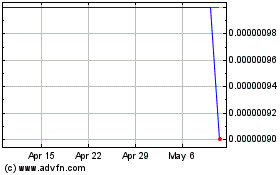

Hyperdynamics (CE) (USOTC:HDYNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024