UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No.

1 to

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO §240.13d-1(a) AND

AMENDMENTS THERETO FILED PURSUANT TO §240.13d-2(a)

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Amyris, Inc.

(Name of Issuer)

Common Stock, par value $0.0001

(Title of Class of Securities)

03236M101

(CUSIP Number)

Eu Jin Chua

Managing Director, Legal & Regulations

Temasek International Pte. Ltd.

60B Orchard Road

#06-18

Tower 2

The Atrium@Orchard

Singapore 238891

With

Copies to:

Jonathan Kellner

Linklaters LLP

Rua

Leopoldo Couto Magalhães, 700 -1 º andar sala 11

Itaim Bibi - 04542-000 São Paulo - SP

Tel. No.: +(55.11) 3074.9520

(Name, Address and Telephone Number of Persons Authorized to Receive Notices and Communications)

December 10, 2014

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. x

The information required on this cover page shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS: Temasek Holdings (Private) Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP:

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS:

Not applicable. |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: Republic of Singapore |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

39,781,036* |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

39,781,036* |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,781,036* |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES:

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 36.66%** |

| 14 |

|

TYPE OF REPORTING PERSON:

HC |

| * |

See Item 5 of this statement on Schedule 13D. Includes (i) 2,670,370 shares of Common Stock issuable upon conversion of the Convertible Notes, which are currently convertible, (ii) 8,710,801 shares of

Common Stock issuable upon conversion of the Tranche II Note, which will become convertible on January 15, 2015 or earlier upon the occurrence of certain events and (iii) 18,046,387 shares of Common Stock issuable upon conversion of the

Tranche I Note (as defined below), which will become convertible on February 8, 2015 or earlier upon the occurrence of certain events. |

| ** |

Based on 108,503,392 shares of Common Stock which is the sum of the (a) 79,075,834 shares of common stock outstanding on October 31, 2014, as set forth in the Issuer’s Form 10-Q (No. 001-34885) for the

quarterly period ended September 30, 2014 filed with the Securities and Exchange Commission on November 7, 2014, (b) the 29,427,558 shares of Common Stock that may be obtained upon conversion of the Convertible Notes, Tranche II Note

and Tranche I Note. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS: Fullerton Management Pte Ltd |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP:

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS:

Not applicable. |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: Republic of Singapore |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

39,781,036* |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

39,781,036* |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,781,036* |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES:

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 36.66%** |

| 14 |

|

TYPE OF REPORTING PERSON:

HC |

| * |

See Item 5 of this statement on Schedule 13D. Includes (i) 2,670,370 shares of Common Stock issuable upon conversion of the Convertible Notes, which are currently convertible, (ii) 8,710,801 shares of

Common Stock issuable upon conversion of the Tranche II Note, which will become convertible on January 15, 2015 or earlier upon the occurrence of certain events and (iii) 18,046,387 shares of Common Stock issuable upon conversion of the

Tranche I Note (as defined below), which will become convertible on February 8, 2015 or earlier upon the occurrence of certain events. |

| ** |

Based on 108,503,392 shares of Common Stock which is the sum of the (a) 79,075,834 shares of common stock outstanding on October 31, 2014, as set forth in the Issuer’s Form 10-Q (No. 001-34885) for the

quarterly period ended September 30, 2014 filed with the Securities and Exchange Commission on November 7, 2014, (b) the 29,427,558 shares of Common Stock that may be obtained upon conversion of the Convertible Notes, Tranche II Note

and Tranche I Note. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS: Cairnhill Investments (Mauritius) Pte Ltd |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP:

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS:

Not applicable. |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: Mauritius |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

39,781,036* |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

39,781,036* |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

39,781,036* |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES:

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 36.66%** |

| 14 |

|

TYPE OF REPORTING PERSON:

HC |

| * |

See Item 5 of this statement on Schedule 13D. Includes (i) 2,670,370 shares of Common Stock issuable upon conversion of the Convertible Notes, which are currently convertible, (ii) 8,710,801 shares of

Common Stock issuable upon conversion of the Tranche II Note, which will become convertible on January 15, 2015 or earlier upon the occurrence of certain events and (iii) 18,046,387 shares of Common Stock issuable upon conversion of the

Tranche I Note (as defined below), which will become convertible on February 8, 2015 or earlier upon the occurrence of certain events. |

| ** |

Based on 108,503,392 shares of Common Stock which is the sum of the (a) 79,075,834 shares of common stock outstanding on October 31, 2014, as set forth in the Issuer’s Form 10-Q (No. 001-34885) for the

quarterly period ended September 30, 2014 filed with the Securities and Exchange Commission on November 7, 2014, (b) the 29,427,558 shares of Common Stock that may be obtained upon conversion of the Convertible Notes, Tranche II Note

and Tranche I Note. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS: Maxwell (Mauritius) Pte Ltd |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP:

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS:

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: Mauritius |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

39,781,036* |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

39,781,036* |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

39,781,036* |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES:

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 36.66%** |

| 14 |

|

TYPE OF REPORTING PERSON:

CO |

| * |

See Item 5 of this statement on Schedule 13D. Includes (i) 2,670,370 shares of Common Stock issuable upon conversion of the Convertible Notes, which are currently convertible, (ii) 8,710,801 shares of

Common Stock issuable upon conversion of the Tranche II Note, which will become convertible on January 15, 2015 or earlier upon the occurrence of certain events and (iii) 18,046,387 shares of Common Stock issuable upon conversion of the

Tranche I Note (as defined below), which will become convertible on February 8, 2015 or earlier upon the occurrence of certain events. |

| ** |

Based on 108,503,392 shares of Common Stock which is the sum of the (a) 79,075,834 shares of common stock outstanding on October 31, 2014, as set forth in the Issuer’s Form 10-Q (No. 001-34885) for the

quarterly period ended September 30, 2014 filed with the Securities and Exchange Commission on November 7, 2014, (b) the 29,427,558 shares of Common Stock that may be obtained upon conversion of the Convertible Notes, Tranche II Note

and Tranche I Note. |

Note to Schedule 13D

This Amendment No. 1 (“Amendment No. 1”) to Schedule 13D amends and supplements the Schedule 13D filed on

November 25, 2014 (the “Original Schedule 13D” and, together with this Amendment No. 1, the “Statement”), and is being filed by Temasek Holdings (Private) Limited (“Temasek”), Fullerton

Management Pte Ltd (“FMPL”), Cairnhill Investments (Mauritius) Pte Ltd (“Cairnhill”) and Maxwell (Mauritius) Pte Ltd (“Maxwell”) (Temasek, FMPL, Cairnhill and Maxwell are collectively referred to

hereinafter as the “Reporting Persons”) in respect of the common stock, par value of $0.0001 per share, of Amyris, Inc. (the “Issuer”), a Delaware corporation with its principal executive offices located at 5885

Hollis Street, Suite 100, Emeryville, CA 94608.

This Amendment No. 1 is being filed by the Reporting Persons solely to report that,

within sixty days of December 10, 2014, the Reporting Persons have the right to acquire 18,046,387 shares of Common Stock issuable upon conversion of a previously acquired senior convertible note with a current face value of $38,799,731 (the

“Tranche I Note”). Pursuant to Rule 13d-3(d)(1), as of December 10, 2014, Maxwell is deemed to be the beneficial owner of the 18,046,387 shares of Common Stock issuable upon conversion of the Tranche I Note.

Maxwell acquired the Tranche I Note on October 16, 2013. The Tranche I Note matures on October 16, 2018 and is convertible into

shares of Common Stock at the option of Maxwell at any time after February 8, 2015 or upon the occurrence of certain other events. The conversion price is equal to $2.44, subject to adjustment. Interest on the Tranche I Note is payable in kind

for the first 30 months and is added to the principal every six months, which includes interest added to the principal balance after the date of issuance.

Capitalized terms used but not defined herein have the meanings given to them in the Statement.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Statement is hereby amended and restated in its entirety as follows:

(a) As of December 10, 2014, Maxwell is the direct beneficial owner of 10,353,478 shares of Common Stock. Maxwell is deemed under Rule

13d-3(d)(1) to have beneficial ownership of (i) the shares of Common Stock issuable upon conversion of the Tranche I Note, which will become convertible on February 8, 2015 or earlier upon the occurrence of certain events, (ii) the

shares of Common Stock issuable upon conversion of the Tranche II Note, which will become convertible on January 15, 2015 or earlier upon the occurrence of certain events, and (iii) the shares of Common Stock issuable upon conversion of

the Convertible Notes, which are currently convertible. Maxwell is deemed to be the beneficial owner of 18,046,387 shares of Common Stock issuable upon conversion of the Tranche I Note, 8,710,801 shares of Common Stock issuable upon conversion of

the Tranche II Note and 2,670,370 shares of Common Stock issuable upon conversion of the Convertible Notes.

As of December 10, 2014,

Maxwell is the direct beneficial owner and deemed beneficial owner of 39,781,036 shares of Common Stock.

The percentage of beneficial

ownership of the Reporting Persons was calculated by dividing (i) the respective shares of Common Stock beneficially owned and deemed to be beneficially owned by the Reporting Persons as of December 10, 2014 (as set forth in the prior

paragraph) by (ii) 108,503,392 shares of Common Stock, which is the sum of the (a) 79,075,834 shares of Common Stock outstanding as of October 31, 2014, as set forth in the Issuer’s Form 10-Q (No. 001-34885) for the quarterly

period ended September 30, 2014 filed with the Securities and Exchange Commission on November 7, 2014 and (b) the 29,427,558 shares of Common Stock that may be obtained by Maxwell upon conversion of the Tranche I Note, Tranche II Note

and the Convertible Notes held by Maxwell.

To the knowledge of the Reporting Persons, the executive officers and directors of the

Reporting Persons have no beneficial ownership of Common Stock separate from the beneficial ownership held by the Reporting Persons.

(b)

Cairnhill, through its ownership of Maxwell, may be deemed to share voting and dispositive power over the 39,781,036 shares of Common Stock beneficially owned or deemed to be beneficially owned by Maxwell.

FMPL, through its ownership of Cairnhill, may be deemed to share voting and dispositive power over the 39,781,036 shares of Common Stock

beneficially owned or deemed to be beneficially owned by Cairnhill and Maxwell.

Temasek, through its ownership of FMPL, may be deemed to

share voting and dispositive power over the 39,781,036 shares of Common Stock beneficially owned or deemed to be beneficially owned by FMPL, Cairnhill and Maxwell.

(c) The Reporting Persons have not engaged in any transactions in the Issuer’s securities during the sixty days prior to the obligation to

file this Schedule 13D. To the knowledge of the Reporting Persons, there have been no transactions by any director or executive officer of any of the Reporting Persons in securities of the Issuer during the past sixty days.

(d) Not Applicable.

(e) Not

Applicable.

Item 7. Materials to be Filed as Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 1 |

|

Information regarding the Instruction C persons. |

|

|

| 2 |

|

Letter Agreement, dated February 23, 2013, among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(1) |

|

|

| 3 |

|

Securities Purchase Agreement, made and entered into as of August 8, 2013, by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other investors.(2) |

|

|

| 4 |

|

Amendment No. 1 to Securities Purchase Agreement, dated October 16, 2013 by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other investors.(3) |

|

|

| 5 |

|

Amendment No. 2 to Securities Purchase Agreement, dated December 24, 2013 by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other investors.(4) |

|

|

| 6 |

|

Warrant to Purchase Stock, dated October 16, 2013, issued to Maxwell (Mauritius) Pte Ltd.(5) |

|

|

| 7 |

|

Amended and Restated Investors Rights Agreement, dated June 21, 2010, by and among Amyris Biotechnologies, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(6) |

|

|

| 8 |

|

Amendment No. 1 to Amended and Restated Investors’ Rights Agreement, dated February 23, 2012, by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(7) |

|

|

| 9 |

|

Amendment No. 2 to Amended and Restated Investors’ Rights Agreement, dated December 24, 2012, by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(8) |

|

|

| 10 |

|

Amendment No. 3 to Amended and Restated Investors’ Rights Agreement, dated March 27, 2013, by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(9) |

|

|

| 11 |

|

Amendment No. 4 to Amended and Restated Investors’ Rights Agreement, dated October 16, 2013, by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(10) |

|

|

| 12 |

|

Amendment No. 5 to Amended and Restated Investors’ Rights Agreement, dated December 24, 2013, by and among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(11) |

|

|

| 13 |

|

Voting Agreement, dated August 8, 2013, among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other

investors.(12) |

|

|

| 14 |

|

Amended and Restated Letter Agreement, dated May 8, 2014, among Amyris, Inc., Maxwell (Mauritius) Pte Ltd, and certain other investors.(13) |

|

|

| 15 |

|

Joint Filing Agreement.(14) |

| (1) |

Incorporated by reference to Exhibit 4.02 to the Issuer’s Form 10-Q (No. 001-34885) for the quarterly period ended March 31, 2012 filed with the Securities and Exchange Commission on May 9, 2012.

|

| (2) |

Incorporated by reference to Exhibit 4.01 to the Issuer’s Form 10-Q (No. 001-34885) for the quarterly period ended September 30, 2013 filed with the Securities and Exchange Commission on November 5, 2013.

|

| (3) |

Incorporated by reference to Exhibit 4.24 to the Issuer’s Form 10-K (No. 001-34885) for the year ended December 31, 2013 filed with the Securities and Exchange Commission on April 2, 2014.

|

| (4) |

Incorporated by reference to Exhibit 4.25 to the Issuer’s Form 10-K (No. 001-34885) for the year ended December 31, 2013 filed with the Securities and Exchange Commission on April 2, 2014.

|

| (5) |

Incorporated by reference to Exhibit 4.09 to the Issuer’s Form 10-K (No. 001-34885) for the year ended December 31, 2013 filed with the Securities and Exchange Commission on April 2, 2014.

|

| (6) |

Incorporated by reference to Exhibit 4.02 to the Issuer’s Form S-1 (No. 333-166135) filed with the Securities and Exchange Commission on June 23, 2010. |

| (7) |

Incorporated by reference to Exhibit 4.06 to the Issuer’s Form S-3 (No. 333-180005) filed with the Securities and Exchange Commission on March 9, 2012. |

| (8) |

Incorporated by reference to Exhibit 4.04 to the Issuer’s Form 10-K (No. 001-34885) for the year ended December 31, 2012 filed with the Securities and Exchange Commission on March 28, 2013.

|

| (9) |

Incorporated by reference to Exhibit 4.02 to the Issuer’s Form 10-Q (No. 001-34885) for the quarterly period ended March 31, 2013 filed with the Securities and Exchange Commission on June 9, 2013.

|

| (10) |

Incorporated by reference to Exhibit 4.06 to the Issuer’s Form 10-K (No. 001-34885) for the year ended December 31, 2013 filed with the Securities and Exchange Commission on April 2, 2014.

|

| (11) |

Incorporated by reference to Exhibit 4.07 to the Issuer’s Form 10-K (No. 001-34885) for the year ended December 31, 2013 filed with the Securities and Exchange Commission on April 2, 2014.

|

| (12) |

Incorporated by reference to Exhibit 4.02 to the Issuer’s Form 10-Q (No. 001-34885) for the quarterly period ended September 30, 2013 filed with the Securities and Exchange Commission on November 5, 2013.

|

| (13) |

Incorporated by reference to Exhibit 4.01 to the Issuer’s Form 10-Q (No. 001-34885) for the quarterly period ended June 30, 2014 filed with the Securities and Exchange Commission on August 8, 2014.

|

| (14) |

Incorporated by reference to Exhibit 15 to the Schedule 13D (No. 005-85969) filed by Maxwell on November 25, 2014. |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this

statement is true, complete and correct.

|

|

|

|

|

|

|

| December 19, 2014 |

|

|

|

TEMASEK HOLDINGS (PRIVATE) LIMITED |

|

|

|

|

|

|

|

|

By: |

|

/s/ Choo Soo Shen Christina |

|

|

|

|

|

|

Name: Choo Soo Shen Christina |

|

|

|

|

|

|

Title: Authorized Signatory |

|

|

|

|

|

|

|

FULLERTON MANAGEMENT PTE LTD |

|

|

|

|

|

|

|

|

By: |

|

/s/ Cheong Kok Tim |

|

|

|

|

|

|

Name: Cheong Kok Tim |

|

|

|

|

|

|

Title: Director |

|

|

|

|

|

|

|

CAIRNHILL INVESTMENTS (MAURITIUS) PTE LTD |

|

|

|

|

|

|

|

|

By: |

|

/s/ Rooksana Shahabally |

|

|

|

|

|

|

Name: Rooksana Shahabally |

|

|

|

|

|

|

Title: Director |

|

|

|

|

|

|

|

MAXWELL (MAURITIUS) PTE LTD |

|

|

|

|

|

|

|

|

By: |

|

/s/ Rooksana Shahabally |

|

|

|

|

|

|

Name: Rooksana Shahabally |

|

|

|

|

|

|

Title: Director |

Exhibit 1

INFORMATION REGARDING THE INSTRUCTION C PERSONS

The following sets forth the name, position, address, principal occupation, and citizenship of each director and executive officer of the

applicable Reporting Persons (such executive officers and directors, the “Instruction C Persons”). To the best of the Reporting Persons’ knowledge, (i) none of the Instruction C Persons during the last five years has been

convicted in a criminal proceeding (excluding traffic violations or other similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws and (ii) none of the Instruction C

Persons owns any shares of Common Stock.

TEMASEK HOLDINGS (PRIVATE) LIMITED

|

|

|

|

|

| Name, Business Address, Position |

|

Principal Occupation |

|

Citizenship |

| Lim Boon Heng 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891

(Chairman and Director, Temasek) |

|

Chairman, Temasek |

|

Singaporean |

| Cheng Wai Keung 3 Killiney Road

#10-01 Winsland House 1 Singapore 239519

(Deputy Chairman, Temasek) |

|

Chairman and Managing Director, Wing Tai

Holdings Limited |

|

Singaporean |

| Kua Hong Pak 205 Braddell Road

East Wing 7th Floor Singapore 579701

(Director, Temasek) |

|

Managing Director & Group CEO,

ComfortDelGro Corporation Limited |

|

Singaporean |

| Goh Yew Lin 50 Raffles Place

#33-00 Singapore Land Tower Singapore 048623

(Director, Temasek) |

|

Managing Director, G.K. Goh Holdings

Limited |

|

Singaporean |

| Teo Ming Kian Caldecott Broadcast Centre,

Andrew Road Singapore 299939

(Director, Temasek) |

|

Chairman, MediaCorp Pte. Ltd. |

|

Singaporean |

| Marcus Wallenberg SE-106 40 Stockholm

Sweden |

|

Chairman, Skandinaviska Enskilda Banken,

Saab AB and Foundation Asset Management Sweden AB |

|

Swedish |

|

|

|

| (Director, Temasek) |

|

|

|

|

|

|

|

| Lien Jown Leam Michael One Raffles Place

(formerly known as OUB Centre) #51-00 Singapore 048616

(Director, Temasek) |

|

Executive Chairman, Wah Hin and Company Private

Limited |

|

Singaporean |

| Wong Yuen Kuai Lucien One Marina

Boulevard #28-00 Singapore 018989

|

|

Chairman and Senior Partner, Allen &

Gledhill LLP |

|

Singaporean |

| (Director, Temasek) |

|

|

|

|

| Robert Bruce Zoellick c/o 101 Constitution

Avenue, NW Suite 1000 East Washington, DC 20001

(Director, Temasek) |

|

Chairman, Goldman Sachs International

Advisors |

|

USA |

|

|

|

|

|

| Chin Yoke Choong Bobby c/o Interlocal Exim Pte

Ltd 2 Kim Chuan Lane, Kong Siang Group Building

Singapore 532072 |

|

Deputy Chairman, NTUC Enterprise Cooperative

Limited |

|

Singaporean |

|

|

|

| (Director, Temasek) |

|

|

|

|

| Ng Chee Siong Robert 11th—12th Floors, Tsim Sha Tsui Centre,

Salisbury Road, Tsim Sha Tsui, Kowloon, Hong Kong |

|

Chairman, Sino Land Company Ltd |

|

Singaporean /

Hong Kong PR |

|

|

|

| (Director, Temasek) |

|

|

|

|

| Ho Ching 60B Orchard Road #06-18 Tower 2

The Atrium@Orchard Singapore 238891 |

|

Executive Director & CEO, Temasek |

|

Singaporean |

|

|

|

| (Executive Director & CEO, Temasek) |

|

|

|

|

| Gregory L. Curl 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891 |

|

President, Temasek International Pte. Ltd. |

|

USA |

|

|

|

| (President, Temasek International Pte. Ltd.) |

|

|

|

|

| Lee Theng Kiat 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891 |

|

President, Temasek International Pte. Ltd. |

|

Singaporean |

|

|

|

| (President, Temasek International Pte. Ltd.) |

|

|

|

|

|

|

|

| Chan Wai Ching 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891 |

|

Co-Head, Corporate Development Group, Head,

Organisation & People, Temasek International Pte. Ltd. |

|

Singaporean |

|

|

|

| (Co-Head, Corporate Development Group, Head,

Organisation & People, Temasek International Pte. Ltd.) |

|

|

|

|

| Cheo Hock Kuan 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891 |

|

Head, Strategic & Public Affairs, Temasek

International Pte. Ltd. |

|

Singaporean |

|

|

|

| (Head, Strategic & Public Affairs,

Temasek International Pte. Ltd.) |

|

|

|

|

| Chia Song Hwee 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891 |

|

Head, Investment Group, Co-Head, China,

Co-Head, Credit Portfolio, Temasek International Pte.

Ltd. |

|

Singaporean |

|

|

|

| (Head, Investment Group, Co-Head, China,

Co-Head, Credit Portfolio, Temasek International Pte.

Ltd.) |

|

|

|

|

| Dilhan Pillay Sandrasegara 60B Orchard Road

#06-18 Tower 2 The Atrium@Orchard Singapore 238891 |

|

Head, Enterprise Development Group, Head,

Singapore, Co-Head, Americas, Temasek International Pte.

Ltd. |

|

Singaporean |

|

|

|

| (Head, Enterprise Development Group, Head,

Singapore, Co-Head, Americas, Temasek International Pte.

Ltd.) |

|

|

|

|

|

|

|

|

|

| Heng Chen Seng David 60B Orchard Road #06-18

Tower 2 The Atrium@Orchard Singapore 238891

(Co-Head, Markets Group,

Head, Consumer & Real Estate, Head, South East Asia,

Temasek International Pte. Ltd.) |

|

Co-Head, Markets Group, Head, Consumer &

Real Estate, Head, South East Asia, Temasek International

Pte. Ltd. |

|

Singaporean |

|

|

|

| Leong Wai Leng 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891

(Head, Corporate Development Group,

Chief Financial Officer, Co-Head, Portfolio Management,

Temasek Holdings (Private) Limited) |

|

Head, Corporate Development Group Chief

Financial Officer, Co-Head, Portfolio Management, Temasek

Holdings (Private) Limited |

|

Singaporean |

| Nagi Adel Hamiyeh 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891

(Co-Head, Enterprise Development Group,

Head, Industrials, Head, Australia & New Zealand,

Head, Africa & Middle East, Temasek International Pte. Ltd.) |

|

Co-Head, Enterprise Development Group, Head,

Industrials, Head, Australia & New Zealand, Head, Africa

& Middle East, Temasek International Pte. Ltd. |

|

Singaporean |

| Neil Garry McGregor 60B Orchard Road #06-18

Tower 2 The Atrium@Orchard Singapore 238891

(Senior Managing Director, Enterprise Development Group, Temasek International Pte.

Ltd.) |

|

Senior Managing Director, Enterprise Development Group,

Temasek International Pte. Ltd. |

|

New Zealander |

| Pek Siok Lan 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891

(General Counsel,

Temasek International Pte. Ltd) |

|

General Counsel, Temasek International Pte.

Ltd. |

|

Singaporean |

| Ravi Mahinder Lambah 60B Orchard Road #06-18

Tower 2 The Atrium@Orchard Singapore 238891

(Head, Telecom, Media & Technology,

Co-Head, India, Co-Head, Africa & Middle East,

Temasek International Pte. Ltd.) |

|

Head, Telecom, Media & Technology, Co-Head,

India, Co-Head, Africa & Middle East, Temasek

International Pte. Ltd. |

|

Indian |

| Rohit Sipahimalani 60B Orchard Road #06-18

Tower 2 The Atrium@Orchard Singapore 238891

(Co-Head, Investment Group,

Co-Head, Portfolio & Strategy Group, Head,

Energy & Resources, Head, India, Head, Portfolio

Strategy & Value Management, Temasek International Pte. Ltd.) |

|

Co-Head, Investment Group, Co-Head, Portfolio

& Strategy Group, Head, Energy & Resources, Head,

India, Head, Portfolio Strategy & Value Management,

Temasek International Pte. Ltd. |

|

Singaporean |

|

|

|

|

|

| Sim Hong Boon 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891

(Head, Markets Group,

President, Americas, Head, Credit Portfolio,

Temasek International Pte. Ltd.) |

|

Head, Markets Group, President, Americas,

Head, Credit Portfolio, Temasek International Pte. Ltd. |

|

USA |

| Tan Chong Lee 60B Orchard Road #06-18 Tower

2 The Atrium@Orchard Singapore 238891

(Head, Portfolio and Strategy Group,

Head, Europe, Head, Portfolio Management,

Head, Strategy, Co-Head, Singapore, Temasek International Pte.

Ltd.) |

|

Head, Portfolio and Strategy Group, Head,

Europe, Head, Portfolio Management, Head, StrategyCo-Head,

Singapore, Temasek International Pte. Ltd. |

|

Singaporean |

| Wu Yibing 60B Orchard Road #06-18 Tower 2

The Atrium@Orchard Singapore 238891

(Head, China,

Temasek International Pte. Ltd.) |

|

Head, China, Temasek International Pte.

Ltd. |

|

USA |

|

|

|

| Benoit Louis Marie Francois Valentin 23 King

Street London SW1Y 6QY United Kingdom

(Senior Managing Director, Europe,

Co-Head, Industrials, Temasek International Pte. Ltd.) |

|

Senior Managing Director, Europe, Co-Head,

Industrials, Temasek International Pte. Ltd.) |

|

France |

FULLERTON MANAGEMENT PTE LTD

|

|

|

|

|

| Name, Business Address, Position |

|

Principal Occupation |

|

Citizenship |

| Leong Wai Leng c/o 60B Orchard Road #06-18,

Tower 2 The Atrium@Orchard Singapore 238891

Director |

|

Head – Corporate Development Group, Chief

Financial Officer, Co-Head, Portfolio Management, Temasek

Holdings (Private) Limited |

|

Singaporean |

| Cheong Kok Tim c/o 60B Orchard Road #06-18,

Tower 2 The Atrium@Orchard Singapore 238891

Director |

|

Managing Director – Legal & Regulations,

Temasek International Pte. Ltd. |

|

Singaporean |

CAIRNHILL INVESTMENTS (MAURITIUS) PTE LTD

|

|

|

|

|

| Name, Business Address, Position |

|

Principal Occupation |

|

Citizenship |

| Ashraf Ramtoola c/o CIM CORPORATE SERVICES LTD,

Les Cascades, Edith Cavell Street, Port Louis, Mauritius Director |

|

Senior Manager, CIM Corporate Services

Ltd |

|

Mauritian |

| Rooksana Bibi Shahabally Coowar c/o CIM

CORPORATE SERVICES LTD, Les Cascades, Edith Cavell Street, Port Louis, Mauritius

Director |

|

Head of Client Management, CIM Corporate

Services Ltd |

|

Mauritian |

| Poy Weng Chuen c/o 60B Orchard Road #06-18,

Tower 2 The Atrium@Orchard Singapore 238891 |

|

Director – Finance, Temasek International

Pte. Ltd. |

|

Singaporean |

|

|

|

|

|

| Director Tan Chee Wei

c/o 60B Orchard Road #06-18, Tower 2 The Atrium@Orchard

Singapore 238891

Director |

|

Director – Finance,

Temasek International Pte. Ltd. |

|

Singaporean |

MAXWELL (MAURITIUS) PTE LTD

|

|

|

|

|

| Name, Business Address, Position |

|

Principal Occupation |

|

Citizenship |

| Ashraf Ramtoola c/o CIM CORPORATE SERVICES LTD,

Les Cascades, Edith Cavell Street, Port Louis, Mauritius Director |

|

Senior Manager, CIM Corporate Services

Ltd |

|

Mauritian |

| Rooksana Bibi Shahabally Coowar c/o CIM

CORPORATE SERVICES LTD, Les Cascades, Edith Cavell Street, Port Louis, Mauritius

Director |

|

Head of Client Management, CIM Corporate

Services Ltd |

|

Mauritian |

| Poy Weng Chuen c/o 60B Orchard Road #06-18,

Tower 2 The Atrium@Orchard Singapore 238891

Director |

|

Director – Finance, Temasek International

Pte. Ltd. |

|

Singaporean |

| Tan Chee Wei c/o 60B Orchard Road #06-18, Tower

2 The Atrium@Orchard Singapore 238891

Director |

|

Director – Finance, Temasek International

Pte. Ltd. |

|

Singaporean |

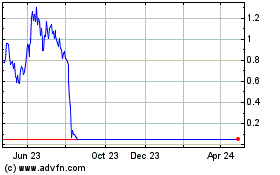

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Apr 2023 to Apr 2024