UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

------------------------------------------------------------------------

Amendment Number One to

FORM 8-K

------------------------------------------------------------------------

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED)

Earliest Event Date requiring this Report: 03/27/2015

------------------------------------------------------------------------

CAPSTONE COMPANIES, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

------------------------------------------------------------------------

|

FLORIDA

|

0-28331

|

84-1047159

|

|

(State of Incorporation or

|

(Commission File Number)

|

(I.R.S. Employer

|

|

Organization)

|

Identification No.)

|

|

350 Jim Moran Blvd.

Suite 120

Deerfield Beach, Florida 33442

(Address of principal executive offices)

(954) 252-3440

(Registrant's telephone number, including area code)

ITEM 8.01 Other Events. Capstone Companies, Inc. (formerly “CHDT Corporation”) (“Company”) conducted a webcast/teleconference on March 27, 2015 to review financial results for the fourth quarter of fiscal year 2014 (as reported in the Form 10-K report filed with the Commission on March 27, 2013). A transcript of Company statements is attached as Exhibit 99.1 to this Report. Attached to this Report as Exhibit 99.2, is a Press Release concerning the financial results for the fiscal quarter ending December 31, 2014 and released by the Company on March 27, 2015.

The information presented in Item 8.01 of this Current Report on Form 8-K and its exhibits or sources incorporated by reference herein shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, unless we specifically state that the information is to be considered “filed” under the Exchange Act or specifically incorporate it by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

ITEM 9.01 Financial Statements and Exhibits

|

EXHIBIT NUMBER

|

EXHIBIT DESCRIPTION

|

|

99.1

|

Transcript of March 27, 2015 Webcast by Capstone Companies, Inc.

|

|

99.2

|

Press Release and Q4 Financials – December 31, 2014

|

*Filed Herein

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CAPSTONE COMPANIES, INC., A FLORIDA CORPORATION

Date: April 3, 2015

By: /s/ Stewart Wallach

Chief Executive Officer

| Capstone Companies, Inc. |

|

|

| 2014 Financial Results |

|

|

| Teleconference and Webcast |

|

OTCQB: CAPC |

| March 27, 2015 |

|

|

Operator: Greetings and welcome to the Capstone Companies 2014 Financial Results conference call. At this time, all participants are in a listen-only mode.

If anyone should require Operator assistance during the conference, please press star, zero,

on your telephone keypad. As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host Garett Gough, Investor Relations. Thank you, sir, you may begin.

Garett Gough: Thank you, Christine, and good morning, everyone. We appreciate your time and interest in Capstone Companies. On the call with me today are Stewart Wallach, Capstone’s President and Chief Executive Officer, and Gerry McClinton, Capstone's Chief Financial Officer.

As you are aware, we may make forward-looking statements during today's presentation. These statements apply to future events, which are subject to risks and uncertainties, as well as other factors that could cause the actual results to differ materially from where we are today. These factors are outlined in our earnings release, as well as in documents filed by the Company with the Securities and Exchange Commission, which can be found at our website or at sec.gov.

So with that, I’ll turn the call over to Stewart.

Stewart Wallach: Thank you, Garett, and good morning to everybody. I appreciate your time with us today.

Before introducing Gerry McClinton to review the financial results, I'd like to take a moment to discuss a few points that not only had an impact on our year-end 2014 results, but will also affect Q1 and Q2 of 2015. While our 2014 revenue was down approximately $1 million, more than 50% of that reduction resulted from the planned exit of a product category, specifically book lights. Gerry will discuss this in further detail, and I am confident that you will see that this planned exit was handled in such a way as to mitigate any long-term implications that typically occur when exiting a product category, such as discontinued inventories.

Additionally, although we didn't highlight this in discussions over the course of 2014, the West Coast port disputes did have an impact on our 2014 revenue opportunities and future bookings. The cutting back of promotional activities was not entirely clear to us until later in the year.

In mid-February, we had a strategic update teleconference call, during which I emphasized the fact that Capstone's vision has always been to gain a significant share of the total LED market as opposed to the niche market of power failure lighting, through which we entered the business. Considering that the overall LED market is growing at the rate of 45% per year, this will build the total market to $42 billion by 2019. As a point of reference, the total LED market was $4.8 billion in 2012.

In an effort to strengthen the Company's competitive position, we actually pursued the licensing of a national brand for home LED lighting products, and strengthened our overseas infrastructure to better handle the growth of our expanded product lines. For those who may have missed our most recent strategic update in February, it came with great pleasure for me to announce our exclusive North American trademark license for the Hoover brand for LED lighting.

Hoover is a household icon and one of the most trusted brands in America. For more than a hundred years, the Hoover brand has provided America's homeowners with innovative floor care products and a dedication to premium quality and customer service. I'd like to reference that the strength of the iconic brand was substantiated by brand extension research, commissioned by Capstone, as it relates to the LED market. This work was conducted by Radius, a global market research company.

As a point of clarification, we will maintain the Capstone lighting brand on all of our exterior lighting and existing products where retailers prefer to maintain the status quo.

At this point, I'd like to turn the call over to Gerry to share a few details with you about our 2014 financial results, and then, following his review, I will come back with a few closing comments. Gerry?

Gerry McClinton: Thank you, Stewart, and good morning, everyone. Before we review the numbers, I would like to provide some information that might assist you in better understanding the financial results, and provide further insight into Management's strategic decision-making process as we build your company.

The Company's annual financial performance results from the execution of a strategic plan that serves to guide Management over the course of the year. This plan can be impacted by events outside of the Company that, at times, are beyond our control. During 2014, one such occurrence took place, the West Coast port dispute, which I will expand upon further.

With limited financial resources available to us, we are very selective in how we allocate the funds to support strategic initiatives. We build the Company to a level of sustainability and cash flow, and then structurally and strategically prepare the Company for the next level of growth. In order to support sustained revenue growth and continue to expand product lines and categories, the Company's infrastructure must also be developed and in place. Funding required to develop these product launches must also be available and allocated. The Company's 2014 financial performance is the culmination of these strategic decisions and management of its funds and resources. As we review the results, I will identify the strategic investments that were made in 2014 and impacted this year's results, but will also allow us to maximize our opportunities for building the Company. So, let's review the numbers.

Net revenue for the year ended December 31, 2014 was $13.6 million compared with $14.6 million in 2013. That's a reduction of $1 million or approximately 6.8% from 2013. During 2014, we experienced consistent sales in our Eco-i-Lite power failure light category, and we had continued growth in our wireless motion sensor light category. In fact, it was 32% higher than in 2013. During the year, we also launched a promotional wireless remote control outlet product, which sold well in the warehouse club channel.

Now, conversely, we exited the book light category due to continued declines in consumer use resulting from the influence of digital reading technologies, and retail space has reduced accordingly. This decision to exit the category resulted in a reduction of annual revenue totalling $570 thousand; however, as a result of proper planning, we were able to exit the category with essentially no on-hand inventory remaining.

As we continued to invest in retail support programs, particularly during the holiday shopping period, we provided $915 thousand of product promotional and marketing allowances to retailers. These allowances contributed to the reduction of our revenue to $13.6 million, and reduced net income accordingly. These significant investments in retail support programs have proven effective in product placement.

Additionally, the West Coast port dispute impacted our overall net revenue and backlog at year end. Let me highlight the implications.

All of our goods are received into West Coast ports. The continuing port slowdown and the protracted contract dispute between the union and the West Coast Port Authority resulted in containers being substantially delayed and product being available in stores six to eight weeks later than required by retailers. The impact of these delays, combined with the fact that there were no indications that the dispute was ending, created a lot of uncertainty with retailers, as there were no assurances that arriving containers would be offloaded in the West Coast ports and merchandise delivered to the stores for the designated promotional period. As a result, retailers decided to cancel or postpone their promotion activity. The impact of this dispute has been felt throughout the retail industry.

A new agreement was finalized on February 20, 2015, but there remains a backlog of vessels to be offloaded. It is estimated that the flow of containers will not be back to normal operating conditions for a few more months. We fully expect retailers to resume their promotional activities now that the port issue is fully resolved.

Cost of sales for the year ended December 31, 2014 were $10.8 million compared with

$11.0 million in the prior year. That's a reduction of $200 thousand, or 18.8%, from the previous year. This represents 79.5% and 75.3%, respectively, of total net revenue. For 2014, as a percent of net sales, cost of sales increased by approximately 4.2% over 2013. This is partly the result of an additional manufacturing cost totalling $225 thousand in connection with a

$2 million order for our warehouse club, as the original factory could not produce the order on time. As a result, the product had to be reengineered by another factory at a significantly higher unit cost. This was a non-recurring one-time expense. As previously mentioned, we also provided $915 thousand to retail support programs, which had the impact of increasing the cost of sales to net sales percentage by approximately 5%.

Overall, manufacturing material and labor costs have remained steady during 2014. This has been achieved through efficient product design, strategic and volume material buying, and negotiations with our factory.

Gross profit for the year ended December 31, 2014 was approximately $2.8 million, a reduction of $800 thousand, or approximately 22.2%, from the 2013 gross profit of $3.6 million. Gross profit as a percent of sales was 20.4% for the year compared with 24.7% for 2013. The overall gross profit reduction compared with 2013 was primarily the result of the addition of

$225 thousand once off manufacturing expense charged to cost of sales and the $915 thousand of strategic promotional allowances that reduced sales and had the impact of reducing gross profit. Combined, these strategic decisions resulted in gross profit for 2014 being reduced by approximately $1.1 million.

Our total operating expenses were $2.9 million in 2014 compared with $2.5 million in 2013, a net increase of $397 thousand or 15.9%. During 2014, we continued to incur strategic and planned expenses in infrastructure and product development projects that were necessary for future product growth.

Now, let's be specific about this. Sales and marketing expenses for the year ended December 31, 2014 were $316 thousand. For 2013, expenses were $490 thousand. During 2014, the Company continued its marketing product promotion strategy specifically for retail product advertising and promotions to further stimulate at the point-of-sale. Compensation expenses were approximately $1.4 million in 2014, an increase of $434 thousand, or 44.6%, from

$973 thousand expensed in 2013. Of this increase, $300 thousand, an estimated 71%, related to hiring the Hong Kong office employee infrastructure, which now includes executive management, general management, electrical engineering, sourcing merchants, logistics management and quality control personnel. This investment was necessary to sustain and effectively manage the growth planned in 2015.

Professional fees for 2014 were $190 thousand compared with $326 thousand in 2013, a reduction of $136 thousand or 41.8%. Now, as we staffed our Hong Kong office, we were able to greatly reduce the cost of outside consultant fees, which was reduced by the $146 thousand in 2014. We have incurred some new professional fees for our Hong Kong operation for the appointment of a Hong Kong accounting firm to maintain our financial records and prepare our Hong Kong financial audit and tax returns.

Product development expenses for 2014 were $374 thousand compared with $226 thousand in 2013. That's an increase of $149 thousand or 65.8%. During 2014, we incurred increased expense in product development to support the release of the many new items for 2015 from product design and electrical engineering to product prototyping and testing and regulatory certifications by outside third party labs. We also incurred additional testing expense in having certain products certified for global markets.

Other general and administration for 2014 was $605 thousand, up $126 thousand from

$479 thousand in 2013. The expense increase was a result of $73 thousand of additional rental expense associated with the addition of the Hong Kong office and $47 thousand from higher travel expense during the year associated with increased retail or sales presentations and international trips to China.

Interest expense for the year ended December 31, 2014 was $328 thousand, a reduction of

$61 thousand, compared with $389 thousand in 2013. The overall net interest reduction is the result of specific, stated goals to reduce the interest burden. During 2014, we repaid $808 thousand of old loans and interest that resulted in interest savings of $49 thousand. Also during the year, Sterling National Bank further expanded the availability of our credit line to $7 million, and changed the timing of when we could submit orders for funding. This allowed us to have more access to purchase order funding at a much lower interest rate. It is our goal to continue to reduce all outstanding loans as cash flow allows in order to reduce the interest burden as much as possible.

The Company had an overall net income loss for the year of December 31, 2014 of

$437 thousand. For the year ended December 31, 2013, the Company had a net income of $727 thousand. In 2014, we incurred $564 thousand of required infrastructure expense for the expansion of the Hong Kong operation, $316 thousand expensed in direct promotional advertising activity, and $374 thousand in product development in new technology for future product launches. This represents a total of $1.3 million of expenses incurred to support the Company's overall strategic plan.

If we had not incurred the $1.3 million related to strategic investments, our net income would've surpassed last year's results, even with the lower net revenue; however, without those expenditures, we would not be in a position structurally to pursue the new revenue opportunities that we now have in place.

As mentioned in my opening comments, we are preparing the Company for the next level of growth. In order to support sustained revenue growth and continue to expand product categories, funding must also be available and allocated. We would note that all of these referenced strategic investments were achieved through cash flow generated by operations. The Company did not incur any additional debt in 2014 to pay for these investments. In fact, we were able to pay off $108 thousand of old debt. The Company is now prepared for the next level of growth.

I'll talk a little bit now about the cash flow under operating activities. Cash flow provided by operating activities was $5.1 million in 2014 compared with approximately $2.9 million used by operating activities in 2013. This was mainly achieved by the $5.8 million collection of accounts receivable in 2014.

Our cash flows from operations are primarily dependent on our net income adjusted for non-cash expenses and the timings of collection of receivables, levels of inventory, and payments to suppliers. By expanding our Hong Kong operation, we are building an operational structure that can develop and release quality products to market quicker than we have been able to accomplish in previous years. Additionally, Capstone International has negotiated more favorable credit terms and credit lines with our new factory.

Cash used for investing activities in 2014 was $89 thousand compared with $513 thousand in 2013. With the Company's new branding initiative and product expansion into many new LED home lighting categories, the Company will continue to invest in new tooling, product molds, package designs and displays.

Net cash used in financing activities for the year ended December 31, 2014 was $5.2 million compared with $3.5 million of net cash provided by financing activities in 2013. During 2014, we used $801 thousand to pay off old debt and interest. At December 31, the Company was in compliance with all the covenants pursuant to our existing credit facilities.

To fund the development, expansion, marketing and inventory of the new branded product line, the Company will require additional working capital during this development and launch phase. The Company is currently reviewing alternate sources to supplement funding for working capital; however, CEO and Director Stewart Wallach and Director Dr. Jeffery Postal will provide gap funding to supplement shortfalls during this phase.

This concludes my financial summary for 2014. I'll turn the call back to you, Stewart.

Stewart Wallach: Thank you very much, Gerry. As I reflect on Capstone's past year, I want to share with you, our shareholders, the sense of pride that I have in our Management Teams for their loyalty to the Company and the resiliency that they continue to demonstrate as we go through these challenging growth transitions. I have said many times before when comparing us to other penny stock companies, we are a real company with real people selling real products. Although that statement seems simple, I can tell you that the work and commitment that goes into executing our strategic initiatives is anything but simple.

Over the course of my career, I have fortunately been involved in the development of a number of successful companies, but, frankly, I can't recall a company our size competing in such an enormous market and gaining success as we have. We are on the shelves of every major big box retailer in America. The demands placed on companies to sustain themselves in this market are greater than ever. As the retail market dynamics continue to shift, we continue to meet these obligations. We have built a fundamentally sound Company in the most cost effective way, and have at all times sought innovative ways to differentiate our Company, its products and its image in the marketplace, while always maintaining a low cost of operations.

Our exclusive alliance with Light Engine Limited, our investments in AC Kinetics, and recently securing the exclusive North American trademark license for the Hoover brand for LED lighting are testimonies to these efforts. Although we pride ourselves on being a disciplined and focused organization, over the past year, we have seen a number of delays in some of our initiatives. The Capstone power control designed by AC Kinetics took longer than anticipated, and the integration of the technology by Light Engine into solid state lighting fixtures also took longer than anticipated due to extensive validation testing. These timing issues, in conjunction with some of the challenges that are not in our control, such as the West Coast port dispute that Gerry alluded to earlier, have not once dampened the attitudes of any of our Capstone associates.

In closing, I want to reaffirm my bullishness on this company, the direction it's proceeding and the rewards that await us all. To that end, the insiders continue to hold their large positions in the Company, and the two largest shareholders, Dr. Postal and myself, continue to support the Company financially when needed. Q1 and Q2, as a result of the product delays, the branding launches, the issues of cutback promotional activity due to the West Coast port situation will not yield favorable financial results. As additional working capital will be required to support operations while funding the expanded product lines and our new branding initiatives, the Finance Team is reviewing various options to support this situation; however, as in the past, Dr. Postal and I will provide gap financing if required.

Our Company is poised to expand its market reach and achieve the levels of sales growth that I believe our innovative products are capable of. I look forward to reporting on our successes in the months ahead. For our long-time shareholders that have been through several phases of our growth and development, I would like to once again thank you personally for your support. We are making great progress in this Company, and the successful future we have all invested in is nearing.

I'd like to thank you once again for all your time, and I look forward to speaking with you in the not too distant future. Thank you.

Operator: Ladies and gentlemen, this does conclude today's teleconference. You may disconnect your lines at this time. Thank you for your participation and have a wonderful day.

7

Capstone Companies, Inc. Reports 2014 Results

|

·

|

Strategic actions during 2014 expected to drive significant future growth

|

|

·

|

Generated $5.1 million of cash from operations during 2014

|

DEERFIELD BEACH, FL, March 27, 2015 – Capstone Companies, Inc. (OTCQB: CAPC) (“Capstone” or the “Company”), leader in LED power failure lighting solutions and innovator of LED lighting designs, today reported its financial results for 2014.

Stewart Wallach, Capstone’s CEO, commented, “During 2014 we took several important steps to help Capstone grow and become a leader in LED lighting industry. We partnered with Light Engine Ltd., a major player in the LED lighting industry, to accelerate product line expansion and bring new innovations to market faster. Additionally, as announced at our mid-February Strategic Update, we recently secured the exclusive N. A. trademark license for the Hoover® brand for LED lighting products. Hoover® is a household icon and one of the most trusted brands in America! For more than 100 years, the Hoover® brand has provided America’s homeowners with innovative floor care products and a dedication to premium quality and customer service. We are proud to brand our extended LED lighting programs with the Hoover® trademark and will formally launch our Hoover® LED Home program at the International Hardware Show in May 2015. We have passed a major hurdle in achieving the levels of sales growth that I believe our innovative products are capable of. We now can leverage this highly-respected and well-known brand to help expand our LED lighting programs.

“Transitioning to the new brand requires a short-term interruption to our sales levels to ensure a smooth transition on our major retail customer’s store shelves, but as we have previously said that was recognized at the outset of this strategy and will only be temporary in nature. Once we begin distributing our Hoover® branded products to our customers, my expectation is for sales to fully recover quickly and resume or improve on the growth trajectory that we experienced in the quarters prior to this planned interruption of sales.”

2014 Review

Revenue for 2014 was $13.6 million, a decrease of $1.0 million from 2013 which reflects two major factors. The Company’s decision to exit the book light category in 2014, as a result of declining consumer interest due to the growing use of digital reading technologies, accounted for approximately $570 thousand of the revenue decline. Additionally, the labor dispute and resulting disruption of services at ports on the United States West Coast resulted in product shipment delays and lost retailer promotional periods.

Gross profit decreased to $2.8 million, or 20.4% of sales, from $3.6 million or 24.7% of sales in 2013. Gross profit and margin were impacted by the reduced sales levels and the combined effect of $1.1 million of strategic promotional and manufacturing expenses in 2014.

Operating expenses for 2014 were $2.9 million compared with $2.5 million in the prior-year period. In 2014, $1.3 million of the operating expenses were strategic investments for the expansion of Capstone’s Hong Kong office infrastructure, direct product advertising expenses and new product development.

Operating loss was $0.1 million for 2014 compared with operating income of $1.1 million in the corresponding period of 2013.

Net loss was $0.4 million which was down from net income of $0.7 million in 2013. The expansion of the Company’s infrastructure, significant product promotions, advertising expenses and product development expenditures impacted 2014 net income by a total of $2.2 million.

Webcast and Teleconference to Review Results and Outlook

The Company will host a live webcast and conference call on Friday, March 27, 2015 at 10:30 a.m. ET. During the call, management will review the financial and operating results and discuss the Company’s corporate strategy and outlook, followed by a question-and-answer session. The conference call can be accessed by dialling (201) 689-8562. The listen-only audio webcast can be monitored at www.capstonecompaniesinc.com.

A telephonic replay will be available from 1:30 p.m. ET the day of the teleconference until Friday, April 3, 2015. To listen to the replay of the call, dial (858) 384-5517 and enter replay pin number 13600776. Alternatively, the archive of the webcast will be available on the Company’s website at www.capstonecompaniesinc.com. A transcript will also be posted to the website, once available.

About Capstone Companies, Inc.

Capstone Companies, Inc. is a public holding company that engages, through its wholly-owned subsidiaries, Capstone Industries, Inc., Capstone Lighting Technologies, LLC, and Capstone International HK, Ltd., in the development, manufacturing, logistics, and distribution of consumer and institutional products to accounts throughout North America and in international markets. See www.capstonecompaniesinc.com for more information about the Company and www.capstoneindustries.com for information on our current product offerings.

FORWARD-LOOKING STATEMENTS:

This news release contains "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995, as amended. Such statements consist of words like “anticipate,” “expect,” “project,” “continue” and similar words. These statements are based on the Company’s and its subsidiaries’ current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements, include consumer acceptance of the Company’s products, its ability to deliver new products, the success of its strategy to broaden market channels and the relationships it has with retailers and distributors. Prior success in operations does not necessarily mean success in future operations. The ability of the Company to adequately and affordably fund operations and any growth will be critical to achieving and sustaining any expansion of markets and revenue. The introduction of new products or the expanded availability of products does not mean that the Company will enjoy better financial or business performance. The risks associated with any investment in Capstone Companies, Inc., which is a small business concern and a "penny-stock Company” and, as such, a highly risky investment suitable for only those who can afford to lose such investment, should be evaluated together with the risks and uncertainties more fully described in the Company’s Annual and Quarterly Reports filed with the Securities and Exchange Commission. Capstone Companies, Inc. undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. Contents of referenced URL’s are not incorporated into this press release.

FINANCIAL TABLES FOLLOW. THE FOLLOWING SUMMARY FINANCIAL STATEMENT SHOULD BE READ ALONG WITH THE FORM 10-K FINANCIAL STATEMENT FILED BY THE COMPANY WITH THE SECURITIES AND EXCHANGE COMMISSION.

For more information, contact

|

Company:

|

Investor Relations:

|

|

Aimee Gaudet

|

Garett Gough, Kei Advisors LLC

|

|

Corporate Secretary

|

(716) 846-1352

|

|

(954) 252-3440, ext 313

|

ggough@keiadvisors.com

|

|

CAPSTONE COMPANIES, INC. AND SUBSIDIARIES

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

| |

|

| |

|

|

|

|

|

|

| |

|

For the Year Ended

|

|

| |

|

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

Revenues

|

|

$ |

13,624,518 |

|

|

$ |

14,593,826 |

|

|

Cost of sales

|

|

|

(10,842,813 |

) |

|

|

(10,983,364 |

) |

|

Gross profit

|

|

|

2,781,705 |

|

|

|

3,610,462 |

|

|

Gross margin

|

|

|

20.4 |

% |

|

|

24.7 |

% |

| |

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

315,566 |

|

|

|

489,791 |

|

|

Compensation

|

|

|

1,406,709 |

|

|

|

972,922 |

|

|

Professional fees

|

|

|

189,734 |

|

|

|

326,077 |

|

|

Product development

|

|

|

374,245 |

|

|

|

225,754 |

|

|

Other general and administrative

|

|

|

604,823 |

|

|

|

479,298 |

|

|

Total operating expenses

|

|

|

2,891,077 |

|

|

|

2,493,842 |

|

|

Net operating (loss) income

|

|

|

(109,372 |

) |

|

|

1,116,620 |

|

|

Operating margin

|

|

|

-0.8 |

% |

|

|

7.7 |

% |

| |

|

|

|

|

|

|

|

|

|

Other expense:

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(327,962 |

) |

|

|

(389,486 |

) |

|

Total other expense

|

|

|

(327,962 |

) |

|

|

(389,486 |

) |

| |

|

|

|

|

|

|

|

|

|

Income (loss) before tax provision

|

|

|

(437,334 |

) |

|

|

727,134 |

|

| |

|

|

|

|

|

|

|

|

|

Provision for income tax

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(437,334 |

) |

|

$ |

727,134 |

|

| |

|

|

|

|

|

|

|

|

|

Income per common share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

- |

|

|

$ |

- |

|

|

Diluted

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

654,524,231 |

|

|

|

657,503,683 |

|

|

Diluted

|

|

|

654,524,231 |

|

|

|

813,450,260 |

|

|

CAPSTONE COMPANIES, INC. AND SUBSIDIARIES

|

|

|

CONSOLIDATED BALANCE SHEETS

|

|

| |

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

Assets:

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

Cash

|

|

$ |

313,856 |

|

|

$ |

436,592 |

|

|

Accounts receivable - net

|

|

|

977,597 |

|

|

|

6,927,238 |

|

|

Advances

|

|

|

14,456 |

|

|

|

- |

|

|

Inventory

|

|

|

128,984 |

|

|

|

298,099 |

|

|

Prepaid expense

|

|

|

358,046 |

|

|

|

1,082,784 |

|

|

Total Current Assets

|

|

|

1,792,939 |

|

|

|

8,744,713 |

|

| |

|

|

|

|

|

|

|

|

|

Fixed Assets:

|

|

|

|

|

|

|

|

|

|

Computer equipment & software

|

|

|

12,272 |

|

|

|

66,448 |

|

|

Machinery and equipment

|

|

|

299,693 |

|

|

|

667,096 |

|

|

Furniture and fixtures

|

|

|

5,665 |

|

|

|

5,665 |

|

|

Less: Accumulated depreciation

|

|

|

(223,589 |

) |

|

|

(661,210 |

) |

|

Total Fixed Assets

|

|

|

94,041 |

|

|

|

77,999 |

|

| |

|

|

|

|

|

|

|

|

|

Other Non-current Assets:

|

|

|

|

|

|

|

|

|

|

Product development costs - net

|

|

|

- |

|

|

|

19,664 |

|

|

Deposit

|

|

|

12,193 |

|

|

|

- |

|

|

Investment (AC Kinetics)

|

|

|

500,000 |

|

|

|

500,000 |

|

|

Goodwill

|

|

|

1,936,020 |

|

|

|

1,936,020 |

|

|

Total Other Non-current Assets

|

|

|

2,448,213 |

|

|

|

2,455,684 |

|

|

Total Assets

|

|

$ |

4,335,193 |

|

|

$ |

11,278,396 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

644,629 |

|

|

$ |

1,931,527 |

|

|

Note payable - Sterling Factors

|

|

|

286,945 |

|

|

|

4,237,144 |

|

|

Notes and loans payable to related parties - current maturities

|

|

|

1,936,679 |

|

|

|

3,220,074 |

|

|

Total Current Liabilities

|

|

|

2,868,253 |

|

|

|

9,388,745 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingent Liablities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' Equity:

|

|

|

|

|

|

|

|

|

|

Preferred Stock, Series A, par value $.001 per share, authorized

100,000,000 shares, issued -0- shares

|

|

|

- |

|

|

|

- |

|

|

Preferred Stock, Series B-1, par value $.0001 per share, authorized

50,000,000 shares, issued -0- shares

|

|

|

- |

|

|

|

- |

|

|

Preferred Stock, Series C, par value $1.00 per share, authorized

1,000 shares, issued 1,000 shares

|

|

|

1,000 |

|

|

|

1,000 |

|

|

Common Stock, par value $.0001 per share, authorized 850,000,000

shares, 654,010,532 & 657,760,532 shares issued at

December 31, 2014 & December 31, 2013

|

|

|

65,401 |

|

|

|

65,777 |

|

|

Additional paid-in capital

|

|

|

7,187,058 |

|

|

|

7,172,059 |

|

|

Accumulated deficit

|

|

|

(5,786,519 |

) |

|

|

(5,349,185 |

) |

|

Total Stockholders' Equity

|

|

|

1,466,940 |

|

|

|

1,889,651 |

|

|

Total Liabilities and Stockholders’ Equity

|

|

$ |

4,335,193 |

|

|

$ |

11,278,396 |

|

|

CAPSTONE COMPANIES, INC. AND SUBSIDIARIES

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

| |

|

|

|

|

|

|

| |

|

For the Year Ended

|

|

| |

|

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Continuing operations:

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(437,334 |

) |

|

$ |

727,134 |

|

|

Adjustments necessary to reconcile net (loss) income to net cash used in

operating activities:

|

|

|

|

|

|

|

|

|

|

Stock issued for expenses

|

|

|

- |

|

|

|

14,064 |

|

|

Stock cancellation

|

|

|

(28,877 |

) |

|

|

- |

|

|

Depreciation and amortization

|

|

|

81,220 |

|

|

|

95,756 |

|

|

Compensation expense from stock options

|

|

|

43,500 |

|

|

|

20,250 |

|

|

Accrued sales allowance

|

|

|

155,346 |

|

|

|

- |

|

|

(Increase) decrease in accounts receivable

|

|

|

5,794,295 |

|

|

|

(4,253,683 |

) |

|

(Increase) decrease in inventory

|

|

|

169,115 |

|

|

|

286,271 |

|

|

(Increase) decrease in prepaid expenses

|

|

|

724,738 |

|

|

|

(731,781 |

) |

|

(Increase) decrease in other assets

|

|

|

(14,456 |

) |

|

|

(23,972 |

) |

|

Increase (decrease) in accounts payable and accrued expenses

|

|

|

(1,286,898 |

) |

|

|

817,361 |

|

|

Increase (decrease) in accrued interest on notes payable

|

|

|

(63,395 |

) |

|

|

104,643 |

|

|

Net cash provided by (used in) operating activities

|

|

|

5,137,254 |

|

|

|

(2,943,957 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Investment

|

|

|

- |

|

|

|

(500,000 |

) |

|

Deposits

|

|

|

(12,193 |

) |

|

|

- |

|

|

Purchase of property and equipment

|

|

|

(77,598 |

) |

|

|

(12,695 |

) |

|

Net cash provided by (used in) investing activities

|

|

|

(89,791 |

) |

|

|

(512,695 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Proceeds from notes payable

|

|

|

14,700,000 |

|

|

|

12,737,405 |

|

|

Repayments of notes payable

|

|

|

(18,650,199 |

) |

|

|

(9,745,420 |

) |

|

Proceeds from notes and loans payable to related parties

|

|

|

950,000 |

|

|

|

4,538,000 |

|

|

Repayments of notes and loans payable to related parties

|

|

|

(2,170,000 |

) |

|

|

(4,048,000 |

) |

|

Net cash provided by (used in) financing activities

|

|

|

(5,170,199 |

) |

|

|

3,481,985 |

|

| |

|

|

|

|

|

|

|

|

|

Net (Decrease) Increase in Cash and Cash Equivalents

|

|

|

(122,736 |

) |

|

|

25,333 |

|

|

Cash and Cash Equivalents at Beginning of Year

|

|

|

436,592 |

|

|

|

411,259 |

|

|

Cash and Cash Equivalents at End of Year

|

|

$ |

313,856 |

|

|

$ |

436,592 |

|

5

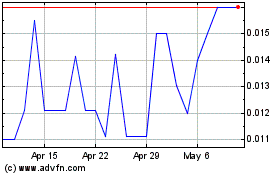

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Apr 2023 to Apr 2024