UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 16, 2015

Gevo, Inc.

(Exact Name

of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-35073 |

|

87-0747704 |

| (State or Other Jurisdiction

of Incorporation) |

|

Commission

File Number |

|

(I.R.S. Employer

Identification Number) |

345 Inverness Drive South, Building C, Suite 310, Englewood, CO 80112

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (303) 858-8358

N/A

(Former Name, or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(e) Compensatory Arrangements of Certain Officers.

On February 16, 2015, Gevo, Inc. (the “Company”) entered into an agreement (the “Second Amendment Agreement”) to amend

the Company’s existing employment agreement (the “Existing Agreement”), with Patrick Gruber, Ph.D., the Company’s Chief Executive Officer, dated as of June 4, 2010 (as amended by that certain Amendment Agreement,

dated December 21, 2011 (the “First Amendment Agreement”)), in order to align Dr. Gruber’s compensation with the strategic objectives of the Company. Upon the effectiveness of the Second Amendment Agreement, for a

three-month period starting on the date of the grant, Dr. Gruber will receive 25% of his base pay, which amounts to $31,250 for three months, in shares of restricted stock instead of cash. The shares of restricted stock will be priced at the

closing price of the Company’s common stock on the date of the grant and will cliff vest 100% on the one-year anniversary of the date of the grant. In the event of a change of control, a termination of Dr. Gruber or a resignation by

Dr. Gruber, the shares of restricted stock will accelerate on a prorated basis.

Except as amended by the First Amendment Agreement and the Second

Amendment Agreement, the Existing Agreement, which was filed with the Securities and Exchange Commission on November 4, 2010, as Exhibit 10.14 to the Company’s Registration Statement on Form S-1/A, continues in full force and effect. The

description of the Second Amendment Agreement set forth in this Item 5.02 is not complete and is qualified in its entirety by reference to the full text of the Second Amendment Agreement, a copy of which is attached hereto as Exhibit 10.1.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

| 10.1 |

|

Second Amendment Agreement, by and between Gevo, Inc. and Patrick Gruber, dated February 16, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| Gevo, Inc. |

|

|

| By: |

|

/s/ Brett Lund |

|

|

Brett Lund |

|

|

Chief Legal Officer |

Date: February 17, 2015

Exhibit 10.1

SECOND AMENDMENT AGREEMENT

This Second Amendment Agreement (the “Agreement”), is entered into as of February 16, 2015 (the

“Effective Date”), by and between Gevo, Inc., a Delaware corporation (the “Company”), and Pat Gruber, an individual (the “Employee”). Capitalized terms used but not defined

herein shall have the meaning assigned to them in the Employment Agreement (as defined below).

RECITALS

WHEREAS, the Company and the Employee previously entered into an Employment Agreement, dated as of

June 4, 2010, (as amended by that certain Amendment Agreement, dated as of December 21, 2011, the “Employment Agreement”), pursuant to which, among other things, the Employee agreed to render certain specified

services to the Company during the Term;

WHEREAS, the Company desires to amend the Employment

Agreement to align the compensation of the Employee with the strategic objectives of the Company, including, without limitation, by paying 25% of the Employee’s base salary in restricted stock for a period of three months; and

WHEREAS, the Employee has agreed to such amendments, on the terms and subject to the conditions set forth

in this Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing recitals, and for other good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties, intending to be legally bound, agree as follows:

1. Amendment to Employment Agreement. The Employee and the Company agree

that for a three-month period starting on the date of the grant and ending three months from the date of the grant, the Employee will receive 25% of his Base

Pay, which amounts to $31,250.00 for three months, in shares of restricted stock instead of cash. The shares of restricted stock will be issued pursuant to the Company’s Amended and Restated 2010 Stock Incentive Plan, will be priced at the

closing price of the Company’s common stock on the date of the grant and will cliff vest 100% on the one-year anniversary of the date of the grant. In the event of a Change of Control, a termination of the Employee or a resignation by the

Employee, the shares of restricted stock will accelerate on a prorated basis.

2. Withholding. The Company shall have the right to deduct or

withhold from any payments made pursuant to this Agreement any and all amounts it is required to deduct or withhold and any and all amounts the Employee agrees it may deduct or withhold (e.g., for federal income and employee social security taxes

and all state or local income taxes now applicable or that may be enacted and become applicable during the Term).

3. Effective Date. This

Agreement shall become effective as of the Effective Date specified above. Except as modified by this Agreement, the Employment Agreement shall remain in full force and effect in accordance with its terms. In the event of a conflict or inconsistency

between this Agreement and the Employment Agreement, the provisions of this Agreement shall govern.

1.

4. Amendment. By executing this Agreement below, each of the Company and the Employee certifies

that this Agreement has been executed and delivered in compliance with the terms of Section 9.1 of the Employment Agreement.

5.

Assignment. This Agreement is binding upon the parties hereto and their respective successors, assigns, heirs and personal representatives. Except as otherwise provided herein, neither of the parties hereto may make any assignment of this

Agreement, or any interest herein, without the prior written consent of the other party, except that, without such consent, this Agreement shall be assigned to any corporation or entity which shall succeed to the business presently being operated by

Company, by operation of law or otherwise, including by dissolution, merger, consolidation, transfer of assets, or otherwise.

6. Governing

Law. This Agreement shall be construed and enforced in accordance with the laws of the State of Colorado, without giving effect to the principles of conflict of laws thereof.

7. Arbitration. Any controversy or claim arising out of, or related to, this Agreement, or the breach thereof, shall be settled by binding arbitration

in Denver, Colorado, in accordance with the employment arbitration rules then in effect of the American Arbitration Association including the right to discovery, and the arbitrator’s decision shall be binding and final, and judgment upon the

award rendered may be entered in any court having jurisdiction thereof. Each party hereto shall pay its or their own expenses incident to the negotiation, preparation and resolution of any controversy or claim arising out of, or related to, this

Agreement, or the breach thereof; provided, however, the Company shall pay and be solely responsible for any attorneys’ fees and expenses and court or arbitration costs incurred by the Employee as a result of a claim brought by either the

Employee or the Company alleging that the other party breached or otherwise failed to perform this Agreement or any provision hereof to be performed by the other party if the Employee prevails in the contest in whole or in part.

8. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall constitute an original and both of which, when taken

together, shall constitute one agreement. Facsimile signatures shall be as effective as original signatures.

[REMAINDER OF PAGE

INTENTIONALLY LEFT BLANK]

2.

The parties hereto have caused this Agreement to be executed and delivered as of the day and year

first written above.

|

|

|

| EMPLOYEE: |

|

| /s/ Pat Gruber |

| Pat Gruber |

|

|

|

|

| COMPANY: |

|

| GEVO, INC. |

|

|

| By: |

|

/s/ Brett Lund |

| Name: Brett Lund |

| Title: Chief Legal Officer |

[SIGNATURE PAGE TO SECOND AMENDMENT AGREEMENT]

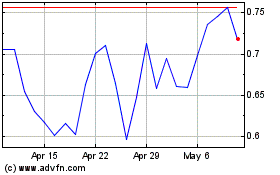

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

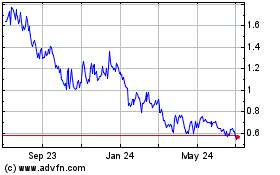

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024