UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MEXUS GOLD US

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

20-4092640

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

1805 N. Carson Street, Suite 150,

Carson City, NV

|

|

89701

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

2015 Stock Incentive Plan

(Full title of the plan)

Paul Thompson, Sr.

Chief Executive Officer

Mexus Gold US

1805 N. Carson Street, Suite 150

Carson City, NV 89701

(Name and address of agent for service)

(916) 776-2166

(Telephone number, including area code, of agent for service)

_______________________________

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company in Rule 12b-2 of the Exchange Act.

|

Large Accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of securities to be registered

|

Amount to be

registered (1)

|

Proposed

maximum offering

price per

share (2)

|

Proposed

maximum

aggregate offering

price (2)

|

Amount of

registration

fee (3)

|

|

Common stock, par value

$0.001 per share (Reserved for issuance under the

Mexus Gold US 2015 Stock Incentive Plan)

|

30,000,000

|

$0.03

|

$900,000

|

$105.58

|

(1) Represents the maximum number of shares of common stock issuable pursuant to awards under the Mexus Gold US 2015 Stock Incentive Plan (the “Plan”). This Registration Statement shall also cover any additional shares of common stock that become issuable by reason of any stock dividend, stock split, recapitalization or other similar transaction of or by the registrant that results in an increase in the number of the registrant’s outstanding shares of common stock or shares issuable pursuant to awards granted under the Plan.

(2) Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) and 457(h) of the Securities Act of 1933, as amended. The above calculation is based on the closing price of the common stock reported on OTCMarkets.com on July 15, 2015.

(3) Represents the Proposed Maximum Aggregate Offering Price multiplied by $0.0001162.

|

|

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

|

Mexus Gold US (the “Company”) prepared this Registration Statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register an aggregate of 30,000,000 shares of the Company’s common stock that may be issued pursuant to the Mexus Gold US 2015 Stock Incentive Plan (the “Plan”). The documents containing the information specified in Part I of this Registration Statement will be sent or given to participants in the Plan, as specified by Rule 428(b)(1) promulgated under the Securities Act. Such documents need not be filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 promulgated under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3, Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirement of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the Commission are incorporated herein by reference, other than those furnished pursuant to Item 2.02 or Item 7.01 of Current Reports on Form 8-K:

(a) The Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2015, filed with the Commission on July 14, 2015.

(b) The Company’s Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2014, filed with the Commission on February 20, 2015.

(e) The Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2014, filed with the Commission on November 19, 2014.

(d) The Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2014, filed with the Commission on August 19, 2014.

(e) The Company’s Current Reports on Form 8-K filed with the Commission since March 31, 2014:

|

a.

|

Current Report on Form 8-K, filed with the Commission on July 15, 2015.

|

In addition, all documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), excluding any information furnished pursuant to any Current Report on Form 8-K, prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document that also is or is deemed to be incorporated by reference herein, as the case may be, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Officers and Directors.

Subsection 1 of Section 78.037 of the Nevada Revised Statutes (the “Nevada Law”) empowers a corporation to eliminate or limit the personal liability of a director or officer to the corporation or its stockholders for damages for breach of fiduciary duty as a director or officer, but such a provision must not eliminate or limit the liability of a director or officer for (a) acts or omissions which involve intentional misconduct, fraud or a knowing violation of law or (b) the payment of distributions in violation of Section 78.300 of the Nevada Law.

Subsection 1 of Section 78.7502 of the Nevada Law empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he or she is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise (an “Indemnified Party”), against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the Indemnified Party in connection with such action, suit or proceeding if the Indemnified Party acted in good faith and in a manner the Indemnified Party reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceedings, had no reasonable cause to believe the Indemnified Party’s conduct was unlawful.

Subsection 2 of Section 78.7502 of the Nevada Law empowers a corporation to indemnify any Indemnified Party who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that such person acted in the capacity of an Indemnified Party against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by the Indemnified Party in connection with the defense or settlement of such action or suit if the Indemnified Party acted under standards similar to those set forth above, except that no indemnification may be made in respect of any claim, issue or matter as to which the Indemnified Party shall have been adjudged to be liable to the corporation or for amounts paid in settlement to the corporation unless and only to the extent that the court in which such action or suit was brought determines upon application that in view of all the circumstances the Indemnified Party is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Section 78.7502 of the Nevada Law further provides that to the extent an Indemnified Party has been successful on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsection (1) or (2) described above or in the defense of any claim, issue or matter therein, the corporation shall indemnify the Indemnified Party against expenses (including attorneys’ fees) actually and reasonably incurred by the Indemnified Party in connection therewith.

Subsection 1 of Section 78.751 of the Nevada Law provides that any discretionary indemnification under Section 78.7502 of the Nevada Law, unless ordered by a court or advanced pursuant to Subsection 2 of Section 78.751, may be made by a corporation only as authorized in the specific case upon a determination that indemnification of the Indemnified Person is proper in the circumstances. Such determination must be made (a) by the stockholders, (b) by the board of directors of the corporation by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding, (c) if a majority vote of a quorum of such disinterested directors so orders, by independent legal counsel in a written opinion, or (d) by independent legal counsel in a written opinion if a quorum of such disinterested directors cannot be obtained.

Subsection 2 of Section 78.751 of the Nevada Law provides that a corporation’s articles of incorporation or bylaws or an agreement made by the corporation may require the corporation to pay as incurred and in advance of the final disposition of a criminal or civil action, suit or proceeding, the expenses of officers and directors in defending such action, suit or proceeding upon receipt by the corporation of an undertaking by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court that he is not entitled to be indemnified by the corporation. Said Subsection 2 further provides that the provisions of that Subsection 2 do not affect any rights to advancement of expenses to which corporate personnel other than officers and directors may be entitled under contract or otherwise by law.

Subsection 3 of Section 78.751 of the Nevada Law provides that indemnification and advancement of expenses authorized in or ordered by a court pursuant to said Section 78.751 does not exclude any other rights to which the Indemnified Party may be entitled under the articles of incorporation or any by-law, agreement, vote of stockholders or disinterested directors or otherwise, for either an action in his official capacity or in another capacity while holding his office. However, indemnification, unless ordered by a court pursuant to Section 78.7502 or for the advancement of expenses under Subsection 2 of Section 78.751 of the Nevada Law, may not be made to or on behalf of any director or officer of the corporation if a final adjudication establishes that his or her acts or omissions involved intentional misconduct, fraud or a knowing violation of the law and was material to the cause of action. Additionally, the scope of such indemnification and advancement of expenses shall continue as to an Indemnified Party who has ceased to hold one of the positions specified above, and shall inure to the benefit of his or her heirs, executors and administrators.

Section 78.752 of the Nevada Law empowers a corporation to purchase and maintain insurance or make other financial arrangements on behalf of an Indemnified Party for any liability asserted against such person and liabilities and expenses incurred by such person in his or her capacity as an Indemnified Party or arising out of such person’s status as an Indemnified Party whether or not the corporation has the authority to indemnify such person against such liability and expenses.

The Bylaws of the Company provide for indemnification of Indemnified Parties substantially identical in scope to that permitted under the Nevada Law. Such Bylaws provide that the expenses of directors and officers of the Company incurred in defending any action, suit or proceeding, whether civil, criminal, administrative or investigative, must be paid by the Company as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of such director or officer to repay all amounts so advanced if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the Company.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits

|

Exhibit

No.

|

Description

|

| |

|

|

4.1

|

Mexus Gold US 2015 Stock Incentive Plan*

|

|

4.2

|

Form of Stock Award Agreement

|

|

4.3

|

Form of Stock Option Grant Notice

|

|

5.1

|

Opinion of Phillip E. Koehnke, APC

|

|

23.1

|

Consent of De Joya Griffith, LLC *

|

|

24

|

Power of Attorney (included on signature page)*

|

* Filed herewith

Item 9. Undertakings

The Company hereby undertakes to file, during the period in which any offers or sales are being made, a post-effective amendment to this registration statement to include any prospectus required by section 10(a)(3) of the Securities Act, and to reflect in such prospectus any material change in the information contained in this registration statement and to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

The Company hereby undertakes to deliver or cause to be delivered with the prospectus, to each person to whom the prospectus is sent or given, the latest annual report to security holders that is incorporated by reference to the prospectus and furnish pursuant to any meeting the requirements of Rule 14a-3 or Rule 14c-3 under the Exchange Act; and, to deliver or cause to be delivered to each person to whom the prospectus is sent or given, the latest quarterly report that is specifically incorporated by reference in the prospectus.

The undersigned hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Company’s annual report pursuant to section 13(a) or section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Exchange Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Exchange Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunder duly authorized in Walnut Grove, California.

| |

By:

|

/s/ Pul Thompson, Sr.

Paul Thompson, Sr., Chief Executive Officer

|

POWER OF ATTORNEY

The undersigned sole director and officer of Mexus Gold US does hereby constitute and appoint Paul Thompson, Sr., his true and lawful attorney-in-fact and agent, with full power of substitution, for him, and in his name, place and stead, in any and all capacities, to sign the Registration Statement filed herewith and any and all amendments (including post-effective amendments) to the Registration Statement, with all exhibits thereto and all documents in connection therewith, with the Commission, granting unto said attorney-in-fact and agent, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agents, or any of them, or his or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the listed capacities on July 17, 2015:

|

Name

|

Title

|

| |

|

|

/s/ Paul Thompson, Sr.

|

Director

|

|

Paul Thompson, Sr.

|

|

Exhibit 4.2

Mexus Gold US

Stock Award Agreement

Under

Mexus Gold US 2015 Stock Incentive Plan

THIS STOCK AWARD AGREEMENT (the “Agreement”) is entered into as of _________________, 20__ by and between _________________________ (hereinafter referred to as “Grantee”) and Mexus Gold US, a Nevada corporation (hereinafter referred to as the “Company”), pursuant to the Company’s 2015 Stock Incentive Plan (the “Plan”). Any capitalized term not defined herein shall have the same meaning ascribed to it in the Plan.

R E C I T A L S:

A. Grantee is an employee, director or consultant of the Company, and in connection therewith has rendered services for and on behalf of the Company or an Affiliate.

B. The Company desires to issue shares of the Company’s Common Stock to Grantee for the consideration set forth herein to compensate Grantee for past services to the Company and/or to provide an incentive for Grantee to remain a service provider of the Company and to exert added effort towards its growth and success.

NOW, THEREFORE, in consideration of the mutual covenants hereinafter set forth, and for other good and valuable consideration, the parties agree as follows:

1. Issuance of Shares. The Company hereby offers to issue to Grantee an aggregate of ___________) shares of Common Stock of the Company (the “Shares”) on the terms and conditions herein set forth. Unless this offer is earlier revoked in writing by the Company, Grantee shall have ten (10) days from the date of the delivery of this Agreement to Grantee to accept the offer of the Company by executing and delivering to the Company two copies of this Agreement, without condition or reservation of any kind whatsoever, together with the consideration to be delivered by Grantee pursuant to Section 2 below, if applicable. If the Grantee does not accept the offer represented by this Agreement as set forth above within ten (10) days, such offer shall be null and void.

2. Consideration. The consideration for the grant of the Shares shall be the services already rendered to the Company by the Grantee. The total value of the services provided shall be reported to tax authorities as being $___________, which is equal to the aggregate Fair Market Value of the Shares granted.

3. Vesting of Shares. The Shares shall be fully vested as of the date of this Agreement.

4. No Right to Continued Service. The issuance of the Shares does not confer upon Grantee any right to continue as an Employee or Director of, or Consultant to, the Company or an Affiliate, nor does it limit in any way the right of the Company or an Affiliate to terminate Grantee’s employment or other relationship with the Company or an Affiliate, at any time, with or without cause.

5. Tax Consequences. Grantee understands that Grantee (and not the Company) shall be responsible for the Grantee’s own tax liability that may arise as a result of the grant of the Shares. Grantee represents that Grantee has consulted any tax consultants Grantee deems advisable in connection with the receipt of the Shares and that Grantee is not relying on the Company or the Company’s counsel for any tax advice. The Company intends to report the value of the Shares granted, at the value describe in Section 2, to appropriate tax authorities. The Company has the authority to require Grantee to remit to the Company an amount sufficient to satisfy all federal, state, and local taxes required by law to be withheld with respect to any taxable event arising as a result of the receipt of the Shares.

6. Miscellaneous.

(a) This Agreement shall bind and inure to the benefit of the parties’ heirs, legal representatives, successors and permitted assigns.

(b) This Agreement and the Plan constitute the entire agreement between the parties pertaining to the subject matter contained herein and they supersede all prior and contemporaneous agreements, representations and understandings of the parties. A copy of the Plan has been delivered to Grantee and also may be inspected by Grantee at the principal office of the Company, and Grantee hereby consents to receive any updates to the Plan or Plan prospectus electronically. The parties agree that the entire text of the Plan is incorporated by reference as if copied herein. No supplement, modification or amendment of this Agreement shall be binding unless executed in writing by all of the parties. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other provisions, whether or not similar, nor shall any waiver constitute a continuing waiver. No waiver shall be binding unless executed in writing by the party making the waiver. In the event there exists any conflict or discrepancy between any of the terms in the Plan and this Agreement, the terms of the Plan shall be controlling. A copy of the Plan has been delivered to Grantee and also may be inspected by Grantee at the principal office of the Company.

(c) By execution of this Agreement, Grantee consents to the delivery of any notice to the stockholders given by the Company in the form of an electronic transmission.

(d) Should any portion of the Plan or this Agreement be declared invalid and unenforceable, then such portion shall be deemed to be severable from this Agreement and shall not affect the remainder hereof.

(e) All notices required or permitted hereunder shall be in writing and shall be deemed effectively given: (i) upon personal delivery to the party to be notified; (ii) three (3) days after having been sent by registered or certified mail, return receipt requested, postage prepaid; or (iii) one (1) day after deposit with a nationally recognized overnight courier, specifying next day delivery, with written verification of receipt. All communications shall be sent to the Company at its principal executive office, and to Grantee at the address set forth on the signature page to this Agreement, or at such other address as the Company or Grantee may designate by ten (10) days advance written notice to the other party hereto.

(f) By executing the Agreement, the Company and Grantee waive their respective rights hereunder to have any such disputes or claims tried by a judge or jury.

(g) This Agreement may be executed in any number of counterparts, each of which when so executed and delivered will be deemed an original, and all such counterparts together will constitute one and the same instrument.

(h) This Agreement shall be construed according to the laws of the State of New York.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

|

THE COMPANY:

|

|

GRANTEE:

|

| |

|

|

|

Mexus Gold US

|

|

|

| |

|

|

|

|

|

By:

|

|

|

|

|

| |

|

|

|

|

Name:

|

|

|

|

|

| |

|

|

(Print Name)

|

|

Title

|

|

|

|

|

| |

|

|

Address:

|

|

| |

|

|

|

|

| |

|

|

|

|

Exhibit 4.3

Mexus Gold US

Stock Option Grant Notice

Mexus Gold US 2015 Stock Incentive Plan

FOR GOOD AND VALUABLE CONSIDERATION, Mexus Gold US (the “Company”), hereby grants to the Optionee named below, a stock option (the “Option”) to purchase any part or all of the specified number of shares of its Common Stock (“Option Shares”), upon the terms and subject to the conditions set forth in this Stock Option Grant Notice (the “Grant Notice”), at the specified purchase price per share without commission or other charge. The Option is granted pursuant to the Company’s 2015 Stock Incentive Plan (the “Plan”) and the Stock Option Agreement (the “Option Agreement”), promulgated under the Plan and in effect as of the date of this Grant Notice.

|

Optionee:

|

|

|

Date of Grant:

|

|

|

Vesting Commencement Date:

|

|

|

Number of Option Shares :

|

|

|

Exercise Price (Per Share):

|

|

|

Total Exercise Price:

|

|

|

Expiration Date:

|

Ten years after Date of Grant

|

|

Type of Grant:

|

q Incentive Stock Option1

|

q Nonstatutory Stock Option

|

| |

|

|

| |

|

|

|

Exercise Schedule:

|

q Same as Vesting Schedule

|

q Early Exercise Permitted

|

Vesting Schedule: Except as otherwise provided in the Option Agreement, the number of Option Shares that are vested (disregarding any resulting fractional share) as of any date shall be determined as follows: (i) no Option Shares will be vested prior to the Vesting Commencement Date; (ii) twenty-five percent (25%) of the Option Shares will be vested upon the one (1) year anniversary of the Vesting Commencement Date, provided, however, that there has not been a Termination of Service as of such date; and (iii) the balance of the Option Shares will be vested in a series of thirty-six (36) successive equal monthly installments measured from the first anniversary of the Vesting Commencement Date, provided, however, that there has not been a Termination of Service as of each such date. In no event will the Option become exercisable for any additional Option Shares after a Termination of Service.

|

Payment:

|

By one or a combination of the following items (described in the Plan):

|

| |

|

|

| |

q

|

By cash or check

|

| |

|

|

| |

q

|

By net exercise, if the Company has established procedures for net exercise

|

Additional Terms/Acknowledgements: The undersigned Optionee acknowledges receipt of, and understands and agrees to, this Stock Option Grant Notice, the Option Agreement, and the Plan. Further, by their signatures below, the Company and the Optionee agree that the Option is governed by this Grant Notice and by the provisions of the Plan and Option Agreement, both of which are attached to and made a part of this Grant Notice. Optionee acknowledges receipt of copies of the Plan and the Option Agreement, represents that the Optionee has read and is familiar with their provisions, and hereby accepts the Option subject to all of their terms and conditions. Optionee further acknowledges that, as of the Date of Grant, this Grant Notice, the Option Agreement and the Plan set forth the entire understanding between Optionee and the Company regarding the acquisition of stock in the Company and supersede all prior oral and written agreements on that subject, with the exception of options previously granted under the Plan.

1 If this is an Incentive Stock Option, it (plus other outstanding Incentive Stock Options) cannot be first exercisable for more than $100,000 in value (measured by exercise price) in any calendar year. Any excess over $100,000 is a Nonstatutory Stock Option.

|

Mexus Gold US

|

|

Optionee: [name]

|

| |

|

|

|

|

|

By:

|

|

|

|

|

| |

[Name, Title]

|

|

Signature

|

| |

|

|

|

|

|

Date:

|

|

|

Date:

|

|

|

|

(I) Stock Option Agreement;

|

|

|

(II) 2015 Stock Incentive Plan

|

STOCK OPTION AGREEMENT

(INCENTIVE STOCK OPTION OR NONSTATUTORY STOCK OPTION)

Mexus Gold US 2015 Stock Incentive Plan

Effective as of _____________, 2015

Pursuant to the Stock Option Grant Notice (“Grant Notice”) and this Option Agreement (“Option Agreement”), Mexus Gold US, a Nevada corporation (the “Company”) has granted to Optionee an option under the Company’s 2015 Stock Incentive Plan (the “Plan”), to purchase the number of shares of the Company’s Common Stock indicated in Optionee’s Grant Notice, at the exercise price indicated in such Grant Notice. This Option Agreement is incorporated by reference into and made a part of the Grant Notice. Whenever capitalized terms are used in this Option Agreement, they shall have the meaning specified (i) in the Plan, (ii) in the relevant Grant Notice, or (iii) below, unless the context clearly indicates to the contrary.

The details of the Option granted to Optionee are as follows:

1. Term of Option. Subject to the maximum time limitations in Sections 5(b) and 6(a) of the Plan, the term of the Option shall be the period commencing on the Date of Grant and ending on the Expiration Date (as defined in the Grant Notice), unless terminated earlier as provided herein or in the Plan.

2. Exercise Price. The Exercise Price of the Option granted hereby shall be as provided in the Grant Notice.

3. Exercise of Option.

(a) The Grant Notice sets forth the rate at which the Option Shares shall become subject to purchase (“vest”) by Optionee.

(b) In the event of a Change in Control of the Company, except as otherwise may be provided in the Plan or Grant Notice, the vesting of the Option shall not accelerate, and the Option shall terminate if not exercised (to the extent then vested and exercisable) at or prior to such Change in Control.

(c) Optionee shall exercise the Option, to the extent exercisable, in whole or in part, by sending written notice to the Company on a Notice of Exercise in the form attached to the Grant Notice of his or her intention to purchase Option Shares hereunder, together with a check in the amount of the full purchase price of the Option Shares to be purchased, or such other form of payment as permitted by the Grant Notice. Except as otherwise consented to by the Company, Optionee shall not exercise the Option at any one time with respect to less than five percent (5%) of the total Option Shares set forth in the Grant Notice unless Optionee exercises all of the Option then vested and exercisable.

(d) If the Option is an Incentive Stock Option, by Optionee’s exercise of the Option, Optionee agrees that he or she will notify the Company in writing within fifteen (15) days after the date of any disposition of any of the shares of the Common Stock issued upon exercise of the Option that occurs within two (2) years after the date of the Date of Grant or within one (1) year after such shares of Common Stock are transferred upon exercise of the Option.

(e) Optionee agrees to complete and execute any additional documents which the Company reasonably requests that Optionee complete in order to comply with applicable federal, state and local securities laws, rules and regulations.

(f) Subject to the Company’s compliance with all applicable laws, rules and regulations relating to the issuance of such Option Shares and Optionee’s compliance with all the terms and conditions of the Grant Notice, this Option Agreement, and the Plan, the Company shall promptly deliver the Option Shares to Optionee.

(g) Except as otherwise provided herein or in the Plan, the Option may be exercised during the lifetime of Optionee only by Optionee.

(h) In the event that Optionee is an Employee eligible for overtime compensation under the Fair Labor Standards Act of 1938, as amended (i.e., a “Non-Exempt Employee”), Optionee may not exercise his or her Option until the later of (i) the date that he or she shall have completed at least six (6) months of service to the Company measured from the Date of Grant specified in Optionee’s Grant Notice, or (ii) the date set forth in the Grant Notice for when the Option is first exercisable.

4. Exercise Prior to Vesting (“Early Exercise”).

If expressly permitted by the Grant Notice and subject to the provisions of this Option Agreement, Optionee may, at any time that is both (i) prior to a Termination of Service; and (ii) prior to the Expiration Date, elect to exercise all or part of the Option, including the nonvested portion of the Option; provided, however, that:

(a) a partial exercise of the Option shall be deemed to cover first any vested Option Shares and then the earliest vesting installment(s) of unvested Option Shares;

(b) any Option Shares so purchased from installments which have not vested as of the date of exercise shall be subject to a purchase option in favor of the Company, pursuant to an Early Exercise Stock Purchase Agreement in form satisfactory to the Company;

(c) Optionee shall enter into the Early Exercise Stock Purchase Agreement with a vesting schedule that will result in the same vesting as if no early exercise had occurred; and

(d) as provided in the Plan, if the Option is an Incentive Stock Option, to the extent that the aggregate Fair Market Value (determined at the time of grant) of Common Stock with respect to which the Option plus all other Incentive Stock Options held by Optionee are exercisable for the first time during any calendar year (under all plans of the Company and its Affiliates) exceeds One Hundred Thousand Dollars ($100,000), the Options or portions thereof that exceed such limit (according to the order in which they were granted) shall be treated as Nonstatutory Stock Options.

5. Option Not Transferable. The Option granted hereunder shall not be transferable in any manner other than as provided in Section 6(d) of the Plan. More particularly (but without limiting the foregoing), the Option may not be assigned, transferred (except as expressly provided in the Plan), pledged or hypothecated in any way, shall not be assignable by operation of law and shall not be subject to execution, attachment or similar process. Any attempted assignment, transfer, pledge, hypothecation or other disposition of the Option contrary to the provisions hereof, or the levy of any execution, attachment or similar process upon the Option, shall be null and void and without effect.

6. Termination of Option.

(a) To the extent not previously exercised, the Option shall terminate on the Expiration Date; provided, however, that except as otherwise provided in this Section 6, the Option may not be exercised more than sixty (60) days after the Termination of Service of Optionee for any reason (other than for Cause, as defined below, or upon Optionee’s death or Disability). Within such sixty (60)-day period, except as may otherwise be specifically provided in this Option Agreement or any other agreement between Optionee and the Company which has been approved by the Board, Optionee may exercise the Option only to the extent the same was exercisable on the date of such termination and said right to exercise shall terminate at the end of such period.

(b) In the event of the Termination of Service of Optionee as a result of Optionee’s Disability, the Option shall be exercisable for a period of six (6) months from the date of such termination, but in no event later than the Expiration Date and only to the extent that the Option was exercisable on the date of such termination.

(c) In the event of the Termination of Service of Optionee as a result of Optionee’s death, the Option shall be exercisable by Optionee’s estate (or by the person who acquires the right to exercise the Option by will or by the laws of descent and distribution) for a period of twelve (12) months from the date of such termination, but in no event later than the Expiration Date and only to the extent that Optionee was entitled to exercise the Option on the date of death.

(d) In the event of the Termination of Service of Optionee for Cause (as defined below), unless otherwise determined by the Board, (A) the Option shall expire as of the date of the first occurrence giving rise to such termination or upon the Expiration Date, whichever is earlier; (B) Optionee shall have no rights with respect to any unexercised portion of the Option; and (C) any Option Shares issued in respect of the exercise of the Option on or after the date of the first act and/or event constituting Cause shall have occurred shall be deemed to have been issued in respect of an expired option, and shall thereupon be deemed null and void ab initio, and Optionee shall have no claims to, or rights in, any such Option Shares. “Cause” means with respect to Optionee, the occurrence of any of the following events, as reasonably determined by the Board in each case: (i) Optionee’s commission of any felony or any crime involving fraud, dishonesty or moral turpitude under the laws of the United States or any state thereof; (ii) Optionee’s commission, or attempted commission, of, or participation in, a fraud or act of dishonesty against the Company or any Affiliate, or any of their respective employees, officers or directors; (iii) Optionee’s intentional, material violation of any contract or agreement between the Optionee and the Company or any Affiliate or of any statutory duty owed to the Company or any Affiliate; (iv) Optionee’s unauthorized use or disclosure of the Company’s or an Affiliate’s material confidential information or trade secrets; (v) Optionee’s gross misconduct in connection with Optionee’s service to the Company or an Affiliate; or (vi) Optionee’s failure to promptly return all documents and other tangible items belonging to the Company or its Affiliates in the Participant’s possession or control, including all complete or partial copies, recordings, abstracts, notes or reproductions of any kind made from or about such documents or information contained therein, upon a Termination of Service for any reason. “Cause” shall not require that a civil judgment or criminal conviction have been entered against, or guilty plea shall have been made by, Optionee regarding any of the matters referred to in clauses (i) through (vi). Accordingly, the Board shall be entitled to determine “Cause” based on the its good faith belief. If the Optionee is criminally charged with a felony or similar offense, that shall be a sufficient, but not a necessary, basis for such a belief. Unless otherwise specifically provided in the Grant Notice, the foregoing definition of “Cause” shall apply for all purposes relating to the Option, notwithstanding any employment or other agreement by and between Optionee and the Company or any Affiliate thereof that defines a termination on account of “Cause” (or a term having similar meaning).

(e) Notwithstanding the foregoing, the Option is subject to earlier termination upon a Change in Control, as provided in Section 3(b) above and in Section 11 of the Plan, or upon the dissolution of the Company. If the Option will terminate in connection with a Change in Control, the Company shall provide written notice to Optionee of a proposed transaction constituting a Change in Control, not less than ten (10) days prior to the anticipated effective date of the proposed transaction.

(f) Notwithstanding anything herein to the contrary, no portion of any Option which is not exercisable by Optionee upon the Termination of Service of such Optionee shall thereafter become exercisable, regardless of the reason for such termination, except as may otherwise be specifically provided in this Option Agreement or any other agreement between Optionee and the Company which has been approved by the Board.

7. No Right to Continued Service. The Option does not confer upon Optionee any right to continue as an Employee or Director of, or Consultant to, the Company or an Affiliate, nor does it limit in any way the right of the Company or an Affiliate to terminate Optionee’s employment or other relationship with the Company or an Affiliate, at any time, with or without Cause.

8. Notice of Tax Election. If Optionee makes any tax election relating to the treatment of the Option Shares under the Internal Revenue Code of 1986, as amended, Optionee shall promptly notify the Company of such election.

9. Acknowledgments of Optionee. Optionee acknowledges and agrees that:

(a) Although the Company has made a good faith attempt to qualify the Option as an incentive stock option within the meaning of Sections 421, 422 and 424 of the Code (if the Grant Notice provides that the Option is an Incentive Stock Option), the Company does not warrant that the Option granted herein constitutes an “incentive stock option” within the meaning of such sections, or that the transfer of Option Shares will be treated for federal income tax purposes as specified in Section 421 of the Code.

(b) Optionee shall notify the Company in writing within fifteen (15) days of each disposition (including a sale, exchange, gift or a transfer of legal title) of the Option Shares made within two years after the issuance of such Option Shares.

(c) If the Grant Notice provides that the Option is an Incentive Stock Option, Optionee understands that if, among other things, he or she disposes of any Option Shares granted within two years of the granting of the Option to him or her or within one year of the issuance of such shares to him or her, then such Option Shares will not qualify for the beneficial treatment which Optionee might otherwise receive under Sections 421 and 422 of the Code.

(d) Optionee and his or her transferees shall have no rights as a shareholder with respect to any Option Shares until the date of the issuance of a stock certificate evidencing such Option Shares. No adjustment shall be made for dividends (ordinary or extraordinary, whether in cash, securities or other property) or distributions or other rights for which the record date is prior to the date such stock certificate is issued, except as provided in Section 10 of the Plan.

(e) Certificates representing Option Shares acquired pursuant to the exercise of Incentive Stock Options shall be imprinted with the following legend:

THE SHARES EVIDENCED BY THIS CERTIFICATE WERE ISSUED BY THE CORPORATION TO THE REGISTERED HOLDER UPON EXERCISE OF AN INCENTIVE STOCK OPTION AS DEFINED IN SECTION 422 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED (“ISO”). IN ORDER TO OBTAIN THE PREFERENTIAL TAX TREATMENT AFFORDED TO ISOs, THE SHARES SHOULD NOT BE TRANSFERRED PRIOR TO THE LATER OF (A) TWO YEARS AFTER THE DATE OF GRANT OF SUCH ISO, OR (B) ONE YEAR AFTER THE DATE OF EXERCISE OF SUCH ISO. SHOULD THE REGISTERED HOLDER ELECT TO TRANSFER ANY OF THE SHARES PRIOR TO SUCH DATE AND FOREGO ISO TAX TREATMENT, THE TRANSFER AGENT FOR THE SHARES SHALL NOTIFY THE CORPORATION IMMEDIATELY. THE REGISTERED HOLDER SHALL HOLD ALL SHARES PURCHASED UNDER THE INCENTIVE STOCK OPTION IN THE REGISTERED HOLDER'S NAME (AND NOT IN THE NAME OF ANY NOMINEE) PRIOR TO THIS DATE OR UNTIL TRANSFERRED AS DESCRIBED ABOVE.

10. Withholding Obligations. Whenever Option Shares are to be issued under the Option Agreement, the Company shall have the right to require Optionee to remit to the Company an amount sufficient to satisfy federal, state and local withholding tax requirements prior to issuance and/or delivery of any certificate or certificates for such Option Shares.

11. No Obligation to Notify. The Company shall have no duty or obligation to Optionee to advise Optionee as to the time or manner of exercising the Option. Furthermore, except as specifically set forth herein or in the Plan, the Company shall have no duty or obligation to warn or otherwise advise Optionee of a pending termination or expiration of the Option or a possible period in which the Option may not be exercised. The Company has no duty or obligation to minimize the tax consequences of the Option granted to Optionee.

12. Miscellaneous.

(a) This Option Agreement shall bind and inure to the benefit of the parties’ heirs, legal representatives, successors and permitted assigns.

(b) This Option Agreement, the Grant Notice and the Plan, constitute the entire agreement between the parties pertaining to the subject matter contained herein and they supersede all prior and contemporaneous agreements, representations and understandings of the parties. No supplement, modification or amendment of this Option Agreement shall be binding unless executed in writing by all of the parties. No waiver of any of the provisions of this Option Agreement shall be deemed or shall constitute a waiver of any other provisions, whether or not similar, nor shall any waiver constitute a continuing waiver. No waiver shall be binding unless executed in writing by the party making the waiver. In the event there exists any conflict or discrepancy between any of the terms in the Plan and this Option Agreement, the terms of the Plan shall be controlling. A copy of the Plan has been delivered to Optionee and also may be inspected by Optionee at the principal office of the Company.

(c) Should any portion of the Plan, the Grant Notice or this Option Agreement be declared invalid and unenforceable, then such portion shall be deemed to be severable from this Option Agreement and shall not affect the remainder hereof.

(d) All notices required or permitted hereunder shall be in writing and shall be deemed effectively given: (i) upon personal delivery to the party to be notified; (ii) three (3) days after having been sent by registered or certified mail, return receipt requested, postage prepaid; or (iii) one (1) day after deposit with a nationally recognized overnight courier, specifying next day delivery, with written verification of receipt. All communications shall be sent to the Company at its principal executive office, and to Optionee at the address set forth in the Company’s records, or at such other address as the Company or Optionee may designate by ten (10) days advance written notice to the other party hereto.

(e) This Option Agreement shall be construed according to the laws of the State of California.

Attachment II

Mexus Gold US 2015 Stock Incentive Plan

Attachment III

Notice Of Exercise

Mexus Gold US

1805 N. Carson Street, Suite 150,

Carson City, NV 89701

Date of Exercise: _______________

Ladies and Gentlemen:

This constitutes notice under my stock option that I elect to purchase the number of shares for the price set forth below.

|

Type of option (check one):

|

Incentive q

|

|

Nonstatutoryq

|

|

Stock option dated:

|

|

|

|

|

Number of shares as to which option is exercised:

|

|

|

|

|

Certificates to be issued in name of:

|

|

|

|

|

Total exercise price:

|

$

|

|

$

|

|

Cash or check payment delivered herewith:

|

$

|

|

$

|

By this exercise, I agree (i) to provide such additional documents as you may require pursuant to the terms of the Mexus Gold US 2015 Stock Incentive Plan, (ii) to provide for the payment by me to you (in the manner designated by you) of your withholding obligation, if any, relating to the exercise of this option, and (iii) if this exercise relates to an incentive stock option, to notify you in writing within fifteen (15) days after the date of any disposition of any of the shares of Common Stock (the “Shares”) issued upon exercise of this option that occurs within two (2) years after the date of grant of this option or within one (1) year after such shares of Common Stock are issued upon exercise of this option.

I acknowledge that all certificates representing any of the Shares subject to the provisions of the Option shall have endorsed thereon appropriate legends reflecting restrictions pursuant to the Option Agreement, the Company’s Certificate of Incorporation, Bylaws and/or applicable securities laws.

Very truly yours,

_______________________________________

Exhibit 5.1

July 17, 2015

Securities and Exchange Commission

450 Fifth Street, N.W.

Washington, D.C. 20549

Re: Mexus Gold US

Registration Statement on Form S-8

Gentlemen:

We have acted as special counsel to Mexus Gold US, a Nevada corporation (the "Company"), in connection with the preparation for filing with the U. S. Securities and Exchange Commission of a Registration Statement on Form S-8 ("Registration Statement") under the Securities Act of 1933, as amended. The Registration Statement relates to the registration of 30,000,000 shares ("Shares") of the Company's common stock, par value $0.001 per share ("Common Stock"), issuable pursuant to the Company’s 2015 Stock Incentive Plan (the “2015 Plan”).

We have examined the 2015 Plan and such corporate records, documents, instruments and certificates of the Company, and have reviewed such other documents as we have deemed relevant under the circumstances. In such examination, we have assumed without independent investigation the authenticity of all documents submitted to us as originals, the genuineness of all signatures, the legal capacity of all natural persons, and the conformity of any documents submitted to us as copies to their respective originals. As to certain questions of fact material to this opinion, we have relied without independent investigation upon statements or certificates of public officials and officers of the Company.

Based upon, subject to the foregoing and assuming that (i) the Company reserves for issuance under the 2015 Plan an adequate number of authorized and unissued shares of Common Stock and (ii) the consideration required to be paid in connection with the issuance and sale of shares of Common Stock under the 2015 Plan is actually received by the Company as provided in the Plan, we are of the opinion that the Shares, when issued in accordance with the 2015 Plan, will be legally issued, fully paid and non-assessable.

In connection with this opinion, we have examined the Registration Statement, the Company's Certificate of Incorporation, as amended, and Bylaws, and such other documents as we have deemed necessary to enable us to render the opinion hereinafter expressed.

We hereby consent to the use of this opinion as an exhibit to the Registration Statement.

|

Very truly yours,

|

| |

/s/ Phillip E. Koehnke, APC

|

|

Phillip E. Koehnke, APC

|

_____________________________________________________________________________________________________________________

P.O. Box 235472 · Encinitas, California 92024 · Tel (858) 229-8116 E-fax (501) 634-0070

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Board of Directors

Mexus Gold US

As independent registered certified public accountants, we hereby consent to the incorporation by reference in this Registration Statement on Form S-8, of our report, which includes an explanatory paragraph regarding the substantial doubt about the Company's ability to continue as a going concern, dated July 15, 2015, included Mexus Gold US’s Annual Report on Form 10-K for the year ended May 31, 2015, and to all references to our Firm under the caption “Experts” appearing in the Registration Statement.

/s/De Joya Griffith, LLC

Henderson, Nevada

July 17, 2015

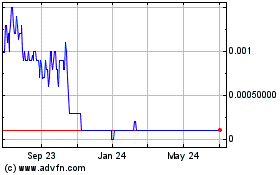

Mexus Gold US (CE) (USOTC:MXSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mexus Gold US (CE) (USOTC:MXSG)

Historical Stock Chart

From Apr 2023 to Apr 2024