UniFirst Corporation (NYSE: UNF) today announced results for its

fourth quarter and full year ended August 29, 2015. Revenues for

the quarter were $359.2 million, up 2.1% from $352.0 million in the

year ago period. Net income was $28.9 million ($1.43 per diluted

share) unchanged from the fourth quarter of fiscal 2014. The

comparison of net income in the quarter was impacted by a lower

effective income tax rate of 37.4% compared to 39.4% in the prior

year. For the full year, revenues were $1.457 billion, up 4.4% from

fiscal 2014. Net income was $124.3 million ($6.15 per diluted

share) up 3.6% from $119.9 million ($5.95 per diluted share)

reported in the prior year.

Ronald D. Croatti, UniFirst President and Chief Executive Office

said, “In our fourth quarter, growth continued to be limited by

macroeconomic factors including headcount reductions at many of our

energy related customers as well as weaker foreign currency

exchange rates adversely affecting our Canadian and European

operations. Although we are pleased with our overall results for

fiscal 2015, we expect these factors to challenge our top and

bottom line results throughout fiscal 2016.”

Revenues in the fourth quarter for our Core Laundry Operations

were $326.6 million, up 1.8% from those reported in the prior

year’s fourth quarter. Adjusting for the effects of acquisitions

and a weaker Canadian dollar, revenue grew 2.2%. This segment’s

income from operations decreased 6.7% compared to the fourth

quarter of fiscal 2014, while the operating margin decreased to

13.1% from 14.3% a year ago. The margin decline reflects higher

merchandise costs, selling and administrative expenses and

depreciation as a percentage of revenues. These items were

partially offset by lower energy, payroll related and legal

expenses during the quarter compared to a year ago.

Revenues for the Specialty Garments segment, which consists of

nuclear decontamination and cleanroom operations, were $20.5

million, up 7.9% from $19.0 million in the fourth quarter of fiscal

2014. Due in part to the improved revenue performance, this

segment’s income from operations increased to $1.5 million in the

current quarter from $0.1 million in last year’s comparable

quarter.

UniFirst continues to maintain a solid balance sheet with no

long-term debt and increasing cash balances. Net cash provided by

operating activities during fiscal 2015 was $226.9 million, up

16.6% from fiscal 2014 and cash and cash equivalents at the end of

the fiscal year totaled $276.6 million, up from $191.8 million at

the end of fiscal 2014.

OutlookMr. Croatti continued, “We

believe that full year fiscal 2016 revenues will be between $1.460

billion and $1.480 billion. We also believe that full year diluted

EPS will be between $5.60 and $5.80. This guidance assumes no

significant further deterioration in our wearer base as a result of

additional layoffs in energy dependent markets that we

service.”

Conference Call InformationUniFirst

will hold a conference call today at 10:00 a.m. (ET) to discuss its

quarterly financial results, business highlights and outlook. A

simultaneous live webcast of the call will be available over the

Internet and can be accessed at www.unifirst.com.

About UniFirst

CorporationHeadquartered in Wilmington, Mass., UniFirst

Corporation is a North American leader in the supply and servicing

of uniform and workwear programs, as well as the delivery of

facility service programs. Together with its subsidiaries, the

company also provides first aid and safety products, and manages

specialized garment programs for the cleanroom and nuclear

industries. UniFirst manufactures its own branded workwear,

protective clothing, and floorcare products, and with over 225

service locations, 275,000 customer locations, and 12,000 employee

Team Partners, the company outfits more than 1.5 million workers

each business day. UniFirst is a publicly held company traded on

the New York Stock Exchange under the symbol UNF and is a component

of the Standard & Poor's 600 Small Cap Index. For more

information visit www.unifirst.com.

Forward Looking StatementsThis

public announcement contains forward looking statements that

reflect the Company’s current views with respect to future events

and financial performance, including projected revenues and

earnings per share. Forward looking statements contained in this

public announcement are subject to the safe harbor created by the

Private Securities Litigation Reform Act of 1995 and are highly

dependent upon a variety of important factors that could cause

actual results to differ materially from those reflected in such

forward looking statements. Such factors include, but are not

limited to, uncertainties regarding the Company’s ability to

consummate and successfully integrate acquired businesses,

uncertainties regarding any existing or newly-discovered expenses

and liabilities related to environmental compliance and

remediation, any adverse outcome of pending or future contingencies

or claims, the Company’s ability to compete successfully without

any significant degradation in its margin rates, seasonal

fluctuations in business levels, our ability to preserve positive

labor relationships and avoid becoming the target of corporate

labor unionization campaigns that could disrupt our business, the

effect of currency fluctuations on our results of operations and

financial condition, our dependence on third parties to supply us

with raw materials, any loss of key management or other personnel,

increased costs as a result of any future changes in federal or

state laws, rules and regulations or governmental interpretation of

such laws, rules and regulations, uncertainties regarding the price

levels of natural gas, electricity, fuel and labor, the impact of

turbulent economic conditions and the current tight credit markets

on our customers and such customers’ workforce, the level and

duration of workforce reductions by our customers, the continuing

increase in domestic healthcare costs, including the ultimate

impact of the Affordable Care Act, demand and prices for our

products and services, rampant criminal activity and instability in

Mexico where our principal garment manufacturing plants are

located, our ability to properly and efficiently design, construct,

implement and operate our new CRM computer system, interruptions or

failures of our information technology systems, including as a

result of cyber-attacks, additional professional and internal costs

necessary for compliance with recent and proposed future changes in

Securities and Exchange Commission, New York Stock Exchange and

accounting rules, strikes and unemployment levels, the Company’s

efforts to evaluate and potentially reduce internal costs, economic

and other developments associated with the war on terrorism and its

impact on the economy, general economic conditions and other

factors described under “Item 1A. Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended August 30, 2014 and

in other filings with the Securities and Exchange Commission. When

used in this public announcement, the words “anticipate,”

“optimistic,” “believe,” “estimate,” “expect,” “intend,” and

similar expressions as they relate to the Company are included to

identify such forward looking statements. The Company undertakes no

obligation to update any forward looking statements to reflect

events or circumstances arising after the date on which such

statements are made.

UniFirst Corporation and

Subsidiaries

Consolidated Statements of Income

Thirteen

weeks ended

August 29,

Thirteen

weeks ended

August 30,

Fifty-two

weeks ended

August 29,

Fifty-two

weeks ended

August 30,

(In thousands, except per share data)

2015 (2)

2014 (2) 2015 (2) 2014 Revenues $

359,208 $ 351,988 $ 1,456,605 $ 1,394,897 Operating

expenses: Cost of revenues (1) 219,442 217,965 884,664 858,306

Selling and administrative expenses (1) 72,612 68,086 294,444

271,564 Depreciation and amortization 21,262 18,515 77,113 71,752

Total operating expenses 313,316 304,566 1,256,221 1,201,622

Income from operations 45,892 47,422 200,384 193,275 Other

(income) expense: Interest expense 225 239 873 772 Interest income

(778 ) (716 ) (3,310 ) (3,131 ) Foreign exchange loss 230 242 1,553

283 Total other (income) expense (323 ) (235 ) (884 ) (2,076 )

Income before income taxes 46,215 47,657 201,268 195,351

Provision for income taxes 17,274 18,785 76,969 75,426 Net

income $ 28,941 $ 28,872 $ 124,299 $ 119,925

Income per

share – Basic Common Stock $ 1.51 $ 1.51 $ 6.50 $ 6.29 Class B

Common Stock $ 1.21 $ 1.21 $ 5.20 $ 5.03

Income per share

– Diluted Common Stock $ 1.43 $ 1.43 $ 6.15 $ 5.95

Income allocated to – Basic Common Stock $ 23,011 $ 22,876 $

98,665 $ 94,849 Class B Common Stock $ 5,803 $ 5,742 $ 24,761 $

23,705

Income allocated to – Diluted Common Stock $

28,821 $ 28,631 $ 123,472 $ 118,626

Weighted average

number of shares outstanding – Basic Common Stock 15,210 15,113

15,182 15,080 Class B Common Stock 4,795 4,741 4,763 4,711

Weighted average number of shares outstanding – Diluted

Common Stock 20,142 20,007 20,079 19,939

(1) Exclusive of depreciation on the Company’s property, plant

and equipment and amortization on its intangible assets

(2) Unaudited

UniFirst Corporation and

Subsidiaries

Condensed Consolidated Balance

Sheets (In thousands) August 29,

2015 (1)

August 30,

2014

Assets Current assets: Cash and cash equivalents $ 276,553 $

191,769 Receivables, net 151,851 152,523 Inventories 80,449 78,858

Rental merchandise in service 140,384 146,449 Prepaid and deferred

income taxes 204 13,342 Prepaid expenses and other current assets

12,382 6,349 Total current assets 661,823 589,290

Property, plant and equipment: Land, buildings and leasehold

improvements 402,781 393,584 Machinery and equipment 535,698

512,842 Motor vehicles 193,643 166,573 1,132,122 1,072,999

Less - accumulated depreciation 618,269 586,717 513,853 486,282

Goodwill 313,133 303,648 Customer contracts and other

intangible assets, net 40,049 41,477 Deferred income taxes 1,475

1,403 Other assets 2,904 2,061 $ 1,533,237 $ 1,424,161

Liabilities and shareholders' equity Current liabilities:

Loans payable and current maturities of long-term debt $ 1,385 $

7,704 Accounts payable 50,826 59,177 Accrued liabilities 113,022

100,818 Accrued and deferred income taxes 18,878 23,342

Total current liabilities 184,111 191,041 Long-term

liabilities: Long-term debt, net of current maturities — 155

Accrued liabilities 54,566 50,235 Accrued and deferred income taxes

52,352 48,271 Total long-term liabilities 106,918 98,661

Shareholders' equity: Common Stock 1,525 1,519 Class B

Common Stock 485 486 Capital surplus 67,611 59,415 Retained

earnings 1,197,000 1,075,572 Accumulated other comprehensive (loss)

income (24,413

)

(2,533

)

Total shareholders' equity 1,242,208 1,134,459 $

1,533,237 $ 1,424,161

(1) Unaudited

UniFirst Corporation and

Subsidiaries

Detail of Operating Results

Revenues

Thirteen

Thirteen

weeks ended weeks ended

August 29, August 30,

Dollar

Percent

(In thousands, except percentages) 2015 (1) 2014

(1) Change Change Core Laundry Operations

$ 326,643 $ 320,993 $ 5,650 1.8 % Specialty Garments 20,522 19,016

1,506 7.9 First Aid 12,043 11,979 64 0.5 Consolidated total $

359,208 $ 351,988 $ 7,220 2.1 %

Fifty-two

Fifty-two weeks

ended weeks ended

August 29, August 30,

Dollar

Percent

(In thousands, except percentages) 2015 (1) 2014

(1) Change Change Core Laundry Operations

$ 1,322,328 $ 1,259,485 $ 62,843 5.0 % Specialty Garments 87,513

91,484 (3,971 ) -4.3 First Aid 46,764 43,928 2,836 6.5 Consolidated

total $ 1,456,605 $ 1,394,897 $ 61,708 4.4 %

Income from Operations

Thirteen

Thirteen weeks ended weeks ended

August 29, August 30,

Dollar

Percent

(In thousands, except percentages) 2015 (1) 2014

(1) Change Change Core Laundry Operations

$ 42,855 $ 45,937 $ (3,082 ) -6.7 % Specialty Garments 1,490 115

1,375 1,195.7 First Aid 1,547 1,370 177 12.9 Consolidated total $

45,892 $ 47,422 $ (1,530 ) -3.2 %

Fifty-two

Fifty-two weeks

ended weeks ended

August 29, August 30,

Dollar

Percent

(In thousands, except percentages) 2015 (1) 2014

(1) Change Change Core Laundry Operations

$ 187,586 $ 182,250 $ 5,336 2.9 % Specialty Garments 7,355 7,178

177 2.5 First Aid 5,443 3,847 1,596 41.5 Consolidated total $

200,384 $ 193,275 $ 7,109 3.7 %

(1) Unaudited

UniFirst Corporation and

Subsidiaries

Consolidated Statements of Cash Flows

Fifty-two Fifty-two weeks ended weeks

ended August 29, August 30, (In thousands)

2015 (1) 2014 Cash flows from operating

activities: Net income $ 124,299 $ 119,925

Adjustments to reconcile net income to cash provided by operating

activities: Depreciation 68,164 62,791 Amortization of intangible

assets 8,949 8,961 Amortization of deferred financing costs 209 209

Share-based compensation 5,366 5,601 Accretion on environmental

contingencies 603 716 Accretion on asset retirement obligations 690

941 Deferred income taxes (3,473 ) 8,439 Changes in assets and

liabilities, net of acquisitions: Receivables (3,494 ) (11,541 )

Inventories (2,236 ) (4,450 ) Rental merchandise in service 4,900

(14,002 ) Prepaid expenses and other current assets (4,005 ) 2,623

Accounts payable (7,648 ) 13,646 Accrued liabilities 17,832 6,890

Prepaid and accrued income taxes 16,761 (6,130 ) Net cash provided

by operating activities 226,917 194,619 Cash flows from

investing activities: Acquisition of businesses (22,359 ) (3,635 )

Capital expenditures (101,163 ) (91,808 ) Other (747 ) 1,269 Net

cash used in investing activities (124,269 ) (94,174 ) Cash

flows from financing activities: Proceeds from loans payable and

long-term debt 6,866 9,388 Payments on loans payable and long-term

debt (13,055 ) (113,247 ) Proceeds from exercise of Common Stock

options, including excess tax benefits 7,799 5,899 Taxes withheld

and paid related to net share settlement of equity awards (5,002 )

(3,527 ) Payment of cash dividends (2,869 ) (2,860 ) Net cash used

in financing activities (6,261 ) (104,347 ) Effect of

exchange rate changes on cash (11,603 ) (1,808 ) Net

increase (decrease) in cash and cash equivalents 84,784 (5,710 )

Cash and cash equivalents at beginning of period 191,769 197,479

Cash and cash equivalents at end of period $ 276,553 $

191,769

(1) Unaudited

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151021005344/en/

UniFirst CorporationSteven S. Sintros, 978-658-8888Senior Vice

President & CFO

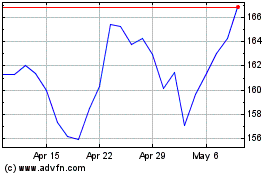

UniFirst (NYSE:UNF)

Historical Stock Chart

From Aug 2024 to Sep 2024

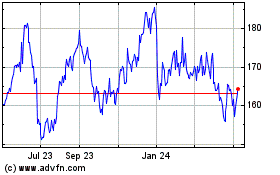

UniFirst (NYSE:UNF)

Historical Stock Chart

From Sep 2023 to Sep 2024