UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check appropriate box:

| [ ] |

Preliminary Proxy Statement |

| [ ] |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| [X] |

Definitive Proxy Statement |

| [ ] |

Definitive Additional Materials |

| [ ] |

Soliciting Material Pursuant §240.14a-12 |

| OCULUS

INNOVATIVE SCIENCES, INC. |

| (Name of Registrant as Specified in

its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement,

if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [X] |

No fee required. |

| |

|

| [ ] |

Fee computed based on table below per Exchange

Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| |

1) |

Title of each class of securities to which transaction

applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction

applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

| [ ] |

Fee paid previously with preliminary materials. |

| |

|

|

| [ ] |

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

| |

|

|

| |

|

|

|

Notice

of 2015 Annual

Stockholders’ Meeting and

Proxy Statement |

Thursday,

September 10, 2015

at 10 a.m. |

1129 N. McDowell Blvd.,

Petaluma, California 94954

TABLE OF CONTENTS

| Letter to our Stockholders from our Management |

|

|

| Letter to our Stockholders from our Board of Directors |

|

|

| Notice of Annual Meeting of Stockholders |

|

|

| Proxy Summary |

|

1 |

| General Voting and Meeting Information |

|

1 |

| Questions and Answers |

|

3 |

| Governance |

|

6 |

| Proposal 1 – Election of Directors |

|

6 |

| Directors and Nominees |

|

6 |

| Director Biographies and Qualifications |

|

7 |

| Committees of the Board of Directors |

|

12 |

| Director Independence and Related Person Transactions |

|

14 |

| Information about Corporate Governance |

|

14 |

| Director Compensation |

|

16 |

| Share Ownership |

|

19 |

| Equity Compensation Plan Information |

|

19 |

| Outstanding Equity Awards |

|

20 |

| Security Ownership of Certain Beneficial Owners |

|

22 |

| Section 16(a) Beneficial Ownership Reporting Compliance |

|

24 |

| Executive Compensation |

|

24 |

| Executive Officers’ Biographies and Qualifications |

|

24 |

| Named Executive Officers |

|

27 |

| Compensation Overview |

|

27 |

| Proposal 2 – Advisory Approval of Executive Compensation |

|

35 |

| Audit Matters |

|

35 |

| Report of the Audit Committee |

|

35 |

| Proposal 3 – Ratification of the Appointment of Independent Registered Public Accounting Firm |

|

37 |

| Principal Accountant Fees and Services |

|

37 |

| Audit Committee Pre-Approval Policies and Procedures |

|

37 |

| Other Matters |

|

39 |

| Proposal 4 – Increase in Authorized Common Stock Shares |

|

39 |

| General Information |

|

42 |

| Stockholder Proposals |

|

43 |

| Householding |

|

43 |

| Other Matters |

|

44 |

| Appendix A – Proxy Card |

|

A–1 |

| Appendix B – Proposed Certificate of Amendment to the Restated Certificate of Incorporation, as amended |

|

B–1 |

1129 N. McDowell Blvd.

Petaluma, California

94954

(707) 283-0550

July 28, 2015

Dear Fellow Stockholder of Oculus Innovative Sciences, Inc.:

Fiscal year 2015 was a solid start in our efforts

to turn Oculus around. We firmly believe the changes and initiatives that were implemented in 2015 set the stage for our future

growth and success. While we believe it is important to continue to focus on and grow our existing product lines and markets, fiscal

year 2015 saw a large shift in our business focus to the dermatology market. Our decision to focus on dermatology was based on

our already strong presence in this market and the ability of our core hypochlorous acid-based technology, Microcyn®, to address

dermatological indications including acne, atopic dermatitis, anti-itch and scar management. We believe our current and future

products will meet strong demand in a market for which healthcare spending has increased in the past decade with a projected annual

revenue of $810 million for atopic dermatitis alone in 2016 worldwide.

In late 2014, we hired the first of an experienced

dermatology management team and sales force in the United States, comprised of seasoned sales veterans that have established relationships

with dermatologists in their respective territories. We continued to expand that team in 2015, gaining sales with our dermatologist

customers. Our internal sales force began marketing our Celacyn scar management gel in the United States in November 2014. Recent

sales numbers have been impressive aiding in a 37% increase in total revenue for the fourth quarter.

Our newly issued patent granted by the United

States Patent and Trademark Office displays our successful research and development efforts in the dermatological field. This patent

treats a chronic dermatological condition called atopic dermatitis, or eczema. According to the National Health Institute’s

National Center for Biotechnology Information, as many as 31.6 million people suffer from this condition in the United States.

What does this new patent, spearheaded by Dr.

Robert Northey, our executive vice president of research and development and Steve Sklar, our patent counsel, mean to Oculus and

its shareholders? Billionaire investor Peter Thiel’s recent book, Zero to One: Notes on Startups, or How to Build the

Future, argues that in an effort to maximize profits and minimize costs, companies should aim to obtain exclusivity in their

respective market space through patents to restrict the ability of competitors from developing alternative products. Economists

teach that patents, by themselves, do not create monopolies, but rather minimize competition by the use of trade secrets and the

patent system. Bob and I believe that pharmaceutical giant Roche has it right - the true value of patents in our industry

is to create temporary market exclusivity. We believe that our new patent for the treatment of atopic dermatitis creates temporary

market exclusivity for this very common and chronic inflammation of the skin until expiration of the patent in 2027.

In fiscal year 2015, we developed and launched

dozens of new products. We believe we have a strong product pipeline, including our new product for treatment of scars that we

intend to launch over the next 12 months. We have also licensed several proprietary dermatology products from two European dermatology

companies that we believe we can bring to market in the near future. We recently received FDA approval for a Microcyn®-based

hydrogel for treatment of burning, itching, and pain experienced with various types of dermatosis, including atopic dermatitis

In addition to building our presence in the

dermatology market, our long-term objectives include:

Expand Our Existing Markets and Generate

International Growth. Our core Microcyn® Technology is a highly effective, unique technology with very broad applications.

Our products have received wide acceptance in 40 countries. It is our aim to establish Microcyn® as the standard for advanced

tissue care and to continue obtaining additional regulatory approvals for our products and their applications in all our global

markets while expanding our international footprint into new countries worldwide.

Diversify. Our Microcyn®-based technology

is the core of our business and we will continue working off the success it has brought. However, we realize that technology diversification

is a prudent long-term strategy for success. As such, we intend to diversify into other technologies by seeking out non-Microcyn®-based

dermatological products and integrating them, over time, into our product portfolio.

Revitalize our Animal Healthcare Market.

Our new animal healthcare partner, SLA Brands, Inc. began selling pet specialty and farm and ranch products in March 2015.

We expect to expand with a second partner into equine later this year

Looking ahead, we believe Oculus is well situated

for future growth and long-term success. We have a dedicated Board with a clear vision for the future and concrete strategies to

achieve our goals; dedicated and talented employees, who work diligently to establish Oculus as a leader in the healthcare industry

and a company of which we can all be proud.

This year, our Annual Meeting of Stockholders

will be held at 10:00 a.m. Pacific Daylight Time, on Thursday, September 10, 2015, at our offices located at 1129 N. McDowell Blvd.,

Petaluma, California.

We look forward to seeing you there and thank

you for your continued support.

Jim Schutz

Chief Executive Officer

Robert Miller

Chief Financial Officer and Chief Operations Officer

1129 N. McDowell Blvd.

Petaluma, California

94954

(707) 283-0550

July 28, 2015

Dear Fellow Stockholder:

The Board of Directors

takes their roles as representatives of the Company seriously and believes that accountability and stockholder communication is

vital to the ongoing growth of the Company.

Pursuant to this, you

are cordially invited to attend the 2015 Annual Meeting of Stockholders of Oculus Innovative Sciences, Inc. The meeting will be

held at 10 a.m. PDT, on Thursday, September 10, 2015, at our offices located at 1129 N. McDowell Blvd, Petaluma, California 94954.

The formal notice of the

2015 Annual Meeting and proxy statement have been made a part of this invitation.

Oculus continues to grow

and evolve, and we are committed to ensuring that highly qualified individuals are seated on our Board of Directors, and that our

capital structure is sufficient to meet our needs. Through careful evaluation of this Proxy Statement you can help us to achieve

these goals.

Your vote is important.

Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet,

as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction form.

Please review the instructions on each of your voting options described in this proxy statement, as well as the notice you received

in the mail. Your shares cannot be voted unless you submit your proxy or attend the Annual Meeting in person.

We have also enclosed

a copy of our 2015 Annual Report for the fiscal year ended March 31, 2015. We encourage you to read our 2015 Annual Report. It

includes our audited financial statements and provides information about our business.

The proxy statement and

the 2015 Annual Report are also available at http://ir.oculusis.com/annuals.cfm, by using the QR codes at the end of this document,

or by contacting our Investor Relations department through email at ir@oculusis.com.

We look forward to seeing

you at our Annual Meeting. Thank you for your ongoing support of and continued interest in Oculus.

Sincerely,

Notice

of 2015 Annual Meeting of Stockholders

Thursday, September

10, 2015 10:00 a.m., Pacific Time

1129

N. McDowell Blvd., Petaluma, CA 94954

We are pleased to invite

you to join our Board of Directors, senior leadership and other stockholders for our 2015 Annual Meeting of Oculus Innovative Sciences,

Inc. Stockholders. The meeting will be held at our offices located at 1129 N. McDowell Blvd., in Petaluma, California 94954, at

10:00 a.m. local time on Thursday, September 10, 2015. The purposes of the meeting are:

| · | | To elect two Class I Directors,

nominated by our Board of Directors, to serve until the 2018 Annual Meeting of Stockholders; |

| · | | To approve, on an advisory,

non-binding basis, the compensation of our named executive officers; |

| · | | To ratify the appointment of

Marcum, LLP as our independent auditors for the fiscal year ending March 31, 2016; |

| · | | To approve an amendment to

our Restated Certificate of Incorporation, as amended, increasing the number of authorized shares of common stock, $0.0001 par

value per share, from 30,000,000 to 60,000,000; and |

| · | | To transact such other business

as may properly come before the meeting and at any adjournments or postponements of the meeting. |

Only stockholders of

record at the close of business on July 13, 2015, are entitled to notice of and to vote at the Annual Meeting and any adjournments

or postponements thereof. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the

Annual Meeting will be available for inspection at the Company’s principal executive offices, 1129 N. McDowell Blvd., Petaluma,

California 94954.

All stockholders are cordially

invited to attend the 2015 Annual Meeting in person. Whether or not you plan to attend, please sign and return the proxy in

the envelope enclosed for your convenience, or vote your shares by telephone or by the Internet as promptly as possible. Telephone

and Internet voting instructions can be found on the attached proxy. Should you receive more than one proxy because your shares

are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be

voted. You may revoke your proxy at any time prior to the 2015 Annual Meeting. If you attend the 2015 Annual Meeting and vote in

person, your proxy will be revoked and only your vote in person at the 2015 Annual Meeting will be counted.

The Proxy Statement and

our Annual Report for the fiscal year ended March 31, 2015, are available at http://ir.oculusis.com/annuals.cfm/. You can also

access these materials by scanning the QR codes on the last page of this Proxy Statement, or by contacting our Investor Relations

department by email at ir@oculusis.com.

| |

By Order of the Board of Directors,

Robert Miller

Chief Financial Officer and

Corporate Secretary

Petaluma, California

July 28, 2015

|

Your

Vote is Important to us. Regardless of whether you plan to attend, we urge all stockholders to vote on the matters described

in the accompanying Proxy Statement. We hope that you will promptly vote and submit your proxy by dating, signing and returning

the enclosed proxy card. This will not limit your rights to attend or vote at the Annual Meeting.

Proxy Summary

General Voting and Meeting Information

This Proxy Statement and

accompanying form of proxy are being mailed to stockholders on or about July 29, 2015, and are to be used at the 2015 Annual Meeting

of Stockholders on September 10, 2015. It is important that you carefully review the proxy materials and follow the instruction

below to cast your vote on all voting matters.

Voting Methods

Even if you plan to attend

the 2015 Annual Meeting of Stockholders in person on September 10, 2015, please vote as soon as possible by using one of the following

advance voting methods. Make sure to have your proxy card or voting instruction form in hand and follow the instructions.

You

can vote in advance through one of three ways:

|

Via the Internet*

– Visit the website listed on your proxy card/voting instruction form. |

|

By Telephone* –

Call the telephone number listed on your proxy card/voting instruction form. |

|

By Mail – If you are a stockholder of record and

receive a notice regarding the availability of proxy materials, you may request a written proxy card by following the instructions

in the notice. Then sign, date, and return your proxy card/voting instruction form in the enclosed envelope. |

*If you are a beneficial

owner you may vote via the telephone or internet if your bank, broker, or other nominee makes those methods available, in which

case they will include the instructions with the proxy materials. If you are a stockholder of record, Oculus will include instructions

on how to vote via internet or telephone directly on your proxy voting card.

Voting at the Annual Meeting

Stockholders of record

may vote at the Annual Meeting. Beneficial owners may vote in person if they have a legal proxy. Even if you plan to attend

the 2015 Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote by telephone or the Internet

so that your vote will be counted if you later decide not to attend the meeting.

Voting

Matters and Board Recommendations

Stockholders are being

asked to vote on the following matters at the 2015 Annual Meeting:

| Proposal |

Recommendation |

| Election of Director |

FOR Each Nominee |

| Election of two Class I director nominees. The Board believes that the nominees’ knowledge, skills, and abilities would positively contribute to the function of the board as a whole. Accordingly, your proxy holder will vote your shares FOR the election of each of the Board’s nominees named below unless you instruct otherwise. |

|

| Advisory Approval of Executive Compensation |

FOR |

| The Say-on-Pay Proposal, to approve, on an advisory basis, the compensation paid to our Named Executive Officers for the fiscal year ended March 31, 2015. The Company has designed its compensation programs to reward and motivate employees to continue to grow the Company. The Compensation Committee takes stockholder views seriously and will take into account the advisory vote in future executive compensation decisions. Accordingly, your proxy holder will vote your Shares FOR the election of each of the Board’s nominees named below unless you instruct otherwise. |

|

| Ratification of the Appointment of Independent Registered Public Accounting Firm |

FOR |

| The Audit Committee has appointed Marcum LLP as our Independent Registered Public Accounting Firm for the fiscal year ending March 31, 2016. The Audit Committee and the Board believe that the retention of Marcum LLP is in the best interests of the Company and its stockholders. |

|

| Amendment to Restated Certificate of Incorporation, as amended, to Increase the Number of Authorized Shares of Common Stock |

FOR |

|

To approve an amendment to

our Restated Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock, $0.0001 par

value per share, from 30,000,000 shares to a total of 60,000,000 authorized shares.

|

|

Questions and Answers

| 1. | What is a proxy statement, what is a proxy and how does it work? |

A proxy statement is a

document that the U.S. Securities and Exchange Commission requires us to give you when we ask you to sign a proxy card designating

someone other than you to vote the stock you own. The written document you sign indicating who may vote your shares of common stock

is called a proxy card and the person you designate to vote your shares is called a proxy. The Board of Directors is asking to

act as your proxy. By signing and returning to us the proxy card enclosed you are designating us as your proxy to cast your votes

at the 2015 Annual Meeting of Stockholders. We will cast your votes as you indicate on the enclosed proxy card.

Our employees, officers

and directors may solicit proxies. We have retained D.F. King & Co., Inc. to solicit proxies for us. We have agreed to compensate

D.F. King a fee of $3,500, as well as reimburse $4.50 per incoming/outgoing stockholder telephone call. We also agreed to reimburse

D.F. King for other reasonable expenses. We will bear the cost of soliciting proxies and will reimburse brokerage houses and other

custodians, nominees and fiduciaries for their reasonable, out-of-pocket expenses for forwarding proxy and solicitation material

to the owners of our common stock.

| 2. | Who is entitled to vote at the 2015 Annual Meeting of Stockholders? |

Only stockholders who were

Oculus Innovative Sciences, Inc. stockholders of record at the close of business on July 13, 2015, (the “Record Date”)

may vote at the 2015 Annual Meeting of Stockholders. As of the close of business on the Record Date, there were 15,956,565 shares

of our common stock outstanding. Each stockholder is entitled to one vote for each share of our common stock held as of the Record

Date.

| 3. | What is the difference between a stockholder of record and a beneficial owner? |

If you are a stockholder

of record (that is if shares are registered directly in your name with Oculus’ transfer agent, Computershare, Inc.), you

will receive a Proxy Statement, Annual Report and proxy card directly from us. If you are a beneficial owner of shares held in

street name (that is, if you hold shares through a broker, bank, or other holder of record), you will receive the Proxy Statement

and Annual Report forwarded to you by your broker, bank, or nominee who is considered, with respect to those shares, the stockholder

of record. As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote your shares by using

the voting instruction form included in the mailing. If you do not give instructions to your bank or brokerage firm, it will nevertheless

be entitled to vote your shares with respect to “routine” items, but will not be permitted to vote your shares with

respect to “non-routine” items. In the case of a non-routine item, your shares will be considered “broker non-votes”

on that proposal.

| 4. | What does it mean if I receive more than one proxy card? |

If you hold your shares in

multiple registrations, or in both registered and street name, you will receive a proxy card for each account. Please mark, sign,

date and return each proxy card you receive. If you choose to vote by telephone or Internet, please vote each proxy card you receive.

| 5. | Will there be any other items of business on the agenda? |

We do not expect any other

items of business because the deadline for stockholder proposals and nominations has already passed. Nonetheless, in case there

is an unforeseen need, the accompanying proxy gives discretionary authority to the persons named on the proxy with respect to

any other matters that might be brought before the meeting. Those persons intend to vote that proxy in accordance with their best

judgment.

| 6. | How will my shares be voted? |

To designate how you would

like to vote, fill out the proxy card indicating how you would like your votes cast.

If you sign and return

the enclosed proxy, but do not specify how to vote, we will vote your shares as follows:

| · | | “FOR” Proposal

No. 1 to elect two Class I director nominees; |

| · | | “FOR” Proposal

No. 2, the Say-on-Pay Proposal, to approve on an advisory basis, the compensation paid to our Named Executive Officers for the

fiscal year ended March 31, 2015; |

| · | | “FOR” Proposal

No. 3 to ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending

March 31, 2016. |

| · | | “FOR” Proposal

No. 4 to approve an amendment to our Restated Certificate of Incorporation, as amended, to increase the number of authorized shares

of common stock, $0.0001 par value per share, from 30,000,000 to a total of 60,000,000 authorized shares. |

| 7. | Can I change my vote or revoke my proxy? |

You may change your vote

or revoke your proxy at any time prior to the vote at the 2015 Annual Meeting. If you submitted your proxy by mail, you must file

with our Secretary, at Oculus Innovative Sciences, Inc., 1129 N. McDowell Blvd., Petaluma, California 94954, a written notice of

revocation or deliver a valid, later-dated proxy. If you submitted your proxy by telephone or the Internet, you may change your

vote or revoke your proxy with a later telephone or Internet proxy, as the case may be. Attendance at the 2015 Annual Meeting

will not have the effect of revoking a proxy unless you give written notice of revocation to the Secretary before the proxy is

exercised or you vote by written ballot at the 2015 Annual Meeting.

| 8. | What is a broker non-vote and what is the impact of not voting? |

A broker “non-vote”

occurs when a bank, broker, or nominee holding shares of common stock for a beneficial owner does not vote on one or more proposals

because the nominee does not have discretionary voting power on that matter, which is also referred to as holding shares in street

name. Your bank or broker does not have discretion to vote uninstructed shares on the proposals in this Proxy Statement, except

for Proposal No. 3 to ratify the appointment of our independent registered public accounting firm and Proposal No. 4 to increase

our authorized common stock. As a result, if you hold your shares in street name, it is critical that you provide instructions

to your bank or broker, if you want your vote to count in the election of directors and the advisory votes related to executive

compensation. If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of

the items of business at the 2015 Annual Meeting.

| 9. | What constitutes a quorum? |

A quorum is the minimum number

of stockholders necessary to conduct the Annual Meeting. The presence at the 2015 Annual Meeting, in person or by proxy, of the

holders of a majority of common stock outstanding on the Record Date will constitute a quorum. As of the close of business on the

Record Date, there were 15,956,565 shares of our common stock outstanding. Votes “for” and “against”, “abstentions”,

and broker “non-votes” will all be counted as present to determine whether a quorum has been established.

| 10. | Is cumulative voting permitted for the election of directors? |

No, each stockholder may

vote only the number of shares he or she owns for a single director candidate.

| 11. | What is the vote required for a proposal to pass? |

Proposal No. 1—Election

of Directors: The affirmative vote of a plurality of the votes cast of the shares of common stock present or represented and

entitled to vote at the 2015 Annual Meeting, in person or by proxy, is required for the election of a nominee. Thus, assuming a

quorum is present at the 2015 Annual Meeting, the two nominees who receive the most affirmative votes will be elected as Class

I directors. Abstentions and broker non-votes will not have any effect on the voting outcome with respect to the election of directors.

Proposal No. 2—Say-on-Pay:

Because this proposal asks for a non-binding, advisory vote, there is no required vote that would constitute approval. We value

the opinions expressed by our stockholders in this advisory vote, and our Compensation Committee, which is responsible for overseeing

and administering our executive compensation programs, will consider the outcome of the vote when designing our compensation programs

and making future compensation decisions for our Named Executive Officers. Abstentions and broker non-votes, if any, will not have

any impact on this advisory vote.

Proposal No. 3—Ratification

of Independent Registered Public Accounting Firm: The affirmative vote of a majority of the votes cast on the proposal at the

2015 Annual Meeting, in person or by proxy, is required to ratify our selection of Marcum LLP as our independent registered public

accounting firm for the fiscal year ending March 31, 2016. Abstentions will have the practical effect of a vote to not ratify our

selection. Because we believe that Proposal No. 3 is a routine proposal on which a broker or other nominee is generally empowered

to vote, broker "non-votes" likely will not result from this proposal. If you are a beneficial owner holding shares through

a broker, bank, or other nominee and you do not instruct your broker or bank, your broker or bank may cast a vote on your behalf

for this proposal.

Proposal No. 4—Amendment

to our Restated Certificate of Incorporation, as amended, to effect an increase in the number of authorized shares of

common stock: The affirmative vote of a majority of the outstanding shares of common stock entitled to vote at the 2015

Annual Meeting is needed to approve an amendment to our Restated Certificate of Incorporation, as amended, to effect an

increase in the number of authorized shares of common stock, $0.0001 par value per share, to equal a total of 60,000,000

authorized shares. A properly executed proxy marked “ABSTAIN” with respect to this proposal will have the

practical effect of a negative vote, although it will be counted for purposes of determining the number of shares of common stock

entitled to vote. Because we believe that Proposal No. 4

is a routine proposal on which a broker or other nominee is generally empowered to vote, broker “non-votes”

likely will not result from this Proposal. Thus, if you are a beneficial owner holding shares through a broker, bank or other

holder of record and you do not vote on this proposal, your broker may cast a vote on your behalf for this proposal.

Governance

Proposal No. 1 – Election

of Directors

Upon

the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has nominated Ms. Sharon Barbari

and Mr. Russell Harrison for election at the 2015 Annual Meeting. The Board believes that the nominees’ knowledge, skills,

and abilities would positively contribute to the function of the board as a whole. Accordingly, your proxy holder will vote your

shares FOR the election of the Board’s nominee named below unless you instruct otherwise.

Directors

and Nominees

At our 2008 Annual Meeting

of Stockholders, our stockholders approved an amendment to our Restated Certificate of Incorporation, as amended, which provided

that directors are classified into three classes, as nearly equal in number as possible, with each class serving for a staggered

three-year term. Our Board currently consists of five directors:

| |

Name |

Position with the Company |

Director

Since |

Term

Expires |

| Class I |

|

|

|

|

| |

Sharon Barbari |

Class I Director |

2014 |

2015 |

| |

Russell Harrison |

Class I Director |

2014 |

2015 |

| Class II |

|

|

|

|

| |

Jay Birnbaum |

Class II Director |

2007 |

2016 |

| |

Jim Schutz |

Chief Executive Officer and Class II Director |

2004 |

2016 |

| Class III |

|

|

|

|

| |

Jerry McLaughlin |

Class III Director |

2013 |

2017 |

With regard to the election

of directors, votes may be cast “FOR” or “WITHHOLD.” Provided that a quorum is present, the affirmative

vote by the holders of a plurality of the shares of common stock present and voting at the 2015 Annual Meeting is required to elect

the nominee for director.

What am I voting on?

Stockholders are being asked

to elect two Class I Director nominees for three-year terms. This section includes information about all Directors, including

Ms. Sharon Barbari and Mr. Russell Harrison who are the Nominees for this year’s election.

|

Your Board of Directors

recommends a vote FOR the election of the director nominees, Ms. Sharon Barbari and Mr. Russell Harrison.

|

Director Biographies and Qualifications

Below are the biographies

of our directors and certain information regarding each director’s experience, attributes, skills and/or qualifications that

led to the conclusion that the director should be serving as a director of Oculus.

|

Sharon Barbari

Current Position:

Director Since:

Age:

Committee Memberships: |

Director

March 2014

61

Audit (Chair),

Nominating and Corporate

Governance |

Ms. Barbari has served

as Executive Vice President of Finance and Chief Financial Officer of Cytokinetics Inc. since July 2009. She served as Senior Vice

President of Finance and Chief Financial Officer from September 2004 through June 2009. From September 2002 to August 2004, Ms.

Barbari served as Chief Financial Officer and Senior Vice President of Finance and Administration of InterMune, Inc., a biopharmaceutical

company. From January 1998 to June 2002, she served at Gilead Sciences, Inc., a biopharmaceutical company, and held several positions

of increasing responsibility including most recently as its Vice President and Chief Financial Officer. From 1996 to 1998, Ms.

Barbari served as Vice President of Strategic Planning at Foote, Cone & Belding Healthcare in San Francisco, an international

advertising and marketing firm. From 1972 to 1995, she was employed by Syntex Corporation where she held various management positions

in corporate finance, financial planning, marketing and commercial planning.

Education:

| |

l |

B.S. in Accounting from San Jose State University |

Special Knowledge,

Skills, and Abilities:

|

Financial Background

Ms. Barbari has worked

in finance for over 35 years and has worked as a CFO for several companies. |

|

Pharmaceutical Background

Ms. Barbari has worked

in the pharmaceutical industry for most of her career and has extensive experience working strategically in the field both internationally

and during the development of clinical-stage products.

|

|

Leadership

Ms. Barbari has more than

30 years of experience as a business leader. She has worked in important business roles for various companies as a Director of

Strategic Planning, as a Vice President and CFO. |

|

Russell Harrison

Current Position:

Director Since:

Age:

Committee Memberships: |

Director

February 2014

70

Audit, Nominating and Corporate

Governance (Chair), Compensation |

Mr. Harrison has served

on our Board of Directors since February 2014. Mr. Harrison is the founding principal of The Leadership Group, LLC, a firm specializing

in strategic change and executive coaching for U.S. and international companies, a position he has held since January 2012. From

2006 to 2012, he was employed by CoolSystems, Inc. d/b/a Game Ready, Inc. and was appointed as its President and Chief Executive

Officer in 2007. Mr. Harrison has also served in the role of Chief Executive Officer for a number of publicly traded and private

technology businesses in both the information technology and medical device technology sectors. From 1995 to 1997, he served as

Chief Information Officer at SITA Telecommunications Holdings in Paris, where he led a team responsible for technology spanning

more than 200 countries and territories. From 1991 to 1993, Mr. Harrison served as the first Chief Information Officer for McKesson

Corporation, responsible for all computer technology-related activities. He also served as a Captain in the United States Marine

Corps.

Education:

| |

l |

BA in Economics from the University of Southern California |

| |

l |

MBA with honors from St. Mary’s College of California |

Special Knowledge,

Skills, and Abilities:

|

Business Development

Mr. Harrison has an excellent

track record building new companies and improving performance in underachieving businesses. He founded an executive leadership

consulting company. |

|

International Business

Mr. Harrison has extensive

experience in global markets, having spent much of his career working internationally. He has worked for foreign-based companies,

including companies with operations in over 200 countries. |

|

Leadership

Mr. Harrison has served

in several leadership and executive roles from serving as CEO and President, to Chief Information Officer. In addition, he is the

founder of an executive leadership consulting company and has been a consultant to top executives. |

|

Jay Birnbaum

Current Position:

Director Since:

Age:

Committee Membership: |

Director

April 2007

70

Audit |

Dr. Birnbaum is a pharmacologist

and since 1999, has been a consultant to pharmaceutical companies in his area of expertise. He previously served as Vice President

of Global Project Management at Novartis/Sandoz Pharmaceuticals Corporation, where he had responsibility for strategic planning

and development of the company’s dermatology portfolio. Dr. Birnbaum is also a co-founder and former Chief Medical Officer

of Kythera Biopharmaceuticals, and has served on the board of directors of Excaliard Pharmaceuticals (a company recently acquired

by Pfizer) and on the scientific advisory boards of several companies.

Education:

| |

l |

B.S. in Biology from Trinity College in Connecticut |

| |

l |

Ph.D. in Pharmacology from the University of Wisconsin |

Special Knowledge,

Skills, and Abilities:

|

Extensive Knowledge

of the Company’s Business

Dr. Birnbaum has served on our

Board for 8 years, and has gained a deep understanding of the workings and direction of the Company. He has successfully

guided the Company through leadership and strategy transitions evidencing his commitment to the Company and his willingness

to adapt to ensure its continued success. |

|

Pharmaceutical Background

Dr. Birnbaum has extensive

experience in pharmacology, having served as a practicing pharmacologist and consultant for over a decade. Dr. Birnbaum also was

the co-founder and former Chief Medical Officer of Kythera. |

|

Leadership

Dr. Birnbaum has extensive

leadership experience in the pharmaceutical industry. He has co-founded a biopharmaceutical company, served on the board of directors

for companies in the industry, as well as, serving on several scientific advisory boards in the life sciences field. |

|

Jim Schutz

Current Position:

Director Since:

Age: |

President, Chief Executive

Officer, Director

May 2004

52 |

Mr. Schutz was appointed

our President and Chief Executive Officer on February 4, 2013. Prior to this appointment, he most recently held the position of

our Chief Operating Officer and General Counsel, and has served in various other capacities as an executive officer of our Company

since August 2003. From August 2001 to August 2003, Mr. Schutz served as General Counsel at Jomed (formerly EndoSonic Corp.), an

international medical device company. From 1999 to July 2001, Mr. Schutz served as in-house counsel at Urban Media Communications

Corporation, an internet/telecom company based in Palo Alto, California.

Education:

| |

l |

B.A. in Economics from the University of California, San Diego |

| |

l |

J.D. from the University of San Francisco School of Law |

Special Knowledge,

Skills, and Abilities:

|

Extensive Knowledge

of the Company’s Business

Mr. Schutz has been working

for our Company for 13 years in various positions, and has gained a deep understanding of the workings and direction of our Company.

Through his experience within the Corporation, Mr. Schutz has gained the knowledge, expertise, and ideas, to take Oculus to higher

levels as its President and Chief Executive Officer. |

|

Legal Background

Mr. Schutz has significant

legal experience. He

l served

as General Counsel to our Company from 2003 to 2012;

l served

as Jomed’s General Counsel from 2001 to 2003; and

l served

as General Counsel at Urban Media Communications Corporation from 1999 to 2001.

Mr. Schutz is able to

consistently utilize his legal training and experience when making decisions in the best interest of the Company. |

|

Leadership

Mr. Schutz has extensive

leadership experience in our Company having served as its President, CEO and COO. Through these roles he has gained the insight

into the unique management style that makes our Company successful. |

|

Jerry McLaughlin

Current Position:

Director Since:

Age:

Committee Membership: |

Lead Independent Director

March 2013

67

Compensation (Chair) |

Mr. McLaughlin served

as Interim Chief Executive Officer of Applied BioCode, Inc. from November 2011 to April 2013. In April 2011, he also founded and

currently serves as Chairman and Chief Executive Officer, of DataStream Medical Imaging Systems, Inc., a start-up to develop diagnostic

imaging software applications that work in conjunction with existing digital radiology platforms. He previously served as President

of DataFlow Information Systems, from July 2007 to December 2011, and President and Chief Executive Officer of CompuMed, Inc. from

May 2002 to June 2007. Mr. McLaughlin also serves on the board of directors of DataStream Medical Imaging Systems, Inc., a private

company in the medical imaging software industry.

Education:

| |

l |

B.S. in Pharmacy from State University of New York at Buffalo |

Special Knowledge,

Skills, and Abilities:

|

Sales and Marketing

Mr. McLaughlin possesses

significant sales and marketing experience, having worked with several companies in the scientific industry. |

|

Healthcare Industry

Mr. McLaughlin has a depth

of experience operating and serving as senior management in the scientific, software and medical device industry, including having

positions of increasing authority at DataStream Medical Imaging Systems; DataFlow Information Systems and CompuMed, Inc. |

|

Leadership

Mr. McLaughlin has extensive

leadership experience both as a director and executive at multiple companies. His range of experiences offers versatility and skill

in many areas of leadership. |

Board Meetings

Our

Board of Directors held 11 meetings in fiscal year 2015 and, in addition, took action from time to time by unanimous written consent.

In fiscal year 2015, no incumbent director attended fewer than 75% of the total number of Board meetings (held during the period

for which such director served) and average attendance of our incumbent directors at Board and applicable Committee meetings was

90%. The independent directors met regularly in executive sessions

without the participation of the Chief Executive Officer or the other members of management. We do not have a policy that requires

the attendance of directors at our Annual Meetings of Stockholders. Our Chief Executive Officer and President, Mr. Jim Schutz,

attended the 2014 Annual Meeting of Stockholders held on September 10, 2014.

Committees of the

Board of Directors

Our Board of Directors

has appointed an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The Board of

Directors has determined that each director who serves on these committees is “independent,” as that term is defined

by the NASDAQ Listing Rules and rules of the SEC. The Board of Directors has adopted written charters for its Audit Committee,

its Compensation Committee and its Nominating and Corporate Governance Committee. Copies of these charters are available on our

website at http://ir.oculusis.com/governance.cfm. In addition to the number of meetings referenced below, the Committees also

took actions by unanimous written consent.

Information about each

of our committees is stated below

| Name of Committee Member |

Audit |

Compensation |

Nominating and Corporate Governance |

| Sharon Barbari |

« |

|

● |

| Jerry McLaughlin |

|

« |

|

| Russell Harrison |

● |

● |

« |

| Jay Birnbaum |

● |

|

|

«Committee

Chair

Audit Committee

|

Sharon Barbari

Committee

Chair |

Other Committee Members:

Jay Birnbaum, and Russell Harrison

Meetings Held in Fiscal

Year 2015: 5

|

Primary Function:

To assist the Board of Directors

in fulfilling its oversight responsibilities related to our financial statements, system of internal control over financial reporting,

and auditing, accounting and financial reporting processes. Other specific duties and responsibilities of the Audit Committee are

to appoint, compensate, evaluate and, when appropriate, replace our independent registered public accounting firm; review and pre-approve

audit and permissible non-audit services; review the scope of the annual audit; monitor the independent registered public accounting

firm’s relationship with us; and meet with the independent registered public accounting firm and management to discuss and

review our financial statements, internal control over financial reporting, and auditing, accounting and financial reporting processes.

Compensation Committee

|

Jerry McLaughlin

Committee

Chair |

Other Committee

Members:

Russell Harrison

Meetings Held

in Fiscal Year 2015:5 |

Primary Function:

To assist the Board of Directors

in meeting its responsibilities in regards to oversight and determination of executive compensation and to review and make recommendations

with respect to major compensation plans, policies and programs of our Company. Other specific duties and responsibilities of the

Compensation Committee are to review and approve goals and objectives relevant to the recommendations for approval by the independent

members of the Board of Directors regarding compensation of our Chief Executive Officer and other executive officers, establish

and approve compensation levels for our Chief Executive Officer and other executive officers, and to administer our stock plans

and other equity-based compensation plans.

The Compensation Committee

has engaged Radford Survey & Consulting, an Aon Hewitt Company (“Radford”) as its independent external advisor

to advise them on the overall size and scope of equity compensation for the Company as a whole. Radford also provided guidance

on the structure of potential equity compensation for directors, executive officers and employees. The Compensation Committee reviewed

its relationship with Radford, considered Radford’s independence and the existence of potential conflicts of interest, and

determined that the engagement of Radford did not raise any conflict of interest or other issues that would adversely impact Radford’s

independence. In reaching this conclusion, the Compensation Committee considered various factors, including the six factors set

forth in the SEC and NASDAQ rules regarding compensation advisor conflicts of interest and independence.

Nominating and Corporate

Governance Committee

|

Russell Harrison

Committee

Chair

|

Other Committee

Members:

Sharon Barbari

Meetings Held

in Fiscal Year 2015: 3 |

Primary Function:

To identify qualified

individuals to become members of the Board of Directors, determine the composition of the Board and its Committees, and to monitor

a process to assess Board effectiveness. Other specific duties and responsibilities of the Nominating and Corporate Governance

Committee are to recommend nominees to fill vacancies on the Board of Directors, review and make recommendations to the Board of

Directors with respect to director candidates proposed by stockholders, and review, on an annual basis, the functioning and effectiveness

of the Board and its Committees.

Director

Independence and Related Person Transactions

Independent Directors

Standard for Independence—We

determine independence using the definitions set forth in the NASDAQ Listing Rules and the rules under the Securities Exchange

Act of 1934. These definitions define independence based on whether the director or a family member of the director has been employed

by the Company in the past three years, how much compensation the director or family member of a director received from the Company,

how much stock the director or a family member of the director owns in the Company and whether the director or a family member

of the director is associated with the Company’s independent auditor.

As of July 13, 2015, we have

determined that the following directors are independent:

· Sharon Barbari

· Russell Harrison

· Jerry McLaughlin; and

· Jay Birnbaum

Related Person Transactions

It is our policy that all

employees, officers and directors must avoid any activity that is, or has the appearance of, conflicting with the interests of

our Company. This policy is included in our Code of Business Conduct, and our Board formally adopted a Related Party Transaction

Policy and Procedures in July 2007 for the approval of interested transactions with persons who are Board members or nominees,

executive officers, holders of 5% of our common stock, or family members of any of the foregoing. The Related Party Transaction

Policy and Procedures are administered by our Audit Committee. We conduct a review of all related party transactions for potential

conflict of interest situations on an ongoing basis and all such transactions relating to executive officers and directors must

be approved by the Audit Committee. There have been no relevant related party transactions meeting the disclosure requirements

in this period.

Arrangements or Understandings

between our Executive Officers or Directors and Others

There are no arrangements

or understandings between our executive officers or directors and any other person pursuant to which he was or is to be selected

as a director or officer.

Information about

Corporate Governance

Board Leadership Structure

Since February 1, 2013,

we have had separate individuals serving as Chairman of the Board of Directors and our Principal Executive Officer. Mr. Jim Schutz

began serving as our Chief Executive Officer on February 1, 2013. The Board appointed Mr. Jerry McLaughlin to serve as the Lead

Independent Director effective March 26, 2014. As Chief Executive Officer, Mr. Schutz manages the day-to-day affairs of the Company

and, as Lead Independent Director, Mr. McLaughlin leads the Board meetings and leads the Board in overseeing management.

The Board believes that

this structure is currently serving our Company well, and intends to maintain it where appropriate and practicable in the future.

We have had varying board leadership models over our history, at times separating the positions of Chairman and Chief Executive

Officer and at times combining the two. The Board believes that the right structure should be informed by the needs and circumstances

of our Company, the Board and our stockholders, and we believe having an independent director lead the Board best serves these

interests.

Risk Oversight Management

The Board of Directors

takes an active role, as a whole, and at the committee level, in overseeing management regarding our Company’s risks. Our

management keeps the Board of Directors apprised of significant risks facing our Company and the approach being taken to understand,

manage and mitigate such risks. Specifically, strategic risks are overseen by the full Board of Directors; financial risks are

overseen by the Audit Committee; risks relating to compensation plans and arrangements are overseen by the Compensation Committee;

risks associated with director independence and potential conflicts of interest are overseen by the Audit Committee or the full

Board of Directors. The Board has in the past and plans to, when necessary in the future, create a Special Transaction Committee

to review potential or actual conflicts of interest. Additional review or reporting on enterprise risks is conducted as needed,

or as requested by the full Board of Directors, or the appropriate committee.

Director Nominations

The Board of Directors

nominates directors for election at each Annual Meeting of Stockholders and appoints new directors to fill vacancies when they

arise. The Nominating and Corporate Governance Committee has the responsibility to identify, evaluate, recruit and recommend qualified

candidates to the Board of Directors for nomination or election.

One of the Board of Directors’

objectives in evaluating director nominations is to ensure that its membership is composed of experienced and dedicated individuals

with a diversity of backgrounds, perspectives and skills. The Nominating and Corporate Governance Committee will select nominees

for director based on their character, judgment, diversity of experience, business acumen, and ability to act on behalf of all

stockholders. We do not have a formal diversity policy. However, the Nominating and Corporate Governance Committee endeavors to

have a Board representing diverse viewpoints as well as diverse expertise at policy-making levels in many areas, including business,

accounting and finance, healthcare, manufacturing, marketing and sales, education, legal, government affairs, regulatory affairs,

research and development, business development, international aspects of our business, technology and in other areas that are relevant

to our activities.

The Nominating and Corporate

Governance Committee believes that nominees for director should have experience, such as those mentioned above, that may be useful

to Oculus and the Board of Directors, high personal and professional ethics and the willingness and ability to devote sufficient

time to carry out effectively their duties as directors. The Nominating and Corporate Governance Committee believes it appropriate

for at least one, and, preferably, multiple, members of the Board of Directors to meet the criteria for an “audit committee

financial expert” as defined by rules of the SEC, and for a majority of the members of the Board of Directors to meet the

definition of “independent director” as defined by the NASDAQ Listing Rules. The Nominating and Corporate Governance

Committee also believes it appropriate for key members of our management to participate as members of the Board of Directors. Prior

to each Annual Meeting of Stockholders, the Nominating and Corporate Governance Committee identifies nominees first by evaluating

the current directors whose term will expire at the Annual Meeting and who are willing to continue in service. These candidates

are evaluated based on the criteria described above, including as demonstrated by the candidate’s prior service as a director,

and the needs of the Board of Directors with respect to the particular talents and experience of its directors. In the event that

a director does not wish to continue in service, the Nominating and Corporate Governance Committee determines not to re-nominate

the director, a vacancy is created on the Board of Directors as a result of a resignation, an increase in the size of the Board

or other event, the Committee will consider various candidates for Board membership, including those suggested by the Committee

members, by other Board members, by any executive search firm engaged by the Committee or by stockholders. The Committee recommended

the nominees for election included in this Proxy Statement.

A stockholder who wishes

to suggest a prospective nominee for the Board of Directors should notify Oculus’ Secretary, or any member of the Committee,

in writing and include any supporting material the stockholder considers appropriate. In addition, our Bylaws contain provisions

addressing the process by which a stockholder may nominate an individual to stand for election to the Board of Directors at our

Annual Meeting of Stockholders. In order to nominate a candidate for director, a stockholder must give timely notice in writing

to Oculus’ Secretary and otherwise comply with the provisions of our Bylaws. To be timely, our Bylaws provide that we must

have received the stockholder’s notice not earlier than 90 days nor more than 120 days in advance of the one-year anniversary

of the date the Proxy Statement was released to the stockholders in connection with the previous year’s Annual Meeting of

Stockholders; however, if we have not held an Annual Meeting in the previous year or the date of the Annual Meeting is changed

by more than 30 days from the date contemplated at the time of the mailing of the prior year’s Proxy Statement, we must have

received the stockholder’s notice not later than the close of business on the later of the 90th day prior to the Annual Meeting

or the seventh day following the first public announcement of the Annual Meeting date. Information required by the Bylaws to be

in the notice includes the name and contact information for the candidate, the name and contact information of the person making

the nomination, and other information about the nominee that must be disclosed in proxy solicitations under Section 14 of the Securities

Exchange Act of 1934 and the related rules and regulations under that Section.

Stockholder nominations

must be made in accordance with the procedures outlined in, and must include the information required by, our Bylaws and must be

addressed to: Secretary, Oculus Innovative Sciences, Inc., 1129 N. McDowell Blvd., Petaluma, California 94954. You can obtain a

copy of our Bylaws by writing to the Secretary at this address.

Stockholder Communications

with the Board of Directors

If you wish to communicate

with the Board of Directors, you may send your communication in writing to: Secretary, Oculus Innovative Sciences, Inc., 1129 N.

McDowell Blvd., Petaluma, California 94954. Please include your name and address in the written communication and indicate whether

you are a stockholder of Oculus. The Secretary will review any communication received from a stockholder, and all material communications

from stockholders will be forwarded to the appropriate director or directors or Committee of the Board of Directors based on the

subject matter.

Director Compensation

The following table sets

forth the amounts and the value of other compensation earned or paid to our directors for their service in fiscal year 2015.

| Name of Director |

Fees Earned or Paid in Cash ($) |

Option Awards ($)1, 2 |

Total ($) |

| Jim

Schutz3 |

0 |

0 |

0 |

| Russell Harrison6 |

27,250 |

20,7594 |

48,009 |

| Sharon Barbari7 |

27,250 |

18,1314 |

45,381 |

| Jay Birnbaum8 |

73,750 |

40,5594,5 |

114,309 |

| Jerry McLaughlin9 |

76,250 |

51,0704,5 |

127,320 |

| (1) | | The table omits the columns stock awards, non-equity incentive plan compensation,

change in pension value and nonqualified deferred compensation earnings and all other compensation because our directors did not

receive any of these compensation items in fiscal year 2015. |

| (2) | | Represents the aggregate grant date fair value of stock option awards granted during

the fiscal year ended March 31, 2015 as computed in accordance with FASB ASC Topic 718, Compensation — Stock Compensation.

The fair value of each stock option award is estimated for the fiscal year ended March 31, 2015, on the date of grant using the

Black-Scholes option valuation model. A discussion of the assumptions used in calculating the amounts in this column may be found

in Note 14 to our audited consolidated financial statements for the year ended March 31, 2015, included in our Annual Report on

Form 10-K filed with the SEC on June 16, 2015. These amounts do not represent the actual amounts paid to or realized by the directors

during the fiscal year ended March 31, 2015. |

| (3) | | As a Company employee, Mr. Schutz did not receive compensation for his service as

a director during the fiscal year ended March 31, 2015. |

| (4) | | Pursuant to our non-employee director compensation plan effective March 26, 2014, as amended,

non-employee directors may elect to receive any fees, except for audit committee fees in options to purchase shares of our

common stock, such options shall vest immediately and the exercise price shall be the closing price of the

Company’s stock on the date such options are granted. All of our directors elected to receive a portion of their

retainer in stock options as indicated in the table below. |

| Director |

Amount in $ |

Number of Shares

received in Lieu of Cash |

| Russell Harrison |

20,759 |

23,974 |

| Sharon Barbari |

18,131 |

20,939 |

| Jay Birnbaum |

17,081 |

19,726 |

| Jerry McLaughlin |

27,592 |

31,864 |

| (5) | | Pursuant to our non-employee director compensation plan in effect for the fiscal year

ended March 31, 2015, after each of our regularly scheduled Annual Meetings of Stockholders, each non-employee director was automatically

granted an annual option to purchase 15,000 shares of our common stock, provided that no annual grant shall be granted to a non-employee

director in the same calendar year that such person received his or her initial grant. On October 1, 2014, we granted 15,000 options

to purchase 15,000 shares of our common stock with an exercise price of $2.21 per share, with a fair value of $23,478, to both

Mr. Birnbaum and Mr. McLaughlin, with the options vesting in equal monthly increments over a period of one year, and set to expire

on October 1, 2024. |

| (6) | | For the fiscal year ended in March 31, 2015, Mr. Harrison earned $47,000 for his services

as a director. Of this aggregate amount of $47,000, Mr. Harrison received $32,500 as his annual retainer for serving on the Board,

$7,500 for his services as a non-chairperson on the Audit Committee, $2,000, for his services as a non-chairperson on the Compensation

Committee and $5,000, for his services as the chairperson of the Nominations and Corporate Governance Committee. The retainer

fee reflects a payment of $6,813 in cash and $4,938 in options made in June 2015 for service during the period of January 1, 2015

through March 31, 2015. Other than the retainer for his services as a member of the Audit Committee, which must be paid in cash,

Mr. Harrison elected to receive 50% of the aggregate retainer owed for his services as a director in stock options, in lieu of

cash. |

| (7) | | For the fiscal year ended in March 31, 2015, Ms. Barbari earned $44,500 for her services

as a director. Of this aggregate amount of $44,500, Ms. Barbari received $32,500 as her annual retainer for serving on the Board,

$10,000 for her services as the chairperson of the Audit Committee, $2,000, for her services as a non-chairperson of the Nominating

and Corporate Governance Committee. The retainer fee reflects a payment of $6,813 in cash and $4,313 in options made in June 2015

for service during the period of January 1, 2015 through March 31, 2015. Other than the retainer for her services as a member

of the Audit Committee, which must be paid in cash, Ms. Barbari elected to receive 50% of the aggregate retainer owed for her

services as a director in stock options, in lieu of cash. |

| (8) | | For the fiscal year ended in March 31, 2015, Mr. Birnbaum earned $40,000 for his services

as a director. Of this aggregate amount of $40,000, Mr. Birnbaum received $32,500 as his annual retainer for serving on the Board,

$7,500 for his services as a non-chairperson on the Audit Committee. The retainer fee reflects a payment of $50,000 made in arrears

in FY 2015 for services performed as a member of the Special Transaction Committee relating to the IPO of Ruthigen, Inc., a formerly

wholly owned subsidiary of our Company, in the fiscal year ended March 31, 2014, and a payment of $5,938 in cash and $4,063 in

options made in June 2015 for service during the period of January 1, 2015 through March 31, 2015. Other than the retainer for

his services as a member of the Audit Committee, which must be paid in cash, Mr. Birnbaum elected to receive 50% of the aggregate

retainer owed for his services as a director in stock options, in lieu of cash. |

| (9) | | For the fiscal year ended

in March 31, 2015, Mr. McLaughlin earned $52,500 for his services as a director. Of this aggregate amount of $52,500, Mr. McLaughlin

received $32,500 as his annual retainer for serving on the Board, $15,000 for his annual retainer as the Lead Independent Director

and $5,000, for his services as the chairperson of the Compensation Committee. The

retainer fee reflects a payment of $50,000 made in arrears in FY 2015 for services performed as a member of the Special Transaction

Committee relating to the IPO of Ruthigen, Inc., a formerly wholly owned subsidiary of our Company, in the fiscal year ended March

31, 2014, and a payment of $6,563 in cash and $6,563 in options made in June 2015 for service during the period of January 1,

2015 through March 31, 2015. Mr. McLaughlin elected to receive 50% of the aggregate retainer owed for his services as a director

in stock options, in lieu of cash. |

Narrative to Director

Compensation Table

Non-employee

Director Compensation Plan Effective March 26, 2014, as amended.

Pursuant to our non-employee

director compensation plan effective March 26, 2014, as amended, each nonemployee director is entitled to the following annual retainers:

| · Board Member |

$32,500 |

| · Lead Independent Director |

$15,000 |

| · Chair

of the Audit Committee |

$10,000 |

| · Chair of the Compensation Committee |

$5,000 |

| · Chair of the Nominating and Corporate Governance Committee |

$5,000 |

| · Audit Committee member (other than Chair) |

$7,500 |

| · Compensation Committee Member (other than Chair) |

$2,000 |

| · Nominating and Corporate Governance Committee Member (other than the Chair) |

$2,000 |

All Audit Committee retainers

must be paid in cash. All other retainers may be paid in cash, options or as a stock grant, at the election of each director. We

also reimburse our nonemployee directors for reasonable expenses in connection with attendance at board of director and committee

meetings.

In addition to cash compensation for

services as a member of the board, non-employee directors are also eligible to receive nondiscretionary, automatic grants of

stock options under the Non-Employee Director Compensation Plan. An outside, non-employee director who joins our board is

automatically granted an initial option to purchase 50,000 shares upon first becoming a member of our board. The initial

option vests and becomes exercisable over three years, with the first one-third of the shares vesting on the first

anniversary of the date of grant and the remainder vesting in equal monthly increments thereafter. After each of our

regularly scheduled Annual Meetings of Stockholders, each non-employee director is automatically granted an option to

purchase 15,000 shares of our common stock, provided that no annual grant shall be granted to a non-employee director in the

same calendar year that such person received his or her initial grant. These options vest in equal monthly increments over

the period of one year.

In July 2014, the Board

eliminated the provisions in the 2006 Plan that provided for automatic option grants to non-employee directors to eliminate redundancy

in our non-employee director compensation.

Share Ownership

Equity

Compensation Plan Information

Pursuant to Item 201(d) of

Regulation S-K, “Securities Authorized for Issuance Under Equity Compensation Plans,” we are providing the following

information summarizing information about our equity compensation plans as of March 31, 2015.

| Plan Category |

Number of Securities

to

be issued upon

exercise of

outstanding options

and

rights |

Weighted average

exercise

price of

outstanding

options and rights |

Number of Securities

remaining

available for

future issuance under

equity compensation

plans

(excluding

securities reflected

in

column (a)) |

| Equity

compensation plans approved by security holders |

2,877,000 |

$6.96 |

1,456,000 |

| Equity compensation plans not approved by security holders |

– |

– |

– |

| Total |

2,877,000 |

$6.96 |

1,456,000 |

Our Oculus Innovative

Sciences, Inc. Amended and Restated 2006 Stock Incentive Plan and our Oculus Innovative Sciences, Inc. 2011 Stock Incentive Plan

were adopted with the approval of our stockholders, and we have previously provided the material terms of such plans.

Outstanding

Equity Awards

The following table shows

grants of options outstanding on March 31, 2015, the last day of our last completed fiscal year, to each of the Named Executive

Officers named in the Summary Compensation Table.

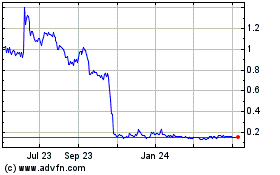

Effective as of the open

of business on April 1, 2013, we effected a reverse stock split of our common stock, par value $0.0001 per share. Every 7 shares

of common stock were reclassified and combined into one share of common stock. No fractional shares were issued as a result of

the reverse stock split. Instead, each resulting fractional share of common stock was rounded up to one whole share. All shares

and per share data have been adjusted to reflect a 1 for 7 reverse stock split, effective April 1, 2013.

| Name |

Grant Date |

Initial

Number

of

Securities

Granted |

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) |

Option

Exercise

Price ($) |

Number of Securities

Underlying

Unexercised

Options (#)

Exercisable |

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable |

Option

Expiration

Date |

| Jim Schutz1 |

10/1/2005 |

893 |

0 |

$71.12 |

893 |

0 |

10/1/2015 |

| 6/15/2007 |

6,624 |

0 |

$50.89 |

6,624 |

0 |

6/15/2017 |

| 3/10/2009 |

26,357 |

0 |

$7.63 |

26,357 |

0 |

3/10/2019 |

| 2/10/2010 |

17,857 |

0 |

$13.37 |

17,857 |

0 |

2/10/2020 |

| 6/7/2010 |

8,929 |

0 |

$13.79 |

8,929 |

0 |

6/7/2020 |

| 3/31/2011 |

19,643 |

0 |

$14.07 |

19,643 |

0 |

3/31/2021 |

| 6/16/2011 |

7,143 |

0 |

$11.20 |

7,143 |

0 |

6/16/2021 |

| 3/7/2012 |

26,786 |

0 |

$8.75 |

26,786 |

0 |

3/7/2022 |

| 8/24/2012 |

21,429 |

0 |

$6.51 |

18,452 |

2,977 |

8/24/2022 |

| 9/19/2013 |

100,000 |

0 |

$6.00 |

50,000 |

50,000 |

9/19/2023 |

| Robert Miller2 |

10/1/2005 |

893 |

0 |

$71.12 |

893 |

0 |

10/1/2015 |

| 3/10/2009 |

26,357 |

0 |

$7.63 |

26,357 |

0 |

3/10/2019 |

| 6/7/2010 |

26,786 |

0 |

$13.79 |

26,786 |

0 |

6/7/2020 |

| 3/31/2011 |

1,786 |

0 |

$14.07 |

1,786 |

0 |

3/31/2021 |

| 6/16/2011 |

25,000 |

0 |

$11.20 |

25,000 |

0 |

6/16/2021 |

| 3/7/2012 |

8,929 |

0 |

$8.75 |

8,929 |

0 |

3/7/2022 |

| 8/24/2012 |

21,429 |

0 |

$6.51 |

18,452 |

2,977 |

8/24/2022 |

| 9/19/2013 |

26,756 |

0 |

$2.97 |

13,377 |

13,379 |

9/19/2023 |

| 3/4/2014 |

130,105 |

0 |

$3.90 |

43,367 |

86,738 |

3/4/2024 |

| Bruce Thornton3 |

5/6/2005 |

2,857 |

0 |

$30.80 |

2,857 |

0 |

5/6/2015 |

| 10/1/2005 |

10,089 |

0 |

$71.12 |

10,089 |

0 |

10/1/2015 |

| 6/15/2007 |

3,571 |

0 |

$50.89 |

3,571 |

0 |

6/15/2017 |

| 12/9/2008 |

27,143 |

0 |

$2.80 |

6,975** |

0 |

12/9/2018 |

| 6/7/2010 |

14,286 |

0 |

$13.79 |

14,286 |

0 |

6/7/2020 |

| 6/16/2011 |

26,786 |

0 |

$11.20 |

26,786 |

0 |

6/16/2021 |

| 3/7/2012 |

8,929 |

0 |

$8.75 |

8,929 |

0 |

3/7/2022 |

| 9/19/2013 |

18,729 |

0 |

$2.97 |

9,364 |

9,365 |

9/19/2023 |

| 3/4/2014 |

108,013 |

0 |

$3.90 |

36,003 |

72,010 |

3/4/2024 |

| Robert Northey4 |

10/1/2005 |

1,964 |

0 |

$71.12 |

1,964 |

0 |

10/1/2015 |

| 1/3/2006 |

714 |

0 |

$71.12 |

714 |

0 |

1/3/2016 |

| 6/15/2007 |

4,821 |

0 |

$50.89 |

4,821 |

0 |

6/15/2017 |

| 12/9/2008 |

14,286 |

0 |

$2.80 |

14,286 |

0 |

12/9/2018 |

| 2/25/2010 |

12,857 |

0 |

$12.81 |

12,857 |

0 |

2/25/2020 |

| 5/17/2011 |

15,714 |

0 |

$13.23 |

15,714 |

0 |

5/17/2021 |

| 9/19/2013 |

18,729 |

0 |

$2.97 |

9,364 |

9,365 |

9/19/2023 |

| 3/4/2014 |

100,702 |

0 |

$3.90 |

33,567 |

67,135 |

3/4/2024 |

*8,571 shares have been

exercised.

**20,168 shares were exercised.

| (1) | | Options with an expiration date of March 7, 2022 vested immediately as to 11,143 shares