UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

------------------------------------------------------------------------

Amendment Number One to

FORM 8-K

------------------------------------------------------------------------

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED)

Earliest Event Date requiring this Report: May 18, 2015

----------------------------------------------------

CAPSTONE COMPANIES, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

------------------------------------------------------------------------

|

FLORIDA

|

0-28331

|

84-1047159

|

|

(State of Incorporation or

|

(Commission File Number)

|

(I.R.S. Employer

|

|

Organization)

|

Identification No.)

|

|

350 Jim Moran Blvd.

Suite 120

Deerfield Beach, Florida 33442

(Address of principal executive offices)

(954) 252-3440

(Registrant's telephone number, including area code)

ITEM 7.01 REGULATION FD DISCLOSURES

Capstone Companies, Inc., a Florida corporation, (“Company”) held an investor conference on Monday, May 18, 2015, at 10:30 a.m., EST, in order discuss the financial results for the fiscal quarter ending March 31, 2015. Attached to this Report as Exhibit 99.1 is a transcript of the conference call.

In accordance with General Instructions B.2 of Form 8-K, the information furnished pursuant to this Item 7.01 in this Amendment Number One to the Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01

|

EXHIBIT NUMBER

|

EXHIBIT DESCRIPTION

|

| |

|

|

99.1

|

Transcript of May 18, 2015 Conference Call by Capstone Companies, Inc.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CAPSTONE COMPANIES, INC., A FLORIDA CORPORATION

Date: May 22, 2015

By: /s/ Stewart Wallach

Chief Executive Officer

| Capstone Companies, Inc. |

|

|

| First Quarter 2015 Financial Results |

|

|

| Teleconference and Webcast |

|

OTCQB: CAPC |

| May 18, 2015 |

|

|

Operator: Greetings and welcome to the Capstone Companies First Quarter 2015 Financial Results Conference Call. At this time, all participants are in a listen-only mode. If anyone should require Operator assistance during the conference, please press star, zero, on your telephone keypad. As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Garett Gough, Investor Relations for Capstone. Please go ahead.

Garett Gough: Thank you, Kevin, and good morning, everyone. We appreciate your time and interest in Capstone Companies. On the call with me today are Stewart Wallach, Capstone’s President and Chief Executive Officer; and Gerry McClinton, Capstone's Chief Financial Officer.

As you are aware, we may make forward-looking statements during today's presentation. These statements apply to future events which are subject to risks and uncertainties, as well as other factors that could cause the actual results to differ materially from where we are today. These factors are outlined in our earnings release, which we put out Friday morning, as well as in documents filed by the Company with the Securities and Exchange Commission which can be found at our website or at sec.gov.

So with that, I’ll turn the call over to Stewart.

Stewart Wallach: Thank you, Garett, and good morning to everybody. I appreciate your time with us today. While the primary purpose of today's webcast is to review the financials of Q1, I'm going to take the opportunity in the closing to expand upon the Company's strategic direction, its most recent product launches at the National Hardware Show, and their relative impact on the balance of 2015. Following Gerry's review of the numbers, I will continue this discussion in an effort to bring you, our Shareholders, up-to-date on all of our current activities. The financial performance is disappointing, but it was anticipated, as discussed in our 2014 year-end and our February 2015 strategic update.

Without any delay, I'd like to turn this over to Gerry for details on the financials. Gerry?

Gerry McClinton: Thank you, Stewart, and good morning, everyone. As we start to report on a new year, we highly recommend that you review the 10-K report for 2014. We have stated previously that the financial results fluctuate greatly from quarter-to-quarter, but the 10-K report reflects a full year's performance and discusses our strategic plans for 2015.

Let's get straight into the report. Revenue; for the three months ended March 31, 2015 and 2014, total net sales were approximately $714,000 and $3.9 million respectively, a reduction of $3.2 million from the previous year. Revenues in the first quarter of 2015 have been impacted by two key events and are the reasons for the lower sales volume in the quarter.

As referenced in our 10-K for the year ended December 31, 2014, the Company has continued to feel the impact of the West Coast ports’ dispute, which resulted in container delays from six to eight weeks. The impact of these delays combined with the fact that the dispute wasn't resolved until February 20, 2015 created uncertainty with retailers, as there were no assurances that arriving containers would be offloaded in the West Coast ports. This resulted in retailers deciding to cancel their promotions entirely, which impacted our first half shipments.

In the first quarter of 2014, revenue was $3.9 million, of which $3 million resulted from promotional sales activity.

During our February 2015 strategic update, the Company announced that it had acquired the exclusive North American trademark license for LED lighting for the over 100-year-old trusted electric brand, Hoover. Currently, the Company made a strategic decision that would support the Capstone brand where the program was currently placed, but would limit new retail placement to reduce the exposure to markdown allowances or inventory returns by retailers that would want to support the new branded Hoover product lines. This will result in revenue reductions in the first half 2015.

For the three months ended March 31, 2015 and 2014, cost of sales were approximately $406,000 and $2.8 million respectively, a reduction of $2.4 million from the previous year. The reduced cost of sales was a result of the lower sales volumes in the period. Overall manufacturing material labor costs have remained steady in China during the period.

Gross profit, for the three months ended March 31, 2015 and 2014, was approximately $307,000 and $1.2 million respectively, a reduction of $873,000 as compared to the same period in 2014. Gross profit as a percentage of sales was estimated 43% in the quarter compared to an estimate of 30% in the same quarter of 2014. The higher gross profit percent to revenue in the first quarter of 2015 was impacted by the reversal of approximately $182,000 which was accrued for promotional activity and was not utilized by retailers.

Operating expenses for the three months ended March 31, 2015 and 2014, total operating expenses were approximately $661,000 and $819,000 respectively, a reduction of $158,000 as compared to the same period in 2014. Total expenses for the first quarter of 2015 were lower than the same period last year. The following summarizes the major expense variances by category in the first quarter 2015 compared to 2014.

Sales and marketing expenses for the three months ended March 31, 2015 and 2014 were $37,000 and $175,000 respectively, a reduction of $138,000. As a result of the lower sales volume in the first quarter of 2015, the Company did not provide advertising promotions for the period.

Compensation expenses for the three months ended March 31, 2015 and 2014 were $361,000 and $295,000 respectively, an increase of $66,000 or 22.3%. This increase is a result of added personnel at our Capstone International Hong Kong office.

Professional fees for the three months ended March 31, 2015 and 2014 were approximately $96,000 and $74,000 respectively, an increase of $22,000 or an estimated 30%. During the first quarter of 2015, we engaged consultant services to strengthen our internal Marketing and Sales Operations departments.

Product development expenses for the three months ended March 31, 2015 and 2014 was approximately $46,000 and $132,000 respectively. That's a reduction of $87,000. These expenses have been reduced as most of the product development costs for recently launched products were incurred in prior periods.

Other general administrative expenses for the three months ended March 31, 2015 and 2014 were approximately $121,000 and $143,000 respectively, a reduction of $21,000. Of this reduction, $18,000 was the result of reduced banking fees caused by the lower sales volume.

Net operating income (loss); for the three months ended March 31, 2015, the operating loss was approximately $354,000 compared to $362,000 income for the quarter ending March 31, 2014, for an operating income reduction of $716,000 as compared to the same period in 2014.

Interest expense; for the three months ended March 31, 2015 and 2014, interest expenses were approximately $37,000 and $101,000 respectively, a reduction of $64,000 as compared to the same period in 2014. The lower interest is the result of loans that were paid off last year and purchase order funding was reduced in accordance with smaller revenues.

Net income (loss); for the three months ended March 31, 2015, the Company had a net loss of approximately $391,000 as compared with a net income in the same period last year of $261,000. The major reason for the net income decrease was the net revenue reduction which resulted in an $873,000 gross profit reduction. The impact of the gross profit reduction was reduced by $158,000 in operating expense reduction and $64,000 of interest reduction.

I'm now going to go into the cash activities. Operating activities for the three months ended March 31, 2015 and 2014, cash flow provided by operating activities was approximately $278,000 and $3.1 million respectively.

Financing activities; net cash used in financing activities for the three months ended March 31, 2015 and 2014 were approximately $442,000 and $3.1 million respectively. During the quarter, we repaid $1.2 million of notes payable and received $807,000 from new notes. To fund the development, marketing and inventory of the Company's expanded product lines, additional funding will be required during this development period and launch phase. The Company is reviewing alternative sources to supplement its funding, however, CEO Stewart Wallach and Director Jeffrey Postal will provide gap funding to supplement shortfalls during this launch phase.

As of March 31, 2015, the Company was in compliance with all of the covenants pursuant to the existing credit facilities.

This concludes my financial summary for the first quarter of 2015. I will now turn the call back to Stewart.

Stewart Wallach: Thank you, Gerry. You know, as I sit here listening to Gerry reporting on our performance, I'm wrestling with the fact that although the numbers were predicted, there's a rationale for what's occurring. It is frustrating to me, as I know it must be for you, that we seem to be taking a step backwards. I say wrestling with this notion because as the CEO of this Company and its largest Shareholder, I'm also aware of the significant strides we are taking in building and expanding our business to compete at the highest level.

In mid-February at our Strategic Update, I emphasized the fact that our vision was to gain a significant market share of the total LED market as opposed to the niche market through which we entered the business, power failure lighting. Considering that the entire LED market is expected to grow to an estimated $42 billion by 2019, I am confident that the steps we are taking are prudent and necessary to achieve the success story that we all deserve—Shareholders and Capstone Associates alike.

If I had to critique our Company today, I would have to say at times we are a bit too ambitious and set goals for ourselves and timelines for those goals that are a reach for a company our size. We operate with a high expectation of all of our Associates and I assure you, starting with your CEO, the commitments that the Capstone Team has in meeting its goals couldn't be greater. I refuse to lessen our expectations and will continue to push ourselves in areas of product development, innovation, sales, and marketing efforts.

This past year we underwent a number of Management changes and this was a bit of a wake-up call for myself. Our Sales Operations department was not operating to expectations and this is a key to our future success. Additionally, I have over the past six months taken it upon myself to get directly involved at the national account levels, and I am confident to say that our Company is not only well-received, but well-respected. It is upon this reputation that we are building our business.

At the recent Hardware Show, we launched an estimated 80 products. By comparison, prior years at Hardware Show participation, our average product launches ranged from six to 10 products. The products are at various stages of prototype, pre-production, and most actually are production-ready. We pushed to introduce these products at the Hardware Show so we could firsthand gauge the reaction from our retail clients. Simply stated, we did very well.

I found it somewhat humorous, as a side note, that we had to continually ask our major competitors to leave our booth. It seems we were the talk of the Show and the interest of our competition was piqued. This only serves to motivate us even more and our 2014 decision to enter all categories of interior LED lighting was clearly validated at the Show.

Whether it be the introduction of the Hoover brand, our innovative twist on bathroom vanity lighting, or the integration of AC Kinetics’ power control technology into varying products, including light bulbs, the feedback exceeded our expectations. Product reviews in these product categories are scheduled throughout June, July, and August at the major retailers. We have a great deal of preparation required, but we will be ready, and based on the firsthand response from the Show, we expect to expand our retail presence significantly.

Referencing back to our overly ambitious objectives at times, we did anticipate to have our website completed so that you may appreciate the expanded product lines and innovations that I'm referencing. We did fall behind on this as a result of products coming in at the very last minute and being forwarded directly to the Show. As I am speaking with you today, we have not yet had a chance to photograph most of the new products and upload them for your review. In fact, we're still waiting for product to be returned from the Hardware Show which will take at least another week.

Although this website is delayed, the website completion does not impact the salability of our products, or the direct retail sales efforts which are conducted on a face-to-face basis. So, please bear with us; visit us from time to time and you’ll be seeing regular updates on a daily basis.

As previously stated, the performance through the first half is, one, Q2 will be compromised for the reasons mentioned earlier, but I do anticipate our backlog to be building by Q3. We will do our absolute best to get these products to market as fast as possible to ensure our future success.

I would like to thank all of you for your ongoing support and I look forward to speaking with you in the months ahead. Thank you.

Operator: This concludes today's teleconference. You may disconnect your lines at this time and have a great day.

Page 5 of 5

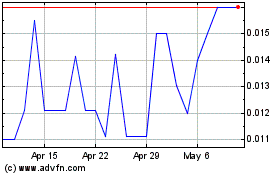

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Apr 2023 to Apr 2024