UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): January 6, 2015

AMARANTUS BIOSCIENCE HOLDINGS, INC.

(Exact name of registrant as specified in

its charter)

| Nevada |

000-55016 |

26-0690857 |

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

IRS Employer

Identification No.) |

|

655 Montgomery Street, Suite 900

San Francisco, CA |

94111 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(408) 737-2734

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01 |

Entry into a Material Definitive Agreement |

Effective on January 6, 2015, Amarantus

Bioscience Holdings, Inc. (the “Company”) entered into an amendment (the “Amendment”) to that certain

Option Agreement (the “Original Option Agreement”, as disclosed on the Company’s Current Report on Form 8-K

filed with the Securities and Exchange Commission on November 17, 2014) with Lonza Walkersville, Inc.

(“Lonza”).

Pursuant to the Amendment, the Company and

Lonza agreed that they intend to enter into a settlement agreement and dismiss certain litigation (the “Settlement”)

between Lonza and Regenicin, Inc. (“Regenicin”) (the “Action”), an Action to which the Company owns all

of Regenicin’s rights, title and claims, by no later than February 5, 2015.

Additionally, pursuant to the Amendment,

on January 7, 2015, the Company paid to Lonza, additional cash consideration of $400,000, which extended the Original Option Agreement

until February 28, 2015. The Company may also provide Lonza with additional consideration of $300,000 no later than March 2, 2015,

and upon such payment, the Original Option Agreement may be extended to March 31, 2015.

The foregoing description of the Amendment

does not purport to be complete and is qualified in its entirety by reference to the complete text of the Amendment, which is filed

as Exhibit 10.1 hereto, and which is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective on January 6, 2015, Dr. John W.

Commissiong agreed to continue to be employed as the Chief Scientific Officer (“CSO”) of the Company pursuant to

the terms and conditions of an offer letter dated December 31, 2014 (the “Offer Letter”).

Pursuant to the Offer Letter, Dr. Commissiong

will serve as the Company’s CSO for an initial term of one year, after which Dr. Commissiong’s employment will be at-will.

Dr. Commissiong’s initial base salary shall be $175,000 per annum (“Base Salary”), which shall immediately and

automatically increase to $266,000 per annum upon the Company becoming listed on a national stock exchange. Dr. Commissiong shall

be eligible for a bonus of up to thirty (30%) percent of the Base Salary, the award of which shall be based upon the satisfaction,

in the Company’s discretion, of certain performance conditions and milestones to be set by the Company and the Company’s

Compensation Committee. Dr. Commissiong also received a signing bonus of $10,000.

Additionally, pursuant to the Offer Letter,

it will be recommended at the next meeting of the Company’s Board of Directors (the “Board”) that the Company

grant Dr. Commissiong an option to purchase 3,500,000 million shares of the Company’s common stock at a price per share equal

to the fair market value per share of the Common Stock on the date of grant, as determined by Board. Twenty-five (25%) percent

of such shares shall vest 12 months after the date of grant, subject to Dr. Commissiong’s continued employment with the Company.

The remaining shares shall vest monthly over the following thirty-six (36) months in equal monthly installments, subject to Dr.

Commissiong’s continued employment with the Company.

The foregoing description of the Offer Letter

does not purport to be complete and is qualified in its entirety by reference to the complete text of the Offer Letter, which is

filed as Exhibit 10.2 hereto, and which is incorporated herein by reference.

Item 8.01 Other Events.

On January 8, 2015,

the Company issued a press release announcing that it will participate in the Eighth Annual OneMedForum on January 12 - 13, 2015,

at the Marriott Marquis in San Francisco, CA.

Item 9.01 Financial Statements and Exhibits.

| 10.1 |

First Amendment to Option Agreement by and between Lonza Walkersville, Inc. and Amarantus Bioscience Holdings, Inc. |

| |

|

| 10.2 |

Offer Letter to Dr. John W. Commissiong

dated December 31, 2014 |

| 99.1 |

Press Release dated January 8, 2015 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

|

|

AMARANTUS BIOSCIENCE HOLDINGS, INC. |

| |

|

|

|

|

|

| Date: January 9, 2015 |

|

By: |

/s/ Gerald E. Commissiong |

|

| |

|

|

|

Name: Gerald E. Commissiong |

|

| |

|

|

|

Title: Chief Executive Officer |

|

Exhibit 10.1

First Amendment to Option Agreement

This First Amendment (this “Amendment”),

dated as of January 5, 2015 (the “Amendment Effective Date”), amends that certain Option Agreement (the “Option

Agreement”), dated October 27, 2014 (the “Effective Date”), between Amarantus Bioscience Holdings, Inc.,

a Nevada corporation (“Amarantus”) and Lonza Walkersville, Inc., a Delaware corporation ( “Lonza”).

The parties identified above are sometimes hereinafter individually referred to as a “Party” and collectively

as the “Parties”.

WHEREAS, upon the terms and subject to the conditions contained herein, Lonza and Amarantus have agreed to amend the Option

Agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, the Parties to this Amendment

agree as follows:

(a) Definitions. Capitalized terms not otherwise defined

herein shall have the definitions provided in the Option Agreement.

(b) Dismissal. Lonza

and Amarantus (individually and as successor to and on behalf of Regenicin, Inc. (“Regenicin”)) and Regenicin intend

to enter into a settlement agreement and dismissal of litigation (the “Settlement Agreement and Dismissal of Litigation”)

no later than February 5, 2015 relating to the following action: on or about September 30,

2013, Regenicin commenced an action in the Superior Court of Fulton County entitled, Regenicin, Inc. v. Lonza Walkersville, Inc.,

Lonza Group, Ltd. and Lonza America, Inc., Case No. 2013-CV-237150, which action was removed to the United States District Court

for the Northern District of Georgia, Case No. 1:13-cv-3596, and thereafter transferred to the United States District Court for

the District of New Jersey, Case No. 1:13-cv-3596 (the “Action”); and on or about November 19, 2014, Amarantus entered

into an asset purchase agreement with Regenicin pursuant to which Amarantus acquired, inter alia, all of Regenicin’s rights,

title and claims related to the Action, including but not limited to all claims set forth in the Action, and any and all claims

Regenicin had or may have had to Lonza’s and/or Cutanogen Corporations’s intellectual property, manufacturing rights,

licensing rights and know-how technology.

(c) Additional Consideration. In addition to the consideration

already paid under the Option Agreement, Amarantus shall pay Lonza $400,000 no later than January 7, 2015, by wire transfer of

immediately available funds to an account previously specified in writing by Lonza. In addition to the foregoing, upon Amarantus’

written request and payment to Lonza of an additional $300,000 no later than March 2, 2015, by wire transfer of immediately available

funds to an account previously specified in writing by Lonza, this Option Agreement may be further extended to March 31, 2015.

No more than $700,000 is due and payable under this Amendment. All of the additional consideration under this Amendment is non-refundable

and will not be creditable against any amounts payable under the SPA.

(d) Extension of Option Period. The Option Period

as defined in Section 1.1 of the Option Agreement is extended, upon payment of $400,000 of the additional consideration set forth

in (c) above, through February 28, 2015 and may be further extended, upon payment of an additional $300,000 of the additional consideration

set forth in (c) above, through March 31, 2015; provided, however, if Lonza and Amarantus do not enter into the Settlement Agreement

and Dismissal of Litigation by February 5, 2015, the Option Period and Option Agreement shall immediately terminate on February

5, 2015.

(e) Amendment to SPA. Amarantus and Lonza hereby agree

to add the following to Section 9.5 of the Form SPA:

| | BOTH PARTIES HEREBY AGREE THAT TO THE FULLEST EXTENT PERMITTED BY LAW, SELLER’S LIABILITY TO PURCHASER, FOR ANY AND ALL

CLAIMS, LOSSES, EXPENSES, OR DAMAGES, WHATSOEVER, ARISING OUT OF OR IN ANY WAY RELATED TO THIS AGREEMENT FROM ANY CAUSE OR CAUSES,

INCLUDING, BUT NOT LIMITED TO, NEGLIGENCE, ERRORS, OMISSIONS OR STRICT LIABILITY, SHALL NOT EXCEED FOUR MILLION DOLLARS ($4,000,000).

TO THE EXTENT THAT THIS CLAUSE CONFLICTS WITH ANY OTHER CLAUSE, THIS CLAUSE SHALL TAKE PRECEDENCE OVER SUCH CONFLICTING CLAUSE.

IF APPLICABLE LAW PREVENTS ENFORCEMENT OF THIS CLAUSE, THEN THIS CLAUSE SHALL BE DEEMED MODIFIED TO PROVIDE THE MAXIMUM PROTECTION

FOR SELLER AS IS ALLOWABLE UNDER APPLICABLE LAW. |

IN WITNESS WHEREOF, each Party hereto has caused this

Amendment to be executed on its behalf by its duly authorized representative.

| LONZA WALKERSVILLE, INC. |

|

AMARANTUS BIOSCIENCE HOLDINGS, INC. |

|

| |

|

|

|

|

|

| By: |

/s/ Bradley Luria |

|

By: |

/s/ Robert Farrell |

|

| Name: |

Bradley Luria |

|

Name: |

Robert Farrell |

|

| Title: |

Assistant Secretary |

|

Title: |

Chief Financial Officer |

|

|

AMARANTUS BIOSCIENCE HOLDINGS, Inc.

655 Montgomery Street,

Suite 900

San Francisco, CA 94111

Phone: 415 688 4484 Fax: 408 852 4427

www.amarantus.com info@amarantus.com |

December 31, 2014

Dr. John Commissiong

1269 Lakeside Drive, Apt. 1103

Sunnyvale, CA 94085

Dear Mr. Commissiong:

This offer letter will

confirm your continued employment with Amarantus Bioscience Holdings, Inc. (the “Company”) as its Chief Scientific

Officer. This offer letter supersedes any and all previous employment agreements with the Company, whether oral or in writing.

Your continued employment shall be for an initial term of one year following your acceptance of this offer letter (the “Initial

Term”). Following the Initial Term, your employment with the Company shall be at will.

Initially your annual

base salary shall be $175,000 ($14,583.33 per month) (your “Base Salary”), which will be paid semi-monthly in accordance

with the Company’s normal payroll procedures. Upon the Company’s “up-listing” to National Listing, your

annual Base Salary will immediately be increased to $266,000, on the next regularly scheduled payroll date following the up-listing.

As an employee, you are also eligible to receive certain employee benefits. You should note that the Company may modify job titles,

salaries and benefits from time to time as it deems necessary.

In addition to your

Base Salary, you will also be eligible for a discretionary performance bonus (the “Performance Bonus”) equal to up

to 30% of your Base Salary. Award of this Performance Bonus is conditioned upon satisfaction, in the Company’s sole discretion,

of Performance Bonus Conditions to be proposed by the CEO and agreed with the Compensation Committee. The milestones and their

weight for your 2014 Performance Bonus is attached hereto as Exhibit A. The Performance Bonus, if any, shall be paid in

accordance with applicable law and on or before March 15th of each year during which you are still employed by the Company. You

will not be eligible for a Performance Bonus if you are not employed by the Company on the date upon which the Performance Bonus,

if any, is to be paid.

The Company will also

provide you with a Signing Bonus of $10,000, less standard deductions and withholdings, within ten (10) days of you execution of

this Employment Agreement.

In addition, it will

be recommended at the first meeting of the Company’s Board of Directors following your acceptance of this offer letter that

the Company grant you an option to purchase 3.5 million shares of the Company’s Common Stock at a price per share equal to

the fair market value per share of the Common Stock on the date of grant, as determined by the Company’s Board of Directors.

25% of the shares subject to the option shall vest 12 months after the date your vesting begins subject to your continuing employment

with the Company, and no shares shall vest before such date. The remaining shares shall vest monthly over the next 36 months in

equal monthly amounts subject to your continuing employment with the Company. This option grant shall be subject to the terms and

conditions of the Company’s Equity Incentive Plan and Stock Option Agreement, including vesting requirements. No right to

any stock is earned or accrued until such time that vesting occurs, nor does the grant confer any right to continue vesting or

employment.

In addition I am pleased

to confirm it is the intention of the Company to establish a separate wholly owned subsidiary (the “Research Subsidiary)

to accommodate all the Company’s Discovery Research activities; that a standalone Stock Option Scheme will be established

for that Research Subsidiary and that you will be granted an option to purchase shares in the Research Subsidiary. The details

of this Stock Option Plan for the Research Subsidiary will be established in consultation with the Company’s CFO.

Also I confirm that the Founders Royalty

as agreed by the Board of Directors and documented in the Minutes of the Board Meeting held on 26 October 2010 will remain in place.

We also ask that, if

you have not already done so, you disclose to the Company any and all agreements relating to your prior employment that may affect

your eligibility to be employed by the Company or limit the manner in which you may be employed. It is the Company’s understanding

that any such agreements will not prevent you from performing the duties of your position and you represent that such is the case.

Moreover, you agree that, during the term of your employment with the Company, you will not engage in any other employment, occupation,

consulting or other business activity directly related to the business in which the Company is now involved or becomes involved

during the term of your employment, nor will you engage in any other activities that conflict with your obligations to the Company.

Similarly, you agree not to bring any third party confidential information to the Company, including that of your former employer,

and that in performing your duties for the Company you will not in any way utilize any such information.

As a Company employee,

you are expected to abide by the Company’s rules and standards. Specifically, you are required to sign an acknowledgment

that you have read and that you understand the Company’s rules of conduct which are included in the Company Handbook.

As a condition of your

employment, you are also required to sign and comply with an At-Will Employment, Confidential Information, Invention Assignment

and Arbitration Agreement which requires, among other provisions, the assignment of patent rights to

any invention made during your employment at the Company, and non-disclosure of Company proprietary information. In the event of

any dispute or claim relating to or arising out of our employment relationship, you and the Company agree that (i) any and

all disputes between you and the Company shall be fully and finally resolved by binding arbitration, (ii) you are waiving

any and all rights to a jury trial but all court remedies will be available in arbitration, (iii) all disputes shall be resolved

by a neutral arbitrator who shall issue a written opinion, (iv) the arbitration shall provide for adequate discovery, and

(v) the Company shall pay all the arbitration fees, except an amount equal to the filing fees you would have paid had you

filed a complaint in a court of law.

To accept the Company’s

offer, please sign and date this letter in the space provided below. This letter, along with any agreements relating to proprietary

rights between you and the Company, set forth the terms of your employment with the Company and supersede any prior representations

or agreements including, but not limited to, any representations made during your recruitment, interviews or pre-employment negotiations,

whether written or oral. This letter may not be modified or amended except by a written agreement signed by the Chairman of the

Company’s Board of Directors and you.

We look forward to

your favorable reply and to continue working with you at Amarantus Bioscience Holdings, Inc.

Sincerely,

| |

/s/ Gerald Commissiong |

| |

Mr. Gerald E. Commissiong |

| |

|

| |

President and CEO |

| Agreed to and accepted: |

|

| |

|

|

| Signature: |

/s/ Dr. John Commissiong |

|

| |

|

|

| Printed Name: |

Dr. John Commissiong |

|

| |

|

|

| Date: |

December 31, 2014 |

|

Exhibit A

| MILESTONES |

% OF PERFORMANCE BONUS |

COMPLETION TIMING |

| Establish a functional research laboratory |

5 |

12-31-14 |

| Initiate two academic collaborations |

10 |

04-30-15 |

| Complete updating of the Cell Bank |

20 |

06-30-15 |

| Establish proteomics collaboration with Applied Bionics, Hayward, CA |

5 |

03-31-15 |

| Discovery of one new neurotrophic factor |

60 |

12-31-15 |

| TOTAL |

100% |

|

Exhibit

99.1

Amarantus to Participate in the Eighth

Annual OneMedForum Conference on

January 12 - 13, 2015

SAN FRANCISCO, CA and GENEVA, SWITZERLAND

– January 8, 2015 - Amarantus BioScience Holdings, Inc.

(OTCQB: AMBS), a biotechnology company focused on the development of diagnostics in Alzheimer’s disease and therapeutic

products in the areas of neurology, psychiatry, ophthalmology and regenerative medicine, announced that it will participate in

the Eighth Annual OneMedForum on January 12 - 13, 2015, at the Marriott Marquis in San Francisco, CA.

The Company will present an overview of

its investigational drug MANF (mesencephalic-astrocyte-derived neurotrophic factor) for the treatment of Retinitis Pigmentosa (RP)

and Retinal Artery Occlusion (RAO) and its Phase 2b-ready small molecule drug candidate Eltoprazine for the treatment of Parkinson's

disease levodopa-induced dyskinesia (PD LID) and Adult ADHD. The Amarantus management team will also participate in a panel discussion

on Brain Health and Neurological Diseases.

MANF Development Program Presentation

| Date: |

Monday, January 12, 2015 |

| Time: |

4:00 p.m. Pacific Time / 7:00 p.m. Eastern Time |

| Presenter: |

Roman Urfer, Ph.D., Chief Development Officer at NeuroAssets |

Brain Health and Neurological Diseases

Panel

| Date: |

Tuesday, January 13, 2015 |

| Time: |

3:00 - 3:45 p.m. Pacific Time / 6:00 - 6:45 p.m. Eastern Time |

| Participants: |

John Commissiong, Ph.D., Chief Scientific Officer and Board of Directors |

| |

David Lowe, Ph.D., Board of Directors |

Eltoprazine Development Program Presentation

| Date: |

Tuesday, January 13, 2015 |

| Time: |

4:20 p.m. Pacific Time / 7:20 p.m. Eastern Time |

| Presenter: |

Charlotte Keywood, M.D., Chief Medical Officer at Amarantus |

Live audio webcasts of the two presentations

may be accessed via the News and Events page of the Investor Relations section of the Amarantus corporate web site under the IR

Calendar at www.amarantus.com. Webcast replays will be available approximately two hours after the presentation ends and

will be archived for 30 days.

About OneMedForum

OneMedForum was launched in 2008

to bring together the companies and investors that OneMedPlace was beginning to cultivate through its online community. The date

and location were selected to leverage the influx of healthcare investors and company executives that gather each January in San

Francisco. OneMed has continuously worked to facilitate the discovery of lesser-known quality companies, with a range of media

tools, technologies, and content that have been developed over the past eight years. Since 2008, over 400 companies have presented

at OneMedForum, and almost 300 leading investors have served on panels.

About Mesencephalic-Astrocyte-derived

Neurotrophic Factor (MANF)

MANF (mesencephalic-astrocyte-derived

neurotrophic factor) is believed to have broad potential because it is a naturally-occurring protein produced by the body for

the purpose of reducing and preventing apoptosis (cell death) in response to injury or disease, via the unfolded protein response.

By manufacturing MANF and administering it to the body, Amarantus is seeking to use a regenerative medicine approach to assist

the body with higher quantities of MANF when needed. Amarantus is the front-runner and primary holder of intellectual property

(IP) around MANF, and is initially focusing on the development of MANF-based protein therapeutics.

MANF's lead indication is retinitis pigmentosa,

and additional indications including Parkinson's disease, diabetes and Wolfram's syndrome are currently pursued. Further applications

for MANF may include Alzheimer's disease, traumatic brain injury (TBI), myocardial infarction, antibiotic-induced ototoxicity and

certain other rare orphan diseases currently under evaluation.

About Eltoprazine

Eltoprazine is a small molecule

5HT1a/1b partial agonist in clinical development for the treatment of Parkinson's disease levodopa-induced dyskinesia (PD LID)

and Adult ADHD. Eltoprazine has been evaluated in over 600 human subjects to date, with a very strong and well-established safety

profile. Eltoprazine was originally developed by Solvay Pharmaceuticals for the treatment of aggression. Upon Solvay's merger

with Abbott Pharmaceuticals, the Eltoprazine program was out-licensed to PsychoGenics. PsychoGenics licensed Eltoprazine to Amarantus

following successful proof-of-concept trials in PD LID and adult ADHD.

About Amarantus BioScience Holdings,

Inc.

Amarantus BioScience Holdings (AMBS) is

a biotechnology company developing treatments and diagnostics for diseases associated with neurodegeneration and protein misfolding-related

apoptosis. AMBS has licensed Eltoprazine ("Eltoprazine"), a phase 2b ready small molecule indicated for Parkinson's

disease Levodopa induced dyskinesia and Adult ADHD. AMBS has an exclusive worldwide license to the Lymphocyte Proliferation test

("LymPro Test®"), which was developed by Prof. Thomas Arendt, Ph.D., from the University of Leipzig, for Alzheimer's

disease and owns the intellectual property rights to a therapeutic protein known as Mesencephalic-Astrocyte-derived Neurotrophic

Factor ("MANF") and is developing MANF-based products as treatments for brain and ophthalmic disorders. AMBS also owns

intellectual property for the diagnosis of Parkinson's disease ("NuroPro") and the discovery of neurotrophic factors

("PhenoGuard™"). In November 2014, AMBS entered into an exclusive option agreement with Lonza Walkersville, Inc.,

a subsidiary of Lonza Group Ltd., to acquire Cutanogen Corporation, a subsidiary of Lonza Walkersville, to develop Engineered

Skin Substitute (ESS-W), an autologous skin replacement product for the treatment of Stage 3 and Stage 4 intractable severe burns.

For further information please visit www.Amarantus.com, or connect with the Company on Facebook, LinkedIn,

Twitter and Google+.

Forward-Looking Statements

Certain statements, other than purely historical

information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results,

and the assumptions upon which those statements are based, are forward-looking statements. These forward-looking statements generally

are identified by the words "believes," "project," "expects," "anticipates," "estimates,"

"intends," "strategy," "plan," "may," "will," "would," "will be,"

"will continue," "will likely result," and similar expressions. Forward-looking statements are based on current

expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from

the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently

uncertain. Factors which could have a material adverse effect on our operations and future prospects on a consolidated basis include,

but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates,

competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating

forward-looking statements and undue reliance should not be placed on such statements.

Investor Contact:

Jenene Thomas

Jenene Thomas Communications, LLC

Investor Relations and Corporate Communications

Advisor

T: (US) 908.938.1475

E: jenene@jenenethomascommunications.com

Media Contact:

Planet Communications

Deanne Eagle, Media Contact

T: (US) 917.837.5866

Source: Amarantus Bioscience Holdings,

Inc.

###

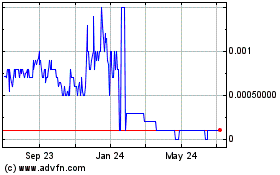

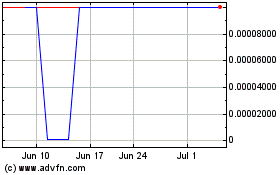

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Sep 2023 to Sep 2024