- Revenues increased 6.8% to $223.6

million for Q2 2015 from $209.4 million in Q2 2014, and were $411.5

million for the first six months of 2015 compared to $420.1 million

for the same period in 2014.

- Operating income increased 6.1% to

$36.1 million for Q2 2015 from $34.0 million in Q2 2014, and

was $44.9 million for the first six months of 2015 compared to

$75.8 million for the same period in 2014.

- Adjusted EBITDA(5), a non-GAAP measure,

increased 21.9% to $51.4 million in Q2 2015 from $42.2 million in

Q2 2014, and was $71.8 million for the first six months of 2015

compared to $91.3 million for the same period in 2014.

- Diluted earnings per share for Q2 2015

was $0.83 compared to $0.86 in Q2 2014, and was $0.90 for the first

six months of 2015 compared to $2.34 for the first six months of

2014.

- Adjusted diluted earnings per share(5),

a non-GAAP measure, increased 20.0% to $1.14 in Q2 2015 from $0.95

in Q2 2014, and was $1.43 for the first six months of 2015 compared

to $2.06 for the first six months of 2014.

- Company updates full year 2015 revenue

guidance to a range of $870.0 million to $900.0 million.

Huron Consulting Group Inc. (NASDAQ: HURN), a leading provider

of business consulting services, today announced financial results

for the second quarter ended June 30, 2015.

“We are pleased with our performance in the second quarter as

each of our segments reported solid growth compared to first

quarter results,” said James H. Roth, chief executive officer and

president, Huron Consulting Group. “Revenue in our legacy

healthcare practice gained momentum as work on some of our new

engagements continued to progress. Among some of our larger

hospital and health system clients, the complexity and level of

coordination that is required to successfully achieve our targeted

outcomes tend to lengthen the time from assessment through

implementation, and we are better positioned for success when the

timing and environment are right for our clients. Our updated

revenue guidance range reflects the possibility that some

healthcare revenues will be recognized in 2016. Accordingly, we

have updated our annual revenue guidance to $870.0 to $900.0

million while we have narrowed our earnings guidance for adjusted

EPS to the higher end of our initial range to $3.80 to $4.00.”

“Consistent with the strong underlying demand for our services,

two of our segments, Education and Life Sciences and Business

Advisory, reported record quarterly revenues, and our Legal segment

continued to see improvement over recent results,” Roth added.

Second Quarter 2015 Results

Revenues for the second quarter of 2015 were $223.6 million, an

increase of 6.8% compared to $209.4 million for the second quarter

of 2014. The Company's second quarter 2015 operating income was

$36.1 million, an increase of 6.1% compared to $34.0 million in the

second quarter of 2014. Net income was $18.8 million, or $0.83 per

diluted share, for the second quarter of 2015 compared to $19.9

million, or $0.86 per diluted share, for the same period last

year.

Second quarter 2015 earnings before interest, taxes,

depreciation and amortization ("EBITDA")(5) was $50.1 million, or

22.4% of revenues, compared to $41.6 million, or 19.9% of revenues,

in the comparable quarter last year.

In addition to using EBITDA to evaluate the Company’s financial

performance, management uses non-GAAP financial measures, which

exclude the effect of the following items (in thousands):

Three Months Ended June 30, 2015

2014 Amortization of intangible assets $ 8,573 $ 2,912

Restructuring charges $ 597 $ 1,034 Litigation and other (gains)

losses $ 750 $ (440 ) Non-cash interest on convertible notes $

1,775 $ — Tax effect $ (4,596 ) $ (1,402 )

Adjusted EBITDA(5) was $51.4 million, or 23.0% of revenues, in

the second quarter of 2015, compared to $42.2 million, or 20.1% of

revenues, in the comparable quarter last year. Adjusted net

income(5) was $25.9 million, or $1.14 per diluted share, for the

second quarter of 2015, compared to $22.0 million, or $0.95 per

diluted share, for the comparable period in 2014.

The average number of full-time billable consultants(1)

increased 2.4% to 1,826 in the second quarter of 2015 compared to

1,784 in the same quarter last year. Full-time billable consultant

utilization rate(2) was 74.5% during the second quarter of 2015

compared to 77.8% during the same period last year. Average billing

rate per hour for full-time billable consultants(3) was $239 for

the second quarter of 2015 compared to $232 for the second quarter

of 2014. The average number of full-time equivalent

professionals(4) was 1,109 in the second quarter of 2015 compared

to 1,157 for the comparable period in 2014.

Year-to-Date 2015 Results

Revenues for the first six months of 2015 were $411.5 million

compared to $420.1 million for the first six months of 2014. The

Company's operating income for the first six months of 2015 was

$44.9 million compared to $75.8 million in the first six months of

2014. Net income was $20.3 million, or $0.90 per diluted share, for

the first six months of 2015 compared to $54.0 million, or $2.34

per diluted share, for the same period last year.

EBITDA(5) was $69.1 million, or 16.8% of revenues, for the first

six months of 2015, compared to $90.6 million, or 21.6% of

revenues, for the same period in 2014.

In evaluating the Company’s financial performance, management

uses non-GAAP financial measures, which exclude the effect of the

following items (in thousands):

Six Months Ended June 30, 2015

2014 Amortization of intangible assets $ 13,655 $ 5,430

Restructuring charges $ 2,187 $ 1,163 Litigation and other (gains)

losses $ 524 $ (440 ) Non-cash interest on convertible notes $

3,529 $ — Tax effect $ (7,819 ) $ (2,461 ) Net tax benefit related

to “check-the-box” election $ — $ (10,244 )

Adjusted EBITDA(5) was $71.8 million, or 17.5% of revenues, in

the first six months of 2015 compared to $91.3 million, or 21.7% of

revenues, in the comparable period last year. Adjusted net

income(5) was $32.4 million, or $1.43 per diluted share, for the

first six months of 2015 compared to $47.5 million, or $2.06 per

diluted share, for the comparable period in 2014.

The average number of full-time billable consultants(1)

increased 5.0% to 1,839 in the first six months of 2015 compared to

1,751 in the same period last year. Full-time billable consultant

utilization rate(2) was 73.2% during the first six months of 2015

compared with 76.0% during the same period last year. Average

billing rate per hour for full-time billable consultants(3) was

$229 for the first six months of 2015 compared to $240 for the same

period last year. The average number of full-time equivalent

professionals(4) was 1,049 in the first six months of 2015 compared

to 1,333 in the comparable period of 2014.

Operating Segments

Huron’s results reflect a portfolio of service offerings focused

on helping clients address complex business challenges.

The Company’s year-to-date revenues by operating segment as a

percentage of total Company revenues are as follows: Huron

Healthcare (53%); Huron Education and Life Sciences (20%); Huron

Legal (18%); and Huron Business Advisory, which includes EPM &

Analytics, (9%). Financial results by segment are included in the

attached schedules and in Huron's forthcoming Form 10-Q filing for

the quarter ended June 30, 2015.

Acquisitions

Effective January 1, 2015, Huron completed its acquisition of

Sky Analytics, Inc., a Massachusetts-based provider of legal

spend management software for corporate law departments.

On February 12, 2015, Huron completed its acquisition of Studer

Group®, a premier professional services firm that assists

healthcare providers to achieve cultural transformation to deliver

and sustain exceptional improvement in clinical outcomes and

financial results.

On July 1, 2015, Huron completed its acquisition of the India

affiliate (Rittman Mead India) of Rittman Mead Consulting Ltd., a

data and analytics consulting firm that specializes in the

implementation of enterprise performance management (EPM) and

analytics systems.

Outlook for 2015(6)

Based on currently available information, the Company updates

guidance for full year 2015 revenues before reimbursable expenses

to a range of $870.0 million to $900.0 million. The Company also

narrowed its previously issued earnings guidance to the upper end

and now anticipates EBITDA in a range of $172.2 million to $180.2

million, Adjusted EBITDA in a range of $176.0 million to $184.0

million, GAAP diluted earnings per share in a range of $2.75 to

$2.95, and non-GAAP Adjusted diluted earnings per share in a range

of $3.80 to $4.00.

Management will provide a more detailed discussion of its

outlook during the Company’s earnings conference call webcast.

Second Quarter 2015 Webcast

The Company will host a webcast to discuss its financial results

today, July 28, 2015, at 5:00 p.m. Eastern Time (4:00 p.m.

Central Time). The conference call is being webcast by NASDAQ OMX

and can be accessed at Huron Consulting Group’s website at

http://ir.huronconsultinggroup.com. A replay will be available

approximately two hours after the conclusion of the webcast and for

90 days thereafter.

Use of Non-GAAP Financial Measures(5)

In evaluating the Company’s financial performance and outlook,

management uses EBITDA, Adjusted EBITDA, Adjusted EBITDA as a

percentage of revenues, Adjusted net income, and Adjusted diluted

earnings per share, which are non-GAAP measures. Management

believes that such measures, as supplements to operating income,

net income, and diluted earnings per share, and other GAAP

measures, are useful indicators for investors. These useful

indicators can help readers gain a meaningful understanding of the

Company's core operating results and future prospects. Investors

should recognize that these non-GAAP measures might not be

comparable to similarly titled measures of other companies. These

measures should be considered in addition to, and not as a

substitute for or superior to, any measure of performance, cash

flows or liquidity prepared in accordance with accounting

principles generally accepted in the United States.

About Huron Consulting Group

Huron Consulting Group helps clients in diverse industries

improve performance, transform the enterprise, reduce costs,

leverage technology, process and review large amounts of complex

data, address regulatory changes, recover from distress and

stimulate growth. Our professionals employ their expertise in

finance, operations, strategy, analytics, and technology to provide

our clients with specialized analyses and customized advice and

solutions that are tailored to address each client's particular

challenges and opportunities to deliver sustainable and measurable

results. The Company provides consulting services to a wide variety

of both financially sound and distressed organizations, including

healthcare organizations, leading academic institutions, Fortune

500 companies, governmental entities and law firms. Huron has

worked with more than 450 health systems, hospitals, and academic

medical centers; more than 400 corporate general counsel; and more

than 400 universities and research institutions. Learn more at

www.huronconsultinggroup.com.

Statements in this press release that are not historical in

nature, including those concerning the Company’s current

expectations about its future requirements and needs, are

“forward-looking” statements as defined in Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are identified by words such as “may,” “should,”

“expects,” “provides,” “anticipates,” “assumes,” “can,” “will,”

“meets,” “could,” “likely,” “intends,” “might,” “predicts,”

“seeks,” “would,” “believes,” “estimates,” “plans” or “continues.”

These forward-looking statements reflect our current expectations

about our future requirements and needs, results, levels of

activity, performance, or achievements. Some of the factors that

could cause actual results to differ materially from the

forward-looking statements contained herein include, without

limitation: failure to achieve expected utilization rates, billing

rates and the number of revenue-generating professionals; inability

to expand or adjust our service offerings in response to market

demands; our dependence on renewal of client-based services;

dependence on new business and retention of current clients and

qualified personnel; failure to maintain third-party provider

relationships and strategic alliances; inability to license

technology to and from third parties; the impairment of goodwill;

various factors related to income and other taxes; difficulties in

successfully integrating the businesses we acquire and achieving

expected benefits from such acquisitions; risks relating to

privacy, information security, and related laws and standards; and

a general downturn in market conditions. These forward-looking

statements involve known and unknown risks, uncertainties and other

factors, including, among others, those described under “Item 1A.

Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2014, that may cause actual results, levels of

activity, performance or achievements to be materially different

from any anticipated results, levels of activity, performance or

achievements expressed or implied by these forward-looking

statements. We disclaim any obligation to update or revise any

forward-looking statements as a result of new information or future

events, or for any other reason.

HURON CONSULTING GROUP INC. CONSOLIDATED STATEMENTS OF

EARNINGS (In thousands, except per share amounts)

(Unaudited) Three Months Ended Six

Months Ended June 30, June 30, 2015

2014 2015 2014 Revenues and

reimbursable expenses: Revenues $ 223,644 $ 209,405 $ 411,497 $

420,136 Reimbursable expenses 21,389 21,141 38,544

40,244 Total revenues and reimbursable expenses

245,033 230,546 450,041 460,380

Direct costs and reimbursable

expenses (exclusive of depreciation and amortization shown in

operating expenses): Direct costs 125,490 124,289 250,491 247,899

Amortization of intangible assets and software development costs

4,969 1,290 7,481 2,391 Reimbursable expenses 21,470 20,899

38,723 40,330 Total direct costs and

reimbursable expenses 151,929 146,478 296,695

290,620

Operating expenses and other operating (gains)

losses: Selling, general and administrative expenses 46,665

43,184 88,998 80,872 Restructuring charges 597 1,034 2,187 1,163

Litigation and other (gains) losses 750 (440 ) 524 (440 )

Depreciation and amortization 9,000 6,267 16,777

12,323 Total operating expenses and other operating

(gains) losses 57,012 50,045 108,486 93,918

Operating income 36,092 34,023 44,860 75,842

Other income

(expense), net: Interest expense, net of interest income (4,764

) (1,594 ) (9,158 ) (2,965 ) Other income (expense), net 167

169 (560 ) 345 Total other expense, net (4,597 )

(1,425 ) (9,718 ) (2,620 ) Income before income tax expense 31,495

32,598 35,142 73,222 Income tax expense 12,662 12,685

14,807 19,183 Net income $ 18,833 $ 19,913

$ 20,335 $ 54,039 Earnings per share: Basic $

0.85 $ 0.88 $ 0.92 $ 2.39 Diluted $ 0.83 $ 0.86 $ 0.90 $ 2.34

Weighted average shares used in calculating earnings per share:

Basic 22,220 22,645 22,174 22,617 Diluted 22,654 23,098 22,628

23,092

HURON CONSULTING GROUP INC. CONSOLIDATED BALANCE

SHEETS (In thousands, except share and per share

amounts) (Unaudited) June 30,

December 31, 2015 2014 Assets Current

assets: Cash and cash equivalents $ 16,828 $ 256,872 Receivables

from clients, net 118,013 98,640 Unbilled services, net 96,248

91,392 Income tax receivable 5,067 8,125 Deferred income taxes, net

13,481 14,772 Prepaid expenses and other current assets 20,598

16,358 Total current assets 270,235 486,159 Property

and equipment, net 49,098 44,677 Long-term investment 22,050 12,250

Other non-current assets 25,589 20,998 Intangible assets, net

110,428 24,684 Goodwill 807,107 567,146 Total assets

$ 1,284,507 $ 1,155,914

Liabilities and

stockholders’ equity Current liabilities: Accounts payable $

8,773 $ 11,085 Accrued expenses 21,606 17,315 Accrued payroll and

related benefits 58,932 106,488 Current maturities of long-term

debt — 28,750 Deferred revenues 23,828 12,738 Total

current liabilities 113,139 176,376 Non-current liabilities:

Deferred compensation and other liabilities 16,526 10,838 Long-term

debt, net of current portion 467,630 327,852 Deferred lease

incentives 13,308 13,359 Deferred income taxes, net 47,893

26,855 Total non-current liabilities 545,357 378,904

Commitments and contingencies Stockholders’ equity

Common stock; $0.01 par value; 500,000,000 shares authorized;

25,135,647 and 24,976,395 shares issued at June 30, 2015 and

December 31, 2014, respectively 243 241 Treasury stock, at cost,

2,189,815 and 2,097,173 shares at June 30, 2015 and December 31,

2014, respectively (100,205 ) (94,074 ) Additional paid-in capital

449,091 442,308 Retained earnings 275,149 254,814 Accumulated other

comprehensive income (loss) 1,733 (2,655 ) Total

stockholders’ equity 626,011 600,634 Total

liabilities and stockholders’ equity $ 1,284,507 $ 1,155,914

HURON CONSULTING GROUP INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited) Six Months Ended June 30,

2015 2014 Cash flows from operating

activities: Net income $ 20,335 $ 54,039

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 24,431 15,071 Share-based

compensation 11,776 10,273 Amortization of debt discount and

issuance costs 4,663 677 Allowances for doubtful accounts and

unbilled services (1,034 ) (281 ) Deferred income taxes 3,191 5,816

Changes in operating assets and liabilities, net of acquisitions:

(Increase) decrease in receivables from clients (7,550 ) (4,679 )

(Increase) decrease in unbilled services (824 ) (37,220 )

(Increase) decrease in current income tax receivable / payable, net

3,106 (13,966 ) (Increase) decrease in other assets (4,125 ) 3,812

Increase (decrease) in accounts payable and accrued liabilities

2,863 10,517 Increase (decrease) in accrued payroll and related

benefits (47,114 ) (32,764 ) Increase (decrease) in deferred

revenues 8,613 904

Net cash provided by operating

activities

18,331 12,199

Cash flows from investing

activities: Purchases of property and equipment, net (9,869 )

(11,433 ) Investment in life insurance policies (5,127 ) (797 )

Purchases of businesses (331,990 ) (51,391 ) Purchases of

convertible debt investment (3,138 ) — Capitalization of internally

developed software costs (398 ) — Proceeds from note receivable —

328 Net cash used in investing activities (350,522 )

(63,293 )

Cash flows from financing activities: Proceeds

from exercise of stock options — 779 Shares redeemed for employee

tax withholdings (4,650 ) (3,140 ) Tax benefit from share-based

compensation 2,823 4,602 Share repurchases (13,498 ) (9,539 )

Proceeds from borrowings under credit facility 256,500 74,000

Repayments on credit facility (149,000 ) (64,000 ) Payments for

debt issue costs — (41 ) Payments for capital lease obligations (34

) (42 ) Deferred acquisition payment — (471 ) Net cash

provided by financing activities 92,141 2,148 Effect

of exchange rate changes on cash 6 33 Net decrease in cash and cash

equivalents (240,044 ) (48,913 ) Cash and cash equivalents at

beginning of the period 256,872 58,131 Cash and cash

equivalents at end of the period $ 16,828 $ 9,218

HURON CONSULTING GROUP INC. SEGMENT OPERATING RESULTS AND

OTHER OPERATING DATA (Unaudited) Three

Months EndedJune 30,

PercentIncrease(Decrease)

Segment and Consolidated Operating Results (in thousands):

2015 2014 Huron Healthcare: Revenues $

118,506 $ 100,967 17.4% Operating income $ 45,531 $ 38,475 18.3%

Segment operating income as a percentage of segment revenues 38.4 %

38.1 %

Huron Education and Life Sciences: Revenues $ 42,939

$ 37,747 13.8% Operating income $ 13,174 $ 11,633 13.2% Segment

operating income as a percentage of segment revenues 30.7 % 30.8 %

Huron Legal: Revenues $ 39,626 $ 53,296 (25.6)% Operating

income $ 10,285 $ 15,790 (34.9)% Segment operating income as a

percentage of segment revenues 26.0 % 29.6 %

Huron Business

Advisory: Revenues $ 22,186 $ 16,574 33.9% Operating income $

6,684 $ 5,129 30.3% Segment operating income as a percentage of

segment revenues 30.1 % 30.9 %

All Other: Revenues $ 387 $

821 (52.9)% Operating loss $ (530 ) $ (520 ) 1.9% Segment operating

loss as a percentage of segment revenues N/M N/M

Total

Company: Revenues $ 223,644 $ 209,405 6.8% Reimbursable

expenses 21,389 21,141 1.2%

Total revenues and

reimbursable expenses $ 245,033 $ 230,546 6.3%

Statements of Earnings reconciliation: Segment operating

income $ 75,144 $ 70,507 6.6% Items not allocated at the segment

level: Other operating expenses and gains 30,052 30,217 (0.5)%

Depreciation and amortization expense 9,000 6,267

43.6% Total operating income 36,092 34,023 6.1% Other expense, net

4,597 1,425 222.6%

Income before income tax

expense $ 31,495 $ 32,598 (3.4)%

Other

Operating Data (excluding All Other): Number of full-time

billable consultants (at period end) (1): Huron

Healthcare 1,087 1,114 (2.4)% Huron Education and Life Sciences 428

407 5.2% Huron Legal 98 124 (21.0)% Huron Business Advisory 204

172 18.6% Total 1,817 1,817 —%

Average number of

full-time billable consultants (for the period)

(1): Huron Healthcare 1,090 1,071 Huron Education and

Life Sciences 427 415 Huron Legal 103 129 Huron Business Advisory

206 169 Total 1,826 1,784

HURON CONSULTING GROUP

INC. SEGMENT OPERATING RESULTS AND OTHER OPERATING DATA

(CONTINUED) (Unaudited) Three Months Ended

June 30, Other Operating Data (continued):

2015 2014 Full-time billable consultant

utilization rate (2): Huron Healthcare 75.8 %

81.7 % Huron Education and Life Sciences 76.0 % 71.8 % Huron Legal

53.0 % 68.0 % Huron Business Advisory 75.1 % 75.3 % Total 74.5 %

77.8 %

Full-time billable consultant average billing rate per

hour (3): Huron Healthcare $ 230 $ 229 Huron

Education and Life Sciences $ 237 $ 225 Huron Legal $ 243 $ 251

Huron Business Advisory $ 292 $ 257 Total $ 239 $ 232

Revenue

per full-time billable consultant (in thousands): Huron

Healthcare $ 82 $ 88 Huron Education and Life Sciences $ 86 $ 75

Huron Legal $ 59 $ 80 Huron Business Advisory $ 104 $ 94 Total $ 84

$ 85

Average number of full-time equivalents (for the

period) (4): Huron Healthcare 188 58 Huron

Education and Life Sciences 33 44 Huron Legal 880 1,048 Huron

Business Advisory 8 7 Total 1,109 1,157

Revenue

per full-time equivalent (in thousands): Huron Healthcare $ 156

$ 115 Huron Education and Life Sciences $ 183 $ 146 Huron Legal $

38 $ 41 Huron Business Advisory $ 95 $ 104 Total $ 63 $ 49

HURON CONSULTING GROUP INC.

SEGMENT OPERATING RESULTS AND OTHER

OPERATING DATA

(Unaudited)

Six Months EndedJune 30,

PercentIncrease(Decrease)

Segment and Consolidated Operating Results (in thousands):

2015 2014 Huron Healthcare: Revenues $

216,510 $ 208,515 3.8% Operating income $ 74,511 $ 89,695 (16.9)%

Segment operating income as a percentage of segment revenues 34.4 %

43.0 %

Huron Education and Life Sciences: Revenues $ 82,836

$ 71,323 16.1% Operating income $ 24,954 $ 18,080 38.0% Segment

operating income as a percentage of segment revenues 30.1 % 25.3 %

Huron Legal: Revenues $ 73,053 $ 108,271 (32.5)% Operating

income $ 13,877 $ 28,278 (50.9)% Segment operating income as a

percentage of segment revenues 19.0 % 26.1 %

Huron Business

Advisory: Revenues $ 37,924 $ 29,956 26.6% Operating income $

8,283 $ 7,684 7.8% Segment operating income as a percentage of

segment revenues 21.8 % 25.7 %

All Other: Revenues $ 1,174 $

2,071 (43.3)% Operating loss $ (1,522 ) $ (978 ) 55.6% Segment

operating loss as a percentage of segment revenues N/M N/M

Total

Company: Revenues $ 411,497 $ 420,136 (2.1)% Reimbursable

expenses 38,544 40,244 (4.2)%

Total revenues and

reimbursable expenses $ 450,041 $ 460,380 (2.2)%

Statements of Earnings reconciliation: Segment operating

income $ 120,103 $ 142,759 (15.9)% Items not allocated at the

segment level: Other operating expenses and gains 58,466 54,594

7.1% Depreciation and amortization expense 16,777 12,323

36.1% Total operating income 44,860 75,842 (40.9)% Other

expense, net 9,718 2,620 270.9%

Income before

income tax expense $ 35,142 $ 73,222 (52.0)%

Other Operating Data (excluding All Other): Number of

full-time billable consultants (at period end)

(1): Huron Healthcare 1,087 1,114 (2.4)% Huron

Education and Life Sciences 428 407 5.2% Huron Legal 98 124 (21.0)%

Huron Business Advisory 204 172 18.6% Total 1,817

1,817 —%

Average number of full-time billable consultants (for

the period) (1): Huron Healthcare 1,099 1,028

Huron Education and Life Sciences 425 424 Huron Legal 109 134 Huron

Business Advisory 206 165 Total 1,839 1,751

HURON

CONSULTING GROUP INC. SEGMENT OPERATING RESULTS AND OTHER

OPERATING DATA (CONTINUED) (Unaudited) Six

Months Ended June 30, Other Operating Data

(continued): 2015 2014 Full-time

billable consultant utilization rate (2):

Huron Healthcare 74.1 % 80.4 % Huron Education and Life Sciences

76.2 % 70.0 % Huron Legal 52.9 % 66.2 % Huron Business Advisory

72.4 % 72.0 % Total 73.2 % 76.0 %

Full-time billable consultant

average billing rate per hour (3): Huron

Healthcare $ 221 $ 249 Huron Education and Life Sciences $ 231 $

213 Huron Legal $ 246 $ 241 Huron Business Advisory $ 261 $ 248

Total $ 229 $ 240

Revenue per full-time billable consultant (in

thousands): Huron Healthcare $ 153 $ 190 Huron Education and

Life Sciences $ 168 $ 140 Huron Legal $ 119 $ 146 Huron Business

Advisory $ 179 $ 173 Total $ 157 $ 173

Average number of

full-time equivalents (for the period) (4): Huron

Healthcare 159 55 Huron Education and Life Sciences 35 42 Huron

Legal 849 1,229 Huron Business Advisory 6 7 Total

1,049 1,333

Revenue per full-time equivalent (in thousands):

Huron Healthcare $ 302 $ 243 Huron Education and Life Sciences $

330 $ 285 Huron Legal $ 71 $ 72 Huron Business Advisory $ 184 $ 187

Total $ 115 $ 86 (1) Consists of our full-time

professionals who provide consulting services and generate revenues

based on the number of hours worked. (2) Utilization rate for our

full-time billable consultants is calculated by dividing the number

of hours all of our full-time billable consultants worked on client

assignments during a period by the total available working hours

for all of these consultants during the same period, assuming a

forty-hour work week, less paid holidays and vacation days. (3)

Average billing rate per hour for our full-time billable

consultants is calculated by dividing revenues for a period by the

number of hours worked on client assignments during the same

period. (4) Consists of consultants who work variable schedules as

needed by our clients, as well as other professionals who generate

revenues primarily based on number of hours worked and units

produced, such as pages reviewed and data processed. Also includes

our cultural transformation consultants from the Studer Group

acquisition, which include coaches and their support staff, and

full-time employees who provide software support and maintenance

services to our clients.

N/M - Not meaningful

HURON CONSULTING GROUP INC. RECONCILIATION OF NET INCOME

TO

ADJUSTED EARNINGS BEFORE INTEREST,

TAXES, DEPRECIATION AND AMORTIZATION (5)

(In thousands) (Unaudited) Three

Months Ended Six Months Ended June 30, June

30, 2015 2014 2015

2014 Revenues $ 223,644 $ 209,405 $

411,497 $ 420,136 Net income $ 18,833 $ 19,913 $

20,335 $ 54,039 Add back: Income tax expense 12,662 12,685 14,807

19,183 Interest and other expenses 4,597 1,425 9,718 2,620

Depreciation and amortization 13,969 7,557 24,258

14,714

Earnings before interest, taxes,

depreciation and amortization (EBITDA) (5) 50,061 41,580

69,118 90,556 Add back: Restructuring charges 597 1,034 2,187 1,163

Litigation and other (gains) losses 750 (440 ) 524

(440 )

Adjusted EBITDA (5) $ 51,408 $ 42,174

$ 71,829 $ 91,279

Adjusted EBITDA as a

percentage of revenues (5) 23.0 % 20.1 % 17.5 % 21.7 %

RECONCILIATION OF NET INCOME TO

ADJUSTED NET INCOME (5)

(In thousands) (Unaudited) Three

Months Ended Six Months Ended June 30, June

30, 2015 2014 2015

2014 Net income $ 18,833 $ 19,913 $

20,335 $ 54,039

Weighted average shares –

diluted 22,654 23,098 22,628 23,092

Diluted earnings per

share $ 0.83 $ 0.86 $ 0.90 $ 2.34

Add back: Amortization of intangible assets 8,573 2,912 13,655

5,430 Restructuring charges 597 1,034 2,187 1,163 Litigation and

other (gains) losses 750 (440 ) 524 (440 ) Non-cash interest on

convertible notes 1,775 — 3,529 — Tax effect (4,596 ) (1,402 )

(7,819 ) (2,461 ) Net tax benefit related to “check-the-box”

election — — — (10,244 ) Total adjustments,

net of tax 7,099 2,104 12,076 (6,552 )

Adjusted net income (5) $ 25,932 $ 22,017

$ 32,411 $ 47,487

Adjusted diluted earnings

per share (5) $ 1.14 $ 0.95 $ 1.43

$ 2.06 (5) In evaluating the Company’s financial

performance, management uses earnings before interest, taxes,

depreciation and amortization (“EBITDA”), Adjusted EBITDA, Adjusted

EBITDA as a percentage of revenues, Adjusted net income, and

Adjusted diluted earnings per share, which are non-GAAP measures.

Our management uses these non-GAAP financial measures to gain an

understanding of our comparative operating performance (when

comparing such results with previous periods or forecasts). These

non-GAAP financial measures are used by management in their

financial and operating decision making because management believes

they reflect our ongoing business in a manner that allows for

meaningful period-to-period comparisons. Management also uses these

non-GAAP financial measures when publicly providing our business

outlook, for internal management purposes, and as a basis for

evaluating potential acquisitions and dispositions. We believe that

these non-GAAP financial measures provide useful information to

investors and others in understanding and evaluating Huron’s

current operating performance and future prospects in the same

manner as management does, if they so choose, and in comparing in a

consistent manner Huron’s current financial results with Huron’s

past financial results. Investors should recognize that these

non-GAAP measures might not be comparable to similarly titled

measures of other companies. These measures should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance, cash flows or liquidity prepared in

accordance with accounting principles generally accepted in the

United States.

HURON CONSULTING GROUP INC. RECONCILIATION

OF NON-GAAP MEASURES FOR FULL YEAR 2015 OUTLOOK

RECONCILIATION OF NET INCOME TO

ADJUSTED EARNINGS BEFORE INTEREST,

TAXES, DEPRECIATION AND AMORTIZATION (6)

(In millions) (Unaudited) Year Ending

December 31, 2015 Guidance Range Low

High Projected revenues - GAAP $ 870.0 $ 900.0

Projected net income - GAAP $ 61.5 $ 66.5 Add back:

Income tax expense 42.0 45.0 Interest and other expenses 18.0 18.0

Depreciation and amortization 50.7 50.7

Projected

earnings before interest, taxes, depreciation and amortization

(EBITDA) (6) 172.2 180.2 Add back: Restructuring charges

4.0 4.0 Other gain (0.2 ) (0.2 )

Projected adjusted EBITDA

(6) $ 176.0 $ 184.0

Projected adjusted

EBITDA as a percentage of projected revenues (6) 20.2 %

20.4 %

RECONCILIATION OF NET INCOME

TO ADJUSTED NET INCOME

(6)

(In millions) (Unaudited) Year Ending

December 31, 2015 Guidance Range Low

High Projected net income - GAAP $ 61.5 $ 66.5

Projected diluted earnings per share - GAAP $ 2.75

$ 2.95 Add back: Amortization of intangible assets

30.2 30.2 Restructuring charges 4.0 4.0 Other gain (0.2 ) (0.2 )

Non-cash interest on convertible notes 7.0 7.0 Tax effect (16.5 )

(16.5 ) Total adjustments, net of tax 24.5 24.5

Projected

adjusted net income (6) $ 86.0 $ 91.0

Projected adjusted diluted earnings per share (6) $

3.80 $ 4.00 (6) In evaluating the Company’s

outlook, management uses Projected EBITDA, Projected adjusted

EBITDA, Projected adjusted EBITDA as a percentage of revenues,

Projected adjusted net income, and Projected adjusted diluted

earnings per share, which are non-GAAP measures. Management

believes that the use of such measures, as supplements to Projected

net income and Projected diluted earnings per share, and other GAAP

measures, are useful indicators for investors. These useful

indicators can help readers gain a meaningful understanding of the

Company’s core operating results and future prospects without the

effect of non-cash or other one-time items. Investors should

recognize that these non-GAAP measures might not be comparable to

similarly titled measures of other companies. These measures should

be considered in addition to, and not as a substitute for or

superior to, any measure of performance, cash flows or liquidity

prepared in accordance with accounting principles generally

accepted in the United States.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150728006521/en/

Huron Consulting Group Inc.Media Contact:Jenna Nichols,

312-880-5693jnichols@huronconsultinggroup.comorInvestor

Contact:C. Mark Hussey or John Kelly,

312-583-8722investor@huronconsultinggroup.com

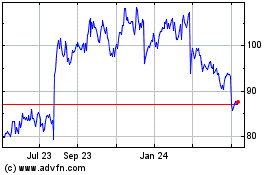

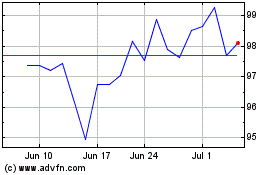

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Apr 2023 to Apr 2024