UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) May 6, 2015 (April 30, 2015)

_______________

MINERCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

_______________

|

| | |

NEVADA | 333-156059 | 27-2636716 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

800 Bering Drive

Suite 201

Houston, TX 77057

(Address of principal executive offices, including zip code.)

(888) 473-5150

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On October 24, 2014, through our subsidiary, Level 5 Beverage Company, Inc., (“Level 5”), we entered into an Agreement (the “Membership Interest Purchase Agreement”) with Avanzar Sales and Distribution, LLC, a California Limited Liability Company (“Avanzar”) to acquire an initial thirty percent (30%) equity position and fifty-one percent (51%) voting interest for the Purchase Price of $500,000 with a twenty-one percent (21%) Option and Second Option to acquire up to seventy-five percent (75%) of Avanzar. The Agreement is Effective as of September 15, 2014.

On February 10, 2015, the Company completed the initial acquisition initiated in October, 2014. On March 24, 2015, Level 5 exercised its Initial Purchase Option to acquire an additional twenty-one percent (21%). The consideration payable by Level 5 to Avanzar for the Initial Purchase Option to be acquired shall be an aggregate of Four Hundred Thousand Dollars ($400,000), of which Two Hundred Thousand Dollars ($200,000) has been paid and the remaining balance of Two Hundred Thousand Dollars ($200,000), will be payable as follows: additional payments in amounts of at least Twenty-five Thousand Dollars ($25,000) payable every 30 days until the aggregate of Four Hundred Thousand U.S Dollars ($400,000) is paid in full no later than December 31, 2015.

On April 30, 2015, Level 5 exercised Second Purchase Option to acquire an additional twenty-four percent (24%). The consideration payable to the existing members of Avanzar for the Second Purchase Option to be acquired shall be an aggregate of One Million Seventy Hundred Fifty Thousand Dollars ($1,750,000). The company issued 336,543 shares of its Class C Preferred stock pursuant to the exercise of the Second Purchase Option to the six (6) existing members of Avanzar.

The foregoing description of the Second Purchase Option is qualified in its entirety by reference to the full text of the Initial Purchase Option, attached as Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

On May 6, 2015, we issued the attached press release that included a description of the agreement. A copy of the press release is attached as Exhibit 99.1 to this Report on Form 8-K.

ITEM 3.02. SALE OF UNREGISTERED SECURITIES

On April 30, 2015, Level 5 exercised Second Purchase Option to acquire an additional twenty-four percent (24%). The consideration payable to the existing members of Avanzar for the Second Purchase Option to be acquired shall be an aggregate of One Million Seventy Hundred Fifty Thoursand Dollars ($1,750,000). The company issued 336,543 shares of its Class C Preferred stock pursuant to the exercise of the Second Purchase Option to the six (6) existing members of Avanzar.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

| | | | | | |

| | Incorporated by reference | |

Exhibit | Document Description | Form | | Date | Number | Filed herewith |

10.1 | Notice of Exercise of Second Purchase Option | | | | | X |

10.2 | Membership Interest Purchase Agreement | 8-K | | 10/27/14 | 10.1 | |

10.3 | Notice of Exercise of Initial Purchase Option | 8-K | | 3/26/14 | 10.1 | |

99.1 | Press Release, dated May 6, 2015 | | | | | X |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| MINERCO RESOURCES, INC. | |

| | | |

5/6/2015 | By: | /s/ V. Scott Vanis | |

| | | |

| | | |

| | | |

NOTICE OF EXERCISE OF INITIAL OPTION

Level 5 Beverage Company, Inc.

16501 Sherman Way, Suite 215

Van Nuys, California 91411

April 30, 2015

Avanzar Sales and Distribution, LLC

3260 Lilly Avenue

Long Beach, California 90808

Attention: William Juarez, Jr.

Ladies and Gentlemen:

Reference is made to that certain Membership Interest Purchase Agreement (the “Purchase Agreement”), made and entered into on the 24th day of October, 2014, with an Effective Date of September 15, 2014, by and between Level 5 Beverage Company, Inc., a Delaware corporation, with offices located at 16501 Sherman Way, Suite 215, Van Nuys, California 91411 (the “Purchaser”), Avanzar Sales and Distribution, LLC, a California limited liability company with offices at 3260 Lilly Avenue, Long Beach, California 90808 (the “Company”), and William H. Juarez, Jr., Joseph A. Shippee and Robert Saunders, with an address at 3260 Lilly Avenue, Long Beach, California 90808. Capitalized terms used herein but not defined herein shall have the meanings ascribed to such terms in the Purchase Agreement.

In accordance with Section 1.1, Section 1.2, Section 2.1 and Section 8.1 of the Purchase Agreement, the Purchaser hereby notifies the Company of its exercise of the Second Option Membership Interests, which when added to the Initial Membership Interests, Initial Option Membership Interests and Second Option Membership Interest issued to Purchaser, shall represent a right to seventy-five percent (75%) of the total economic benefits of the membership interests outstanding of the Company at the time of the issuance (which shall be forty-five percent (45%) of the outstanding Class A Membership Interests after taking into account the issuance).

The parties hereto agree that the consideration payable by the Purchaser to the Company for the Second Option Membership Interests to be acquired on the on the date April 30, 2015, shall be an aggregate payments of One million seven hundred fifty thousand dollars ($1,750,000) which shall be paid in Series C Preferred Shares of Minerco Resources, Inc. (OTC:MINE), parent company of Level 5 Beverage Company, Inc. at a ratio of $1.041853 per share owned by existing members in the following proportions:

|

| | |

Member | Member existing shares | Shares of Class C paid out |

William Juarez Jr | 576,444 | 115,495 |

Joseph Shippee | 551,376 | 110,472 |

Robert Saunders | 401,856 | 80,515 |

Kevin Barker | 56,280 | 11,277 |

Jose Gutierrez | 56,280 | 11,277 |

Gustavo Gutierrez | 37,464 | 7,507 |

Please confirm that the foregoing is in accordance with your understanding by signing in the space provided below and returning to us a duplicate of this notice.

Very truly yours,

LEVEL 5 BEVERAGE COMPANY, INC.

|

| |

By: | /s/ V. Scott Vanis |

| Name: V. Scott Vanis |

| Title: Chief Executive Officer

|

AGREED:

MINERCO RESOURCES, INC.

|

| |

By: | /s/ V. Scott Vanis |

| Name: V. Scott Vanis |

| Title: Chief Executive Officer

|

ACCEPTED AND AGREED TO:

AVANZAR SALES AND DISTRIBUTION, LLC

By: ___/s/ William Juarez, Jr.____________

Name: William Juarez, Jr.

Title: President

Minerco's Level 5 Increases Avanzar Stake to 75%

Minerco Continues Strategy of Creating Shareholder Value Through

Acquisition of Cash-Flowing Assets

HOUSTON, May 06, 2015 -- Minerco Resources, Inc. (OTC:MINE), parent company of Level 5 Beverage Company, Inc., the makers of VitaminFIZZ®, announced that Level 5 has exercised its option to purchase an additional 24% equity stake in Avanzar Sales and Distribution, LLC in California. This option increases Level 5's equity stake in Avanzar to 75%. Minerco previously announced the initial purchase of the controlling interest last year and a 21% equity purchase option during March of this year in Avanzar.

"Minerco is taking accelerated and strategic steps to acquire cash flowing assets to increase our stockholders' equity," said V. Scott Vanis, Minerco's Chairman and CEO. "Our partnership with Avanzar continues to be mutually beneficial on multiple levels. With our support and their expertise, Avanzar has been able to increase its clientele and geographic network, which in turn has quickly increased the number of retailers carrying VitaminFIZZ and all of Avanzar’s products."

Avanzar is a leading full service broker and distributor of world-class consumables and products. The company distributes specialty snacks and beverages to over 5,300 Southern California locations from Santa Barbra to San Diego. Avanzar’s high-profile accounts include Gelson’s, Kmart, Stater Bros., Walmart and Winco as well as recently expanded contracts with Albertsons and Walgreens.

Bill Juarez, the President of Avanzar, stated, "We are very pleased to have Minerco and Level 5 increase their investment in our organization. This partnership has resulted in significant expansion in our service offerings and our footprint. We are well positioned to continue our growth and breadth for all parties.”

About Avanzar

Headquartered in Brea, California, Avanzar Sales and Distribution specializes in working with early stage, fast moving consumer brands to develop and implement sales and distribution strategies. The Company operates a full service brokerage which includes account management, trade development and logistics services as well as in house DSD operations throughout Southern California. Avanzar distributes products to some of the most trusted retailers in the United States, including Kroger, Albertsons, HEB, Golub (Price Chopper), Whole Foods, Walgreens, 7-Eleven, Tesoro, Circle K, Chevron, Kmart, Walmart, Stater Bros., Gelson's and Winco. www.avanzarsales.com

About Minerco Resources, Inc.

Minerco Resources, Inc. (OTC:MINE), is the parent company specializing in the food and beverage industry. Its portfolio of companies include Level 5 Beverage Company, Inc. (Level 5), Avanzar Sales & Distribution, LLC and The Herbal Collection™. Level 5 is a specialty beverage company that develops, produces, markets and distributes a diversified collection of forward-thinking, healthful consumer brands. Level 5 brands include VitaminFIZZ®, Vitamin Creamer® and Island Style™. http://minercoresources.com

Public Disclosure

Details of the Company's business, finances and agreements can be found as part of the Company's continuous public disclosure as a fully reporting issuer under the Securities Exchange Act of 1934 filed with the Securities and Exchange Commission's ("SEC") EDGAR database. For more information, please visit: http://www.minercoresources.com. The above

statements have not been evaluated by the Food and Drug Administration (FDA). These products are not intended to diagnose, treat, cure or prevent any disease.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events. Although we believe that the expectations and assumptions upon which they are based are reasonable, we can give no assurance that such expectations and assumptions will prove to have been correct. Some of these uncertainties include, without limitation, the company's ability to perform under existing contracts or to procure future contracts. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties, including without limitation, successful implementation of our business strategy and competition, any of which may cause actual results to differ materially from those described in the statements. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward-looking statements.

###

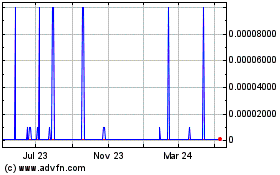

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Mar 2024 to Apr 2024

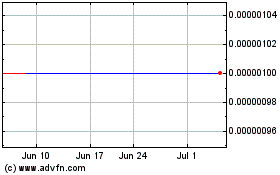

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Apr 2023 to Apr 2024