Current Report Filing (8-k)

June 05 2015 - 8:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2015

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-13270 |

|

90-0023731 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 10603 W. Sam Houston Pkwy N., Suite 300

Houston, Texas |

|

77064 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 849-9911

NOT APPLICABLE

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On June 4, 2015, Flotek Industries, Inc. (the “Company”)

announced that its Board of Directors had authorized a new share repurchase program allowing the Company to repurchase up to $50 million of the Company’s common stock. The Company’s Board of Directors had previously authorized a share

repurchase program under which the remaining authorized amount is approximately $8.0 million. The Company intends to complete the existing repurchase program before repurchasing shares under the new program. Under the new program, the Company’s

common stock could be purchased through a combination of discretionary purchases on the open market or in privately negotiated transactions as permitted under Securities Exchange Act of 1934 Rule 10b-18. Attached hereto as Exhibit 99.1 and

incorporated by reference herein is the press release announcing the approval of the new share repurchase program.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release dated June 4, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC. |

|

|

|

| Date: June 4, 2015 |

|

|

|

/s/ Robert M. Schmitz |

|

|

|

|

Robert M. Schmitz |

|

|

|

|

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release dated June 4, 2015. |

Exhibit 99.1

|

|

|

|

|

FOR IMMEDIATE RELEASE

CONTACT: Investor Relations

(713) 726-5376

IR@flotekind.com |

Flotek Industries, Inc. Announces Authorization of New $50 Million Share Repurchase Program

HOUSTON, June 4, 2015 /PRNewswire/ — Flotek Industries, Inc. (“Flotek” or the “Company’) (NYSE: FTK - News)

today announced that the Company’s Board of Directors has authorized the repurchase of up to an aggregate of $75 million in Flotek common stock, expanding the existing program by $50 million.

Repurchases under the program will be made in open market or privately negotiated transaction in compliance with Securities and Exchange Commission Rule

10b-18, subject to market conditions, applicable legal requirements, lending requirements and other relevant factors. This share repurchase plan does not obligate Flotek to acquire any particular amount of common stock, and it may be suspended at

any time at the Company’s discretion. As of April 16, 2015 the company has approximately 53.5 million shares of Common Stock outstanding.

Flotek’s Board had previously authorized a share repurchase program under which the remaining authorized amount is approximately $8.0 million. The

Company intends to complete this repurchase program before repurchasing shares under the new program.

“We remain committed to exploring every avenue

to maximize value for our shareholders,” said John Chisholm, Flotek’s Chairman, President and Chief Executive Officer. “The expansion of our share repurchase program reaffirms the availability of this important tool in our box of

options to optimize value. We believe there are a number of opportunities to continue to build long-term value in the current market environment, including the opportunity to invest in ourselves. When appropriate, this additional repurchase program

will allow us to do just that.”

About Flotek Industries, Inc.

Flotek is a global developer and distributor of a portfolio of innovative oilfield technologies, including specialty chemicals and down-hole drilling and

production equipment. It serves major and independent companies in the domestic and international oilfield service industry. Flotek Industries, Inc. is a publicly traded company headquartered in Houston, Texas, and its common shares are traded on

the New York Stock Exchange under the ticker symbol “FTK.”

For additional information, please visit Flotek’s web site at

www.flotekind.com.

|

|

|

|

|

| Flotek Industries, Inc. |

|

Media Release

FOR IMMEDIATE RELEASE |

|

June 4, 2015 |

Forward-Looking Statements

Certain statements set forth in this Press Release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as expects, anticipates, intends, plans, believes, seeks, estimates

and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Press Release.

Although forward-looking statements in this Press Release reflect the good faith judgment of management, such statements can only be based on facts and

factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking

statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, demand for oil and natural gas drilling services in the areas and markets in which the Company operates, competition,

obsolescence of products and services, the Company’s ability to obtain financing to support its operations, environmental and other casualty risks, and the impact of government regulation.

Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filings on Form 10-K

(including without limitation in the “Risk Factors” Section), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only

as of the date of this Press Release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Press Release.

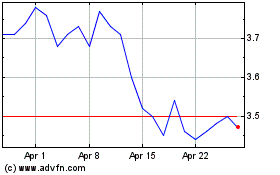

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

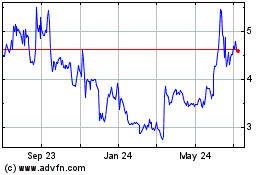

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024