UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: April 2015

Commission file number 0-24762

(Translation of registrant’s name into English)

1140 Bay Street, Suite 4000

Toronto, Ontario, Canada

M5S 2B4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes [ ] No [X]

If “Yes” is marked, indicate the file number assigned to the Registrant in connection with Rule 12g3-2(b): N/A

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

FIRSTSERVICE CORPORATION

|

| |

|

|

| |

|

|

| Date: April 22, 2015 |

/s/ John B. Friedrichsen |

|

| |

Name: John B. Friedrichsen

Title: Senior Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

|

Description of Exhibit

|

|

99.1

|

Report of Voting Results for Annual and Special Meeting of FirstService Shareholders held on April 21, 2015

|

|

99.2

|

Press release dated April 22, 2015

|

EXHIBIT 99.1

FIRSTSERVICE CORPORATION

("FirstService")

Annual and Special Meeting of

FirstService Shareholders held on April 21, 2015

REPORT OF VOTING RESULTS

Pursuant to Section 11.3 of National Instrument 51-102 – Continuous Disclosure Obligations

| |

|

|

Proxies/Votes Received

|

| |

Brief Description of

Matter Voted Upon

|

Outcome

of Vote (1)

|

For

|

Against

|

Withheld

|

Not Voted/

Not Valid

|

|

1.

|

In respect of the appointment of PricewaterhouseCoopers LLP, Chartered Accountants and Licensed Public Accountants, as the independent auditors of FirstService until the close of the next annual meeting of the shareholders and authorizing the directors of FirstService to fix their remuneration

|

Approved

|

54,621,583

(97.99%)

|

–

|

1,118,625

(2.01%)

|

–

|

|

2.

|

In respect of the individual election, as directors of FirstService, of the nine nominees named in the Management Information Circular of FirstService dated March 16, 2015 (the "Circular")

|

|

|

|

|

|

| |

· |

David R. Beatty

|

Approved

|

53,917,142

(97.67%)

|

–

|

1,285,073

(2.33%)

|

537,993

|

| |

· |

Brendan Calder

|

Approved

|

54,590,695

(98.89%)

|

–

|

611,520

(1.11%)

|

537,993

|

| |

· |

Peter F. Cohen

|

Approved

|

53,927,887

(97.69%)

|

–

|

1,274,328

(2.31%)

|

537,993

|

| |

· |

John (Jack) P. Curtin, Jr.

|

Approved

|

55,183,123

(99.97%)

|

–

|

19,092

(0.03%)

|

537,993

|

| |

· |

Bernard I. Ghert

|

Approved

|

54,781,504

(99.24%)

|

–

|

420,711

(0.76%)

|

537,993

|

| |

· |

Michael D. Harris

|

Approved

|

53,732,883

(97.34%)

|

–

|

1,469,332

(2.66%)

|

537,993

|

| |

· |

Jay S. Hennick

|

Approved

|

54,781,434

(99.24%)

|

–

|

420,781

(0.76%)

|

537,993

|

| |

· |

Frederick F. Reichheld

|

Approved

|

54,871,015

(99.40%)

|

–

|

331,053

(0.60%)

|

538,140

|

| |

· |

Michael Stein

|

Approved

|

54,825,345

(99.32%)

|

–

|

376,870

(0.68%)

|

537,993

|

| |

|

|

Proxies/Votes Received

|

| |

Brief Description of

Matter Voted Upon

|

Outcome

of Vote (1)

|

For

|

Against

|

Withheld

|

Not Voted/

Not Valid

|

|

3.

|

In respect of approving an amendment to the FirstService Stock Option Plan, as amended, to increase the maximum number of Subordinate Voting Shares reserved for issuance pursuant to the exercise of stock options granted thereunder by 1,000,000, all as more particularly set forth and described in the Circular

|

Approved

|

45,302,897

(82.07%)

|

9,899,318

(17.93%)

|

–

|

537,993

|

|

4.

|

In respect of approving the special resolution in respect of the arrangement under Section 182 of the Business Corporations Act (Ontario) involving FirstService (being the Arrangement Resolution, as defined in the Circular), all as more particularly set forth and described in the Circular

|

|

|

|

|

|

| |

· |

By the holders of FirstService Subordinate Voting Shares, voting separately as a class, present in person or represented by proxy at the meeting

|

Approved

|

29,277,908

(99.60%)

|

118,175

(0.40%)

|

–

|

537,993

|

| |

· |

By the holders of FirstService Multiple Voting Shares, voting separately as a class, present in person or represented by proxy at the meeting

|

Approved

|

26,513,880

(100%)

|

0

(0%)

|

–

|

–

|

| |

· |

By not less than a majority of the votes cast at the meeting by the holders of FirstService Subordinate Voting Shares, voting separately as a class (other than the votes attaching to FirstService Subordinate Voting Shares held, directly or indirectly, by an interested party", an "affiliate" and "control persons" of FirstService)

|

Approved

|

27,004,382

(99.56%)

|

118,175

(0.44%)

|

–

|

537,993

|

|

5.

|

In respect of approving the ordinary resolution in respect of adopting the stock option plan of New FSV Corporation (being the New FSV Stock Option Plan Resolution, as defined in the Circular), all as more particularly set forth and described in the Circular

|

Approved

|

45,237,386

(81.95%)

|

9,964,829

(18.05%)

|

–

|

537,993

|

|

(1)

|

The votes for items 1, 2, 3 and 5 were conducted and approved by way of a show of hands; the number of votes disclosed for these items reflects those proxies received by management in advance of the meeting. The vote for item 4 was conduct and approved by way of ballot.

|

DATED: April 22, 2015

EXHIBIT 99.2

FirstService Shareholders Overwhelmingly Approve Plan to Separate Into Two Independent Public Companies

Colliers International and FirstService Corporation to Have Compelling Investment Opportunities

TORONTO, April 22, 2015 (GLOBE NEWSWIRE) -- FirstService Corporation (TSX:FSV) (Nasdaq:FSRV) ("FirstService") today announced that the previously announced spin-off transaction, to be implemented through a tax efficient statutory plan of arrangement (the "Arrangement"), has received the requisite shareholder approval at FirstService's annual and special meeting of shareholders held on April 21, 2015 (the "Meeting"). The Arrangement was approved by 99.60% of the Subordinate Voting Shares of FirstService voted at the Meeting and 100% of the Multiple Voting Shares of FirstService voted at the Meeting. As required under Canadian securities laws, the Arrangement was also approved by 99.56% of the Subordinate Voting Shares of FirstService voted at the Meeting, excluding shares held by "interested parties" and "control persons" of FirstService.

Completion of the Arrangement remains subject to certain conditions, including final court approval. If the final court order is granted and all other conditions precedent to the Arrangement are satisfied or waived, FirstService expects to complete the Arrangement on June 1, 2015.

At the Meeting, the nine director nominees listed in FirstService's management information circular dated March 16, 2015 (the "Circular") were elected as directors. Directors have been elected to serve until the close of the next annual meeting of shareholders. The detailed results of the vote are set out below.

|

|

|

|

|

|

|

% Votes |

|

Nominee |

Votes For |

% Votes For |

Votes Withheld |

Withheld |

|

David R. Beatty |

53,917,142 |

97.67% |

1,285,073 |

2.33% |

|

Brendan Calder |

54,590,695 |

98.89% |

611,520 |

1.11% |

|

Peter F. Cohen |

53,927,887 |

97.69% |

1,274,328 |

2.31% |

|

John (Jack) P. Curtin, Jr. |

55,183,123 |

99.97% |

19,092 |

0.03% |

|

Bernard I. Ghert |

54,781,504 |

99.24% |

420,711 |

0.76% |

|

Michael D. Harris |

53,732,883 |

97.34% |

1,469,332 |

2.66% |

|

Jay S. Hennick |

54,781,434 |

99.24% |

420,781 |

0.76% |

|

Frederick F. Reichheld |

54,871,015 |

99.40% |

331,053 |

0.60% |

|

Michael Stein |

54,825,345 |

99.32% |

376,870 |

0.68% |

* As a vote for each motion was taken by a show of hands, the number of votes disclosed reflects only those proxies received by management in advance of the Meeting.

In addition, at the Meeting, FirstService shareholders approved, by a vote by show of hands, the appointment of PricewaterhouseCoopers LLP as the auditor of FirstService for the ensuing year, an amendment to the existing FirstService stock option plan and the adoption of the "new" FirstService Corporation stock option plan, all as described in the Circular.

About FirstService

FirstService is a global leader in the rapidly growing real estate services sector, one of the largest markets in the world. FirstService manages more than 2.5 billion square feet of residential and commercial properties through its three industry-leading service platforms: Colliers International - one of the largest global players in commercial real estate services; FirstService Residential - North America's largest manager of residential communities; and FirstService Brands – one of North America's largest providers of essential property services delivered through individually branded franchise systems and company-owned operations.

FirstService generates more than US$2.7 billion in annual revenues and has more than 24,000 employees world-wide. With significant insider ownership and an experienced management team, FirstService has a long-term track record of creating value and superior returns for shareholders since becoming a publically listed company in 1993. The Subordinate Voting Shares of FirstService trade on NASDAQ under the symbol "FSRV" and on the TSX under the symbol "FSV". More information is available at www.firstservice.com.

Advisory Regarding Forward-Looking Information

Information in this press release that is not a historical fact is "forward-looking information". Words such as "plans", "intends", "outlook", "expects", "anticipates", "estimates", "believes", "likely", "should", "could", "will", "may" and similar expressions are intended to identify statements containing forward-looking information. Forward-looking information in this press release is based on current objectives, strategies, expectations and assumptions which management considers appropriate and reasonable at the time. The forward-looking information in this press release include, but are not limited to, statements with respect to: the proposed Arrangement and expected future attributes of each of "new" FirstService Corporation and Colliers International following the completion of the Arrangement; the timing and expectations with respect to the granting of the final court order; and the expected completion date of the Arrangement.

By its nature, forward-looking information is subject to risks and uncertainties which may be beyond the ability of FirstService to control or predict. The actual results, performance or achievements of Colliers International or "new" FirstService Corporation could differ materially from those expressed or implied by forward-looking information. Factors that could cause actual results, performance, achievements or events to differ from current expectations include, among others, risks and uncertainties related to: obtaining approvals, waivers, rulings, court orders and consents, or satisfying other requirements, necessary or desirable to permit or facilitate completion of the Arrangement (including regulatory approvals and a Canadian tax ruling); future factors that may arise making it inadvisable to proceed with, or advisable to delay, all or part of the Arrangement; the operations and financial condition of Colliers International and "new" FirstService Corporation as separately traded public companies, including the reduced industry and geographical diversification resulting from this separation; the impact of the Arrangement on the trading prices for, and market for trading in, the shares of FirstService, Colliers International and "new" FirstService Corporation; the potential for significant tax liability for a violation of the tax-deferred spinoff rules; the potential benefits of the Arrangement; business cycles, including general economic conditions in the countries in which Colliers International and "new" FirstService Corporation operate, which will, among other things, impact demand for services and the cost of providing services; the ability of each of Colliers International and "new" FirstService Corporation to implement its business strategy, including their ability to acquire suitable acquisition candidates on acceptable terms and successfully integrate newly acquired businesses with its existing businesses; changes in or the failure to comply with government regulations; changes in foreign exchange rates; increased competition; credit of third parties; changes in interest rates; and the availability of financing. Additional information on certain of these factors and other risks and uncertainties that could cause actual results or events to differ from current expectations can be found in FirstService's Annual Information Form for the year ended December 31, 2014 under the heading "Risk Factors" (which factors are adopted herein and a copy of which can be obtained at www.sedar.com). Certain risks and uncertainties specific to the proposed Arrangement, Colliers International and "new" FirstService Corporation are further described in the Circular. Other factors, risks and uncertainties not presently known to FirstService or that FirstService currently believes are not material could also cause actual results or events to differ materially from those expressed or implied by statements containing forward-looking information.

Readers are cautioned not to place undue reliance on statements containing forward-looking information that are included in this press release, which are made as of the date of this press release, and not to use such information for anything other than their intended purpose. FirstService disclaims any obligation or intention to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law.

CONTACT: COMPANY CONTACTS:

Jay S. Hennick

Founder & CEO

(416) 960-9500

John B. Friedrichsen

Senior Vice President & CFO

(416) 960-9500

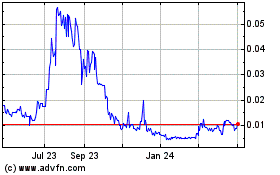

Nexus Energy Services (PK) (USOTC:IBGR)

Historical Stock Chart

From Aug 2024 to Sep 2024

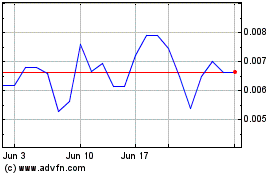

Nexus Energy Services (PK) (USOTC:IBGR)

Historical Stock Chart

From Sep 2023 to Sep 2024