Dakshidin Announces Joint Venture with Sunset Capital Assets

January 13 2015 - 4:00PM

Access Wire

LAS VEGAS, NV / ACCESSWIRE / January 13, 2015 /

Dakshidin (OTC: DKSC) announced today that the Company has entered

into a 50/50 Joint Venture Agreement with Sunset Capital Assets

(OTC: SSBN).

"We are thrilled that, with Sunset Capital onboard, we now have

a partner with the background, skills and contacts to implement our

technology on the highly regulated financial industry side of the

equation." said Dakshidin CEO J. Mark Seaton. "The pieces we need

to make this venture successful are now falling into place. We are

encouraged with the long term prospects for the company and its

shareholders."

Under the terms of the agreement, Dakshidin will deploy and

manage its recently acquired technology platform that will allow

the company to offer a wide variety of financial products and

services including:

- A General Purpose Reloadable Debit Card (GPR - a bank account

on a card)

- Scoot (Patented Mobile Money Transfer Service)*

- Payday advance

- Micro loans

- Remittances

Bert Watson Jr., CIO of Sunset Capital Assets, stated "As a

management team with over 75 years of banking and Investment

Banking experience, we immediately understood the value and

potential of the technology Dakshidin had acquired. We recognized

the synergy between the two companies and will partner with

Dakshidin to help deploy this technology and fully participate in

this potentially very lucrative and exciting opportunity. We are

looking forward to continuing to build upon this strong and

fruitful relationship going forward."

According to the terms of the joint venture, Sunset Capital

Assets will serve in multiple capacities intended to facilitate a

variety of business and financial opportunities. The group will tap

its current business relationships, government contacts, and

banking industry contacts to secure Investment Banking services to

facilitate the launch of the joint venture. Sunset also announced

that it intends to incorporate Dakshidin technologies into the

international banking platform it is currently

developing.

In June of 2014 Dakshidin announced it had concluded its first

strategic asset acquisition; a state of the art proprietary

electronic payment platform from The Tyburn Group Inc. based in

Northern California.

The prepaid and debit platform allows Dakshidin to offer an

end-to-end solution supporting all aspects of card issuing

services.

Key features include:

- Automated Application Processing

- Customer Relationship Management

- Product and Service Management

- Card Management

- Statistics and MIS Reporting

The product is ideal for that segment of the population

(unbanked/underbanked) who either do not qualify for or have no

desire for a traditional bank account. The estimated size of the

market in the US alone is currently estimated to be between forty

and fifty million people and expanding.

The platform also provides a potential solution to a recognized

problem facing the legal medical marijuana industry as it allows

customers to pay for their prescriptions using a closed loop card

issued and managed by Dakshidin thereby alleviating the current

situation whereby dispensary owners, due to their inability to

accept credit cards, are forced to keeping large amounts of cash on

their premises.

Scoot* is a mobile application that allows ANY cell phone to be

used for making direct money transfers through SMS text messaging

without having to use a bank account. The Scoot platform is

compatible with any stored-value or debit card network

(MasterCard/Visa). Debit Cards are currently accepted at over 23

million merchants and ATMs in 210 countries. Users can simply

purchase a reloadable stored-value debit card from Scoot.com which

will link their cell phone number to that card. Scoot users can

manage their card accounts and send money from one stored-value

debit card to another using text messaging with their cell phone

numbers as the unique identifier. Transferred funds can immediately

be used by the recipient in the same way as any other debit

card.

About Sunset Capital Assets

Sunset Capital Assets, Inc. is a boutique, global investment and

advisory firm headquartered in Jacksonville, FL and well

capitalized with assets valued in excess of $500 million. Founded

in 2012; the right combination of values, intellectual capital, and

financial resources defines Sunset as a firm positioned for

significant growth. Sunset takes a pioneering, consulting-based

approach to corporate equity investing, partnering with management

teams to build class-leading businesses and improve their

operations. Since inception, the firm has extended this approach

across asset classes and seeks to build one of the strongest

organically grown alternative asset platforms in the world. Further

information is available at www.sunsetcapitalassets.com.

Forward-Looking Statements: The information in this press

release includes certain "forward-looking" statements within the

meaning of the Safe Harbor provisions of Federal Securities Laws.

Investors are cautioned that such statements are based upon

assumptions that in the future may prove not to have been accurate

and are subject to significant risks and uncertainties, including

the future financial performance of the Company. Although the

Company believes that the expectations reflected in its

forward-looking statements are reasonable, it can give no assurance

that such expectations or any of its forward-looking statements

will prove to be correct. Readers are cautioned not to place undue

reliance on these forward-looking statements that speak only as of

the date of this release, and the Company undertakes no obligation

to update publicly any forward-looking statements to reflect new

information, events, or circumstances after the date of this

release except as required by law.

Dakshidin Corporation

Toll free number 1 888-818-9167

email - ir@dakshidin.com

https://www.facebook.com/dakshidincorp

https://twitter.com/dakshidin

SOURCE: Dakshidin Corporation

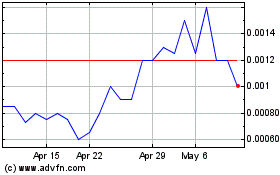

Dakshidin (PK) (USOTC:DKSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

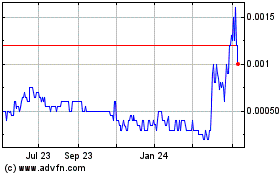

Dakshidin (PK) (USOTC:DKSC)

Historical Stock Chart

From Apr 2023 to Apr 2024